Architecture Glass Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443026 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Architecture Glass Market Size

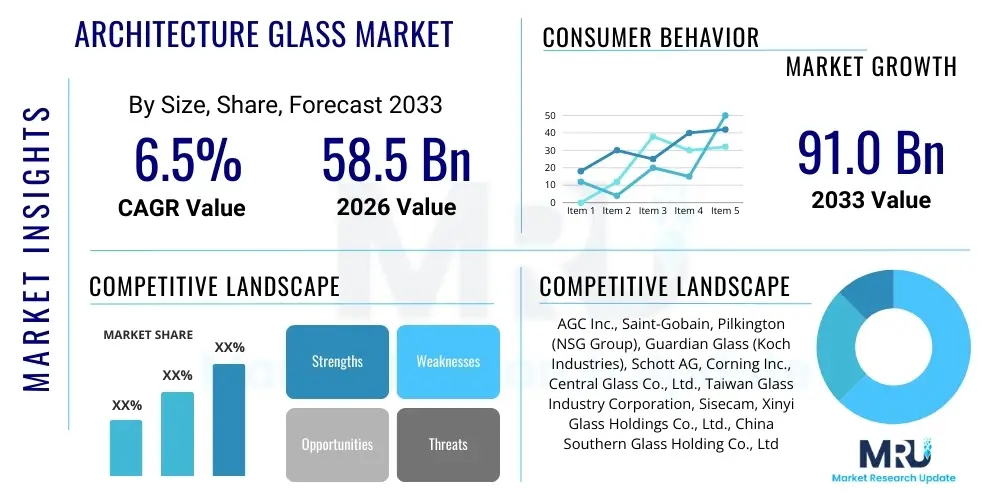

The Architecture Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 58.5 Billion in 2026 and is projected to reach USD 91.0 Billion by the end of the forecast period in 2033.

Architecture Glass Market introduction

Architecture glass, integral to modern construction and design, encompasses a diverse range of specialized glass products engineered for structural integrity, aesthetic appeal, and enhanced functionality in buildings. These products include standard float glass, laminated glass, tempered glass, insulated glass units (IGUs), and high-performance variants such as low-emissivity (Low-E) glass and smart glass. The primary applications span commercial, residential, and industrial sectors, utilized extensively in facades, windows, doors, skylights, interior partitions, and structural glazing systems. Key benefits derived from modern architectural glass include superior thermal insulation, acoustic dampening, increased natural light penetration, UV protection, and improved security and safety through shatter resistance.

The core driving factors propelling this market growth are stringent governmental regulations mandating energy efficiency in new construction, the global shift towards green building standards (such as LEED and BREEAM certifications), and rapid urbanization, particularly in emerging economies. Furthermore, technological advancements have introduced innovative glass products that dynamically adapt to environmental changes, such as electrochromic or photovoltaic glass, enhancing building sustainability and operational performance. The increasing demand for aesthetically pleasing and structurally ambitious designs, often requiring large format and complex curved glass structures, further solidifies the market trajectory.

The market environment is highly competitive, characterized by continuous innovation focused on integrating digital technologies and sustainable materials. Manufacturers are prioritizing research into coatings that minimize solar heat gain while maximizing visible light transmission, thereby reducing reliance on artificial cooling and lighting systems. The long-term success of stakeholders hinges on their ability to offer customizable, multifunctional glass solutions that address contemporary architectural challenges related to extreme weather conditions, urban noise pollution, and the imperative for zero-energy buildings.

Architecture Glass Market Executive Summary

The Architecture Glass Market is poised for substantial growth, primarily fueled by global construction buoyancy and the imperative for sustainable infrastructure development. Business trends indicate a robust shift towards value-added products, particularly smart glass technologies and highly efficient insulated glazing units (IGUs), moving away from commodity flat glass. Key industry players are consolidating their positions through vertical integration and strategic partnerships to secure supply chains for specialized coatings and raw materials. Furthermore, the market is experiencing significant disruption from prefabricated construction methodologies, where pre-glazed modules streamline installation and reduce overall project timelines, enhancing profitability and market penetration for manufacturers capable of large-scale, customized production.

Regionally, Asia Pacific (APAC) stands as the fastest-growing market, driven by massive infrastructure investments in China, India, and Southeast Asian nations, coupled with stringent new building codes promoting energy conservation. North America and Europe, while mature, exhibit high adoption rates for premium, high-performance glass products, sustained by renovation projects and regulatory pressure to meet Net-Zero building targets. Trends across these developed markets emphasize aesthetic integration, demanding minimal framing and maximum transparency, which necessitates advancements in structural glass integrity and specialized mounting hardware. The Middle East and Africa (MEA) region shows strong potential due to ambitious mega-projects focusing on futuristic, energy-efficient designs to combat high solar irradiance.

In terms of segmentation, the Low-E Glass segment dominates the product type category due to its pervasive application in energy-saving envelopes, while the Commercial application segment retains the largest market share, driven by office buildings, institutional structures, and retail complexes. Emerging segments, such as self-cleaning and dynamic shading glass, present significant future growth opportunities. Investment trends confirm a focus on automating production processes to reduce manufacturing defects and environmental footprint, alongside rigorous quality assurance measures to meet diverse international building standards (e.g., European standards EN, North American ASTM). The overall market landscape suggests sustained expansion centered on sustainability, customization, and technological integration.

AI Impact Analysis on Architecture Glass Market

User queries regarding the impact of Artificial Intelligence (AI) on the Architecture Glass Market commonly center on efficiency gains in manufacturing, optimization of complex building designs, predictive maintenance of smart glass systems, and enhancing sustainability analysis. Users frequently ask: "How can AI optimize the Low-E coating process?" "Will AI design tools replace traditional façade engineers?" and "What role does machine learning play in predicting glass failure or maintenance needs?" The core themes revolve around using AI to manage the complexity inherent in high-performance glass production and integrating AI-driven insights into the architectural design phase to ensure optimal energy performance and structural integrity. There is a clear expectation that AI will transition architectural glass from a static component to a dynamic, responsive part of the building ecosystem, driving cost reduction and environmental performance simultaneously.

In manufacturing, AI and machine learning algorithms are revolutionizing the float glass process. These technologies analyze vast datasets from sensors tracking temperature, stress, and chemical composition, allowing for real-time adjustments to ensure uniformity and reduce defects in high-tolerance coatings like thin-film Low-E layers. This precision significantly lowers material waste and energy consumption during production. Furthermore, AI-powered computer vision systems are being implemented for automated quality control, identifying micro-fractures or imperfections at speeds unattainable by human inspectors, thereby elevating the overall quality and reliability of architectural glass products destined for demanding structural applications.

In the application phase, AI dramatically enhances architectural design and building operations. Generative design tools use AI to simulate millions of façade designs, evaluating factors like daylighting, solar heat gain, wind load, and material stresses simultaneously, optimizing glass specifications for specific geographical locations and climates far beyond traditional simulation software capabilities. For smart glass installations (e.g., electrochromic), predictive maintenance models driven by AI monitor electrical performance and usage patterns to anticipate failures, ensuring uninterrupted functionality and maximizing the life cycle of the dynamic glazing system. This integration allows for truly responsive building envelopes that autonomously adjust light and heat transmission based on occupancy and real-time environmental data.

- AI optimizes float glass production parameters, reducing energy use and material waste.

- Machine learning enhances quality control through automated defect detection in specialized coatings and lamination processes.

- Generative design tools use AI to optimize façade geometry and glass specifications for maximum energy efficiency.

- Predictive maintenance algorithms monitor smart glass systems (electrochromic, PDLC) to forecast necessary repairs and service.

- AI-driven simulation aids in complex structural glazing analysis, ensuring compliance with stringent safety and wind-load standards.

- AI enables personalized thermal comfort control by integrating glass performance data with occupant preferences.

DRO & Impact Forces Of Architecture Glass Market

The Architecture Glass Market is driven by the global pursuit of energy efficiency, accelerated urbanization leading to high-rise construction, and ongoing innovation in smart glazing technologies. Restraints include the high initial cost associated with specialized glass products (like triple glazing or integrated PV glass), supply chain volatility for essential raw materials (such as soda ash and silica), and the complexity of installation and maintenance for advanced façade systems. Opportunities abound in emerging markets focused on rapid infrastructure development, the growing demand for retrofit solutions in older buildings to meet modern energy standards, and the expansion of nanotechnology to create next-generation coatings with superior properties. These forces collectively exert a significant impact, pushing the market toward specialized, high-value glass solutions despite cost barriers.

Drivers: The most significant driver is the increasing regulatory stringency worldwide concerning carbon emissions from the built environment. Governments are implementing mandatory energy performance certificates and green building standards, making high-performance glass (Low-E, insulated) a necessity rather than a luxury. Furthermore, consumer preference has shifted towards interiors with enhanced natural light and expansive views, fueling the demand for large-format structural glazing. Rapid technological cycles, introducing products like vacuum insulated glass (VIG) and dynamic shading solutions, continually refresh the market and create demand for upgraded installations.

Restraints: Capital expenditure remains a major restraint, particularly in cost-sensitive developing markets, where standard float glass is often preferred over expensive alternatives like electrochromic or laminated security glass. The inherent weight and vulnerability of glass necessitate complex logistics and careful handling, increasing project risk and insurance costs. Moreover, the shortage of skilled labor proficient in installing complex curtain wall and structural glazing systems acts as a bottleneck, particularly for highly customized, large-scale architectural projects. The energy-intensive nature of glass manufacturing also presents a long-term environmental challenge that requires continuous innovation to address.

Opportunities and Impact Forces: Significant opportunities exist in the retrofitting sector, as millions of existing commercial buildings require upgrades to meet contemporary thermal performance standards. The confluence of digitization (BIM, digital twins) with glass manufacturing processes presents an opportunity for highly customized, error-free production. Impact forces, such as climate change and demographic shifts towards dense urban living, are intensifying the need for thermally robust, acoustically insulated, and resilient façade materials, making performance characteristics the dominant purchasing criteria over simple cost considerations. This robust combination of mandatory regulatory pull and technological push will sustain high growth in premium segments.

- Drivers: Stringent energy efficiency regulations, increasing demand for structural and aesthetic glazing, urbanization growth, and technological advancements in coatings.

- Restraints: High capital expenditure for specialized glass, complexity in handling and installation, supply chain reliance on energy-intensive production, and fluctuating raw material prices.

- Opportunities: Large-scale building retrofit programs, expansion into smart/dynamic glazing systems, growth in Vacuum Insulated Glass (VIG) technology, and customization driven by BIM integration.

- Impact Forces: Regulatory push (environmental mandates), technological pull (smart features), socio-economic changes (urban density), and safety concerns (security and fire rating requirements).

Segmentation Analysis

The Architecture Glass Market is meticulously segmented based on product type, function, material, and application, enabling a granular understanding of market dynamics and regional preferences. Product segmentation includes traditional float glass, tempered, laminated, insulated glass units (IGU), and specialty products such as Low-E, reflective, and electrochromic glass. Functional segmentation delineates between safety (security and fire-rated), solar control (thermal), and acoustic glass. Application segmentation, which accounts for the largest revenue share, divides the market into commercial, residential, and industrial construction sectors, each having distinct performance requirements related to thermal insulation, light transmission, and safety standards. This detailed segmentation highlights the trend toward multi-functional, composite glass solutions that address complex requirements within a single installation.

The analysis of these segments reveals that Insulated Glass Units (IGUs) and Low-E Glass dominate in volume due to their direct impact on energy performance, making them standard components in most new constructions in developed economies. However, high growth rates are anticipated in the functional segments, particularly for fire-rated and security laminated glass, driven by heightened public safety concerns and stricter building codes for public infrastructure and high-rise commercial structures. Geographically, segmentation analysis demonstrates a clear bifurcation: mature markets prioritize smart and aesthetic value-added glass, while developing markets focus on affordable IGUs and safety glass to meet rapidly expanding construction volumes.

Market stakeholders continually use this segmentation data to tailor their product portfolios. For instance, companies focusing on the residential sector emphasize aesthetic properties, noise reduction, and affordability, while those targeting high-end commercial applications prioritize advanced thermal performance, large-format custom shapes, and integration with building management systems (BMS). The integration of nanotechnology into functional coatings is blurring the lines between traditional glass types, creating new sub-segments like self-cleaning glass and integrated photovoltaic glass (BIPV), signaling a future market defined by highly customized, performance-driven products.

- Product Type:

- Float Glass

- Laminated Glass

- Tempered Glass

- Insulated Glass Units (IGU)

- Low-E Glass

- Specialty Glass (Self-Cleaning, Electrochromic)

- Function:

- Safety and Security Glass

- Solar Control Glass

- Acoustic/Noise Reduction Glass

- Decorative/Aesthetic Glass

- Application:

- Commercial (Offices, Retail, Institutional)

- Residential (Single-Family, Multi-Family)

- Industrial

- Raw Material:

- Soda-Lime-Silica Glass

- Laminating Interlayers (PVB, SGP)

- Coatings (Metallic Oxide, Ceramic)

Value Chain Analysis For Architecture Glass Market

The value chain for the Architecture Glass Market is complex, beginning with energy-intensive upstream raw material extraction and processing and extending through highly specialized midstream manufacturing and downstream distribution to complex installation. Upstream involves the mining and processing of essential components like silica sand, soda ash, and dolomite, followed by the high-temperature melting process in float glass plants. Efficiency and sustainability at this stage are crucial, given the massive energy requirement for glass production. Midstream is characterized by secondary processing, including cutting, tempering, laminating, coating (e.g., Low-E application), and assembly into specialized products like IGUs or smart glass modules. This stage is highly technologically driven, relying on advanced machinery for precision.

Downstream analysis focuses on logistics, distribution, and project installation. Distribution channels are bifurcated into direct sales to large construction developers or façade specialists and indirect sales through specialized distributors and regional retailers for smaller residential or renovation projects. Due to the fragility and custom dimensions of architectural glass, logistics management, including specialized transport and handling, is a critical component of the downstream segment. The installation phase, often involving highly skilled contractors for structural glazing and curtain wall systems, represents a significant value-add, as the performance of the glass is heavily reliant on correct mounting and sealing.

The integration between raw material suppliers, glass processors, and end-user architects is becoming increasingly seamless, facilitated by Building Information Modeling (BIM) tools. Direct channels are preferred for high-value, large commercial projects where specifications are highly customized, ensuring direct communication regarding tolerances and performance requirements. Indirect channels, while offering broader reach, necessitate rigorous inventory management for standard glass types. Controlling the cost and environmental footprint of the upstream segment, while maximizing efficiency and complexity in the midstream processing, defines the competitive advantage for major industry players.

Architecture Glass Market Potential Customers

The primary customers for architectural glass products are stratified across various sectors, dominated by large-scale construction developers and specialized façade engineering companies undertaking commercial and public projects. These customers require high volumes of customized, high-performance glass meeting stringent regulatory standards for structural integrity, fire safety, and energy efficiency. Architects and consultants significantly influence purchasing decisions by specifying the type, coating, and overall system design of the glass façade, making them crucial indirect buyers whose preferences shape market demand for innovative products like switchable privacy glass or solar control coatings.

Another major customer base includes residential developers and individual homeowners. While residential projects typically utilize smaller volumes per installation, the aggregate demand is substantial, particularly for energy-efficient insulated glass units and safety laminated glass in high-end housing. This segment is highly sensitive to aesthetic appeal, noise reduction capabilities, and overall cost-effectiveness. Furthermore, government agencies and municipal bodies procuring glass for public infrastructure, hospitals, schools, and transport hubs represent a stable customer segment, emphasizing durability, security features, and compliance with public accessibility and safety codes.

Finally, the growing retrofitting and renovation sector constitutes a rapidly expanding customer group. These customers, often building owners or facility managers, seek to replace older, inefficient single or double glazing with modern, high-performance IGUs or smart window solutions to lower operational energy costs and improve tenant comfort. Their purchasing decisions are primarily driven by Return on Investment (ROI) calculations based on projected energy savings and compliance with evolving governmental mandates concerning building performance upgrades. Manufacturers must offer comprehensive lifecycle cost analyses to penetrate this critical market segment effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 58.5 Billion |

| Market Forecast in 2033 | USD 91.0 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGC Inc., Saint-Gobain, Pilkington (NSG Group), Guardian Glass (Koch Industries), Schott AG, Corning Inc., Central Glass Co., Ltd., Taiwan Glass Industry Corporation, Sisecam, Xinyi Glass Holdings Co., Ltd., China Southern Glass Holding Co., Ltd., Viracon (Apogee Enterprises), Asahi India Glass Limited, Euroglas GmbH, Kibing Group, Jinjing Group, Fuyao Glass Industry Group Co., Ltd., CSG Holding Co., Ltd., Trulite Glass and Aluminum Solutions, Vetrotech Saint-Gobain. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Architecture Glass Market Key Technology Landscape

The technological landscape of the Architecture Glass Market is rapidly evolving, moving far beyond basic tempering and lamination towards highly specialized surface treatments and integrated functionalities. A key area of innovation is the development of advanced coatings, most notably Low-Emissivity (Low-E) coatings, applied via magnetron sputtering vacuum deposition (MSVD) or pyrolytic processes. These coatings selectively reflect infrared radiation while allowing visible light to pass through, significantly enhancing thermal performance. Continuous research focuses on multi-layer coatings that offer solar control during summer and thermal retention during winter, maximizing energy savings year-round. This technological advancement is central to meeting rigorous green building standards globally.

Another crucial technological development involves dynamic glazing systems, including electrochromic, thermochromic, and liquid crystal (PDLC) switchable glass. Electrochromic technology allows users or automated building management systems to control the tint and light transmission characteristics of the glass electronically, optimizing daylighting and minimizing glare without the need for physical blinds. While these technologies involve higher initial costs, their ability to drastically reduce heating, ventilation, and air conditioning (HVAC) loads justifies the investment in high-performance commercial and institutional buildings. Furthermore, the integration of Building Integrated Photovoltaics (BIPV) into glass façades represents a vital step towards creating truly energy-positive buildings, where the glass not only controls temperature but also generates electricity.

Structural glass technology has also seen massive progress, driven by the demand for aesthetically minimalist and transparent building envelopes. This involves the use of specialized, high-strength interlayers (such as SentryGlas Plus – SGP) in laminated glass, allowing for significantly increased spans and minimal structural support elements, enabling expansive, floor-to-ceiling glass walls. Advances in automated glass cutting, bending, and shaping equipment, often guided by high-precision robotics, facilitate the creation of complex three-dimensional curved glass panels for iconic architectural designs, which were previously impractical or prohibitively expensive to manufacture. These precision manufacturing capabilities are fundamentally changing the potential scope of modern architecture.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the largest and fastest-growing market for architectural glass, primarily driven by unprecedented urban development and infrastructure expansion across China, India, and ASEAN nations. Government initiatives focusing on affordable housing and the rapid construction of high-rise commercial centers necessitate vast volumes of safety and energy-efficient glass. The adoption rate of basic IGUs is accelerating, transitioning from single-pane towards more energy-compliant double and triple glazing, often driven by new national energy codes. Key market drivers in this region include population density necessitating vertical growth and significant investment in public infrastructure projects (airports, metros, smart cities).

- North America: North America represents a mature, high-value market characterized by high demand for sophisticated and specialized glass products. The market is primarily sustained by the renovation and retrofit segment, driven by strict mandates like Title 24 in California and similar regional building energy efficiency codes, which necessitate upgrades to existing commercial structures. There is a strong uptake of smart glass (electrochromic and dimmable) and high-security laminated glass, especially in government, corporate headquarters, and high-end residential sectors. Focus remains heavily on achieving Net-Zero or near-Net-Zero energy targets, making premium, vacuum-insulated glass (VIG) a growing niche.

- Europe: Europe is a leader in adopting sustainable and innovative architectural glass solutions, propelled by the European Union’s Energy Performance of Buildings Directive (EPBD) and aggressive climate neutrality goals. This has made triple glazing the standard in many Nordic and central European countries. The market exhibits high demand for advanced acoustic insulation glass, driven by dense urban living and noise pollution concerns. Furthermore, the aesthetic preference for highly transparent, frameless façade solutions fuels the need for high-strength, low-iron structural glass and specialized interlayers. R&D is heavily supported to integrate BIPV technology into traditional building materials.

- Latin America (LATAM): The LATAM market is experiencing steady growth, highly influenced by construction booms in metropolitan areas like São Paulo, Mexico City, and Santiago. Demand is concentrated in the commercial and upper-middle-class residential sectors. While cost sensitivity is higher compared to North America and Europe, there is increasing regulatory pressure for basic energy efficiency, driving the uptake of tempered and laminated safety glass, particularly due to seismic activity concerns in certain areas. Market penetration for advanced Low-E coatings is growing but remains focused on premium commercial developments and high-tourist zones.

- Middle East and Africa (MEA): The MEA region is characterized by high demand for solar control glass necessary to mitigate extreme desert climates. Major mega-projects in the GCC nations (Saudi Arabia, UAE) are driving intense demand for highly reflective, heavily coated glass and complex, large-format custom designs. The focus here is less on insulation for heating and more on blocking solar heat gain (high Shading Coefficient). Investment in glass manufacturing capabilities within the region is growing to reduce import reliance, supported by strong governmental funding for sustainable and futuristic construction initiatives like NEOM. Security glazing is also a significant segment due to high-value infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Architecture Glass Market.- AGC Inc.

- Saint-Gobain

- Pilkington (NSG Group)

- Guardian Glass (Koch Industries)

- Schott AG

- Corning Inc.

- Central Glass Co., Ltd.

- Taiwan Glass Industry Corporation

- Sisecam

- Xinyi Glass Holdings Co., Ltd.

- China Southern Glass Holding Co., Ltd.

- Viracon (Apogee Enterprises)

- Asahi India Glass Limited

- Euroglas GmbH

- Kibing Group

- Jinjing Group

- Fuyao Glass Industry Group Co., Ltd.

- CSG Holding Co., Ltd.

- Trulite Glass and Aluminum Solutions

- Vetrotech Saint-Gobain

Frequently Asked Questions

Analyze common user questions about the Architecture Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Architecture Glass Market?

The most significant driver is the enforcement of global energy efficiency and green building regulations, such as LEED and governmental mandates, which require high-performance glazing solutions like Low-E glass and Insulated Glass Units (IGUs) to minimize building energy consumption and carbon footprint.

What are the main differences between Low-E glass and standard insulated glass units (IGU)?

An IGU is a unit comprising two or more glass panes separated by a gas-filled space, primarily for insulation. Low-E glass is an IGU pane that features a microscopic metallic oxide coating to reflect infrared heat energy, dramatically improving thermal performance and solar control beyond that of a standard IGU.

How is smart glass technology impacting modern building design and operational costs?

Smart glass, such as electrochromic glazing, allows for dynamic control over light transmission and heat gain, reducing the reliance on artificial lighting and HVAC systems. This dynamic control enhances occupant comfort while significantly lowering the overall operational energy costs and complexity of façade management.

Which geographical region exhibits the highest growth potential for architectural glass?

Asia Pacific (APAC) shows the highest growth potential, fueled by massive government investment in infrastructure, rapid urbanization, and a large volume of new commercial and residential construction projects across emerging economies like China, India, and Southeast Asia.

What challenges restrain the widespread adoption of advanced architectural glass products?

The primary restraints include the substantially higher initial manufacturing and installation costs associated with specialty products (e.g., dynamic glazing, triple VIG), supply chain volatility for key raw materials, and the need for specialized, highly skilled labor for complex structural façade systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager