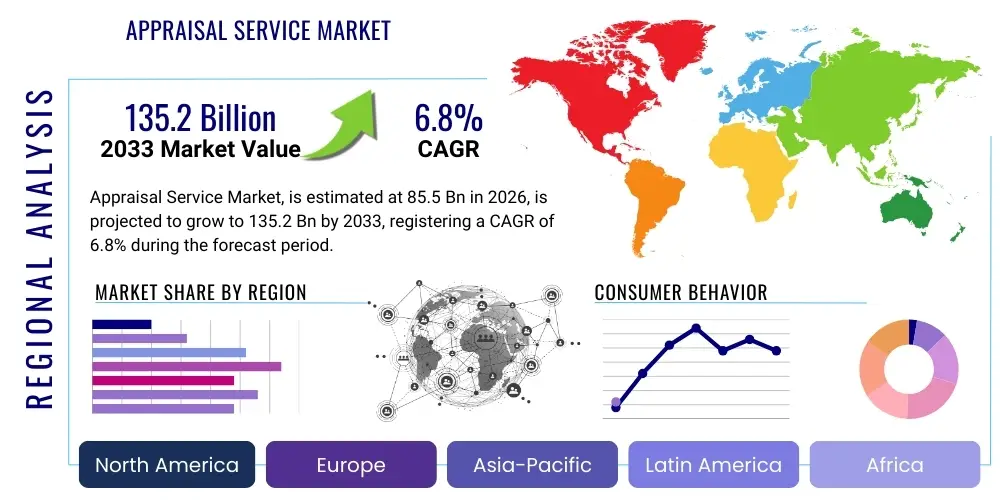

Appraisal Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443206 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Appraisal Service Market Size

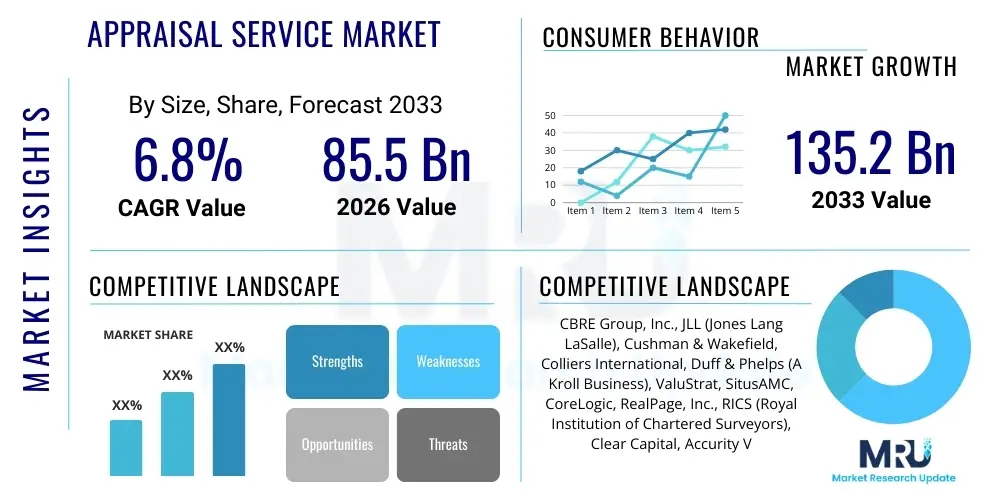

The Appraisal Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $85.5 Billion in 2026 and is projected to reach $135.2 Billion by the end of the forecast period in 2033. This robust expansion is fueled by increasing regulatory requirements across financial sectors, continuous volatility in global asset markets requiring timely valuation, and the accelerating adoption of advanced valuation methodologies, including artificial intelligence and machine learning tools, which enhance efficiency and accuracy.

Market size estimations reflect the cumulative revenue generated from valuation activities across diverse asset classes, encompassing real estate, business enterprises, machinery and equipment, and personal property. The valuation requirements stemming from mortgage lending, corporate mergers and acquisitions (M&A), insurance underwriting, taxation assessments, and financial reporting standards (such as IFRS and GAAP) are the primary demand drivers. Furthermore, the rising global wealth and the subsequent need for proper wealth management and estate planning contribute significantly to sustained demand for expert appraisal services globally.

Appraisal Service Market introduction

The Appraisal Service Market encompasses professional, unbiased services dedicated to determining the fair market value, investment value, or other defined values of assets. These services are crucial components of global financial infrastructure, providing the necessary foundation for secured lending, accurate financial statement reporting, successful transactional activities, and equitable legal outcomes. Key appraisal products include real estate appraisals (residential and commercial), business valuation (BV) for M&A, intellectual property (IP) valuation, and valuation of tangible assets like machinery and fine arts.

Major applications span mortgage origination, where appraisals protect lenders and ensure regulatory compliance; corporate finance, particularly during restructuring, initial public offerings (IPOs), and shareholder disputes; and government operations, involving property tax assessment and eminent domain cases. The principal benefit of professional appraisal services is the provision of credible, defensible, and objective value opinions, reducing financial risk and facilitating transparent decision-making across complex transactions. Accuracy and independence are hallmarks that underscore the reliability of the appraisal outcome.

Driving factors propelling market growth include tightening regulatory scrutiny, especially in the banking and financial services sector, which mandates stringent valuation processes. Additionally, the proliferation of global M&A activity necessitates precise business and asset valuation, while technological advancements, such as the integration of advanced data analytics and predictive modeling, are enhancing service delivery speed and precision, attracting new market participants and increasing service efficiency.

Appraisal Service Market Executive Summary

The Appraisal Service Market is characterized by accelerating technological integration and consolidation among leading providers, shifting the business landscape toward digitally enabled and data-driven valuation models. Key business trends include the rise of hybrid appraisal models combining physical inspection with advanced remote data capture, significant investment in automated valuation models (AVMs) and generative AI tools to handle high-volume, low-complexity valuations, and increasing focus on niche, complex valuations such as intangible assets (e.g., software, brand equity) and specialized industrial properties. Service customization and the ability to navigate evolving global accounting standards (e.g., ASC 805, IFRS 13) are critical competitive differentiators.

Regionally, North America maintains market leadership due to its highly mature real estate financing market and stringent regulatory environment (e.g., FIRREA). However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapid urbanization, massive infrastructure development, and burgeoning M&A activities, particularly in countries like China and India. European growth is steady, driven by cross-border investment and harmonization efforts related to valuation standards, while emerging markets in Latin America and MEA are seeing increased demand as foreign direct investment (FDI) mandates formal asset valuation procedures.

Segment trends highlight the persistent dominance of the Real Estate sector, though the fastest growth is observed in Business Valuation (BV) driven by the surge in technology company valuations and private equity transactions. Within technology adoption, the ‘Online/Digital’ segment, including services relying heavily on AVMs and desktop appraisals, is outpacing traditional, physical inspection-based methods due to efficiency gains and improved data accessibility, pushing the industry toward a digitally integrated operational framework across all major asset classes.

AI Impact Analysis on Appraisal Service Market

User queries regarding the impact of Artificial Intelligence (AI) on the Appraisal Service Market predominantly revolve around themes of professional redundancy, accuracy improvements, and data security risks. Common concerns center on whether Automated Valuation Models (AVMs) powered by AI will entirely replace licensed appraisers, particularly for residential properties, and how AI can ensure compliance with localized market nuances and regulatory complexity. Conversely, users express strong interest in AI's capacity to process massive datasets instantaneously, reduce turnaround times, minimize human bias, and enhance predictive modeling for specialized asset classes, such as quantifying the value of highly unique industrial equipment or complex intellectual property portfolios, ultimately increasing the scope and sophistication of professional valuation services.

The core shift introduced by AI is not replacement, but augmentation, transforming the appraiser's role from data gatherer to specialized analyst and quality reviewer. AI algorithms significantly improve the quality and speed of comparable sales analysis and market trend identification, enabling appraisers to focus their expertise on complex adjustments, specialized property characteristics, and the subjective interpretation required for unique or volatile markets. Furthermore, AI tools are crucial for ensuring high data fidelity and automating the audit trail required by financial regulators, thereby reducing liability for appraisal firms.

Deployment of generative AI within the appraisal workflow is streamlining report generation, synthesizing complex market narratives, and customizing reports based on specific client needs or regulatory formats. This technological integration is standardizing operational efficiency across the sector, lowering the marginal cost of high-volume valuations, and allowing specialized appraisers to dedicate resources to non-standard, high-value assignments that demand subjective human judgment and expert market knowledge, ultimately elevating the industry's overall service quality.

- AI drives hyper-efficiency in data aggregation, cleansing, and comparable sales identification (Comps analysis).

- Increased accuracy and reduced variance in low-complexity residential and standard commercial property valuations via AVMs.

- Transformation of the appraiser role into a supervisory, analytical, and complex problem-solving function.

- Enhanced predictive modeling capabilities for forecasting asset performance and value volatility.

- Automation of standardized reporting, documentation, and compliance checks (Generative AI applications).

- Potential for mass customization of valuation reports tailored to specific lender or regulatory requirements.

- Integration of machine learning for advanced risk assessment and identification of potential appraisal fraud or bias.

DRO & Impact Forces Of Appraisal Service Market

The Appraisal Service Market is significantly shaped by a confluence of driving regulatory demands, structural market restraints, and promising technological opportunities. Key drivers include stringent regulatory environments globally, demanding independent and credible valuations for financial stability, coupled with high transactional volume in M&A and real estate financing sectors. Restraints primarily involve the industry’s resistance to rapid technological change, reliance on traditional methodologies in certain geographies, and a persistent shortage of highly specialized, licensed appraisers capable of valuing complex, non-standard assets. However, significant opportunities arise from the ongoing digital transformation, the growing asset class of intangible property (IP), and the expansion into emerging markets requiring formal valuation frameworks.

Impact forces currently exerting pressure on the market involve both external economic factors and internal technological disruption. Economically, interest rate fluctuations directly impact real estate transaction volumes and subsequently, appraisal demand, while global economic uncertainty necessitates increased business valuation activities for restructuring purposes. Internally, the accelerating deployment of data science and AI-driven valuation tools is fundamentally altering cost structures and competitive dynamics. Firms that successfully integrate these technologies gain substantial competitive advantages in speed and scalability, while those lagging risk obsolescence, thus creating a strong pressure for continuous technological adoption.

Furthermore, the market faces strong governmental and institutional impact forces focused on increasing transparency and reducing systemic risk, particularly following past financial crises. This leads to stricter oversight of valuation practices and mandatory adoption of international valuation standards (e.g., IVSC standards), forcing market players to invest heavily in training, quality control, and advanced data security measures. The collective weight of these forces ensures that the market remains dynamic, highly regulated, and rapidly evolving toward data-centric operations.

Segmentation Analysis

The Appraisal Service Market is highly fragmented and segmented based on the type of asset being valued, the method of appraisal delivery, and the end-use application requiring the valuation. Segmentation by asset type—Real Estate, Business Valuation, Machinery & Equipment, and Personal Property—reflects the diverse expertise required for distinct asset classes, with real estate dominating overall revenue due to the vast volume of mortgage-backed transactions globally. Segmentation by method—Traditional (physical inspection) vs. Online/Digital (AVMs, desktop appraisals)—highlights the digital transition occurring across the industry, driven by efficiency and cost pressures. Finally, segmentation by end-user—Lenders, Corporations, Government, and Private Individuals—reveals the primary sources of demand and their unique regulatory requirements.

- By Asset Type:

- Real Estate (Residential, Commercial, Industrial, Agricultural)

- Business Valuation (Enterprise Value, Equity Value, Portfolio Valuation)

- Machinery & Equipment (Industrial Assets, Fixed Assets)

- Personal Property (Fine Arts, Collectibles, Jewelry, Rare Assets)

- Intangible Assets (Intellectual Property, Brand Value, Goodwill)

- By Service Type/Method:

- Traditional Appraisal (Physical Inspection Required)

- Desktop Appraisal (Remote Data Verification)

- Automated Valuation Models (AVMs)

- Evaluation Reports

- By End-User:

- Financial Institutions & Lenders

- Corporations & Businesses (M&A, Financial Reporting)

- Government & Public Sector (Taxation, Eminent Domain)

- Private Individuals & Wealth Management

- By Location/Geography:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Appraisal Service Market

The value chain for the Appraisal Service Market begins with upstream activities focused on securing essential inputs: data collection and access to licensed appraisal expertise. Upstream inputs involve sophisticated data providers offering access to transaction databases, public records, geospatial information, and advanced analytical software platforms (e.g., AVM developers). Key players at this stage include major data aggregators, GIS mapping providers, and dedicated valuation software firms. Securing high-quality, verified, and timely market data is paramount, as the integrity of the entire valuation process hinges on the reliability of these foundational inputs. The availability of specialized professional talent, including Certified General Appraisers and valuation experts with specific industry knowledge (e.g., energy, healthcare), is a significant upstream constraint that influences service quality and delivery timelines.

The core midstream activity involves the actual execution of the appraisal service, encompassing scope definition, physical inspection or remote data verification, market analysis, application of valuation methodologies (Cost Approach, Sales Comparison Approach, Income Approach), and final report generation. This stage is dominated by independent appraisal firms, large multinational advisory companies, and internal valuation departments within financial institutions. The efficiency of the midstream process is increasingly dependent on integrating technology, such as mobile inspection apps, cloud-based workflow management, and standardized reporting templates, enabling faster turnaround times and consistent quality control across various assignments and regulatory jurisdictions.

Downstream activities center on the distribution channel and the final delivery of the appraisal report to the end-user, often facilitated directly (appraiser-to-client) or indirectly through intermediaries. Direct distribution is common for complex corporate valuations, while indirect distribution, involving lenders or mortgage brokers acting as liaisons between the appraiser and the borrower/homeowner, dominates the residential real estate segment. Technology platforms are crucial downstream components, providing secure, compliant portals for report delivery and archival. The effectiveness of the distribution channel impacts client satisfaction, with speed, security, and integration capabilities into the client's existing enterprise systems (e.g., loan origination systems) being critical competitive factors.

Appraisal Service Market Potential Customers

Potential customers for appraisal services are extremely diverse, reflecting the fundamental necessity of asset valuation across nearly all sectors of the modern economy. The largest segment of end-users consists of Financial Institutions and Lenders, including commercial banks, credit unions, mortgage companies, and investment banks, which require reliable valuations to secure loans, manage collateral risk, and meet regulatory capital requirements. Without accurate appraisals, the stability of secured lending markets would be jeopardized, making this segment a persistent anchor of market demand, continuously seeking valuations for real estate, business assets, and complex financial instruments.

Another major segment includes Corporations and Businesses, ranging from small enterprises to multinational conglomerates. These customers utilize appraisal services extensively for strategic decision-making, including Mergers and Acquisitions (M&A) due diligence, financial reporting compliance (e.g., purchase price allocation, impairment testing), insurance purposes, litigation support, and capital planning. Companies operating internationally often require valuations compliant with multiple accounting standards (e.g., GAAP, IFRS), driving demand for firms with global expertise and robust technical capabilities across diverse asset classes, including intangible assets like patents and trademarks.

The public sector, comprising Government entities at local, state, and federal levels, represents a significant customer base. Governments rely on appraisals for property tax assessments, condemnation proceedings (eminent domain), disposal of public assets, and various infrastructure planning projects. Finally, Private Individuals and Wealth Management firms constitute the consumer segment, requiring valuations for estate planning, inheritance tax purposes, divorce settlements, and the insuring or selling of specialized personal property such as art collections, antiques, or vintage automobiles. The need for expert, unbiased valuation across these varied stakeholders ensures sustained market vitality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $85.5 Billion |

| Market Forecast in 2033 | $135.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CBRE Group, Inc., JLL (Jones Lang LaSalle), Cushman & Wakefield, Colliers International, Duff & Phelps (A Kroll Business), ValuStrat, SitusAMC, CoreLogic, RealPage, Inc., RICS (Royal Institution of Chartered Surveyors), Clear Capital, Accurity Valuation, Lender's Service Inc. (LSI), Veros Real Estate Solutions, Altus Group, American Appraisal (A Duff & Phelps company), Integra Realty Resources (IRR), Mercer Capital, Valuation Research Corporation (VRC), RSM US LLP |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Appraisal Service Market Key Technology Landscape

The technological landscape of the Appraisal Service Market is rapidly transitioning from reliance on manual processes and proprietary internal databases to sophisticated, interconnected digital platforms leveraging massive data inputs. Automated Valuation Models (AVMs) represent a foundational technology, employing statistical modeling and machine learning algorithms to estimate property values quickly and cost-effectively, particularly for standardized residential properties. The accuracy and reliability of AVMs are continually improving through the integration of superior big data sets, including high-resolution geospatial imagery, tax records, and detailed neighborhood attributes, enabling real-time market value assessments that support preliminary lending decisions and portfolio monitoring.

Beyond AVMs, cloud-based appraisal management platforms (AMCs) and workflow solutions are crucial for streamlining the entire valuation lifecycle, from order assignment and regulatory compliance checks to digital report delivery and storage. These platforms enhance transparency and communication between lenders, appraisers, and internal review staff, ensuring standardized procedures and accelerating turnaround times. Furthermore, advanced data visualization tools and predictive analytics are increasingly utilized by specialized business and intangible asset valuers to model complex financial scenarios and quantify risk associated with future cash flows, moving valuation beyond static historical data toward forward-looking, dynamic assessments.

The emerging technologies, including drone usage for remote property inspection (improving safety and access to complex structures), integration of blockchain for verifiable and secure transaction records, and Generative AI for automating report narrative creation and synthesis of market commentary, are poised to define the next phase of market evolution. These technologies collectively aim to mitigate operational risks, significantly reduce the time and cost associated with generating appraisal reports, and broaden the scope of services available, ultimately necessitating substantial investment in IT infrastructure and continuous professional training across major appraisal firms.

Regional Highlights

- North America: This region dominates the global market, primarily driven by the highly developed and intensely regulated U.S. residential and commercial real estate finance sectors. Strict governmental oversight (e.g., the Dodd-Frank Act, FIRREA) mandates independent, high-quality appraisals for mortgage lending, securing consistent demand. The market here is also a first-mover in adopting AVMs and hybrid appraisal models, particularly for portfolio servicing and disaster recovery valuations. The vast volume of M&A activity also fuels strong demand for complex business and intangible asset valuation services.

- Europe: Characterized by stable but slower growth, the European market is influenced by varied national regulations and the increasing harmonization effort under EU directives, encouraging the adoption of International Valuation Standards (IVS). Cross-border investment and complex corporate restructuring drive demand. The UK, Germany, and France are the largest markets, focusing heavily on traditional, highly credentialed appraisers for commercial property and sophisticated corporate valuation assignments, especially related to IFRS reporting standards.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive urbanization, massive public and private infrastructure investment (e.g., China’s Belt and Road Initiative), and rapidly maturing financial markets in countries like China, India, and Southeast Asia. The demand is shifting from basic asset valuation to sophisticated corporate and intellectual property valuations necessary for global expansion and IPOs. Technological adoption, while lagging slightly, is accelerating rapidly, particularly the deployment of localized AVMs adapting to unique land ownership and regulatory complexities.

- Latin America (LATAM): Growth in LATAM is spurred by increasing foreign direct investment, which necessitates transparent and independent valuation protocols previously less common. Brazil and Mexico are key markets, showing growing adoption of modern valuation practices to align with international financial standards. Political and economic volatility, however, often requires valuation firms to employ specialized risk assessment methodologies, driving demand for firms with local expertise in turbulent economic environments.

- Middle East & Africa (MEA): This region is characterized by significant demand tied to energy sector assets and mega-development projects, especially in the GCC countries (Saudi Arabia, UAE). The focus is often on real estate and infrastructure valuation. Regulatory reforms aimed at enhancing financial market transparency are forcing greater compliance with international valuation and accounting standards (IVSC/IFRS), opening opportunities for major global appraisal firms to partner with local entities to modernize valuation practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Appraisal Service Market.- CBRE Group, Inc.

- JLL (Jones Lang LaSalle)

- Cushman & Wakefield

- Colliers International

- Duff & Phelps (A Kroll Business)

- ValuStrat

- SitusAMC

- CoreLogic

- RealPage, Inc.

- RICS (Royal Institution of Chartered Surveyors)

- Clear Capital

- Accurity Valuation

- Lender's Service Inc. (LSI)

- Veros Real Estate Solutions

- Altus Group

- American Appraisal (A Duff & Phelps company)

- Integra Realty Resources (IRR)

- Mercer Capital

- Valuation Research Corporation (VRC)

- RSM US LLP

Frequently Asked Questions

Analyze common user questions about the Appraisal Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Appraisal Service Market?

The Appraisal Service Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period spanning 2026 to 2033, driven largely by regulatory demands and technological adoption in valuation processes.

How is AI impacting the future employment of professional appraisers?

AI is augmenting, rather than replacing, the role of professional appraisers. While Automated Valuation Models (AVMs) handle high-volume, standardized valuations, human appraisers are transitioning to specialized roles focusing on complex property analysis, quality control, and subjective interpretation required for unique assets and volatile markets.

Which market segment is expected to show the fastest growth rate?

The Business Valuation (BV) and Intangible Assets segments are expected to show the fastest growth, propelled by sustained global Mergers and Acquisitions (M&A) activity and the increasing capitalization and reporting requirements for intellectual property and digital assets.

What are the primary drivers accelerating demand in the Appraisal Service Market?

Key drivers include increasingly stringent regulatory frameworks in the financial and lending sectors, the necessity for independent valuations in corporate transactions (M&A), and the advancement of data-driven valuation technologies that enhance speed and accuracy across service delivery.

Which geographical region currently leads the global market in terms of revenue?

North America currently holds the largest share of the Appraisal Service Market revenue, attributed to its mature real estate financing industry, high transactional volume, and established, comprehensive regulatory requirements for property and corporate asset valuation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager