Arcade Gaming Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442087 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Arcade Gaming Market Size

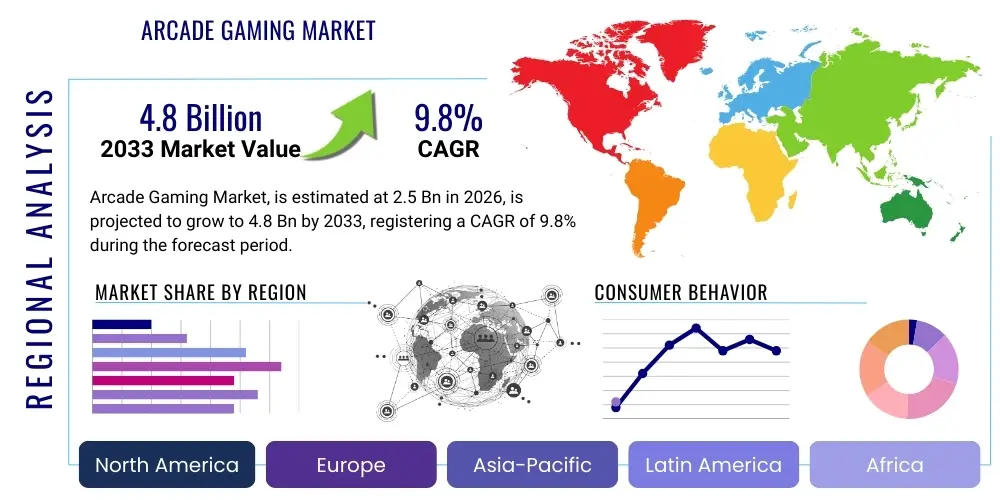

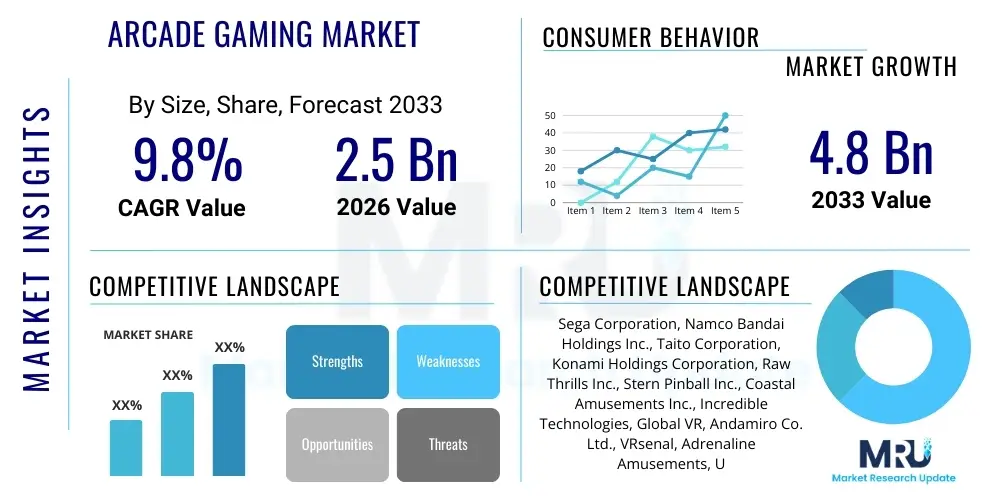

The Arcade Gaming Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

Arcade Gaming Market introduction

The Arcade Gaming Market encompasses the revenue generated from coin-operated entertainment machines, characterized by their high graphical fidelity, specialized physical interfaces, and immersive gameplay experiences tailored for public venue consumption. These specialized gaming systems contrast sharply with home consoles and mobile platforms by offering unique, often large-scale, experiences that necessitate dedicated hardware environments, such as video game cabinets, pinball machines, redemption games, and various simulation units. Historically a foundational pillar of the global entertainment industry, the sector is currently undergoing a significant modernization driven by technological advancements in virtual reality (VR), augmented reality (AR), and sophisticated motion simulation, redefining the social gaming landscape within Family Entertainment Centers (FECs), dedicated arcades, and mixed-use leisure facilities.

Major applications of arcade gaming equipment extend beyond traditional gameplay into domains such as competitive esports training facilities, interactive museum exhibits, and experiential retail environments designed to enhance customer engagement and dwell time. The inherent benefit of arcade gaming lies in its capacity to deliver high-fidelity, immediate, and intensely social experiences that are often difficult to replicate in a home setting due to cost and space constraints. The industry structure supports a continuous cycle of innovation, where manufacturers are constantly pushing the boundaries of physical interaction and graphical processing power, ensuring that the public arcade remains a premium destination for unique digital entertainment. Key product types driving current market expansion include large-format video games, sophisticated rhythm and sports simulation machines, and high-payout redemption games designed to attract diverse demographic groups, from casual consumers to dedicated enthusiasts.

Driving factors for the renewed growth in the arcade gaming sector include a strong wave of nostalgia among adult consumers, coupled with aggressive investment in location-based entertainment (LBE) centers globally, particularly in densely populated urban areas. Furthermore, the convergence of arcade technology with emerging consumer trends, such as the demand for shared social experiences outside the home and the integration of cashless payment systems and loyalty programs, significantly enhances operational efficiency and customer retention. The increasing proliferation of advanced display technologies, like 4K and high dynamic range (HDR) screens, along with tactile feedback systems, contributes directly to the perceived value and premium nature of the arcade experience, setting it apart from ubiquitous home gaming alternatives. This continuous cycle of hardware refreshment and experiential novelty is fundamental to sustaining market momentum and attracting new cohorts of players.

Arcade Gaming Market Executive Summary

The Arcade Gaming Market Executive Summary reveals a robust rebound driven by the strategic repositioning of arcades as sophisticated Location-Based Entertainment (LBE) venues, moving away from fragmented, small-scale operations toward consolidated, high-capital FECs. Business trends indicate a pronounced shift towards experiential gaming, where simulation and virtual reality technologies command premium pricing and higher utilization rates compared to traditional video cabinets. Manufacturers are prioritizing networked gaming infrastructure and integrating mobile functionalities, allowing players to track scores, manage loyalty points, and engage in social sharing, effectively bridging the gap between physical LBE and the digital ecosystems of home gaming. This integration enhances customer stickiness and provides invaluable data on player preferences, enabling dynamic content updates and optimized machine placement strategies within venues.

Regional trends highlight the Asia Pacific (APAC) region as the dominant powerhouse, primarily fueled by massive consumer spending in countries like Japan, China, and South Korea, where arcade culture is deeply embedded and continues to receive significant technological investment. North America and Europe, while mature, are experiencing revitalization through the "barcade" phenomenon—combining classic arcade games with upscale food and beverage services—targeting the adult demographic and tapping into discretionary leisure spending. Emerging markets in Latin America and the Middle East are demonstrating high growth potential, driven by rapid urbanization and the establishment of large shopping mall complexes that incorporate FECs as key anchor tenants, necessitating the deployment of modern, high-throughput arcade equipment to cater to a young, tech-savvy population eager for novel entertainment forms.

Segmentation trends illustrate that the Video Games segment, particularly involving high-end simulation and competitive esports titles, maintains the largest market share, characterized by high production values and rapid refresh cycles. However, the Redemption Games segment, which includes prize-dispensing machines and coin pushers, demonstrates the most stable revenue streams due to its wide appeal across age groups and proven business model of maximizing average spend per visit. Furthermore, the Virtual Reality (VR) Arcade segment is registering the fastest growth, propelled by decreasing hardware costs, improving resolution, and the development of dedicated, multi-user VR experiences that cannot be replicated affordably at home. The market is increasingly polarizing between high-investment, cutting-edge technology platforms and reliable, high-yield classic or redemption machines, requiring operators to diversify their machine mix to optimize profitability and attract a broader customer base.

AI Impact Analysis on Arcade Gaming Market

User queries regarding AI's influence on the Arcade Gaming Market frequently center on concerns about machine maintenance predictability, the enhancement of game difficulty and personalization, and the use of AI in optimizing location profitability. Users are particularly keen to understand how AI can move beyond simple Non-Player Character (NPC) behavior to create dynamic, adaptive gameplay challenges that extend the replayability of expensive physical units. There is also significant interest in AI-driven operational intelligence, specifically the capability to predict machine failure before it occurs, ensuring maximum uptime, a critical factor for arcade operators where idle machines represent direct revenue loss. Additionally, users anticipate that AI will play a role in personalized marketing within FECs, recommending specific games or offers based on real-time player profile analysis, thereby maximizing consumer engagement and average revenue per user (ARPU).

The application of Artificial Intelligence within the arcade environment is transforming both the front-end player experience and the back-end management operations. On the consumer-facing side, advanced AI algorithms are being employed to dynamically adjust the difficulty level of modern arcade games, creating customized challenges that maintain player interest for longer periods, irrespective of skill level. This adaptive challenge generation prevents high-skill players from quickly mastering the game, while simultaneously ensuring novice players do not become frustrated immediately, thereby broadening the game's appeal and enhancing perceived value. Furthermore, AI contributes to more realistic and complex physical simulations in driving, flying, and sports games, utilizing predictive modeling to enhance collision detection, environmental physics, and opponent AI, leading to a much richer and more immersive experience that justifies the premium location-based pricing model.

Operationally, AI’s greatest impact is seen in predictive maintenance and optimized floor planning. Utilizing machine learning models trained on sensor data (temperature, coin drop rate, input sensitivity, motor stress), operators can accurately forecast hardware failures in high-traffic machines, allowing for proactive maintenance scheduling rather than reactive repairs. This shift minimizes downtime, which is crucial for profitability. Moreover, AI-powered spatial analytics analyze traffic flow, machine utilization rates, and demographic clusters within the venue, recommending optimal machine relocation or layout adjustments to maximize visibility and revenue generation across the entire floor. These tools provide operators with unprecedented levels of data-driven insight, transforming the traditional guesswork of arcade management into a precise, continuously optimized business model.

- AI-driven Adaptive Difficulty Scaling: Enhances replay value by dynamically adjusting game complexity based on player performance, sustaining engagement.

- Predictive Maintenance Analytics: Uses sensor data and machine learning to forecast equipment failure, dramatically reducing downtime and repair costs.

- Optimized Floor Layout: AI algorithms analyze player flow and machine usage data to recommend optimal placement for maximizing traffic and revenue per square foot.

- Personalized Player Recommendations: Utilizes real-time behavioral data to suggest games, promotions, or loyalty rewards to individual players, boosting ARPU.

- Advanced Simulation Realism: Improves physics and environmental responsiveness in simulation games, leading to a superior and more convincing experiential quality.

DRO & Impact Forces Of Arcade Gaming Market

The Arcade Gaming Market is fundamentally shaped by a confluence of driving factors, restrictive elements, and strategic opportunities that collectively dictate the trajectory of growth and profitability. Key drivers include the exponential expansion of Location-Based Entertainment (LBE) sectors globally, particularly in developing economies, coupled with significant technological leaps in display, motion, and virtual reality hardware, which consistently elevate the quality and uniqueness of the arcade offering beyond home console capabilities. The enduring appeal of shared, out-of-home social experiences, especially among younger demographics seeking alternatives to solitary digital consumption, serves as a crucial socio-cultural driver. These positive forces generate an upward momentum, justifying high capital expenditure in new machine development and venue refurbishment, ensuring the market remains vibrant and relevant in the broader entertainment ecosystem.

However, the market faces significant restraints, primarily centered around the high initial capital investment required for state-of-the-art arcade equipment, which carries substantial risk for independent operators and necessitates high utilization rates to achieve a viable return on investment (ROI). Furthermore, the pervasive competition from readily accessible, low-cost or free-to-play home console and mobile gaming platforms consistently draws consumer attention and leisure spending away from physical venues. The substantial physical footprint required for large-format arcade machines, especially high-end simulators, restricts growth in urban centers where real estate costs are prohibitive. These restraints challenge the profitability models, demanding greater operational efficiency, constant content refreshment, and highly sophisticated venue management to maintain competitiveness against highly capitalized digital entertainment giants.

Strategic opportunities exist predominantly in the targeted development of proprietary, high-fidelity content exclusive to the arcade environment, leveraging advanced VR and full-motion simulation that home systems cannot replicate. The increasing integration of esports infrastructure within LBE venues represents a massive growth avenue, transforming arcades into community hubs for competitive gaming, complete with prize pools and broadcasting capabilities. Furthermore, emerging business models focused on hybrid dining and entertainment concepts, such as "eatertainment," successfully draw older, higher-spending demographics. The ultimate impact force on the market is the consumer demand for novelty and immersion; successful operators who consistently refresh their machine lineup with cutting-edge, highly differentiated experiences—especially those integrating AI and networked competitive play—will capture the overwhelming majority of market share and demonstrate superior resilience against competing digital entertainment forms.

Segmentation Analysis

The Arcade Gaming Market is comprehensively segmented based on product type, end-user application, and geographical region, offering granular insights into specific revenue streams and growth drivers. Product segmentation is crucial, differentiating revenue generation between specialized hardware categories, such as high-cost video games, stable revenue-generating redemption machines, and technologically intensive simulation units. This analysis helps manufacturers prioritize R&D investment and guides operators in curating a profitable machine mix tailored to their target demographic, balancing the high-excitement draw of new video titles with the dependable revenue of prize-based games. The evolving role of technology means that segments are constantly being refined, with VR/AR machines increasingly classified separately due to their unique operational requirements and market trajectory.

Application segmentation primarily distinguishes between FECs (Family Entertainment Centers), dedicated arcades, movie theaters, and specialized location-based attractions like museums or theme parks. FECs remain the dominant application segment globally, driven by their integrated approach to family leisure that combines gaming with food and activities, maximizing dwell time and spend. However, the fastest growth is observed in specialized location-based attractions that utilize arcade technology to create unique, high-value, immersive experiences, often leveraging IP-based content. Understanding these applications is vital for distribution strategies, as the purchasing criteria, maintenance requirements, and content shelf-life differ significantly between a high-volume FEC operator and a premium, one-off theme park installation.

Geographical segmentation highlights disparities in consumer spending habits, content preferences, and regulatory environments, underscoring the non-uniform nature of the global market. While product segmentation provides an understanding of what is sold, and application segmentation clarifies where it is utilized, the regional analysis is critical for strategic market entry and localization efforts. The structure of this segmentation reveals that the future growth narrative will be driven less by volume of machine sales and more by the recurring revenue models associated with sophisticated networked games, content licensing, and subscription services aimed at maintaining the freshness of the experiential offering across all utilized segments.

- By Product Type:

- Video Games (Racing, Shooting, Fighting, Rhythm)

- Redemption Games (Prizes, Tickets, Vouchers)

- Simulation Games (Motion Platforms, VR/AR Environments)

- Pinball Machines

- Other Novelty and Merchandiser Machines

- By Application:

- Family Entertainment Centers (FECs)

- Dedicated Arcades

- Movie Theaters and Malls

- Bars and Restaurants (Barcades)

- Theme Parks and Specialized Location-Based Attractions

- By Technology:

- Traditional (Coin-Operated)

- Virtual Reality (VR)

- Augmented Reality (AR)

- Full Motion/Hydraulic Simulation

- Networked and Esports Ready Machines

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain)

- Asia Pacific (China, Japan, South Korea, India)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Arcade Gaming Market

The value chain for the Arcade Gaming Market is complex, beginning with upstream hardware and software component suppliers and culminating in the consumer experience at the downstream retail location. Upstream activities involve specialized manufacturing of high-durability components, including custom PCBs, industrial-grade display systems, motion actuators, and highly reliable input mechanisms (joysticks, buttons). Key players in this stage are semiconductor manufacturers, specialized display suppliers, and industrial designers who dictate the physical longevity and technological capability of the final machine. The high reliance on customized, heavy-duty components, necessary for sustained public use, means that procurement costs are significantly higher than those for consumer electronics, posing a continuous challenge in managing manufacturing expenses and ensuring component resilience.

Midstream activities encompass the actual development, integration, and assembly of the arcade cabinets. This stage involves game development studios creating unique software tailored for the specific physical interaction of the arcade platform, followed by integration by major manufacturers who assemble the components into the final product. Distribution channels play a critical role here, often involving specialized commercial distributors who manage logistics, import/export regulations, and financing solutions tailored for LBE operators. Direct channels are predominantly used by the largest manufacturers when dealing with global chains of FECs, ensuring consistent branding and volume pricing. Indirect channels involve regional distributors who provide crucial installation, localized maintenance, and often financing support to smaller, independent arcade operators, acting as the essential bridge between the manufacturer and the end-use location.

Downstream analysis focuses on the operation and consumer interaction, where the actual revenue is generated. This involves FEC operators, bar owners, and theme park management who purchase the equipment, manage the physical venue, handle customer services, and implement pricing strategies. Success at this stage relies heavily on maximizing machine uptime through diligent maintenance, optimizing the machine mix for maximum ARPU, and leveraging marketing to drive foot traffic. The inherent need for continuous content refreshment means that the relationship between the midstream content developers and downstream operators is critical; maintenance contracts, licensing agreements, and content update strategies form a continuous revenue loop. Ultimately, the efficiency of the entire chain hinges on the smooth operation of the specialized distribution channel which ensures reliable, high-performance equipment reaches the demanding public environment.

Arcade Gaming Market Potential Customers

Potential customers for the Arcade Gaming Market are primarily commercial entities categorized as Location-Based Entertainment (LBE) operators, rather than individual consumers. The core buyers are integrated Family Entertainment Centers (FECs) that rely on a diverse portfolio of arcade games—spanning high-payout redemption, kiddie rides, and major video titles—to anchor their entertainment offering. These large-scale operators, such as major chains and regional giants, demand highly durable, networked equipment with robust operational analytics and guaranteed service contracts, often procuring equipment in high volumes to maintain high floor refresh rates and maximize square footage utilization. Their primary objective is maximizing throughput and average spend per visitor, making reliable equipment and high-yield redemption mechanisms key purchasing criteria.

Secondary, yet rapidly growing, customer segments include specialty venues such as Barcades (bars/restaurants incorporating classic or modern arcade games), boutique cinema chains looking to enhance pre-show engagement, and resort/hotel operators seeking premium leisure amenities. Barcades, in particular, target the adult demographic with disposable income, often prioritizing nostalgic titles or sophisticated competitive games suitable for group play, where the machine acts as a social catalyst. These customers often require smaller, highly curated selections and favor machines with proven brand recognition that align with their venue's theme, prioritizing aesthetic appeal and social engagement over sheer volume of play, unlike large FECs.

Finally, there is a specialized segment of customers in institutional and corporate settings, including corporate training centers, interactive museum exhibits, and large theme parks. Theme parks demand hyper-customized, high-end simulation experiences—often exclusive IP content—that command very high purchase prices but are designed for multi-year installation cycles. Museums and corporate settings utilize arcade technology for gamified educational content or team-building exercises, focusing on interactive installations that prioritize engagement and novelty over traditional coin-drop revenue. These customers prioritize technological innovation, system reliability, and unique content exclusivity above all else, representing the pinnacle of high-margin, bespoke system sales within the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | CAGR 9.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sega Corporation, Namco Bandai Holdings Inc., Taito Corporation, Konami Holdings Corporation, Raw Thrills Inc., Stern Pinball Inc., Coastal Amusements Inc., Incredible Technologies, Global VR, Andamiro Co. Ltd., VRsenal, Adrenaline Amusements, Unis Technology Ltd., Betson Enterprises, ICE (Innovative Concepts in Entertainment) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Arcade Gaming Market Key Technology Landscape

The technological landscape of the Arcade Gaming Market is characterized by a rapid migration towards highly specialized, integrated hardware solutions that maximize immersion and player interactivity, often leveraging technologies that are computationally too intensive or physically too large for widespread home use. Central to this evolution is the deployment of advanced virtual reality (VR) and augmented reality (AR) systems, which move beyond tethered headsets into full-scale, location-based free-roam experiences using proprietary tracking systems and high-resolution commercial-grade displays. Full-motion hydraulic and electric simulation platforms are becoming standard for racing and flight titles, incorporating precise force feedback and haptic elements to create an unparalleled physical sensation. This reliance on high-spec, dedicated technology ensures that the value proposition of the arcade remains distinctly superior to consumer alternatives, justifying the continued investment in physical locations.

Another pivotal technological development involves sophisticated networking and cloud infrastructure supporting competitive and cooperative gameplay across multiple machines and even different physical locations. Modern arcade titles are increasingly designed with esports potential in mind, requiring low-latency network connections, integrated leaderboards, and user-profile management accessible via mobile applications. This networking capability is also vital for the operational intelligence platform, utilizing Internet of Things (IoT) sensors embedded within machines to monitor performance metrics such as coin drop counts, temperature fluctuations, motor stress, and software usage in real-time. This data feeds into AI-driven predictive maintenance systems, ensuring operational efficiency and minimizing revenue loss from machine downtime—a core technological requirement for large-scale FEC chains seeking streamlined asset management.

Furthermore, the shift toward cashless payment solutions and integrated loyalty programs represents a significant technological modernization. Utilizing near-field communication (NFC) cards, mobile wallets, and proprietary venue cards eliminates the friction associated with traditional coin operation, increasing average transaction value and improving overall operational efficiency by reducing the need for cash handling and change management. Display technology continues to evolve rapidly, with high refresh rate, large-format 4K and Micro-LED displays becoming prevalent, maximizing visual impact and consumer draw. The synthesis of high-end graphics, responsive physical simulation, and pervasive operational analytics is defining the current technological competitive edge, making hardware durability and proprietary content licensing the most valuable assets within the modern arcade technology landscape.

Regional Highlights

The Arcade Gaming Market exhibits distinct regional dynamics, with Asia Pacific (APAC) maintaining its position as the undisputed global leader in terms of market size, technological adoption, and cultural acceptance. Countries like Japan and South Korea have a highly mature and historically significant arcade culture, which continues to drive innovation in rhythm games, competitive fighting games, and sophisticated multi-player titles. China represents the most aggressive growth engine, fueled by massive urbanization, rising disposable incomes, and widespread development of large, modern shopping malls that incorporate state-of-the-art FECs. APAC operators are highly focused on content exclusivity and rapid machine turnover, ensuring they always offer the latest experiences, frequently integrating localized content and mobile interoperability features to cater to their highly digitized consumer base.

North America and Europe constitute mature markets that have shifted focus from traditional street arcades to large, consolidated Family Entertainment Centers (FECs) and the burgeoning "eatertainment" sector. North America, driven largely by the U.S. market, sees high demand for large-format redemption games and licensed IP-based video simulators. The revitalization efforts in these regions often involve creating hybrid concepts—like the Barcade model—which successfully attract older consumers seeking nostalgic entertainment paired with premium dining and drinking options. European markets, particularly the UK and Germany, show strong interest in competitive esports-ready platforms and unique VR experiences, adapting arcade technology into sophisticated social destinations that move beyond simple gaming into full-fledged leisure activities.

Latin America and the Middle East & Africa (MEA) regions present significant future growth opportunities, characterized by rapidly expanding urban middle classes and high rates of youth population growth. The Middle East, particularly the GCC nations, is investing heavily in large-scale luxury retail and tourism infrastructure, necessitating the inclusion of high-end, technologically advanced entertainment venues within mega-malls and resorts. Demand here favors premium, large-footprint simulation and VR installations that match the luxurious aesthetic of the venues. Latin America’s growth is more fragmented but is accelerating as local entrepreneurs establish modern FECs in major metropolitan hubs, capitalizing on the high demand for accessible, shared leisure experiences, often prioritizing redemption games due to their stable revenue yield and broad family appeal.

- Asia Pacific (APAC): Dominant market share; driven by cultural acceptance, massive urbanization (China), and technological leadership (Japan/South Korea) in rhythm and competitive games.

- North America: Strong market revival fueled by FEC consolidation, high demand for licensed IP games, and the proliferation of "Barcades" targeting the adult demographic.

- Europe: Focus on premium, social gaming experiences; high adoption rates for advanced VR LBE systems and integrated esports platforms within leisure centers.

- Middle East & Africa (MEA): High growth potential driven by government investment in tourism and leisure infrastructure, prioritizing high-end, luxury VR and simulation installations in mega-malls.

- Latin America (LATAM): Emerging growth market; high demand for family-oriented FECs and redemption games; accelerated adoption in major urban centers like São Paulo and Mexico City.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Arcade Gaming Market.- Sega Corporation

- Namco Bandai Holdings Inc.

- Taito Corporation

- Konami Holdings Corporation

- Raw Thrills Inc.

- Stern Pinball Inc.

- Coastal Amusements Inc.

- Incredible Technologies

- Global VR

- Andamiro Co. Ltd.

- VRsenal

- Adrenaline Amusements

- Unis Technology Ltd.

- Betson Enterprises

- ICE (Innovative Concepts in Entertainment)

- Tsunami Visual Technologies

- Triotech Amusement

- Wahlap Technology

- LAI Games

- Fun Industries

Frequently Asked Questions

Analyze common user questions about the Arcade Gaming market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the renewed growth in the Arcade Gaming Market?

Renewed growth is primarily driven by the expansion of Location-Based Entertainment (LBE) venues, particularly large Family Entertainment Centers (FECs), coupled with significant technological advancements in Virtual Reality (VR), full-motion simulation, and networked competitive gaming which offer experiences unattainable in home settings. Nostalgia among adult consumers also plays a major role.

How is Virtual Reality impacting the profitability of arcades?

VR significantly boosts arcade profitability by offering unique, high-value, multi-user free-roam experiences that command premium pricing per play. VR units maximize floor space utilization and draw tech-savvy consumers, providing a differentiated offering that justifies the high capital investment required for dedicated VR equipment.

Which segment holds the largest market share in terms of product type?

The Video Games segment historically holds the largest market share, driven by a continuous cycle of new high-fidelity titles. However, Redemption Games are crucial for stable, recurring revenue, attracting families and maximizing average revenue per user (ARPU) through prize mechanisms.

What is the role of AI in arcade management and maintenance?

AI is transforming operational efficiency by enabling predictive maintenance. Machine learning algorithms analyze IoT sensor data from equipment to forecast potential hardware failures, allowing operators to schedule proactive repairs and dramatically minimize machine downtime, thereby maximizing revenue uptime.

Why is the Asia Pacific (APAC) region dominant in the global arcade market?

APAC dominance stems from a deeply ingrained cultural acceptance of arcade gaming (especially in Japan and South Korea), significant urbanization, and continuous high-volume investment in state-of-the-art FECs in countries like China, resulting in rapid technology adoption and high consumer spending on location-based entertainment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager