Amorphous Ribbons Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443022 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Amorphous Ribbons Market Size

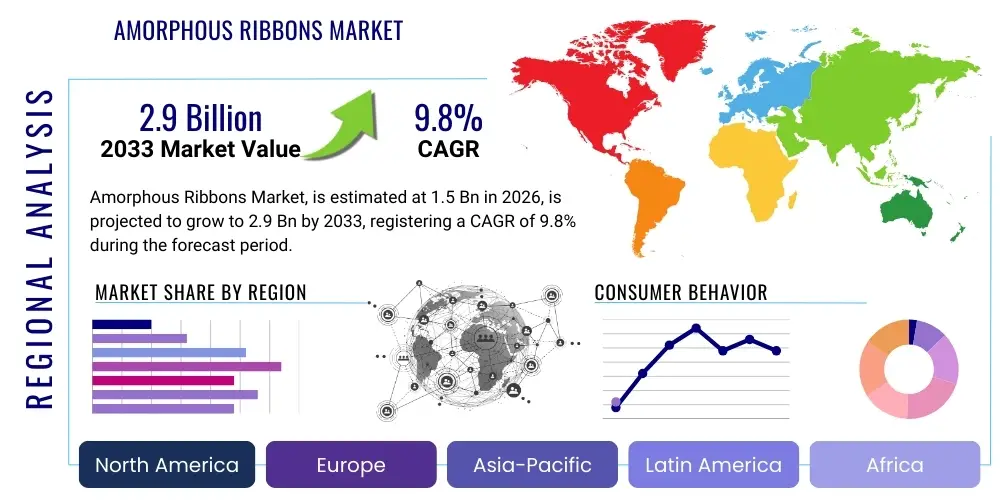

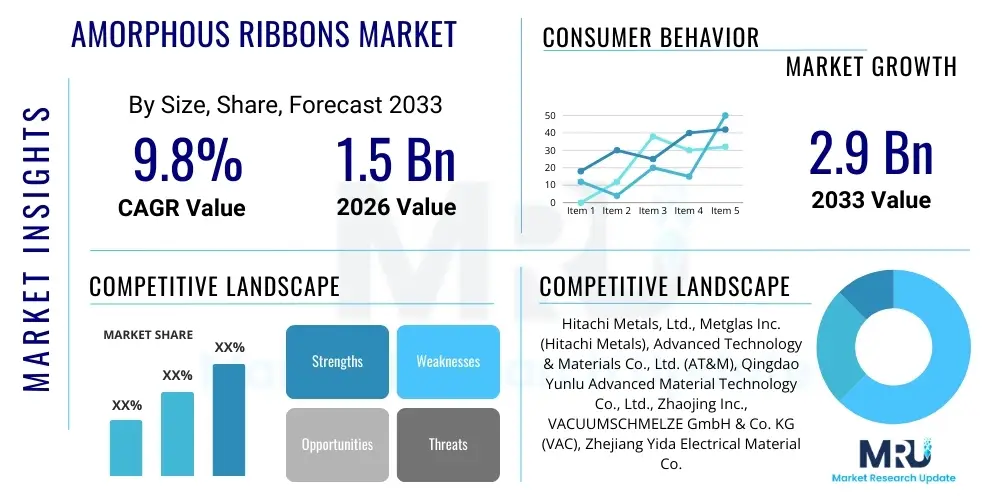

The Amorphous Ribbons Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

The expansion of the Amorphous Ribbons Market is primarily fueled by the global imperative for improved energy efficiency, particularly in power infrastructure and electronic devices. Amorphous ribbons, characterized by their non-crystalline structure, offer exceptional soft magnetic properties, resulting in significantly lower core losses compared to traditional silicon steel. This efficiency advantage positions them as a critical material for next-generation distribution transformers, inductors, and various high-frequency power electronics applications. Regulatory pressures across major economies, enforcing stricter energy conservation standards for electrical grids, are compelling utilities and manufacturers to adopt these advanced materials, ensuring sustained market growth throughout the forecast period.

Furthermore, the rapid proliferation of electric vehicles (EVs), renewable energy infrastructure (solar and wind), and advanced data centers is driving increased demand for compact, efficient, and reliable power components. Amorphous ribbons enable the design of smaller and lighter components while maintaining or improving power handling capabilities, addressing critical challenges in space-constrained and weight-sensitive applications. The material science advancements, particularly in developing new metallic glass compositions that are more cost-effective and exhibit enhanced performance characteristics (such as higher saturation induction), are further accelerating their commercial viability and market penetration into niche and high-volume industrial segments globally.

Amorphous Ribbons Market introduction

The Amorphous Ribbons Market encompasses the production, distribution, and utilization of metallic alloys processed rapidly from the melt state, preventing crystallization and forming a non-crystalline, or 'glassy,' structure, typically in the form of thin ribbons. These materials, also known as metallic glasses or amorphous metals, possess highly desirable properties, particularly exceptional soft magnetic characteristics, high strength, and superior corrosion resistance. The unique atomic disorder eliminates traditional crystal defects, leading to drastically reduced hysteresis losses and core losses compared to conventional crystalline magnetic materials, making them pivotal in enhancing energy conversion efficiency.

The primary product application areas for amorphous ribbons span across the entire energy infrastructure, ranging from large-scale power distribution systems to micro-electronic devices. Major applications include cores for high-efficiency distribution transformers, essential components in power supplies (such as switched-mode power supplies - SMPS), magnetic shielding, anti-theft devices, and various precision sensors. The intrinsic benefits of using amorphous ribbons—chiefly their ability to significantly lower standby power consumption and operating temperatures—translate directly into substantial operational cost savings and reduced environmental impact, strongly positioning them as indispensable materials in the transition towards smart grid technologies and high-density power management.

Key driving factors propelling the market include stringent governmental regulations aimed at curbing carbon emissions and improving power grid efficiency, particularly in regions like North America and Europe. The escalating global investments in smart grid infrastructure and the explosive growth of the Electric Vehicle (EV) industry, requiring efficient onboard charging and power conversion components, further underpin market expansion. The technological breakthroughs in mass production techniques, such as Planar Flow Casting, are steadily reducing manufacturing costs, making amorphous metal components competitive against traditional materials and thereby fostering widespread industrial adoption across diverse global economies.

Amorphous Ribbons Market Executive Summary

The Amorphous Ribbons Market is defined by robust technological innovation centered on achieving superior energy efficiency in power transmission and conversion systems. Business trends indicate a strategic focus on expanding production capacity in Asia Pacific, which serves as the primary manufacturing hub for electronic goods and transformers. Companies are heavily investing in R&D to develop novel iron-based (Fe-based) amorphous alloys that offer optimal balance between cost and magnetic performance, targeting mass applications like grid distribution transformers. A critical business trend involves vertical integration among major players, securing the supply chain from raw material processing (high-purity metals) to the final component manufacturing (wound cores), thereby ensuring quality control and cost competitiveness in a fiercely competitive environment. Furthermore, market participants are establishing strategic alliances with utilities and power electronics designers to co-develop custom solutions tailored for specific regional efficiency mandates.

Regionally, Asia Pacific (APAC) continues to dominate the market share, driven by rapid industrialization, massive power infrastructure projects, and supportive government initiatives (e.g., in China and India) promoting energy-efficient grid components. North America and Europe, characterized by mature electricity grids and strong environmental consciousness, represent high-value markets focusing on premium, high-frequency amorphous cores used in advanced power electronics, solar inverters, and high-performance electric vehicle charging systems. Regional trends show a significant uptick in demand for Cobalt-based (Co-based) amorphous ribbons in specialized sensor applications and high-frequency noise suppression components within these developed economies, emphasizing precision and reliability over sheer volume production. Latin America and MEA are emerging markets, primarily adopting amorphous core technology through imports driven by modernization efforts and infrastructure expansion.

Segmentation trends highlight the continued dominance of the iron-based segment due to its cost-effectiveness and suitability for distribution transformer cores, which account for the largest application volume. However, the application segment is showing the fastest growth rate in power electronics and inductors, reflecting the shift towards high-frequency operation and miniaturization in consumer electronics and automotive systems. There is an increasing demand for specialized, low-magnetostriction amorphous ribbons for advanced metering and current sensing applications, driving innovation within the specialized alloy composition segments. The convergence of smart grid technology and the push toward decentralized renewable energy generation sources are continuously reshaping demand patterns across all major end-user segments.

AI Impact Analysis on Amorphous Ribbons Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Amorphous Ribbons Market revolve primarily around four key areas: accelerated material discovery, optimization of complex manufacturing processes, predictive quality control, and enhanced supply chain efficiency. Users frequently ask how AI can help identify new, superior metallic glass compositions faster than traditional trial-and-error methods, specifically targeting alloys with higher saturation induction (Bs) or reduced costs. There is also strong interest in utilizing Machine Learning (ML) models to fine-tune the highly sensitive rapid solidification techniques—such as Planar Flow Casting—to ensure ribbon uniformity, thickness control, and minimal defects, which are critical determinants of magnetic performance. Concerns often center on the computational resources required and the integration challenges of predictive maintenance systems powered by AI in traditional manufacturing settings. Overall, the expectation is that AI will be a transformative tool, speeding up R&D cycles and significantly lowering the production variability and resulting costs of amorphous ribbons, thereby improving market accessibility and competitiveness against traditional crystalline materials.

AI's role in optimizing the production workflow, from the initial melt composition to the final annealing process, is becoming crucial for maintaining competitive advantages. AI algorithms can analyze real-time data from casting nozzles, cooling rates, and environmental conditions to dynamically adjust process parameters, ensuring optimal ribbon quality and consistency across large batches. Furthermore, in the realm of predictive maintenance, AI models monitor equipment wear and potential failures in highly expensive machinery, minimizing downtime and maximizing throughput. This data-driven approach allows manufacturers to achieve the high tolerances required for advanced power electronics applications, where even slight material inconsistencies can lead to performance degradation. The implementation of AI is thus not merely incremental improvement but a fundamental shift towards smart manufacturing in this specialized material sector.

The influence of AI extends into demand forecasting and supply chain management for the specialized raw materials (e.g., high-purity Boron, Silicon, and specific transition metals). By analyzing global energy policy changes, EV adoption rates, and semiconductor manufacturing cycles, AI provides highly accurate predictions of future demand, enabling manufacturers to optimize inventory levels and negotiate raw material contracts more effectively. This resilience built into the supply chain, supported by AI-driven analytics, is vital for a niche market like amorphous ribbons, where sudden shifts in demand or supply shortages can significantly impact production schedules and profitability. The integration of AI tools is moving amorphous ribbon production towards a highly automated, adaptive, and efficient operational model.

- AI accelerates the discovery of novel metallic glass compositions by modeling complex phase diagrams and predicting optimal cooling rates.

- Machine Learning (ML) algorithms optimize the Planar Flow Casting process parameters, ensuring uniform ribbon thickness and reducing defects.

- Predictive maintenance systems utilize AI to minimize downtime of high-cost casting equipment, maximizing operational efficiency.

- AI-driven quality control analyzes high-speed imaging of the ribbon surface for immediate identification and correction of material flaws.

- Advanced analytics enhance supply chain resilience by accurately forecasting demand from utility, automotive, and electronics sectors.

- AI assists in optimizing magnetic annealing processes to achieve targeted soft magnetic properties (low core loss, high permeability).

DRO & Impact Forces Of Amorphous Ribbons Market

The Amorphous Ribbons Market is primarily propelled by global regulatory mandates emphasizing energy efficiency, specifically the adoption of high-efficiency distribution transformers (Drivers). These materials offer significantly reduced no-load losses, aligning perfectly with initiatives like the Minimum Energy Performance Standards (MEPS) established globally. A major restraint, however, remains the high initial capital expenditure required for specialized production equipment (such as planar flow casters) and the relatively higher cost of the final amorphous core compared to conventional silicon steel cores, which often deters immediate mass adoption in cost-sensitive markets. Significant opportunity exists in the burgeoning Electric Vehicle (EV) sector, where amorphous metals are ideal for high-frequency onboard chargers and traction motor components, and in the renewable energy sector for efficient solar inverters and wind turbine systems. The core impact force shaping the market dynamics is the dual pressure of technological differentiation (performance superiority) versus cost competitiveness (manufacturing complexity), forcing manufacturers to constantly innovate production scalability and material compositions.

Drivers are strongly influenced by geopolitical shifts towards sustainable development and energy independence. The push towards smart grids necessitates components that can handle variable loads with minimal loss, a characteristic inherent to amorphous cores. Furthermore, the miniaturization trend in consumer electronics and medical devices requires power components that are compact yet extremely efficient, bolstering demand for high-performance, thin amorphous ribbons. Conversely, market restraints include technical limitations related to the material’s brittleness, which complicates post-processing and handling, requiring specialized manufacturing techniques for winding and assembly. Supply chain maturity also remains a constraint; while primary metal sources are abundant, the availability of specialized, high-purity raw material blends necessary for specific magnetic properties can sometimes pose logistical challenges and price volatility.

The core opportunities lie in advanced material engineering, focusing on new chemistries that improve thermal stability and mechanical robustness, expanding their suitability into high-temperature, high-stress applications like aerospace and high-speed rail. Another critical opportunity resides in exploiting the high magneto-impedance effect in amorphous materials for next-generation, highly sensitive magnetic sensors used in industrial automation and security systems. The interplay of these forces ensures a dynamic market landscape where technological leaders who can successfully scale production and manage manufacturing complexity while simultaneously lowering the material cost relative to performance gains will capture significant market share. The regulatory environment acts as a consistent tailwind, providing a stable foundation for demand growth, while cost and technical processing difficulties present short-term hurdles that require dedicated R&D efforts to overcome.

Segmentation Analysis

The Amorphous Ribbons Market is comprehensively segmented based on material type, thickness, application, and geography, reflecting the diverse requirements of end-user industries ranging from utilities to high-tech electronics. Material segmentation is crucial as different compositions (Iron-based, Cobalt-based, etc.) dictate the final magnetic and mechanical properties, directly influencing suitability for specific applications like power transformers versus high-frequency inductors. The application segment, which includes distribution transformers, power electronics, and sensors, provides the clearest view of market demand volume and growth trajectories, with the energy efficiency mandates driving the transformer segment, and technology miniaturization fueling the power electronics segment. Thickness segmentation, though technical, is vital for performance optimization, with thinner ribbons typically preferred for higher frequency operations in sensitive electronic circuits.

The dominant material segment is Iron-based (Fe-based) amorphous ribbons due to their superior combination of low cost, high saturation magnetization, and suitability for 50/60 Hz distribution transformers, representing the largest volume demand globally. Growth in this segment is intrinsically tied to global power grid investment and replacement cycles. However, the fastest growth is observed in specialized materials like Cobalt-based (Co-based) amorphous ribbons, which offer near-zero magnetostriction and exceptional thermal stability, making them indispensable for highly sensitive magnetic sensors, advanced anti-theft systems, and precision measuring instruments where minimal signal distortion is paramount. The increasing complexity of industrial automation and security systems ensures sustained high-CAGR growth for these specialized compositions.

Further analysis of the application segments reveals that while distribution transformers remain the revenue backbone, the power electronics segment—including inductors, chokes, and DC/DC converters crucial for EV infrastructure, solar inverters, and high-performance computing—is rapidly gaining prominence. This trend is driven by the industry-wide necessity to increase power density and operating frequencies to achieve system miniaturization without compromising efficiency. Manufacturers are developing customized amorphous core shapes and optimized ribbon formulations to meet these demanding specifications. Geographic segmentation reinforces the importance of Asia Pacific as both a manufacturing base and a high-demand end-user market, propelled by state-led investment in large-scale energy infrastructure and the mass production of electronic goods.

- By Material Type:

- Iron-Based Amorphous Ribbons (Fe-based)

- Cobalt-Based Amorphous Ribbons (Co-based)

- Other Amorphous Alloys (Ni-based, Fe-Ni alloys, etc.)

- By Application:

- Distribution Transformers (Power Grid Infrastructure)

- Power Electronics (SMPS, Inverters, Converters)

- Inductors and Chokes

- Magnetic Sensors and Measurement Devices

- Other Applications (Anti-Theft Systems, Magnetic Shielding)

- By Thickness:

- Standard Thickness (e.g., >25 µm)

- Thin Ribbons (e.g., 20 µm to 25 µm)

- Ultra-Thin Ribbons (e.g., <20 µm)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Amorphous Ribbons Market

The value chain for the Amorphous Ribbons Market is intricate, beginning with the sourcing of highly pure metallic raw materials, primarily transition metals (Iron, Cobalt, Nickel) and metalloids (Boron, Silicon, Phosphorus). Upstream analysis focuses on securing stable, high-quality inputs, as impurity levels directly impact the magnetic properties of the final ribbon. Suppliers of high-purity specialty alloys hold significant power in this phase, often leading to integrated strategies by major ribbon producers to control quality and cost. The manufacturing stage, or the core conversion process, involves melting these alloys and rapidly solidifying them using sophisticated techniques like Planar Flow Casting, which requires substantial specialized capital investment and technical expertise, representing the highest value-add activity in the chain.

Following the conversion, the amorphous ribbons undergo critical downstream processing, including cutting, winding, and thermal annealing, which is essential to relieve internal stresses and optimize the soft magnetic properties for specific applications. The downstream users, primarily manufacturers of electrical components (transformer cores, inductors), often require custom specifications regarding core geometry and size. Distribution channels are typically a mix of direct sales to large, integrated transformer manufacturers and indirect sales through specialized component distributors who serve smaller power electronics firms and niche sensor markets. The direct channel allows for greater technical collaboration and customization, particularly for utility-grade distribution transformers, where performance validation is stringent.

The market structure is characterized by both direct sales relationships with large utility equipment suppliers and original equipment manufacturers (OEMs), and indirect distribution networks targeting fragmented end-user segments like SMPS manufacturers and sensor integrators. Indirect channels provide market reach and logistics efficiency for standard components, whereas direct engagement is crucial for custom engineering projects, particularly in high-voltage applications or mission-critical automotive power conversion systems. Efficient supply chain management, minimizing material waste and optimizing the energy-intensive casting process, is paramount to maintaining cost competitiveness throughout the entire value chain, enabling amorphous materials to penetrate markets traditionally dominated by grain-oriented electrical steel.

Amorphous Ribbons Market Potential Customers

Potential customers for amorphous ribbons are highly diversified, extending across the electricity generation, transmission, and consumption sectors. The largest volume buyers are traditionally utility companies and their primary equipment suppliers (e.g., Siemens, ABB, GE) that purchase distribution transformers. These buyers prioritize high-efficiency components to meet grid modernization objectives and comply with national energy consumption mandates, making them the foundational end-users for high-volume Fe-based amorphous core ribbons. Their purchasing decisions are driven by long-term operating cost savings derived from reduced core losses and extended component lifespan.

Another rapidly expanding customer base is the power electronics manufacturing industry, including companies specializing in solar inverters, wind turbine converters, data center power supplies, and, critically, automotive electrification components. EV OEMs and their tier-one suppliers are increasingly adopting amorphous materials for high-frequency onboard chargers, traction motor inductors, and DC/DC converters, valued for their ability to handle high switching frequencies efficiently while minimizing component size and weight. These customers demand reliability, high thermal performance, and compliance with stringent automotive grade standards, often preferring thin and ultra-thin ribbons for compactness.

Finally, niche but high-value customers exist in the industrial automation and sensor market. Manufacturers of advanced security systems (Electronic Article Surveillance - EAS), high-precision current transducers, and specialized medical imaging equipment utilize amorphous ribbons, particularly Co-based alloys, for their superior sensitivity and low noise characteristics. These buyers require specialized, custom-manufactured geometries and often prioritize performance specifications (such as low magnetostriction or high permeability at low frequencies) over volume pricing, contributing significantly to the high-margin segment of the market. The continuous evolution of IoT and smart manufacturing further guarantees a stable demand from this technology-focused customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals, Ltd., Metglas Inc. (Hitachi Metals), Advanced Technology & Materials Co., Ltd. (AT&M), Qingdao Yunlu Advanced Material Technology Co., Ltd., Zhaojing Inc., VACUUMSCHMELZE GmbH & Co. KG (VAC), Zhejiang Yida Electrical Material Co., Ltd., China Steel Corporation (CSC), Liquidmetal Technologies, Inc., Foshan Huaxin Magnetic Materials Co., Ltd., MK Electron Co., Ltd., AMETEK Specialty Metal Products, Changchun Daxing Technologies Co., Ltd., Kunshan Gold-light Industrial Co., Ltd., Delta Electronics, Inc. (Magnetics Division), Nippon Steel Corporation, Honeywell International Inc., Toshiba Materials Co., Ltd., TDK Corporation, Ningbo Dongsheng Magnetoelectric Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amorphous Ribbons Market Key Technology Landscape

The manufacturing and processing of amorphous ribbons are highly technologically intensive, centered around achieving extremely rapid cooling rates necessary to bypass crystallization. The foundational technology remains the Planar Flow Casting (PFC) method, a derivative of rapid solidification processing, where molten metal is ejected onto a rapidly spinning, cooled copper wheel. The high velocity and cooling rate (often exceeding 10^6 Kelvin per second) are critical determinants of the ribbon’s glassy structure and ultimate magnetic performance. Ongoing technological advancements focus on improving the uniformity and maximizing the width of the cast ribbon while minimizing inherent defects such as surface roughness or air pockets. Optimization of nozzle design and precise control over the melt temperature and ejection pressure are continuous areas of innovation within PFC technology, aimed at improving scalability and reducing production costs.

Beyond the core casting process, the subsequent thermal treatment, known as magnetic annealing, is equally vital. This technology involves heating the amorphous ribbon below its crystallization temperature in a controlled magnetic field. Annealing is necessary to relieve internal stresses induced during casting and to induce magnetic anisotropy, thereby optimizing key soft magnetic properties like permeability and core loss for specific operating conditions (e.g., 50 Hz or high-frequency). Advanced annealing techniques are continuously being developed, utilizing vacuum, hydrogen, or inert gas atmospheres, sometimes coupled with specific field application protocols, to tailor the material for demanding applications like high-frequency power switching or current sensing where extremely precise magnetic characteristics are required. Research is also focused on utilizing flash annealing methods to achieve stress relaxation more rapidly and efficiently.

A burgeoning technological frontier involves the development of new alloy compositions and the integration of coating technologies. Research into high-entropy metallic glasses and more complex multi-component systems aims to improve the mechanical properties (reducing brittleness) and thermal stability, allowing amorphous materials to be utilized in harsher operating environments. Furthermore, surface coating technologies, such as thin oxide layers or protective polymer coatings, are being employed to enhance corrosion resistance and electrical insulation between ribbon layers in wound cores, ensuring long-term reliability in humid or high-temperature conditions. The successful commercialization of wider ribbons and highly customized core geometries through automated winding and bonding technologies are crucial technological drivers enabling mass adoption in utility-scale equipment.

Regional Highlights

Regional dynamics heavily influence the Amorphous Ribbons Market due to varying levels of infrastructural development, environmental regulations, and local manufacturing capabilities. Asia Pacific (APAC) stands out as the global leader in both consumption and manufacturing. This dominance is driven by massive investment in power infrastructure expansion, particularly in China and India, which are rapidly deploying high-efficiency distribution transformers to upgrade aging grids and meet surging electricity demand. Furthermore, APAC houses the largest manufacturing base for consumer electronics and electric vehicles, generating immense demand for amorphous materials in power electronics and charging systems. Favorable government policies and subsidies promoting the use of energy-saving materials further reinforce APAC's market position, fostering local production giants and intensive R&D efforts.

Europe represents a high-value market characterized by some of the world's most stringent energy efficiency mandates, such as the EcoDesign Directive, which compels utilities to prioritize low-loss components. While the volume of distribution transformer replacement is lower than in APAC, European demand is focused on highly sophisticated applications, including specialized industrial power conversion equipment, high-performance renewable energy inverters (solar and wind), and advanced sensing technologies. Germany and the UK are primary consumers, emphasizing technological quality and material performance over raw cost minimization. The push towards decentralized energy generation and smart grid implementation continues to drive steady demand for high-reliability amorphous core components across the continent.

North America is another vital market, particularly the United States, driven by grid modernization initiatives and substantial growth in data center infrastructure. The U.S. market emphasizes the reliability and long-term operating costs associated with distribution transformers. The rapid acceleration of the EV manufacturing sector and the federal push for sustainable energy solutions are increasing the adoption of amorphous ribbons in high-power applications. While manufacturing capacity is significant, much of the raw ribbon supply is imported, underscoring the strong reliance on global supply chains. Latin America and the Middle East and Africa (MEA) are emerging regions, where infrastructure development and resource utilization projects are nascent but accelerating, leading to future potential for market penetration as these economies invest in modern, efficient power distribution systems.

- Asia Pacific (APAC): Dominates market share due to unparalleled infrastructure development, stringent local efficiency standards (China, India), and being the global manufacturing hub for EVs and consumer electronics. High volume demand for Fe-based ribbons.

- North America: Significant growth driven by modernization of aging electrical grids, rapid EV adoption rates, and robust demand from the data center and industrial power supply sectors. Focus on high-performance materials.

- Europe: Characterized by high regulatory pressure (EcoDesign) enforcing efficiency standards; strong focus on specialized, high-frequency power electronics, renewable energy converters, and sensor applications.

- Latin America & MEA: Emerging markets with potential growth tied to urbanization, electrification projects, and industrial expansion, relying largely on imported technology for efficient transformer manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amorphous Ribbons Market.- Hitachi Metals, Ltd.

- Metglas Inc. (Subsidiary of Hitachi Metals)

- Advanced Technology & Materials Co., Ltd. (AT&M)

- Qingdao Yunlu Advanced Material Technology Co., Ltd.

- VACUUMSCHMELZE GmbH & Co. KG (VAC)

- Zhejiang Yida Electrical Material Co., Ltd.

- China Steel Corporation (CSC)

- Liquidmetal Technologies, Inc.

- Foshan Huaxin Magnetic Materials Co., Ltd.

- MK Electron Co., Ltd.

- AMETEK Specialty Metal Products

- Changchun Daxing Technologies Co., Ltd.

- Kunshan Gold-light Industrial Co., Ltd.

- Delta Electronics, Inc. (Magnetics Division)

- Nippon Steel Corporation

- Toshiba Materials Co., Ltd.

- TDK Corporation

- Ningbo Dongsheng Magnetoelectric Technology Co., Ltd.

- Hitachi Global Life Solutions, Inc.

- Zhaojing Inc.

Frequently Asked Questions

Analyze common user questions about the Amorphous Ribbons market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of amorphous ribbons over traditional silicon steel in transformers?

Amorphous ribbons offer significantly lower core losses (up to 70% reduction in no-load losses) due to their non-crystalline structure, which minimizes magnetic hysteresis and eddy current losses, leading to vastly improved energy efficiency and reduced operational costs in distribution transformers.

Which material composition segment is currently dominating the Amorphous Ribbons Market?

Iron-based (Fe-based) amorphous ribbons currently dominate the market volume segment. They are preferred for high-volume applications like distribution transformer cores because they offer a cost-effective balance of high saturation magnetization and low core loss, crucial for grid efficiency mandates.

How does the growth of Electric Vehicles (EVs) impact the demand for amorphous ribbons?

The EV sector is a major growth driver, demanding amorphous ribbons for high-frequency power electronics components, including efficient onboard chargers, DC/DC converters, and specialized motor inductors. Amorphous materials enable compact, lightweight, and highly efficient power systems necessary for modern EV architecture.

What is the main technological challenge facing the mass adoption of amorphous ribbons?

The main challenge is the high capital cost and technical complexity of the rapid solidification manufacturing process (Planar Flow Casting), coupled with the material's inherent brittleness, which increases processing difficulty and contributes to higher initial component costs compared to conventional magnetic materials.

Which geographical region is expected to exhibit the highest growth rate during the forecast period?

Asia Pacific (APAC), particularly driven by China and India, is projected to maintain the highest growth rate. This is fueled by unprecedented government investment in smart grid infrastructure and the expansive manufacturing output of electronics and EVs across the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager