Aramid Insulation Paper Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442424 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Aramid Insulation Paper Market Size

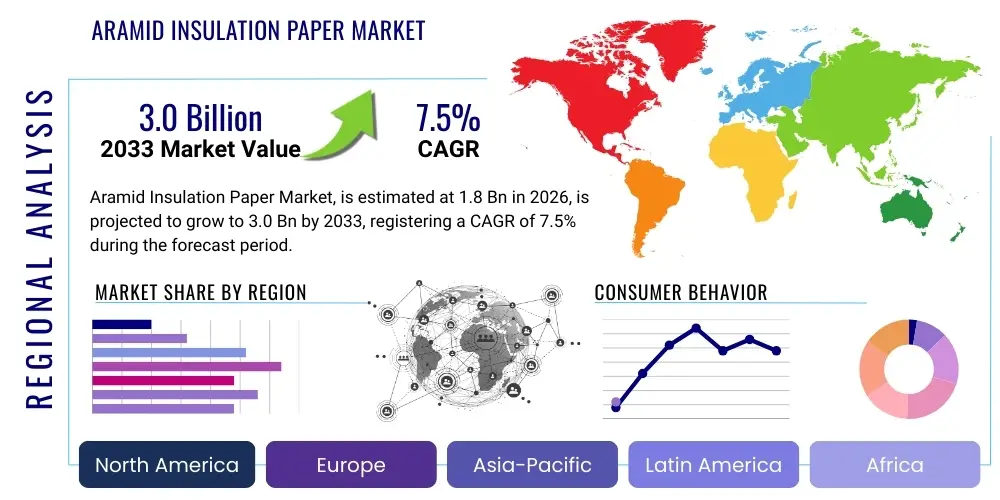

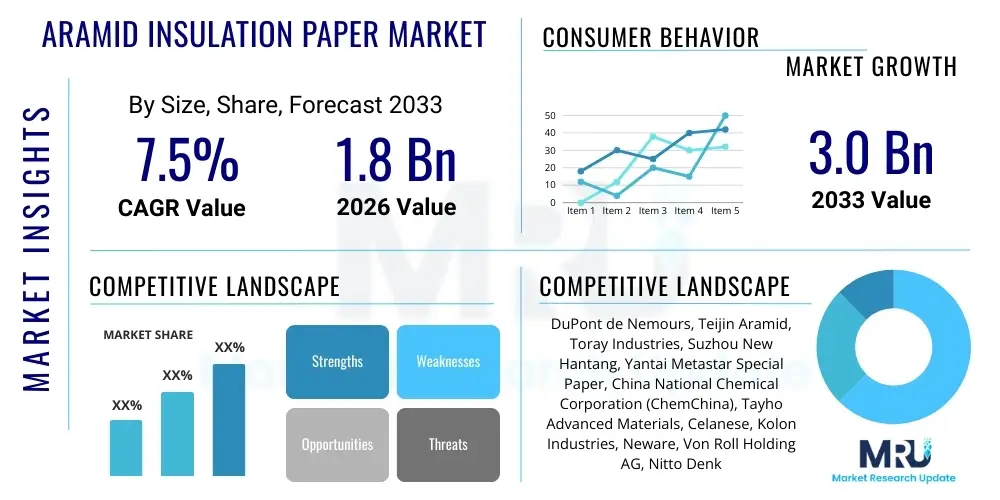

The Aramid Insulation Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.0 Billion by the end of the forecast period in 2033. This robust expansion is primarily attributed to the escalating demand for high-performance electrical insulation materials across critical industries, particularly in the electrification of the automotive sector and the necessity for reliable energy infrastructure development globally. The inherent properties of aramid paper, such as superior thermal stability, excellent mechanical strength, and exceptional dielectric performance, position it as an indispensable component in advanced electrical systems, ensuring longevity and operational safety.

Aramid Insulation Paper Market introduction

The Aramid Insulation Paper Market encompasses the global production, distribution, and consumption of papers derived from meta-aramid and para-aramid fibers, engineered specifically for high-stress electrical and thermal insulation applications. These specialized papers are crucial components in a wide array of electrical equipment, including transformers, motors, generators, and increasingly, in sophisticated energy storage systems like electric vehicle (EV) batteries. Aramid paper is characterized by its outstanding thermal endurance, often operating reliably at temperatures exceeding 200°C, resistance to chemicals and radiation, and superior flame retardancy, making it a critical safety and efficiency material in modern electrical engineering.

Major applications of aramid insulation paper span high-voltage equipment, traction motors in rail and electric vehicles, military and aerospace components requiring lightweight yet robust insulation, and renewable energy installations such as wind turbine generators. The product’s description centers on its non-woven, fibrous structure, which provides a high degree of conformability and impregnability with insulating resins and varnishes, crucial for achieving Type H or higher thermal class insulation systems. The primary benefits derived from using aramid paper include enhanced equipment lifespan, reduced maintenance costs, the ability to miniaturize electrical components due to higher power density handling, and compliance with stringent international safety standards (e.g., UL recognized components).

Driving factors for this market include the global transition towards electrification, particularly in transportation (EVs) and industrial processes, demanding insulation capable of handling higher operating voltages and temperatures. Furthermore, massive investments in smart grid infrastructure and the rapid expansion of renewable energy generation capacity necessitate reliable, long-lasting insulation solutions. Regulatory pressures emphasizing energy efficiency and fire safety in public infrastructure and commercial electronics also contribute significantly to the accelerating adoption of aramid insulation paper over conventional materials like cellulosic paper or certain plastics, affirming its status as a high-value strategic material.

Aramid Insulation Paper Market Executive Summary

The Aramid Insulation Paper Market is experiencing dynamic growth, propelled by robust business trends centered on miniaturization and high-density power solutions. Key business trends involve strategic vertical integration by major manufacturers to secure raw material supply (aramid fiber), coupled with intensive R&D efforts focused on developing thinner, lighter papers with enhanced thermal conductivity for advanced battery management systems (BMS) in electric vehicles. Consolidation and strategic partnerships between aramid paper producers and electrical component manufacturers are common, aimed at standardizing high-performance insulation systems and accelerating time-to-market for next-generation electrical machinery. Manufacturers are also adapting their production methodologies to align with Industry 4.0 principles, integrating AI and automation to ensure higher yield rates and stricter quality control, particularly crucial for applications where component failure is catastrophic.

Regionally, Asia Pacific (APAC) dominates the market share due to its preeminence in global electronics manufacturing, coupled with aggressive government initiatives supporting EV production and high-speed rail development, particularly in China, South Korea, and Japan. Europe and North America exhibit strong growth, driven by stringent energy efficiency regulations, significant investments in grid modernization, and a mature aerospace and defense sector requiring highly reliable aramid products. The regional trends highlight a shift in manufacturing focus towards localization, especially post-pandemic, ensuring supply chain resilience for critical materials used in national infrastructure and key technologies, thereby influencing pricing stability and availability across various geographic zones.

Segment trends reveal that the meta-aramid paper segment retains dominance due to its balanced thermal and mechanical properties, suitable for general electrical insulation. However, the para-aramid fiber-based papers and composites segment is witnessing the fastest growth, primarily due to their unparalleled tensile strength and dimensional stability, making them ideal for specialized, high-stress applications such as flexible printed circuits and certain aerospace structures. Application-wise, the transformer and motor insulation segment remains the largest consumer, but the EV battery insulation segment is projected to be the primary growth driver over the forecast period, characterized by increasing demand for thermal runaway barriers and phase insulation materials capable of withstanding extreme temperature cycling inherent in high-performance battery packs.

AI Impact Analysis on Aramid Insulation Paper Market

User queries regarding the impact of Artificial Intelligence (AI) on the Aramid Insulation Paper Market primarily center on how AI can optimize manufacturing processes, enhance material quality control, and accelerate research into novel aramid formulations. Common concerns revolve around the integration costs of sophisticated AI-driven systems, the availability of skilled labor to manage predictive maintenance models, and how AI can improve supply chain forecasting for essential precursors. Users are particularly keen on understanding AI's role in detecting microscopic defects in paper homogeneity, a factor critical for ensuring dielectric strength integrity in high-voltage applications. The consensus expectation is that AI will significantly boost operational efficiency (OEE) and lead to the development of 'smart' aramid papers with embedded sensing capabilities, though initial adoption might be hindered by the specialized nature of aramid manufacturing equipment.

The application of AI in the aramid paper industry extends beyond quality assurance. AI algorithms are increasingly being deployed for predictive maintenance of highly specialized papermaking machinery, minimizing unplanned downtime which is exceptionally costly in continuous manufacturing environments. Furthermore, generative AI models are beginning to assist material scientists in simulating the molecular behavior of new aramid polymer structures under various thermal and electrical stresses, significantly reducing the physical prototyping cycle time and accelerating the introduction of next-generation insulation products that meet increasingly demanding performance specifications required by high-power electronic devices and advanced electrical motors. This digital transformation, driven by AI, is fundamentally altering the competitive landscape by rewarding manufacturers capable of rapid material innovation and flawless production consistency.

- AI optimizes fiber alignment and uniformity during the wet-lay process, enhancing paper dielectric performance.

- Predictive analytics minimizes equipment downtime and optimizes energy consumption in energy-intensive manufacturing.

- Machine vision systems utilize AI for real-time, non-destructive quality inspection, identifying microscopic flaws in insulation sheets.

- Generative AI accelerates R&D by simulating thermal runaway scenarios and material degradation processes.

- Supply chain AI tools improve forecasting accuracy for aramid precursor chemicals and manage inventory levels effectively.

DRO & Impact Forces Of Aramid Insulation Paper Market

The Aramid Insulation Paper Market is characterized by a strong interplay of positive and negative forces. Drivers are primarily anchored in the global shift towards electrification and the inherent need for safety, pushing demand across multiple sectors. Restraints, conversely, revolve around supply chain constraints and the high cost associated with both the raw materials and the complex manufacturing processes required to produce high-grade aramid papers. Opportunities emerge from material science advancements, such as the development of hybrid aramid papers and composite structures designed for dual functionality (e.g., thermal and electromagnetic shielding). The collective impact forces dictate that while the underlying demand is inelastic due to safety and performance requirements, profitability is heavily influenced by the volatile pricing of aramid polymers and the capital investment required for capacity expansion.

A key driver is the explosive growth of the Electric Vehicle (EV) industry, where aramid paper is essential for thermal management and ensuring battery safety, specifically as inter-cell insulation and thermal barriers to prevent the propagation of thermal runaway events. The continued global emphasis on renewable energy infrastructure, including high-efficiency transformers and generators for solar and wind farms, also necessitates aramid's high thermal class rating. However, the market faces significant restraints, notably the reliance on a limited number of specialized raw material suppliers globally, which creates supply chain bottlenecks and subjects manufacturers to substantial price volatility. Furthermore, the specialized manufacturing knowledge and significant capital expenditure required to establish production facilities act as high barriers to entry for new competitors.

Opportunities for market expansion are concentrated in the development of Ultra-High Voltage Direct Current (UHVDC) transmission systems, which require insulation materials with exceptional long-term reliability under severe electrical stress. Another significant opportunity lies in the customization of aramid papers for 3D printing applications, allowing for complex insulation geometries in specialized electronic components. The overall impact forces are overwhelmingly positive, driven by non-negotiable performance requirements in high-reliability systems. The high performance and safety mandates in aerospace, defense, and high-speed rail ensure sustained demand, forcing end-users to absorb the higher material costs, thereby maintaining the market's robust growth trajectory despite cost-related restraints.

Segmentation Analysis

The Aramid Insulation Paper Market is meticulously segmented based on product type, application, and thermal class, reflecting the diverse end-user requirements for electrical and thermal management. Segmentation by product type differentiates between meta-aramid paper, known for its excellent balance of thermal stability and mechanical properties, and para-aramid paper, prized for its superior mechanical strength and structural integrity, often used in composite forms. The application segments highlight the primary consumption sectors, dominated by rotating machines (motors and generators) and static equipment (transformers), alongside the rapidly emerging EV and electronics domains. Understanding these segments is crucial for manufacturers to tailor their product specifications—such as paper thickness and density—to meet precise regulatory and performance standards in each vertical.

Further granularity is achieved through segmentation by thermal class, which adheres to international insulation standards, ranging from Class H (180°C) up to Class C (220°C and above). This classification directly influences the material selection for equipment operating under extreme thermal loads, such as traction motors in high-speed trains or advanced aerospace components. The diversity in segmentation underscores the highly specialized nature of the aramid insulation paper industry, where performance specifications are critical determinants of competitive positioning and market penetration. Strategic focus on the fastest-growing segments, particularly those tied to high-voltage direct current (HVDC) transmission and electric mobility, is vital for long-term growth.

- By Product Type:

- Meta-Aramid Paper (e.g., Nomex type)

- Para-Aramid Paper (e.g., Kevlar type)

- Hybrid and Composite Aramid Papers

- By Application:

- Transformers (Distribution, Power, Specialty)

- Motors and Generators (Rotating Machines)

- Electric Vehicle (EV) Battery Insulation and Thermal Barriers

- Aerospace and Defense

- Flexible Printed Circuits (FPC) and Electronics

- Others (Cable Insulation, Capacitors)

- By Thermal Class:

- Class F (155°C)

- Class H (180°C)

- Class C (220°C and above)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Aramid Insulation Paper Market

The value chain for the Aramid Insulation Paper Market is highly specialized and capital-intensive, starting with the upstream supply of specialized aramid polymers (polyamides). Upstream analysis reveals that the synthesis of these polymers is highly concentrated, involving complex chemical processes and proprietary technology, creating a critical dependency on a handful of global chemical giants. This stage determines the quality, thermal rating, and cost structure of the final product. Manufacturers of aramid insulation paper acquire these polymer fibers, which are then processed through specialized papermaking techniques—typically wet-lay or dry-lay—requiring sophisticated calibration to ensure uniform thickness, density, and pore structure for optimal dielectric performance.

The middle segment involves the conversion of the raw aramid pulp into finished insulation products, including slitting, calendering, and sometimes coating or lamination to produce composites (e.g., aramid-polyimide films). Distribution channels are critical; these materials are often high-value, low-volume products requiring highly technical sales support. Direct distribution is common for large OEM customers (e.g., major transformer and motor manufacturers) who require specific quality certifications and just-in-time delivery schedules. Indirect channels involve specialized electrical insulation distributors and material converters who provide localized cutting, kitting, and custom shaping services before supplying to smaller electrical repair shops or niche electronics manufacturers, adding regional value and technical service support.

Downstream analysis focuses on the integration of aramid paper into end-use equipment. Major buyers include transformer winding companies, electric motor manufacturers, and increasingly, battery pack assemblers. The performance of the aramid paper directly impacts the safety and efficiency ratings of the final electrical apparatus. The shift towards miniaturization in electronics and electric vehicles places immense pressure on the downstream users to procure only the highest quality insulation, driving demand for premium products and robust traceability throughout the supply chain. Regulatory compliance, particularly adherence to UL and IEC standards for electrical systems, mandates stringent quality control throughout the entire value chain, from polymer synthesis to final component integration.

Aramid Insulation Paper Market Potential Customers

The primary potential customers and end-users of Aramid Insulation Paper are concentrated in sectors that require non-negotiable levels of thermal stability, mechanical robustness, and dielectric integrity for operational safety and longevity. The largest purchasing segment includes Original Equipment Manufacturers (OEMs) specializing in heavy electrical equipment, such as power and distribution transformer manufacturers, and companies producing industrial, traction, and specialized high-efficiency electric motors and generators. These buyers use aramid paper for layer insulation, phase insulation, barrier insulation, and winding encapsulation, where failure can result in catastrophic equipment damage and extensive downtime.

A rapidly expanding segment of buyers includes manufacturers of Electric Vehicle (EV) battery packs and Battery Management Systems (BMS). As the electric mobility sector scales up, there is an intense demand for aramid insulation to serve as reliable thermal barriers between individual battery cells and modules, mitigating the risk of thermal runaway propagation. These customers prioritize lightweight solutions that offer maximum thermal performance and flame retardancy. Furthermore, the aerospace and defense sectors constitute high-value niche buyers, utilizing aramid paper in wiring harnesses, avionics components, and critical communication systems where insulation must withstand extreme temperature variations, radiation, and vibrations without compromising performance.

Other significant end-users encompass manufacturers of specialized electronic components, including flexible printed circuit board (FPCB) manufacturers and companies producing high-frequency magnet wires and high-voltage capacitors. These segments demand ultra-thin, dimensionally stable aramid papers and films. Electrical maintenance and repair operations (MROs) also serve as consistent, though smaller, potential customers, requiring aramid paper for the refurbishment and rewinding of large industrial motors and generators to restore or upgrade their thermal class rating, ensuring continued operational efficiency and compliance with modern safety standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont de Nemours, Teijin Aramid, Toray Industries, Suzhou New Hantang, Yantai Metastar Special Paper, China National Chemical Corporation (ChemChina), Tayho Advanced Materials, Celanese, Kolon Industries, Neware, Von Roll Holding AG, Nitto Denko, Taimide Technology Inc., Lydall (now part of Solenis), Shenzhen Guanjie Special Material. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aramid Insulation Paper Market Key Technology Landscape

The Aramid Insulation Paper Market relies on sophisticated processing technologies to translate high-performance aramid polymers into thin, durable, and electrically stable paper sheets. The core technology employed is the wet-lay papermaking process, adapted specifically for synthetic fibers. This involves finely dispersing short-cut aramid fibers and fibrids (small, highly branched particles derived from aramid) in an aqueous medium. Precision control over the ratio of fibers to fibrids is paramount, as fibrids act as binders, creating the necessary mechanical integrity and dense structure required for high dielectric strength. Technological advancements are focused on improving the dispersion homogeneity to eliminate weak points that could lead to electrical failure under high stress, often involving advanced shear mixers and forming sections.

Post-processing technologies are equally crucial, primarily involving high-temperature pressing (calendering) and sintering. Calendering is used to compress the fibrous sheet, controlling the final thickness and density, which directly impacts the paper's mechanical strength and dielectric constant. Advanced thermal treatment, or sintering, is necessary to fully develop the mechanical properties and maximize the thermal stability of the paper structure, ensuring the final product meets stringent Class C thermal requirements. Recent technological trends include the integration of nanotechnology, where inorganic nanoparticles or specialized barrier coatings are applied to the aramid matrix to enhance resistance to partial discharge (PD) and improve thermal dissipation characteristics, vital for miniaturized, high-power electronic devices.

Furthermore, automation and digital control systems (often leveraging AI and machine learning, as noted previously) form a significant part of the current technology landscape. Manufacturers are investing heavily in sensors and control loops to monitor parameters such as web tension, moisture content, and consistency in real-time during the entire manufacturing run. This focus on Industry 4.0 techniques minimizes waste and ensures batch-to-batch consistency, which is vital given the critical safety applications of the end product. Another key area is the development of composite technologies, such as aramid paper laminated with polyimide or PTFE films, offering synergistic benefits like enhanced moisture resistance or improved mechanical resilience in demanding environments like oil-filled transformers or cryogenic applications.

Regional Highlights

The global Aramid Insulation Paper market exhibits distinct regional dynamics driven by varying levels of industrialization, regulatory landscapes, and investment in key electrical infrastructure sectors. Asia Pacific (APAC) stands out as the predominant market, characterized by rapid urbanization, massive investments in renewable energy infrastructure (particularly in China and India), and its unparalleled dominance in global electronics manufacturing and electric vehicle production. The region’s focus on high-speed rail and utility modernization projects further cements its position as the largest consumer and a major producer of aramid insulation materials. Manufacturers in this region benefit from economies of scale and often focus on supplying both domestic and international OEM markets.

North America and Europe represent mature, high-value markets, where growth is fueled less by sheer volume and more by the demand for premium, specialized products required for aerospace, defense, and stringent grid modernization initiatives. Europe, specifically, benefits from rigorous EU safety and energy efficiency directives, accelerating the replacement of older electrical equipment with high-performance, aramid-insulated components. The demand in these regions is heavily skewed towards high-thermal-class papers (Class H and Class C) used in high-power density motors and specialized transformers required for advanced industrial machinery and energy transmission systems, where longevity and reliability are prioritized over initial material cost.

The Latin America and Middle East & Africa (MEA) regions are emerging markets with significant potential, primarily driven by new infrastructure projects, particularly in power generation and transmission. MEA’s robust investments in oil and gas infrastructure, which require specialized electrical equipment resistant to high temperatures and harsh environmental conditions, are key demand drivers. Latin America’s market growth is tied to modernization of outdated utility infrastructure and increasing foreign investment in manufacturing facilities. While smaller in size compared to APAC, these regions offer untapped potential for global aramid paper manufacturers looking to establish localized distribution networks and capitalize on large-scale governmental utility contracts.

- Asia Pacific (APAC): Dominates consumption due to unparalleled manufacturing capacity in electronics and EVs; high growth attributed to government-led smart grid and high-speed transportation investments in China and India.

- Europe: Characterized by high-specification demand driven by strict environmental and safety regulations; strong market for premium aramid products in aerospace and high-efficiency industrial motors.

- North America: Stable growth fueled by defense applications, aerospace programs, and replacement cycle for aging power infrastructure, with increasing focus on domestically sourced high-performance insulation.

- Latin America (LATAM): Emerging demand linked to utility infrastructure modernization and industrial automation projects across Brazil and Mexico.

- Middle East & Africa (MEA): Growth stimulated by large-scale energy sector investments, including oil & gas facilities and large utility power generation projects requiring thermal endurance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aramid Insulation Paper Market.- DuPont de Nemours, Inc. (Nomex)

- Teijin Aramid B.V. (Twaron, Teijinconex)

- Toray Industries, Inc.

- Suzhou New Hantang Paper Co., Ltd.

- Yantai Metastar Special Paper Co., Ltd.

- China National Chemical Corporation (ChemChina)

- Tayho Advanced Materials Co., Ltd.

- Celanese Corporation

- Kolon Industries, Inc.

- Neware Technology Limited

- Von Roll Holding AG

- Nitto Denko Corporation

- Taimide Technology Inc.

- Lydall (now part of Solenis)

- Shenzhen Guanjie Special Material Co., Ltd.

- Mitsui Chemicals, Inc.

- Fuxing Group

- Hangzhou Dingye Special Paper Co., Ltd.

- Longtai New Materials Co., Ltd.

- Grasim Industries Limited

Frequently Asked Questions

Analyze common user questions about the Aramid Insulation Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Aramid Insulation Paper and why is it preferred over traditional insulation materials?

Aramid insulation paper is a high-performance material made from synthetic aromatic polyamide fibers (meta- or para-aramid). It is preferred due to its superior thermal stability (withstanding temperatures up to 220°C+), excellent dielectric strength, and mechanical durability, making it essential for high-stress applications like EV batteries and high-voltage transformers where traditional materials like cellulose paper would rapidly fail or pose fire risks. Its longevity reduces maintenance and enhances equipment safety.

How is the demand for Aramid Insulation Paper linked to the Electric Vehicle (EV) industry?

The EV industry is a critical demand driver. Aramid paper is vital for thermal management within battery packs, serving as inter-cell insulation and thermal barriers. Its high-temperature resistance and flame-retardant properties are indispensable for preventing thermal runaway propagation, thereby directly addressing core safety concerns and enabling higher energy density designs in modern lithium-ion battery systems.

Which geographical region dominates the Aramid Insulation Paper Market?

Asia Pacific (APAC), particularly driven by China, currently dominates the market both in terms of consumption and production capacity. This dominance is due to massive government investments in renewable energy infrastructure, high-speed rail networks, and the region's leading position in global electronics and electric vehicle manufacturing supply chains, necessitating vast volumes of high-performance insulation materials.

What are the primary challenges restraining the growth of this market?

The primary restraints are the high cost and volatility of aramid raw materials, as the synthesis of the specialized polymers is concentrated among a few global chemical suppliers. Additionally, the complexity and high capital expenditure required for the specialized wet-lay manufacturing process pose significant barriers to entry and limit capacity responsiveness to sudden demand spikes, potentially affecting global price stability.

What role does technology play in the future of Aramid Insulation Paper manufacturing?

Technology, particularly Industry 4.0 integration and AI, is crucial. Advanced manufacturing technologies focus on improving fiber dispersion homogeneity for enhanced dielectric performance and utilizing AI for real-time quality control and predictive maintenance. Future advancements are geared towards developing hybrid aramid composites and incorporating nanotechnology to boost partial discharge resistance in ultra-high voltage applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager