Aquarium Substrate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441295 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Aquarium Substrate Market Size

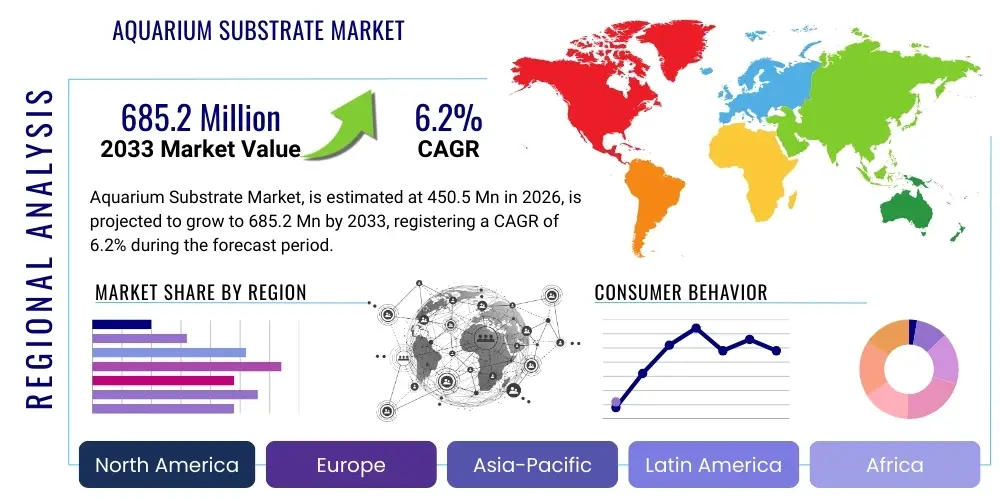

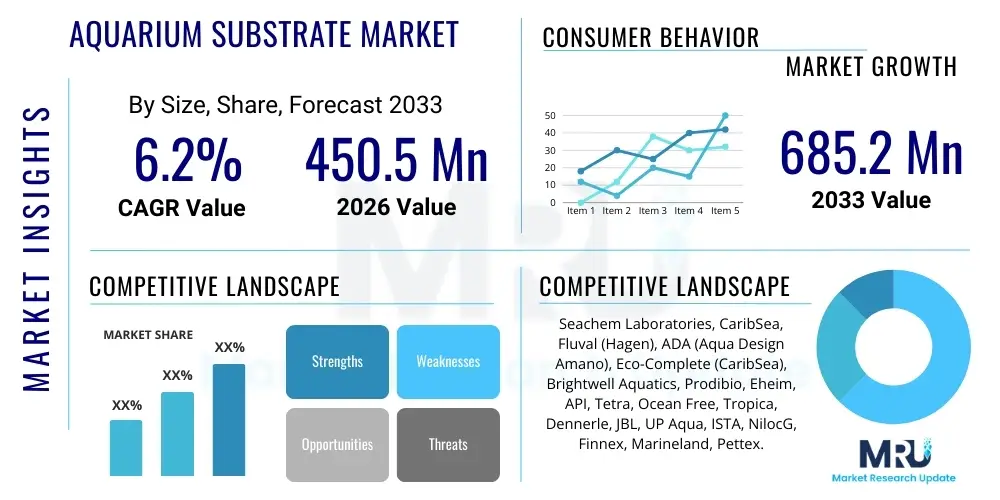

The Aquarium Substrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 685.2 Million by the end of the forecast period in 2033.

Aquarium Substrate Market introduction

The Aquarium Substrate Market encompasses the sales of various materials, including natural gravel, specialized soils, sand, and composite materials, used to cover the bottom of aquariums and provide a foundation for aquatic ecosystems. These products are crucial for filtration efficiency, nutrient provision for aquatic plants, anchoring decorations, and providing a natural habitat layer for fish and invertebrates. The primary function of a substrate extends beyond mere aesthetics; it plays a vital role in buffering pH levels, housing beneficial bacteria colonies essential for the nitrogen cycle, and replicating biotope-specific environments, ranging from Amazonian blackwater setups to African rift lake cichlid tanks. The sophisticated requirements of planted aquariums, particularly those utilizing high-tech CO2 injection and intense lighting, necessitate the use of specialized substrates that are rich in micronutrients, further segmenting and driving innovation within this market space.

Major applications of aquarium substrates span across freshwater ornamental fishkeeping, sophisticated planted aquascaping, and marine reef keeping. Freshwater aquariums typically demand inert gravel or nutrient-rich soil products, while marine tanks often rely on aragonite or specialized marine sands for calcium buffering and density requirements. The benefits derived from quality substrates include enhanced water quality stability, reduced maintenance through improved biological filtration, and significant contribution to the overall aesthetic appeal of the aquatic display. Furthermore, the selection of the correct substrate material is paramount for the health of specific bottom-dwelling species, preventing injury to sensitive barbels and encouraging natural digging behaviors, thereby directly impacting fish welfare and longevity. The increasing consumer focus on creating complex, self-sustaining biotope tanks is a major demand driver.

Driving factors propelling the growth of the Aquarium Substrate Market include the rising global interest in pet fish ownership, particularly among millennials and younger generations seeking low-maintenance domestic pets, and the booming popularity of aquascaping as a hobby. Aquascaping, the art of arranging aquatic plants, stones, and driftwood in an aesthetically pleasing manner, requires premium, highly functional substrates like baked clay and specialized soil products that support robust plant growth and maintain critical water parameters. Innovations in substrate processing, such as pre-treated materials that reduce cloudiness and pre-cycled substrates containing starter bacteria, also enhance market attractiveness and ease of use for novice hobbyists, further fueling market expansion in established regions like North America and Europe, and rapidly growing markets in Asia Pacific.

Aquarium Substrate Market Executive Summary

The Aquarium Substrate Market is characterized by a strong shift towards specialized, high-performance products, moving away from generic inert gravel. Business trends indicate significant investment in research and development aimed at creating substrates optimized for specific aquarium types, such as nutrient-dense soils for planted tanks and pH-buffering sands for cichlid setups. Sustainability is becoming a crucial business consideration, with manufacturers exploring ethically sourced natural materials and recyclable packaging, driven by increased consumer environmental awareness. Furthermore, the market is experiencing consolidation among specialized soil producers and expansion by large pet care conglomerates seeking to integrate high-margin substrate lines into their comprehensive product offerings, leading to intense competition in the premium segment and greater differentiation based on technical performance metrics like cation exchange capacity (CEC) and granule porosity.

Regional trends reveal that North America and Europe maintain leading market shares due to high disposable incomes, deeply established hobbyist communities, and a high penetration rate of premium pet products, driving demand for technologically advanced substrates. The Asia Pacific region, led by countries like China, Japan, and South Korea, is emerging as the fastest-growing market, primarily fueled by rapid urbanization, increasing discretionary spending on ornamental pets, and the established cultural importance of aquascaping originating from Japan. In terms of segmental dynamics, the specialized soil segment is exhibiting the highest growth rate, driven by the explosive demand from the aquascaping community, while the sand and gravel segments, though mature, continue to hold significant volume share due to their widespread use in basic freshwater and marine setups. Online distribution channels are experiencing transformative growth, offering convenience and direct access to specialized, niche substrate products often unavailable in traditional brick-and-mortar pet stores.

Segmentation trends highlight the increasing importance of application-specific products. Freshwater substrates currently dominate the market, largely due to the lower entry barrier and higher number of freshwater hobbyists globally. However, the saltwater and reef tank substrate segment is forecast to see accelerated growth, influenced by the increasing complexity and miniaturization of reef systems requiring high-quality, biologically active substrates to support sensitive coral and invertebrate life. The shift towards natural materials, particularly those offering inherent biological or chemical benefits (like iron-rich clay or aragonite), underscores a consumer preference for products that contribute actively to the biological balance of the aquarium, reducing reliance on chemical additives. This specialization drives higher average selling prices (ASPs) across the market, supporting robust revenue growth despite the maturity of the basic gravel segment.

AI Impact Analysis on Aquarium Substrate Market

User queries regarding AI's impact on the Aquarium Substrate Market primarily revolve around leveraging artificial intelligence for environmental monitoring, personalized substrate recommendations, and optimizing inventory management based on niche demand cycles. Key themes include how AI can analyze water chemistry data (pH, GH, KH, nutrient levels) to recommend the optimal substrate type (e.g., buffering clay vs. inert sand) tailored to a specific species list and aesthetic goal. Users are concerned about whether AI-driven systems could automate the calculation of substrate volume needed, minimize waste, and predict regional demand for specialized materials based on social media trends in aquascaping. Expectations are focused on AI enhancing the precision and efficiency of the substrate selection process for hobbyists and improving supply chain resilience for manufacturers by forecasting material requirements, especially for ethically sourced or geographically limited raw materials such as specific types of volcanic rock or mineral deposits used in premium soils.

- AI-driven water parameter analysis leading to precise substrate product recommendations, optimizing water chemistry and biological filtration efficiency.

- Predictive demand modeling for raw material sourcing (e.g., specific quartz types, volcanic soil components), minimizing supply chain bottlenecks and cost volatility.

- Automated inventory management and optimized distribution routes for heavy, low-value-density products like gravel, improving logistical efficiency.

- Generative design tools assisting aquascapers in simulating the visual impact and biological performance of various substrates before purchase.

- Chatbots and virtual assistants offering instant, expert advice on substrate preparation, cycling, and long-term maintenance protocols, enhancing customer service.

- Quality control monitoring in manufacturing through machine vision, ensuring consistent granule size, color, and mineral composition in high-grade substrate batches.

DRO & Impact Forces Of Aquarium Substrate Market

The Aquarium Substrate Market is strongly influenced by the global growth in the ornamental fish trade and the rapid consumer acceptance of highly specialized aquascaping techniques, acting as primary drivers. Restraints include the high initial setup cost associated with premium, nutrient-rich substrates, which often deters entry-level hobbyists, and the environmental concerns surrounding the sourcing and transportation of large volumes of heavy mineral materials. Opportunities are abundant in the development of lightweight, synthetic, high-performance substrates that mimic natural benefits without the associated bulk and weight, alongside expansion into emerging economies where pet ownership is rising rapidly. These forces combine to create an environment where innovation in material science (Opportunity) often overcomes the hurdle of high cost (Restraint), driven by the persistent demand for biologically balanced, aesthetically superior aquatic environments (Driver). Regulatory oversight regarding the mineral content and sourcing legality of natural materials also introduces an impact force requiring compliance and transparency throughout the supply chain.

Drivers: The increasing technological sophistication of aquarium setups, demanding substrates that actively contribute to water parameter maintenance (e.g., pH buffering, nutrient delivery), is a major driver. Furthermore, the massive proliferation of digital content, including tutorials and competitive aquascaping exhibitions disseminated via platforms like YouTube and Instagram, fuels aspirational purchases of professional-grade substrates. Health benefits associated with maintaining an aquarium, such as stress reduction, have also marginally contributed to increased adoption rates, translating into higher sales of foundational products like substrates. The rise of the planted tank hobby, which necessitates specialized, iron-rich, porous soils, directly increases the average transaction value in this market, providing substantial revenue growth potential.

Restraints: Significant restraints include the high weight and volume of the product, resulting in substantial shipping costs that inflate final consumer prices, particularly for e-commerce sales, which compete directly with local pet stores. Market saturation in developed regions for basic gravel products limits overall growth potential in the inert segment. Moreover, the lack of awareness among novice hobbyists regarding the difference between basic inert gravel and biologically active substrates often leads to the purchase of cheaper, less effective alternatives, requiring greater market education efforts. Contamination risks associated with poorly sourced or improperly washed natural materials pose periodic quality challenges that can erode consumer trust and preference for natural options.

Opportunities: Key opportunities lie in the formulation of bio-enhanced substrates pre-inoculated with beneficial bacteria, offering instant biological filtration capability and reducing the critical tank cycling period. Developing sustainable, locally sourced, or lab-grown substrates that reduce reliance on distant mining or harvesting operations presents significant environmental and logistical advantages. The expansion of premium substrates into the highly lucrative professional public aquarium and commercial aquaculture sectors offers a high-volume, high-specification market segment yet to be fully capitalized upon. Furthermore, integrating smart technology into substrate packaging or advisory systems, perhaps leveraging QR codes for customized maintenance guides, can differentiate offerings and capture tech-savvy consumers.

Impact Forces: The ongoing evolution of global trade tariffs and environmental regulations affects the sourcing costs of specific mineral components, such as volcanic rock or specialized clays often mined in specific geological zones. Changes in consumer preferences towards specific aquarium styles (e.g., moving from bare-bottom tanks to deeply layered nature aquariums) instantaneously shifts demand patterns between segments. The dominance of a few large, integrated pet supply retailers significantly influences pricing power and distribution leverage across the market, shaping manufacturer margins and market accessibility. Additionally, scientific breakthroughs in microbial ecology are continuously redefining the functional expectations of a substrate, forcing manufacturers to innovate rapidly to maintain relevance in the highly competitive premium segment.

Segmentation Analysis

The Aquarium Substrate Market is comprehensively segmented based on product type, material composition, application area (aquarium type), and distribution channel, reflecting the high degree of specialization required by modern hobbyists. The product type segmentation differentiates between inert materials like sand and gravel, and biologically active materials such as specialized soils and mineral mixes. Material composition addresses whether the substrate is sourced naturally (e.g., quartz, aragonite, river pebble) or artificially manufactured (e.g., baked ceramic, polymer-coated gravel). This detailed segmentation helps manufacturers target specific functional needs—from supporting microbial colonies in planted tanks to buffering pH in marine setups—and aids retailers in optimizing inventory to match the increasingly sophisticated demands of the consumer base, ensuring that niche markets, such as high-end planted aquascaping, are adequately served with performance-specific products.

- By Product Type:

- Gravel

- Sand (Inert & Buffering)

- Specialized Soil/Clay (Nutrient-rich)

- Mixed Substrates (Blends)

- By Material Composition:

- Natural Materials (Quartz, Silica, Aragonite, Volcanic Rock)

- Artificial/Manufactured Materials (Baked Clay, Polymer-Coated Ceramics)

- By Application/Aquarium Type:

- Freshwater Aquariums (Planted, Tropical, Cichlid)

- Saltwater Aquariums (Fish-Only, Reef/Coral)

- Brackish Aquariums

- By Distribution Channel:

- Offline (Pet Specialty Stores, Supermarkets, Mass Merchandisers)

- Online (E-commerce Platforms, Manufacturer Websites)

Value Chain Analysis For Aquarium Substrate Market

The value chain for the Aquarium Substrate Market begins with upstream activities involving the sourcing and extraction of raw materials, which are often geological in nature, such as silica, quartz, volcanic ash, or calcium carbonate minerals. Upstream analysis focuses on securing high-quality, uncontaminated sources, often requiring specialized mining or harvesting operations followed by rigorous screening and washing processes to remove impurities. Logistical efficiency at this stage is critical due to the high weight and low value-density of the raw materials. Downstream analysis involves the final processing, packaging, branding, and distribution of the finished goods. Manufacturers invest heavily in processing (e.g., baking clay for specialized soils, coating inert gravel) to enhance biological or chemical performance characteristics, adding significant value before the product moves to the distribution phase. Effective quality control ensures uniform granule size and color consistency, crucial factors in premium market acceptance.

The distribution channel is multi-faceted, encompassing both direct sales to large commercial accounts and indirect distribution through a complex network. Indirect distribution primarily relies on specialized pet product wholesalers and distributors who manage bulk inventory and deliver to thousands of independent pet stores, specialized aquarium shops, and large mass merchandisers globally. Direct sales channels are increasingly utilized by manufacturers via their own e-commerce platforms to capture higher margins and directly engage with consumers, especially for highly niche or premium products that require detailed technical explanation. E-commerce platforms, whether general retail giants or specialized aquatic marketplaces, have drastically altered the downstream flow, enabling easy access for consumers to a vast array of specialized, internationally sourced substrates, bypassing traditional retail bottlenecks. The challenge in distribution remains optimizing the logistics for shipping heavy, fragile bags of substrate efficiently and affordably to end-users.

Efficiency within the value chain is determined by the ability to minimize material wastage during processing and reduce freight costs, which constitute a significant portion of the final product price. Specialized soil producers often integrate backward to control the sourcing of specific volcanic clays, maintaining proprietary mineral compositions and ensuring consistency, which enhances their competitive positioning. The consumer interface, or the final step in the value chain, is increasingly supported by educational content and product tutorials (often utilizing digital platforms) provided by manufacturers and retailers, aimed at ensuring proper substrate setup and maximizing biological effectiveness, thereby reinforcing brand loyalty and justifying premium pricing for highly functional products.

Aquarium Substrate Market Potential Customers

Potential customers for the Aquarium Substrate Market are highly segmented, ranging from entry-level hobbyists seeking simple, aesthetically pleasing gravel to highly technical professionals requiring precision-engineered substrates. The primary end-users fall into three main categories: amateur hobbyists, professional aquascapers and dedicated enthusiasts, and commercial entities. Amateur hobbyists typically purchase basic inert gravel or sand through mass-market retailers for simple tropical setups. In contrast, dedicated enthusiasts, often possessing multiple tanks or specialized setups (e.g., breeding tanks, reef tanks, biotope tanks), are the primary buyers of premium, specialized substrates, including nutrient-rich soils, pH-buffering aragonite sands, and unique aesthetic materials like ADA Aquasoil or high-grade quartz.

Commercial entities represent a stable and growing customer base, including public aquariums, zoological institutions, academic research laboratories utilizing aquatic models, and large-scale commercial fish and shrimp aquaculture operations. Public aquariums demand consistent, high-volume, and often custom-blended substrates that meet stringent display and water quality standards, often purchasing directly from manufacturers or specialized bulk suppliers. Furthermore, the burgeoning service industry of aquarium maintenance and installation companies serves residential and corporate clients, acting as key B2B buyers who rely on consistent, quality substrates for the systems they manage and install. These professional buyers prioritize reliability, technical specifications, and bulk pricing advantages, making them crucial targets for volume sales and long-term contracts. The growth in the professional aquascaping contest circuit further drives demand for the most premium and technically advanced products, serving as trendsetters for the wider hobbyist community.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 685.2 Million |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Seachem Laboratories, CaribSea, Fluval (Hagen), ADA (Aqua Design Amano), Eco-Complete (CaribSea), Brightwell Aquatics, Prodibio, Eheim, API, Tetra, Ocean Free, Tropica, Dennerle, JBL, UP Aqua, ISTA, NilocG, Finnex, Marineland, Pettex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aquarium Substrate Market Key Technology Landscape

The technological landscape of the Aquarium Substrate Market is dominated by advances in material science and surface treatment processes designed to enhance biological filtration and nutrient delivery. Key technologies center around maximizing the effective surface area and porosity of the substrate granules to house extensive colonies of nitrifying bacteria, which is critical for maintaining water quality and the nitrogen cycle. For instance, manufacturers employ high-temperature baking and sintering processes to create ceramic and clay-based substrates with complex internal pore structures, such as porous lava rock derivatives or bio-rings that, when crushed, offer superior biological media functionality compared to simple quartz gravel. This focus on maximizing porosity directly translates into improved water clarity and stability, a major selling point for premium products. Furthermore, advancements in chemical composition include proprietary mineral coatings that slowly leach essential trace elements (like iron, manganese, and magnesium) into the water column, specifically formulated to support the demanding growth requirements of specialized aquatic plants, thereby reducing the need for continuous liquid fertilization.

Another significant technological advancement involves pH-modifying and buffering substrates. For specialized aquariums, such as those housing African cichlids (requiring high pH and hardness) or those mimicking soft, acidic blackwater environments (requiring buffering down), manufacturers use precise blends of calcium carbonate, dolomite, or peat derivatives integrated into the substrate. Aragonite sand, for example, is technologically refined to maximize its dissolution rate, effectively buffering marine aquarium water against acidic crashes and maintaining crucial alkalinity levels necessary for coral health. The manufacturing process for these products involves micronization and precise particle sizing to ensure homogeneity and prevent compaction, which can lead to anaerobic zones detrimental to the ecosystem. New processes are also focusing on creating lightweight, inert polymer-based alternatives that are easier and cheaper to ship while still providing adequate anchoring for plants and mimicking natural aesthetics.

Packaging technology is also evolving, driven by the need for enhanced convenience and preservation. This includes vacuum-sealing nutrient-rich soils to prevent oxidation and degradation before use, and incorporating multi-layer barrier materials that maintain the integrity and sterility of the substrate. Furthermore, the integration of bio-technology through the application of proprietary beneficial bacteria cultures directly onto the substrate material during the final packaging stage represents a significant innovation. These pre-cycled substrates accelerate the crucial tank cycling phase, reducing the waiting time before adding livestock, and significantly lowering the barrier to entry for new hobbyists. This focus on "instant cycling" and guaranteed biological activity is highly valued by consumers and represents a key competitive differentiator built upon sophisticated microbiological technology and sterile processing environments, positioning the product not just as a substrate, but as an active biological component of the aquarium system.

Regional Highlights

The Aquarium Substrate Market demonstrates distinct consumption patterns and growth trajectories across global regions, heavily influenced by disposable income, cultural acceptance of pet fish keeping, and local logistical capabilities to handle heavy goods.

- North America (United States, Canada, Mexico): North America is a mature market characterized by high consumer awareness regarding premium, high-tech substrates. The region leads in the adoption of specialized products, particularly nutrient-rich soils and high-grade marine sands, driven by a large, affluent hobbyist community and the robust presence of major international pet retail chains. E-commerce dominance allows for the widespread distribution of heavy substrates despite shipping challenges. Demand is consistently high for products supporting complex planted tanks (aquascaping) and sophisticated reef systems.

- Europe (Germany, UK, France, Italy, Spain): Europe holds a significant market share, strongly supported by Germany's entrenched culture of aquaristics and stringent environmental standards. The emphasis in Europe is often placed on sustainability and natural aesthetic materials. German and Dutch manufacturers are recognized globally for their high-quality specialized soils and inert gravels. Regulations regarding the sourcing of materials and chemical safety play a critical role, fostering a demand for certified, high-purity products. Eastern European countries are showing rapidly accelerating growth as incomes rise and interest in the hobby expands.

- Asia Pacific (China, Japan, South Korea, India): APAC is the fastest-growing region, primarily driven by China's expanding middle class and the cultural importance of aquascaping originating in Japan (pioneered by ADA/Takashi Amano). Japan and South Korea remain key innovators in the specialized soil segment, setting global trends for planted tank substrates. China is transforming from a manufacturing hub into a massive consumer market, showing soaring demand for both locally produced and imported premium materials. Infrastructure development facilitates better distribution, although local brands often dominate the basic segment due to cost advantages over imported alternatives.

- Latin America (Brazil, Argentina): Latin America represents an emerging market with substantial untapped potential. While currently dominated by basic, locally sourced gravel and sand due to economic constraints, the hobbyist community is rapidly growing, particularly in large urban centers like São Paulo and Mexico City. Increased market penetration by global brands offering entry-level specialized products is expected to accelerate growth. Logistical challenges and import tariffs often raise the cost of premium imported substrates, creating opportunities for regional processing facilities utilizing locally available mineral resources.

- Middle East and Africa (MEA): This region accounts for the smallest but steadily growing market share. Growth is concentrated in the Gulf Cooperation Council (GCC) countries, driven by high per capita incomes and a demand for luxury home aesthetics, including custom-built aquariums. Saltwater and reef setups are particularly popular, driving demand for high-quality aragonite and synthetic reef substrates. Africa's market remains largely fragmented, though South Africa shows increasing development in the organized pet retail sector, slowly transitioning consumers from raw, unprocessed river gravel to standardized, packaged products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aquarium Substrate Market.- Seachem Laboratories

- CaribSea

- Fluval (Hagen)

- ADA (Aqua Design Amano)

- Eco-Complete (CaribSea)

- Brightwell Aquatics

- Prodibio

- Eheim

- API

- Tetra

- Ocean Free

- Tropica

- Dennerle

- JBL

- UP Aqua

- ISTA

- NilocG

- Finnex

- Marineland

- Pettex

Frequently Asked Questions

Analyze common user questions about the Aquarium Substrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between inert gravel and specialized aquarium soil?

Inert gravel or sand primarily serves as an anchor and aesthetic base, offering minimal biological or chemical benefits. Specialized aquarium soil, typically made of baked clay or volcanic ash, is nutrient-rich and porous, actively buffering pH levels and supplying essential minerals to aquatic plants and beneficial bacteria colonies, making it crucial for high-performance planted tanks.

How does substrate choice impact water parameters in freshwater aquariums?

The substrate profoundly impacts water parameters. Aragonite or crushed coral raises pH and carbonate hardness (KH), ideal for African cichlids. Nutrient-rich soils typically buffer the water towards a slightly acidic pH (6.0–6.5), which is optimal for most tropical fish and aquatic plants, ensuring stable chemistry and reducing maintenance needed for parameter control.

Which region currently dominates the consumption and innovation of premium aquarium substrates?

North America and Europe currently dominate consumption in terms of value due to established hobbyist bases and high disposable incomes. However, Asia Pacific, particularly Japan and South Korea, often leads innovation in high-end, specialized planted tank substrates and aquascaping materials, setting global trends for aesthetic and functional performance.

Are there sustainable or eco-friendly substrate options available in the market?

Yes, sustainability is a growing trend. Manufacturers are increasingly offering substrates sourced ethically, using recycled glass or ceramic materials, or utilizing locally available, responsibly harvested natural minerals. Look for certifications or clear sourcing statements on volcanic rock and specialty clay products.

What is the role of substrate in the biological filtration process of an aquarium?

The substrate acts as the primary habitat for beneficial nitrifying bacteria (Nitrosomonas and Nitrobacter) which are essential for biological filtration. These bacteria colonize the massive surface area (especially in porous substrates) and convert harmful ammonia and nitrites into less toxic nitrates, maintaining a balanced and healthy aquatic ecosystem.

The extensive analysis of the Aquarium Substrate Market reveals a complex ecosystem driven by consumer specialization and technological advancement in material science. The market’s resilience stems from the enduring appeal of the ornamental fish trade, coupled with the rapid global expansion of high-end aquascaping. Future growth will be highly dependent on manufacturers’ abilities to address logistical challenges associated with product weight and capitalize on the growing demand for biologically enhanced, easy-to-use substrates, particularly through optimized e-commerce distribution. The shift towards application-specific products, supported by targeted marketing and robust educational content, will solidify the segmentation and drive higher revenue per unit across all major geographical regions, especially APAC, which is quickly becoming a critical hub for both consumption and product design excellence.

In conclusion, the market is poised for steady expansion, fueled by innovation in creating active substrates that minimize hobbyist intervention while maximizing ecological stability within the confined aquarium environment. The incorporation of advanced processing techniques, such as high-temperature firing and mineral infusion, ensures that substrates remain a high-value component of any aquarium setup. As consumer knowledge increases, the demand for highly porous, nutrient-retentive materials with specific buffering capabilities will supersede the demand for generic, inert materials, ensuring continued premiumization of the substrate offerings globally. This market dynamic necessitates that key players focus on securing sustainable sourcing channels and investing in proprietary material formulations to maintain competitive advantage against emerging local manufacturers.

The influence of digital media and the global connectivity of the aquascaping community cannot be overstated; trends established by competitive events quickly translate into consumer purchasing decisions, often favoring niche, high-cost imported soils over readily available local alternatives. This reliance on global trends necessitates flexible and responsive supply chains capable of managing international logistics for high-density, specialized mineral products. Furthermore, the integration of AI-driven tools into the customer journey, simplifying complex parameter analysis and product selection, will be critical for retaining market share, particularly among newer generations of aquarium enthusiasts who expect seamless, data-driven purchasing experiences. This technological integration positions the substrate market at the intersection of traditional pet supply and modern aquatic bio-technology.

The structural characteristics of the market, specifically the high barriers to entry related to material sourcing and processing technology required for specialized soils, protect the market positions of established leaders like ADA and CaribSea. However, opportunities remain for innovative entrants focused on lightweight, highly functional alternatives or bio-enhanced products that offer clear environmental and convenience benefits. The long-term viability of the industry rests on continuous technological improvement in substrate performance, particularly regarding their capacity to manage heavy metals, sequester excess nutrients, and maintain long-term structural integrity without frequent replacement. The increasing market complexity demands that manufacturers move beyond merely supplying an inert base and instead offer a crucial, biologically active component of the enclosed aquatic ecosystem.

Regional variations in water hardness and temperature also play a significant role in substrate preference, dictating the required buffering capacity and material composition. For instance, regions with naturally soft water may see higher demand for buffering soils, while areas with hard water may prioritize inert materials or specialized planted tank soils that actively lower GH and KH. This geographical variability underlines the necessity of localized product strategies, tailored marketing, and region-specific distribution partnerships. The distribution channel evolution, particularly the pivot towards online sales, is forcing traditional brick-and-mortar retailers to focus on personalized advice and immediate product availability, leveraging their physical presence to compete against the cost efficiencies offered by large e-commerce platforms handling heavy goods logistics.

Ultimately, the Aquarium Substrate Market's projected growth trajectory reflects a broader societal trend towards nature immersion and sophisticated home aesthetics. As aquariums evolve from simple glass boxes to complex, living pieces of art (aquascapes), the substrate transitions from a mere layer to the fundamental biological engine of the system. This perception shift justifies the premium pricing of engineered products, ensuring that the specialized soil and marine aragonite segments will continue to outperform traditional gravel in terms of both revenue growth and margin expansion over the forecast period. The competitive landscape will likely be defined by intellectual property related to proprietary mineral blends and biological inoculation techniques, further emphasizing the market’s technological nature.

The extensive characterization of market drivers, restraints, and opportunities confirms that while economic fluctuations and raw material costs pose short-term challenges, the fundamental underlying demand for complex aquatic ecosystems will sustain market expansion. Strategic investments in supply chain optimization, particularly in reducing the environmental footprint of transportation, will be key to unlocking sustainable profitability in this heavy-volume segment. Moreover, the integration of sophisticated consumer education strategies, detailing the technical benefits of specialized substrates over conventional options, is essential for converting basic hobbyists into high-value enthusiasts, thereby maximizing the long-term revenue potential of the global Aquarium Substrate Market throughout the defined forecast period of 2026 to 2033.

The market trajectory further suggests a clear bifurcation: a volume-driven segment comprising basic sands and gravel, primarily served by local and regional suppliers focused on cost efficiency, and a high-value segment encompassing specialized soils, marine sands, and engineered ceramics, dominated by global brands leveraging R&D and proprietary formulations. Success in the latter segment requires continuous innovation in areas such as slow-release fertilization technology, enhanced cation exchange capacity (CEC) to efficiently absorb and release nutrients, and materials that minimize water cloudiness upon setup. These technological advancements ensure ease of use and superior biological outcomes, which directly justify the higher price points associated with premium products, thus supporting the forecasted CAGR despite global economic pressures on consumer goods.

From a regulatory standpoint, the sourcing of natural materials must increasingly comply with international standards regarding sustainable extraction and non-contamination, particularly avoiding heavy metal content, which can be toxic to sensitive aquatic life. This necessity for certified purity further elevates the cost structure for premium substrate producers but simultaneously creates a barrier to entry for smaller, less compliant competitors. The market is thus shifting towards transparent supply chains where the provenance and processing methods of the substrate materials are a core part of the product’s value proposition. This focus on verifiable quality aligns perfectly with the educated consumer base in key regions such as North America and Western Europe, who prioritize safety and ecological responsibility alongside aesthetic appeal in their aquarium setups.

The final consumption patterns underscore the importance of material weight and logistical efficiency. Since substrates are heavy, they are disproportionately impacted by fuel prices and shipping costs, making local manufacturing or regional processing facilities strategically advantageous. Manufacturers are constantly seeking methods to increase the functional value per unit weight—for example, by creating highly porous, lightweight ceramic granules—to mitigate the escalating costs associated with global freight. This engineering challenge represents a critical area of R&D investment, aiming to deliver the biological and chemical performance of dense natural materials in a lighter, more economically viable format for worldwide distribution via high-growth e-commerce channels. The ongoing battle between product performance and logistical cost optimization will be a defining feature of the competitive landscape for the remainder of the forecast period.

The influence of specialized, niche market segments, particularly the high-investment realm of professional aquascaping and advanced reef keeping, significantly impacts overall market trends. These demanding users act as early adopters and test beds for the most advanced substrates, providing invaluable feedback that drives commercial product iteration. The aesthetic demands of aquascaping, requiring specific grain sizes, colors, and textures (e.g., fine black soils for contrast, specific quartz blends for riverbed simulation), ensure that product diversification remains high. This continuous requirement for customization necessitates flexible manufacturing operations capable of producing a wide variety of specialized blends in smaller, more frequent batches, diverging from the traditional bulk production model seen in the generic gravel segment. This trend towards customization adds complexity to the supply chain but ensures high margins in the premium sector.

Furthermore, marine substrates, particularly those utilizing aragonite, face unique technological requirements related to surface stability and biological activity. Research focuses on creating 'live sand' products, often packaged wet and enriched with dormant marine bacteria, which are designed to immediately seed the biological filter in saltwater tanks. This immediate functionality is highly valued in the reef-keeping community, where establishing a stable nitrogen cycle quickly is crucial for the survival of expensive coral and fish livestock. The challenges in this segment include maintaining product viability during shipping and ensuring compliance with regulations governing the transport of biological materials. Successful companies in the saltwater segment must possess strong bio-technology capabilities alongside mineral processing expertise.

In summary, the Aquarium Substrate Market is evolving rapidly from a commoditized goods sector to a high-technology specialty domain. The market's future will be dictated by material innovation, strategic geopolitical sourcing, and the successful navigation of e-commerce logistics for heavy products. Consumer education remains paramount to justifying the premium price points of advanced substrates over basic gravel. As global interest in aquatic aesthetics and responsible pet ownership continues to expand, the demand for substrates that actively support biological balance and plant health will secure the market's robust growth through 2033, reinforcing its position as an indispensable component of the pet care and aquatic hobby industry globally.

This market requires continuous adaptation to specialized needs. For example, specific substrates are formulated for shrimp tanks, which demand highly inert yet porous materials that do not leach unwanted minerals and maintain specific pH ranges critical for shrimp molting and breeding success. The precision required for these niche applications pushes the boundaries of material science, often utilizing proprietary blends of inert ceramics and specialized minerals. Manufacturers must therefore maintain highly diversified product portfolios to effectively capture these granular segments, as these niche areas often exhibit greater price inelasticity due to the critical nature of the substrate to livestock health. The competitive edge is thus shifting from simple cost leadership in gravel to functional superiority in specialized soil systems.

The regulatory environment, particularly concerning ecological impact, is also tightening, affecting sourcing practices globally. The ethical mining and processing of natural materials, such as quartz and volcanic ash, are increasingly scrutinized. Companies demonstrating commitment to environmental stewardship through responsible sourcing, reduced carbon footprint in manufacturing, and use of recyclable packaging are gaining favor among conscious consumers. This push for "green" substrates, while potentially increasing input costs, provides a significant marketing advantage and aligns the industry with broader global sustainability trends. The requirement for detailed mineral analysis reports accompanying batches of premium substrate is becoming standard practice, further professionalizing the supply chain and enhancing customer trust in product composition and safety.

Lastly, technological advancements are impacting the longevity and reusability of substrates. Research is ongoing into substrates that maintain their nutrient profile and structural integrity for extended periods—perhaps five to ten years—reducing the frequency with which hobbyists must undertake the arduous task of completely tearing down and replacing the substrate layer. This focus on durability and long-term performance represents a major value proposition for the premium segment, addressing a key pain point for advanced aquarists. Such innovations, combined with the convenience offered by online distribution and AI-powered customer support, ensure that the Aquarium Substrate Market continues its growth trajectory as a vital and evolving part of the global pet industry ecosystem.

The market's future success is also tied to demographic changes. The rise in pet ownership among younger, urban populations often translates into smaller, highly curated living spaces, driving demand for nano-aquariums and highly efficient, concentrated substrate solutions. These smaller setups necessitate substrates with maximized efficiency—high CEC, superior porosity, and rapid biological activity—to compensate for the limited water volume. This trend counterbalances the larger volume requirements of commercial and public aquariums, ensuring diversified revenue streams across tank size segments. Therefore, product formulation flexibility to cater to both macro (public display) and micro (desktop nano) markets is essential for comprehensive market penetration and sustained expansion into niche application areas globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager