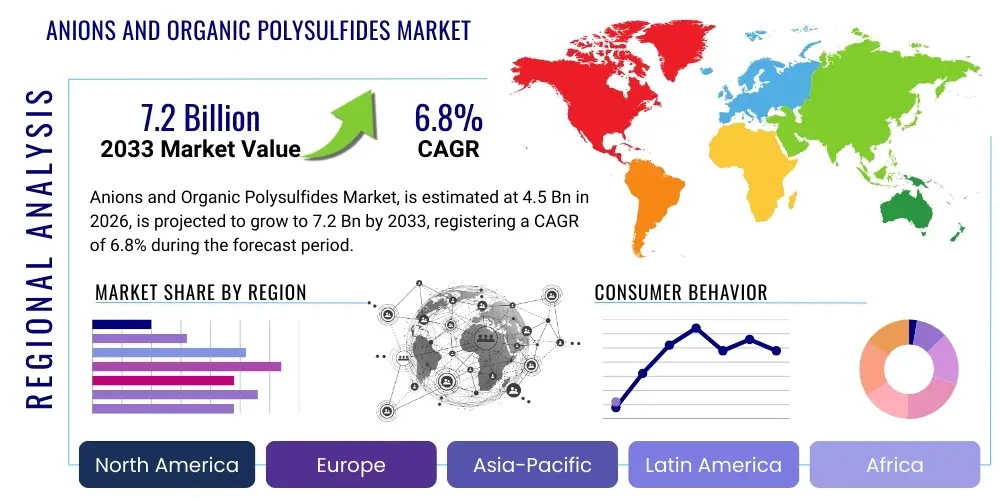

Anions and Organic Polysulfides Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442678 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Anions and Organic Polysulfides Market Size

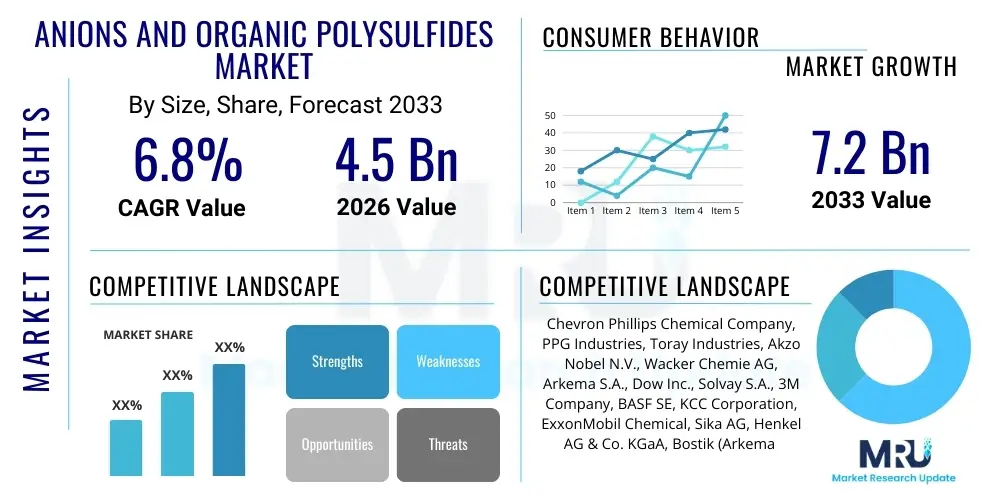

The Anions and Organic Polysulfides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Anions and Organic Polysulfides Market introduction

The market for anions and organic polysulfides encompasses a diverse chemical landscape, primarily driven by the unique properties these compounds lend to high-performance industrial materials. Organic polysulfides, particularly those based on the thiokol structure, are renowned for their exceptional resistance to solvents, oils, ozone, and weathering, making them indispensable in critical sealing and adhesive applications, notably within the aerospace, construction, and automotive sectors. These polymers are synthesized through complex reactions, often utilizing specific anionic initiators or intermediates to control molecular weight and end-group functionality. The inherent versatility of these materials allows them to be formulated into liquid sealants, solid elastomers, and specialized additives, addressing demanding environmental and mechanical specifications across a wide range of industries globally. The market's foundational strength lies in the replacement of traditional materials with polysulfides in scenarios requiring enhanced durability and chemical inertness, such as aircraft fuel tank sealants and chemical-resistant coatings.

Organic polysulfides are polymeric materials characterized by sulfur-sulfur linkages within the main chain, contributing to their high flexibility at low temperatures and impressive sealing capabilities. These polymers are typically categorized by their structure, ranging from linear to branched architectures, which dictates their viscosity and curing characteristics. Conversely, the "Anions" component of the market often refers to sulfur-containing inorganic or organic anions (like thiosulfates or polysulfide ions) used as precursors, cross-linking agents, or catalytic intermediates in the synthesis and processing of the final polysulfide product, ensuring precise control over the vulcanization and curing processes. This synergistic use allows manufacturers to tailor the final product’s performance profile, balancing parameters such as tensile strength, elongation, and cure speed, which are crucial for specialized applications like insulating glass sealants and protective coatings for marine environments. The demand is further fueled by the stringent quality requirements mandated by regulatory bodies in highly sensitive end-use industries.

Key driving factors supporting the sustained growth of this market include the global surge in infrastructure development, necessitating durable construction sealants, and the continuous innovation in the aerospace sector, where fuel-resistant and extreme-temperature tolerant materials are non-negotiable. Furthermore, the emerging applications of polysulfides in advanced battery technologies, specifically in lithium-sulfur (Li-S) batteries, present a substantial long-term growth opportunity, positioning these materials at the nexus of the energy transition. The benefits derived from using polysulfides—superior elasticity retention over time, resistance to UV degradation, and compatibility with various substrates—make them a preferred choice over silicones and polyurethanes in specific high-stress environments. However, sustained research and development efforts are essential to mitigate environmental concerns and enhance the processability of newer generation polysulfide chemistries to capture broader industrial adoption. The complexity of manufacturing high-purity polysulfides and their precursors demands high technical expertise, thereby maintaining a relatively concentrated competitive landscape.

Anions and Organic Polysulfides Market Executive Summary

The Anions and Organic Polysulfides Market is currently undergoing significant transformation, characterized by distinct business trends focused on sustainability, diversification of supply chains, and technological specialization. Business trends highlight a pronounced shift towards the development of lower-VOC (Volatile Organic Compound) and bio-based polysulfide sealants, driven by increasingly strict environmental regulations in North America and Europe, pushing major manufacturers to reformulate their core product lines. Strategic mergers, acquisitions, and collaborative joint ventures are becoming prevalent as companies seek to consolidate market share, gain access to specialized synthesis techniques, and penetrate high-growth regional markets, particularly in Asia Pacific. Furthermore, the commercialization of polysulfide derivatives optimized for use as solid-state electrolytes or conductive binders in next-generation batteries is rapidly gaining momentum, signaling a long-term shift away from reliance solely on traditional sealant applications and fostering market diversification into the high-technology energy storage domain.

Regionally, the Asia Pacific (APAC) market is expected to exhibit the fastest growth trajectory, predominantly fueled by rapid urbanization, massive infrastructure projects in countries like China and India, and the burgeoning expansion of the domestic automotive and electronics manufacturing bases. While North America and Europe remain mature markets, they are characterized by high value realization, driven by demand for premium, highly certified polysulfide products required in aerospace maintenance, repair, and overhaul (MRO), and advanced construction projects that adhere to stringent building energy efficiency standards. Latin America and the Middle East & Africa (MEA) offer nascent, yet promising, markets, primarily driven by investments in oil and gas infrastructure where the chemical resistance of polysulfides is critically valued for pipeline coatings and industrial tank linings, thus necessitating specialized product imports and localized distribution partnerships to serve these remote markets effectively.

Segmentation trends reveal that the Sealants segment retains the largest share of the market by application due to the enduring requirement for high-integrity sealing in structural applications across various industries, yet the Lubricants and Battery Additives segments are projecting the highest CAGRs moving forward. By product type, liquid polysulfide polymers are dominating the revenue landscape, preferred for their ease of application and ability to form seamless, robust seals in complex geometries, especially in the construction and automotive aftermarket. The market is also witnessing specialization within the end-user vertical, with aerospace demand setting the benchmark for performance, demanding superior temperature resistance and fuel compatibility, which translates to premium pricing and stricter barrier to entry for new suppliers. Conversely, the construction segment is volume-driven, focusing on cost-efficiency and durability in large-scale commercial and residential building projects, leading to differentiation in product offerings tailored for specific application needs.

AI Impact Analysis on Anions and Organic Polysulfides Market

User queries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Anions and Organic Polysulfides Market predominantly center on optimization of chemical synthesis parameters, prediction of long-term material performance, and enhancement of supply chain resilience. Key themes include concerns about improving yield rates in complex polymerization reactions, leveraging ML to rapidly screen and design novel polysulfide structures with enhanced properties (e.g., lower curing time or improved bio-degradability), and utilizing predictive analytics for better management of volatile sulfur and organic precursor supplies. Users are also keen on understanding how AI can streamline quality control by analyzing spectroscopic data and identifying impurities in real-time, thereby reducing batch failures and ensuring regulatory compliance. The expectation is that AI will significantly shorten the R&D cycle for new polysulfide formulations and drastically improve operational efficiency within manufacturing facilities, transforming the historically empirical approach to specialty chemical production into a data-driven science.

- AI-driven optimization of polymerization kinetics and reaction conditions, reducing synthesis time and energy consumption.

- Machine Learning models predict the long-term chemical degradation and mechanical performance of polysulfide sealants under extreme environmental stress.

- Predictive analytics enhance supply chain transparency and resilience for sulfur and precursor chemicals, mitigating price volatility and shortages.

- Automated quality control systems use image recognition and sensor data to detect defects in polysulfide-based products (e.g., sealants and coatings) during manufacturing.

- AI facilitates the rapid screening of novel organic polysulfide chemical structures for targeted applications, accelerating material innovation and property discovery.

DRO & Impact Forces Of Anions and Organic Polysulfides Market

The trajectory of the Anions and Organic Polysulfides Market is profoundly shaped by a unique combination of powerful Drivers, significant Restraints, and emerging Opportunities, which together form the Impact Forces dictating market expansion and investment decisions. A primary driver is the accelerating demand for high-performance sealants in critical infrastructure sectors, including aerospace, defense, and high-rise construction, where material failure carries significant safety and financial implications, thus prioritizing the chemical and thermal stability provided by polysulfides. Simultaneously, the global push towards electrification and energy storage is creating a robust opportunity within the Lithium-Sulfur (Li-S) battery space, utilizing organic polysulfides as essential components for cathodes and electrolytes, potentially opening up a massive high-tech application segment currently only marginally explored. However, the market faces constraints related to the volatility and toxicity associated with certain sulfur-containing raw materials, coupled with increasing regulatory scrutiny on VOC emissions and disposal challenges for spent polysulfide materials, necessitating continuous investment in green chemistry alternatives and advanced recycling technologies.

Drivers related to technological advancements specifically include the evolution of automotive manufacturing towards lightweighting, where polysulfide adhesives and sealants are increasingly used to bond dissimilar materials (e.g., aluminum and composites) while ensuring structural integrity and corrosion resistance, which is vital for electric vehicle battery packs and chassis. Furthermore, the opportunity to develop tailored, specialty polysulfide formulations for additive manufacturing (3D printing) applications is emerging, allowing for the creation of complex, high-resilience components for industrial machinery and medical devices, offering a novel pathway for market penetration beyond traditional casting and sealing methods. This innovation momentum is crucial for overcoming inherent market restraints, such as the relatively long curing times of standard polysulfide formulations compared to rival polyurethane or silicone technologies, which can hinder their adoption in high-speed assembly line environments, demanding ongoing research into faster-cure catalysts and UV-curable polysulfide systems.

The cumulative impact forces suggest a market moving towards premiumization and specialization, where growth will be concentrated in high-value, niche applications rather than broad commodity usage. The strongest impact force is the integration of polysulfides into the energy storage value chain, which represents a paradigm shift from a mature chemical market to a high-growth technological market. While raw material price fluctuation presents a persistent short-term restraint, the long-term opportunity hinges on successful technological breakthroughs in creating non-toxic, sustainable, and highly processable polysulfide variants. Ultimately, the market success will be determined by the ability of key players to navigate the complex regulatory landscape while successfully commercializing these next-generation materials for both established sectors, such as pipeline coatings, and disruptive sectors, such as next-generation electric vehicle batteries and high-altitude aerospace applications, cementing polysulfide’s role as a critical high-performance material.

Segmentation Analysis

The Anions and Organic Polysulfides Market is comprehensively segmented based on product type, specific application, and end-use industry, reflecting the diverse chemical structures and performance requirements across its consumer base. Segmentation by product type primarily differentiates between various anionic precursors, essential chemical intermediates, and the final organic polysulfide polymers (often generically referred to as Thiokol polymers), each serving a distinct function in the manufacturing or application process. The application segmentation delineates the major uses, with high-performance Sealants and industrial Adhesives constituting the bulk of the market volume, while niche, high-value applications are found in specialized Lubricants, chemical-resistant Coatings, and increasingly, components for advanced Battery technology. This structured segmentation provides manufacturers and stakeholders with a clear framework for understanding market dynamics, tailoring product development efforts, and prioritizing sales and distribution strategies based on regional demand and regulatory specificities, ensuring efficient resource allocation and maximizing market penetration across varied industrial requirements globally.

- By Type:

- Liquid Polysulfide Polymers (LPP)

- Solid Polysulfide Elastomers

- Inorganic Sulfur Anions (e.g., Sodium Polysulfide)

- Organic Precursors and Intermediates

- By Application:

- Sealants (Aerospace, Insulating Glass, Construction)

- Adhesives

- Rubber Compounding Agents

- Coatings and Linings (Chemical Tanks, Marine)

- Lubricant Additives

- Battery Components (Li-S Batteries)

- By End-Use Industry:

- Aerospace & Defense

- Automotive & Transportation

- Building & Construction

- Chemical & Oil Refining

- Marine

- Energy & Power (Including Batteries)

Value Chain Analysis For Anions and Organic Polysulfides Market

The value chain for the Anions and Organic Polysulfides Market commences with the Upstream Analysis, which focuses on the sourcing and supply of critical raw materials. The foundational inputs include elemental sulfur, various organic precursors such as bis(2-chloroethyl) formal or dichlorodioxane, and alkaline reagents like sodium hydroxide or sodium sulfide used to generate the necessary anionic intermediates for polymerization. This upstream segment is characterized by high energy intensity and dependence on the petrochemical and mining industries for consistent and affordable supply of these primary inputs, making it sensitive to global commodity price fluctuations, particularly those impacting sulfur and oil-derived organic chemicals. Efficiency and technological innovation at this stage are crucial, as the purity of raw materials directly influences the molecular weight distribution and end-group functionality of the resulting polysulfide polymer, dictating its performance characteristics and suitability for demanding applications like aerospace sealants.

The central phase involves the manufacturing and formulation processes, where specialized chemical synthesis transforms these raw materials into liquid polysulfide polymers or solid elastomers. This stage includes complex, tightly controlled polymerization, purification, and compounding processes. Manufacturers often employ direct distribution channels for large volume sales to major industrial consumers, such as construction material suppliers or aerospace OEMs (Original Equipment Manufacturers), thereby maintaining tight control over product quality, specification adherence, and technical support. For smaller volume and geographically dispersed markets, an indirect distribution network utilizing specialized chemical distributors and regional agents is essential. These intermediaries provide localized warehousing, customized repackaging, and essential technical service support, bridging the gap between centralized production facilities and diverse end-users who require specific quantities and formulation advice for application in highly specialized environments.

The Downstream Analysis involves the application and ultimate consumption of the polysulfide product across various end-use sectors. For example, in aerospace, products undergo rigorous certification and are applied by specialized MRO (Maintenance, Repair, and Overhaul) teams for fuel tank sealing. In the construction sector, products are used by applicators for expansion joints and insulating glass units. The performance of the final product in the field dictates the reputation and long-term viability of the manufacturer. The trend toward customized, multi-component polysulfide systems requires strong technical collaboration between the manufacturer and the end-user to ensure optimal curing and performance under specific operating conditions. This intense focus on application-specific solutions drives the necessity for continuous interaction between the downstream applicators and the upstream polymer chemists, ensuring that product innovation remains aligned with evolving industry needs, such as the demand for rapid-cure or bio-renewable polysulfide alternatives, completing the cyclical nature of the value chain interaction.

Anions and Organic Polysulfides Market Potential Customers

Potential customers for anions and organic polysulfides span several highly regulated and technically demanding industrial sectors that require materials offering superior resistance to harsh chemicals, extreme temperatures, and mechanical stress. The primary segment comprises aerospace maintenance and manufacturing facilities, including major aircraft OEMs and specialized MRO providers, which rely heavily on polysulfide sealants for integral fuel tank sealing, cabin pressurization, and structural bonding due to their unparalleled resistance to jet fuels and ozone exposure. A second critical customer base is the automotive industry, specifically OEMs involved in electric vehicle (EV) manufacturing, utilizing polysulfide adhesives and gasketing materials for battery pack assembly and sealing to protect against moisture and vibration, ensuring long-term functional integrity. Furthermore, construction chemical manufacturers and professional insulating glass fabricators represent a significant volume demand, utilizing polysulfide sealants for durable joint sealing and creating hermetic seals in double and triple-pane windows that require excellent long-term elasticity and UV resistance under fluctuating climate conditions. These end-users prioritize product longevity, certified performance data, and consistent batch quality when selecting suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chevron Phillips Chemical Company, PPG Industries, Toray Industries, Akzo Nobel N.V., Wacker Chemie AG, Arkema S.A., Dow Inc., Solvay S.A., 3M Company, BASF SE, KCC Corporation, ExxonMobil Chemical, Sika AG, Henkel AG & Co. KGaA, Bostik (Arkema Group), Huntsman Corporation, Evonik Industries AG, Momentive Performance Materials, Chemetall (BASF), Guangzhou Lushan Advanced Material Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anions and Organic Polysulfides Market Key Technology Landscape

The technological landscape of the Anions and Organic Polysulfides Market is marked by innovation focused on refining polymerization efficiency, developing novel curing systems, and addressing sustainability challenges. A significant area of focus is the advancement in controlled radical polymerization techniques, which allow for tighter control over the molecular weight distribution of the polysulfide polymer. This control is critical for tailoring the material's viscosity and ensuring consistent performance in specialized applications like aerospace sealants, where precise flow and cure characteristics are essential. Furthermore, manufacturers are heavily investing in developing advanced catalyst systems that enable faster curing times at ambient or low temperatures, overcoming one of the traditional drawbacks of polysulfides, thereby enhancing their suitability for high-throughput assembly line environments in the automotive and general manufacturing sectors, ensuring rapid return to service and improved production efficiency.

Another crucial technological development involves the exploration of green chemistry routes for polysulfide synthesis. This includes transitioning away from highly volatile or toxic organic precursors toward bio-derived feedstocks or utilizing solvent-free polymerization processes, directly addressing global regulatory pressure regarding environmental impact and worker safety. Research is also progressing rapidly in integrating polysulfide materials into the advanced energy sector, particularly in enhancing the lifespan and performance of Lithium-Sulfur (Li-S) batteries. Key technological breakthroughs here involve the development of polysulfide-based functional binders and surface coatings that effectively mitigate the "shuttle effect" of polysulfide ions within the battery cell, which currently limits cycle life, thereby making Li-S technology a more viable commercial alternative to traditional lithium-ion systems through innovative material engineering.

The application technology aspect is equally dynamic, involving the evolution of multi-component mixing and dispensing equipment necessary for on-site application of liquid polysulfide sealants. These sophisticated systems ensure precise stoichiometry and homogenous mixing of the polymer base, curing agent, and various fillers just before application, which is vital for achieving the advertised mechanical properties and ensuring consistent cure throughout the applied bead. Additionally, research into incorporating polysulfide materials into composite structures and utilizing them in additive manufacturing processes (3D printing) is opening new avenues for complex geometry fabrication requiring superior chemical resistance. These innovations collectively aim to lower manufacturing costs, improve the environmental profile of the products, and expand the utility of polysulfides into high-growth, high-technology areas where traditional elastomers cannot meet the performance demands, solidifying the market’s technological trajectory toward high performance and sustainability.

Regional Highlights

- North America: This region maintains a strong position in the high-value segment of the market, driven primarily by the robust aerospace and defense industries, which mandate the use of certified, fuel-resistant polysulfide sealants and adhesives for military and commercial aircraft MRO operations. The stringent regulatory environment, coupled with significant investments in green building initiatives, is fostering demand for low-VOC and sustainable polysulfide formulations, positioning the region as a leader in product premiumization and specialized applications. Furthermore, the burgeoning electric vehicle market is rapidly adopting advanced polysulfide-based gasketing solutions for battery enclosures, cementing North America's role as a major hub for R&D and high-specification manufacturing, though competition from alternative chemistries like silicones and polyurethanes remains fierce in the general construction sector, pushing polysulfide suppliers to focus heavily on performance differentiation. The region's early adoption of stringent environmental standards often serves as a global benchmark for product development.

- Europe: Characterized by stringent chemical regulations, such as REACH, Europe is a mature market focused on innovation in sustainability and advanced manufacturing. The construction sector, particularly in Western Europe, drives demand for high-quality, durable insulating glass sealants and protective coatings that meet rigorous thermal performance standards. The regional automotive industry, transitioning rapidly towards electric mobility, utilizes polysulfides for highly durable sealing applications within EV platforms. European manufacturers often lead in the adoption of bio-based and lower-toxicity alternatives, responding proactively to legislative mandates and consumer preferences for environmentally responsible materials, resulting in a higher average selling price (ASP) for specialty polysulfide products compared to global averages. The presence of major chemical companies and specialized formulation expertise ensures continued high-quality production and technological advancement.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by immense infrastructure development in emerging economies like China, India, and Southeast Asia, leading to massive consumption of construction sealants and adhesives. The rapid expansion of automotive production and general manufacturing capacity within the region creates massive volume demand for industrial-grade polysulfide elastomers and additives. While cost-competitiveness is a key factor, increasing awareness of quality and longevity is driving a gradual shift towards high-performance specialty chemicals, particularly in the rapidly growing local aerospace and advanced electronics sectors in countries like Japan and South Korea. Local manufacturing capabilities are expanding rapidly, leading to increased self-sufficiency, although specialized precursors and high-end formulations are often still imported from North America and Europe to meet the demands of highly technical industries.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities, primarily driven by investments in oil and gas infrastructure, mining, and large-scale public works projects. The Middle East, with its extensive petrochemical facilities and demand for chemical-resistant coatings in harsh desert environments, relies on the superior barrier properties of polysulfides. LATAM’s growth is linked to regional construction booms and automotive production. Demand in both regions is highly sensitive to commodity prices and geopolitical stability, but the requirement for robust, temperature-stable materials ensures a steady, albeit smaller, market for specialized polysulfide formulations. Distribution relies heavily on international partnerships due to limited local production of the base polymers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anions and Organic Polysulfides Market.- Chevron Phillips Chemical Company

- PPG Industries

- Toray Industries

- Akzo Nobel N.V.

- Wacker Chemie AG

- Arkema S.A.

- Dow Inc.

- Solvay S.A.

- 3M Company

- BASF SE

- KCC Corporation

- ExxonMobil Chemical

- Sika AG

- Henkel AG & Co. KGaA

- Bostik (Arkema Group)

- Huntsman Corporation

- Evonik Industries AG

- Momentive Performance Materials

- Chemetall (BASF)

- Guangzhou Lushan Advanced Material Co., Ltd.

Frequently Asked Questions

What are the primary applications driving the demand for organic polysulfides?

The primary applications driving demand for organic polysulfides are high-performance sealants in the aerospace and construction industries, particularly for integral fuel tank sealing, aircraft windshield bonding, structural joint sealing in buildings, and insulating glass units, due to their superior chemical resistance and flexibility.

How is the Anions and Organic Polysulfides Market impacted by the shift towards electric vehicles (EVs)?

The EV shift positively impacts the market as polysulfide materials are increasingly utilized in EV battery packs for specialized sealing and gasketing applications to protect sensitive components from moisture, vibration, and thermal fluctuations, ensuring enhanced safety and longevity of the battery systems.

What key restraint challenges the growth of the polysulfides market?

A key restraint challenging market growth is the regulatory scrutiny over Volatile Organic Compounds (VOCs) and the complexity surrounding the handling and disposal of certain sulfur-containing raw materials, which necessitates costly investment in green chemistry and compliance measures for manufacturers.

Which geographical region exhibits the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), driven by massive investment in infrastructure development, rapid urbanization, and the expansion of the regional automotive and electronics manufacturing bases, leading to high volume consumption.

What is the role of anions in the manufacturing of organic polysulfides?

Anions, particularly sulfur-containing ions, serve as critical precursors or initiators in the polymerization process, enabling the precise control of the molecular structure, chain length, and end-group functionality of the organic polysulfide polymers, which dictates the material's final mechanical and chemical properties.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager