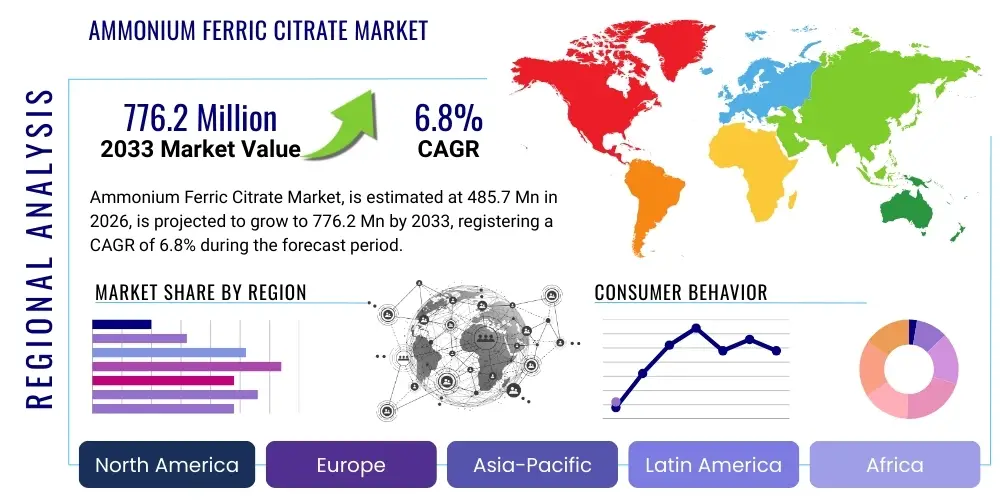

Ammonium Ferric Citrate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442067 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Ammonium Ferric Citrate Market Size

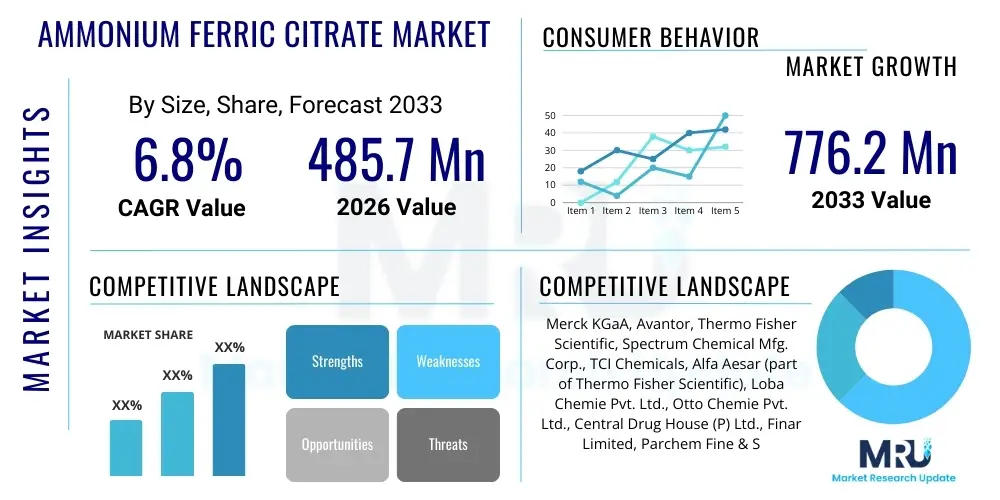

The Ammonium Ferric Citrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 715.0 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the expanding applications of Ammonium Ferric Citrate (AFC) across vital industries, particularly in pharmaceuticals for treating iron deficiency and in the food and beverage sector as a stabilizing agent and coloring material. The increasing global awareness regarding micronutrient deficiencies, especially anemia, propels the adoption of AFC-based supplements and fortified foods, thereby ensuring a robust growth pathway for the market across key geographies.

Ammonium Ferric Citrate Market introduction

The Ammonium Ferric Citrate market encompasses the global trade, production, and utilization of this specific iron-based compound, known chemically for its high solubility and relatively low toxicity profile when used within established regulatory limits. Ammonium Ferric Citrate (AFC) exists typically as brown scales or green granules, with the brown form commonly used in the food industry and the green form often preferred in pharmaceutical applications due to its higher iron content and distinct chemical properties. The compound serves multiple critical functions, leveraging its ability to act as a source of bioavailable iron, a reducing agent, and a photographic sensitizer, positioning it as a versatile chemical intermediate.

Major applications for Ammonium Ferric Citrate are diverse, spanning the pharmaceutical, food and beverage, water treatment, and specialty chemical industries. In medicine, AFC is crucial for formulating oral iron supplements prescribed for treating iron deficiency anemia, owing to its effectiveness in raising hemoglobin levels. Within the food sector, it is utilized as a food additive (E number E381) for stabilizing certain products, providing color, and acting as a source of fortification in dietary supplements and processed foods. Furthermore, its historical significance in blueprint production and modern role in chemical analysis underscore its technological relevance.

The primary driving factors sustaining the market expansion include the escalating global prevalence of nutritional deficiencies, necessitating widespread supplementation and food fortification programs, especially in emerging economies with high rates of malnutrition. Additionally, continuous innovations in drug delivery systems and the rising acceptance of functional foods containing essential micronutrients contribute significantly to market buoyancy. The inherent benefits of AFC, such as its high aqueous solubility, making it easier for pharmaceutical formulations and food matrices, further enhance its demand compared to less bioavailable iron salts, thus supporting the projected CAGR through 2033.

Ammonium Ferric Citrate Market Executive Summary

The Ammonium Ferric Citrate market is characterized by stable growth driven by critical applications in global health and the food industry, segmented predominantly by type (Green and Brown) and application (Pharmaceuticals, Food & Beverage, and others). Current business trends indicate a strong move toward high-purity, pharmaceutical-grade AFC manufacturing, requiring adherence to stringent Pharmacopoeial standards such as USP and EP, reflecting the demand for enhanced safety and efficacy in medicinal products. Furthermore, strategic collaborations between chemical producers and functional food manufacturers are shaping product innovation, focusing on encapsulation and taste-masking technologies to improve consumer compliance with iron supplements. Regulatory shifts, particularly concerning food safety and iron intake limits, are constantly influencing supply chain dynamics and market access.

Regionally, the Asia Pacific (APAC) market leads in both consumption and production volumes, largely fueled by vast population bases prone to iron deficiency, coupled with expanding pharmaceutical manufacturing and a burgeoning middle class adopting fortified foods. North America and Europe maintain significant market shares, characterized by demand for specialized, high-cost pharmaceutical formulations and stringent quality control, driving technological advancements in synthesis and purification. Emerging regional trends involve increased regulatory scrutiny in Latin America and the Middle East, pushing local manufacturers to invest in quality assurance systems compliant with international standards, while simultaneously opening opportunities for standardized global suppliers.

Segment-wise, the Pharmaceutical application segment dominates revenue due to the high value associated with drug formulation and the persistent need for anemia treatment globally. However, the Food & Beverage segment is projected to exhibit the fastest growth rate, fueled by mandatory and voluntary food fortification initiatives targeting widespread public health improvement, particularly in cereals, dairy alternatives, and infant formulas. The Green AFC segment is gaining prominence over the Brown variant in high-value applications, attributed to its specified chemical composition and superior suitability for advanced drug delivery systems, indicating a premiumization trend within the overall market structure.

AI Impact Analysis on Ammonium Ferric Citrate Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Ammonium Ferric Citrate market reveals key themes centered around manufacturing efficiency, regulatory compliance, and R&D acceleration. Users frequently inquire about how AI can optimize the complex chemical synthesis process of AFC, ensuring higher yield and reduced impurity profiles while maintaining strict regulatory adherence. Concerns often relate to predictive quality control—specifically, whether AI algorithms can anticipate deviations in raw material quality (ferric salts and citric acid) and adjust production parameters dynamically. Expectations are high regarding AI's ability to streamline the pharmaceutical formulation phase, identifying optimal AFC concentrations and excipient compatibility for maximal bioavailability and stability in finished products, thereby speeding up time-to-market for new therapeutic iron supplements.

The integration of AI and Machine Learning (ML) is beginning to transform AFC production landscapes by enabling predictive maintenance of complex reaction vessels and crystallization equipment, drastically reducing unscheduled downtime and improving overall manufacturing throughput. In quality assurance, AI-powered image processing and spectral analysis are deployed to monitor product homogeneity and detect trace impurities with precision far exceeding traditional manual testing protocols. This application ensures that AFC batches, particularly those designated for high-stakes pharmaceutical use, meet the highly specific dissolution and purity standards mandated by global pharmacopeias, leading to increased supplier reliability and reduced product recalls.

Furthermore, AI significantly impacts the research and development pipeline for iron supplements. ML models can analyze vast datasets concerning iron absorption kinetics and metabolic pathways, facilitating the design of novel iron delivery compounds or optimized AFC derivatives with improved gastrointestinal tolerance and absorption profiles. This accelerates the identification of key parameters influencing iron bioavailability, moving beyond empirical testing towards data-driven formulation science. For the end-users, this translates into more effective and patient-friendly anemia treatments, while for manufacturers, it represents a substantial competitive advantage in product differentiation and intellectual property generation.

- AI optimizes AFC chemical synthesis parameters for enhanced yield and reduced energy consumption.

- Machine Learning algorithms predict and mitigate potential impurity formation during crystallization and drying processes.

- AI-driven predictive maintenance minimizes operational downtime in large-scale AFC manufacturing facilities.

- Natural Language Processing (NLP) accelerates regulatory intelligence by swiftly analyzing updated safety guidelines and compliance requirements for AFC use in food and pharma.

- Computational chemistry, accelerated by AI, assists in developing novel encapsulation techniques to improve AFC stability and reduce metallic taste in oral supplements.

DRO & Impact Forces Of Ammonium Ferric Citrate Market

The Ammonium Ferric Citrate market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO) which collectively define the Impact Forces shaping its competitive landscape and future trajectory. The primary driver is the undeniable global health challenge posed by iron deficiency anemia, necessitating continuous, high-volume production of effective, bioavailable iron supplements like AFC. Concurrently, the increasing legislative push for mandatory food fortification programs in countries battling widespread malnutrition bolsters demand in the food additive segment. These factors create strong upward pressure, ensuring steady growth, provided manufacturers can overcome supply chain complexities.

Restraints primarily revolve around the stringent regulatory environment and the volatility associated with key raw materials. The pharmaceutical and food safety authorities (such as the FDA, EFSA, and WHO) impose strict quality control measures, demanding high purity levels that necessitate costly and sophisticated manufacturing processes, acting as a barrier to entry for smaller players. Moreover, fluctuations in the global prices of primary chemical inputs, specifically ferric chloride and citric acid, can impact production costs and compress profit margins, requiring agile procurement strategies and hedging mechanisms to mitigate financial risk and maintain competitive pricing globally.

Opportunities in the AFC market are heavily concentrated in technological innovation and geographical expansion. The development of advanced microencapsulation techniques and specialized controlled-release formulations for oral supplements presents significant potential for improved patient outcomes and market penetration by addressing common side effects like gastrointestinal discomfort. Geographically, untapped or underserved regions, particularly in Sub-Saharan Africa and certain parts of South Asia, present immense potential for market growth as public health organizations increase initiatives focused on iron supplementation. The impact forces indicate that the market is moderately fragmented but moving towards consolidation, where players emphasizing vertical integration and robust regulatory compliance will gain disproportionate market share, leveraging high-quality AFC products to meet specialized pharmaceutical demand.

Segmentation Analysis

The Ammonium Ferric Citrate market is comprehensively segmented based on its structural composition (Type), its functional utilization (Application), and the required purity standards (Grade). This segmentation strategy is crucial for understanding the diverse requirements of end-user industries and tailoring production to meet specific quality metrics. The Type segmentation distinguishes between Green and Brown Ammonium Ferric Citrate, which differ fundamentally in their iron content and oxidation state, thereby making them suitable for disparate uses—Green AFC often preferred for high-value therapeutic applications, and Brown AFC commonly utilized in food coloring and less sensitive industrial processes. The continuous refinement of separation and purification technologies allows manufacturers to precisely target these distinct market segments.

The application segment provides the deepest insight into consumption patterns, with Pharmaceuticals and Food & Beverage representing the most significant revenue generators. Pharmaceutical demand is inelastic, driven by essential public health needs for iron deficiency treatment, demanding high-purity, sterile, and pharmacopoeial-grade material. Conversely, the Food & Beverage segment is highly sensitive to consumer trends, regulatory changes regarding fortification, and competitive pricing pressures. Other niche applications, including analytical chemistry, specialty water treatment, and photographic emulsions, though smaller in volume, often require highly specialized grades of AFC, contributing to the diversity of market offerings and technological specialization.

Future segmentation trends suggest a growing importance of the Grade segmentation (e.g., USP Grade, FCC Grade, Industrial Grade), reflecting the global standardization push across multiple jurisdictions. Manufacturers are increasingly focusing on obtaining dual or multiple certifications (e.g., Kosher, Halal, GMP, ISO) to access diverse global consumer bases and specialized markets. This complex segmentation ensures that market players can strategically position their products, minimizing substitution risks while maximizing profitability through specialized, value-added products that cater precisely to the stringent quality requirements of end-users across the healthcare and nutrition sectors.

- By Type:

- Green Ammonium Ferric Citrate

- Brown Ammonium Ferric Citrate

- By Application:

- Pharmaceuticals (Oral Iron Supplements, Injectables)

- Food & Beverage (Fortification, Coloring Agent E381, Stabilizer)

- Photographic Emulsions (Blueprint Paper, Printing)

- Chemical Synthesis & Analysis (Laboratory Reagents, Water Treatment)

- Other Industrial Uses

- By Grade:

- Pharmaceutical Grade (USP/EP/BP)

- Food Grade (FCC)

- Industrial Grade

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Ammonium Ferric Citrate Market

The value chain of the Ammonium Ferric Citrate market begins with the upstream procurement of essential raw materials, primarily high-purity ferric chloride, ferrous sulfate, and various forms of citric acid. Upstream analysis involves assessing the global availability, stability, and pricing volatility of these precursors, which are often commodities subject to global supply and demand fluctuations, notably impacting the final cost structure of AFC. Key upstream activities include the mining or procurement of iron ore and the industrial fermentation necessary to produce citric acid. Robust supply chain management and strategic long-term contracts with primary chemical suppliers are essential for AFC manufacturers to maintain consistent product quality and cost competitiveness, particularly for pharmaceutical-grade material which demands highly traceable and certified raw inputs.

The central manufacturing stage involves the highly technical chemical reaction between the ferric salt and citric acid, followed by purification, crystallization, and drying processes that dictate the final product's quality, solubility, and form (green vs. brown scales). This stage is capital and technology-intensive, requiring specialized reaction equipment and strict adherence to Current Good Manufacturing Practices (cGMP), especially when targeting the pharmaceutical market. Manufacturers focus heavily on optimizing yield and minimizing impurity profiles, often through proprietary filtration and drying techniques. Quality control and assurance are paramount, involving sophisticated analytical testing to ensure compliance with pharmacopoeial standards (e.g., assay content, heavy metals, microbial limits) before the product moves to downstream processes.

Downstream analysis focuses on the distribution channels and end-user consumption. Direct distribution channels involve large-volume transactions where AFC manufacturers supply directly to major pharmaceutical companies or large food processors who integrate the material into their final products. Indirect distribution relies on global and regional specialty chemical distributors and wholesalers who manage inventory, repackaging, and logistical support for smaller buyers and laboratory use. The choice of distribution channel depends on the required grade, volume, and geographic reach. The effectiveness of the downstream segment is highly dependent on cold chain logistics (for specific grades), regulatory documentation support, and the provision of technical service to ensure end-users utilize AFC correctly in complex formulations like injectable iron therapies or fortified dairy products.

Ammonium Ferric Citrate Market Potential Customers

The primary potential customers for Ammonium Ferric Citrate originate from three major industrial sectors: pharmaceutical and nutraceutical manufacturers, large-scale food and beverage processors, and specialty chemical and analytical laboratories. Pharmaceutical companies constitute the highest-value customer segment, utilizing AFC as a crucial active pharmaceutical ingredient (API) or essential excipient in the production of oral iron supplements, particularly for treating clinical iron deficiency anemia. These customers require AFC of the highest purity (USP/EP Grade), demanding stringent documentation, batch-to-batch consistency, and robust regulatory support, often entering into long-term supply agreements with certified manufacturers.

The second substantial customer base lies within the food and beverage industry, comprising companies specializing in mandatory and voluntary food fortification programs. This includes manufacturers of infant formula, breakfast cereals, flours, dairy alternatives, and energy drinks, where AFC is incorporated as a source of bioavailable iron (E381) and sometimes as a coloring agent or stabilizer. Food grade customers prioritize cost-effectiveness and certification (FCC Grade, Halal, Kosher), seeking products that minimally affect the sensory characteristics of the final food product, driving demand for innovations in taste-masking and solubility.

Further potential customers include organizations involved in water treatment, especially those employing chemical coagulation or analytical chemistry reagents, and specialty printing companies that utilize AFC in historical photographic processes like cyanotype (blueprint). While these customers represent smaller volume segments, they often require specialized product specifications or custom packaging, driving diversification among AFC suppliers. Overall, market outreach must be tailored to these distinct customer profiles, addressing the high quality requirements of pharma, the volume and cost-efficiency demands of food processing, and the technical specifications of specialty industrial applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 715.0 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adani Pharmachem, Avantor Inc., Merck KGaA, Sigma-Aldrich, Spectrum Chemical Mfg. Corp., Tata Chemicals Ltd., Global Calcium Pvt Ltd., Fuso Chemical Co., Ltd., Ferro Chem Industries, Jost Chemical Co., Wuxi Yangtong Chemical Co., Ltd., Loba Chemie Pvt. Ltd., American Elements, Hefei TNJ Chemical Industry Co., Ltd., T.R. Enterprises, GFS Chemicals, Inc., Macsen Laboratories, PMP Fermentation Products, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ammonium Ferric Citrate Market Key Technology Landscape

The technology landscape within the Ammonium Ferric Citrate market is primarily focused on achieving higher purity, improving stability, and ensuring cost-effective, scalable production compliant with global health standards. The core manufacturing process involves sophisticated methods of chemical synthesis and precise control over reaction parameters, requiring specialized equipment to manage exothermic reactions and crystallization processes. Key technological advancements center around continuous flow chemistry systems, which are increasingly replacing traditional batch processing. Continuous manufacturing offers superior control over nucleation and crystal growth, directly leading to better-defined particle size distribution and enhanced chemical purity, essential for pharmaceutical-grade AFC where bioavailability and dissolution rates are critical performance indicators. Furthermore, advanced filtration and membrane separation techniques are paramount in removing heavy metal contaminants and achieving ultra-low impurity profiles, meeting stringent regulatory limits imposed by the USP and European Pharmacopeia.

Beyond the synthesis phase, significant technological efforts are directed toward downstream processing and formulation enhancement. Specialized drying technologies, such as spray drying and vacuum drying, are employed to produce highly stable, non-hygroscopic AFC powders or granules, improving shelf life and handling characteristics. Crucially, in the pharmaceutical application segment, the industry is witnessing rapid adoption of microencapsulation and liposomal delivery systems. These technologies are utilized to encapsulate the AFC molecule, effectively masking its metallic taste and reducing the incidence of gastrointestinal side effects, which are common barriers to patient adherence to oral iron therapies. This technological innovation not only improves product acceptance but also allows for controlled release formulations, optimizing iron absorption kinetics.

In terms of quality control, the integration of advanced analytical chemistry tools represents a vital technological trend. High-Performance Liquid Chromatography (HPLC) coupled with mass spectrometry (MS) is increasingly used for ultra-trace impurity detection and complex chemical characterization, ensuring AFC batches are consistently compliant. Process Analytical Technology (PAT) deployment, often coupled with AI for real-time monitoring, allows manufacturers to adjust synthesis parameters dynamically, minimizing waste and maximizing efficiency. These technologies collectively drive the market towards standardized, high-volume production of specialized AFC variants that meet the increasingly sophisticated demands of the global nutraceutical and pharmaceutical industries seeking highly reliable and safe iron sources for large-scale public health intervention programs.

Regional Highlights

The dynamics of the Ammonium Ferric Citrate market exhibit significant regional variations, influenced by regulatory frameworks, public health needs, industrial infrastructure, and local dietary habits. Understanding these nuances is crucial for strategic market penetration and supply chain planning. The analysis covers North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA), recognizing their distinct contributions to global demand and supply.

Asia Pacific (APAC) stands out as the largest and fastest-growing market for Ammonium Ferric Citrate, driven primarily by high population density, high prevalence of iron deficiency anemia, and robust governmental initiatives focused on food fortification programs. Countries like India, China, and Indonesia are major consumers due to large-scale pharmaceutical manufacturing bases and massive public health campaigns targeting malnutrition. China is a major global producer of AFC, capitalizing on lower labor and input costs, although growing concerns about environmental standards are pushing manufacturers towards cleaner, high-quality production methods. The regional trend focuses on volume production for both domestic consumption and international export, requiring careful navigation of diverse national regulatory standards within the region.

North America (NA) represents a high-value market characterized by stringent quality standards (FDA regulations) and a strong focus on advanced pharmaceutical formulations. The demand here is driven by prescription-based oral supplements and a sophisticated nutraceutical industry emphasizing high-purity, specialty-grade AFC. While production volume is lower than in APAC, the average selling price for AFC products, particularly those used in advanced drug delivery systems, is significantly higher. Market growth is stable, underpinned by established healthcare infrastructure and a high degree of technological integration in formulation and quality control processes.

Europe closely mirrors the North American market in terms of quality requirements (EMA/EFSA standards), with a strong emphasis on traceability and sustainability in sourcing raw materials. The region's demand is balanced between pharmaceutical use and application in the refined European food sector as a permitted additive (E381). Regulatory pressures, particularly around acceptable daily intake levels and heavy metal limits, dictate market access. Germany, France, and the UK are key markets, driving innovation in encapsulation technologies to comply with patient-centric formulation requirements, ensuring that AFC products are well-tolerated and highly efficacious.

Latin America (LATAM) is emerging as a critical growth region, characterized by increasing healthcare expenditure and targeted government programs addressing nutritional deficiencies. Countries such as Brazil and Mexico present significant market potential for both imported and locally manufactured AFC, especially in the context of expanding access to generic medications and fortified staple foods. However, currency volatility and fragmented regulatory landscapes across different nations pose challenges, requiring adaptable market entry strategies focused on local partnership and efficient distribution networks to overcome logistical hurdles.

The Middle East & Africa (MEA) region shows substantial potential, particularly driven by public health needs and rapid population growth. The implementation of specific regional food fortification mandates, particularly in Saudi Arabia, UAE, and South Africa, is boosting the demand for food-grade AFC. Challenges include developing reliable distribution infrastructure and addressing the need for specialized Halal and Kosher certifications for food applications. The market often relies heavily on imports from APAC and European manufacturers, though regional players are gradually establishing local production capabilities to reduce dependency on international supply chains and improve lead times.

- Asia Pacific: Dominant market share and highest growth rate; driven by high anemia prevalence and extensive government fortification mandates in China and India.

- North America: High-value market focused on pharmaceutical-grade material; stable growth driven by established nutraceutical industry and strict FDA quality standards.

- Europe: High regulatory environment; strong demand for pharmaceutical and food-grade AFC (E381); emphasis on advanced formulation technology and sustainability.

- Latin America: Emerging market with high potential due to rising healthcare investment; growth focused on fortified foods and generic iron supplements, facing supply chain challenges.

- Middle East & Africa: Significant potential driven by population growth and new fortification policies; reliance on imports; increasing requirement for specific religious certifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ammonium Ferric Citrate Market.- Adani Pharmachem

- Avantor Inc.

- Merck KGaA

- Sigma-Aldrich

- Spectrum Chemical Mfg. Corp.

- Tata Chemicals Ltd.

- Global Calcium Pvt Ltd.

- Fuso Chemical Co., Ltd.

- Ferro Chem Industries

- Jost Chemical Co.

- Wuxi Yangtong Chemical Co., Ltd.

- Loba Chemie Pvt. Ltd.

- American Elements

- Hefei TNJ Chemical Industry Co., Ltd.

- T.R. Enterprises

- GFS Chemicals, Inc.

- Macsen Laboratories

- PMP Fermentation Products, Inc.

- Kanto Chemical Co., Inc.

- Parchem fine & specialty chemicals

Frequently Asked Questions

Analyze common user questions about the Ammonium Ferric Citrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Ammonium Ferric Citrate in the pharmaceutical industry?

Ammonium Ferric Citrate (AFC) is primarily used in pharmaceuticals as an oral iron supplement to treat or prevent iron deficiency anemia, owing to its high solubility and effective bioavailability compared to other iron salts. It is critical for restoring healthy hemoglobin levels in patients.

What is the difference between Green and Brown Ammonium Ferric Citrate?

The main difference lies in their chemical composition and iron content. Green AFC typically contains a higher iron concentration (16.5% to 18.5% Fe) and is often preferred for high-purity pharmaceutical applications, while Brown AFC is more commonly used as a food additive (E381) and for industrial coloring, exhibiting slightly varied iron content.

How do global food fortification initiatives impact the demand for AFC?

Global food fortification mandates, especially those endorsed by the WHO, significantly increase the demand for food-grade AFC (E381) as it is a highly soluble and cost-effective iron source used to fortify staple foods like flour, rice, and infant cereals in regions struggling with high rates of malnutrition and micronutrient deficiency.

What are the key technological challenges in AFC manufacturing?

The primary technological challenges involve achieving extremely high purity levels—especially the removal of heavy metal traces—and maintaining consistent batch-to-batch quality and specific crystal structure, which is vital for compliance with stringent regulatory standards (USP/EP) for therapeutic use.

Which geographical region leads the global consumption of Ammonium Ferric Citrate?

The Asia Pacific (APAC) region leads the global consumption of Ammonium Ferric Citrate, driven by its large population base, high prevalence of iron deficiency anemia, and extensive pharmaceutical manufacturing infrastructure catering to both regional and global demands for iron supplements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager