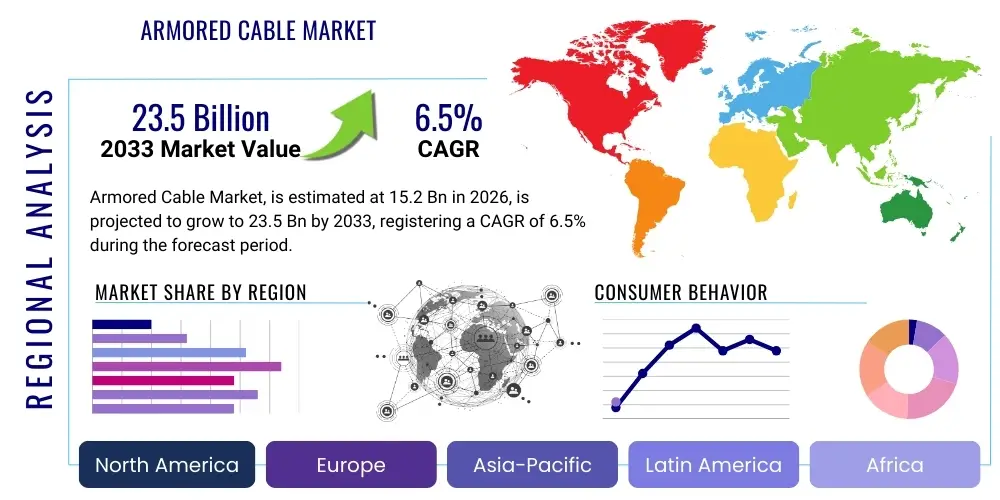

Armored Cable Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443113 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Armored Cable Market Size

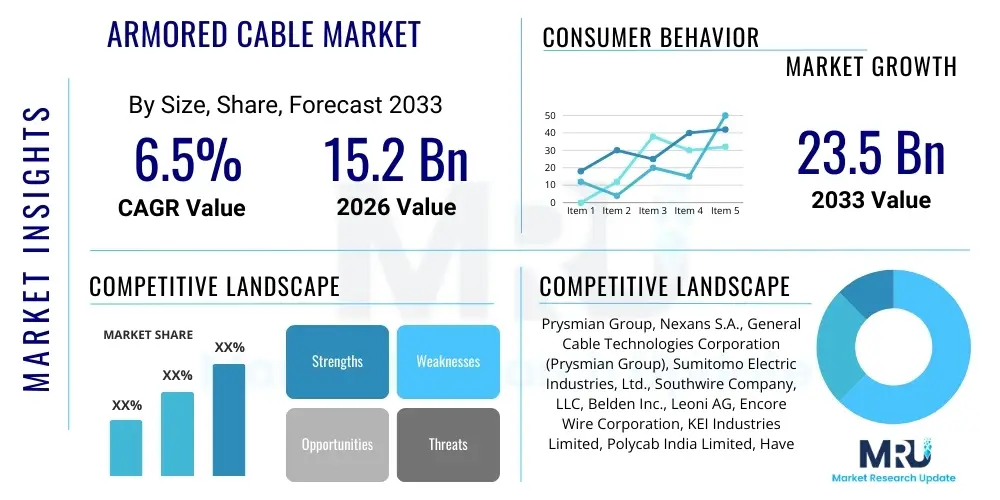

The Armored Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 23.5 Billion by the end of the forecast period in 2033.

Armored Cable Market introduction

Armored cables, defined by their integral protective layer, are indispensable components in robust electrical installations requiring enhanced mechanical protection against crushing, impact, and tensile stress. These cables typically feature steel tape armor (STA), steel wire armor (SWA), or interlocking aluminum armor, shielding the underlying conductors and insulation layers from environmental and operational hazards. This structural resilience ensures continuous power transmission and data integrity in harsh conditions, making them critical for high-reliability applications where traditional non-armored cables would fail due to physical damage.

The core applications of armored cables span across utility infrastructure, heavy industrial settings, commercial construction, and military installations. In the utility sector, they are extensively used for underground and subsea power transmission. Industrially, they are vital in petrochemical plants, mining operations, and manufacturing facilities where abrasion and chemical exposure are high risks. Key benefits driving their adoption include superior durability, enhanced safety features like resistance to rodent damage, and compliance with stringent international safety codes (e.g., NEC, IEC). The principal factor fueling market growth is the global acceleration of infrastructure development, especially large-scale power grid modernization and the expansion of renewable energy projects requiring reliable, long-distance cabling.

Armored Cable Market Executive Summary

The Armored Cable Market is characterized by robust growth driven by escalating urbanization and substantial investment in critical infrastructure globally. Business trends highlight a strong focus on developing lightweight, flexible, and fire-resistant armored cables, particularly those employing interlocked aluminum armor (AIA) for easier installation and reduced material costs in commercial buildings. Furthermore, heightened scrutiny on industrial safety and regulatory mandates for hazard-prone environments are compelling end-users in the oil & gas and mining sectors to upgrade to higher voltage and specialized protective armored systems, driving demand for premium products and custom engineered solutions.

Regional trends indicate that the Asia Pacific (APAC) region is poised to maintain market dominance, primarily due to massive ongoing infrastructure expansion in China, India, and Southeast Asia, encompassing smart city projects and nationwide grid expansion initiatives. North America and Europe, while mature, exhibit steady growth fueled by the replacement of aging infrastructure (rehabilitation projects) and the proliferation of data centers and renewable energy integration projects (solar farms, offshore wind), which necessitate high-reliability, medium-voltage armored connections. Segment trends reveal that the medium voltage (1kV to 35kV) category is experiencing the fastest uptake, largely attributed to increased power distribution network complexity and the need for efficient power transmission over longer distances in industrial parks and large commercial complexes.

AI Impact Analysis on Armored Cable Market

User inquiries regarding AI's influence on the Armored Cable Market generally center on optimizing manufacturing processes, predicting cable failures, and automating complex installation procedures. Key themes include the integration of machine learning (ML) for predictive maintenance to extend cable lifespan and reduce costly downtime, the use of AI vision systems for quality control in the armor layering process, and the development of intelligent supply chain systems to manage volatile raw material costs (copper, steel, aluminum). Concerns often revolve around the initial capital investment required for AI implementation in traditional cable manufacturing facilities and the need for skilled labor capable of managing these sophisticated systems.

AI is expected to drive substantial shifts in operational efficiency rather than radically altering the core product. Specifically, AI-driven digital twins and simulation environments are increasingly being used in the design phase to optimize armor geometry for specific stress tolerances, leading to lighter yet stronger cables. Furthermore, on the demand side, AI integrated into smart grids is creating a need for 'smarter' armored cables equipped with embedded sensors for real-time diagnostics, condition monitoring, and proactive fault detection, ensuring unparalleled network resilience crucial for highly automated utility operations. This shift elevates the cable from a passive component to an active data source within the electrical ecosystem.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data (temperature, vibration, partial discharge) to predict failure points in installed armored cables, minimizing unscheduled outages in critical infrastructure.

- Optimized Manufacturing Quality: Machine vision and ML models detect minute defects during the armor application process, ensuring consistent quality and reducing scrap rates.

- Intelligent Supply Chain Management: AI predicts fluctuations in commodity prices (copper, aluminum), enabling manufacturers to optimize procurement strategies for raw materials.

- Automated Inventory and Logistics: Robotic systems guided by AI streamline the handling and custom cutting of heavy armored cable drums in distribution centers, improving efficiency.

- Smart Grid Integration: AI-enabled control systems demand cables with specialized low-latency communication capabilities, potentially leading to armored cables with integrated fiber optics or smart sensor arrays.

DRO & Impact Forces Of Armored Cable Market

The dynamics of the Armored Cable Market are shaped by a complex interplay of global infrastructure growth, stringent safety regulations, and fluctuating raw material costs. Drivers primarily revolve around accelerated infrastructure spending in emerging economies and the imperative for grid hardening and resilience against extreme weather events. Restraints often include the significant initial capital expenditure required for high-voltage armored cable projects and the inherent difficulty associated with installation, maintenance, and repair compared to non-armored alternatives. Opportunities arise from technological advancements, such as the development of lightweight materials and specialized armoring techniques for renewable energy installations (e.g., offshore wind farms), alongside the growing trend towards incorporating fiber optic elements within armored structures for integrated power and data transmission.

Impact forces currently prioritize market demand stemming from industrialization and power sector expansion. The rapid pace of global urbanization is consistently generating demand for reliable power distribution networks, particularly underground systems that rely heavily on armored cables for safety and longevity in dense metropolitan areas. Concurrently, the increasing regulatory requirement across various jurisdictions for fire safety and mechanical protection in public buildings and critical infrastructure is acting as a powerful pull factor, ensuring continuous adherence to high-quality armored cable standards, thereby limiting the entry of low-quality alternatives.

However, the market remains highly sensitive to volatility in commodity markets, particularly copper and aluminum prices. Since armored cables require substantial metal content, sudden price spikes can compress manufacturer margins and necessitate complex contractual adjustments with long-term infrastructure project buyers. Successful market navigation hinges on manufacturers’ ability to manage these input costs through efficient procurement, while simultaneously innovating to reduce material consumption through superior design, thereby mitigating the impact of these fluctuating economic forces on the final product price and market accessibility.

- Drivers: Global infrastructure modernization, proliferation of data centers, stringent industrial safety regulations, expansion of renewable energy capacity (wind/solar).

- Restraints: High volatility of raw material prices (copper, aluminum), complexities and costs associated with installation and repair of heavy cables, stringent environmental requirements for cable disposal.

- Opportunity: Integration of fiber optics for hybrid cables, demand for specialized cables in extreme environments (e.g., deep-sea, high-temperature), technological advancements in lightweight armoring materials.

- Impact forces: Urbanization rate (High positive), Commodity price fluctuation (High negative), Regulatory adherence (Medium positive).

Segmentation Analysis

The Armored Cable Market is extensively segmented based on the critical characteristics that dictate product use and performance across various end-user environments. Primary segmentation categories include Armor Type (Steel Wire Armor, Steel Tape Armor, Interlocked Aluminum), Voltage Rating (Low, Medium, High), and End-User Industry (Industrial, Commercial, Utilities, Infrastructure). Understanding these segments is crucial for manufacturers to tailor their product offerings to specific operational demands, such as the high tensile strength required for Steel Wire Armored (SWA) cables in mining, versus the lighter, more flexible Interlocked Aluminum Armored (AIA) cables favored in indoor commercial applications.

The Voltage Rating segment reveals a notable divergence in market growth. While Low Voltage (up to 1 kV) armored cables constitute a large volume market due to widespread use in building wiring, the Medium Voltage (1 kV to 35 kV) segment is anticipated to exhibit the most rapid growth. This acceleration is directly linked to global investment in power grid reinforcement, localized substation connections, and the integration of distributed generation sources. The segmentation by End-User Industry underscores the dominance of the Utilities sector, driven by long-term, large-scale projects related to power transmission and distribution, followed closely by the Industrial sector which requires robust cabling for mission-critical machinery and control systems.

- By Armor Type:

- Steel Wire Armored (SWA)

- Steel Tape Armored (STA)

- Interlocked Aluminum Armored (AIA/MC)

- Double Steel Tape Armored (DSTA)

- Aluminum Wire Armored (AWA)

- By Voltage Rating:

- Low Voltage (Below 1 kV)

- Medium Voltage (1 kV to 35 kV)

- High Voltage (Above 35 kV)

- By End-User Industry:

- Utilities and Energy (Power Generation, Transmission, Distribution)

- Industrial (Oil & Gas, Mining, Manufacturing, Chemicals)

- Commercial and Residential Construction (Data Centers, High-Rise Buildings)

- Infrastructure and Transportation (Railways, Airports, Tunnels)

- By Insulation Material:

- XLPE (Cross-linked polyethylene)

- PVC (Polyvinyl Chloride)

- EPR (Ethylene Propylene Rubber)

Value Chain Analysis For Armored Cable Market

The value chain for the Armored Cable Market begins fundamentally with the upstream supply of core raw materials—primarily refined copper and aluminum (for conductors), steel (for armor), and specialized polymers (for insulation and sheathing). Upstream analysis focuses on the extraction, processing, and cost volatility of these metals, which directly influence manufacturing costs. Manufacturers often engage in long-term procurement contracts or hedging strategies to mitigate price fluctuations, given that raw materials account for a significant portion of the total production cost. Key suppliers in this stage include global metal refiners and specialized chemical companies providing high-performance insulation compounds like XLPE and PVC, crucial for meeting specific voltage and fire-resistance standards.

The midstream phase involves the core activities of cable manufacturing: conductor drawing, insulation extrusion, laying-up of cores, and the critical armoring process (SWA, STA, or AIA application), followed by outer sheathing and rigorous quality testing. Technological sophistication in this stage, such as high-speed stranding machines and continuous vulcanization lines, defines a company's competitive edge in terms of volume, quality, and compliance with industry standards (e.g., IEC 60502). Large manufacturers often integrate backward by owning conductor drawing facilities to control quality and cost, whereas smaller specialized players focus on niche, high-voltage, or customized armored products.

Downstream distribution channels are complex, involving both direct sales to large utility and infrastructure projects and indirect sales through specialized electrical distributors, wholesalers, and system integrators. For massive projects like power plants or major utility upgrades, manufacturers often engage in direct procurement contracts. Conversely, for commercial and residential construction (Low Voltage applications), the sales cycle relies heavily on indirect channels, utilizing distributors for inventory management and local market penetration. The final stage involves installation and maintenance services, often executed by certified electrical contractors, ensuring the armored cable systems are correctly terminated and sealed to preserve their mechanical and electrical integrity.

Armored Cable Market Potential Customers

Potential customers for armored cables represent diverse sectors requiring robust, reliable, and mechanically protected electrical connections, prioritizing durability over cost in critical applications. The most substantial end-user group is the utility sector, encompassing national grid operators, municipal power companies, and independent power producers (IPPs). These entities demand medium to high-voltage armored cables for transmission and distribution (T&D) networks, especially in underground and subsea applications where environmental protection and long-term reliability are paramount. The utility segment's buying decisions are heavily influenced by regulatory compliance, projected lifespan, and total cost of ownership (TCO) over decades.

The second major consumer base comprises heavy industries, including oil and gas, mining, and large-scale manufacturing. In these harsh environments, armored cables are non-negotiable due to the presence of flammable gases, corrosive chemicals, and high physical stress (e.g., in boreholes or process areas). Potential customers here seek specialized armored cables, often featuring custom jacketing materials and intrinsically safe designs, prioritizing operational continuity and strict adherence to specific industrial certifications (e.g., ATEX, MSHA). Their purchase cycles are often tied to capital expenditure for new plant construction, expansion, or mandatory safety upgrades.

Furthermore, the rapidly expanding infrastructure and commercial construction segment, particularly data centers, high-rise buildings, and transportation systems (railways, metros), represents a high-growth customer base. Data centers, requiring massive power input with absolute redundancy, rely on fire-resistant, interlocked aluminum armored cables (MC cables) for efficient power distribution within the facility. Similarly, public transit systems utilize robust armored cables for signaling, traction power, and auxiliary systems, where passenger safety and uninterrupted service demand maximum mechanical protection and compliance with low-smoke, zero-halogen (LSZH) standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 23.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans S.A., General Cable Technologies Corporation (Prysmian Group), Sumitomo Electric Industries, Ltd., Southwire Company, LLC, Belden Inc., Leoni AG, Encore Wire Corporation, KEI Industries Limited, Polycab India Limited, Havells India Ltd., The Okonite Company, AFL (Fujikura), ZTT (Zhongtian Technology), LS Cable & System Ltd., Furukawa Electric Co., Ltd., Tele-Fonika Kable S.A., NKT A/S, Riyadh Cables Group, Ducab. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Armored Cable Market Key Technology Landscape

The technology landscape within the Armored Cable Market is primarily focused on enhancing safety, improving material efficiency, and increasing power density. A critical development is the widespread adoption of Cross-linked Polyethylene (XLPE) insulation for medium and high-voltage armored cables, replacing older materials like paper-insulated lead-sheathed (PILC) cables. XLPE offers superior thermal stability, higher dielectric strength, and extended service life, making it the preferred standard for modern utility and industrial applications. Furthermore, innovation in sheathing materials, particularly the shift towards Low Smoke Zero Halogen (LSZH) compounds, is essential for cables deployed in enclosed public spaces (e.g., tunnels, subways) to minimize toxic gas and smoke emission during a fire, directly addressing stringent safety regulations in developed economies.

In terms of physical protection, technological evolution is evident in the manufacturing of Interlocked Aluminum Armor (AIA) or Metal Clad (MC) cables. Modern production techniques allow for the creation of thinner, yet mechanically robust, aluminum tapes and wires, significantly reducing the overall weight and flexibility of the cable assembly. This innovation is crucial for speeding up installation times in commercial buildings, where labor costs are high. Additionally, advanced corrosion-resistant coatings are being applied to steel armor (SWA/STA) used in demanding external or underground environments, such as coastal areas or chemical plants, thereby ensuring the longevity of the protective barrier and maintaining system integrity over the required operational period.

Another significant trend involves the integration of monitoring technologies. Smart armored cables are being developed with embedded fiber optic sensors (Distributed Temperature Sensing - DTS) or specialized sensor layers within the cable jacket. These technologies allow for continuous, real-time monitoring of critical parameters such as temperature hotspots, mechanical strain, and partial discharge activity. This technological leap supports advanced predictive maintenance strategies, essential for managing high-value assets like submarine cables or critical industrial feeders, enabling operators to identify and rectify minor faults before they escalate into catastrophic failures, thus substantially improving reliability and reducing total operational costs.

Regional Highlights

The global armored cable market exhibits strong regional disparities in terms of maturity, regulatory environment, and growth drivers, necessitating tailored market strategies. The Asia Pacific (APAC) region is indisputably the largest and fastest-growing market, primarily fueled by unprecedented rates of urbanization and massive government investments in infrastructure. Nations like China and India are leading the deployment of new power generation capacity, including thermal and renewable projects, coupled with extensive expansions of their national transmission and distribution grids. This high volume demand spans across all voltage levels, with a significant emphasis on standardized, cost-effective steel wire and steel tape armored cables for industrial parks and metropolitan power distribution. The need for robust cabling in rapidly constructed environments ensures sustained, high-volume consumption across this region.

North America and Europe represent mature markets characterized by replacement demand, regulatory complexity, and a focus on high-reliability, specialized applications. In North America, the shift towards renewable energy integration (onshore wind, solar) drives demand for specialized medium-voltage armored collection cables. Furthermore, the construction of massive data centers necessitates high volumes of compliant, interlocked aluminum armored (Type MC) cables. European markets emphasize adherence to stringent safety standards, particularly concerning fire performance (CPR mandates) and environmental sustainability, fostering a strong market for LSZH (Low Smoke, Zero Halogen) armored cables and advanced, recyclable materials for utility grid modernization projects designed for enhanced resilience against extreme climate events. Regulatory pressure is a key differentiator in these regions.

The Middle East and Africa (MEA) and Latin America (LATAM) regions present significant growth opportunities tied to oil and gas infrastructure expansion and nascent urbanization projects. In the Gulf Cooperation Council (GCC) countries, massive construction projects, including futuristic cities and extensive oil and gas facility upgrades, mandate robust, often custom-engineered, armored cables capable of handling high temperatures and corrosive environments. Meanwhile, LATAM’s growth is more localized, driven by mining operations (requiring highly durable SWA cables) and efforts to improve inadequate national power grid infrastructure, leading to targeted demand for medium voltage armored distribution cables, albeit with higher exposure to geopolitical and economic instability which affects project timelines.

- Asia Pacific (APAC): Dominates the market due to accelerated power grid modernization, smart city development, and large-scale manufacturing expansion in China, India, and Southeast Asia. Characterized by high-volume demand for MV and LV armored cables.

- North America: Driven by aging infrastructure replacement, significant investment in data center construction, and mandatory use of specialized armored cables (e.g., Type MC/AIA) in commercial and industrial settings, focusing heavily on regulatory compliance and fire safety standards.

- Europe: Growth stems from renewable energy integration (offshore and onshore wind farms), stringent CPR (Construction Products Regulation) compliance promoting LSZH materials, and government-led initiatives for high-speed rail and smart grid development, emphasizing quality and sustainability.

- Middle East & Africa (MEA): Growth is tied to massive capital projects in the oil and gas sector (upstream and downstream), extensive urban development in GCC states (e.g., Saudi Arabia, UAE), and T&D network expansions in large African economies. Demand is often for heavy-duty, corrosion-resistant armored solutions.

- Latin America (LATAM): Market expansion is supported by robust demand from the mining industry (Chile, Peru), oil and gas exploration (Brazil, Mexico), and governmental efforts to stabilize and extend national power distribution networks, focusing on durable SWA cables for rugged terrain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Armored Cable Market.- Prysmian Group

- Nexans S.A.

- General Cable Technologies Corporation (Prysmian Group)

- Sumitomo Electric Industries, Ltd.

- Southwire Company, LLC

- Belden Inc.

- Leoni AG

- Encore Wire Corporation

- KEI Industries Limited

- Polycab India Limited

- Havells India Ltd.

- The Okonite Company

- AFL (Fujikura)

- ZTT (Zhongtian Technology)

- LS Cable & System Ltd.

- Furukawa Electric Co., Ltd.

- Tele-Fonika Kable S.A.

- NKT A/S

- Riyadh Cables Group

- Ducab

Frequently Asked Questions

Analyze common user questions about the Armored Cable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and advantage of using armored cable over standard cable?

The primary function of armored cable is to provide enhanced mechanical protection, shielding the conductors and insulation layers from physical damage such as crushing, impact, and abrasion. The main advantage is increased reliability and safety, allowing deployment in harsh environments like underground installations, industrial facilities, and high-traffic areas where standard cables would be vulnerable to failure.

Which type of armor—Steel Wire Armored (SWA) or Interlocked Aluminum Armored (AIA)—is typically preferred for indoor commercial construction?

Interlocked Aluminum Armored (AIA), often referred to as Metal Clad (MC) cable, is typically preferred for indoor commercial construction. AIA is lighter, more flexible, and easier to install and bend compared to the heavy steel wire armor (SWA), resulting in lower labor costs and faster installation times within accessible building spaces.

How do fluctuations in copper prices affect the overall armored cable market profitability?

Fluctuations in copper and aluminum prices significantly impact armored cable profitability because raw metals constitute a major portion of the cable's production cost. High volatility necessitates manufacturers to employ sophisticated hedging strategies and often results in price adjustments (metal surcharges) passed on to end-users, potentially slowing down long-term infrastructure project planning due to cost uncertainty.

What role do fire safety regulations, such as LSZH standards, play in the demand for armored cables?

Fire safety regulations, particularly the requirement for Low Smoke Zero Halogen (LSZH) materials, are critical drivers, especially in Europe and high-density urban areas. LSZH armored cables minimize the emission of toxic fumes and corrosive gases during a fire, making them mandatory for use in enclosed public spaces like subways, hospitals, and data centers, ensuring compliance and enhancing safety.

Which geographic region exhibits the fastest growth potential for armored cables in the forecast period, and why?

The Asia Pacific (APAC) region exhibits the fastest growth potential, driven by rapid urbanization, massive government investment in utility infrastructure expansion (power grids and renewable energy integration), and sustained growth in the industrial manufacturing and commercial construction sectors across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Single Core Armored Cable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Cable Glands Market Size Report By Type (Non-Hazardous Area Cable Glands, Hazardous Area Cable Glands, Armored Cable Glands, Unarmored Cable Glands, Brass, Aluminium, Plastic, Stainless Steel, Other Material Types), By Application (Aerospace, Construction, Manufacturing and Processing, Oil and Gas, Power and Utilities, Other, Marine, Mining, Chemicals), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager