Ankle Arthrodesis Plate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442594 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Ankle Arthrodesis Plate Market Size

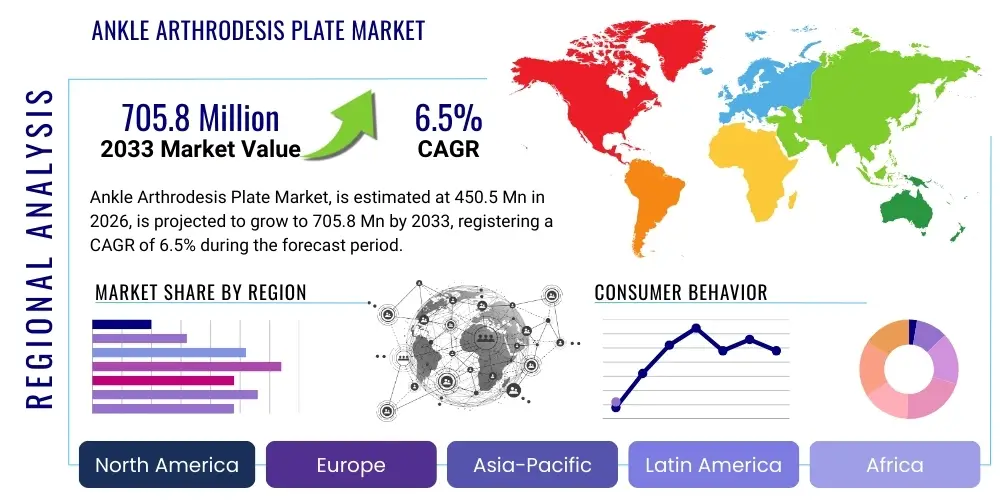

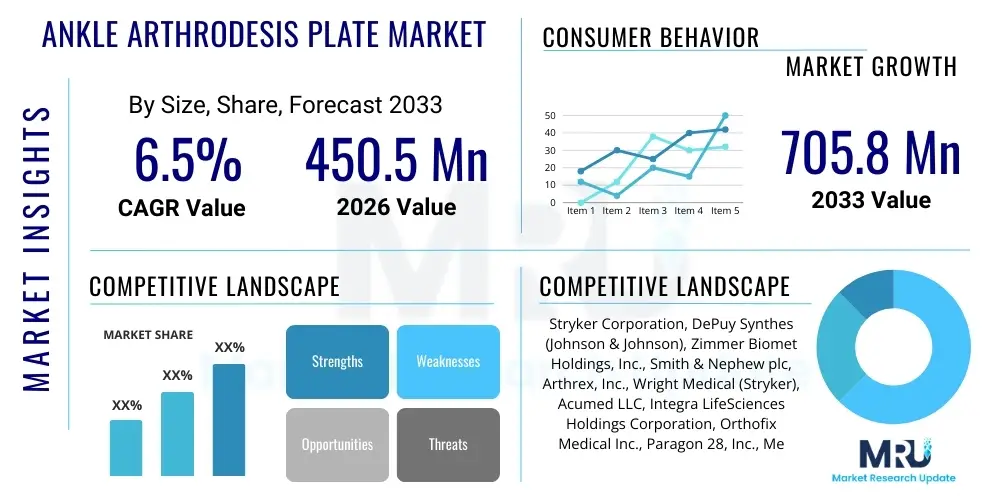

The Ankle Arthrodesis Plate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 705.8 million by the end of the forecast period in 2033.

Ankle Arthrodesis Plate Market introduction

The Ankle Arthrodesis Plate Market focuses on specialized orthopedic implants crucial for surgical stabilization procedures targeting severe degenerative or traumatic conditions of the ankle and hindfoot, primarily end-stage arthritis, post-traumatic deformities, and certain neuromuscular disorders that compromise joint integrity. Ankle arthrodesis, or fusion surgery, utilizes these rigid plates and complementary screw systems to immobilize the joint complex, promoting osseous union to effectively eliminate pain and provide long-term functional stability where motion preservation is not feasible. The plates are distinguished by their anatomical contouring—designed to conform precisely to the complex curvature of the tibia, talus, and calcaneus—and often incorporate locking technology, enhancing fixation rigidity even in compromised bone quality. The foundational elements driving this specialized market include an aging global demographic, increasing rates of debilitating joint diseases, and ongoing surgical innovations that favor robust and minimally invasive fixation solutions, ensuring improved patient recovery profiles and high fusion success rates globally.

Ankle Arthrodesis Plate Market Executive Summary

Business trends within the Ankle Arthrodesis Plate market are strongly characterized by continuous product iteration focused on biomechanical superiority and enhanced clinical versatility. Leading orthopedic manufacturers are intensely invested in developing low-profile, pre-contoured plates that specifically accommodate various surgical approaches—anterior, lateral, and posterior—thereby reducing soft tissue stripping and minimizing the risk of wound complications, which are historically challenging in ankle surgery. There is a palpable shift towards modular and integrated fixation systems that allow surgeons to customize construct rigidity based on patient bone quality and specific pathology, often bundling plates with associated cannulated screws or bio-enhanced materials designed to promote rapid bone healing. Furthermore, competitive strategies increasingly involve educational outreach and surgical training programs to drive adoption of specific company instrumentation sets, cementing brand loyalty among specialized foot and ankle surgeons who prioritize system reliability and compatibility across a wide range of complex cases, including revisions and severe deformity correction surgeries.

Regional dynamics illustrate a divergence in growth maturity and technological adoption patterns. North America, propelled by high healthcare spending and a well-established network of specialized orthopedic centers, maintains its revenue leadership, consistently integrating technologies such as 3D-printed implants and AI-assisted surgical planning platforms into routine practice. Conversely, the Asia Pacific (APAC) region is rapidly accelerating its market penetration, supported by substantial governmental and private investment in healthcare infrastructure expansion, particularly in high-population economies like India and China, where the growing middle class is gaining access to advanced orthopedic care previously unavailable. European markets emphasize value-based healthcare, demanding robust clinical evidence supporting the long-term cost-effectiveness and durability of fixation hardware, often favoring established market leaders with extensive regulatory clearances and documented success records spanning multiple decades of clinical use.

Segment trends confirm the continued dominance of titanium-based locking plate systems, which are overwhelmingly preferred due to their superior performance characteristics—including resistance to corrosion, high strength-to-weight ratio, and non-ferromagnetic properties facilitating post-operative imaging. The anatomical location segment reveals that tibiotalar arthrodesis plates, used for primary ankle fusion, represent the largest volume, but the pan-talar (tibiotalocalcaneal) segment is experiencing rapid expansion due to the increasing incidence of complex hindfoot pathology requiring triple arthrodesis or staged fusion procedures. End-user migration is also a notable trend: while complex cases remain anchored in large specialized hospitals, the increasing feasibility of standard ankle fusions being performed in Ambulatory Surgical Centers (ASCs) is creating a demand for streamlined, all-in-one surgical kits that support faster turnover and optimized supply chain management within these cost-sensitive outpatient settings.

AI Impact Analysis on Ankle Arthrodesis Plate Market

The core inquiries from users regarding AI's influence in the Ankle Arthrodesis Plate Market focus heavily on achieving unprecedented levels of surgical precision and mitigating the high non-union rates associated with complex hindfoot fusions. Stakeholders commonly question how AI algorithms, processing vast amounts of patient demographic, imaging, and surgical outcome data, can optimize plate sizing and screw trajectory planning to counteract the biomechanical forces unique to the ankle joint, which is constantly under significant weight-bearing stress. Concerns also center on the integration complexity—specifically, how seamlessly AI planning software will interface with existing intraoperative C-arm and 3D imaging technologies, and the necessary training required for orthopedic surgeons to effectively utilize these advanced diagnostic and planning tools to minimize human error and procedural variability in critical screw placement.

A major expected impact is AI's ability to refine implant design itself. Generative AI tools are being applied to simulate millions of load cycles and stress distributions on various plate geometries, rapidly prototyping lighter yet stronger fixation devices specifically tailored to patient bone density metrics derived from quantitative CT scans. This shift from standardized manufacturing to personalized bio-engineering represents a paradigm change, moving plate design away from generalized anatomical fits towards micro-optimized constructs. Furthermore, machine learning models are becoming adept at real-time intraoperative analysis, providing immediate feedback to surgeons concerning the achieved reduction, alignment, and screw purchase quality during the procedure, serving as a powerful decision support system to maximize the probability of long-term fusion success and minimize the need for painful and costly revision surgeries later in the patient’s clinical journey.

- AI-driven pre-operative planning improves plate sizing and placement accuracy, minimizing implant overhang and soft tissue impingement risks through sophisticated 3D model processing.

- Machine learning algorithms analyze large patient outcome datasets to predict non-union risk based on co-morbidities (e.g., diabetes, smoking), guiding surgeons toward more aggressive fixation or supplementary bone grafting when necessary.

- AI-enhanced robotic assistance systems aid in precise bone resection and joint preparation, ensuring perfect alignment and parallel screw trajectories critical for successful multi-plane fusion, particularly in pan-talar procedures.

- Generative design AI optimizes plate lattice structures and contouring, potentially reducing material usage while maintaining or increasing structural integrity (lightweight yet stronger implants) by simulating complex ankle loading conditions.

- Automated image analysis of post-operative radiographs using AI facilitates early, objective detection of complications, such as loosening, stress shielding, or delayed union, prompting timely clinical intervention before failure becomes catastrophic.

- Predictive analytics help healthcare systems manage inventory and logistics by forecasting demand for specific plate sizes and types based on regional surgical volumes and seasonal trauma rates, optimizing supply chain efficiency.

DRO & Impact Forces Of Ankle Arthrodesis Plate Market

Market drivers for Ankle Arthrodesis Plates are fundamentally linked to inescapable demographic shifts and the resulting public health burden. The rapidly expanding global elderly population is inherently more susceptible to end-stage degenerative joint diseases, including osteoarthritis of the ankle, often exacerbated by prior trauma, ligamentous instability, or inflammatory arthritis. This increasing pool of potential patients requiring definitive surgical intervention forms a robust baseline demand. Additionally, the growing global incidence of high-energy trauma, sports injuries, and diabetic foot complications often necessitates primary or secondary ankle fusion using stable plating systems. Technological momentum, particularly the widespread clinical validation of anatomical locking plate technology, which significantly enhances the biomechanical outcome and reduces complications compared to historical fixation methods like large screws or non-locking plates, further stimulates market growth and drives surgical preference toward these advanced systems.

Significant market restraints primarily involve the economic burden and clinical risks associated with these complex procedures. Ankle arthrodesis surgery carries substantial procedural costs, including the price of premium titanium locking implants, specialized instrumentation, prolonged operating room time, and subsequent rehabilitation services, which can strain healthcare budgets, especially in price-sensitive developing markets. Clinically, the risk of non-union (failure of the bone to fuse), post-operative infection, and the subsequent development of adjacent joint arthritis—where stress is shifted to neighboring joints—remains a serious constraint, requiring careful patient selection and often complex revision surgery. Furthermore, increasing regulatory requirements globally, demanding extensive pre-market clinical data and long-term follow-up studies, escalate R&D costs and slow down the commercialization timeline for genuinely innovative products, dampening rapid market expansion.

Opportunities for growth are concentrated on developing highly specialized and efficient solutions. The shift toward Minimally Invasive Surgery (MIS) techniques represents a major opportunity, demanding smaller incisions, specialized instruments, and streamlined low-profile plates optimized for percutaneous screw insertion, promising reduced morbidity and quicker discharge times. Further opportunities lie in the integration of surface modification technologies, such as plasma-sprayed titanium or hydroxyapatite coatings, which enhance the osteoconductive properties of the plate and promote faster integration at the bone interface. The strongest impact force shaping this market is the synergistic effect of technological acceleration and demographic pressure: as the population ages and orthopedic technology advances, the clinical necessity and feasibility of ankle fusion surgery become increasingly undeniable, compelling manufacturers to continually refine their fixation systems to meet the dual requirements of absolute stability and minimal patient impact.

Segmentation Analysis

The Ankle Arthrodesis Plate Market is dissected across critical dimensions to reflect the complexity of surgical needs and evolving clinical preferences, enabling precise targeting of product development and commercial efforts. Segmentation based on anatomical location is paramount, differentiating between plates required for tibiotalar (primary ankle joint fusion), subtalar (fusion of the joint below the ankle), and complex tibiotalocalcaneal (TTC) or pan-talar fusion, which addresses the entire hindfoot stability complex. Each location presents unique biomechanical challenges and requires distinct plate geometries, lengths, and screw configurations to achieve successful load distribution and stabilization. The materials segment, dominated by titanium, highlights the industry's focus on biocompatibility and mechanical longevity under high-stress weight-bearing conditions, while stainless steel serves primarily as a cost-effective option in select markets or specialized applications requiring enhanced stiffness.

Product design segmentation distinctly separates traditional non-locking systems from advanced locking plate technology. The superior pull-out resistance and angular stability offered by locking plates make them the standard of care, particularly valuable when treating patients with poor bone quality often associated with chronic disease or advanced age. This technology facilitates the creation of a stable internal frame independent of compression between the plate and bone, significantly improving outcomes in high-risk patients. Conversely, end-user segmentation shows that specialized surgical expertise and resource intensity keep the majority of complex cases within the hospital setting. However, the rapidly growing Ambulatory Surgical Center (ASC) segment is increasingly adopting arthrodesis procedures for standard, low-comorbidity patients, driving demand for simplified, efficient implant systems that reduce procedural duration and inventory footprint, reflecting a major cost optimization trend within U.S. healthcare.

- By Anatomical Location:

- Tibio-Talar Arthrodesis Plates (Primary Ankle Fusion)

- Subtalar Arthrodesis Plates (Hindfoot Stabilization)

- Tibiotalocalcaneal (TTC) Arthrodesis Plates (Pan-Talar Fusion for complex deformities)

- Double Arthrodesis Plates (Simultaneous fusion of two adjacent joints)

- By Material:

- Titanium Plates (Dominant, preferred for strength and MRI compatibility)

- Stainless Steel Plates (Cost-effective, higher stiffness profile)

- Bioabsorbable Plates (Emerging, aimed at eliminating hardware removal procedures)

- By Product Design:

- Locking Plate Systems (Fixed-angle stability, high preference)

- Non-Locking Plate Systems (Compression-based fixation, traditional method)

- By Surgical Approach:

- Anterior Approach Plates (Often for primary tibiotalar fusion)

- Lateral/Medial Approach Plates (Used for subtalar and TTC fusions)

- Posterior Approach Plates (For specialized high-risk fusions, minimizing anterior soft tissue damage)

- By End-User:

- Hospitals (High-volume complex trauma and revision centers)

- Ambulatory Surgical Centers (ASCs) (Increasing volume of elective, low-complexity cases)

- Orthopedic Clinics (Limited direct purchasing, primarily procedure referral and post-operative care)

Value Chain Analysis For Ankle Arthrodesis Plate Market

The upstream segment of the Ankle Arthrodesis Plate value chain is characterized by the high specialization required for sourcing medical-grade raw materials. Suppliers of titanium (Ti-6Al-4V ELI) and certified stainless steel alloys must comply with extremely rigorous regulatory specifications to ensure zero contamination and consistent mechanical properties, which are critical for patient safety and implant performance under cyclic loading. This segment also includes specialized tool and die makers, and providers of advanced manufacturing infrastructure such as specialized surface treatment facilities (anodization, plasma sterilization) and sophisticated Computer Numerical Control (CNC) machining centers necessary for milling complex, multi-planar plate geometries. The high barrier to entry and the dependency on global commodity pricing for specialty metals mean that upstream suppliers exert substantial influence on overall production costs and the strategic resilience of the finished product supply chain for device manufacturers.

Midstream operations are dominated by large, integrated orthopedic device manufacturers who perform complex design, engineering, and manufacturing functions. This stage involves significant investment in R&D to continuously iterate plate designs for anatomical perfection and biomechanical optimization, often using simulation software like Finite Element Analysis (FEA) to predict long-term fatigue life and fusion success probability. Manufacturing processes include forging, precision machining, post-machining surface treatments, and rigorous quality control testing (e.g., destructive cyclic loading tests). Sterilization and final packaging are also critical midstream activities, ensuring that the finished sterile plates, often packaged alongside their proprietary instrumentation and screws in sterile, reusable trays, comply with global regulatory standards (FDA, CE Mark) before they are released into the distribution network for clinical use in hospitals and ASCs.

The downstream distribution channel involves highly specialized logistics due to the critical nature and high value of the implants. Distribution is primarily executed through a hybrid model: major manufacturers maintain a direct sales force for key accounts, surgeon relationship management, and intraoperative technical support, while relying heavily on regional distributors and specialized 3rd party logistics (3PL) providers to manage inventory consignment programs and ensure timely delivery of surgical kits. The indirect channel is essential for maintaining consignment stock within hospitals, ensuring that the full range of plate sizes and corresponding screw lengths are immediately available for both elective and emergent trauma procedures. Effective inventory management and rapid response logistics are competitive differentiators in the downstream segment, critical for supporting high-stakes orthopedic surgery schedules and minimizing logistical failures that could delay life-altering patient care.

Ankle Arthrodesis Plate Market Potential Customers

The primary customer base for Ankle Arthrodesis Plates consists of specialized healthcare facilities capable of performing complex orthopedic and podiatric surgeries. Large tertiary and quaternary hospitals, particularly those designated as Level I Trauma Centers, constitute the highest-value segment. These institutions treat the most severe trauma and complex revision cases, demanding a broad inventory of specialized plates, including pan-talar and custom fixation solutions. Purchasing decisions in this environment are influenced heavily by orthopedic department heads and senior foot and ankle surgeons, who prioritize implant reliability, availability of comprehensive instrumentation sets, and the robustness of the manufacturer's clinical support staff during complex surgical procedures, often overriding purely cost-driven considerations to ensure optimal patient outcomes and manage risk effectively.

Ambulatory Surgical Centers (ASCs) represent the fastest-growing customer segment, especially in regions focused on shifting elective surgical volume out of expensive inpatient settings. ASCs are ideal customers for standardized, high-volume procedures, typically selecting patients with lower complexity and fewer comorbidities who are candidates for primary tibiotalar or subtalar fusions. The purchasing criteria for ASCs are markedly different from large hospitals; they place significant emphasis on supply chain efficiency, reduced inventory complexity (favoring all-in-one sterile kits), ease of use to minimize operative time, and overall system cost-effectiveness. Manufacturers often develop specific product lines or standardized procedure packs tailored to meet the lean operational demands and constrained budget structures of the ASC environment, focusing on maximizing throughput.

In addition to facilities, the individual orthopedic surgeon or specialized podiatrist acts as a key opinion leader and direct influencer of purchase. Manufacturers dedicate significant resources to establishing clinical relationships and providing extensive product training, as the surgeon ultimately selects the specific implant system used in the operating room. Furthermore, third-party payers, insurance companies, and governmental reimbursement bodies (e.g., CMS in the US) indirectly act as crucial customers by setting the financial landscape. Their coverage policies and reimbursement rates dictate which procedures are financially viable for hospitals and ASCs, thus shaping the demand for high-cost, premium fixation devices versus more standardized, lower-cost alternatives, creating a continuous tension between clinical desirability and economic feasibility in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 705.8 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, DePuy Synthes (Johnson & Johnson), Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Arthrex, Inc., Wright Medical (Stryker), Acumed LLC, Integra LifeSciences Holdings Corporation, Orthofix Medical Inc., Paragon 28, Inc., Medtronic plc, Merete Medical GmbH, Xtant Medical Holdings, Inc., In2Bones Global, Inc., Advanced Orthopaedic Solutions, Novastep SAS, Globus Medical Inc., DJO Global, Inc., CrossRoads Extremity Systems, Enovis Corporation (formerly Colfax) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ankle Arthrodesis Plate Market Key Technology Landscape

The core technological foundation of the Ankle Arthrodesis Plate market rests heavily upon advanced metallurgical science and precision engineering. The ongoing evolution of locking plate design is paramount; modern plates feature variable-angle locking capabilities, allowing surgeons to steer screws within a fixed cone of angulation while maintaining the rigid fixed-angle construct. This adaptability is critical for navigating complex anatomy and achieving optimal screw purchase in fragmented bone. Furthermore, plate surfaces are often treated using technologies like Type II or Type III anodization to increase fatigue resistance and reduce cold welding between the plate and screw heads. The trend favors highly refined, low-profile plate geometry, which not only conforms intimately to the periosteum but also reduces palpability and minimizes the need for subsequent implant removal, addressing a significant patient complaint regarding traditional bulky orthopedic hardware.

Additive manufacturing, specifically Electron Beam Melting (EBM) and Selective Laser Melting (SLM) for titanium, is fundamentally changing plate design capabilities. These 3D printing techniques enable the creation of highly porous, interconnected lattice structures on the bone-contacting surface of the plate. These porous surfaces mimic cancellous bone, significantly increasing the effective surface area for biological fixation and promoting rapid osseointegration and bone ingrowth, potentially accelerating the time to solid fusion. This technology is critical for developing patient-specific implants (PSIs) that perfectly match complex deformities or bone defects, minimizing the intraoperative contouring required of the surgeon and ensuring maximum contact coverage, a vital factor in high-load bearing joints like the ankle.

Beyond the implant itself, auxiliary technologies are increasingly integrated. Advanced instrumentation systems often incorporate specialized drill guides and depth gauges designed specifically for minimally invasive surgery (MIS), facilitating percutaneous screw insertion with minimal soft tissue disruption. Furthermore, the convergence of orthopedic implants with bio-enhancement strategies, such as the localized delivery of bone morphogenetic proteins (BMPs) or platelet-rich plasma (PRP) directly to the fusion site through specialized channels or coated plate surfaces, represents a significant technological avenue. This focus on biological augmentation, coupled with real-time feedback systems (e.g., strain gauge technology or instrumented screws) that potentially measure construct rigidity during or immediately after fixation, outlines a future where technology provides not only mechanical stability but also biological cues and verifiable structural integrity, ultimately maximizing predictable fusion outcomes in challenging clinical scenarios.

Regional Highlights

North America continues its strong market domination, anchored by the United States, which is characterized by high rates of elective and trauma-related arthrodesis procedures and a willingness among healthcare providers to adopt premium, advanced locking systems and patient-matched implants. The robust competitive landscape among major orthopedic manufacturers drives continuous innovation, ensuring that cutting-edge technologies, including robotic-assisted surgery and 3D planning software, are first commercialized and adopted here. High per capita healthcare expenditure, comprehensive medical insurance coverage for specialized orthopedic surgery, and a rapidly expanding population seeking active, pain-free lifestyles further cement North America’s position as the largest revenue generator and a critical hub for market growth validation and technological benchmarking.

The European market, while mature, exhibits steady and resilient growth, largely concentrated in the EU5 nations (Germany, France, UK, Italy, Spain). This region places exceptional emphasis on regulatory conformity, with the Medical Device Regulation (MDR) setting high bars for clinical efficacy and post-market surveillance, favoring implants with proven long-term track records. Market drivers include the region's generally older demographic structure, leading to higher prevalence of age-related joint degeneration, and efficient, though cost-conscious, public healthcare systems. Adoption of new technologies, particularly MIS systems, is gaining momentum, but manufacturers must successfully demonstrate strong health economic value propositions, proving that the higher initial cost of advanced plates is offset by reduced revision rates and shorter hospital stays.

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate, driven by a confluence of macroeconomic and healthcare development factors. Rapid urbanization, increasing prevalence of obesity and diabetes (which significantly contribute to foot and ankle pathologies), and massive investment in modernizing hospital infrastructure across emerging economies like China, India, and Southeast Asian nations are opening up vast untapped patient populations. While price sensitivity remains a factor, driving strong demand for standardized stainless steel and titanium systems, the increasing presence of international manufacturers and rising surgical training standards are paving the way for gradual adoption of advanced locking and anatomical plating systems, particularly in key private and specialized medical centers catering to the growing affluent demographic.

Latin America presents a heterogeneous market landscape where economic volatility significantly impacts purchasing power and procedural volumes. Brazil and Mexico lead regional consumption, benefiting from stronger private healthcare sectors that mirror North American trends in adopting premium orthopedic devices. However, access to specialized arthrodesis plates remains heavily restricted outside major metropolitan centers, and regulatory complexities often delay product launch. In the Middle East and Africa (MEA), growth is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), driven by ambitious governmental initiatives to establish regional medical tourism hubs. These countries demand state-of-the-art orthopedic technology, often supplied by Western multinationals, ensuring high uptake of the latest locking plate systems, while the broader African continent remains a niche market constrained by healthcare infrastructure limitations and affordability issues.

- North America: Market leader due to advanced infrastructure, high trauma incidence, favorable reimbursement environment, and rapid uptake of locking plate and 3D printing technologies. Key focus on outpatient surgical efficiencies (ASCs) and complex trauma care protocols.

- Europe: Stable, mature market driven by an aging demographic structure and stringent regulatory standards (MDR compliance). Strong emphasis on long-term clinical evidence, durability, and cost-effective delivery models across public health systems.

- Asia Pacific (APAC): Highest CAGR forecast; fueled by expanding healthcare access, rapidly increasing elderly population base, urbanization-related trauma, and substantial governmental and private investment in specialty orthopedic care centers in major economies.

- Latin America (LATAM): Growth constrained by economic variability; adoption centered in major urban centers and private healthcare systems (Brazil, Mexico). Focus on balancing cost and clinical efficacy.

- Middle East & Africa (MEA): Emerging markets with high investment in orthopedic specialty centers (GCC states), driving demand for premium, technologically advanced implants and international standards of care, often facilitated by medical tourism initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ankle Arthrodesis Plate Market.- Stryker Corporation

- DePuy Synthes (Johnson & Johnson)

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Arthrex, Inc.

- Wright Medical (Stryker)

- Acumed LLC

- Integra LifeSciences Holdings Corporation

- Orthofix Medical Inc.

- Paragon 28, Inc.

- Medtronic plc

- Merete Medical GmbH

- Xtant Medical Holdings, Inc.

- In2Bones Global, Inc.

- Advanced Orthopaedic Solutions

- Novastep SAS

- Globus Medical Inc.

- DJO Global, Inc.

- CrossRoads Extremity Systems

- Enovis Corporation (formerly Colfax)

Frequently Asked Questions

Analyze common user questions about the Ankle Arthrodesis Plate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Ankle Arthrodesis Plate and who is the ideal candidate for the procedure?

The primary function is to achieve rigid internal fixation across the ankle joint to promote permanent bony fusion (arthrodesis), effectively eliminating chronic pain and instability caused by severe end-stage arthritis, post-traumatic deformity, or avascular necrosis. The ideal candidate is typically a patient with debilitating, non-responsive ankle arthritis who requires a definitive solution for pain relief and functional weight-bearing stability, accepting the necessary trade-off of joint motion loss.

Which material is most commonly used for ankle fusion plates and what are the specific benefits of that choice?

Titanium and specialized titanium alloys are predominantly utilized for ankle fusion plates. The benefits include superior biocompatibility, high strength-to-weight ratio crucial for load-bearing applications, and favorable elastic properties that help minimize stress shielding. Critically, titanium is non-ferromagnetic, ensuring patients can undergo post-operative MRI scans without significant artifact interference, aiding in future diagnostics.

How do modern locking plate systems address the challenge of poor bone quality in elderly patients?

Locking plate systems address poor bone quality by creating a fixed-angle construct where the screw threads lock directly into the plate, bypassing the need for compression between the plate and fragile bone surface. This acts as an internal scaffold, distributing load uniformly and preventing screw pull-out in osteoporotic bone, which is common in older patient populations requiring ankle fusion.

What key factors are driving the growth of the Ankle Arthrodesis Plate Market and how do they influence future innovation?

Market growth is significantly driven by the increasing global prevalence of end-stage ankle arthritis resulting from an aging population and rising rates of trauma and chronic conditions like diabetes. This demand compels future innovation toward developing specialized, patient-specific 3D-printed implants and refined minimally invasive surgical (MIS) instruments that promise reduced morbidity, faster recovery, and enhanced fusion rates.

What are the main distribution channels used by manufacturers to supply Ankle Arthrodesis Plates to end-users?

The distribution relies heavily on a hybrid approach, combining direct sales teams for managing key accounts and providing surgical support, with indirect channels utilizing specialized regional distributors and 3PL providers. This setup ensures rapid delivery of high-value consignment inventory, crucial for immediate availability in both large hospitals for trauma cases and efficient restocking within growing Ambulatory Surgical Centers (ASCs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager