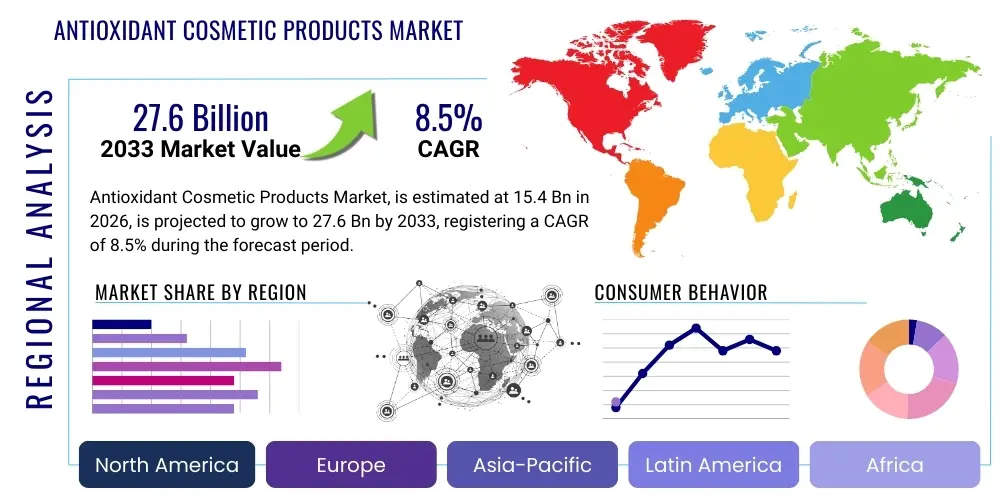

Antioxidant Cosmetic Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441136 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Antioxidant Cosmetic Products Market Size

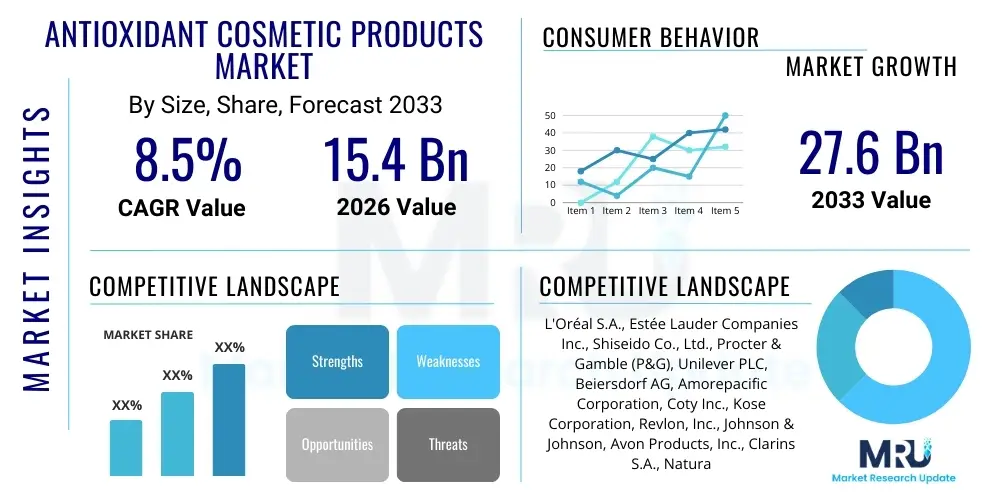

The Antioxidant Cosmetic Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.4 Billion in 2026 and is projected to reach USD 27.6 Billion by the end of the forecast period in 2033.

Antioxidant Cosmetic Products Market introduction

The Antioxidant Cosmetic Products Market encompasses a wide array of skin care, hair care, and makeup formulations designed to counteract the damaging effects of free radicals, which are primarily generated by environmental stressors such as UV radiation, pollution, and blue light exposure. These products utilize natural or synthetic antioxidant compounds—including vitamins (C, E, A), polyphenols, carotenoids, and various botanical extracts—to stabilize reactive oxygen species (ROS), thereby mitigating oxidative stress on biological structures. The primary objective is to slow down intrinsic and extrinsic aging processes, reduce inflammation, and enhance overall skin health and resilience. This market segment has seen accelerated expansion due to growing consumer awareness regarding preventative aging measures and the pervasive integration of wellness concepts into daily beauty routines. Formulators are continuously seeking novel, highly efficacious, and stable antioxidant delivery systems to maximize product performance and shelf life.

Major applications for antioxidant cosmetics span preventative aging creams, specialized serums targeting hyperpigmentation, high-SPF sunscreens enhanced with free radical scavengers, and protective primers designed to create a barrier against urban pollution. These formulations are particularly crucial in high-density urban areas where particulate matter and smog contribute significantly to premature aging. The sophistication of cosmetic chemistry has allowed for the creation of multi-functional products that not only neutralize free radicals but also simultaneously boost collagen production, repair DNA damage, and improve the skin’s moisture barrier function. This holistic approach to epidermal care drives sustained consumer interest and premiumization across the sector. Product development is heavily influenced by efficacy studies and clinical validation to ensure claims meet stringent regulatory and consumer expectations regarding health benefits.

Key driving factors propelling the market include the global demographic shift towards an aging population actively seeking 'age-defying' solutions, increasing levels of atmospheric pollution worldwide necessitating protective measures, and significant advancements in biotechnology leading to the discovery and stabilization of potent, naturally derived antioxidants. Furthermore, the robust growth of the e-commerce sector and digital media has amplified consumer education regarding the science of oxidative stress, prompting proactive purchasing decisions. Regulatory scrutiny on ingredient transparency and sustainability also plays a role, pushing manufacturers toward ethically sourced and cleaner label formulations. The synergy between medical aesthetics and cosmetic science further validates the therapeutic benefits of these ingredients, reinforcing consumer confidence.

Antioxidant Cosmetic Products Market Executive Summary

The Antioxidant Cosmetic Products Market is characterized by vigorous innovation focused heavily on ingredient encapsulation and bioavailability, aimed at delivering highly sensitive compounds like Vitamin C effectively to target skin layers. Business trends show a strong emphasis on traceability and natural sourcing, driven by consumer demand for 'clean beauty' and sustainable practices. Strategic mergers, acquisitions, and partnerships between large cosmetic corporations and specialized biotech firms focusing on novel antioxidant compounds are common, seeking to secure exclusive ingredient supply and intellectual property. Furthermore, customization and personalization, enabled by diagnostic technologies, are emerging trends, allowing brands to formulate tailored antioxidant cocktails based on individual skin needs and environmental exposure profiles. The premiumization of the serum and facial treatment sub-segments continues to drive revenue growth.

Regional trends indicate that North America and Europe currently dominate the market, largely due to high disposable incomes, advanced awareness of skin health, and mature retail infrastructure supporting high-end cosmetic brands. However, the Asia Pacific (APAC) region, particularly China, Japan, and South Korea, is exhibiting the highest growth trajectory. This acceleration is fueled by the region's strong culture of meticulous skincare (K-Beauty and J-Beauty influences), rapid urbanization leading to increased pollution concerns, and the expanding middle class’s capacity to spend on preventative luxury goods. Emerging markets in Latin America and the Middle East are also showing increasing adoption, specifically for sun protection and anti-pollution products, indicating market diversification beyond traditional Western consumer bases.

Segmentation trends highlight that the largest market share belongs to the facial care segment, including serums, moisturizers, and masks, reflecting the consumer focus on facial aging signs. Ingredients derived from natural sources, such as green tea extract, resveratrol, and various berry extracts, are rapidly gaining prominence over synthetic alternatives, aligning with broader clean label initiatives. The distribution channel analysis confirms that specialty retail stores and online platforms are pivotal for market penetration, offering consumers expert advice and extensive product comparisons. The shift towards waterless or anhydrous formulations is also noticeable, often necessitated by the inherent instability of certain potent antioxidants, demanding sophisticated and preservative-free delivery formats.

AI Impact Analysis on Antioxidant Cosmetic Products Market

User inquiries regarding AI in the Antioxidant Cosmetic Products Market primarily center on three themes: how AI is accelerating new ingredient discovery and formulation safety (chem-informatics), the role of AI in personalizing consumer recommendations based on oxidative stress assessment (diagnostic tools), and the optimization of supply chain logistics for sensitive, perishable ingredients. Users are highly interested in AI’s capability to predict ingredient synergies and stability, thereby minimizing formulation trial-and-error. They also frequently query the use of machine learning to analyze environmental data (pollution levels, UV indices) to recommend location-specific protective routines, indicating a desire for hyper-personalized, dynamic skincare solutions driven by intelligent systems.

- AI-driven identification of novel, potent natural or synthetic antioxidant compounds through large-scale genomic and proteomic data analysis.

- Optimization of cosmetic formulation stability and efficacy using predictive modeling, reducing time-to-market for new products.

- Personalized product recommendation engines utilizing machine learning algorithms to match user skin profiles and environmental exposure data with specific antioxidant cocktails.

- Enhanced supply chain management for temperature-sensitive raw materials, utilizing predictive analytics to ensure ingredient potency upon delivery.

- Diagnostic tools, often smartphone-based, using computer vision to assess signs of oxidative stress and recommend appropriate protective products.

- Automated quality control and purity verification of high-value antioxidant extracts, ensuring compliance and consumer safety standards.

DRO & Impact Forces Of Antioxidant Cosmetic Products Market

The market dynamics are significantly influenced by a confluence of accelerating drivers, structural restraints, and evolving opportunities, all subject to impactful external forces. Key drivers include heightened global awareness of photoaging and oxidative damage, coupled with rising consumer demand for scientifically backed, preventative skincare. Conversely, major restraints involve the inherent instability and short shelf-life of several high-performance antioxidants (e.g., L-Ascorbic Acid), necessitating complex and costly stabilization technologies. Furthermore, regulatory hurdles related to ingredient claims and classification (cosmetic vs. therapeutic) complicate marketing efforts. The opportunity lies in the burgeoning field of personalized medicine applied to cosmetology, particularly developing bespoke formulations based on individual genetic predispositions to oxidative stress, alongside significant potential in the burgeoning blue light and infrared protection segments.

Impact forces are multifaceted, ranging from technological breakthroughs in nanotechnology, which allows for advanced encapsulation and targeted delivery of active ingredients, to shifting consumer demographics. The growing influence of digitally native consumers demands transparency, sustainability, and immediate results, forcing brands to overhaul sourcing and manufacturing practices. Furthermore, climate change, specifically the increasing intensity of UV radiation and global pollution levels, acts as a continuous external driver, fueling the necessity for more robust protective products. Economic cycles also exert pressure; while the premium sector remains relatively resilient, inflationary pressures can lead some consumers to trade down to mass-market equivalents, impacting overall revenue composition.

The market also faces inherent challenges related to the consistent and ethical sourcing of natural raw materials, especially botanical extracts, which can suffer from supply volatility due to climate or agricultural issues. This necessitates strong vertical integration or robust supply chain partnerships. However, the move toward biotechnology—utilizing microbial fermentation and synthetic biology to produce stable, pure, and scalable antioxidant compounds (like specific peptides or biosynthetic carotenoids)—presents a significant mitigating factor and a major growth opportunity. Successfully navigating the balance between 'natural' perception and technological feasibility is paramount for market leaders seeking sustained competitive advantage.

Segmentation Analysis

The Antioxidant Cosmetic Products Market is segmented based on the type of ingredient used, the product formulation format, the specific application area, and the end-use consumer demographic. Analysis of these segments reveals distinct consumer preferences and pockets of high growth. The ingredient segmentation, differentiating between natural and synthetic origins, is particularly crucial as it directly impacts purchasing decisions driven by 'clean beauty' trends. Product segmentation is dominated by sophisticated facial treatments, while application segmentation shows robust expansion in daily wear products offering broad-spectrum environmental protection, including pollution defense and digital screen light protection. Understanding these matrices is essential for strategic product portfolio management and targeted marketing efforts within the industry.

- By Ingredient Type:

- Natural/Plant-Derived (e.g., Vitamin E, Green Tea Extract, Resveratrol, Astaxanthin)

- Synthetic (e.g., Coenzyme Q10, Idebenone, Synthetic Vitamin C derivatives, Butylated Hydroxytoluene (BHT))

- By Product Form:

- Creams and Moisturizers

- Serums and Concentrates

- Lotions

- Masks and Cleansers

- Sunscreens and Primers

- By Application Area:

- Facial Care (Largest segment)

- Body Care

- Hair Care

- Eye Care

- By Distribution Channel:

- Online Retail (E-commerce platforms, brand websites)

- Offline Retail (Specialty Retail Stores, Hypermarkets/Supermarkets, Pharmacy/Drug Stores)

- By End-User:

- Male

- Female (Dominant segment)

Value Chain Analysis For Antioxidant Cosmetic Products Market

The value chain for antioxidant cosmetics is complex, beginning with the upstream sourcing and extraction of active ingredients, where challenges related to purity, stability, and sustainable harvesting are prominent. Upstream activities involve agricultural cultivation for botanical extracts, specialized chemical synthesis for compounds like CoQ10, and advanced fermentation processes for bio-derived ingredients such as peptides or certain vitamins. Key players at this stage include specialized ingredient suppliers (e.g., DSM, BASF, Croda), who invest heavily in research and development to create stable, bioavailable, and novel antioxidant technologies, often employing encapsulation or carrier systems before the ingredient even reaches the formulator. Ensuring rigorous quality control and certification (e.g., COSMOS, ECOCERT) is critical in the upstream segment to validate natural or organic claims prevalent in the downstream marketing.

The midstream stage involves formulation, manufacturing, and packaging. Formulators (often large CMOs or in-house labs of major brands) integrate the active antioxidant ingredients into a final product base, balancing pH, texture, stability, and sensory attributes. This stage is technologically intensive, requiring specialized equipment to handle sensitive ingredients, often under inert gas environments to prevent oxidation during processing. Packaging plays a pivotal role; airless pumps, dark glass, or opaque containers are essential to protect the final product from light and oxygen degradation, which directly impacts product efficacy and shelf life. Adherence to Good Manufacturing Practices (GMP) and compliance with diverse regional cosmetic regulations (e.g., EU Cosmetics Regulation, FDA standards) are paramount for market access and consumer trust.

Downstream distribution channels are bifurcated into direct and indirect routes. Direct distribution includes brand-owned physical stores and e-commerce websites, providing maximum control over branding and customer experience. Indirect channels, which form the bulk of sales, include specialty beauty retailers (e.g., Sephora, Ulta), large-scale pharmacies, and hypermarkets. The rise of online retail platforms—both third-party marketplaces and dedicated beauty e-tailers—has democratized access but simultaneously increased the competitive intensity. Effective channel management requires differentiated marketing strategies: educational content is key in online environments, while personalized consultation drives sales in specialty physical retail. Logistics within the downstream segment must ensure appropriate temperature control during transit and storage to maintain product integrity until it reaches the end consumer.

Antioxidant Cosmetic Products Market Potential Customers

The primary customer base for antioxidant cosmetic products is highly diverse yet unified by a focus on preventative maintenance and addressing visible signs of aging and environmental damage. The largest segment comprises females aged 30 and above, who exhibit high purchasing power and a proactive approach to skincare, viewing these products as foundational components of their daily routine. These consumers are typically highly educated about ingredients, responsive to clinical testing data, and willing to invest in premium or luxury brands that substantiate efficacy claims. They are driven by long-term skin health objectives, including preventing collagen breakdown, mitigating UV damage effects, and achieving a radiant, even complexion. Product loyalty in this group is often tied to demonstrable results and positive peer reviews, making digital and influencer marketing crucial.

A rapidly expanding customer demographic is the younger cohort, encompassing millennials and Generation Z, who are increasingly adopting antioxidant products (particularly serums and anti-pollution sprays) as preventative measures, spurred by extensive exposure to digital media highlighting the impact of urban living and blue light exposure. This group values transparency, sustainability, and vegan or cruelty-free certifications. Their purchasing decisions are heavily influenced by social media trends and endorsements from micro-influencers. The products targeting this segment tend to be lighter in texture, often focused on detoxification and protection against environmental stressors rather than correcting established wrinkles, emphasizing proactive health rather than reactive repair.

Furthermore, male consumers represent a significant, though smaller, growth opportunity. As general male grooming practices become more sophisticated, there is an increasing adoption of specialized antioxidant moisturizers and sun protection products, often marketed with simplified routines and masculine packaging. Institutional buyers, such as high-end spas, dermatologists, and medical aesthetic clinics, also constitute a high-value customer group. These professional customers require concentrated, highly stable formulations for use in conjunction with procedures like chemical peels or microdermabrasion, prioritizing clinical-grade purity and proven compatibility with sensitive post-procedural skin. These institutions often serve as key opinion leaders, influencing the product choices of direct-to-consumer buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.4 Billion |

| Market Forecast in 2033 | USD 27.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Estée Lauder Companies Inc., Shiseido Co., Ltd., Procter & Gamble (P&G), Unilever PLC, Beiersdorf AG, Amorepacific Corporation, Coty Inc., Kose Corporation, Revlon, Inc., Johnson & Johnson, Avon Products, Inc., Clarins S.A., Natura & Co Holding S.A., The Procter & Gamble Company (P&G Beauty), LVMH Moët Hennessy Louis Vuitton SE, Rodan + Fields, LLC, Kiehl's Since 1851, Murad LLC, PCA Skin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antioxidant Cosmetic Products Market Key Technology Landscape

The technological landscape in the antioxidant cosmetic market is rapidly evolving, driven primarily by the necessity to overcome the inherent limitations of high-efficacy active ingredients, chiefly their vulnerability to degradation by light, heat, and oxygen. One foundational technology is advanced encapsulation, which involves housing the sensitive antioxidant molecule within a protective shell, such as liposomes, nanosomes, or solid lipid nanoparticles (SLNs). These delivery systems serve two critical functions: stabilizing the ingredient during storage and processing, thereby extending shelf life, and facilitating targeted, deeper penetration into the skin layers (enhanced bioavailability). Liposomal encapsulation, for instance, allows hydrophilic compounds like Vitamin C to be efficiently transported through the skin’s lipid barrier, significantly boosting therapeutic impact compared to conventional emulsion systems. Continued research focuses on smart delivery capsules that release the payload only upon specific triggers, such as pH change or enzymatic activity encountered within the skin’s structure.

Another pivotal technological area is synthetic biology and fermentation-derived ingredients. Due to concerns regarding the purity, scalability, and sustainability of traditional botanical extracts, manufacturers are increasingly leveraging microbial platforms (yeast, bacteria) to produce highly standardized and pure antioxidant compounds, such as specific carotenoids (e.g., Astaxanthin), resveratrol, or specialized peptides. This bio-fermentation approach ensures chemical consistency across batches, mitigating the variability often found in nature-sourced materials due to climate or geographical factors. This process also aligns well with 'clean' formulation standards as it often eliminates the need for harsh solvents used in traditional extraction processes. Furthermore, the development of stable, oil-soluble derivatives of traditionally water-soluble antioxidants (like various Vitamin C esters) represents a chemical technology breakthrough that expands formulation flexibility, enabling inclusion in anhydrous and oil-based serums where stability is generally superior.

The convergence of digital diagnostics with formulation science is also creating significant technological shifts. Non-invasive devices and smartphone applications utilize spectroscopy, specialized cameras, and AI algorithms to measure skin parameters, including moisture levels, melanin content, and, crucially, markers of oxidative stress, such as sebum oxidation or micro-inflammation. These tools generate personalized data used for either direct consumer guidance or integration into specialized compounding machinery in retail environments, allowing for the on-demand creation of bespoke antioxidant blends. This integration represents a major shift toward Precision Cosmetology. Lastly, in the manufacturing phase, microfluidic techniques are increasingly employed for precise mixing and controlled production of uniform micro-emulsions and nano-dispersions, ensuring high homogeneity and optimum distribution of the active antioxidant within the final product matrix, minimizing potential localized degradation points.

Regional Highlights

Regional dynamics are highly heterogeneous, reflecting differences in aging demographics, pollution levels, consumer wealth, and established skincare cultures. Each region contributes distinctly to global market growth, driven by unique environmental and socioeconomic factors.

- North America (US and Canada): Characterized by high consumer spending on premium and doctor-recommended clinical skincare brands. The market is saturated with established players and innovative startups, focusing heavily on stable Vitamin C and multi-antioxidant complex serums. Key drivers include high awareness of UV damage and a strong medical aesthetics culture supporting intensive post-procedure skin maintenance using high-potency antioxidants. The US leads in the adoption of AI-driven personalized product recommendations.

- Europe (Germany, UK, France): Driven by stringent regulatory standards (EU Cosmetics Regulation) which promote safety and detailed ingredient transparency. European consumers prioritize sustainable, natural, and certified organic antioxidant sources. France and Germany are leaders in dermocosmetics, emphasizing clinically tested and pharmaceutically backed formulations, particularly for sensitive skin types needing pollution and blue light protection.

- Asia Pacific (APAC) (China, Japan, South Korea): The fastest-growing region globally, fueled by intensive preventative skincare routines (e.g., 10-step routines) and high urbanization rates necessitating anti-pollution solutions. South Korea and Japan are innovation hubs, pioneering novel fermentation techniques for antioxidant production and leading in functional cosmetic formats like sheet masks and ampoules heavily infused with ingredients like Centella Asiatica and ginseng extracts. China's burgeoning middle class drives massive volume growth across all price points.

- Latin America (LATAM) (Brazil, Mexico): Strong demand is observed for high-SPF sunscreens integrated with robust antioxidants, reflecting the region's high solar index and outdoor lifestyle. The market is highly price-sensitive but shows increasing interest in local, ethically sourced botanical ingredients unique to the region (e.g., Amazonian extracts). Brazil represents the largest market, focusing on both facial and body antioxidant care.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, characterized by a preference for luxury, high-end international brands. Market demand is driven by high solar exposure and heat, requiring specialized, temperature-stable formulations offering intense hydration alongside free radical protection. Increasing health tourism and wellness expenditure contribute significantly to market expansion in key urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antioxidant Cosmetic Products Market.- L'Oréal S.A.

- Estée Lauder Companies Inc.

- Shiseido Co., Ltd.

- Procter & Gamble (P&G)

- Unilever PLC

- Beiersdorf AG

- Amorepacific Corporation

- Coty Inc.

- Kose Corporation

- Johnson & Johnson

- Clarins S.A.

- Natura & Co Holding S.A.

- Chanel S.A.

- Dior (LVMH Moët Hennessy Louis Vuitton SE)

- Rodan + Fields, LLC

- Murad LLC

- Dr. Barbara Sturm

- SkinCeuticals (L'Oréal subsidiary)

- The Ordinary (Deciem/Estée Lauder subsidiary)

- PCA Skin

Frequently Asked Questions

Analyze common user questions about the Antioxidant Cosmetic Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most effective antioxidant ingredients currently used in cosmetics?

The most effective ingredients include L-Ascorbic Acid (Vitamin C) and its stable derivatives, Alpha-Tocopherol (Vitamin E), Retinoids (Vitamin A derivatives), Niacinamide (Vitamin B3), Resveratrol, and Astaxanthin. Efficacy is highly dependent on formulation stability and bioavailability, often enhanced through nano-encapsulation technology for optimized delivery.

How does the stability of Vitamin C derivatives impact market product development?

The notorious instability of pure Vitamin C (L-Ascorbic Acid) is a major constraint. Market development focuses on creating highly stable, oil-soluble derivatives like Tetrahexyldecyl Ascorbate or Magnesium Ascorbyl Phosphate, which maintain potency longer and allow for broader formulation applications, thereby increasing overall product shelf life and consumer trust.

Are natural antioxidants significantly better than synthetic ones, based on market trends?

Market trends show a strong consumer preference for natural/plant-derived antioxidants due to the 'clean beauty' movement. While both natural (e.g., botanical extracts) and synthetic (e.g., Coenzyme Q10) ingredients can be highly effective, the market is favoring sustainable, traceable natural sources, driving extensive research into bio-fermented natural compounds for enhanced purity and ethical sourcing.

What is the primary role of antioxidant cosmetics in protection against environmental stressors?

Antioxidant cosmetics serve as vital frontline defense by neutralizing Reactive Oxygen Species (ROS) and free radicals generated by UV radiation, air pollution (particulate matter), and blue light exposure. Their primary function is to prevent oxidative damage that leads to cellular degradation, inflammation, and premature aging, complementing physical barriers like sunscreen.

How is AI being utilized to enhance the antioxidant cosmetic supply chain?

AI is crucial for optimizing the supply chain by predicting demand volatility and ensuring the precise sourcing and handling of sensitive, perishable raw materials. Predictive maintenance and smart warehousing powered by AI ensure active ingredients are stored and transported under optimal temperature and humidity conditions, preserving their efficacy until they reach the manufacturing facility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager