Amorphous Steels Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442615 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Amorphous Steels Market Size

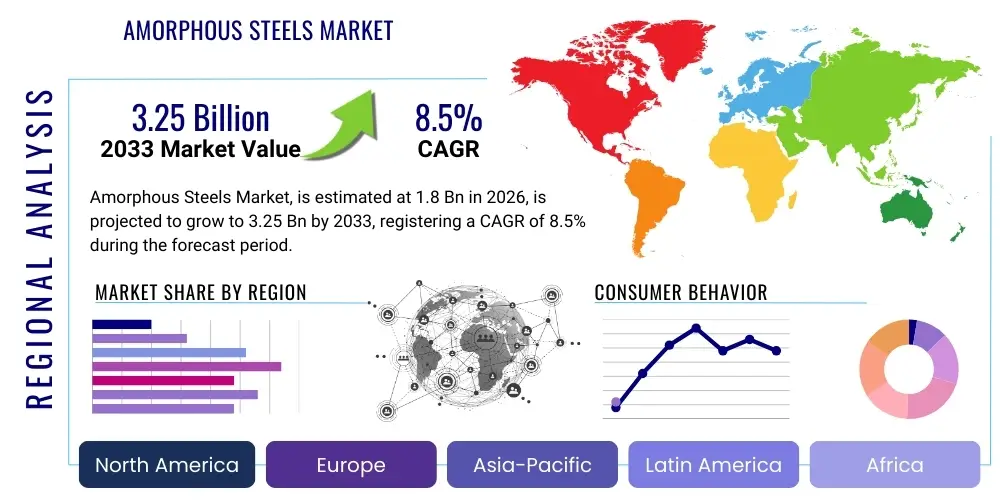

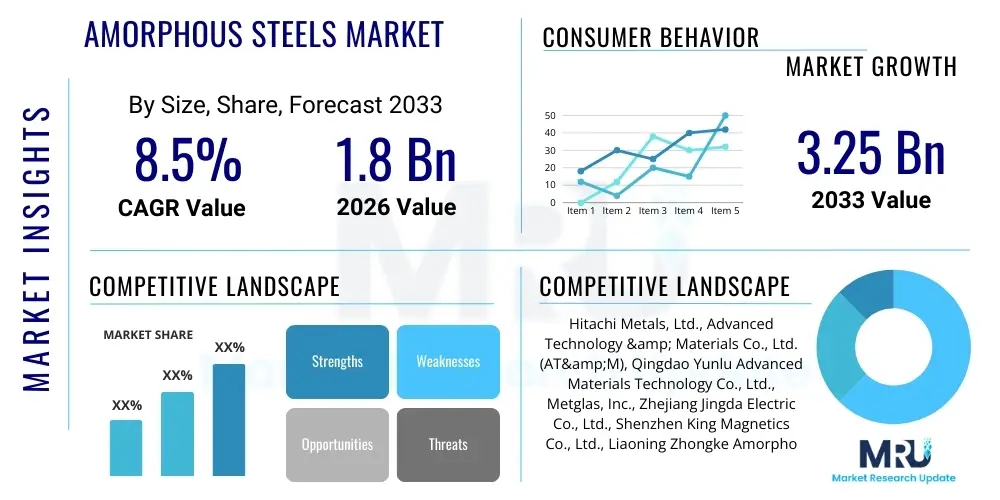

The Amorphous Steels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2033.

Amorphous Steels Market introduction

The Amorphous Steels Market, often referred to as Metallic Glass or Amorphous Metal, comprises non-crystalline alloys produced by ultra-rapid cooling of molten metal, preventing the formation of a crystalline atomic structure. This unique, disordered atomic arrangement results in exceptional soft magnetic properties, high strength, and superior corrosion resistance compared to traditional crystalline steels. The primary product form is typically thin ribbons, which are then used to manufacture core components for electrical devices.

Major applications of amorphous steels are predominantly found within the electrical and electronics sectors, particularly in the manufacturing of distribution transformers, electric motors, inductors, and various types of magnetic shields. Amorphous metal cores are essential for energy-efficient transformers, significantly reducing no-load losses (core losses) by up to 70% compared to those built with conventional silicon steel. This efficiency is critical for modern power grids and grid modernization initiatives focused on sustainable energy consumption.

The market growth is fundamentally driven by global mandates for energy efficiency, especially in rapidly industrializing economies where infrastructure expansion is underway. Governments worldwide are implementing strict minimum energy performance standards (MEPS) for electrical equipment, pushing utilities and manufacturers toward high-efficiency materials like amorphous steel. Furthermore, the increasing integration of renewable energy sources, which require efficient transformation and transmission equipment, solidifies the demand trajectory for these advanced metallic materials.

Amorphous Steels Market Executive Summary

The Amorphous Steels Market is characterized by robust business trends centered on technological refinement in manufacturing processes, focusing on increasing ribbon width and thickness consistency while reducing production costs. Key industry participants are investing heavily in expanding production capacity, particularly in Asia Pacific, to capitalize on the massive governmental push for energy-efficient power infrastructure upgrades. The transition towards smart grids and electric vehicle (EV) infrastructure further mandates the adoption of materials offering low energy loss, positioning amorphous steels as a strategic component for future electrical systems.

Regionally, Asia Pacific maintains market dominance due to accelerated industrialization, widespread rural electrification programs, and supportive regulatory frameworks in countries like China and India promoting the deployment of amorphous core transformers. North America and Europe also demonstrate significant growth, driven by stringent energy conservation regulations and the replacement of aging power infrastructure with modern, high-efficiency equipment. These established markets are increasingly adopting amorphous steel not only for utility-scale applications but also for specialized industrial motor and power electronics applications.

Segment trends reveal that the Transformer segment, particularly distribution transformers, continues to hold the largest market share owing to large-scale grid deployment and replacement cycles. However, the Electronics and Motors segments are projected to exhibit the fastest growth, propelled by the surging demand for highly efficient magnetic components in consumer electronics, data centers, and the burgeoning electric vehicle powertrain market. Material composition segmentation is seeing increased research into cobalt-based and specialized iron-based alloys to tailor properties for specific high-frequency or high-temperature applications, thus diversifying the application base beyond traditional power transmission.

AI Impact Analysis on Amorphous Steels Market

Common user questions regarding AI's impact on the Amorphous Steels Market frequently revolve around how artificial intelligence can accelerate the discovery of new alloy compositions, optimize the highly sensitive manufacturing processes (like rapid solidification), and improve quality control in high-volume production. Users seek information on AI's role in predictive maintenance for complex melt-spinning machinery and its application in modeling the long-term magnetic performance characteristics of amorphous cores under varying load conditions. The overarching theme is the expectation that AI and machine learning (ML) will significantly reduce the R&D cycle time for next-generation amorphous materials, making production more cost-effective and materials performance more predictable, thereby widening the gap between amorphous steels and conventional crystalline alloys.

- AI-driven material informatics accelerates the discovery and screening of novel amorphous alloy compositions with enhanced magnetic properties or superior glass-forming ability, reducing dependency on costly trial-and-error R&D.

- Machine Learning algorithms optimize critical manufacturing parameters in the melt-spinning process, such as nozzle geometry, cooling rate uniformity, and substrate speed, leading to improved ribbon quality and reduced scrap rates.

- Predictive maintenance implemented via AI monitors sensors within high-speed casting equipment, forecasting potential component failure and minimizing expensive downtime associated with ribbon production.

- AI facilitates enhanced quality control by analyzing high-resolution imaging and magnetic property measurements of the produced ribbons in real-time, ensuring stringent quality specifications are met for high-end applications.

- Integration of amorphous steel components into smart grid applications utilizes AI to optimize transformer deployment and load management based on the superior efficiency characteristics of amorphous cores, maximizing energy savings across the network.

DRO & Impact Forces Of Amorphous Steels Market

The Amorphous Steels Market expansion is primarily driven by global regulatory shifts mandating energy efficiency in electrical distribution systems, coupled with sustained infrastructure investment across developing regions. However, the market faces significant restraints, notably the relatively higher initial material and manufacturing costs compared to traditional silicon steel, which necessitates long-term cost-benefit analysis for wide-scale adoption. Opportunities are abundant in niche high-frequency applications, such as electric vehicle chargers and renewable energy inverters, where the superior magnetic properties of amorphous metals provide critical performance advantages.

Key drivers include government incentives and subsidies promoting energy-efficient transformers, rapid urbanization requiring reliable and efficient power grids, and the proliferation of data centers demanding high-performance electrical components. Conversely, challenges arise from the inherent material brittleness, which complicates post-processing and transformer core assembly, and the limited supply chain dominance held by a few key technology providers. The impact forces are substantially positive, driven by the indispensable role amorphous steel plays in meeting global net-zero emission targets through verifiable reductions in energy transmission losses, compelling utilities and infrastructure planners towards adoption despite the capital expenditure required.

Technological advancement focused on continuous casting process improvement and developing ductile amorphous alloys represents a strong market opportunity. Furthermore, market forces are being amplified by the increasing adoption rate in non-traditional electrical applications, such as high-efficiency industrial motors and magnetic sensors, diversifying the revenue streams beyond the core transformer market. Regulatory tightening, especially in Europe and North America concerning transformer losses, acts as a pivotal force accelerating the transition away from older technologies, ensuring the sustained viability and growth potential of the amorphous steels industry.

Segmentation Analysis

The Amorphous Steels Market is systematically segmented based on composition, application, end-user industry, and geographical region to provide a detailed understanding of market dynamics and opportunity landscapes. Segmentation by composition primarily distinguishes between iron-based and cobalt-based amorphous alloys, where iron-based alloys dominate due to their cost-effectiveness and suitability for power applications, while cobalt-based alloys serve specialized, high-performance needs requiring high magnetic permeability. Application segmentation reveals the critical role amorphous steels play across power conversion equipment, with distribution transformers being the largest volume consumer, complemented by high-growth segments like motors and specialized electronics.

- By Composition:

- Iron-based Amorphous Alloys (Fe-Si-B)

- Cobalt-based Amorphous Alloys (Co-Fe-Ni-Si-B)

- Other Amorphous Alloys (e.g., Rare Earth containing)

- By Application:

- Distribution Transformers (Amorphous Metal Core Transformers - AMTs)

- Electric Motors

- Inductors and Chokes

- Power Electronics (e.g., SMPS, Inverters, DC-DC Converters)

- Magnetic Shielding and Sensors

- By End-User Industry:

- Power Utilities and Grid Infrastructure

- Industrial Manufacturing

- Consumer Electronics

- Automotive (Electric Vehicles and Charging Infrastructure)

- Aerospace and Defense

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For Amorphous Steels Market

The value chain for amorphous steels is complex, beginning with the highly specialized upstream analysis involving the sourcing of high-purity raw materials such as iron, silicon, boron, and proprietary additives required for achieving the glassy state during processing. Upstream activities also encompass extensive R&D efforts focused on optimizing alloy chemistry and glass-forming ability, which is a key differentiator among producers. Due to the proprietary nature of the rapid solidification (melt spinning) technology, the raw material preparation and alloy formulation stage represents a significant entry barrier and value accrual point.

Midstream processing involves the energy-intensive and technologically demanding production of amorphous metal ribbons through continuous casting and subsequent specialized annealing treatments required to induce optimal soft magnetic properties. This stage is dominated by specialized manufacturers possessing the requisite high-speed vacuum casting equipment. Distribution channels, both direct and indirect, then play a crucial role in connecting manufacturers to end-users. Direct channels are utilized for large volume sales to major transformer and electrical component manufacturers, often involving strategic partnerships and long-term supply contracts, providing customized ribbon widths and thicknesses tailored to specific core designs.

Downstream analysis focuses on the final integration of amorphous steel ribbons into functional products, primarily by electrical equipment Original Equipment Manufacturers (OEMs). This includes the specialized process of core winding and assembly for distribution transformers and the fabrication of high-frequency components for power electronics. End-user consumption spans power utilities, industrial enterprises, and increasingly, the automotive sector. The value chain highlights that value addition is maximized through technological ownership in the midstream production phase and robust strategic relationships with high-volume downstream integrators, differentiating the market based on material quality, consistent supply, and technological customization capabilities.

Amorphous Steels Market Potential Customers

The primary potential customers and buyers of amorphous steels are the manufacturers of electrical distribution equipment, particularly those specializing in transformers and magnetic cores, forming the backbone of utility consumption. This includes major global power equipment manufacturers who require high-efficiency materials to meet regulatory standards and minimize operational losses within their installed bases. Beyond utilities, industrial end-users comprise manufacturers of high-efficiency electric motors used in automation and industrial drives, seeking reduced energy consumption and improved performance characteristics compared to traditional motor cores.

A rapidly expanding customer base resides within the technology sectors, specifically power electronics companies designing high-frequency switching power supplies (SMPS), inverters for solar and wind energy systems, and components essential for telecommunications infrastructure. The electric vehicle (EV) sector represents a critical growth area, requiring amorphous metal components for highly efficient onboard chargers, traction motors, and inductive charging systems, where the material’s low core loss at high switching frequencies is indispensable for maximizing battery range and charging speed. These buyers prioritize materials that offer verifiable efficiency improvements and reliable performance under demanding operational conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals, Ltd., Advanced Technology & Materials Co., Ltd. (AT&M), Qingdao Yunlu Advanced Materials Technology Co., Ltd., Metglas, Inc., Zhejiang Jingda Electric Co., Ltd., Shenzhen King Magnetics Co., Ltd., Liaoning Zhongke Amorphous Technology Co., Ltd., Tohoku Steel Co., Ltd., China Amorphous Technology Co., Ltd., VacuTec Meßtechnik GmbH, Bomatec AG, Amotech Co., Ltd., Magnetics, Jiangsu Dongda Amorphous Metallic Materials Co., Ltd., Henan Zhongyue Amorphous Technology Co., Ltd., Guangdong Golden Leaves Technology Development Co., Ltd., Shanghai Metal Corporation, POSCO, Thyssenkrupp, Samwha Capacitor Group (Related materials). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amorphous Steels Market Key Technology Landscape

The core technology underpinning the Amorphous Steels Market is the rapid solidification technique, predominantly executed through the melt spinning process. This sophisticated manufacturing method involves melting the precursor metallic alloys and ejecting the molten material onto a rapidly rotating, cooled wheel (often copper) at speeds ensuring cooling rates exceed one million degrees Celsius per second. This extreme cooling rate bypasses the thermodynamic barrier to crystallization, resulting in a glassy, non-crystalline ribbon structure. Technological advancements are focused on improving the width and uniformity of this ribbon casting, optimizing machine uptime, and minimizing defects to enhance yield and material stability.

A crucial secondary technology involves specialized post-processing, particularly annealing, which is performed under controlled magnetic fields and temperatures far below the crystallization point. This critical thermal treatment is essential to relieve internal stresses induced during the rapid cooling and to optimize the material’s soft magnetic properties, such as permeability and core loss, making it suitable for transformer and inductive applications. Research efforts are continuously directed toward developing optimized magnetic field annealing protocols that cater to various end-use requirements, balancing core loss reduction with acceptable levels of material brittleness.

Further technological differentiation lies in alloy design, utilizing advanced computational materials science to predict ideal compositions that offer superior glass-forming ability, higher saturation flux density, and enhanced thermal stability. Recent innovations include the integration of protective coatings and specialized lamination techniques to improve the handling characteristics and physical integrity of the final transformer cores. The integration of advanced sensors and data analytics into the melt spinning line represents a shift toward Industry 4.0 practices, ensuring real-time control over the entire production environment and leading to a more consistent, high-performance product, further solidifying the technological dominance of amorphous steel producers.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily fueled by massive infrastructure projects, robust grid expansion initiatives in China and India, and supportive governmental policies mandating the use of energy-efficient transformers. China, in particular, has driven large-scale adoption, positioning it as both a major producer and consumer.

- North America: Driven by aging infrastructure replacement and strict regulatory pressure from entities like the Department of Energy (DOE) imposing Minimum Energy Performance Standards (MEPS). The focus is on implementing smart grid technologies and deploying efficient materials in utility and burgeoning EV infrastructure sectors.

- Europe: Characterized by highly stringent energy efficiency directives (e.g., European Ecodesign Regulation). Growth is consistent, driven by the strong commitment to renewable energy integration and the subsequent need for high-efficiency components in power generation and distribution networks across key economies like Germany and the UK.

- Latin America: This region exhibits growing demand, particularly in Brazil and Mexico, linked to rapid urbanization and the expansion of national electricity grids. Adoption is slower than in APAC but is accelerating due to international lending institutions prioritizing funding for energy-efficient infrastructure projects.

- Middle East and Africa (MEA): Growth is primarily concentrated in Gulf Cooperation Council (GCC) countries investing heavily in smart city development and large-scale industrial projects. The need to minimize energy waste in power transmission, especially in hot climates, makes the superior efficiency of amorphous metal cores highly attractive for regional utilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amorphous Steels Market.- Hitachi Metals, Ltd.

- Advanced Technology & Materials Co., Ltd. (AT&M)

- Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- Metglas, Inc.

- Zhejiang Jingda Electric Co., Ltd.

- Shenzhen King Magnetics Co., Ltd.

- Liaoning Zhongke Amorphous Technology Co., Ltd.

- Tohoku Steel Co., Ltd.

- China Amorphous Technology Co., Ltd.

- VacuTec Meßtechnik GmbH

- Bomatec AG

- Amotech Co., Ltd.

- Magnetics

- Jiangsu Dongda Amorphous Metallic Materials Co., Ltd.

- Henan Zhongyue Amorphous Technology Co., Ltd.

- Guangdong Golden Leaves Technology Development Co., Ltd.

- Shanghai Metal Corporation

- POSCO

- Thyssenkrupp

- Samwha Capacitor Group

Frequently Asked Questions

Analyze common user questions about the Amorphous Steels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of amorphous steel over traditional silicon steel in transformers?

The primary advantage is significantly reduced energy loss, specifically core losses (no-load losses). Amorphous steel cores reduce these losses by 60% to 70% compared to conventional crystalline silicon steel, leading to substantial energy savings over the operational lifespan of a distribution transformer and improved grid efficiency.

Which end-use application dominates the consumption of amorphous steels globally?

The Distribution Transformers segment is the dominant application globally. Amorphous Metal Core Transformers (AMTs) are mandated or strongly encouraged by energy regulations worldwide due to their superior efficiency, driving high volume consumption in grid modernization and replacement cycles.

What are the main constraints impacting the wider adoption of amorphous steel technology?

The main constraints include the higher initial cost of amorphous metal ribbon manufacturing compared to silicon steel, and the inherent brittleness of the material, which necessitates specialized handling and transformer core assembly processes to prevent material damage and maintain performance integrity.

How is the Electric Vehicle (EV) industry influencing the Amorphous Steels Market?

The EV industry is a critical growth driver, increasing demand for amorphous alloys for use in high-frequency applications such as efficient traction motors, high-power density inductors, and fast charging systems, where the material's low loss characteristics at high switching frequencies are vital for performance.

Which geographical region exhibits the fastest growth potential for Amorphous Steels?

Asia Pacific (APAC), particularly driven by China and India, exhibits the fastest growth potential. This growth is underpinned by extensive rural electrification projects, accelerated urbanization, and strong governmental commitment to energy efficiency standards in utility infrastructure development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager