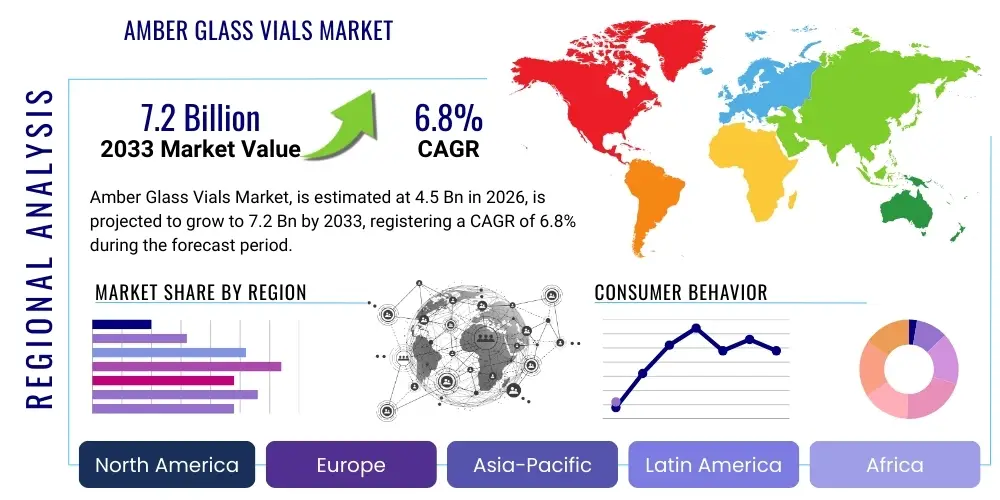

Amber Glass Vials Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442867 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Amber Glass Vials Market Size

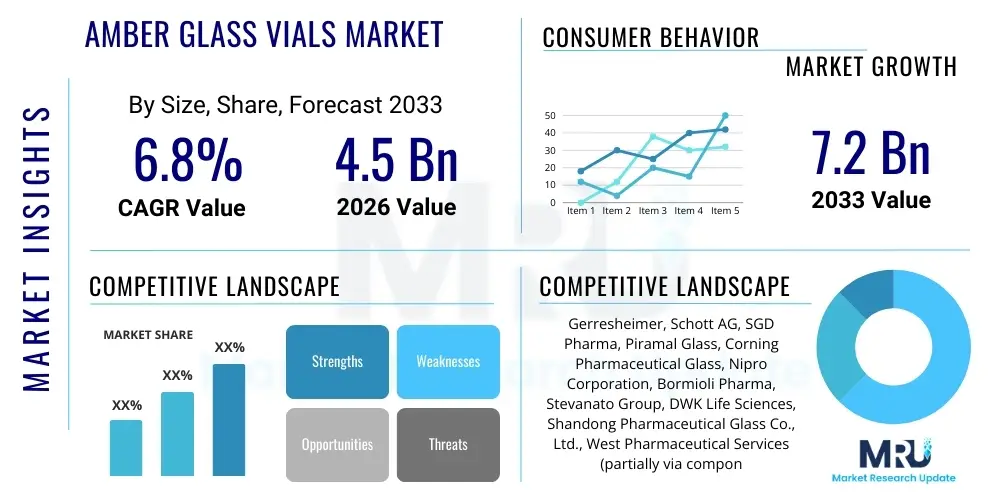

The Amber Glass Vials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Amber Glass Vials Market introduction

The Amber Glass Vials Market encompasses the manufacturing and distribution of small, cylindrical containers made from Type I borosilicate glass, treated with iron oxide compounds to impart an amber hue. This specific coloration provides critical photoprotection, filtering out harmful ultraviolet (UV) and blue light wavelengths (typically below 450 nm), which are known to degrade photosensitive pharmaceutical compounds, biological samples, and specialty chemicals. Amber glass vials are essential components in the primary packaging ecosystem, particularly in regulated industries like pharmaceuticals and biotechnology, where maintaining product stability and efficacy is paramount.

The primary applications of these vials span injectable drugs, vaccines, diagnostic reagents, lyophilized products, and high-value chemical standards. Their inherent inertness, chemical resistance, thermal stability, and low coefficient of expansion, characteristic of borosilicate glass, make them the gold standard for long-term storage and high-integrity containment. Key benefits include enhanced shelf-life for sensitive formulations, compliance with global pharmacopoeial standards (such as USP and EP), and robustness during sterilization and transportation processes. The sustained growth in the market is fundamentally driven by the escalating global demand for parenteral drug delivery systems, the rapid expansion of the biologics and biosimilars sector, and stringent regulatory requirements mandating protective packaging for light-sensitive Active Pharmaceutical Ingredients (APIs).

Furthermore, technological advancements in vial manufacturing, such as tighter dimensional tolerances and improved surface treatments to reduce delamination risk, are boosting market acceptance. The ongoing worldwide efforts in vaccination programs and the increasing prevalence of chronic diseases requiring sophisticated injectable treatments solidify the continuous upward trajectory of the Amber Glass Vials Market. Market players are heavily investing in high-speed, automated production lines and quality control systems to meet the growing volume and strict quality standards demanded by pharmaceutical clients globally.

Amber Glass Vials Market Executive Summary

The Amber Glass Vials Market is experiencing robust growth driven by sustained high demand from the pharmaceutical and biopharmaceutical sectors, particularly for complex injectable formulations and high-volume vaccine production. Business trends highlight a pronounced shift toward Type I borosilicate glass vials due to their superior chemical resistance, aligning with stricter global regulatory mandates (e.g., USP <660>, EP 3.2.1). Key industry developments include strategic mergers and acquisitions aimed at capacity expansion, vertical integration by major glass manufacturers, and a focus on developing specialty vials with enhanced barrier properties, such as internal siliconization or plasma deposition coatings, to mitigate potential drug-container interaction issues.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, primarily fueled by the massive expansion of generic drug manufacturing, burgeoning domestic pharmaceutical industries in China and India, and improving healthcare infrastructure. North America and Europe remain dominant in terms of value, driven by high R&D expenditure in biopharma and stringent quality adherence. Segment trends show that the 5ml-10ml capacity range holds significant market share, catering to standard injectable volumes, while the application segment is overwhelmingly led by pharmaceuticals, with diagnostics reagents also showing accelerated growth post-pandemic due to increased need for rapid testing kits and clinical assays.

The market faces operational challenges related to supply chain stability, particularly concerning the supply of high-purity borosilicate tubing. However, significant opportunities lie in customized packaging solutions, integrating traceability features like serialization, and developing sustainable manufacturing processes to address growing environmental concerns from end-users. Overall, the market remains critically tied to global health investments and regulatory compliance standards, positioning amber glass vials as an indispensable primary packaging solution for sensitive therapeutic products.

AI Impact Analysis on Amber Glass Vials Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) integration can enhance quality control and optimize complex manufacturing processes within the Amber Glass Vials sector. Key user themes center on utilizing AI for detecting micro-defects invisible to traditional visual inspection systems, predicting equipment failure to minimize downtime, and optimizing glass composition parameters for improved thermal resistance and reduced delamination potential. There is also significant interest in AI's role in supply chain management, specifically forecasting raw material demand (borosilicate glass tubing) and optimizing logistics routes for global pharmaceutical distribution, ensuring timely delivery amidst volatile market conditions. Concerns often revolve around the initial capital investment required for adopting advanced AI vision systems and the need for specialized data scientists to maintain and interpret the complex data generated during high-speed production runs. The general expectation is that AI will dramatically raise quality benchmarks, leading to 'zero-defect' manufacturing goals and providing a significant competitive advantage to early adopters.

- Enhanced Quality Control (QC): AI-powered vision systems detect subtle glass defects (cracks, inclusions, wall thickness variation) in real-time at high throughput, exceeding human capability.

- Predictive Maintenance: ML algorithms analyze sensor data from forming machines (e.g., heating elements, feeders) to predict equipment failure, reducing unplanned downtime and optimizing asset utilization.

- Process Optimization: AI models fine-tune furnace temperatures and pulling speeds during borosilicate tube forming and vial conversion, leading to improved glass stability and reduced material wastage.

- Supply Chain Resilience: ML forecasts demand volatility for both raw materials and finished vials, enhancing inventory management and optimizing global distribution networks.

- Compliance and Documentation: Automated data logging and analysis using AI streamline regulatory reporting processes and ensure full compliance traceability for GMP standards.

- Reduced Delamination Risk: AI analyzes factors affecting glass surface chemistry during heat treatment, helping manufacturers implement process adjustments that lower the risk of ion exchange and subsequent delamination.

DRO & Impact Forces Of Amber Glass Vials Market

The Amber Glass Vials Market is propelled by robust drivers centered primarily on the massive global expansion of the pharmaceutical industry, particularly in injectables, biologics, and novel therapies requiring photoprotection. The stringent regulatory environment, which mandates the use of high-quality, inert packaging for sensitive drugs to ensure patient safety and drug efficacy, acts as a continuous growth force. However, the market faces significant restraints, chiefly stemming from the high cost and complex manufacturing requirements of Type I borosilicate glass, coupled with inherent risks associated with glass packaging, such as breakage and potential for delamination. These operational challenges sometimes incentivize the exploration of alternative packaging materials, although glass remains the regulatory standard for many critical applications.

Opportunities within the sector are concentrated on innovation in coating technologies (e.g., internal plasma coatings) aimed at creating ultra-clean, high-barrier inner surfaces that eliminate drug-container interaction, addressing one of the primary restraints. Furthermore, the rising focus on sustainable and recyclable packaging options presents avenues for manufacturers to innovate in resource-efficient production. The market is also heavily influenced by impact forces, notably the globalization of pharmaceutical supply chains, which necessitates standardized, high-volume production capabilities across multiple regions. The speed of drug development, especially for emerging infectious diseases (as witnessed during the pandemic), directly accelerates demand spikes for quality amber vials.

The overall impact force of regulatory alignment (e.g., harmonization of pharmacopoeial standards globally) tends to benefit established players capable of meeting these demanding specifications consistently. The shift towards personalized medicine and smaller batch sizes, while challenging high-volume manufacturers, creates opportunities for specialization in customized vial formats. Successfully navigating these impact forces requires substantial investment in advanced automation and quality assurance systems to maintain competitive pricing while adhering to impeccable quality standards required for global pharmaceutical use.

- Drivers: Growing biopharmaceutical sector; rising demand for vaccines and injectable drugs; stringent regulatory mandates requiring photoprotective packaging; technological improvements in glass forming processes.

- Restraints: High raw material costs and volatility; increasing competition from polymer-based alternatives (COC, COP); risk of glass breakage during transport and manufacturing; complexity and capital intensiveness of setting up high-quality production lines.

- Opportunity: Development of value-added vials (e.g., pre-sterilized, ready-to-use formats); expansion into emerging markets; integration of smart packaging features (e.g., serialization); focus on reducing glass defects via AI-powered inspection.

- Impact Forces: Global regulatory standardization (positive); healthcare expenditure trends (positive); raw material supply chain disruptions (negative); rapid pace of new drug development (positive).

Segmentation Analysis

The Amber Glass Vials Market is systematically segmented based on various criteria, including the type of glass used, the capacity of the vial, and the primary application in the end-user industry. This segmentation provides a granular understanding of market dynamics, allowing manufacturers to align production capabilities with specific client needs, particularly concerning regulatory compliance and drug sensitivity. The segmentation by glass type, distinguishing between hydrolytic resistance classes (Type I, II, III), is perhaps the most critical, as Type I borosilicate glass consistently dominates due to its superior chemical resistance required for sensitive parenteral drugs. Segmentation by application highlights the overwhelming dependency of the pharmaceutical sector on these vials, driving volume and innovation.

Capacity segmentation reveals usage patterns across various therapies; smaller volumes (1ml to 5ml) are generally used for sensitive, high-concentration biologicals and expensive vaccines, while medium volumes (5ml to 10ml) serve standard injectable doses. Larger formats (>10ml) often cater to diagnostic reagents or bulk storage of concentrated APIs. Understanding these segments is crucial for supply chain planning, especially when manufacturers are pressed to provide both large-scale standard formats and highly customized, specialty formats for niche biopharma products. The market's structural health is reflected in the stable growth across all major segments, underscoring the indispensable nature of amber glass in modern medicine.

Furthermore, segmentation often intersects with the format of the closure system, differentiating between crimp-top (for lyophilization and high-integrity sealing) and screw-top vials (often used for clinical trials and laboratory reagents). The continuous evolution in drug delivery methods, such as the rise of biosimilars and complex therapeutic proteins, necessitates precision manufacturing across all these segments to meet the rigorous standards set by global health authorities, ensuring consistency in primary packaging regardless of the vial's final use or size.

- By Type:

- Type I (Borosilicate Glass)

- Type II (Treated Soda-Lime Glass)

- Type III (Soda-Lime Glass)

- By Capacity:

- 1ml – 5ml

- 5ml – 10ml

- >10ml (Up to 100ml)

- By Application:

- Pharmaceuticals (Injectables, Vaccines, Lyophilized Products)

- Cosmetics and Personal Care

- Chemicals and Reagents

- Diagnostics and Clinical Laboratories

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Research and Academic Institutions

Value Chain Analysis For Amber Glass Vials Market

The value chain for the Amber Glass Vials Market begins with the upstream sourcing of specialized raw materials, primarily high-purity silica sand, sodium carbonate, limestone, and crucially, iron oxide and borosilicate glass tubing. The tubing manufacturing stage is highly capital-intensive, requiring precise control over the glass melting and drawing process to produce consistent Type I amber tubing that meets strict dimensional and hydrolytic resistance specifications. Integration with key suppliers of borosilicate glass (often dominated by a few large global players) is critical for manufacturers to ensure supply security and quality consistency, forming the initial value bottleneck.

The core manufacturing stage involves the conversion of the tubing into finished vials using advanced forming and annealing processes. This is followed by rigorous secondary processes like internal surface treatment (e.g., siliconization), washing, sterilization, and 100% automated visual inspection systems (often incorporating AI/ML) to ensure zero defects. Downstream analysis focuses on logistics, where specialized transport conditions are required to prevent breakage and maintain the integrity of sterile or ready-to-use (RTU) formats. Distribution channels are highly specialized, relying heavily on direct sales to large pharmaceutical companies and CMOs, or through validated, highly regulated medical packaging distributors.

The distribution network is segmented into direct sales, which handle bespoke or high-volume orders requiring deep technical support, and indirect channels, which typically serve smaller laboratories, compounding pharmacies, or regional chemical suppliers. Maintaining cold chain compatibility and integrity throughout the downstream process is a significant value addition. The ultimate value lies in the vial's regulatory acceptance and compatibility with high-speed filling lines, determining the total cost of ownership for the pharmaceutical end-user.

Amber Glass Vials Market Potential Customers

The primary and most critical customer base for the Amber Glass Vials Market comprises global pharmaceutical and biotechnology companies, particularly those specializing in the manufacturing of injectable drugs (parenterals), biologics, and innovative gene therapies. These companies demand the highest quality Type I borosilicate amber glass vials due to regulatory mandates requiring minimal extractables and photoprotection for sensitive APIs. The increasing pipeline of biosimilars and complex therapeutic proteins further solidify this sector as the largest consumer, requiring high-volume supply reliability and impeccable quality assurance.

A rapidly growing customer segment consists of Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs). As pharmaceutical companies increasingly outsource production, CMOs require vast quantities of standardized and customized vials to service multiple clients and diverse drug formulations. Their purchasing decisions are heavily influenced by supplier certification, global supply capability, and the availability of ready-to-use (RTU) or sterile vial formats that simplify their filling processes. Other significant potential customers include diagnostic kit manufacturers who utilize amber vials for packaging reagents, buffers, and calibrators, and academic or industrial research laboratories requiring chemically inert, protective containers for high-value research samples and standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gerresheimer, Schott AG, SGD Pharma, Piramal Glass, Corning Pharmaceutical Glass, Nipro Corporation, Bormioli Pharma, Stevanato Group, DWK Life Sciences, Shandong Pharmaceutical Glass Co., Ltd., West Pharmaceutical Services (partially via components), Toyo Glass Co., Ltd., Ardagh Group, Hebei Xingwang Glass Products Co., Ltd., Pacific Glass Corporation, Hindustan National Glass & Industries Ltd., Kishore Glass & Chemicals, Transcom Glass Inc., Nuova Ompi S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amber Glass Vials Market Key Technology Landscape

The technology landscape governing the Amber Glass Vials Market is defined by precision engineering and advanced quality assurance methodologies, moving significantly beyond traditional glass blowing. The foundational technology involves the highly specialized transformation of borosilicate glass tubing into vials using continuous, high-speed forming machines (e.g., rotary indexing machines). Key advancements center on thermal treatment technologies, specifically optimized annealing ovens, which relieve internal stresses in the glass structure, minimizing the risk of breakage and maximizing chemical durability. This precise thermal control is critical for maintaining the hydrolytic resistance classification required for pharmaceutical use.

Modern manufacturing facilities deploy sophisticated sensor-based systems and optical gauging equipment to ensure dimensional consistency, verifying parameters such as wall thickness, concentricity, and flange diameter at production speeds of hundreds of units per minute. A major technological focus is the development of surface modification technologies. These include internal chemical treatments, such as ammonium sulfate processing, and advanced coating techniques like plasma chemical vapor deposition (PCVD) or siliconization. These treatments create an inert barrier layer on the inner surface of the vial, preventing interaction between the drug product and the glass matrix, thereby mitigating the threat of delamination and extractable leaching, which is vital for highly sensitive biologic drugs.

Furthermore, the integration of automation and data analytics is revolutionizing quality control. High-resolution camera systems coupled with machine learning algorithms are standardizing defect detection, moving inspection from subjective human oversight to objective, verifiable, and traceable digital analysis. The concept of "Ready-to-Use" (RTU) vials, which are washed, sterilized, and packaged in nest-and-tub formats ready for aseptic filling lines, represents a significant technological and logistical leap, reducing preparation steps for end-users and minimizing contamination risk in the pharmaceutical filling environment.

Regional Highlights

The Amber Glass Vials Market exhibits distinct regional market dynamics influenced by local pharmaceutical manufacturing strength, regulatory stringency, and healthcare investment. North America, specifically the United States, represents a dominant market in terms of value, driven by high R&D spending on innovative biologics, strong regulatory oversight requiring premium packaging (predominantly Type I), and the presence of major biopharma headquarters and extensive vaccine manufacturing capabilities. The demand here is often focused on specialty vials, RTU formats, and customized solutions for niche therapies.

Europe holds a substantial market share, characterized by mature pharmaceutical hubs in countries like Germany, Switzerland, and France. European market growth is stable, underpinned by adherence to European Pharmacopoeia (EP) standards and a robust generic drug industry. The region is a leader in sustainable packaging practices, prompting manufacturers to invest in environmentally conscious production methods and optimize material usage. Logistics and reliable cross-border supply chains are critical in the European theater.

Asia Pacific (APAC) is projected to be the fastest-growing region globally. This explosive growth is fueled by massive capacity expansion in domestic pharmaceutical manufacturing in countries like India, China, and South Korea, which are becoming global supply hubs for generic drugs and vaccines. Improving healthcare access, increasing disposable income, and government initiatives to bolster domestic drug production accelerate the demand for both standard and high-quality amber vials. While China focuses on vast volume production, India is leveraging its established position as a key global supplier of affordable medicines, driving huge requirement volumes for primary packaging.

Latin America and the Middle East & Africa (MEA) represent emerging markets. Growth in Latin America is tied to expanding public healthcare systems and increasing local drug production, while MEA growth is driven by rising investments in healthcare infrastructure and the establishment of local manufacturing centers, aiming to reduce dependency on imports, particularly in Gulf Cooperation Council (GCC) countries.

- North America (US, Canada): Dominant in value; driven by biologics, high regulatory compliance, and demand for RTU formats.

- Europe (Germany, UK, France): Mature market; stability driven by stringent EP standards and strong generics industry; focus on sustainability and quality automation.

- Asia Pacific (China, India, Japan): Fastest growth rate; massive expansion of generic and vaccine manufacturing; increasing local production capacity and improving healthcare penetration.

- Latin America (Brazil, Mexico): Emerging market; growth fueled by expanding pharmaceutical production for domestic consumption and regional distribution.

- Middle East & Africa (GCC, South Africa): Growth concentrated around healthcare infrastructure projects and strategic government investments in pharmaceutical self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amber Glass Vials Market.- Gerresheimer AG

- Schott AG

- SGD Pharma

- Piramal Glass (now Piramal Pharma Solutions)

- Corning Pharmaceutical Glass

- Nipro Corporation

- Bormioli Pharma S.p.A.

- Stevanato Group S.p.A.

- DWK Life Sciences

- Shandong Pharmaceutical Glass Co., Ltd. (SPG)

- West Pharmaceutical Services (Focus on components and systems)

- Toyo Glass Co., Ltd.

- Ardagh Group

- Hebei Xingwang Glass Products Co., Ltd.

- Pacific Glass Corporation

- Hindustan National Glass & Industries Ltd.

- Kishore Glass & Chemicals

- Transcom Glass Inc.

- Nuova Ompi S.p.A. (Stevanato subsidiary)

- Vetropack Holding Ltd.

Frequently Asked Questions

Analyze common user questions about the Amber Glass Vials market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why is amber glass mandatory for certain pharmaceutical products?

Amber glass is mandatory because it effectively filters out ultraviolet (UV) and short-wavelength blue light (below 450 nm). This photoprotection is essential for maintaining the stability, integrity, and efficacy of light-sensitive pharmaceutical compounds, preventing photodegradation reactions during storage and transport.

What is the primary difference between Type I and Type III amber glass vials?

Type I amber glass, typically borosilicate, offers the highest chemical and hydrolytic resistance, making it suitable for injectable drugs and high-ppurity formulations. Type III amber glass, being soda-lime glass, has lower chemical resistance and is usually reserved for non-parenteral or stable dry powder pharmaceuticals.

How does the shift towards Ready-to-Use (RTU) vials impact the market?

The shift towards RTU formats significantly streamlines pharmaceutical filling operations by delivering vials pre-washed, sterilized, and packaged in trays. This reduces contamination risk and capital expenditure for end-users, driving growth in the high-quality, pre-processed vial segment.

What are the main risks associated with using glass vials for sensitive biologics?

The main risks include glass delamination (flaking of the internal glass surface) and leaching of extractables (metal ions) into the drug solution, potentially compromising drug stability and safety. These risks are mitigated through the use of high-purity Type I glass and internal surface treatment technologies.

Which geographical region is expected to lead market growth in the coming years?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the robust expansion of the pharmaceutical and vaccine manufacturing sectors, especially in key economies like China and India, serving both domestic and international markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager