Amorphous Polyolefins Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441759 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Amorphous Polyolefins Market Size

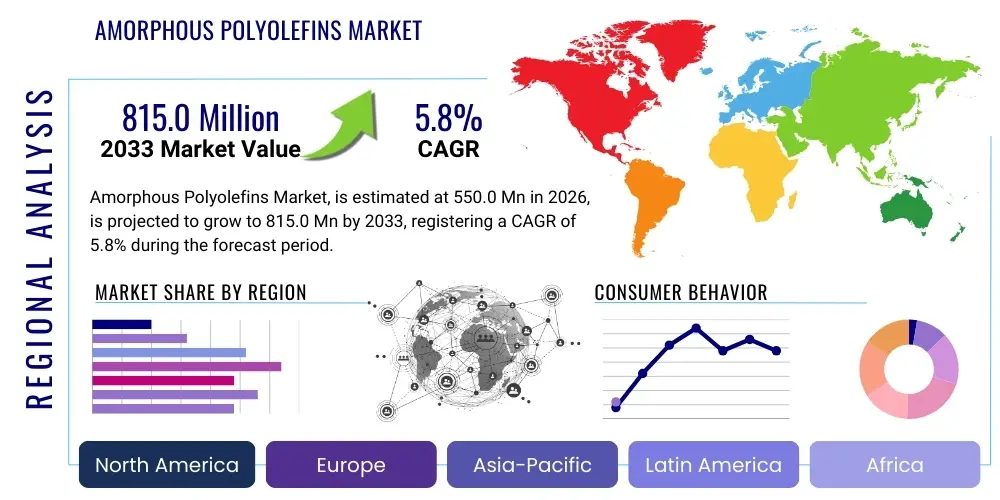

The Amorphous Polyolefins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550.0 million in 2026 and is projected to reach USD 815.0 million by the end of the forecast period in 2033.

Amorphous Polyolefins Market introduction

Amorphous Polyolefins (APOs), often referred to as Atactic Polypropylene (APP) or Amorphous Polyethylene, are specialty synthetic polymers characterized by their low molecular weight, lack of crystalline structure, and exceptional adhesive properties. Unlike semi-crystalline or highly crystalline polymers, APOs exhibit low melt viscosity, high thermal stability, and excellent compatibility with a wide array of waxes, resins, and other polymers, making them indispensable components in complex formulation systems. These unique properties allow APOs to serve primarily as high-performance components in hot melt adhesives, sealants, and coatings where flexibility, tackiness, and superior bond strength are crucial requirements. The distinct non-crystalline nature ensures that the material remains pliable and effective across varying temperature ranges, which is critical for demanding applications in the packaging, construction, and automotive sectors.

The primary applications of Amorphous Polyolefins center around their role as essential components in hot melt adhesives (HMAs), particularly in the production of nonwovens such as diapers and hygiene products, as well as in packaging applications like case and carton sealing. Their inherent chemical inertness and resistance to moisture and solvents further solidify their position in demanding environments, including roofing membranes, asphalt modification, and protective coatings for pipes and cables. The benefits derived from using APOs include enhanced cohesive strength, rapid setting times in adhesive formulations, and improved weatherability and flexibility when used as asphalt modifiers in road construction. Market growth is principally driven by the burgeoning demand for high-speed, durable packaging solutions globally, coupled with increasing infrastructure spending, particularly in the Asia Pacific region, necessitating high-performance road surfacing materials and protective sealants. Furthermore, the rising adoption of APOs in sound dampening materials within the automotive industry provides a sustained impetus for market expansion.

Amorphous Polyolefins Market Executive Summary

The global Amorphous Polyolefins market trajectory indicates robust expansion, largely steered by significant business trends focusing on sustainability and specialized end-use requirements. Key business stakeholders are investing heavily in developing bio-based or partially bio-sourced APO derivatives to align with stringent environmental regulations and rising consumer preference for eco-friendly materials, especially within the disposable hygiene and flexible packaging industries. Segmentation trends reveal that the hot melt adhesives application segment maintains the largest market share due attributed to its critical role in packaging, assembly, and disposable goods manufacturing. Conversely, the segment dedicated to asphalt modification is poised for the fastest compound annual growth, driven by massive infrastructure projects globally and the need for pavement materials offering enhanced durability, rutting resistance, and crack prevention in diverse climatic conditions. Strategic mergers and acquisitions among key manufacturers are prevalent, aiming to consolidate raw material sourcing capabilities and expand geographic reach, particularly into rapidly industrializing economies.

Regionally, Asia Pacific (APAC) stands out as the predominant and fastest-growing market for Amorphous Polyolefins, fueled by rapid urbanization, significant investments in construction, and the expansion of the manufacturing base, particularly in China, India, and Southeast Asian nations. North America and Europe, characterized by mature automotive and hygiene industries, exhibit stable demand driven by innovation focused on light weighting materials and stricter performance standards for hot melt sealants. The trend toward specialization is evident across all regions, with manufacturers tailoring APO molecular weights and melt indices to meet precise performance specifications required by the nonwovens and high-performance automotive bonding markets. Furthermore, fluctuating feedstock prices, primarily derived from petroleum cracking processes, pose a structural challenge, compelling manufacturers to optimize supply chain efficiencies and explore alternative, more stable sourcing methodologies, including utilization of refinery off-gases, which impacts overall profitability metrics across the value chain.

AI Impact Analysis on Amorphous Polyolefins Market

Common user questions regarding AI's impact on the Amorphous Polyolefins market typically revolve around how artificial intelligence and machine learning (ML) can optimize complex polymerization processes, streamline product formulation, and enhance supply chain resilience given the volatility of petrochemical feedstocks. Users often express concerns or expectations related to AI's ability to predict and model structure-property relationships in APOs, enabling the rapid development of novel grades tailored for specialized end-use applications such as advanced medical adhesives or high-performance automotive parts. The key themes summarized from user inquiries highlight the expectation that AI will significantly reduce R&D cycles, improve manufacturing yield by minimizing off-spec batches through real-time predictive analytics, and ultimately drive down operational costs, making APOs more competitive against traditional polymer alternatives. Furthermore, there is considerable interest in AI-powered demand forecasting tools essential for navigating the highly cyclical nature of the packaging and construction sectors, which are major consumers of APOs.

The integration of AI in the Amorphous Polyolefins industry is transitioning from conceptual stage research to operational implementation, primarily focusing on process optimization. ML algorithms are being deployed to analyze vast datasets pertaining to catalytic conditions, temperature profiles, pressure fluctuations, and reactor residence times in Ziegler-Natta or metallocene polymerization facilities. This analytical capability allows manufacturers to establish predictive models that maintain optimal operating parameters, thus ensuring highly consistent product quality and reducing energy consumption per unit of production. Moreover, AI-driven digital twin technology is increasingly used to simulate the compounding process of APOs with additives like tackifiers, plasticizers, and waxes, facilitating faster, more precise formulation adjustments required for niche applications, such as specific medical-grade hot melts that demand exceptional purity and biocompatibility standards. The long-term impact is expected to foster 'smart' manufacturing plants capable of autonomous quality control and predictive maintenance, minimizing unplanned downtime.

- AI optimizes polymerization reaction parameters, enhancing yield and product consistency for specific molecular weights.

- Machine Learning models accelerate the formulation of complex hot melt adhesive blends, predicting optimal tackifier and wax ratios.

- Predictive analytics minimizes feedstock price risk by optimizing procurement strategies based on global energy market trends.

- Digital twin technology simulates compounding and extrusion processes, reducing material waste during R&D and scale-up phases.

- AI-powered quality control systems utilize image recognition and sensor data to ensure adherence to stringent product specifications in real time.

- Improved supply chain logistics and demand forecasting driven by AI enhance inventory management for seasonal demands in construction and packaging industries.

DRO & Impact Forces Of Amorphous Polyolefins Market

The Amorphous Polyolefins market dynamics are heavily influenced by a critical balance of robust demand drivers, structural restraints, and emerging opportunities that collectively define the impact forces shaping its growth trajectory. The principal driver is the explosive global demand for disposable hygiene products, particularly in developing economies, where APO-based hot melt adhesives are essential for constructing nonwoven structures with reliable integrity and softness. Concurrently, escalating global infrastructure development mandates high-performance materials for road construction and roofing, propelling the demand for APOs as effective asphalt and bitumen modifiers, offering superior thermal and mechanical performance. However, this growth momentum is consistently tempered by significant structural restraints, notably the inherent volatility and dependence on crude oil prices, which directly impact the cost of petrochemical feedstocks like propylene and ethylene. Furthermore, intense competition from alternative adhesive technologies, such as pressure-sensitive adhesives (PSAs) based on Styrenic Block Copolymers (SBCs) or ethylene vinyl acetate (EVA), particularly in cost-sensitive packaging applications, restricts market expansion in certain segments.

Impact forces are predominantly driven by technological shifts and regulatory compliance. Opportunities are substantially generated by the rapid advancements in metallocene catalyst technology, which allows for the production of APOs with narrower molecular weight distributions and more controlled stereochemistry, leading to superior performance characteristics (e.g., higher heat resistance and better sprayability) sought after in specialized industrial assembly and automotive bonding. A significant emerging opportunity lies in the development and commercialization of bio-based Amorphous Polyolefins, derived from renewable sources like bio-propylene, addressing sustainability concerns and potentially mitigating the reliance on fluctuating fossil fuel markets. This shift is strongly supported by regulatory bodies, particularly in Europe, favoring materials with reduced carbon footprints and improved end-of-life recyclability. Successful navigation of these forces requires manufacturers to prioritize backward integration for feedstock security and aggressive investment in R&D focusing on specialty, high-value applications where APOs offer unique performance advantages that alternatives cannot easily replicate.

The impact forces analysis also highlights the increasing stringency of environmental, health, and safety (EHS) regulations globally, particularly concerning volatile organic compounds (VOCs) emissions from adhesive and coating systems. This regulatory push serves as both a restraint and an opportunity. It is a restraint because manufacturers must invest heavily in reformulation and testing, increasing operating expenditure. Yet, it presents a substantial opportunity for APOs, which often naturally contribute to lower VOC formulations compared to solvent-based systems, thus enabling end-users in automotive and furniture manufacturing to meet increasingly strict indoor air quality standards. The geographical distribution of infrastructure spending further acts as a major impact force; robust government stimulus packages targeting civil engineering projects translate directly into surging demand for asphalt modifiers, effectively boosting regional market volumes and shifting production focus toward construction-grade APOs.

Segmentation Analysis

The Amorphous Polyolefins market is fundamentally segmented across various dimensions, including product type, application, and end-use industry, reflecting the diverse functional requirements these polymers fulfill across global industrial sectors. Product segmentation primarily differentiates between Amorphous Polypropylene (APP) and Amorphous Polyethylene (APE), with APP typically dominating due to its superior performance profile in adhesive formulations, offering a balance of tack, thermal stability, and low-temperature flexibility. Segmentation by application highlights the polymer’s versatility, ranging from critical roles in hot melt adhesives, which represents the largest revenue generator, to specialized use in sealants, coatings, and modifiers for asphalt and bitumen, each demanding specific material properties tailored to performance specifications, such as elasticity or rigidity.

Further granularity is achieved through end-use industry segmentation, categorizing consumption within major sectors such as packaging, construction, automotive, and nonwovens. The packaging industry acts as a primary consumption engine, relying on APO-based HMAs for high-speed carton and case sealing due to their fast set times and reliable adhesion to diverse substrates. The construction sector, encompassing both roofing and road paving, is the critical area driving demand for high-grade modifiers. Analyzing these segments is crucial for strategic planning, as it reveals that while nonwovens offer high-volume consistency, the automotive segment demands smaller volumes but requires extremely high-performance APO grades for interior assembly, sound dampening, and carpet backing, commanding premium pricing and driving product innovation toward enhanced thermal endurance and noise reduction capabilities. The evolving landscape suggests a steady shift towards higher-performance APO grades suitable for specialty applications.

- By Type:

- Amorphous Polypropylene (APP)

- Amorphous Polyethylene (APE)

- Amorphous Poly Alpha Olefins (APAO)

- By Application:

- Hot Melt Adhesives (HMA)

- Sealants

- Coatings

- Asphalt and Bitumen Modification

- Compounding and Polymer Modification

- By End-Use Industry:

- Packaging

- Construction (Roofing, Road Paving)

- Automotive (Interior Trim, Sound Dampening)

- Nonwovens and Hygiene Products

- Electronics

- Others (Footwear, Furniture Assembly)

- By Grade:

- Standard Grade

- High-Performance Grade

Value Chain Analysis For Amorphous Polyolefins Market

The value chain for the Amorphous Polyolefins market initiates with the upstream sourcing of crucial petrochemical feedstocks, primarily propylene and ethylene, which are derived from refining and cracking processes. Key upstream suppliers include large integrated oil and gas companies and chemical producers possessing access to affordable raw materials, highly influencing the final production cost of APOs due to the price volatility inherent in the energy sector. The core manufacturing stage involves specialized polymerization processes, predominantly utilizing Ziegler-Natta or increasingly sophisticated metallocene catalysts to produce the low molecular weight, amorphous polymer structure. This stage involves significant capital expenditure and technological know-how to achieve specific melt viscosity and softening points required by end-users. Manufacturers often employ compounding processes downstream, where the neat APO resin is blended with additives, tackifiers, oils, and waxes to create customized formulations suitable for specific application needs, such as nonwoven adhesives or asphalt modifiers.

Distribution within the APO market utilizes both direct and indirect channels. Large, multinational APO producers often maintain direct sales forces and technical service teams to serve major, high-volume downstream customers, suchoning large adhesive formulators, integrated construction materials companies, and tier-one automotive suppliers. This direct engagement is crucial for offering specialized technical support, ensuring product integration, and managing highly complex customized orders. Conversely, indirect distribution channels involve strategic partnerships with regional chemical distributors and specialized material brokers who handle smaller volume transactions and ensure market penetration into fragmented end-use markets, such as small-to-medium-sized packaging operations or local construction firms. These distributors play a vital role in localized inventory management and just-in-time delivery, particularly in geographically diverse regions like Asia Pacific.

The downstream analysis reveals that the largest consumers are hot melt adhesive formulators and compounders. These entities procure APOs as base polymers and formulate the final adhesive products sold to the ultimate end-users—the packaging plants, nonwoven converters, and construction contractors. The performance of the final end-product, such as the bond strength of a diaper or the flexibility of road pavement, directly depends on the consistency and specialized properties of the APO supplied. Therefore, technological collaboration and quality assurance throughout the value chain, from feedstock to final formulation, are paramount for maintaining market competitiveness and meeting stringent industry standards imposed by sectors like healthcare and food contact packaging.

Amorphous Polyolefins Market Potential Customers

The primary consumers and end-users of Amorphous Polyolefins span across several high-volume industrial sectors, driven by the need for reliable bonding, sealing, and modification performance. Potential customers predominantly include major global manufacturers of hot melt adhesives (HMAs), who utilize APOs as a critical backbone polymer for producing high-tack, low-viscosity formulations required in fast-paced production lines. Large packaging and converting companies constitute a major buyer base, relying on APO-based HMAs for robust sealing of corrugated boxes, laminates, and flexible packaging solutions designed for high throughput and diverse material compatibility. Another significant cluster of buyers exists within the nonwovens sector, comprising global producers of disposable hygiene products suching diapers, adult incontinence products, and feminine care items, where APOs provide the essential structural and elastic bonding necessary for product integrity and consumer comfort.

The secondary, yet rapidly expanding, segment of potential customers includes specialized contractors and material suppliers within the infrastructure and construction industries. These buyers utilize APOs primarily as modifiers for asphalt and bitumen, targeting improved road durability, reduced cracking, and enhanced resistance to extreme temperatures. Furthermore, automotive component manufacturers are crucial buyers, especially those specializing in interior trim, carpet backing, and noise, vibration, and harshness (NVH) mitigation solutions, where APOs are incorporated into specialized coatings and sound-dampening pads due to their viscoelastic properties and strong adhesion to metal and plastic substrates. Direct sales are often crucial in the construction and automotive sectors, demanding specific technical certifications and close supply chain integration for just-in-time delivery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Million |

| Market Forecast in 2033 | USD 815.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Chemical Company, LyondellBasell Industries N.V., REXtac LLC, Evonik Industries AG, Huntsman Corporation, Chevron Phillips Chemical Company LLC, TotalEnergies, Sinopec Group, INEOS Group Holdings S.A., Dairen Chemical Corporation, SK Global Chemical Co., Ltd., Wacker Chemie AG, Dow Inc., Mitsui Chemicals, Inc., Braskem S.A., Solvay S.A., Versalis S.p.A., Lubrizol Corporation, 3M Company, BASF SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amorphous Polyolefins Market Key Technology Landscape

The technological landscape of the Amorphous Polyolefins market is dominated by specific polymerization technologies aimed at controlling the stereoregularity and molecular architecture necessary for amorphous characteristics. The traditional production method heavily relies on Ziegler-Natta catalysis systems, which, through careful manipulation of temperature and co-monomer incorporation, manage to produce a predominantly atactic or random molecular structure characteristic of APOs. However, the modern technology shift is increasingly favoring advanced Metallocene Catalyst Systems. Metallocene catalysis offers superior control over the polymerization process, enabling manufacturers to produce APOs with a much narrower molecular weight distribution, leading to enhanced performance consistency, lower melt viscosity for better processing, and tailored properties like improved thermal stability and flexibility, which are highly valued in high-end adhesive and automotive applications.

Beyond the core polymerization technology, significant innovation is focused on process optimization, including reactor design and continuous manufacturing techniques, to improve efficiency and reduce the energy footprint associated with APO production. Manufacturers are also heavily investing in compounding and formulation technologies. This downstream technical focus involves optimizing mixing techniques and utilizing advanced process monitoring tools to ensure uniform dispersion of APOs with various additives (tackifiers, plasticizers, antioxidants) to meet specific customer requirements, such as enhanced sprayability for nonwoven adhesives or increased UV resistance for roofing sealants. The development of advanced analytical testing methods, including sophisticated rheometers and thermal analysis tools, plays a crucial supporting role in ensuring batch-to-batch consistency and validating compliance with increasingly strict performance standards across end-use industries.

The future technology landscape is centered on sustainable innovation, specifically the technological breakthroughs enabling the viable large-scale production of bio-based Amorphous Polyolefins. This involves either utilizing bio-derived feedstocks (e.g., bio-propylene or bio-ethylene produced via fermentation or biomass gasification) or developing novel catalytic processes that allow for the incorporation of renewable components while maintaining the critical amorphous structure and performance characteristics. Additionally, advancements in computational chemistry and predictive modeling are being integrated to simulate polymerization reactions and molecular interactions, further accelerating the design and testing of new APO grades with optimized tack and cohesion profiles, bypassing extensive and time-consuming physical lab experimentation.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily driven by expansive infrastructure development in China and India, leading to high demand for APOs in asphalt modification and protective coatings for new construction. Furthermore, the immense population base and improving disposable incomes are fueling the explosive growth of the disposable hygiene (nonwovens) and packaging sectors, especially in Southeast Asia, necessitating high volumes of hot melt adhesives. Government initiatives promoting domestic manufacturing and favorable investment policies further incentivize market growth, positioning APAC as the global consumption hub for Amorphous Polyolefins.

- North America: This region maintains a strong, mature market, characterized by high adoption rates in the automotive and high-performance industrial adhesives sectors. Demand is sustained by stringent performance requirements in vehicle manufacturing, particularly for lightweighting and NVH reduction, requiring specialized APO grades. The construction sector, particularly roofing and commercial sealing applications, provides stable demand. Innovation here is heavily focused on sustainability, driven by large corporate users seeking low-VOC and bio-based adhesive solutions to comply with increasingly strict environmental regulations.

- Europe: Europe is characterized by strict environmental and regulatory oversight, which both challenges and drives innovation. The market exhibits steady growth, fueled by the push towards circular economy principles, leading to high demand for APO grades that facilitate recycling and offer low-emission characteristics in construction and packaging. The region is a key adopter of advanced metallocene-catalyzed APOs for premium applications in technical coatings and high-end automotive assembly, where performance and reliability are prioritized over cost. Germany, France, and Benelux countries are central to European consumption due to their robust manufacturing and automotive bases.

- Latin America (LATAM): The LATAM market, while smaller, offers significant growth potential, linked directly to recovering construction sectors and expanding manufacturing capabilities, notably in Brazil and Mexico. The nonwovens and consumer goods packaging sectors are primary demand drivers. Market growth is sensitive to local economic stability and foreign investment influx, focusing on basic and standard APO grades for high-volume, cost-sensitive applications.

- Middle East and Africa (MEA): Growth in MEA is primarily attributed to large-scale construction projects, especially within the GCC nations (UAE, Saudi Arabia), where APOs are critical for high-temperature asphalt modification and specialized sealants designed for extreme desert climates. The region's proximity to feedstock sources (crude oil and natural gas) also facilitates regional production capabilities, although local consumption capacity remains focused on infrastructure and rapid urbanization needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amorphous Polyolefins Market.- Eastman Chemical Company

- LyondellBasell Industries N.V.

- REXtac LLC

- Evonik Industries AG

- Huntsman Corporation

- Chevron Phillips Chemical Company LLC

- TotalEnergies

- Sinopec Group

- INEOS Group Holdings S.A.

- Dairen Chemical Corporation

- SK Global Chemical Co., Ltd.

- Wacker Chemie AG

- Dow Inc.

- Mitsui Chemicals, Inc.

- Braskem S.A.

- Solvay S.A.

- Versalis S.p.A.

- Lubrizol Corporation

- 3M Company

- BASF SE

Frequently Asked Questions

Analyze common user questions about the Amorphous Polyolefins market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Amorphous Polyolefins (APOs) and their primary function in industrial applications?

Amorphous Polyolefins are non-crystalline, low molecular weight polymers typically derived from propylene or ethylene. Their primary function is serving as base polymers or modifiers in hot melt adhesives, sealants, and coatings, providing superior flexibility, high tack, and thermal stability crucial for packaging, nonwovens, and construction materials.

Which application segment holds the largest share of the Amorphous Polyolefins market?

The Hot Melt Adhesives (HMA) segment holds the largest market share. APOs are essential in HMAs for high-speed packaging, product assembly, and the manufacture of disposable hygiene items (nonwovens) due to their fast set times and reliable bonding characteristics on diverse substrates.

What are the key drivers propelling the growth of the APO market?

Key growth drivers include escalating global demand for nonwoven disposable hygiene products, massive government investments in infrastructure and road construction (requiring asphalt modification), and the growing need for high-performance, low-VOC adhesive systems in automotive and construction industries worldwide.

How do volatile raw material prices impact the Amorphous Polyolefins industry?

Volatile raw material prices, primarily propylene and ethylene derived from petrochemical cracking, significantly restrain the APO market by creating cost uncertainty, fluctuating profit margins for manufacturers, and necessitating complex hedging and supply chain optimization strategies to mitigate financial risk.

Which regional market is projected to exhibit the fastest growth for Amorphous Polyolefins?

The Asia Pacific (APAC) region is projected to be the fastest-growing market. This accelerated growth is attributed to rapid industrialization, extensive construction and infrastructure projects, and the expanding consumer base driving demand in the packaging and nonwovens sectors across countries like China and India.

The preceding report represents a detailed analysis of the Amorphous Polyolefins market, synthesizing key data on size projections, operational dynamics, technological landscapes, and strategic competitive positioning across major global regions, tailored for expert market insight.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager