Animal Diagnostics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441573 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Animal Diagnostics Market Size

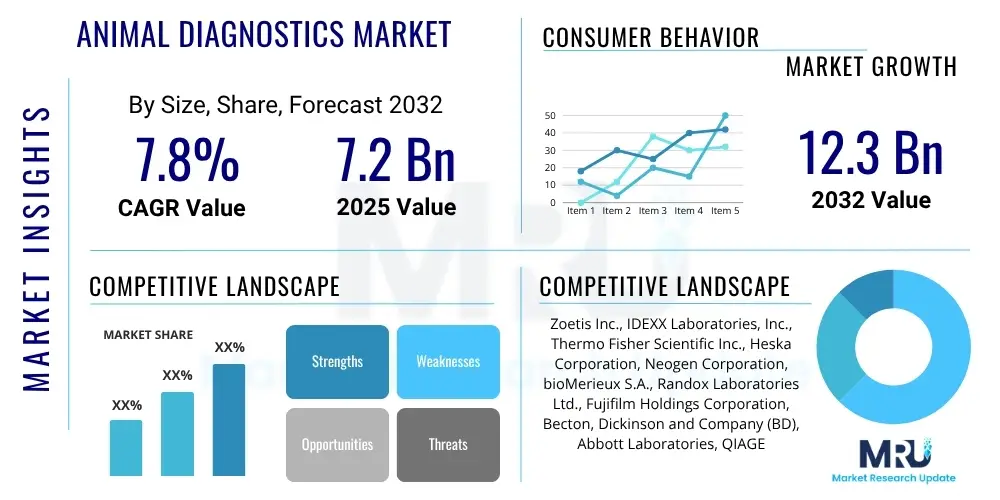

The Animal Diagnostics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033.

Animal Diagnostics Market introduction

The Animal Diagnostics Market encompasses a wide array of tools and services used for the timely and accurate identification of diseases, monitoring of animal health status, and therapeutic management in both companion animals and livestock. This crucial sector includes diagnostic instruments, consumables, reagents, and services leveraging advanced technologies such as clinical chemistry, molecular diagnostics (PCR), immunodiagnostics (ELISA), and hematology. The primary application areas span routine wellness checks, pre-surgical screening, infectious disease detection, and chronic disease management, supporting veterinary professionals in making informed clinical decisions that enhance animal welfare and food safety.

The core products offered range from centralized laboratory equipment, capable of high-throughput testing, to point-of-care (POC) devices that provide rapid results directly in veterinary clinics, significantly improving turnaround times for critical diagnoses. The market benefits substantially from the increasing trend of pet humanization, where owners are willing to spend more on sophisticated healthcare for their pets, driving demand for complex diagnostic procedures. Furthermore, the imperative for zoonotic disease surveillance, ensuring public health and safety, necessitates robust diagnostic systems for livestock and production animals.

Key driving factors propelling market expansion include rising global consumption of meat and dairy products, which mandates stringent disease control measures in livestock, coupled with technological advancements leading to the development of more sensitive, specific, and user-friendly diagnostic platforms. The ongoing threat posed by emerging infectious diseases and the necessity for effective antimicrobial stewardship programs further solidify the critical role of timely and accurate animal diagnostics in the global health ecosystem.

Animal Diagnostics Market Executive Summary

The Animal Diagnostics Market is experiencing robust expansion driven by pronounced consumer trends favoring pet humanization and significant structural shifts in global food security protocols. Business trends indicate a strong move toward decentralized testing, with substantial investment channeled into developing sophisticated point-of-care instruments that deliver laboratory-grade accuracy in clinical settings. Major industry players are focusing on strategic mergers, acquisitions, and collaborations to expand their testing portfolios, particularly in molecular diagnostics, offering highly specific panels for complex infectious diseases in both production and companion animals. Furthermore, digitalization is integrating diagnostic devices with practice management software, enhancing data sharing and diagnostic workflow efficiency.

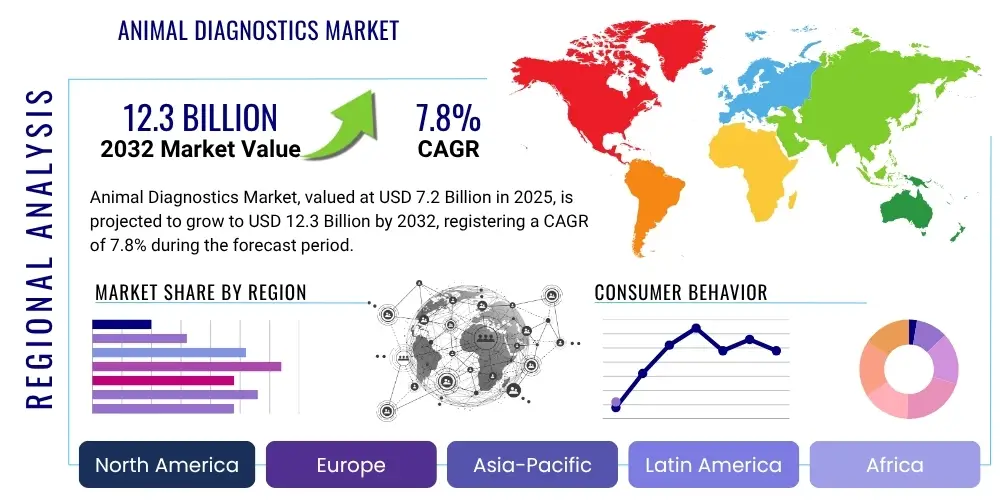

Regional trends highlight North America and Europe as dominant markets due to high veterinary expenditure, advanced healthcare infrastructure, and stringent regulatory frameworks concerning animal health and food safety. However, the Asia Pacific region is projected to register the highest growth rate, fueled by rapid expansion of livestock farming operations, increasing disposable income leading to higher pet adoption rates, and governmental initiatives aimed at controlling endemic livestock diseases like African Swine Fever and Foot-and-Mouth Disease. Latin America and the Middle East and Africa are emerging as high-potential regions, focusing on establishing modern veterinary infrastructure to meet rising demands.

Segment trends underscore the dominance of consumables and reagents, which represent the largest revenue share due to their recurrent purchase nature integral to every test conducted. Among technologies, molecular diagnostics, particularly real-time PCR, is exhibiting the fastest growth due to its superior sensitivity and specificity for early pathogen detection, crucial for rapid containment strategies. In terms of animal type, the companion animal segment is the leading revenue generator, directly benefiting from increased healthcare spending per pet, while the livestock segment remains essential for ensuring global food security and public health surveillance.

AI Impact Analysis on Animal Diagnostics Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) are transforming veterinary clinical practice, particularly regarding diagnostic accuracy, workflow efficiency, and cost reduction. Common questions revolve around the application of deep learning in analyzing complex diagnostic images (such as radiographs, ultrasounds, and histopathology slides) and the role of AI in predictive modeling for disease outbreaks in farm animals. Key concerns center on data privacy, the standardization of large-scale veterinary datasets necessary for training effective algorithms, and the practical accessibility of these technologies for smaller veterinary practices. The overwhelming expectation is that AI will automate routine tasks, minimize human error, and unlock new insights from vast pools of diagnostic data, thereby accelerating the identification of rare diseases and optimizing treatment protocols.

AI’s influence is rapidly permeating the animal diagnostics sector, primarily through enhanced image recognition and data interpretation capabilities. Machine learning models are being deployed to analyze complex clinical data, including complete blood counts, biochemical profiles, and genetic markers, offering sophisticated pattern recognition that traditional methods often miss. This analytical power leads to significantly faster and more accurate diagnoses, particularly in oncology, pathology, and endocrinology. Furthermore, AI systems are instrumental in managing diagnostic workflow, prioritizing samples based on urgency, and ensuring quality control in high-throughput laboratory environments, thus increasing operational efficiency across the entire diagnostic chain.

The integration of AI is not limited to clinical environments; it is also profoundly impacting livestock management and epidemiological surveillance. Predictive AI models utilize environmental factors, vaccination records, and sensor data from farms to forecast potential disease outbreaks, enabling proactive intervention rather than reactive treatment. This shift is critical for maintaining herd health, reducing antibiotic use (supporting antimicrobial stewardship), and safeguarding the global food supply. As AI technologies become more accessible and integrated into point-of-care devices, they will empower general practitioners with specialist-level diagnostic support, democratizing high-quality veterinary care globally.

- AI optimizes analysis of imaging data (radiographs, CT, MRI), improving diagnostic precision for complex conditions.

- Machine learning algorithms enhance molecular diagnostics interpretation, speeding up pathogen identification and mutation analysis.

- Predictive analytics use epidemiological data to forecast disease outbreaks in livestock, enabling preventative measures.

- AI integration supports point-of-care devices, offering automated interpretation and reducing reliance on specialized lab personnel.

- Automation of lab workflow and quality control minimizes human error and increases throughput efficiency in centralized labs.

- Facilitates personalized medicine by correlating individual animal genetic data with clinical profiles to optimize therapeutic strategies.

DRO & Impact Forces Of Animal Diagnostics Market

The Animal Diagnostics Market is propelled by substantial market drivers, most notably the increasing adoption of companion animals globally and the heightened focus on their medical care, often mirroring human healthcare standards (pet humanization). Concurrently, global regulatory bodies are enforcing stricter standards for livestock health and food safety, requiring mandatory diagnostic testing for zoonotic diseases and antibiotic residues, thereby solidifying demand from the production animal sector. Opportunities are emerging predominantly in the development of highly integrated, multi-parameter point-of-care devices and the utilization of genomics and proteomics for highly specific disease characterization, allowing for early detection and targeted intervention, particularly in emerging markets where infrastructure is still developing but demand is surging.

However, the market faces significant restraints. The primary barrier to market growth, especially in developing economies, remains the high initial cost associated with sophisticated diagnostic instruments and the lack of skilled veterinary professionals trained to operate and interpret complex molecular and immunological assays. Furthermore, the regulatory landscape, while driving demand for testing, can also impose delays in the approval and commercialization of new diagnostic platforms, limiting the speed of technological diffusion. Managing and standardizing large volumes of diagnostic data across diverse animal populations also presents a persistent technical challenge, influencing data integration capabilities.

The impact forces within this market are shaped by technological innovation and consumer willingness to invest. The continuous innovation in microfluidics and biosensors is dramatically reducing the size and cost of diagnostic platforms, pushing testing capabilities closer to the patient (POC). High bargaining power from major veterinary diagnostic providers, who often offer bundled solutions (instruments, reagents, and software), influences pricing structures and market entry for smaller innovators. Ultimately, the market trajectory is highly sensitive to epidemiological events, as global pandemics or widespread zoonotic disease outbreaks immediately catalyze demand for robust, rapid, and widespread diagnostic tools across all animal segments, exerting a strong, positive force on market growth.

Segmentation Analysis

The Animal Diagnostics Market is systematically segmented based on product type, technology, animal type, and end-user, providing a granular view of revenue generation across different operational facets. The product segment is crucial, dividing revenue sources between capital-intensive instruments and recurring revenue-generating consumables. Technological segmentation reveals the shift towards faster and more accurate testing modalities, while the animal type division distinguishes the high-value companion animal market from the high-volume livestock sector. End-user analysis maps the adoption and usage patterns across various clinical and institutional settings, highlighting the key purchasers of diagnostic solutions.

Detailed segmentation analysis allows stakeholders to identify high-growth niches. For instance, within the technology segment, advanced techniques like Next-Generation Sequencing (NGS) and microarray analysis, while currently smaller, are set for explosive growth due to their utility in personalized veterinary medicine and genetic disorder screening. Similarly, the end-user segmentation shows that reference laboratories, despite being fewer in number, account for a substantial volume of complex testing, whereas veterinary hospitals and clinics drive the high-volume demand for routine and point-of-care diagnostics. Understanding these dynamics is essential for strategic planning, pricing, and resource allocation across the diverse diagnostic landscape.

- By Product: Instruments, Consumables and Reagents, Services, Software

- By Technology: Clinical Biochemistry, Immunodiagnostics (ELISA, Lateral Flow Assays), Molecular Diagnostics (PCR, Microarrays), Hematology, Urinalysis, Others

- By Animal Type: Companion Animals (Dogs, Cats, Horses, Others), Livestock (Cattle, Poultry, Swine, Sheep, Others)

- By End-User: Veterinary Hospitals and Clinics, Veterinary Reference Laboratories, Veterinary Research Institutes, Farm Animal Practice

Value Chain Analysis For Animal Diagnostics Market

The value chain for the Animal Diagnostics Market is complex, beginning with upstream activities focused on research and development (R&D) of novel assays, biomarkers, and instrumentation components. Key upstream suppliers include biotechnology companies providing specialized antibodies, enzymes, and genetic primers, as well as high-tech manufacturers supplying microfluidic chips, optical components, and integrated circuit boards critical for advanced diagnostic systems. Efficiency and proprietary technology at this stage determine the accuracy, speed, and overall cost-effectiveness of the final diagnostic product. Suppliers must adhere to rigorous quality standards, as the performance of the final assay is directly dependent on the purity and stability of these raw materials.

The midstream involves the core manufacturing, assembly, and quality assurance processes carried out by major diagnostic companies, where raw materials are converted into marketable instruments and packaged reagent kits. Downstream activities involve distribution channels, which are critical for timely delivery of temperature-sensitive reagents and consumables. Distribution relies heavily on a dual strategy: direct sales teams are used for large capital equipment and strategic accounts (e.g., major reference laboratories), while indirect channels, including authorized third-party distributors and specialized wholesalers, handle the bulk of consumable and reagent distribution to thousands of veterinary clinics globally. The selection of distribution method depends on the required technical support and geographic reach.

The final stage involves the end-users—veterinary professionals—who utilize these products to diagnose animals. The market requires substantial post-sales support, including instrument maintenance, technical troubleshooting, and continuous education for veterinary staff on the latest diagnostic techniques. Efficient direct and indirect channels ensure that rapid diagnostics, often needed immediately for emergency cases, are consistently available. This final segment of the value chain also integrates IT infrastructure, as modern devices often require integration with cloud services and laboratory information management systems (LIMS) for seamless data transfer and interpretation, completing the feedback loop back to product development.

Animal Diagnostics Market Potential Customers

The primary buyers and end-users of animal diagnostic products and services span the entire spectrum of animal healthcare and management, ranging from small, independent veterinary practices to large, centralized corporate entities. Veterinary hospitals and clinics represent the largest volume purchasers, driving demand for rapid, user-friendly point-of-care instruments and high-volume consumables needed for routine screening, pre-surgical assessment, and immediate disease identification in companion animals. These customers prioritize ease of use, speed of results, and integration with existing practice management software, enabling immediate treatment decisions and enhancing client satisfaction.

A second major customer segment includes specialized veterinary reference laboratories, both independent and corporate-owned, which handle complex, outsourced testing that requires high-throughput equipment, advanced molecular diagnostics (e.g., next-generation sequencing), and specialized expertise in pathology and toxicology. These laboratories serve as centralized hubs, prioritizing test menu breadth, analytical sensitivity, and adherence to rigorous quality standards. The third critical customer group comprises large-scale farm animal operations and government public health agencies, which utilize diagnostic tools primarily for herd health monitoring, disease surveillance, and ensuring compliance with international trade regulations regarding disease-free status, focusing heavily on cost-effective, high-volume testing solutions for early detection of endemic and emerging zoonotic diseases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IDEXX Laboratories, Zoetis Inc., Thermo Fisher Scientific Inc., Heska Corporation, Neogen Corporation, Virbac, VCA, Inc. (A Mars Company), Abaxis (now part of Zoetis), Fujifilm VET Systems Co., Ltd., Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Qiagen N.V., Randox Laboratories Ltd., Siemens Healthineers, Sysmex Corporation, Agfa-Gevaert N.V., Ceva Santé Animale, Indical Bioscience GmbH, Merck Animal Health, Dalan Animal Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Animal Diagnostics Market Key Technology Landscape

The technological landscape of the Animal Diagnostics Market is characterized by rapid innovation focused on miniaturization, multi-parameter testing, and improved analytical sensitivity. Molecular diagnostics, spearheaded by Real-Time Polymerase Chain Reaction (RT-PCR) and isothermal amplification techniques, remains paramount for highly specific and rapid identification of pathogens, antibiotic resistance genes, and genetic predispositions. The increasing affordability and robustness of these platforms are enabling their migration from centralized reference labs to point-of-care settings. Furthermore, advanced sequencing technologies, such as Next-Generation Sequencing (NGS), are gaining traction for comprehensive pathogen surveillance and complex genomic analysis, particularly in research and specialized veterinary oncology.

Immunodiagnostics continues to be a foundational technology, dominated by Enzyme-Linked Immunosorbent Assays (ELISA) and lateral flow rapid tests, valued for their cost-effectiveness and scalability in screening large populations of animals for antibodies or antigens related to common infectious diseases. Innovation in this area centers on enhancing multiplexing capabilities, allowing a single test device to detect multiple analytes simultaneously, thereby maximizing efficiency. Separately, the instrumentation for clinical chemistry and hematology is evolving rapidly, with newer analyzers incorporating smaller sample volumes and faster processing times, coupled with sophisticated internal quality control systems to ensure reliability in fast-paced veterinary environments.

A crucial technological trend involves the integration of diagnostic devices with digital health ecosystems. Modern analyzers are equipped with connectivity features (Wi-Fi, cloud integration) that automatically transmit results to Veterinary Practice Management Software (VPMS) and centralized cloud databases. This connectivity facilitates telemedicine consultations, improves record-keeping, and allows for large-scale data aggregation for epidemiological modeling. Furthermore, microfluidics and lab-on-a-chip technologies are instrumental in reducing sample handling errors and enabling the development of highly integrated, low-cost diagnostic cartridges suitable for widespread deployment, significantly impacting accessibility in underserved veterinary markets.

Regional Highlights

- North America (Dominant Market): Characterized by the highest veterinary spending per animal, a robust infrastructure of specialized reference laboratories, and widespread adoption of advanced diagnostic technologies, particularly in molecular and companion animal diagnostics. High pet ownership rates and strong regulatory oversight regarding zoonotic diseases drive consistent demand.

- Europe (Mature Market): Features high adoption rates of advanced laboratory instruments and a mature market for livestock health diagnostics due to stringent European Union regulations on food safety and animal welfare. Growth is steady, focused on automation and integration of diagnostic results into digital veterinary records.

- Asia Pacific (Fastest Growing Market): Driven by explosive growth in livestock production to meet rising consumer demand, alongside burgeoning pet adoption in countries like China and India. Government investments in public animal health programs, particularly for endemic disease control (e.g., FMD, ASF), are major market catalysts, favoring cost-effective and scalable diagnostic solutions.

- Latin America (Emerging Market): Growth is underpinned by increasing commercialization of agriculture and rising awareness of modern veterinary care. The market focuses on tackling infectious diseases in both production animals and a rapidly growing companion animal population, though constrained by lower per capita veterinary expenditure compared to Western markets.

- Middle East and Africa (MEA) (Potential Growth): Market development is concentrated in countries with significant livestock industries (e.g., South Africa, Saudi Arabia). Focus remains on basic screening tools and developing infrastructure to manage zoonotic threats and enhance food security standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Animal Diagnostics Market.- IDEXX Laboratories

- Zoetis Inc.

- Thermo Fisher Scientific Inc.

- Heska Corporation

- Neogen Corporation

- Virbac

- VCA, Inc. (A Mars Company)

- Abaxis (now part of Zoetis)

- Fujifilm VET Systems Co., Ltd.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Qiagen N.V.

- Randox Laboratories Ltd.

- Siemens Healthineers

- Sysmex Corporation

- Agfa-Gevaert N.V.

- Ceva Santé Animale

- Indical Bioscience GmbH

- Merck Animal Health

- Dalan Animal Health

Frequently Asked Questions

Analyze common user questions about the Animal Diagnostics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers fueling the growth of the Animal Diagnostics Market?

The market is primarily driven by the trend of pet humanization, leading to increased veterinary healthcare expenditure, coupled with stringent global regulations demanding accurate diagnostics for zoonotic disease surveillance and food safety across livestock populations. Technological migration of sophisticated testing from central labs to point-of-care settings further accelerates accessibility and market size.

Which technology segment exhibits the fastest growth in animal diagnostics?

Molecular Diagnostics, particularly advanced Polymerase Chain Reaction (PCR) and Next-Generation Sequencing (NGS), is the fastest-growing technology segment. This rapid expansion is due to the superior sensitivity and specificity these methods offer for early detection of complex infectious agents, genetic disorders, and rapid antimicrobial resistance profiling, crucial for targeted treatments.

How is the concept of One Health influencing diagnostic product development?

The One Health paradigm, which recognizes the interconnection between human, animal, and environmental health, is driving the development of harmonized diagnostic platforms. This results in products capable of testing for zoonotic pathogens in both animal and human samples, ensuring coordinated surveillance and promoting collaboration between veterinary public health agencies and human healthcare sectors to mitigate emerging infectious disease risks.

What is the significance of Point-of-Care (POC) testing in the veterinary sector?

POC testing is highly significant as it allows veterinary professionals to obtain rapid, laboratory-quality diagnostic results directly in the clinic or field setting, drastically reducing turnaround times from days to minutes. This speed facilitates immediate treatment decisions, particularly critical in emergency medicine and remote field diagnostics for livestock, enhancing both patient outcomes and clinic efficiency.

Which geographic region dominates the Animal Diagnostics Market revenue?

North America currently dominates the Animal Diagnostics Market in terms of revenue share. This is attributed to high levels of disposable income dedicated to pet care, the presence of major industry leaders, and a highly advanced veterinary healthcare infrastructure that consistently adopts cutting-edge diagnostic technologies and implements comprehensive wellness and preventive testing protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Animal Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Companion Animal Diagnostics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager