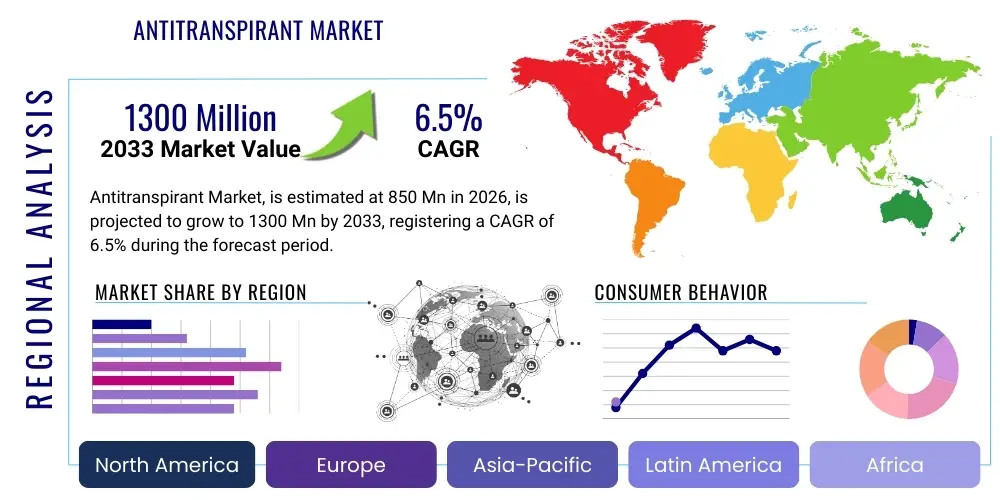

Antitranspirant Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441589 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Antitranspirant Market Size

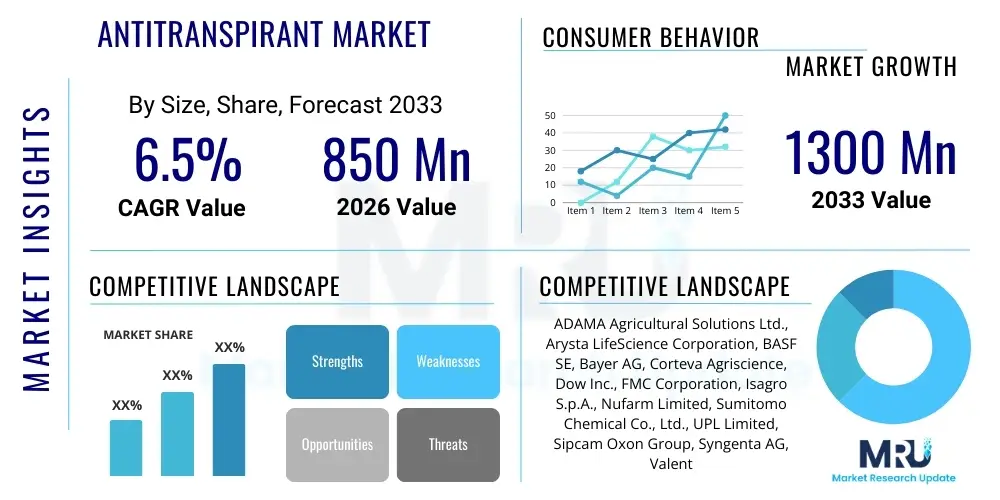

The Antitranspirant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1300 Million by the end of the forecast period in 2033.

Antitranspirant Market introduction

The global Antitranspirant Market encompasses specialized chemical formulations designed primarily for application in agriculture and horticulture to reduce excessive water loss (transpiration) from plants. These products function by either forming a physical barrier (film-forming antitranspirants) or inducing temporary stomatal closure (metabolic antitranspirants), thereby enhancing the plant's water use efficiency, particularly under drought stress conditions, high temperatures, or during transplanting operations. The core objective of these products is to mitigate yield loss and improve plant survival rates by conserving internal moisture reserves, making them vital tools in water-scarce environments and sustainable farming practices.

Major applications of antitranspirants span high-value crops such as fruits, vegetables, and ornamentals, where minimizing water stress is crucial for crop quality and economic viability. They are extensively utilized in nurseries to reduce transplant shock, ensuring successful establishment of seedlings and cuttings. Furthermore, certain formulations are finding increased acceptance in broad-acre crops, especially in regions experiencing unpredictable weather patterns driven by global climate change. The immediate benefits include significant water conservation, improved nutrient uptake efficiency due to reduced stress, and increased overall crop resilience against abiotic factors.

The market is predominantly driven by the escalating challenges posed by climate variability, which includes prolonged drought periods and increasing aridity in key agricultural regions globally. As governmental bodies and international organizations impose stricter regulations favoring water-efficient agricultural methods, the demand for sophisticated antitranspirant products continues to rise. Technological innovations focusing on biodegradable, non-toxic formulations and advanced application techniques are also fueling market expansion, ensuring that these products are both effective and environmentally sustainable for modern farming systems.

Antitranspirant Market Executive Summary

The Antitranspirant Market is characterized by robust growth driven fundamentally by global water scarcity and the pervasive threat of climate change to agricultural productivity. Business trends indicate a decisive shift towards the development of advanced formulations, specifically targeting nano-emulsions and natural, wax-based polymers, offering superior coverage, prolonged efficacy, and minimal phytotoxicity compared to older synthetic materials. Strategic partnerships between chemical manufacturers and precision agriculture technology providers are accelerating the integration of antitranspirant application into smart farming platforms, optimizing dosage and timing based on real-time environmental data.

Regionally, the Asia Pacific (APAC) market is poised for the fastest expansion, fueled by massive agricultural land area, increasing awareness among smallholder farmers regarding water conservation, and rapidly modernizing farming techniques in countries like India and China. North America and Europe, while mature markets, are leading in research and development, particularly focusing on sustainable, bio-based solutions compliant with stringent environmental regulations. The Middle East and Africa (MEA) represent significant opportunity due to extreme aridity, governmental focus on food security, and investment in large-scale irrigation projects where water efficiency is paramount.

Segment trends highlight the dominance of film-forming antitranspirants owing to their proven long-lasting protective effects, though metabolic (stomatal closing) agents are gaining traction for quick, temporary stress mitigation. In terms of crop segments, horticulture and floriculture remain the primary consumers due to the high value associated with preserving crop aesthetics and quality. However, the substantial volume potential lies in the gradual adoption of specialized antitranspirants for major cereal and commodity crops, contingent upon developing cost-effective, broad-spectrum solutions tailored for large-scale application.

AI Impact Analysis on Antitranspirant Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Antitranspirant Market frequently center on how AI can optimize the costly and often variable application process, ensure product effectiveness under fluctuating environmental conditions, and aid in the discovery of next-generation compounds. Users are concerned with achieving precision: determining the exact threshold of water stress that necessitates application and predicting the residual efficacy of the product given specific weather forecasts. The core user expectation is that AI will transform antitranspirant use from a reactive treatment into a proactive, predictive component of integrated water management, fundamentally improving ROI for farmers and minimizing the risk of over-application or phytotoxicity. Furthermore, there is significant interest in AI’s role in screening vast molecular libraries to synthesize more effective and environmentally benign antitranspirant agents.

- AI-driven Predictive Modeling: Optimizing application timing based on localized microclimate data, soil moisture profiles, and crop-specific stress tolerance thresholds.

- Formulation Discovery: Utilizing machine learning algorithms to screen potential compounds, predicting efficacy and toxicity profiles of new film-forming polymers or stomatal regulators.

- Precision Application Systems: Integrating AI with drone or robotic sprayers to ensure targeted, variable rate application, minimizing product waste and maximizing canopy coverage.

- Drought Stress Diagnosis: Using computer vision and deep learning models to analyze satellite or drone imagery for early detection of plant water stress, prompting timely intervention.

- Supply Chain Optimization: Forecasting regional demand based on long-range climate models, ensuring efficient inventory management and distribution of seasonal products.

DRO & Impact Forces Of Antitranspirant Market

The market dynamics of antitranspirants are primarily governed by the increasing global imperative for water conservation in agriculture, offset by practical limitations regarding cost and environmental compatibility. Drivers include the undeniable impact of climate change on rainfall patterns, necessitating adaptive agricultural technologies, coupled with governmental subsidies and initiatives promoting water-efficient farming practices, especially in arid and semi-arid regions. Restraints, conversely, revolve around the high input cost relative to traditional farming methods, the temporary nature of efficacy requiring repeat applications, and the inherent risk of phytotoxicity if products are improperly formulated or applied under extreme heat. These opposing forces dictate the pace of market penetration, particularly among price-sensitive smallholder farmers.

Opportunities are substantial, centered on integrating antitranspirant technology with advanced irrigation and nutrient delivery systems, enhancing overall resource utilization efficiency. The development of specialized, low-concentration nano-formulations that offer superior surface area coverage and greater control over stomatal function presents a major avenue for innovation. Moreover, expansion into non-traditional applications such as urban landscaping, turf management, and forestry—particularly reforestation efforts requiring high seedling survival rates—broadens the potential customer base beyond conventional crop agriculture. Addressing the restraint of cost through scalable, bio-based manufacturing processes will be key to unlocking market potential in staple crops.

Impact forces on the market are high, stemming predominantly from regulatory scrutiny regarding the chemical composition of agricultural inputs and the increasing consumer preference for sustainably produced food. The growing frequency and severity of global drought events act as a powerful external force, compelling farmers and governments to invest in immediate and long-term water-saving solutions like antitranspirants. Furthermore, advancements in competing technologies, such as drought-resistant crop genetics, slightly temper the growth, requiring antitranspirant manufacturers to continuously innovate and demonstrate synergistic benefits rather than standalone efficacy. The alignment of product development with organic and non-toxic standards is an essential impact force shaping market acceptance.

Segmentation Analysis

The Antitranspirant Market is comprehensively segmented based on its functional mechanism, the specific crop application, and the chemical composition of the product, reflecting the diverse needs of the agricultural sector. Understanding these segments is crucial for targeted market entry and strategic product positioning, as efficacy varies significantly depending on crop type and regional climate stress factors. The primary segmentation criterion, mechanism of action, divides the market into physical film-forming barriers and physiological stomatal regulators, each catering to distinct operational requirements and environmental contexts faced by farmers globally.

Segmentation by crop type highlights the disproportionate use of antitranspirants in high-value horticulture (fruits and vegetables) and floriculture, where quality preservation and high yield are non-negotiable, justifying the investment. However, future growth is anticipated to be heavily reliant on the successful development and commercialization of cost-effective solutions for broad-acre crops such as cereals, oilseeds, and pulses, which represent enormous volume potential under widespread drought conditions. Chemical composition segmentation is increasingly leaning towards environmentally sound, biodegradable, and natural compounds, moving away from older synthetic options due to heightened regulatory and consumer scrutiny.

Geographical segmentation remains pivotal, with market strategies tailored to regional water availability, regulatory frameworks, and dominant crop profiles. The adoption rates of advanced spray technologies and integrated digital farming systems also influence the preference for specific product types, where highly specialized, precision-applied formulations thrive in technologically advanced regions, while basic, cost-effective formulations dominate in emerging economies. This multi-faceted segmentation analysis provides a granular view of market demand drivers and competitive landscapes across various agricultural ecosystems.

- By Mechanism of Action:

- Film-Forming Antitranspirants (Waxes, Silicones, Polyethylene)

- Stomatal Closing Antitranspirants (Abscisic Acid (ABA), Certain Hormones)

- Reflective Materials (Kaolin Clay, Light-Reflecting Agents)

- By Crop Type:

- Horticulture (Fruits, Vegetables)

- Floriculture and Ornamentals

- Turf and Nursery Crops

- Broad-Acre Crops (Cereals, Oilseeds)

- By Application Method:

- Foliar Spray

- Soil Drench/Root Dip

- By Chemistry/Composition:

- Synthetic

- Natural/Bio-based (Wax, Oil-based, Resins)

Value Chain Analysis For Antitranspirant Market

The value chain for the Antitranspirant Market begins with the upstream sourcing of specialized chemical raw materials, including high-grade polymers, waxes, oils, surfactants, and specialized solvents required for formulation stability and efficacy. Manufacturers rely heavily on consistent supply and quality control of these inputs, with pricing volatility in petrochemical derivatives often impacting final product costs. R&D activities are crucial at this stage, focusing on developing novel, often proprietary, compounds that comply with increasingly strict agricultural chemical regulations and meet performance benchmarks related to adherence, persistence, and non-phytotoxicity.

The midstream segment involves the core manufacturing, formulation, and packaging processes. This stage is characterized by high technological requirements, particularly for creating stable emulsions and nano-suspensions that ensure optimal spray performance and leaf coverage. After manufacturing, products enter the distribution channels, which are segmented into direct and indirect routes. Direct distribution typically involves sales to large commercial farms, governmental bodies, or major plantation owners, allowing for specialized technical support and customized bulk pricing. Indirect channels rely heavily on a network of agricultural distributors, regional wholesalers, and local agri-retailers who cater to the dispersed market of small to medium-sized farmers.

The downstream analysis focuses on the end-users: primarily commercial farmers, nursery operators, large-scale landscape managers, and forestry professionals. Successful market penetration at this stage is contingent on effective product demonstration, technical advisory services, and integration with existing farming practices, such as compatibility with standard spray equipment and other crop protection chemicals. E-commerce platforms are emerging as a vital distribution channel, particularly for specialized, high-margin products targeting retail consumers and small-scale growers, bypassing traditional distributor markups and offering direct access to specialized product lines.

Antitranspirant Market Potential Customers

The primary end-users and buyers of antitranspirant products are commercial agricultural enterprises and horticultural businesses operating in water-stressed or highly controlled environments. These include large-scale fruit and vegetable growers, particularly those cultivating specialty crops requiring immaculate surface quality, where drought stress can severely impact marketable yield. Nursery operators constitute a crucial customer segment, utilizing antitranspirants extensively during the transplanting phase of seedlings and young trees to minimize shock, guarantee high survival rates, and ensure swift establishment, which is vital for their commercial inventory turnover.

Beyond traditional farming, the demand also originates from urban planning and landscape maintenance sectors, including municipalities managing public parks, golf course operators maintaining high-value turf, and property developers focused on maintaining aesthetic appeal during periods of restricted water use or seasonal stress. Forestry departments and reforestation projects also represent significant, though intermittent, buyers, employing antitranspirants on bare-root stock to improve survival rates during massive planting campaigns intended for land restoration or commercial timber production. These customers prioritize product reliability, verifiable water savings metrics, and compliance with local environmental standards, driving the demand for scientifically proven and biodegradable formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1300 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ADAMA Agricultural Solutions Ltd., Arysta LifeScience Corporation, BASF SE, Bayer AG, Corteva Agriscience, Dow Inc., FMC Corporation, Isagro S.p.A., Nufarm Limited, Sumitomo Chemical Co., Ltd., UPL Limited, Sipcam Oxon Group, Syngenta AG, Valent BioSciences LLC, Biostadt India Limited, Brandt Consolidated, Inc., Haifa Group, Oro Agri Inc., Koppert Biological Systems, Locus Agricultural Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Antitranspirant Market Key Technology Landscape

The technological landscape of the Antitranspirant Market is primarily defined by continuous innovation in polymer chemistry and formulation science aimed at maximizing product coverage, adhesion, and controlled release of active ingredients. Older technologies relied heavily on basic latex or paraffin wax emulsions, which often resulted in uneven film formation, potential clogging of stomata leading to negative yield impacts, and poor wash-off resistance. Modern advancements focus heavily on utilizing high-grade, food-grade polyethylene and biodegradable copolymers, engineered to form semi-permeable membranes that reduce water vapor loss while still permitting essential gaseous exchange (CO2 intake) required for photosynthesis, ensuring high efficacy without compromising plant health.

A significant technological shift is the integration of nanotechnology in formulation development. Nano-emulsions and nano-suspensions allow for the creation of ultra-fine particles, typically less than 100 nanometers, which drastically improves leaf surface coverage, enhances penetration into the cuticle layer, and ensures superior stability in the spray tank. This not only increases the protective lifespan of the antitranspirant but also allows for the use of lower concentrations of active ingredients, addressing both cost constraints and environmental concerns. Furthermore, the development of specialized reflective materials, such as modified kaolin clay particles, incorporates optical technology to reduce solar radiation absorption by leaves, simultaneously lowering leaf temperature and reducing the evaporative demand.

The application technology is also evolving rapidly, moving towards smart spraying systems. Integration of IoT sensors and aerial imagery (drones) allows for real-time monitoring of crop canopy temperature and soil moisture levels. This data is utilized by Variable Rate Technology (VRT) sprayers to apply antitranspirants only where and when stress thresholds are met, moving away from blanket application methods. This precision approach is critical for the economic viability of antitranspirants in broad-acre farming, ensuring that advanced formulations are used judiciously and maximize the return on investment for the farmer.

Regional Highlights

The global Antitranspirant Market exhibits distinct growth patterns and adoption drivers across major geographical regions, influenced heavily by climate, regulatory environment, and the structure of local agricultural economies. North America, encompassing the U.S. and Canada, represents a technologically advanced market segment where the adoption of high-precision farming techniques is common. The region sees strong demand driven by severe, localized drought conditions, particularly in the Western U.S., and the high economic value of specialty crops such as fruits, nuts, and vineyard operations. Regulatory compliance favors bio-based and non-toxic formulations, pushing continuous innovation among manufacturers.

Asia Pacific (APAC) is projected to be the fastest-growing market due to the vast expanse of agricultural land, rapidly increasing populations requiring enhanced food security, and significant governmental investment in irrigation and water efficiency projects, particularly in drought-prone areas like India, Australia, and parts of China. The fragmented nature of farming necessitates cost-effective solutions, but growing environmental awareness is boosting the uptake of advanced, imported formulations. The MEA region is characterized by extreme aridity, making water conservation a national priority. Government subsidies and large-scale agricultural initiatives in the Gulf countries and North Africa are crucial catalysts for market growth, specifically for products that can guarantee improved yield stability under severe water deficit.

Europe presents a unique market scenario driven by extremely stringent regulations concerning agricultural chemicals and a strong consumer preference for organic and sustainably produced goods. This regulatory landscape constrains the use of certain synthetic antitranspirants but fuels robust demand for certified natural, wax-based, and bio-stimulant formulations that aid in stress tolerance. Latin America, particularly Brazil and Argentina, demonstrates substantial market potential due to its expansive soybean and corn production; however, market penetration is currently focused on high-value cash crops, with broad adoption dependent on developing highly efficient, low-cost application methods suitable for large commodity fields.

- North America: High adoption rate in specialty crops (vineyards, orchards); strong driver is recurring severe drought cycles in the Western and Southwestern states; emphasis on precision application and sustainable inputs.

- Europe: Market growth centered on certified organic and biodegradable formulations due to stringent EU chemical regulations (REACH); slow but steady uptake in horticulture and perennial crops.

- Asia Pacific (APAC): Leading growth region driven by large agricultural area, need for food security, and rapid modernization of farming practices in key economies like India and China; demand for both cost-effective and advanced imported products.

- Latin America: Potential growth linked to large-scale commodity agriculture, with current adoption concentrated in high-value exports like fruits (Chile) and specialty coffees (Brazil); application cost remains a major constraint.

- Middle East and Africa (MEA): Critical market due to inherent water scarcity; significant governmental investment in water-saving technologies and food self-sufficiency projects; high demand for guaranteed performance under extreme climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Antitranspirant Market.- ADAMA Agricultural Solutions Ltd.

- Arysta LifeScience Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- Dow Inc.

- FMC Corporation

- Isagro S.p.A.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- UPL Limited

- Sipcam Oxon Group

- Syngenta AG

- Valent BioSciences LLC

- Biostadt India Limited

- Brandt Consolidated, Inc.

- Haifa Group

- Oro Agri Inc.

- Koppert Biological Systems

- Locus Agricultural Solutions

Frequently Asked Questions

Analyze common user questions about the Antitranspirant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of antitranspirants and how do they function?

The primary types are Film-Forming (e.g., wax or polymer emulsions), which create a physical barrier to reduce water vapor escape, and Stomatal Closing agents (e.g., certain hormones), which physiologically induce temporary closure of leaf pores to conserve moisture during peak stress periods.

In which agricultural applications are antitranspirants most effective and commonly used?

Antitranspirants demonstrate the highest efficacy and are most commonly used in high-value horticulture (fruits, vegetables) and in nursery operations, primarily to mitigate transplant shock and improve crop survival and aesthetic quality under heat or drought stress.

What are the key limitations or risks associated with using antitranspirant products?

Key limitations include the potential for phytotoxicity (plant damage) if applied improperly or under extreme heat, the high cost relative to traditional inputs, and the transient efficacy requiring repeat applications, especially for film-forming types which are shed with new plant growth.

How is climate change impacting the global demand and future trajectory of the Antitranspirant Market?

Climate change, leading to increased frequency and severity of droughts globally, acts as the primary driver, compelling farmers to adopt water-saving technologies like antitranspirants to maintain yield stability, ensuring continuous and accelerated market growth.

Are there environmentally friendly or bio-based alternatives available in the Antitranspirant Market?

Yes, the market is experiencing a significant shift towards natural, bio-based alternatives, including formulations based on refined waxes, natural oils, and kaolin clay, which offer reduced environmental risk and comply with strict sustainability standards.

Detailed Market Dynamics and Competitive Landscape Analysis

The competitive landscape of the Antitranspirant Market is moderately fragmented, featuring large multinational agrochemical corporations alongside specialized niche manufacturers focusing exclusively on bio-stimulants and specialty plant stress mitigation products. Major players leverage extensive distribution networks and proprietary R&D capabilities to introduce advanced formulations, often integrating them into broader crop protection and nutrition portfolios. Pricing power remains critical; while premium, high-efficacy products target sophisticated commercial growers in developed economies, volume sales are highly dependent on achieving cost efficiencies that appeal to broad-acre and emerging market farmers, driving manufacturers to seek scale in production.

Strategic movements within the market include increased Merger and Acquisition (M&A) activities, where larger chemical companies acquire smaller firms specializing in novel biological or nano-based antitranspirant technologies to quickly diversify their product offerings and gain access to cutting-edge intellectual property. Collaboration and licensing agreements, particularly concerning the use of patented polymers or genetically engineered compounds for stomatal regulation, are also common. The differentiation strategy is increasingly shifting from mere efficacy to sustainability; companies prioritizing biodegradable, non-residue, and organic-certified formulations are gaining significant market share, aligning with global regulatory trends and consumer preferences for clean agriculture.

Market stability is constantly challenged by the introduction of alternative methods for water management, such as the rapid development and adoption of drought-tolerant crop varieties and sophisticated drip irrigation technologies that inherently reduce water demand. Consequently, antitranspirant providers are focusing on demonstrating synergistic benefits—showing how their products enhance the performance of other water-saving inputs rather than operating in isolation. Furthermore, the reliance on seasonal demand, highly correlated with weather unpredictability, necessitates robust and flexible supply chain management to quickly respond to sudden regional drought events, adding complexity to operational planning.

Future Trends and Growth Opportunities

The future trajectory of the Antitranspirant Market is poised for rapid evolution, driven primarily by technological convergence and the accelerating pressure of environmental sustainability. One of the most prominent future trends involves the integration of antitranspirants with advanced biological inputs, such as microbial bio-stimulants and plant growth regulators. This synergistic approach aims to not only reduce water loss physically but also enhance the plant's inherent capacity to cope with stress at a cellular level, offering a more holistic and robust solution for drought management.

A second major trend focuses on precision delivery systems. As costs of drone technology and satellite imagery decrease, the industry will move toward prescription-based application models. Future products will likely be engineered for optimal performance within specific climate zones and crop types, dispensed via AI-optimized systems that determine precise dosage and location, thereby maximizing water savings and minimizing environmental impact. This personalization of application is essential for unlocking the vast potential of the broad-acre crop segment, where high volume and low margin require absolute efficiency.

Furthermore, significant growth opportunities lie in the commercialization of stomatal closing agents derived from natural sources, moving beyond synthetic Abscisic Acid (ABA) analogues. Researchers are actively exploring natural compounds and genetic modifications that can safely and reversibly control stomatal aperture without detrimental effects on photosynthesis or overall yield. Successfully launching highly stable, naturally derived metabolic antitranspirants that are easily integrated into large-scale irrigation systems will be a key differentiator and a major growth avenue, especially in organic and certified sustainable markets where synthetic inputs are heavily restricted.

- Nano-encapsulation Technology: Developing slow-release, highly stable nano-formulations to extend the product’s protective window and reduce application frequency.

- Bio-Integration: Combining antitranspirants with bio-stimulants (e.g., humic acids, seaweed extracts) to offer comprehensive plant stress management solutions.

- Sensor-Driven Application: Mandating the use of IoT sensors and VRT sprayers for precision application, ensuring product efficacy is maximized based on real-time plant water status.

- Novel Polymer Chemistry: Focusing R&D on developing next-generation, compostable, and fully biodegradable film-forming polymers that leave zero residue in the soil or on the harvested crop.

- Market Expansion in Urban Forestry: Targeting large-scale municipal customers and utility companies for use in protecting high-value urban trees and roadside vegetation against environmental stresses.

Regulatory and Policy Influence

The regulatory environment profoundly shapes the Antitranspirant Market, particularly in Europe and North America, where governmental bodies impose rigorous scrutiny on agricultural chemicals. The primary regulatory challenges revolve around toxicology, residue limits, and environmental persistence. Products containing high levels of non-biodegradable synthetic polymers face intense pressure and potential phase-outs, forcing manufacturers to heavily invest in substitution with bio-based materials. In contrast, products derived from natural waxes or safe, food-grade materials often benefit from fast-tracked registration and preferential market access, particularly in regions promoting organic farming.

Policy influence extends beyond direct chemical regulation to encompass water conservation mandates and climate change adaptation funding. In many arid regions, government subsidies or tax incentives are provided to farmers adopting water-saving technologies, including antitranspirants, thereby significantly boosting market demand. Policies promoting efficient irrigation and precision agriculture technology often indirectly favor advanced antitranspirant formulations that are compatible with these sophisticated delivery systems. Conversely, regions lacking clear policy frameworks or struggling with enforcement of agricultural standards often experience slower adoption rates and higher market penetration by cheaper, less regulated synthetic products.

The global push for harmonized standards, driven by international trade agreements and organizations like the Food and Agriculture Organization (FAO), also influences market access. Manufacturers must ensure their antitranspirant formulations meet diverse national requirements, necessitating substantial investment in global dossier development and extensive field testing under various climatic conditions. Compliance with residue standards is especially critical for export-oriented crops, where even trace residues of unauthorized chemicals can lead to shipment rejections, making certified safe and clean formulations a necessity for international market competitiveness.

Market Challenges and Mitigation Strategies

One of the primary challenges facing the Antitranspirant Market is the difficulty in reliably demonstrating consistent Return on Investment (ROI) to farmers, particularly in low-margin commodity crops. The efficacy of antitranspirants is highly dependent on unpredictable variables such as humidity, wind, temperature fluctuation post-application, and the specific stage of crop growth, leading to perceived performance inconsistency among end-users. This variability hinders mass adoption. Mitigation strategies involve robust, verifiable field trials conducted across multiple seasons and geographies, coupled with the development of AI-driven application guides that predict optimal use windows, thereby reducing the risk of ineffective application.

A second substantial challenge is the inherent risk of phytotoxicity, particularly when non-selective film-forming agents are used or when products are applied at too high a concentration or during excessively hot conditions. Blocking too many stomata can impede carbon dioxide uptake, starving the plant and negatively affecting yield—the opposite of the intended effect. To mitigate this, R&D is heavily focused on developing sophisticated semi-permeable membranes that offer a highly controlled balance between water retention and gas exchange. Furthermore, strict adherence to product application protocols, communicated through comprehensive technical support and educational programs for distributors and farmers, is vital to prevent misuse.

Finally, competition from non-chemical water management alternatives, notably the acceleration in developing genetically modified (GM) and conventionally bred drought-resistant crop varieties, poses a long-term threat. As plant genetics improve, the reliance on external chemical inputs for stress tolerance may diminish. The mitigation strategy for antitranspirant manufacturers involves repositioning the products as complements rather than substitutes for improved genetics. Antitranspirants can be marketed as essential inputs for maximizing the yield potential of drought-tolerant crops during extreme, unexpected stress events, ensuring that the technology remains relevant even in advanced farming systems. This requires continuous innovation in efficacy and formulation cost efficiency.

- ROI Variability: Mitigated by implementing predictive analytics (AI) for application timing and providing detailed economic feasibility studies tailored to specific crop systems.

- Phytotoxicity Risk: Addressed through advanced formulation chemistry focusing on semi-permeable membranes and mandatory technical training for safe application procedures.

- Competition from Genetics: Overcome by repositioning antitranspirants as synergistic stress protectors that enhance the performance and stability of genetically improved crop varieties during acute stress.

- Regulatory Hurdles: Managed by prioritizing R&D for natural, bio-based, and readily biodegradable ingredients to comply proactively with stringent international chemical standards.

- Distribution Logistics: Improving cold chain and specialized warehousing for sensitive biological or specialized formulations to maintain product stability and shelf life across diverse climate zones.

Consumer Perception and Marketing Strategies

Consumer perception, particularly in developed economies, increasingly influences the adoption of agricultural inputs, including antitranspirants. Modern consumers are highly focused on the environmental footprint of food production, demanding transparency regarding the use of synthetic chemicals and prioritizing products associated with sustainable water management and minimized pesticide residues. This perception creates a marketing challenge for antitranspirants, which, despite their water-saving benefits, are still perceived as chemical inputs. Marketing strategies must therefore pivot towards emphasizing the environmental necessity of the product, framing it as a crucial component of water stewardship and climate change adaptation, rather than just a yield enhancer.

Effective marketing strategies center on clear communication of the product’s ecological benefits. Manufacturers are increasingly utilizing independent verification and certification (e.g., organic compliance, non-GMO endorsements) to build trust and differentiate their products. Case studies detailing quantifiable water savings and improved yield stability under demonstrable stress conditions are highly effective in persuading both B2B buyers (large commercial farms) and retail consumers who seek sustainable options. Digital platforms and social media are becoming essential for disseminating scientific evidence and countering potential skepticism regarding chemical use in agriculture.

Furthermore, educational outreach plays a vital role in shaping perception, especially in emerging markets. Programs designed to teach smallholder farmers about the correct application, dosage, and economic benefits of antitranspirants help to demystify the technology and drive adoption. Collaborations with agricultural extension services, non-governmental organizations, and international development agencies are key conduits for this knowledge transfer. For high-end horticultural markets, marketing focuses on the premium quality and extended shelf-life achieved through stress reduction, appealing directly to distributors and high-end retailers concerned with produce aesthetics and post-harvest losses.

Economic Analysis and Pricing Trends

The economic viability of the Antitranspirant Market is heavily contingent upon raw material costs, formulation complexity, and the prevailing price of water and agricultural commodities. Raw material volatility, particularly in petrochemical derivatives used for synthetic film-forming polymers and solvents, exerts upward pressure on manufacturing costs. Specialized metabolic antitranspirants, which often rely on complex organic synthesis, command premium prices due to high R&D investment and lower production volumes. This cost structure fundamentally limits widespread adoption in low-margin broad-acre crops unless subsidized or applied with precision technology.

Pricing strategies in the market are segmented. High-concentration, specialized, biological, or nano-formulations intended for high-value crops (e.g., nursery stock, fruits) adopt premium pricing models, where the cost is justified by the significantly higher value of the protected asset and the guaranteed survival rate. Conversely, basic wax or polymer emulsions targeting general-purpose applications are priced competitively, often relying on high-volume sales. The global trend towards water conservation policies is effectively increasing the perceived value of antitranspirants, as the cost of water itself continues to rise, strengthening the business case for investment in these technologies.

Economic analysis reveals that the true profitability for farmers lies in integrating antitranspirants with full-spectrum stress mitigation programs. The cost-benefit ratio is maximized when the product prevents a catastrophic yield loss during a critical drought period, which often offsets the initial application cost several times over. Future pricing trends are expected to moderate as economies of scale are achieved through increased demand, particularly if manufacturers successfully develop cost-effective, high-efficacy bio-based alternatives that streamline regulatory approval and production processes, making the technology more accessible to the global farming community.

Sustainability and ESG Factors in Antitranspirants

Environmental, Social, and Governance (ESG) criteria are increasingly vital to the Antitranspirant Market, driving innovation and corporate strategy. Environmentally, the primary focus is on reducing the chemical load in agriculture. Companies are measured on their success in transitioning from persistent synthetic polymers to fully biodegradable and non-toxic substances that break down rapidly post-application, minimizing soil and water contamination. The core ESG benefit is the significant contribution to water conservation, addressing the critical E-factor of resource depletion and aligning directly with Sustainable Development Goals (SDGs), particularly those related to water scarcity and sustainable agriculture.

Social factors revolve around ensuring product safety for farm workers and consumers, demanding rigorous testing to guarantee that formulations do not pose inhalation risks or leave harmful residues on food. Furthermore, the social benefit derived from using antitranspirants includes stabilizing food production in climate-vulnerable regions, thereby enhancing food security and supporting the livelihoods of smallholder farming communities who are disproportionately affected by drought and extreme weather events. Companies are incorporating social responsibility into their supply chains, ensuring ethical sourcing of raw materials and responsible waste disposal practices.

Governance aspects emphasize transparency in product labeling, ethical marketing practices, and robust internal controls to ensure compliance with global environmental regulations. Companies with strong governance frameworks often attract greater investment, particularly from sustainability-focused funds. Reporting on quantifiable water savings achieved through product use, combined with transparent communication regarding the product's full lifecycle impact, is becoming standard practice. The integration of ESG principles is not just a regulatory necessity but a powerful market differentiator, attracting environmentally conscious customers and investors.

Market Forecast Summary and Strategic Implications

The Antitranspirant Market is forecasted to maintain a strong growth trajectory through 2033, fundamentally underpinned by the global need for climate change resilient agriculture and escalating water stress. The CAGR of 6.5% reflects the successful scaling of advanced, sustainable formulations that overcome the limitations associated with older, synthetic products. Strategic implications for market participants focus on three core areas: intellectual property investment in nano- and bio-based formulations, the development of robust technical service and education platforms, and geographical expansion into high-growth, water-stressed regions, notably APAC and MEA.

Future revenue growth will be increasingly concentrated in segments that successfully integrate technology, specifically those utilizing precision agriculture tools to optimize application efficiency and those delivering compounds proven safe for organic cultivation. Companies that fail to adapt their product lines to meet stringent environmental standards and high efficacy demands risk stagnation, particularly in regulated Western markets. The increasing frequency of extreme weather events suggests that antitranspirants will transition from a specialty, niche product to a fundamental tool in the standard agricultural toolkit, necessitating aggressive capacity expansion and distribution channel development.

For investors, the market presents significant opportunity, particularly in firms that demonstrate clear leadership in sustainable innovation and possess strong partnerships with AgTech companies providing data-driven solutions. The shift towards proprietary stomatal regulators and reflective antitranspirants provides a clear path to high-margin differentiation, distinguishing them from commodity film-forming waxes. Ultimately, strategic success in this market will depend on the ability to translate scientific advancements into demonstrable economic and ecological value for the end-user farmer, thereby justifying the adoption of premium, cutting-edge water-saving technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager