Anchor handling tug supply vessels Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443551 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Anchor handling tug supply vessels Market Size

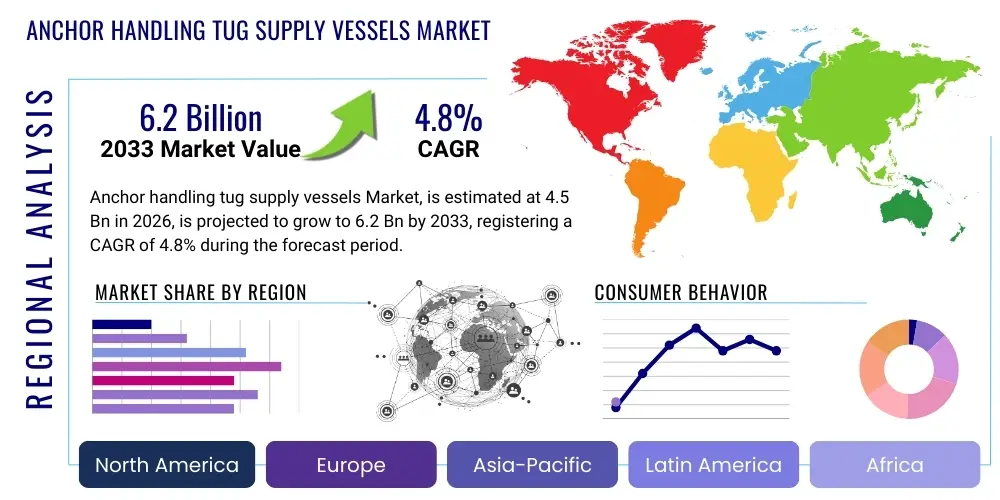

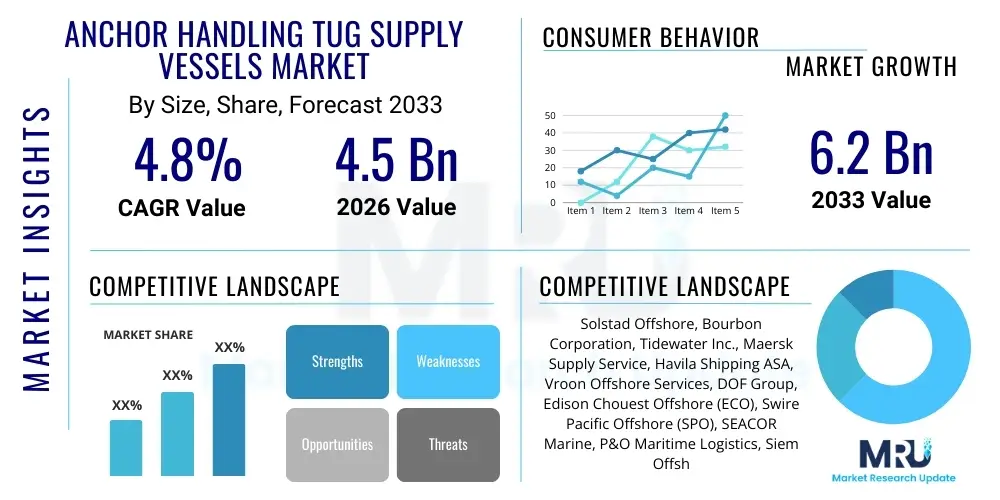

The Anchor handling tug supply vessels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Anchor handling tug supply vessels Market introduction

The Anchor Handling Tug Supply (AHTS) vessels market is an integral component of the offshore oil and gas industry, specializing in critical support functions essential for drilling and production operations. AHTS vessels are high-specification offshore service vessels designed primarily for maneuvering and positioning mobile drilling units, installing and retrieving anchors in deep and ultra-deep waters, and towing various floating installations. Their design emphasizes high bollard pull capacity, dynamic positioning capabilities, and extensive deck space for transporting personnel, equipment, drilling fluids, and dry bulk materials, making them versatile workhorses in challenging marine environments.

The functional requirements of AHTS vessels extend beyond simple towage; they are central to complex rig moves, which require meticulous precision to ensure safety and operational efficiency. Furthermore, these vessels are crucial for the supply chain logistics, delivering essential provisions from shore bases to offshore installations, thereby maintaining continuous drilling and production activities. Key market drivers include the resurgence of deepwater exploration and production (E&P) activities, particularly in regions like the Gulf of Mexico, offshore Brazil, and West Africa, where substantial reserves necessitate robust anchoring systems and high-capacity tow vessels. The ongoing demand for highly specialized vessels capable of handling extreme weather conditions and complying with increasingly stringent environmental regulations further shapes the market landscape.

Major applications for AHTS vessels span the entire lifecycle of an offshore field, from initial seismic survey support and rig mobilization to continuous supply duties and eventual decommissioning support. The inherent benefits of these vessels lie in their multi-purpose design, allowing operators to consolidate logistical needs and improve operational uptime. Driving factors include technological advancements in dynamic positioning systems (DP2/DP3), the adoption of hybrid propulsion systems for fuel efficiency, and regulatory pressure from organizations like the International Maritime Organization (IMO) pushing for lower sulfur emissions (Tier III compliance), which necessitates fleet upgrades and the retirement of older, less efficient tonnage.

Anchor handling tug supply vessels Market Executive Summary

The Anchor Handling Tug Supply (AHTS) market is characterized by cautious optimism driven by stabilizing oil prices and renewed capital expenditure in deepwater basins. Business trends highlight a strong emphasis on operational efficiency, leading to increased demand for high-specification vessels (over 16,000 BHP) equipped with sophisticated automation and fuel-saving technologies, such as battery storage and dual-fuel capabilities. The competitive landscape is consolidating, with larger integrated offshore service providers focusing on fleet modernization to meet the strict technical demands of major oil companies. Furthermore, the burgeoning offshore wind sector presents a significant diversification opportunity, leveraging AHTS capabilities for foundation installation and maintenance, partially mitigating the historical volatility tied exclusively to oil and gas E&P cycles.

Regional trends indicate divergent growth patterns. The Asia Pacific (APAC) region, driven by developing gas fields off Australia, Indonesia, and Malaysia, shows steady demand for mid-to-high specification vessels. North America, specifically the U.S. Gulf of Mexico, remains the premium market for ultra-deepwater AHTS vessels, necessitating DP3 systems and high bollard pull for complex operations. Conversely, mature regions like the North Sea are seeing increased AHTS utilization for platform decommissioning and light construction support, shifting the demand profile towards vessels capable of multi-role functions rather than pure anchor handling duties. Regulatory pressures, especially the requirement for local content and higher environmental standards, significantly influence operational strategies across all key geographic areas.

Segmentation trends reveal that the highest growth is expected in the segment of vessels utilizing advanced dynamic positioning (DP Class 2 and 3), as these are mandatory for most modern deepwater drilling operations, particularly involving semi-submersible rigs and drillships. By power rating, the 12,000–16,000 Brake Horsepower (BHP) category dominates the operational count, but the market value growth is concentrated in the ultra-high horsepower segment (above 16,000 BHP) due to the higher charter rates commanded by these specialized assets. The end-user segment is increasingly favoring long-term contracts (LTCs) with integrated providers to secure reliable, high-specification tonnage, reflecting a strategic move away from opportunistic spot market usage observed during market downturns.

AI Impact Analysis on Anchor handling tug supply vessels Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the AHTS market frequently revolve around achieving fully autonomous vessel operation, improving predictive maintenance accuracy, and optimizing complex logistics and route planning in real-time. Stakeholders are keen to understand how AI can enhance safety protocols, reduce human error during critical operations like anchor handling, and mitigate operational risks associated with dynamic weather conditions. There is significant interest in AI’s role in optimizing fuel consumption and reducing carbon emissions by analyzing propulsion data and tidal patterns instantaneously. The consensus anticipates that while full autonomy faces substantial regulatory and safety hurdles, AI-driven decision support systems, condition-based monitoring, and advanced simulation tools are already fundamentally transforming maintenance schedules, operational efficiency, and training methodologies within the specialized AHTS domain.

- AI-Enhanced Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data from engines, winches, and dynamic positioning systems, predicting potential failures before they occur, maximizing vessel uptime, and reducing drydock periods.

- Optimized Route and Speed Planning: Implementing AI-driven algorithms that factor in meteorological data, tidal currents, charter schedules, and vessel performance characteristics to calculate the most fuel-efficient and timely transit paths, significantly lowering bunkering costs.

- Advanced Dynamic Positioning (DP) Control: Integrating AI with DP systems to improve station-keeping accuracy in extreme sea states, optimizing thruster usage, and reducing fuel burn during complex anchor handling or rig positioning procedures.

- Automated Cargo and Deck Management: Employing computer vision and AI systems to monitor cargo movements, ensure safe loading and offloading sequences, and autonomously assist in the management of complex anchor chains and mooring lines on the stern.

- Remote Monitoring and Operations Support: Facilitating shore-based operations centers to remotely monitor vessel performance, diagnose issues, and provide real-time decision support to on-board crew, leading to reduced manning requirements over the long term.

- Simulation and Training Enhancement: Developing high-fidelity AI-powered simulators that mimic complex real-world scenarios, allowing crew members to train for high-risk anchor handling operations under diverse weather conditions without risking actual assets.

DRO & Impact Forces Of Anchor handling tug supply vessels Market

The Anchor handling tug supply vessels market is shaped by a critical interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces determining its growth trajectory and cyclical nature. A primary driver is the global need for energy security and the consequent rise in deepwater and ultra-deepwater exploration activities, which inherently rely on high-specification AHTS vessels for crucial rig moves and supply operations. However, this demand is significantly restrained by the inherent volatility of crude oil prices, which directly impacts the investment decisions of upstream operators, often leading to project deferrals and fleet oversupply during market troughs. The central opportunity lies in the energy transition, where AHTS capabilities are increasingly utilized in supporting the burgeoning offshore wind and decommissioning sectors, providing a crucial avenue for diversification away from traditional hydrocarbon dependency, thereby offering specialized services in asset removal and renewable energy infrastructure deployment.

Drivers include the necessity of decommissioning mature offshore fields, particularly in regions like the North Sea and the Gulf of Mexico, requiring specialized AHTS vessels for towage and salvage operations. Furthermore, the technological requirement for ultra-deepwater drilling mandates vessels equipped with advanced specifications, such as DP3 redundancy and exceptionally high bollard pull, creating demand for new, sophisticated tonnage. Restraints include the high capital expenditure required for new vessel construction and the stringent regulatory environment (e.g., ballast water treatment regulations and environmental emissions standards), which adds significant operational costs to existing fleets. Additionally, the existing oversupply of older, lower-specification vessels continues to suppress charter rates in certain segments, hindering market recovery for standard AHTS operations.

The key impact forces driving market development are the stringent global shift toward decarbonization and the increasing adoption of digital technologies. Operators are facing pressure to adopt hybrid and alternative fuel solutions (LNG, methanol, or battery-hybrid systems) to meet IMO emissions targets, forcing a significant investment cycle in green technologies. This investment, while costly, creates an opportunity for new market entrants focusing on sustainability. The geopolitical instability and shifts in energy policies also exert a strong influence, affecting global E&P budgets and dictating which offshore basins receive prioritized investment, subsequently impacting regional AHTS demand and utilization rates.

Segmentation Analysis

The Anchor handling tug supply vessels market is comprehensively segmented based on various technical and functional parameters crucial for assessing demand and supply dynamics. Key segmentation criteria include vessel capacity categorized by Brake Horsepower (BHP), which directly correlates to the bollard pull and operational depth capability; the class of Dynamic Positioning (DP) system installed, reflecting redundancy and reliability; and the end-user application, distinguishing between standard supply duties, deepwater anchor handling, and specialized construction support. Analyzing these segments provides stakeholders with granular insights into market trends, allowing for targeted investment in high-demand, high-specification assets versus standard utility vessels.

The segmentation by BHP classification is particularly critical, as modern deepwater operations require vessels exceeding 16,000 BHP, while shallower water operations utilize vessels in the 8,000 to 12,000 BHP range. The DP classification (DP1, DP2, DP3) determines the vessel's ability to maintain position near critical assets, with DP2 and DP3 vessels commanding premium rates due to redundancy requirements in ultra-deepwater environments. Furthermore, geographic segmentation reveals stark differences in market maturity, regulatory constraints, and fleet demographics, necessitating customized operational strategies for regions such as the Arctic, the Gulf of Mexico, and Southeast Asia, each presenting unique operational challenges and demanding specific vessel types.

- By Horsepower (BHP):

- Low (Below 8,000 BHP)

- Medium (8,000 – 12,000 BHP)

- High (12,000 – 16,000 BHP)

- Ultra-High (Above 16,000 BHP)

- By Dynamic Positioning (DP) Class:

- DP 1

- DP 2

- DP 3

- By Application:

- Drilling Rig Towing and Positioning

- Anchor Handling Operations

- Offshore Installation Supply Duties

- Decommissioning Support

- Subsea Construction Support

- By End-User:

- Oil and Gas Exploration and Production (E&P) Companies

- Drilling Contractors

- Subsea Service Providers

- Offshore Wind Farm Developers (Emerging)

Value Chain Analysis For Anchor handling tug supply vessels Market

The value chain for the Anchor handling tug supply vessels market begins with upstream activities involving naval architects, ship designers, and specialized marine equipment manufacturers who develop the high-specification engines, winches, DP systems, and hull designs necessary for these complex vessels. This phase dictates the technical capability and operational efficiency of the final asset. Key upstream suppliers include manufacturers of high-bollard pull propulsion systems (e.g., Wärtsilä, Caterpillar) and providers of specialized mooring and anchoring equipment (e.g., advanced winches and line handling gear). Financial institutions and shipbuilding yards form the critical link in converting design specifications into operational assets, requiring significant capital investment and adherence to stringent class society rules.

The midstream component is dominated by the AHTS vessel owners and operators, who manage the fleet, crew, maintenance, and compliance. These operators secure charters, manage vessel utilization rates, and maintain operational readiness, acting as the primary service providers to the oil and gas industry. Distribution channels primarily involve direct contractual agreements: either long-term charters (LTCs) secured directly with oil majors (e.g., Shell, ExxonMobil) or drilling contractors (e.g., Transocean, Seadrill), or shorter-term spot market contracts mediated by specialized marine brokers. The shift towards LTCs is driven by the desire of end-users to secure high-quality, scarce DP3 tonnage for multi-year deepwater campaigns, ensuring operational continuity and predictability.

Downstream activities involve the direct utilization of the AHTS vessels at the offshore field. End-users, primarily E&P companies and drilling rig operators, rely on these vessels to perform time-critical tasks such as setting and recovering anchors for mobile offshore drilling units (MODUs), towing rigs between locations, and providing essential logistical supply links (fuel, water, drilling mud, casings). The success of the downstream operation hinges entirely on the reliability and capability of the AHTS assets. Indirect distribution and service provision include insurance firms, classification societies (e.g., DNV, ABS), and specialized technical consultancies that support vessel compliance, safety auditing, and performance optimization throughout the asset's operational life.

Anchor handling tug supply vessels Market Potential Customers

The primary customers for Anchor handling tug supply vessels are highly sophisticated entities within the global energy ecosystem, demanding reliability and adherence to strict safety standards. The core end-users are International Oil Companies (IOCs) and National Oil Companies (NOCs) engaged in deepwater exploration and production (E&P), such as BP, TotalEnergies, Petrobras, and Saudi Aramco, particularly those involved in developing complex offshore projects requiring significant rig mobility and deep mooring capabilities. These companies utilize AHTS vessels under medium-to-long term contracts to service their drilling programs, ensuring their expensive drilling rigs are safely and efficiently positioned.

Another major buyer segment includes specialized drilling contractors and rig owners who operate mobile drilling units (semi-submersibles and jack-ups). These contractors frequently charter AHTS vessels directly to execute rig moves required under their drilling contracts with the oil majors. Subsea construction and installation companies also represent a growing customer base, using AHTS vessels for deploying subsea templates, handling complex umbilical and flowline installation support, and providing heavy lifting assistance during infrastructure placement. As the energy transition accelerates, offshore wind developers are emerging as significant potential customers, requiring AHTS vessels for the installation and maintenance of large floating wind turbines and associated mooring systems, leveraging the vessel's high bollard pull and DP capabilities for precision positioning tasks in renewable energy infrastructure projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solstad Offshore, Bourbon Corporation, Tidewater Inc., Maersk Supply Service, Havila Shipping ASA, Vroon Offshore Services, DOF Group, Edison Chouest Offshore (ECO), Swire Pacific Offshore (SPO), SEACOR Marine, P&O Maritime Logistics, Siem Offshore, Harvey Gulf International Marine, BOURBON Offshore, Pacific Radiance Ltd., POSH (Pacc Offshore Services Holdings), Ocean Installer, Hornbeck Offshore Services, Eidesvik Offshore, Zamil Offshore. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anchor handling tug supply vessels Market Key Technology Landscape

The Anchor handling tug supply vessels market is undergoing rapid technological transformation focused on efficiency, safety, and environmental compliance. Central to this evolution is the deployment of advanced Dynamic Positioning (DP) systems, particularly DP2 and DP3, which utilize multiple thrusters, high-precision sensors (DGPS, hydroacoustics, taut wires), and sophisticated computer control to maintain the vessel's exact position, a non-negotiable requirement for deepwater anchor handling and subsea tie-ins. Furthermore, the integration of advanced winch technology, including waterfall and cascading drum arrangements, coupled with automated line handling systems, significantly improves safety during high-tension anchor retrieval operations, minimizing manual intervention and reducing the risk of accidents associated with snap loads.

Propulsion technology is another critical area, with the industry shifting towards energy-efficient and low-emission solutions. The adoption of hybrid propulsion systems, combining traditional diesel engines with battery energy storage systems (BESS), allows AHTS vessels to operate in peak-shaving mode, optimizing engine loading and drastically reducing fuel consumption and NOx/SOx emissions, particularly during standby or transit. Dual-fuel engines capable of running on LNG (Liquefied Natural Gas) are also gaining traction, offering a viable pathway to meet IMO Tier III nitrogen oxide emission limits. These technological upgrades not only improve environmental performance but also reduce operational costs, enhancing the competitiveness of modern AHTS tonnage in the premium deepwater segment, where charterers demand proof of sustainability efforts.

Digitalization and automation technologies, leveraging the Industrial Internet of Things (IIoT), are fundamentally changing how AHTS vessels are managed. Integrated vessel management systems provide real-time data on engine performance, fuel consumption, and operational parameters, enabling shore-based teams to monitor fleet health and advise on optimization strategies. Condition-based monitoring utilizing AI predictive analytics ensures equipment reliability, moving away from scheduled maintenance to necessity-driven repairs. This sophisticated integration of hardware (DP3 systems, high-bollard pull gear) and software (data analytics, remote diagnostics) ensures that the latest generation of AHTS vessels can reliably and safely execute the most demanding tasks in harsh offshore environments, setting a new benchmark for operational excellence in the sector.

Regional Highlights

Regional dynamics within the AHTS market are highly diverse, reflecting varying levels of oil and gas maturity, regulatory stringency, and emerging investment in offshore renewables.

- North America (NA): Dominated by the US Gulf of Mexico (GoM) ultra-deepwater sector, this region demands the highest specification vessels (DP3, 16,000+ BHP). Demand is linked directly to major deepwater projects, focusing on highly reliable, redundant assets. The region serves as a benchmark for premium charter rates and technical complexity, with increasing activity also observed in the Canadian Atlantic for high-impact exploration. Regulatory compliance and safety are paramount, driving continuous fleet modernization.

- Europe: Characterized by the mature North Sea basin, the market is shifting heavily towards decommissioning and life-extension projects. This requires AHTS vessels for platform removal, towing, and specialized subsea support. Crucially, Europe is the global leader in offshore wind development, particularly floating wind, which generates significant new demand for high-bollard pull AHTS vessels capable of moorings installation and maintenance, pushing operators toward hybrid and zero-emission solutions rapidly.

- Asia Pacific (APAC): A region experiencing balanced growth across shallow and deepwater fields, particularly around Australia (LNG projects), Indonesia, Malaysia, and Vietnam. The market is highly segmented, with strong demand for both mid-specification and high-specification AHTS vessels. Local content requirements are rigorous in many national markets, often leading to partnerships and joint ventures between international operators and local service providers. Growth is steady, fueled by long-term regional gas development plans.

- Latin America (LATAM): Brazil is the epicenter of AHTS demand in this region, driven by extensive pre-salt deepwater developments managed primarily by Petrobras. Charter demand focuses on large, highly sophisticated DP2/DP3 vessels to support drillships and semi-submersibles in challenging conditions. Local vessel content requirements (ANP requirements) heavily influence market access and fleet positioning, leading to a localized fleet profile. Mexico’s energy reforms also contribute to demand in the Gulf of Mexico basin.

- Middle East and Africa (MEA): The Middle East sees stable demand, mainly for mid-to-high BHP AHTS vessels supporting conventional shallow-to-mid water drilling and production activities, particularly around Saudi Arabia, UAE, and Qatar. Africa, especially West Africa (Nigeria, Angola, Ghana), remains critical for deepwater E&P, requiring high-spec AHTS vessels, though market activity is sensitive to geopolitical stability and long-term oil price forecasts. The focus here is often on robust vessel design and operational redundancy for remote locations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anchor handling tug supply vessels Market.- Solstad Offshore

- Bourbon Corporation

- Tidewater Inc.

- Maersk Supply Service

- Havila Shipping ASA

- Vroon Offshore Services

- DOF Group

- Edison Chouest Offshore (ECO)

- Swire Pacific Offshore (SPO)

- SEACOR Marine

- P&O Maritime Logistics

- Siem Offshore

- Harvey Gulf International Marine

- BOURBON Offshore

- Pacific Radiance Ltd.

- POSH (Pacc Offshore Services Holdings)

- Ocean Installer

- Hornbeck Offshore Services

- Eidesvik Offshore

- Zamil Offshore

Frequently Asked Questions

What is the primary function of an Anchor handling tug supply vessel (AHTS)?

The core function of an AHTS vessel is the precise maneuvering, towing, and positioning of mobile offshore drilling units (MODUs), along with the installation and recovery of their complex mooring systems and anchors in deep and ultra-deep waters, complementing these duties with essential supply deliveries.

How does Dynamic Positioning (DP) capability affect AHTS market value?

DP capability, particularly DP2 and DP3, significantly increases an AHTS vessel's market value and charter rates because it ensures precise station-keeping redundancy crucial for safe operations near sensitive deepwater infrastructure, making it mandatory for modern drilling programs.

Which regions are driving the demand for ultra-high horsepower AHTS vessels?

Ultra-high horsepower (above 16,000 BHP) AHTS vessels are primarily driven by deepwater and ultra-deepwater exploration and production activity in the US Gulf of Mexico, offshore Brazil (pre-salt fields), and specific deepwater regions off West Africa, where robust bollard pull is essential.

What is the impact of the energy transition on the AHTS sector?

The energy transition presents a major opportunity by driving demand for AHTS vessels in the offshore wind sector, specifically for the installation and maintenance of both fixed and floating wind farm foundations and mooring lines, requiring fleet operators to focus on specialized capabilities and green propulsion systems.

What technological advancements are optimizing AHTS operational efficiency?

Key technological advancements include the integration of hybrid propulsion systems (diesel-electric with battery storage), advanced automated winching and line handling gear to improve safety, and AI-driven predictive maintenance systems to maximize vessel uptime and reduce costly unplanned downtime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager