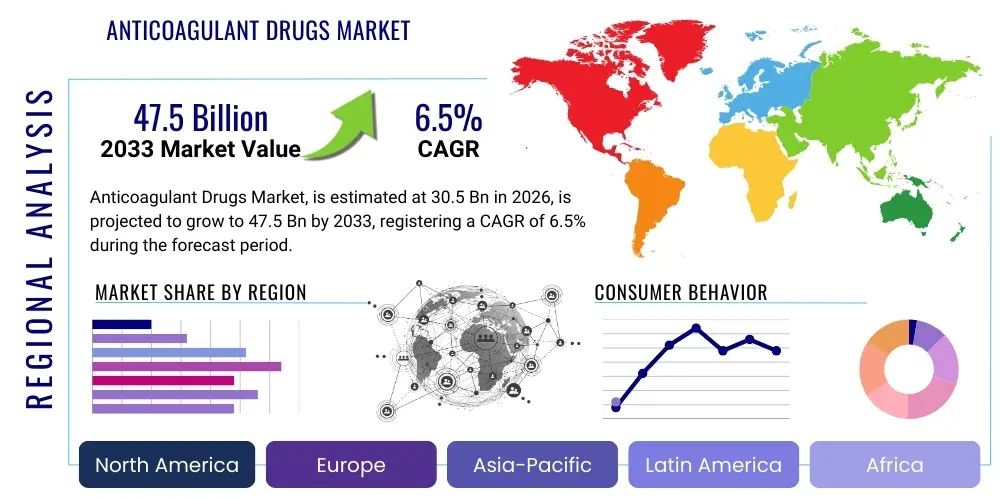

Anticoagulant Drugs Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442490 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Anticoagulant Drugs Market Size

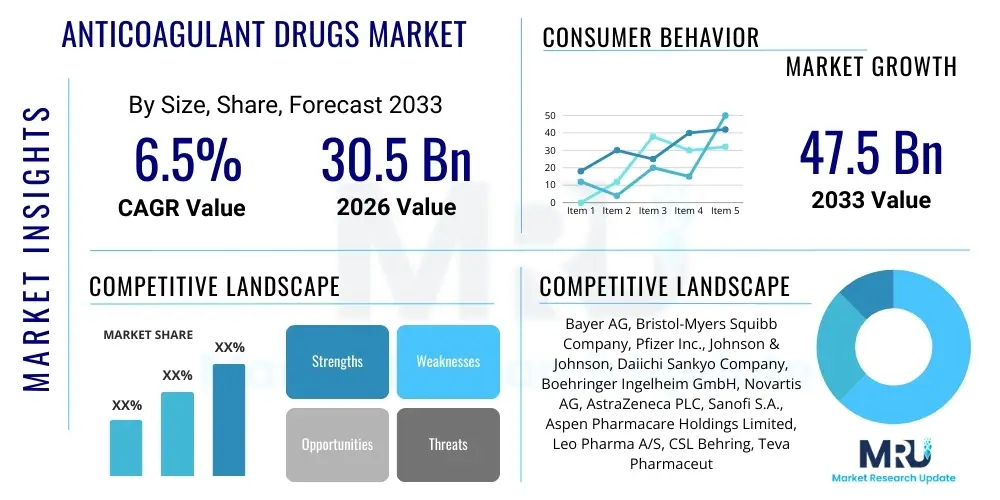

The Anticoagulant Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 30.5 Billion in 2026 and is projected to reach USD 47.5 Billion by the end of the forecast period in 2033. This substantial expansion reflects the increasing global burden of chronic cardiovascular diseases and the profound technological transition from legacy therapies to advanced, patient-centric Direct Oral Anticoagulants (DOACs). The trajectory of growth is underpinned by persistent clinical demand for effective preventative measures against life-threatening thromboembolic events, positioning anticoagulant pharmaceuticals as a cornerstone of modern cardiovascular and surgical care across developed and rapidly developing economies.

Anticoagulant Drugs Market introduction

The Anticoagulant Drugs Market comprises a sophisticated portfolio of pharmacological agents strategically employed to disrupt the biochemical cascade of blood clotting, primarily aiming to prevent the formation or expansion of thrombi. These critical medications are indispensable in the management of high-risk conditions such as non-valvular atrial fibrillation (NVAF), where they significantly mitigate the risk of cardioembolic stroke, and in the prophylaxis and treatment of venous thromboembolism (VTE), encompassing deep vein thrombosis (DVT) and pulmonary embolism (PE). Product descriptions range from injectable therapies like Unfractionated Heparin (UFH) and Low Molecular Weight Heparin (LMWH), essential for acute hospital care and bridging therapy, to the revolutionary oral formulations, notably the Direct Oral Anticoagulants (DOACs). The DOAC class, which includes Factor Xa inhibitors and direct thrombin inhibitors, offers targeted therapeutic action and greater pharmacological predictability compared to traditional Vitamin K Antagonists (VKAs) such as Warfarin.

Major applications for anticoagulant drugs are deeply rooted in cardiovascular medicine, encompassing post-operative thromboprophylaxis, particularly following major orthopedic surgeries like hip and knee replacement, and the long-term secondary prevention of recurrent VTE. The inherent benefits of these drugs are monumental, offering life-saving protection against stroke, myocardial infarction, and systemic embolization, thereby reducing morbidity, mortality, and the immense financial strain associated with managing severe thrombotic complications within healthcare systems. The continuous refinement of these agents focuses on improving the therapeutic index, striving for maximum antithrombotic efficacy with minimum hemorrhagic risk, a critical balance defining success in this therapeutic area. Regulatory bodies globally place high scrutiny on the safety and efficacy data of all new anticoagulant introductions, ensuring the utmost standard of care is maintained.

Key factors driving the sustained growth of this market include profound demographic shifts, characterized by global population aging, which corresponds directly to a higher incidence of AF and VTE. Furthermore, the rising prevalence of lifestyle diseases such as obesity, diabetes mellitus, and hypertension substantially increases the risk profile for thrombotic events, expanding the eligible patient pool requiring anticoagulation. The widespread clinical adoption of DOACs, propelled by extensive clinical trial data validating their superior safety and non-inferior efficacy compared to Warfarin, serves as a primary market accelerant. Moreover, aggressive R&D investment aimed at developing specific, rapidly acting reversal agents for DOACs has bolstered prescriber confidence, facilitating their broader integration into emergency and routine clinical pathways, further cementing their dominance in the market landscape.

Anticoagulant Drugs Market Executive Summary

The global Anticoagulant Drugs Market is characterized by a strong commercial pivot towards highly specific, orally administered agents, establishing the Direct Oral Anticoagulant (DOAC) segment as the undeniable revenue powerhouse. Business trends reflect intense intellectual property competition and strategic maneuvers to capture market share, especially as several pioneering DOAC patents approach or face expiration, catalyzing a surge in generic competition and pressing pricing structures globally. Leading pharmaceutical entities are focusing their R&D efforts on novel targets, such as Factor XI/XIa, aiming to engineer a drug that separates antithrombotic efficacy from the risk of bleeding complications, thereby redefining the safety profile of anticoagulation therapy. Furthermore, the integration of companion diagnostics and digital health tools for adherence monitoring and personalized risk assessment represents a significant business model innovation.

Regional dynamics illustrate a clear bifurcation in market maturity and growth potential. North America retains its status as the largest revenue contributor, underpinned by premium pricing, high physician acceptance of branded products, and sophisticated patient access programs. Conversely, the Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate, driven by the sheer volume of its patient population, rapid improvements in healthcare infrastructure, increased urbanization leading to higher chronic disease incidence, and the gradual, yet significant, expansion of national health insurance coverage facilitating access to modern DOACs. European markets maintain stable, mature growth, though regulatory complexity and strict price controls enforced by national health technology assessment (HTA) agencies often delay or modify the market entry and pricing of new drug formulations.

Segment trends unequivocally highlight the supremacy of Factor Xa inhibitors (e.g., Apixaban and Rivaroxaban) within the Drug Class segmentation, displacing traditional Vitamin K Antagonists (VKAs) across most chronic indications. In terms of therapeutic application, Stroke Prevention in Atrial Fibrillation (SPAF) remains the largest single market segment, reflecting the high incidence and severe consequences of AF-related stroke. The dominance of the Oral route of administration over Injectable therapies for long-term management underscores patient preference for convenience. Overall, the market trajectory is highly sensitive to the successful launch and regulatory clearance of next-generation anticoagulants that can address the remaining clinical need for enhanced safety, especially concerning high-risk bleeding populations, promising continued disruptive innovation over the forecast period.

AI Impact Analysis on Anticoagulant Drugs Market

User queries regarding AI’s influence on the Anticoagulant Drugs Market commonly revolve around improving predictive diagnostics for thrombotic risk, optimizing complex dosing regimens, minimizing adverse drug events, and accelerating novel drug discovery. Users frequently ask how AI can handle the variability in patient response to anticoagulants, particularly Warfarin, and whether machine learning models can accurately predict major bleeding events. A significant theme is the application of natural language processing (NLP) and machine learning (ML) to large electronic health record (EHR) datasets to identify high-risk patient subgroups and tailor personalized prophylactic strategies, thus moving beyond generalized therapeutic guidelines. Concerns often center on data privacy, the validation robustness of AI algorithms in clinical settings, and the potential for algorithmic bias in diverse patient populations.

The consensus expectation is that Artificial Intelligence will revolutionize clinical decision support systems (CDSS) specifically for anticoagulation management. ML algorithms are already being deployed to analyze massive electronic health records (EHRs) to identify patients who are suboptimal candidates for current therapies or those who require specific dose adjustments based on changes in renal function, weight, or concomitant medications. This AI-guided personalized approach significantly enhances patient safety by keeping drug levels within the narrow therapeutic range, minimizing both thrombotic failure and hemorrhagic complications. Furthermore, AI is crucial in pharmacovigilance, utilizing natural language processing (NLP) to swiftly analyze adverse event reports and clinical data from heterogeneous sources, allowing manufacturers and regulators to quickly identify and address emerging safety signals in real-world settings, which is vital for drugs with narrow safety margins.

The long-term impact analysis suggests that AI adoption will necessitate the development of highly standardized clinical data collection protocols and interoperable digital platforms. Companies investing in AI capabilities are expected to gain a significant competitive advantage by offering not just the drug itself, but an integrated care package that includes intelligent monitoring and predictive analytics. This shift moves the market from a traditional product-centric focus to a solutions-centric ecosystem, where predictive algorithms inform drug choice and management. However, regulatory frameworks must evolve to certify these complex algorithms as medical devices, addressing concerns about accountability and transparency ("black box" issues) to ensure widespread clinical acceptance and trust in AI-driven anticoagulant recommendations.

- AI-driven predictive analytics enhance thrombotic risk stratification and identify optimal candidates for primary prevention protocols.

- Machine learning algorithms significantly optimize personalized dosing regimens for Vitamin K Antagonists (VKAs), minimizing INR variability and adverse events.

- Natural Language Processing (NLP) rapidly extracts and synthesizes real-world evidence from clinical notes and claims data to monitor long-term safety profiles of DOACs.

- Accelerated discovery and validation of novel Factor XIa inhibitor compounds through computational modeling and deep learning simulations, reducing R&D timelines.

- Integration of AI into Clinical Decision Support Systems (CDSS) provides real-time alerts to clinicians regarding drug-drug interactions and imminent major bleeding risks.

DRO & Impact Forces Of Anticoagulant Drugs Market

The market for Anticoagulant Drugs operates under dynamic constraints and opportunities dictated by global health trends and pharmaceutical innovation cycles. Key Drivers are primarily epidemiological and clinical: the burgeoning global incidence of Atrial Fibrillation (AF) and Venous Thromboembolism (VTE), strongly correlated with increased life expectancy and prevalent cardiovascular risk factors like obesity and hypertension, creates an expanding patient population requiring chronic prophylaxis. Crucially, the superior efficacy, convenience, and safety profile of Direct Oral Anticoagulants (DOACs)—which eliminate the need for laborious blood monitoring and dietary restrictions associated with Warfarin—are accelerating adoption globally, fueling significant market revenue growth and establishing a new standard of care.

Restraints fundamentally involve economic and clinical complexity. The elevated cost of branded DOACs presents a major barrier to access and affordability, particularly in healthcare systems where reimbursement is constrained or patient out-of-pocket costs are substantial. Furthermore, despite the relative safety improvement, the risk of major, life-threatening hemorrhages remains a critical clinical concern across all anticoagulant classes, necessitating cautious prescribing, careful patient selection, and, in acute settings, the availability of specialized and costly reversal agents. The looming intellectual property cliff for several key DOACs, poised to introduce low-cost generic competition, poses a significant restraint on the market’s aggregated revenue potential post-2025, although it will simultaneously boost patient access.

Significant Opportunities exist in the development of truly next-generation therapies, specifically Factor XIa inhibitors. These agents hold the promise of selectively inhibiting pathological thrombosis while preserving physiological hemostasis, effectively offering anticoagulation without a major bleeding risk—a pharmaceutical holy grail. Geographically, strategic market penetration into high-growth, underserved emerging economies, particularly in the APAC region, offers massive expansion potential as healthcare infrastructure and affordability improve. Impact Forces are primarily driven by international clinical guidelines (e.g., ESC, AHA, ACC) which exert a powerful and immediate influence on physician prescribing behavior. Regulatory approval pathways, competitive pricing strategies, and the continuous output of real-world evidence regarding drug performance further shape the competitive landscape and patient access.

Segmentation Analysis

The segmentation of the Anticoagulant Drugs Market is foundational to understanding competitive dynamics and growth pockets, categorized fundamentally by the drug's mechanism of action. The Drug Class segmentation reveals the Factor Xa Inhibitors (e.g., Rivaroxaban, Apixaban) as the most commercially successful segment, reflecting their strong clinical backing and widespread physician preference for their once or twice-daily dosing schedules and lack of dietary restrictions. Direct Thrombin Inhibitors (e.g., Dabigatran) constitute another major segment of DOACs, demonstrating specialized utility in specific patient groups. Traditional Heparins (UFH and LMWH) maintain a critical niche, primarily reserved for acute treatment in hospital settings, renal impairment patients, and pregnancy, where the rapid onset and short half-life are advantageous, ensuring the segment's enduring importance despite the shift to oral therapies.

Segmentation by Therapeutic Application showcases the severe prevalence and mortality associated with certain conditions. Stroke Prevention in Atrial Fibrillation (SPAF) dominates due to the long-term, chronic nature of AF management and the high societal cost of AF-related stroke. The Venous Thromboembolism (VTE) segment, covering DVT and PE treatment and prophylaxis, also remains vital, heavily utilizing both injectable and oral agents. Furthermore, the Route of Administration segmentation clearly differentiates the chronic outpatient market (Oral) from the acute care inpatient market (Injectable), reflecting differing patient needs and pharmacological requirements. The growth in oral formulations is substantially outpacing injectables due to overwhelming patient convenience and the ability of DOACs to manage VTE and AF entirely outside the hospital setting.

Finally, Distribution Channel segmentation underscores the shift in prescription fulfillment. Retail Pharmacies are increasingly essential as the vast majority of DOAC use is chronic and managed outpatiently. Hospital Pharmacies, while critical for initial stabilization and acute VTE treatment using Heparins, are seeing their role in long-term oral drug dispensing diminish relative to the retail sector. The burgeoning influence of Online Pharmacies and mail-order specialty services, particularly in major Western markets, optimizes patient access and adherence for these long-term therapies, providing competitive pricing and home delivery services that cater specifically to the chronic patient demographic. This multi-faceted segmentation provides a comprehensive framework for assessing both current performance and future investment viability across the diverse therapeutic landscape.

- Drug Class:

- Factor Xa Inhibitors (Rivaroxaban, Apixaban, Edoxaban) - Dominant due to fixed dosing and strong efficacy.

- Direct Thrombin Inhibitors (Dabigatran, Argatroban) - Key for specific renal/hepatic considerations.

- Vitamin K Antagonists (Warfarin, Phenprocoumon) - Legacy drug class, diminishing market share but high volume in generics.

- Heparins (Low Molecular Weight Heparins, Unfractionated Heparins) - Essential for acute care and specialized populations.

- Therapeutic Application:

- Stroke Prevention in Atrial Fibrillation (SPAF) - Largest segment, driving chronic use of DOACs.

- Venous Thromboembolism (VTE) Treatment and Prevention (Deep Vein Thrombosis & Pulmonary Embolism) - High growth area, covers acute and prophylactic use.

- Acute Coronary Syndrome (ACS) - Requires dual antiplatelet/anticoagulant strategies, complex management.

- Mechanical Heart Valve (MHV) - Still heavily reliant on VKAs, a critical niche.

- Route of Administration:

- Oral - Preferred for chronic, outpatient management (DOACs, VKAs).

- Injectable (Intravenous, Subcutaneous) - Reserved for acute intervention and bridging therapy (Heparins).

- Distribution Channel:

- Hospital Pharmacies - Primary channel for Heparins and initial DOAC prescriptions.

- Retail Pharmacies - Dominant channel for long-term maintenance therapy (DOACs, Warfarin).

- Online Pharmacies - Emerging channel enhancing convenience and adherence for chronic users.

Value Chain Analysis For Anticoagulant Drugs Market

The Anticoagulant Drugs Market value chain commences with rigorous upstream research and active pharmaceutical ingredient (API) synthesis, demanding specialized expertise in organic chemistry and biochemistry, especially for complex molecules like Factor Xa inhibitors. API manufacturing is heavily globalized, often involving outsourced specialized contract manufacturing organizations (CMOs) that must adhere to stringent international regulatory standards (e.g., FDA, EMA). Intellectual Property (IP) generation and defense are the highest value-add activities in this upstream phase, securing proprietary positions for branded DOACs and dictating revenue generation potential over patent life. Raw material sourcing, particularly for key chemical precursors, requires a resilient supply chain to mitigate geopolitical or regulatory disruptions, ensuring continuous production of these life-critical drugs.

The midstream phase involves drug formulation, large-scale manufacturing, and comprehensive clinical validation. Manufacturing processes are highly controlled, incorporating quality assurance (QA) and quality control (QC) measures to ensure product uniformity and stability, essential for drugs with narrow therapeutic windows. The core value realization is achieved through successful completion of extensive Phase III clinical trials, proving non-inferiority or superiority to existing standards of care, and securing regulatory approval (e.g., New Drug Application or Marketing Authorization). This phase requires immense capital outlay and strategic management of global clinical sites and data, demonstrating compliance with Good Clinical Practice (GCP) guidelines before transition to commercial production.

Downstream activities center on distribution, sales, and patient access. The distribution network utilizes a mix of direct sales to large hospital systems and indirect channels via wholesalers, specialty distributors, and retail pharmacy chains, ensuring widespread availability for the chronic patient base. Pharmacy Benefit Managers (PBMs) in the US wield immense influence over formulary placement and pricing, serving as gatekeepers who significantly affect market volume and profitability. Crucially, the final step involves patient adherence support; given the critical nature of these drugs, comprehensive patient education, risk management programs (Risk Evaluation and Mitigation Strategies - REMS), and physician training on appropriate prescribing and potential interactions are integral to realizing maximum therapeutic value and maintaining market reputation.

Anticoagulant Drugs Market Potential Customers

The primary and most critical segment of potential customers for anticoagulant drugs consists of the global patient population requiring primary or secondary prevention of thromboembolic events. This encompasses millions of individuals diagnosed with chronic conditions such as Atrial Fibrillation (AF), which necessitates long-term anticoagulation to prevent stroke, as well as those recovering from an initial Venous Thromboembolism (VTE) event who require extended maintenance therapy. As the global population ages and the prevalence of metabolic risk factors increases, driven by sedentary lifestyles, obesity, and diabetes, the demographic pool of potential chronic users of oral anticoagulants expands commensurately, establishing a stable and ever-growing customer base for both branded and generic products.

Institutional customers represent the critical volume purchasers, including large tertiary care hospitals, specialized cardiology and orthopedic centers, and government-managed healthcare systems (e.g., NHS in the UK, centralized procurement agencies in Asia). Hospitals are the main consumers of injectable anticoagulants (Heparins) used in acute settings, emergency rooms, critical care units, and for surgical prophylaxis. These institutions often purchase through highly competitive tender processes or Group Purchasing Organizations (GPOs), prioritizing cost-effectiveness, reliability of supply, and clinical guidelines adherence. The decisions of these institutional buyers profoundly influence the immediate acute care market segment.

A third vital customer segment involves the influential healthcare professionals—cardiologists, hematologists, stroke neurologists, and primary care physicians—who serve as the ultimate prescribers and clinical decision-makers. Pharmaceutical marketing and medical affairs efforts are intensely focused on these specialists to ensure they are fully educated on the benefits, contraindications, and appropriate use of specific drugs, especially the newer DOACs. Their confidence in a product's safety profile, particularly the availability of specific reversal agents, is paramount to market uptake and determines the success of long-term prescription volume, making them indirect, yet decisive, customers within the overall market ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 30.5 Billion |

| Market Forecast in 2033 | USD 47.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer AG, Bristol-Myers Squibb Company, Pfizer Inc., Johnson & Johnson, Daiichi Sankyo Company, Boehringer Ingelheim GmbH, Novartis AG, AstraZeneca PLC, Sanofi S.A., Aspen Pharmacare Holdings Limited, Leo Pharma A/S, CSL Behring, Teva Pharmaceutical Industries Ltd., Viatris (Mylan N.V.), Gilead Sciences, Portola Pharmaceuticals (Acquired by Alexion), Eisai Co., Ltd., Merck & Co., Inc., Otsuka Holdings Co., Ltd., Roche Holding AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anticoagulant Drugs Market Key Technology Landscape

The technological evolution of the Anticoagulant Drugs Market is profoundly marked by a transition from broad-acting, monitored therapies to highly selective, fixed-dose regimens. The development of Direct Oral Anticoagulants (DOACs), particularly Factor Xa inhibitors like Rivaroxaban and Apixaban, represents the pinnacle of current pharmacological technology. These drugs utilize advanced molecular design to selectively target specific enzymes in the coagulation cascade, resulting in predictable plasma concentration profiles and therapeutic effects. This technological achievement allows for fixed-dose administration without the necessity of routine laboratory monitoring, addressing the major compliance and complexity drawbacks of legacy Vitamin K Antagonists. The formulation technology itself, ensuring high oral bioavailability and stability, is a critical proprietary asset for the leading market players, sustaining their competitive edge against generic entrants.

The frontier of anticoagulant technology is focused on targeting novel pathways, specifically the intrinsic pathway component Factor XI (FXI) or its activated form, Factor XIa. This technological focus stems from clinical observations suggesting that FXI inhibition may offer effective thrombosis prevention with a markedly lower risk of bleeding than traditional or current DOACs, as FXI appears less critical for physiological hemostasis than Factor Xa or Thrombin. Companies are leveraging cutting-edge molecular modeling and high-throughput screening technologies to develop highly selective small molecules and monoclonal antibodies aimed at this target. The success of FXI/XIa inhibitors would represent a paradigm shift, effectively decoupling antithrombotic activity from hemorrhagic risk, marking the next major technological disruption in the market and potentially expanding anticoagulation usage into high-risk populations currently excluded due to bleeding concerns.

Beyond molecular innovation, the technological landscape includes critical support technologies. The successful commercialization of specific reversal agents, such as Andexanet alfa and Idarucizumab, involves complex biologic and recombinant DNA technology, ensuring that clinicians have rapid, reliable tools to reverse the effects of DOACs in emergency situations. Furthermore, digital technologies are playing an increasingly crucial role. Telemonitoring systems, smartphone applications for adherence tracking, and sophisticated AI algorithms for personalized risk assessment and dosing guidance are being integrated into treatment protocols. These digital technological overlays enhance patient safety, improve outcomes, and provide manufacturers with valuable real-world data, solidifying the market’s move towards integrated pharmaceutical and digital health solutions.

Regional Highlights

- North America: This region is the revenue powerhouse, primarily due to the rapid and comprehensive adoption of premium-priced DOACs, driven by sophisticated regulatory frameworks (FDA), high levels of physician autonomy, and extensive insurance coverage facilitating access to innovative therapies. The US market dominates, characterized by high prevalence rates of AF and VTE, significant investments in cardiovascular R&D, and robust competitive marketing strategies by key pharmaceutical giants.

- Europe: The market is mature, exhibiting steady growth, heavily influenced by the rigorous cost-effectiveness assessments conducted by national Health Technology Assessment (HTA) bodies. Western European nations (e.g., Germany, France) are significant consumers, with market access dependent on demonstrating superior clinical or economic value over established treatments. Eastern Europe is gradually transitioning towards DOAC adoption, constrained by economic factors and slower reimbursement policy shifts.

- Asia Pacific (APAC): Positioned as the highest growth market due to expanding patient pools stemming from demographic aging and rapid urbanization leading to increased chronic disease incidence. Countries like China and India offer immense untapped potential. Improving healthcare infrastructure, rising disposable incomes, and government initiatives prioritizing non-communicable disease management are rapidly accelerating the shift from legacy VKAs to branded DOACs, despite lingering price sensitivity in rural areas.

- Latin America (LATAM): Exhibits moderate, yet variable, growth across its major economies (Brazil, Mexico). Market penetration of DOACs is increasing but is challenged by economic volatility, reliance on public tenders, and generic competition. The region shows a strong willingness to adopt global clinical guidelines but implementation is often hampered by budget constraints and limited insurance penetration.

- Middle East and Africa (MEA): This is a developing market segment, with growth concentrated in the high-income GCC states (Saudi Arabia, UAE) where substantial government investment in specialized healthcare and high rates of imported premium pharmaceutical products prevail. Adoption in Sub-Saharan Africa is limited, restricted primarily to essential medicine programs focusing on low-cost generics and LMWH for acute hospital use.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anticoagulant Drugs Market.- Bayer AG

- Bristol-Myers Squibb Company

- Pfizer Inc.

- Johnson & Johnson

- Daiichi Sankyo Company

- Boehringer Ingelheim GmbH

- Novartis AG

- AstraZeneca PLC

- Sanofi S.A.

- Aspen Pharmacare Holdings Limited

- Leo Pharma A/S

- CSL Behring

- Teva Pharmaceutical Industries Ltd.

- Viatris (Mylan N.V.)

- Gilead Sciences

- Alexion Pharmaceuticals (Acquired Portola Pharmaceuticals)

- Eisai Co., Ltd.

- Merck & Co., Inc.

- Otsuka Holdings Co., Ltd.

- Roche Holding AG

Frequently Asked Questions

Analyze common user questions about the Anticoagulant Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Anticoagulant Drugs Market?

The primary driver is the significantly increasing global prevalence of atrial fibrillation (AF) and venous thromboembolism (VTE), particularly within the rapidly expanding geriatric population, coupled with the definitive clinical and patient preference shift toward safer and more convenient Direct Oral Anticoagulants (DOACs) that eliminate routine monitoring.

How are Direct Oral Anticoagulants (DOACs) changing therapeutic standards?

DOACs fundamentally change standards by providing predictable pharmacokinetics, requiring fixed daily dosing, and eliminating the need for laborious routine International Normalized Ratio (INR) monitoring required by Warfarin, leading to enhanced patient adherence, reduced treatment variability, and superior safety profiles in non-valvular AF.

Which geographic region holds the largest market share for anticoagulant drugs and why?

North America currently holds the largest market share due to its established, advanced healthcare infrastructure, high disease burden, rapid physician adoption of innovative branded pharmaceuticals, and sophisticated private and public reimbursement mechanisms that facilitate patient access to high-cost premium therapies.

What are the key emerging opportunities in anticoagulant drug development?

The key emerging opportunity lies in the research and development of highly specific next-generation therapies, such as Factor XI/XIa inhibitors, which are hypothesized to offer robust antithrombotic efficacy while drastically reducing the intrinsic risk of major bleeding complications—the most critical limitation of current commercially available anticoagulants.

What impact does AI have on the clinical management and R&D of anticoagulation?

AI is having a dual impact: clinically, it optimizes dosing and predicts patient-specific bleeding risks through advanced Clinical Decision Support Systems; in R&D, it accelerates drug discovery by using machine learning models to identify and validate novel drug targets and streamline early-stage clinical trial design.

What is the significance of reversal agents in the Anticoagulant Drugs Market?

The development of specific reversal agents (antidotes) for DOACs is strategically significant because it addresses a major safety concern, increasing prescriber confidence and facilitating the broader use of DOACs in populations where rapid reversal capability (e.g., emergency surgery, major trauma) is critical for patient management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager