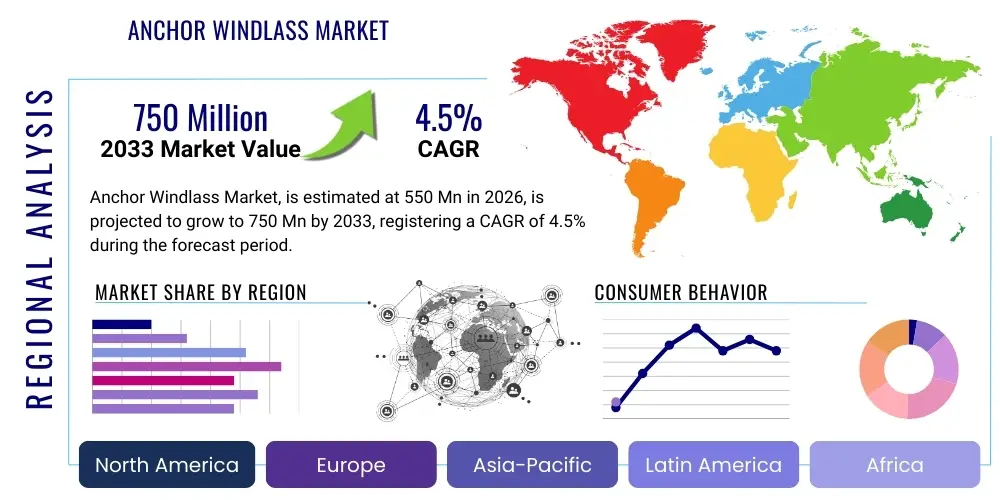

Anchor Windlass Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442839 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Anchor Windlass Market Size

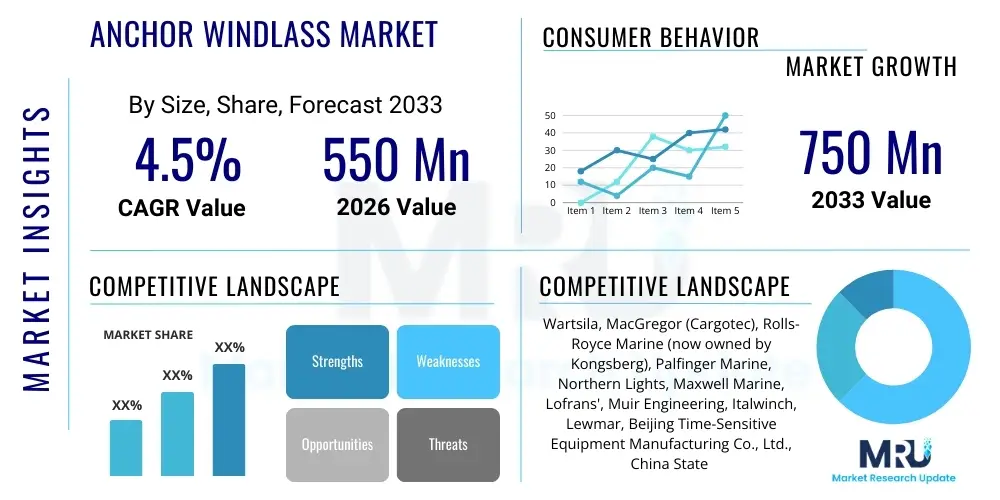

The Anchor Windlass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% (CAGR) between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $750 Million by the end of the forecast period in 2033.

Anchor Windlass Market introduction

The Anchor Windlass Market encompasses the design, manufacturing, distribution, and maintenance of critical deck machinery used primarily for handling anchors and mooring lines on marine vessels. Anchor windlasses are essential safety and operational components, ensuring vessels can securely anchor in various water depths and conditions. Their design complexity varies significantly depending on the size and application of the vessel, ranging from compact electric units for leisure yachts to large, robust hydraulic systems required for massive commercial tankers, cargo carriers, and naval ships. The fundamental purpose remains the mechanization of anchor deployment and retrieval, replacing labor-intensive manual processes, thus enhancing safety, efficiency, and adherence to maritime regulatory standards globally.

The core products within this market include specialized hauling systems categorized predominantly by their power source—electric, hydraulic, or pneumatic—and their configuration, such as vertical or horizontal shafts. Hydraulic windlasses generally dominate the high-capacity commercial and offshore segments due to their superior torque and reliability in continuous, demanding operational environments. Conversely, electric windlasses are increasingly favored in medium-to-smaller vessel classes for their ease of installation and lower maintenance overhead. The major applications span commercial shipping (container ships, bulk carriers), offshore exploration and production (drilling rigs, supply vessels), specialized naval applications, and the burgeoning global leisure marine sector, each demanding specialized certifications and performance characteristics tailored to their unique operational profiles.

Driving factors for sustained market growth include the steady expansion of global maritime trade, necessitating continuous shipbuilding and vessel maintenance, particularly in emerging Asian economies. Furthermore, increasingly stringent international maritime safety regulations, mandating reliable anchoring systems, push vessel operators towards adopting higher-specification, technologically advanced windlasses. Key benefits derived from modern anchor windlass systems include improved crew safety, faster anchoring times, reduced operational wear and tear on chains and lines, and seamless integration with bridge control systems, positioning these systems as indispensable elements of modern marine navigation and vessel management architecture.

Anchor Windlass Market Executive Summary

The Anchor Windlass Market is experiencing a definitive shift towards advanced automation and power efficiency, driven by global efforts to reduce carbon footprints and optimize vessel operating costs. Business trends indicate strong capital expenditure in hydraulic systems designed for extreme weather performance and deep-water anchoring, particularly serving the expanding offshore wind farm installation and maintenance sector. Key industry players are focusing their research and development efforts on integrating smart sensors and remote diagnostics capabilities into their windlasses, aligning with the industry-wide push for digitalization and predictive maintenance solutions. Consolidation remains a notable trend, with major marine equipment suppliers acquiring specialized windlass manufacturers to offer comprehensive deck machinery packages, thus streamlining supply chains for large shipbuilders.

Regional trends highlight the Asia Pacific (APAC) region as the undisputed manufacturing and demand powerhouse, primarily fueled by the substantial shipbuilding capacities in China, South Korea, and Japan. While these nations drive volume production, North America and Europe lead in adopting advanced, high-specification technology, particularly for naval and specialized vessel applications where regulatory compliance and extreme reliability are paramount. The European retrofit market is notably strong, driven by stricter class society requirements and aging vessel fleets needing modernization. Geopolitical stability and fluctuations in global commodity prices, which directly affect maritime trade volumes, are critical external factors influencing regional demand volatility.

Segment trends underscore the dominance of the hydraulic windlass segment due to its reliability in heavy-duty commercial applications, although the electric segment is rapidly gaining traction in mid-sized vessels due to reduced complexity and energy efficiency improvements through Variable Frequency Drives (VFDs). The commercial vessels application segment holds the largest market share, but the offshore segment is projected to exhibit the highest CAGR, supported by renewed investment in deep-sea oil and gas exploration alongside the monumental growth of the renewable offshore energy infrastructure. Capacity-wise, medium to high capacity windlasses (suitable for vessels over 50,000 DWT) represent the most valuable segment, reflecting the increasing average size of global commercial ships.

AI Impact Analysis on Anchor Windlass Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Anchor Windlass Market reveals primary interests centering on the transition from reactive maintenance to predictive operational models, the potential for autonomous anchoring systems, and the integration of AI-powered diagnostics into existing machinery. Users frequently inquire about how AI can detect nascent mechanical failures, optimize anchoring depth selection based on real-time environmental data (such as seabed composition and current strength), and enhance regulatory compliance tracking. A significant concern revolves around the cybersecurity risks associated with networked, smart windlass systems and the need for standardized data protocols to ensure interoperability between different vessel management systems and deck machinery components. Overall, the expectation is that AI will primarily serve as an intelligent layer augmenting the traditional mechanical reliability of windlasses, leading to substantial reductions in downtime and operational expenditure.

The application of AI in this niche market is currently focused less on replacing core mechanical functions and more on augmenting operational decision-making and maintenance scheduling. Machine learning algorithms are being trained on historical failure data, operational logs, and sensor inputs (vibration, temperature, pressure) collected from fleets globally. This extensive data analysis allows the system to establish precise baseline operating norms and flag anomalies that suggest impending component failure, significantly improving the efficacy of condition-based monitoring programs. Such predictive capabilities move the industry beyond standard scheduled maintenance, ensuring maximum uptime and preventing catastrophic equipment failures that could jeopardize vessel safety and cause expensive delays.

Furthermore, AI plays a crucial role in optimizing the actual anchoring process. By integrating algorithms that process real-time hydrographic data, weather forecasts, and dynamic positioning system feedback, smart windlasses can suggest or even automatically execute optimal anchor deployment and retrieval profiles. This precision is vital for large vessels operating in congested ports or environmentally sensitive areas, minimizing chain damage, reducing anchor drag potential, and ensuring compliance with specific environmental regulations regarding seabed disturbance. The long-term vision involves fully integrated, AI-driven mooring systems that communicate autonomously with shore facilities and other vessels, revolutionizing port operations and navigation safety, although this requires substantial regulatory and technological harmonization across the maritime domain.

- Predictive Maintenance: AI algorithms analyze sensor data (load, torque, temperature, vibration) to forecast equipment failure, dramatically reducing unplanned downtime.

- Operational Optimization: Machine learning assists in determining ideal anchoring speeds and depths based on real-time environmental and seabed conditions.

- Autonomous Integration: Enables seamless integration with vessel dynamic positioning systems for automated mooring adjustments.

- Enhanced Diagnostics: AI provides instant, highly accurate fault detection, guiding technicians towards precise maintenance requirements.

- Supply Chain Efficiency: Optimized inventory management for spare parts based on predicted usage and failure rates across a fleet.

- Cybersecurity Challenges: Introduction of network interfaces necessitates robust cybersecurity measures to protect critical machinery controls.

DRO & Impact Forces Of Anchor Windlass Market

The dynamics of the Anchor Windlass Market are governed by a complex interplay of macro-economic drivers, inherent industry restraints, lucrative technological opportunities, and significant external impact forces. A primary driver is the robust, long-term trajectory of global maritime trade, which mandates continuous investment in new shipbuilding across all vessel categories—from container ships vital for global supply chains to specialized vessels supporting niche sectors like LNG transport and offshore energy. Coupled with this infrastructural demand is the accelerating trend toward maritime safety and environmental compliance; international bodies like the IMO (International Maritime Organization) regularly introduce stricter guidelines for anchoring and mooring integrity, forcing vessel operators to upgrade or replace older, less reliable equipment to maintain classification status and insurance validity. The need for fuel efficiency also drives demand for lighter, more efficient electric and hydraulic systems, aligning operational expenditures with environmental goals.

Conversely, the market faces significant restraints, chiefly the cyclical volatility inherent in the global shipbuilding industry. Shipbuilding activity is highly sensitive to global economic health and investment cycles, leading to unpredictable peaks and troughs in demand for new windlass installations. The high initial capital expenditure associated with advanced, high-capacity hydraulic windlass systems, particularly those certified for harsh offshore environments, can deter smaller or financially constrained vessel operators. Furthermore, the specialized nature of the equipment requires highly skilled labor for installation and maintenance, creating logistical and cost restraints, especially in developing regional markets. Competitive pressure from low-cost manufacturers, often lacking the rigorous quality certifications of established players, also presents a challenge to premium market segments focused on high reliability and longevity.

Opportunities in the market are abundant, particularly in the vast global fleet requiring retrofitting. As vessels age, replacing outdated mechanical systems with modern, electronically controlled windlasses equipped with remote monitoring capabilities represents a significant growth vector. The burgeoning offshore renewable energy sector, including fixed and floating offshore wind farms, creates unique demands for high-holding-power anchor systems and specialized windlasses for installation vessels, driving innovation in custom engineering solutions. Furthermore, the integration of IoT sensors and predictive analytics offers manufacturers a chance to shift revenue streams towards high-margin after-sales service and data-driven maintenance contracts. Key impact forces shaping the market include fluctuating steel and copper commodity prices, which directly influence manufacturing costs, and regulatory shifts, such as stricter ballast water management standards that indirectly affect vessel design and required ancillary deck equipment.

Segmentation Analysis

The Anchor Windlass Market is extensively segmented across several dimensions, providing a granulated view of market dynamics based on technology, operational capacity, and end-user application. The segmentation by type is fundamental, differentiating between Electric, Hydraulic, and Manual systems, with hydraulic systems dominating the high-load, continuous-operation segment due to their resilience and power density. Segmentation by application dictates the required capacity and certification level, with Commercial Vessels (including bulk carriers, tankers, and container ships) representing the largest volume demand, while the Naval Vessels segment commands the highest specification and technological complexity due to mission-critical operational requirements. Understanding these segments is crucial for manufacturers to tailor product development, pricing strategies, and distribution channels to meet the diverse needs of the global marine industry effectively.

Further stratification is provided through capacity segmentation, typically categorized into Low (under 3 tons pull), Medium (3 to 15 tons pull), and High (over 15 tons pull), reflecting the gross tonnage of the vessels they serve. High-capacity windlasses are intrinsically linked to the construction and maintenance of ultra-large container vessels (ULCVs) and large offshore drilling units. Geographic segmentation remains paramount, where distinct regional regulatory environments and shipbuilding traditions influence technology preference—for instance, a greater emphasis on electric systems in European recreational boats versus hydraulic dominance in Asian commercial fleets. The interaction between these segments defines the competitive landscape, pushing manufacturers toward modular designs that can be adapted quickly across different capacity and power requirements, ensuring compliance and maximizing market penetration across varied end-user groups.

- By Type:

- Electric Windlass

- Hydraulic Windlass

- Manual Windlass

- By Application:

- Commercial Vessels (Tankers, Bulk Carriers, Cargo Ships)

- Naval Vessels and Coast Guard

- Offshore Vessels (Drilling Rigs, AHTS, FPSOs)

- Leisure Vessels and Yachts

- By Capacity:

- Low Capacity (Up to 3 Ton)

- Medium Capacity (3 Ton to 15 Ton)

- High Capacity (Over 15 Ton)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Retrofit and Replacement)

Value Chain Analysis For Anchor Windlass Market

The value chain for the Anchor Windlass Market begins with the upstream procurement of essential raw materials, primarily high-grade steel, cast iron, and non-ferrous alloys such as bronze for specific components like gypsy wheels, which demand high wear resistance. The manufacturing process is highly specialized, requiring precision machining, complex gear cutting, and assembly of hydraulic or electric power units, often outsourced to specialized suppliers. Strict quality control and certification by classification societies (e.g., ABS, Lloyd's Register, DNV) are mandatory checkpoints in the midstream, adding significant complexity and cost. Manufacturers must possess robust engineering capabilities to customize designs according to vessel specifications, ensuring the windlass integrates perfectly with the ship’s structure and power delivery systems.

Downstream activities focus heavily on distribution and installation. The primary distribution channel is direct sales to major global shipyards (OEM channel) for new construction projects, requiring manufacturers to maintain strong relationships with global shipbuilding hubs, particularly in East Asia. The indirect channel involves sales through marine equipment distributors and integrators, which are crucial for accessing the global aftermarket, particularly for replacement parts, service kits, and retrofit projects. After-sales service forms a critical component of the value chain, encompassing ongoing maintenance, repairs, and technical support. Given the critical safety function of windlasses, quick and reliable access to global service networks dictates long-term customer satisfaction and brand loyalty, making service contracts a key differentiator and revenue stream.

The distinction between direct and indirect distribution is strongly tied to the application segment. Direct sales are preferred for high-value, bespoke projects like naval contracts or ultra-large commercial vessels, where close coordination between the manufacturer and the shipyard is essential for customization and certification compliance. Conversely, the smaller leisure vessel and local repair markets rely heavily on indirect distribution through specialized marine stores and regional service agents. The efficiency of the distribution network determines the time-to-market for replacement parts, which is critical for minimizing vessel downtime. Therefore, optimizing logistics and inventory management across global service hubs is a significant competitive factor impacting the overall value delivered to the end-user.

Anchor Windlass Market Potential Customers

The potential customer base for the Anchor Windlass Market is intrinsically linked to the global fleet structure and the continuous cycle of shipbuilding and vessel maintenance. The largest purchasing segment is commercial vessel operators and owners, including major shipping lines that operate vast fleets of container ships, dry bulk carriers, oil and gas tankers, and chemical carriers. These customers prioritize robustness, minimal maintenance requirements, compliance with international safety standards, and high longevity due to the continuous operational demands and harsh marine environment. Purchasing decisions are typically influenced by classification society recommendations and total cost of ownership (TCO) over the projected lifespan of the vessel, favoring established brands known for reliable engineering and global service presence.

A second major customer group comprises governmental entities, specifically national navies and coast guard agencies. These buyers require anchor windlasses designed to military specifications, emphasizing features such as survivability, high shock resistance, stealth operational capabilities, and adherence to stringent national security and defense procurement regulations. While volume is lower compared to the commercial segment, these contracts command significantly higher average selling prices due to customization and complexity. Furthermore, the specialized offshore industry, encompassing drilling rig operators, floating production storage and offloading (FPSO) units, and anchor handling tug supply (AHTS) vessels, constitutes a high-value customer segment demanding deep-water rated, ultra-high capacity windlasses capable of operating reliably under extreme loads and harsh weather conditions associated with offshore exploration and renewables installation.

Finally, the growing leisure marine sector, encompassing builders and owners of yachts, cruisers, and high-end recreational vessels, represents a steady segment primarily interested in aesthetic integration, ease of use (often electric or automated systems), and low noise operation. While the windlasses are smaller, demand is driven by high-volume manufacturing trends in pleasure craft. Shipyards, acting as the primary point of purchase for new installations, are the most immediate B2B customers, integrating the windlasses into the vessel hull during construction. The aftermarket customers, comprising fleet maintenance departments and third-party repair yards, drive the significant and steady demand for replacement chains, gypsies, motors, and hydraulic components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $750 Million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wartsila, MacGregor (Cargotec), Rolls-Royce Marine (now owned by Kongsberg), Palfinger Marine, Northern Lights, Maxwell Marine, Lofrans', Muir Engineering, Italwinch, Lewmar, Beijing Time-Sensitive Equipment Manufacturing Co., Ltd., China State Shipbuilding Corporation (CSSC) subsidiaries, Fukashima Ltd., Harken, Plimsoll Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anchor Windlass Market Key Technology Landscape

The Anchor Windlass Market is undergoing a steady technological evolution driven by demands for increased operational efficiency, reduced environmental impact, and seamless system integration. One of the most critical technological advancements is the adoption of Variable Frequency Drives (VFDs) in electric windlass systems. VFD technology allows for precise speed and torque control, optimizing energy consumption, reducing electrical load spikes, and significantly improving the control finesse required during delicate anchoring operations. This shift is essential for vessels emphasizing hybrid or fully electric propulsion systems, where efficient power management of auxiliary machinery is paramount. Furthermore, material science innovation plays a role, with manufacturers developing specialized coatings and corrosion-resistant alloys to extend the lifespan of components exposed to harsh saltwater environments, thereby reducing maintenance frequency and increasing operational reliability.

The integration of advanced monitoring and diagnostic systems, leveraging Industrial Internet of Things (IIoT) sensors, constitutes another major technological leap. Modern windlasses are equipped with sensors that continuously monitor critical parameters such as motor temperature, hydraulic pressure, chain tension (load monitoring), and gear vibration. This real-time data is transmitted to the vessel's centralized control system or remote onshore monitoring centers, facilitating condition-based maintenance (CBM). This proactive approach, supported by cloud analytics, allows operators to anticipate mechanical wear and schedule interventions precisely, moving away from time-based maintenance and drastically minimizing the risk of unexpected operational failure, a critical concern for deep-sea operations.

Automation and modular design are defining features of the next generation of anchor windlasses. Modular construction allows shipyards to integrate windlasses more quickly and provides greater flexibility for servicing or replacing individual components rather than the entire unit. In terms of automation, there is a clear trend towards semi-autonomous operation, where the windlass system interfaces directly with the vessel's navigational and dynamic positioning (DP) systems. This integration allows the windlass to automatically adjust chain tension or payout speed in response to changes in environmental conditions (e.g., strong currents or wind gusts), thereby maintaining optimal anchor security without constant manual intervention. Hydraulic systems are also seeing technological improvements through high-efficiency pumps and closed-loop systems that minimize power loss and fluid contamination, enhancing overall system longevity and performance.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the Anchor Windlass Market both in terms of manufacturing volume and demand for new installations. This supremacy is fueled by the colossal shipbuilding industries of China, South Korea, and Japan, which collectively account for the majority of global commercial vessel construction, including VLCCs and mega-container ships. Favorable governmental policies supporting maritime infrastructure and the regional push toward liquefied natural gas (LNG) transport vessels further solidify APAC's position. The rapid development of internal trade routes and increasing defense spending by regional powers contribute substantially to the consistent demand for all segments, particularly high-capacity hydraulic systems.

- Europe: The European market, characterized by stringent environmental and safety regulations, is a leader in adopting advanced, high-specification windlass technologies, especially VFD-controlled electric systems for eco-friendly vessels and leisure marine applications. While shipbuilding capacity is moderate compared to APAC, Europe holds a premium position in specialized vessel construction (e.g., cruise ships, offshore wind installation vessels) and maintains a highly active retrofit and aftermarket segment, driven by strict class society mandates for fleet modernization and maintenance. Key manufacturing centers in Scandinavia and Germany focus on quality, precision, and integration capabilities.

- North America: Demand in North America is significantly driven by naval procurement and the specialized requirements of the domestic offshore energy sector, particularly in the Gulf of Mexico and coastal drilling operations. High technological standards and domestic content requirements often characterize U.S. naval contracts, promoting R&D investment within the region. The leisure marine market in North America is also robust, supporting strong demand for electric and automated windlass systems in yachts and recreational boats, valuing ease of use and reliability.

- Middle East and Africa (MEA): This region is heavily influenced by the oil and gas sector, generating substantial demand for specialized offshore windlasses used in supply vessels, rigs, and FPSOs. Investment cycles in oil exploration dictate market growth, often requiring highly customized and certified equipment. Infrastructure projects, including port expansions and new maritime logistics hubs, are also contributing to increasing demand for medium to high-capacity commercial vessel windlasses.

- Latin America (LATAM): The LATAM market is highly sensitive to commodity prices, affecting both shipbuilding (Brazil) and offshore activities. While smaller in overall volume, the region presents opportunities related to coastal security needs (driving naval demand) and resource transportation, although market penetration can be challenging due to economic variability and reliance on imported equipment from established global players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anchor Windlass Market.- Wartsila Corporation

- MacGregor (Cargotec Corporation)

- Rolls-Royce Marine (Kongsberg Maritime)

- Palfinger Marine

- Northern Lights (A member of the Masco Corporation)

- Maxwell Marine (VETUS)

- Lofrans' (OPEM Srl)

- Muir Engineering Group

- Italwinch (MZ Electronic Srl)

- Lewmar Ltd.

- Beijing Time-Sensitive Equipment Manufacturing Co., Ltd.

- Fukashima Ltd.

- China State Shipbuilding Corporation (CSSC) subsidiaries

- Harken, Inc.

- Plimsoll Corporation

- Hydraulics International, Inc.

- Kawasaki Heavy Industries

- Mitsubishi Heavy Industries

- Markey Machinery Co., Inc.

- C. A. Technologies

Frequently Asked Questions

Analyze common user questions about the Anchor Windlass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hydraulic and electric anchor windlasses?

Hydraulic windlasses are generally preferred for large commercial, naval, and offshore vessels due to their superior torque density, ability to handle continuous heavy loads, and robustness. Electric windlasses are typically utilized for medium to small commercial vessels and the leisure segment, valued for lower complexity, easier installation, and higher energy efficiency, particularly when integrated with VFD technology.

How is regulatory compliance impacting the growth of the Anchor Windlass Market?

Stringent international maritime safety regulations, primarily enforced by organizations like the IMO and classification societies (e.g., DNV, ABS), necessitate regular upgrades and replacements of anchoring systems. These regulations drive demand for certified, high-reliability windlasses equipped with modern load monitoring and control systems, ensuring operational safety and mitigating risks associated with anchor handling.

Which application segment accounts for the highest volume demand in the market?

The Commercial Vessels segment, encompassing bulk carriers, tankers, and container ships, represents the highest volume demand for anchor windlasses globally. This is driven by the massive fleet size and continuous construction activity in major shipbuilding regions, primarily in Asia Pacific.

What role does predictive maintenance (AI) play in the future of anchor windlass operations?

AI and predictive maintenance utilize sensors to monitor vibration, load, and temperature data, predicting potential mechanical failures before they occur. This technology shifts maintenance from reactive or time-based scheduling to condition-based monitoring, maximizing uptime, extending equipment lifespan, and significantly lowering long-term operational costs for vessel owners.

Where are the main growth opportunities for manufacturers in the coming forecast period?

The main growth opportunities lie in the aftermarket retrofit segment, driven by aging global fleets needing modernization, and the rapidly expanding offshore renewable energy sector, which requires highly specialized, high-capacity mooring and anchoring solutions for installation and maintenance vessels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager