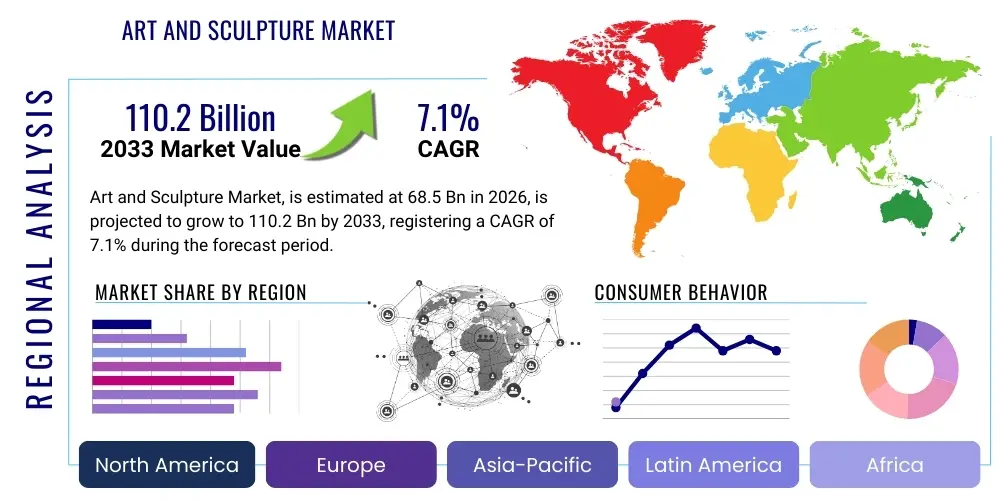

Art and Sculpture Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441788 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Art and Sculpture Market Size

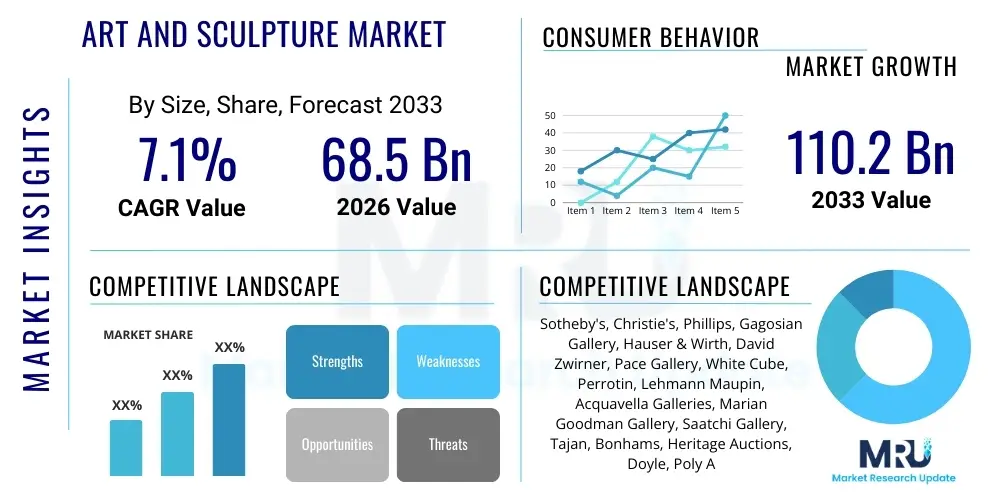

The Art and Sculpture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 68.5 Billion in 2026 and is projected to reach USD 110.2 Billion by the end of the forecast period in 2033. This consistent expansion is primarily driven by the increasing global wealth concentration among High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs), who view art and sculpture as crucial assets for portfolio diversification and status signaling. Furthermore, the robust digitization of auction houses and galleries, coupled with the introduction of novel investment vehicles like art funds and fractional ownership platforms, continues to enhance market liquidity and accessibility, attracting a new generation of younger collectors and investors globally.

Art and Sculpture Market introduction

The Art and Sculpture Market encompasses a diverse range of artistic creations, including paintings, drawings, prints, installations, and three-dimensional works crafted from materials such as bronze, marble, wood, ceramic, and contemporary composites. This market spans across various segments, from Old Masters and Impressionist works to Modern, Post-War, and highly sought-after Contemporary art pieces, catering to a sophisticated global clientele of private collectors, public museums, corporate buyers, and institutional investors. The valuation and trading of these items occur primarily through established international auction houses, private dealer networks, and increasingly sophisticated online platforms and art fairs, emphasizing provenance, condition, and critical reputation as primary determinants of market worth. The intrinsic value derived from aesthetic appeal and cultural significance, coupled with the tangible asset nature of these investments, underpins the market's resilience even amidst broader economic fluctuations.

Major applications of art and sculpture extend beyond traditional aesthetic display, prominently including wealth management strategies where tangible assets provide a hedge against inflation and currency volatility, particularly for high-value purchases. Furthermore, the utilization of sculptures in public spaces, architectural integration, and urban development projects drives demand for large-scale commissions, enhancing civic appeal and cultural identity across major global cities. Key driving factors propelling market expansion include the proliferation of art-focused media and digital documentation, improving transparency and information accessibility for potential buyers, coupled with the ongoing globalization of artistic production and consumption, broadening the scope beyond traditional Western centers to include vibrant markets in Asia and the Middle East. The prestige associated with collecting and the societal importance of cultural heritage preservation further solidify the market's long-term growth trajectory, making it a critical component of the luxury goods and alternative investment sectors.

Art and Sculpture Market Executive Summary

The Art and Sculpture Market is characterized by several prevailing business trends, notably the significant acceleration of digital transformation, where major auction houses are investing heavily in advanced visualization technologies, virtual viewing rooms, and enhanced digital cataloging to facilitate transactions remotely, especially post-2020. A key structural shift involves the increasing prominence of contemporary and street art genres, which appeal strongly to younger affluent demographics, alongside a renewed investor focus on established female artists and artists from marginalized communities, diversifying the traditional market landscape and challenging historical price imbalances. Furthermore, the integration of blockchain technology for tokenizing high-value artworks and providing immutable provenance records is emerging as a critical trend addressing long-standing issues of authenticity and fractional ownership, democratizing access to blue-chip assets.

Regionally, the market dynamics are experiencing a power shift, with Asia Pacific, led by Mainland China, Hong Kong, and increasingly South Korea, consolidating its position as a powerhouse, often rivaling or exceeding North America and Europe in terms of sales volume and record-breaking prices for certain segments, particularly contemporary Asian works. Segment-wise, the highest growth rates are observed in the Digital Art and NFT (Non-Fungible Token) correlated sculpture and installation segments, demonstrating collector willingness to adopt new media forms, although the traditional segments of Modern and Post-War Art maintain their dominance in overall transaction value due to historical stability and recognized scarcity. These trends indicate a market that is simultaneously honoring classical values while aggressively pursuing innovation and global inclusivity, necessitating strategic adaptation by galleries, dealers, and investment funds to capitalize on shifting consumer preferences and technological capabilities.

AI Impact Analysis on Art and Sculpture Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Art and Sculpture Market frequently center on three critical themes: the definition of creativity when applied by an algorithm, the effect of AI-generated art on market valuation and scarcity, and the application of AI tools in authentication and provenance tracking. Consumers and industry professionals express concerns about AI systems being used to rapidly generate derivative or imitative works, potentially saturating lower-tier markets and blurring the lines between human craftsmanship and computational output. Conversely, there is significant interest in how AI can be leveraged to enhance art historical research, predict market trends based on vast sales data, and improve the detection of forgeries by analyzing subtle stylistic patterns beyond human perception. The overarching expectation is that AI will function as both a disruptive creator and a powerful analytical assistant, redefining the roles of artists, collectors, and authenticators within the ecosystem.

The practical integration of AI is already visible in several aspects of the market, including generative artistic processes where algorithms co-create sculptures or design complex structural installations, pushing the boundaries of material science and form. However, this has ignited philosophical debates concerning the copyright ownership and the intrinsic 'human touch' traditionally valued in collectible art, which impacts long-term investment viability. In the secondary market, AI-powered tools are revolutionizing due diligence, offering rapid risk assessment for potential purchases by cross-referencing global databases of stolen art, auction results, and expert opinions. The market anticipates that successful integration will involve AI systems that augment human expertise rather than replace it, ultimately providing enhanced transparency and confidence in transactional processes, thereby stabilizing high-value transactions that require rigorous verification.

- AI systems are utilized for generating complex, novel sculptural forms and conceptual installations, leading to the rise of 'algorithmically assisted' artistry.

- Predictive modeling and machine learning algorithms are increasingly employed by major auction houses to forecast sales performance and identify emerging collecting trends in real time.

- AI-powered image recognition and analysis tools significantly enhance the accuracy and speed of art authentication and fraud detection by analyzing brushstroke patterns, material composition, and provenance documents.

- The incorporation of AI in virtual reality (VR) and augmented reality (AR) viewing rooms allows collectors to digitally place sculptures in their homes, improving the remote purchasing experience.

- Concerns persist regarding the intellectual property rights and originality of art entirely conceived or rendered by algorithms, necessitating new legal frameworks for valuation and copyright assignment.

DRO & Impact Forces Of Art and Sculpture Market

The market dynamics of Art and Sculpture are heavily influenced by a combination of powerful drivers, structural restraints, and emerging opportunities, collectively shaping the investment landscape and collector behavior. Key drivers include the massive global accumulation of wealth, particularly in emerging economies, creating a larger pool of potential collectors seeking tangible, high-value assets for diversification and legacy building. This is augmented by the sophisticated marketing and educational efforts undertaken by global art fairs and institutions, which elevate cultural consumption and artistic appreciation among new demographics. Furthermore, the digitalization of sales channels, allowing global reach and streamlined bidding processes, has injected unprecedented liquidity and efficiency into what was traditionally an opaque market structure. These forces synergistically contribute to consistent demand, particularly for established blue-chip artists whose works are considered safe long-term investments.

Despite robust drivers, the market faces significant restraints, primarily centered on a persistent lack of standardized global transparency concerning pricing, dealer markups, and private sales, which can deter risk-averse institutional investors. High transaction costs, including commissions, taxes, and shipping insurance for valuable pieces, also pose an impediment to fluid market movement. Counterfeiting and provenance uncertainty remain critical challenges, requiring continuous investment in technological verification methods to maintain buyer confidence. Opportunities, however, abound, largely driven by the technological advancements such as blockchain-based provenance tracking and fractional ownership models, which dramatically lower the entry barrier for smaller investors and increase asset tradability. The rise of collectible digital sculpture (NFTs) and the growing appreciation for works related to sustainability and ecological themes represent fertile ground for new market segments, allowing the industry to appeal to contemporary social values while expanding its product offering.

Segmentation Analysis

The Art and Sculpture market is highly fragmented yet structurally defined by clear segmentations based on medium, type, material, application, and geographical origin. Segmentation allows market participants, from auctioneers to investors, to focus on specific niches characterized by distinct risk profiles, price points, and collector bases. For instance, the distinction between fine art (paintings, sculptures) and decorative art significantly impacts valuation methods and sales volume. Analyzing these segments is crucial for forecasting regional growth and understanding shifts in collector preference, such as the current pivot towards contemporary art over historical genres, reflecting changing demographic tastes and increasing global connectivity. This comprehensive segmentation ensures targeted strategies can be developed for inventory acquisition and promotional activities across the diverse global market.

- By Type:

- Paintings (Oil, Acrylic, Watercolor)

- Sculpture and Installation (Bronze, Marble, Wood, Mixed Media)

- Drawings and Works on Paper

- Photography and Digital Art

- Prints (Etchings, Lithographs, Screenprints)

- By Medium/Material:

- Stone (Marble, Granite, Limestone)

- Metal (Bronze, Steel, Aluminum)

- Wood and Ceramics

- New Media and Digital Composites

- By Style/Era:

- Old Masters

- Impressionist and Modern

- Post-War and Contemporary

- Emerging and Urban Art

- By Application/End-User:

- Private Collectors and HNWI

- Museums and Public Institutions

- Corporate and Hospitality Sector

- Art Funds and Investment Vehicles

- By Distribution Channel:

- Auction Houses (Offline and Online)

- Art Galleries and Dealers (Primary Market)

- Online Platforms and Marketplaces

- Art Fairs and Biennales

Value Chain Analysis For Art and Sculpture Market

The value chain of the Art and Sculpture Market begins with the creation phase (upstream), involving artists and studios responsible for conceptualizing and physically producing the artwork. This stage is highly dependent on the availability of high-quality materials, skilled labor, and access to intellectual capital and creative freedom. Upstream analysis highlights the critical role of material suppliers and specialized workshops (foundries, stone carvers) whose quality and ethical sourcing directly impact the final product's value and longevity. Technological innovation in materials science, such as the development of durable, sustainable composite materials for large-scale outdoor sculptures, increasingly influences production capabilities and cost structures in this initial phase.

The midstream and downstream segments involve the commercialization, distribution, and transactional processes. Distribution channels are complex, bifurcated primarily into the primary market (direct sales from artist/gallery) and the secondary market (resale via auction houses or dealers). Direct channels, where galleries and dealers act as crucial gatekeepers, involve intense curation, artist management, and promotion, setting initial market prices and establishing provenance. Indirect channels, particularly major international auction houses, dominate the secondary market, facilitating high-value transactions and price discovery, benefiting significantly from global reach and brand trust. The trend toward digitalization has blurred these lines, with online marketplaces increasingly offering direct sales alongside curated auctions, optimizing inventory management and vastly expanding geographic reach for both buyers and sellers, ultimately enhancing market efficiency and liquidity.

Art and Sculpture Market Potential Customers

Potential customers for the Art and Sculpture Market are exceptionally diverse, yet typically characterized by significant disposable wealth, a strong interest in cultural preservation, and a desire for investment diversification. The core segment comprises High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs) globally, particularly those residing in financial hubs like New York, London, Hong Kong, and increasingly Dubai and Singapore. These individuals purchase art primarily for aesthetic enjoyment, social signaling (status), and as a tangible store of value that is uncorrelated with traditional financial markets, often relying on wealth managers and specialized art advisors to guide their acquisition strategies across various market segments, from contemporary to blue-chip modern masters. The growing philanthropic interest in art also positions private collectors who intend to eventually donate their collections to museums as critical long-term buyers.

Beyond private individuals, institutional buyers form a major customer base, including public and private museums, which continually acquire works to enhance their permanent collections and cultural mandates, driving demand for historical and critically significant pieces. Furthermore, the corporate sector, including multinational banks, luxury retail chains, and high-end hospitality groups, increasingly invests in art and sculpture for public display, branding, and enhancing the aesthetic environment of their premises, recognizing art's role in conveying corporate values and prestige. Art funds and investment vehicles represent a growing customer segment, pooling capital from multiple investors to collectively purchase high-value works, treating art explicitly as an asset class aimed at generating financial returns over a mid-to-long-term holding period, thereby institutionalizing the art investment process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 68.5 Billion |

| Market Forecast in 2033 | USD 110.2 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sotheby's, Christie's, Phillips, Gagosian Gallery, Hauser & Wirth, David Zwirner, Pace Gallery, White Cube, Perrotin, Lehmann Maupin, Acquavella Galleries, Marian Goodman Gallery, Saatchi Gallery, Tajan, Bonhams, Heritage Auctions, Doyle, Poly Auction, China Guardian, Mezzanine Art. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Art and Sculpture Market Key Technology Landscape

The technological landscape impacting the Art and Sculpture Market is undergoing rapid modernization, moving beyond traditional physical preservation techniques to embrace digital tools that enhance provenance, authenticity, and accessibility. A foundational technology is high-resolution digital imaging and 3D scanning, which allows for the creation of precise, non-invasive digital records of artworks, critical for insurance, condition reporting, and virtual exhibitions. For sculpture specifically, advanced techniques like CT scanning and X-radiography are indispensable for analyzing internal structures, detecting repairs, and verifying material integrity without causing physical damage. These technologies not only support conservation efforts but also provide definitive proof of a work's state at the point of sale, mitigating future disputes over condition and originality.

Furthermore, blockchain technology represents perhaps the most transformative digital shift, offering immutable and decentralized ledgers to record the entire transactional history and chain of custody for an artwork. Implementing blockchain drastically reduces the risk of fraud and solves the long-standing challenge of provenance transparency, thereby increasing buyer confidence in high-value secondary market transactions. Coupled with this are sophisticated AI and machine learning algorithms utilized in aesthetic computing, which aid in valuing non-traditional or emerging art forms where historical pricing data is scarce. Virtual and Augmented Reality (VR/AR) platforms are simultaneously revolutionizing the distribution side by creating immersive digital viewing experiences, allowing potential global buyers to experience the scale and texture of sculptures and installations virtually, bypassing geographical limitations and fueling cross-border sales.

Regional Highlights

- North America: North America, particularly the United States, remains a dominant force in the global market, characterized by institutional maturity, vast collector wealth (especially in New York and Los Angeles), and a strong appetite for contemporary and high-tech digital art. The region leads in market innovation, particularly in the adoption of fractional ownership platforms and the institutionalization of Art-as-an-Asset-Class (AAA).

- Europe: Europe maintains its historical significance, anchored by established art hubs like London (despite Brexit shifts), Paris, and Berlin. This region holds the largest market share for Old Masters and Impressionist works, driven by strong cultural heritage institutions and generational wealth. Key growth is occurring in the primary market, with galleries focusing on sustainability-themed and politically engaged contemporary European artists.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, primarily fueled by massive wealth creation in Mainland China, Hong Kong, and South Korea. This region shows a dual focus: strong local demand for regional contemporary masters and aggressive purchasing of international blue-chip art, often setting record prices. Infrastructure development in art logistics and museum construction further solidifies its market position.

- Middle East and Africa (MEA): The MEA market is exhibiting substantial investment, particularly driven by sovereign wealth funds and ambitious cultural projects in the Gulf Cooperation Council (GCC) countries, such as Saudi Arabia and the UAE (Dubai, Abu Dhabi). These regions are focusing heavily on commissioning large-scale public sculptures and establishing world-class museums, creating a robust demand for international and regional artistic talent.

- Latin America: Latin America, while facing economic volatility, possesses vibrant local art scenes, particularly in cities like São Paulo and Mexico City. The market is defined by a passionate collector base focused on regional modernist and contemporary artists, increasingly utilizing online platforms to connect local talent with global buyers, thereby mitigating domestic market challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Art and Sculpture Market.- Sotheby's

- Christie's

- Phillips

- Gagosian Gallery

- Hauser & Wirth

- David Zwirner

- Pace Gallery

- White Cube

- Perrotin

- Lehmann Maupin

- Acquavella Galleries

- Marian Goodman Gallery

- Saatchi Gallery

- Tajan

- Bonhams

- Heritage Auctions

- Doyle

- Poly Auction

- China Guardian

- Mezzanine Art

Frequently Asked Questions

Analyze common user questions about the Art and Sculpture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth trajectory and valuation of the Art and Sculpture Market?

The market is experiencing a robust growth trajectory, projected to reach USD 110.2 Billion by 2033, driven by a 7.1% CAGR. Growth is sustained by increased global wealth, portfolio diversification strategies by HNWIs, and enhanced accessibility through digital platforms and fractional ownership models that expand the collector base significantly.

How is blockchain technology fundamentally changing art provenance and authenticity verification?

Blockchain provides an immutable, decentralized ledger for tracking the full transactional history and chain of custody for an artwork or sculpture. This transparent system dramatically reduces risks associated with forgery and uncertain provenance, boosting buyer confidence and institutionalizing security within the high-value secondary market segment.

Which geographical region is currently demonstrating the highest growth potential in the Art and Sculpture sector?

The Asia Pacific (APAC) region, particularly driven by strong consumer demand and infrastructure investment in countries like China and South Korea, exhibits the highest growth potential. This growth is characterized by significant sales volumes for both international contemporary masterpieces and robust local artistic production.

What role does Artificial Intelligence (AI) play in the creation and valuation of modern sculpture?

AI is used both as a creative partner, assisting artists in generating complex forms and optimizing materials, and as an analytical tool. AI models enhance market valuation by analyzing vast historical sales data, stylistic attributes, and condition reports, offering objective data points for works lacking established auction history.

What are the primary challenges faced by the global Art and Sculpture Market?

Key challenges include persistent market opacity, where pricing and dealer markups lack standardization, and the ongoing threat of sophisticated counterfeiting. Furthermore, high barriers to entry, including substantial transaction costs and limited access to expert appraisal, remain restrictive for broader investment participation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager