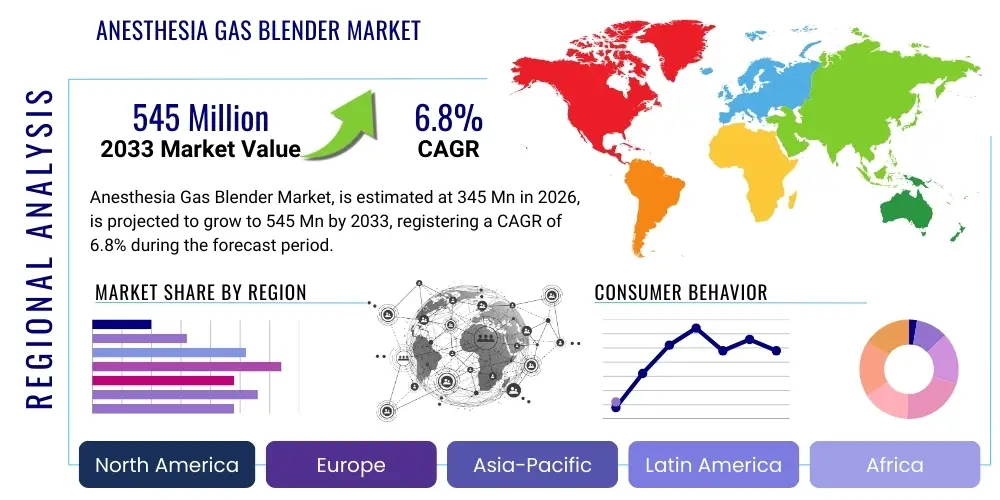

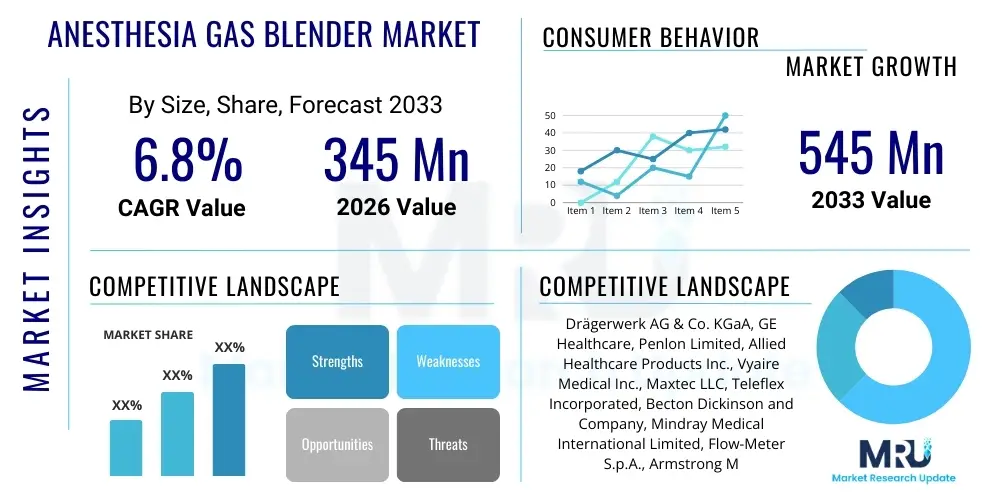

Anesthesia Gas Blender Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441237 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Anesthesia Gas Blender Market Size

The Anesthesia Gas Blender Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $345 Million in 2026 and is projected to reach $545 Million by the end of the forecast period in 2033.

Anesthesia Gas Blender Market introduction

The Anesthesia Gas Blender Market encompasses devices critical for delivering precise mixtures of medical gases, typically oxygen and nitrous oxide or air, to patients undergoing surgical procedures requiring general anesthesia. These sophisticated instruments ensure accurate titration and safe delivery of inhalational agents, acting as a foundational component in modern anesthesia workstations. Product descriptions highlight the transition from traditional, manual blenders to advanced electronic and microprocessor-controlled systems, offering superior accuracy, safety interlocks, and digital integration capabilities, addressing the imperative need for precise fractional inspired oxygen (FiO2) concentration across diverse clinical settings. The evolution of blending technology is primarily driven by the demand for low-flow anesthesia techniques, which require exceptional accuracy in gas mixing to ensure patient safety and optimize operational efficiency by minimizing volatile agent consumption.

Major applications of anesthesia gas blenders span a broad range of surgical environments, including cardiovascular, neurological, orthopedic, and emergency procedures, where controlled ventilation and oxygenation are paramount. These blenders are indispensable in ensuring that the mixture delivered to the patient remains within narrow therapeutic indices, crucial for mitigating risks associated with hyperoxia or hypoxia. The core benefits derived from utilizing high-quality blenders include enhanced patient safety through precise gas delivery, improved cost-efficiency by facilitating low-flow anesthesia practices, and greater procedural flexibility, especially when managing pediatric or neonatal cases requiring extremely accurate flow and concentration control. Furthermore, their integration with advanced monitoring systems allows for real-time adjustments and validation of gas parameters, strengthening the overall safety profile of anesthetic administration.

Driving factors for the expansion of this market include the global increase in surgical procedures, particularly in emerging economies where healthcare infrastructure is rapidly developing, leading to higher adoption rates of modern anesthesia equipment. Technological advancements, such as the incorporation of advanced sensors, predictive analytics, and enhanced ergonomic designs, further stimulate market growth by improving usability and reducing the potential for human error. Furthermore, stringent regulatory guidelines emphasizing patient safety and the standardization of gas delivery systems necessitate the continuous upgrade and replacement of older, less precise blending technologies. The ongoing shift toward minimally invasive surgery and the rising prevalence of chronic diseases requiring surgical intervention also contribute significantly to the sustained demand for reliable anesthesia gas blenders.

Anesthesia Gas Blender Market Executive Summary

The Anesthesia Gas Blender Market is characterized by steady technological evolution and strong integration into multi-functional anesthesia delivery systems. Current business trends indicate a concentrated effort by manufacturers toward developing compact, portable, and electronically controlled blenders featuring enhanced safety alarms and compatibility with Electronic Health Records (EHRs). A significant trend involves the increasing preference for advanced flow blending technologies that support ultra-low flow anesthesia, driven by environmental concerns regarding the emission of potent greenhouse gases and the economic need to reduce consumption of expensive volatile agents. Strategic partnerships and mergers among key players are common, aiming to consolidate market share and leverage specialized technological expertise, particularly in digital sensing and calibration.

Regionally, North America and Europe maintain dominance, primarily due to established healthcare infrastructure, high regulatory standards, and early adoption of sophisticated medical technologies. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by expanding public and private healthcare investments, increasing medical tourism, and a rapidly growing population requiring surgical care. Regional trends also show a diversification of product offerings; while mature markets focus on premium, integrated blenders, developing regions show strong demand for cost-effective, durable, and easily maintainable models. The drive toward centralized hospital procurement systems in several key countries is also influencing pricing strategies and market access.

Segment trends highlight the dominance of hospital end-users, although the Ambulatory Surgical Centers (ASCs) segment is exhibiting the highest growth rate, fueled by the shift of complex procedures from inpatient to outpatient settings. In terms of product type, high-flow blenders remain the mainstay for traditional applications, but the low-flow and precision blender segments are experiencing accelerating demand due to efficacy in closed-circuit and minimal-flow anesthesia techniques. The market for blenders customized for pediatric and neonatal applications is seeing focused investment, given the critical requirement for accuracy in these vulnerable patient populations. Furthermore, the consumables associated with these blenders, such as specialized mixing chambers and filters, continue to provide stable revenue streams for market leaders, reinforcing the importance of proprietary design and supply chain management.

AI Impact Analysis on Anesthesia Gas Blender Market

User queries regarding the impact of Artificial Intelligence (AI) on the Anesthesia Gas Blender Market primarily revolve around how AI can enhance safety, optimize gas consumption, and integrate predictive maintenance into existing blending hardware. Common questions address the feasibility of autonomous gas titration based on patient physiological data, the role of machine learning in detecting subtle equipment malfunctions before catastrophic failure, and whether AI integration will lead to entirely new generations of "smart" anesthesia machines. Users are seeking clarity on the cost-benefit analysis of implementing AI-driven calibration systems versus traditional manual checks and the ethical implications concerning the degree of automation permitted in life-critical medical devices. Key themes emerging from this analysis confirm high user expectation for AI to transform gas delivery from a reactive system to a proactive, highly personalized platform, significantly reducing wastage and improving patient outcomes by precisely matching gas delivery kinetics to real-time metabolic needs.

- AI enables predictive maintenance scheduling for blenders, minimizing downtime and calibration errors.

- Machine learning algorithms optimize gas mixture ratios in real-time, based on patient specific physiological data (e.g., end-tidal gas measurements, hemodynamics).

- AI integration supports autonomous closed-loop anesthesia delivery systems, enhancing precision and reducing anesthetist cognitive load.

- Advanced data analytics driven by AI models identify patterns in volatile agent consumption, driving efficiency and reducing hospital operational costs.

- Computer vision and diagnostic AI tools enhance the accuracy of pre-use safety checks and system integrity verification.

- AI facilitates the development of intelligent alarm systems that differentiate critical failures from transient measurement fluctuations, minimizing false alarms.

DRO & Impact Forces Of Anesthesia Gas Blender Market

The dynamics of the Anesthesia Gas Blender Market are governed by a robust interplay of driving forces stemming from clinical necessity and technological push, countered by inherent restraints related to regulatory hurdles and capital investment requirements. Opportunities are abundant, primarily centered around addressing the demand for precision in low-flow anesthesia and expanding accessibility in emerging markets. The overall impact forces illustrate a moderately high competitive intensity, driven by the specialized nature of the technology and the critical importance of safety standards, necessitating continuous innovation in sensor technology and integration capabilities. The market demonstrates resilience, underpinned by the indispensable role blenders play in surgical protocols globally, ensuring a steady replacement cycle and stable baseline demand.

Key drivers include the global demographic shift toward an aging population requiring more frequent surgical interventions, the continuous technological migration towards integrated anesthesia workstations, and the rising global awareness concerning the environmental and economic benefits of employing low-flow and minimal-flow anesthesia techniques. Furthermore, stringent regulatory frameworks established by bodies like the FDA and CE mandate the use of highly accurate and reliable gas delivery systems, pushing hospitals to upgrade older equipment. Restraints, conversely, include the high initial cost of advanced digital blenders and associated anesthesia delivery systems, posing significant challenges for smaller healthcare facilities or those in developing regions. Additionally, complex and time-consuming regulatory approval processes for new technological iterations can slow down market penetration, while the scarcity of highly trained personnel required to operate and maintain sophisticated electronic blending systems remains a limiting factor in certain geographies. The reliance on consistent supply chains for high-purity medical gases also presents an operational vulnerability that can restrain the consistent use of blenders in remote settings.

Opportunities for market expansion are primarily found in developing customized blenders optimized for specific clinical environments, such as MRI-compatible systems and highly portable units for field medicine or emergency preparedness. The substantial, untapped potential of the Asia Pacific and Latin American markets, characterized by rapid infrastructural development and growing patient volumes, offers significant expansion pathways for market leaders. Furthermore, the growing trend toward adopting hybrid operating rooms and dedicated pain management centers creates new niche applications for precision gas blenders. The overarching impact forces—such as increasing safety mandates (high impact), technological convergence (medium to high impact), and healthcare cost containment pressures (medium impact)—collectively necessitate that manufacturers focus heavily on reliability, modularity, and total cost of ownership reduction to achieve sustained market success. The imperative to integrate seamlessly with digital operating room ecosystems further amplifies the need for standard communication protocols and robust data security features in future product generations.

Segmentation Analysis

The Anesthesia Gas Blender Market is comprehensively segmented based on product type, technology, end-user, and application, allowing for a detailed understanding of diverse customer needs and market dynamics. This detailed classification reflects the varied complexity of surgical environments and the specific requirements for gas delivery precision across different patient demographics. Product differentiation is primarily driven by flow rate capabilities and control mechanisms, separating the market into high-flow units essential for rapid induction and critical care, and precision blenders optimized for long, controlled minimal-flow procedures.

Technology segmentation focuses on the core mechanism of gas mixing—ranging from simple mechanical systems utilizing Venturi principles to complex electronic micro-processor controlled blenders that offer advanced feedback loops and digital calibration. The end-user analysis highlights the dominance of hospitals, which possess large volumes of operating rooms and critical care units, yet also recognizes the accelerating procurement activity within Ambulatory Surgical Centers (ASCs), driven by procedural migration and cost-efficiency initiatives. Application-based segmentation underscores the specific design requirements necessary for ensuring safety across different patient sizes, with neonatal and pediatric applications demanding the highest levels of accuracy and flow control due to the physiological sensitivity of these patient groups.

- By Product Type

- High Flow Blenders

- Low Flow/Precision Blenders

- Custom and Modular Blenders

- By Technology

- Electronic/Microprocessor Controlled Blenders

- Pneumatic/Mechanical Blenders

- By End-User

- Hospitals (Public and Private)

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics and Emergency Medical Services (EMS)

- By Application

- Adult Anesthesia

- Pediatric Anesthesia

- Neonatal and Infant Anesthesia

- Critical Care and ICU Ventilation

- By Gas Type

- Oxygen/Air Blenders

- Oxygen/Nitrous Oxide Blenders

- Multi-Gas Blenders

Value Chain Analysis For Anesthesia Gas Blender Market

The Value Chain Analysis for the Anesthesia Gas Blender Market begins with the upstream activities of raw material procurement and highly specialized component manufacturing. Key components include advanced pressure regulators, precision flow sensors (critical for electronic blenders), microprocessors, and medical-grade plastics and alloys. Upstream success relies heavily on strong partnerships with sensor technology providers and adherence to strict quality control standards for medical-grade materials, as the reliability of the final product directly depends on component integrity. Research and development activities, focusing on minimizing gas leakage, enhancing digital integration, and improving interface design, form a vital segment of the upstream value addition, driving differentiation among competitors.

The central phase of the value chain involves assembly, calibration, and rigorous testing, where manufacturers must adhere to global certifications such as ISO 13485 and regional medical device regulations. Calibration is arguably the most critical step, ensuring the blender delivers gases with the required clinical accuracy. Distribution channels are highly specialized; the market relies significantly on indirect channels, utilizing specialized medical device distributors who possess established relationships with hospital procurement departments and who can provide necessary technical support and training. Direct sales channels are typically reserved for large hospital systems or government tenders, allowing manufacturers greater control over pricing and customer relationship management.

Downstream analysis focuses on post-sale activities, including installation, technical support, scheduled maintenance, and the supply of proprietary spare parts and calibration kits. Given the life-critical nature of the equipment, robust and responsive technical service is a major competitive differentiator. End-users require mandatory, periodic maintenance and calibration services to ensure regulatory compliance and operational safety, generating substantial recurring revenue for the service divisions of manufacturing companies. The increasing complexity of electronic blenders necessitates specialized training for hospital biomedical engineering teams, further solidifying the importance of comprehensive post-sales service offerings.

Anesthesia Gas Blender Market Potential Customers

The primary consumers and end-users of Anesthesia Gas Blenders are institutions and facilities involved in administering general anesthesia, ventilation support, and critical care monitoring. Hospitals constitute the largest customer base, encompassing both large-scale public tertiary care centers and smaller, private community hospitals. These facilities require diverse blenders to equip multiple operating rooms, recovery areas, and Intensive Care Units (ICUs). The procurement cycles in hospitals are often long, characterized by committee decisions and reliance on long-term capital budgeting, necessitating manufacturers to demonstrate superior product lifecycle value and clinical reliability.

Ambulatory Surgical Centers (ASCs) represent the fastest-growing customer segment. As increasingly complex procedures migrate from inpatient hospital settings to outpatient ASCs due to cost efficiencies and improved recovery protocols, the demand for compact, efficient, and easily maneuverable gas blenders in these facilities is soaring. ASCs typically prioritize portability, ease of use, and lower total cost of ownership compared to large hospital systems. Additionally, specialty clinics focusing on procedures such as endoscopic surgery, dental anesthesia, and pain management are increasingly adopting smaller, dedicated blenders for specific procedural requirements. The third significant customer group includes Emergency Medical Services (EMS) and military field hospitals, which require robust, battery-operated, and highly durable blenders capable of maintaining accuracy under extreme environmental conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $345 Million |

| Market Forecast in 2033 | $545 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Drägerwerk AG & Co. KGaA, GE Healthcare, Penlon Limited, Allied Healthcare Products Inc., Vyaire Medical Inc., Maxtec LLC, Teleflex Incorporated, Becton Dickinson and Company, Mindray Medical International Limited, Flow-Meter S.p.A., Armstrong Medical Ltd., Löwenstein Medical Technology GmbH + Co. KG, Infinium Medical, SunMed, Spacelabs Healthcare, Nihon Kohden Corporation, DRE Medical, Dameca a Medtronic Company, Blease Medical Equipment Ltd., Shenzhen Mindray Bio-Medical Electronics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anesthesia Gas Blender Market Key Technology Landscape

The Anesthesia Gas Blender Market is continuously being shaped by advancements focused on enhancing precision, reliability, and digital connectivity. The dominant technological trend involves the shift from purely mechanical proportional systems to highly accurate, micro-processor controlled electronic blenders. These electronic systems utilize advanced mass flow sensors and solenoid valves to dynamically adjust gas ratios, providing feedback loops that ensure the delivered FiO2 concentration remains consistent despite fluctuations in supply pressure or flow rate. This technological maturity allows for integration with sophisticated patient monitoring equipment and the ability to execute closed-loop control systems, minimizing the likelihood of manual setting errors and significantly enhancing patient safety, particularly in sensitive procedures requiring tight control over oxygen delivery.

A secondary, yet crucial, technological development is the implementation of integrated safety features, most notably pressure compensating technology and alarm management systems. Modern blenders incorporate anti-hypoxic safety devices that mechanically or electronically prevent the delivery of gas mixtures containing less than a pre-determined minimum percentage of oxygen, typically 25%. Furthermore, digital blenders often feature enhanced connectivity standards, such as HL7 and proprietary communication protocols, enabling seamless data transfer to hospital EHRs and centralized data repositories. This connectivity is foundational for enabling AI-driven analytics regarding gas consumption efficiency and clinical workflow optimization, supporting the broader push toward digitally integrated operating rooms.

Future technology is geared towards miniaturization and enhanced portability, especially for pre-hospital and critical transport scenarios. Novel sensor technologies are being explored to improve long-term calibration stability, reducing the frequency and cost associated with mandatory service intervals. There is also increasing focus on developing blenders that are robustly compatible with magnetic resonance imaging (MRI) environments, utilizing non-ferromagnetic components to ensure safe operation near powerful superconducting magnets. The core technological objective remains achieving the highest degree of gas delivery accuracy while minimizing the footprint and maximizing the intuitive user interface design, thereby catering to the global trend of less invasive surgical settings and increased operational efficiency.

Regional Highlights

- North America: North America, comprising the United States and Canada, holds the largest share of the Anesthesia Gas Blender Market, driven by high healthcare expenditure, the presence of major medical device manufacturers, and stringent regulatory requirements that necessitate frequent technology upgrades. The region benefits from early adoption of advanced anesthesia workstations and a high volume of complex surgical procedures. The U.S. market is characterized by a strong demand for high-end electronic blenders that integrate seamlessly with hospital IT infrastructure and support advanced clinical techniques like low-flow anesthesia to maximize cost savings and reduce environmental impact. Private insurance coverage ensures widespread access to state-of-the-art medical equipment.

- Europe: Europe is a mature and significant market, primarily led by Germany, the UK, and France. The market here is strongly influenced by the European Medical Device Regulation (MDR), which imposes high standards for safety and performance, fostering continuous innovation in blender technology. Public healthcare systems across the continent emphasize cost-effectiveness, driving the adoption of precision blenders that facilitate ultra-low flow anesthesia, thereby minimizing volatile agent costs. The strong focus on manufacturing excellence and standardization across EU member states ensures a stable and quality-driven market environment.

- Asia Pacific (APAC): The APAC region, including China, India, Japan, and South Korea, is projected to be the fastest-growing market. This exponential growth is fueled by rapidly improving healthcare infrastructure, increasing disposable incomes, and the expansion of medical tourism. While Japan and South Korea represent technologically advanced markets seeking high-precision electronic devices, emerging economies like India and China show robust demand for cost-effective and durable mechanical blenders, alongside increasing procurement of integrated systems for newly established multi-specialty hospitals. Government initiatives to improve surgical access in rural areas are also stimulating demand for portable and robust units.

- Latin America (LATAM): The LATAM market, including Brazil and Mexico, exhibits moderate but steady growth. Market expansion is dependent on economic stability and government investment in public health systems. Key drivers include the modernization of existing hospital facilities and the rising prevalence of chronic diseases requiring surgical intervention. Pricing sensitivity is a critical factor, leading to a strong demand for reliable, mid-range priced pneumatic blenders and localized assembly solutions to manage import duties and logistics costs. Distributors play a crucial role in navigating complex regional regulatory landscapes and providing essential technical support.

- Middle East and Africa (MEA): The MEA market shows heterogeneous growth. The Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE, Qatar) represent high-value markets with significant capital investment in luxury healthcare infrastructure, favoring premium, fully integrated anesthesia systems and electronic blenders from North American and European manufacturers. Conversely, the African continent presents immense untapped potential, with growth driven by international aid, private investment in urban medical centers, and a pressing need for affordable, rugged equipment capable of operating efficiently in resource-limited settings. Standardization of medical gas supply remains a key challenge impacting wider adoption across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anesthesia Gas Blender Market.- Drägerwerk AG & Co. KGaA

- GE Healthcare

- Penlon Limited

- Allied Healthcare Products Inc.

- Vyaire Medical Inc.

- Maxtec LLC

- Teleflex Incorporated

- Becton Dickinson and Company (BD)

- Mindray Medical International Limited

- Flow-Meter S.p.A.

- Armstrong Medical Ltd.

- Löwenstein Medical Technology GmbH + Co. KG

- Infinium Medical

- SunMed

- Spacelabs Healthcare

- Nihon Kohden Corporation

- DRE Medical

- Dameca a Medtronic Company

- Blease Medical Equipment Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Anesthesia Gas Blender market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Anesthesia Gas Blender?

The primary function of an Anesthesia Gas Blender is to accurately and safely mix two or more pressurized medical gases, typically oxygen and nitrous oxide or medical air, ensuring the precise fractional inspired oxygen (FiO2) concentration is delivered to the patient through the anesthesia machine or ventilator.

How do electronic blenders differ from pneumatic blenders in terms of clinical performance?

Electronic blenders offer superior clinical performance due to the use of microprocessors and highly accurate mass flow sensors, providing dynamic control, integrated safety alarms, real-time feedback, and better long-term calibration stability compared to simpler, mechanical pneumatic proportional blenders.

What is driving the adoption of low-flow anesthesia techniques?

The adoption of low-flow anesthesia is primarily driven by economic benefits, as it significantly reduces the consumption and cost of expensive volatile anesthetic agents, and environmental concerns related to minimizing the emission of potent greenhouse gases used in anesthesia.

Which end-user segment is experiencing the fastest growth in the market?

Ambulatory Surgical Centers (ASCs) are the fastest-growing end-user segment, propelled by the increasing trend of shifting surgical procedures from high-cost inpatient hospital settings to more efficient and cost-effective outpatient facilities.

What are the major regulatory challenges manufacturers face in this market?

Manufacturers face major regulatory challenges, including adherence to stringent quality management systems (like ISO 13485) and navigating complex regional medical device approval processes, such as the FDA clearance in North America and the EU's Medical Device Regulation (MDR) requirements for critical life-support equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager