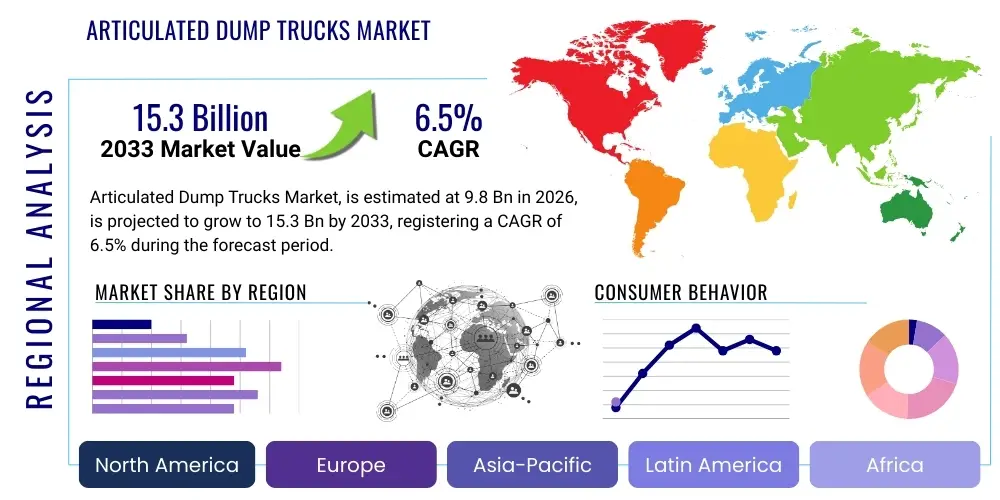

Articulated Dump Trucks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442559 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Articulated Dump Trucks Market Size

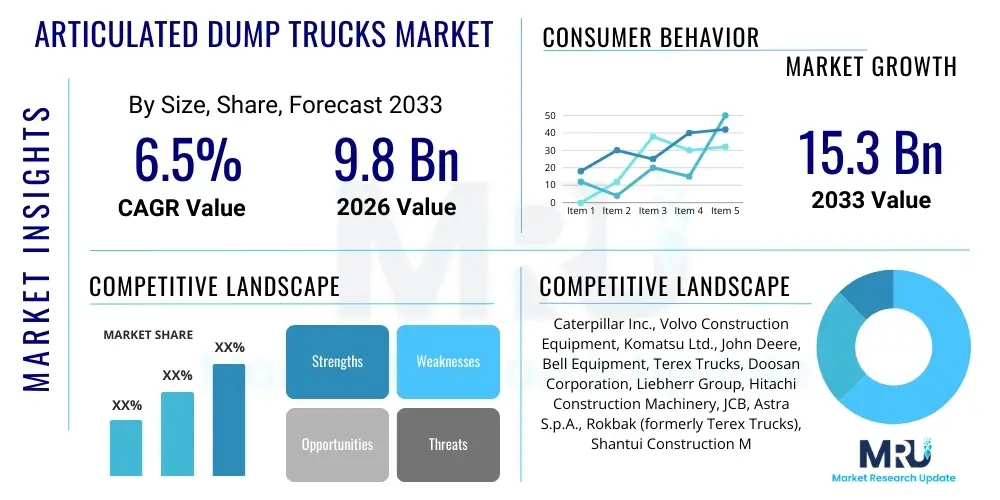

The Articulated Dump Trucks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 9.8 Billion in 2026 and is projected to reach USD 15.3 Billion by the end of the forecast period in 2033.

Articulated Dump Trucks Market introduction

The Articulated Dump Trucks (ADTs) Market encompasses the manufacturing, distribution, and utilization of heavy-duty construction and mining vehicles designed for transporting bulk materials across rough terrain and challenging site conditions. ADTs are characterized by a permanent six-wheel drive system and a unique articulating joint between the cab/engine section and the dump body, allowing superior maneuverability and stability on steep slopes and soft ground where rigid haul trucks might falter. These robust machines are essential assets in the modern infrastructure landscape, enabling efficient material movement in sectors requiring significant earthmoving and aggregate handling.

Major applications for Articulated Dump Trucks span critical heavy industries including quarrying, open-pit mining, large-scale residential and commercial construction, road building, and public works projects suchating dams and tunneling operations. Their capability to handle diverse materials, from overburden and rock to sand and gravel, positions them as indispensable equipment for maximizing productivity in demanding operational environments. The design inherent to ADTs offers significant benefits over traditional trucks, such as lower ground pressure, superior gradeability, and enhanced operational safety under adverse weather or difficult terrain circumstances. They bridge the gap between small, rigid site dumpers and massive, high-capacity mining trucks, offering a versatile middle-ground solution that prioritizes mobility and ruggedness.

Key driving factors supporting the sustained expansion of the ADT market include unprecedented global investment in infrastructure development, particularly across emerging economies in Asia Pacific and Latin America, aiming to support rapid urbanization and industrial growth. Furthermore, continuous technological advancements, such as the integration of advanced telematics, automated features, and stringent emissions standards prompting fleet renewal, are compelling construction and mining companies to invest in newer, more efficient ADT models. The increasing demand for essential commodities, necessitating deeper and more complex mining operations, further solidifies the foundational demand for reliable, high-performing articulated hauling solutions across the globe.

Articulated Dump Trucks Market Executive Summary

The global Articulated Dump Trucks market is exhibiting robust growth, propelled by resilient business trends focusing on efficiency maximization and operational safety across construction and mining sectors. A pivotal business trend involves the industry shift towards larger capacity models, specifically those exceeding 40 metric tons, as companies seek to consolidate hauling cycles and reduce operational costs per ton. Furthermore, rental fleets are playing an increasingly crucial role, offering flexible procurement options that allow smaller and mid-sized contractors access to high-cost machinery without substantial capital investment, thereby stimulating demand for the latest technology-equipped units. Emphasis on sustainable operations is also driving Original Equipment Manufacturers (OEMs) to focus intensely on developing hybrid and fully electric ADT prototypes, positioning long-term ecological compliance as a core competitive differentiator.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market expansion, primarily fueled by massive government spending on public infrastructure, including high-speed rail networks, metropolitan expansion projects, and extensive resource extraction activities across countries like China, India, and Southeast Asian nations. North America and Europe, while being mature markets, are characterized by high replacement cycles driven by stringent Tier 4 Final/Stage V emission regulations and a strong appetite for automation and digital fleet management solutions. Conversely, Latin America and the Middle East & Africa are showing promising growth potential linked to significant investments in oil & gas related infrastructure, raw material exports, and urban development projects, demanding reliable earthmoving equipment capable of handling high volumes in varied geological conditions.

In terms of segmentation trends, the medium capacity segment (25 MT to 40 MT) currently maintains the largest market share due to its optimal balance of payload capacity, maneuverability, and cost-effectiveness, making it highly versatile for general construction and quarrying. However, the largest capacity segment (over 40 MT) is projected to record the highest growth rate during the forecast period, reflecting the scale-up in global mining and large civil engineering projects. Technology adoption is accelerating across all segments, with telematics becoming standard features, enabling real-time monitoring of machine health, fuel consumption, and location, drastically improving maintenance planning and overall fleet utilization across various end-user industries.

AI Impact Analysis on Articulated Dump Trucks Market

Common user inquiries regarding the integration of Artificial Intelligence (AI) into the Articulated Dump Trucks market predominantly revolve around three core themes: the feasibility and cost-effectiveness of implementing fully autonomous hauling systems, the tangible improvements in safety and efficiency derived from predictive maintenance algorithms, and the necessary infrastructure investment required to support digitized fleet operations. Users frequently question the Return on Investment (ROI) for advanced automation, particularly concerning the deployment challenges in complex, multi-vendor construction sites versus controlled mining environments. There is a clear expectation that AI will primarily enhance operational efficiency through optimized route planning, minimize unscheduled downtime by forecasting component failures, and significantly reduce human error related incidents, thereby justifying the substantial initial technology outlay. However, concerns persist regarding data security, standardization of AI platforms across different OEM models, and the resultant change management needed for operators transitioning from manual to supervisory roles in semi-autonomous operations.

The application of AI is fundamentally transforming the operational paradigm of ADTs from simple hauling vehicles into smart, interconnected nodes within a digitized worksite ecosystem. AI-powered software allows for dynamic route optimization, instantly adjusting paths based on real-time ground conditions, traffic flow, and loading/unloading bottlenecks, maximizing cycle times without compromising safety. Furthermore, deep learning algorithms analyze thousands of operational data points—including engine temperature, transmission pressure, and vibration profiles—to provide highly accurate prognostics regarding component health. This predictive capability moves maintenance from reactive or time-based scheduling to condition-based intervention, dramatically extending component lifespan and virtually eliminating catastrophic, unforeseen equipment failure, which is a major cost factor in heavy equipment operations.

Beyond predictive maintenance and route efficiency, AI is critical for enhancing operator safety and eventually enabling full autonomous operation. AI-driven vision systems and proximity sensors are integrated to offer enhanced situational awareness, collision avoidance warnings, and fatigue monitoring for human operators, significantly mitigating risks on busy sites. For autonomous trucks, AI manages complex decision-making processes, including navigation, steering, speed control, and load management without human input, which is particularly beneficial in hazardous or remote mining locations. This shift toward intelligent operation underscores AI’s role not just as an efficiency booster, but as a critical enabler of safer, 24/7 continuous operation in challenging environments, cementing its long-term necessity in the evolution of the ADT market.

- AI enables highly accurate predictive maintenance, reducing unscheduled downtime by anticipating component failures.

- Autonomous hauling systems utilize AI for complex navigation, collision avoidance, and dynamic route optimization, boosting productivity.

- Machine learning algorithms optimize fuel consumption and operational cycle times based on real-time site data analysis.

- AI-powered telematics improve operator safety through fatigue detection and enhanced situational awareness warnings.

- Data analytics driven by AI provide granular insights into fleet performance and asset utilization for strategic decision-making.

DRO & Impact Forces Of Articulated Dump Trucks Market

The Articulated Dump Trucks (ADT) market is fundamentally shaped by a confluence of powerful drivers, structural restraints, and emerging opportunities, all interacting to create dynamic impact forces that dictate market direction and investment strategies. A primary driver is the accelerating pace of global infrastructure development, especially in developing economies, which necessitates large volumes of reliable earthmoving equipment for urbanization projects, road networks, and energy facilities. Coupled with this is the robust, cyclical demand from the global mining sector, which relies heavily on ADTs for overburden removal and ore hauling, particularly as accessible surface deposits deplete and operations move into more remote and challenging geographies requiring the ADT’s unique off-road capability. The ongoing shift toward replacing aging fleets with modern, technologically enhanced, and highly efficient machines also acts as a critical demand driver, sustained by stricter environmental regulations.

Conversely, the market faces significant restraints, notably the high initial procurement cost associated with advanced ADTs, which can pose a barrier to entry for smaller contractors and limit fleet expansion among mid-sized companies, even with available financing options. Furthermore, the reliance on skilled labor for maintenance, operation, and the increasingly complex management of telematics and diagnostic systems presents a persistent challenge; a shortage of qualified technicians and operators can restrict the full utilization of high-tech assets. Economic volatility, particularly fluctuating commodity prices and global supply chain disruptions, also impacts investment decisions in mining and construction, potentially leading to project delays or cancellations that suppress short-term demand for new machinery.

Despite these restraints, substantial opportunities are emerging that promise long-term market growth and technological innovation. The most impactful opportunity lies in the rapid advancement of electrification and hybridization technologies, offering a path to compliance with Net-Zero targets and significantly reducing operational expenses related to fuel consumption. Remote operation and autonomy present another major growth avenue, allowing companies to safely and efficiently operate equipment in hazardous or remote locations, such as high-altitude mines or unstable environments. The expansion of the equipment rental market also provides an opportunity to tap into a wider customer base, lowering capital expenditure risks for end-users and ensuring consistent demand for OEMs focused on high asset utilization and low total cost of ownership (TCO).

The combined impact forces ensure that while initial costs are high, the long-term operational efficiencies gained through technology integration—such as higher payload capacity, better fuel economy, and drastically reduced maintenance through predictive diagnostics—make modern ADTs an unavoidable necessity for large-scale earthmoving. Market competition is intensifying, pushing OEMs toward modular designs and enhanced service contracts, effectively lowering the perceived risk of ownership and accelerating the adoption rate, especially in price-sensitive but growth-oriented emerging markets. The overarching need for sustainable, safe, and productive hauling solutions drives continuous innovation, making technology the key differentiator and impact force shaping purchasing decisions.

Segmentation Analysis

The Articulated Dump Trucks (ADT) market is comprehensively segmented based on three primary categories: Capacity, Mechanism, and End-User Industry. Analyzing these segments provides crucial insights into market dynamics, enabling stakeholders to tailor product development and sales strategies to specific operational needs and regional demands. The Capacity segment, which categorizes trucks based on their maximum payload in metric tons (MT), is highly reflective of the scale of projects undertaken globally, with larger trucks often favored in high-production mining environments and smaller to mid-sized units dominating general construction and earthmoving where maneuverability is paramount. The distribution across capacity segments is highly sensitive to macro-economic trends in both infrastructure investment and commodity demand.

The segmentation by Mechanism differentiates between the standard Dump Body ADTs, which lift the bed to discharge material via gravity, and Ejector Body ADTs, which utilize a hydraulic ram to push the material out horizontally. Ejector models are particularly valued in applications where height restrictions or soft ground conditions prevent conventional tipping, such as tunneling or material placement on unstable slopes. While standard dump bodies constitute the majority of the market due to their simplicity and lower TCO, the demand for specialized ejector models is steadily increasing in highly regulated or niche applications where safety and precision material placement are critical considerations. This differentiation highlights the specialization required within the hauling market.

Finally, the End-User Industry segmentation illustrates where the primary market consumption originates, identifying key sectors that drive demand for ADTs. The Construction industry remains the largest consumer globally, encompassing civil engineering, commercial development, and residential projects. However, the Mining sector represents the most lucrative segment in terms of value and demand for high-capacity, heavy-duty models designed for continuous operation in harsh conditions. Other significant users include the Forestry and Waste Management sectors, which require robust off-road capability for material handling in challenging operational landscapes. The concentration of demand within these specific high-growth sectors provides a clear focus for market expansion and targeted product innovation efforts.

- By Capacity:

- Under 25 Metric Tons (MT)

- 25 MT – 40 MT

- Above 40 MT

- By Mechanism:

- Standard Dump Body

- Ejector Body

- By End-User Industry:

- Construction

- Mining

- Quarrying and Aggregates

- Forestry and Agriculture

- Waste Management and Utilities

- By Drive Type:

- Diesel

- Hybrid

- Electric/Battery-Powered

Value Chain Analysis For Articulated Dump Trucks Market

The value chain for the Articulated Dump Trucks market begins with the Upstream Analysis, which focuses primarily on the sourcing of critical raw materials and specialized components required for heavy machinery manufacturing. This stage involves the procurement of high-strength steel alloys for chassis and dump bodies, high-performance engines (often Tier 4 Final/Stage V compliant) sourced from specialized manufacturers like Cummins or Volvo Power Train, complex hydraulic systems, and heavy-duty axles and transmissions. The stability and resilience of this upstream segment are vital, as fluctuations in steel prices or shortages of sophisticated electronic components (e.g., microprocessors for control systems) can significantly impact OEM production costs and lead times. Strategic partnerships with key component suppliers are therefore critical for ensuring consistent output and maintaining competitive pricing within the market.

Midstream activities are dominated by the Original Equipment Manufacturers (OEMs), who undertake the design, precision manufacturing, assembly, and rigorous testing of the ADTs. This stage involves substantial R&D expenditure focused on improving payload capacity, fuel efficiency, safety features, and integrating digital technologies such as telematics and automation kits. Manufacturing efficiency and quality control are paramount at this stage to produce durable equipment capable of withstanding the extreme operational conditions associated with mining and large-scale construction. Following production, the finished ADTs move into the Downstream Analysis phase, primarily through two main Distribution Channels: Direct Sales and Indirect Sales.

Direct Distribution involves sales or leasing arrangements executed directly between the OEM and very large-scale customers, such as global mining conglomerates or massive government projects, often involving custom specifications and long-term service agreements. Conversely, Indirect Distribution, which constitutes the bulk of the market, relies heavily on extensive networks of authorized dealers, regional distributors, and equipment rental companies. Dealers are essential as they provide localized sales support, financing options, technical servicing, and parts inventory, effectively bridging the geographical gap between the OEM and the end-user. The growth of the rental segment acts as a powerful indirect channel, offering flexible access to ADTs and stimulating demand for the latest models among contractors who prefer operating expenditure over capital expenditure, further enhancing market penetration and increasing fleet utilization globally.

Articulated Dump Trucks Market Potential Customers

The primary customer base for the Articulated Dump Trucks market consists of organizations engaged in large-scale material handling operations where reliability, high volume capacity, and off-road mobility are non-negotiable requirements. Key potential customers include massive civil engineering and construction firms specializing in infrastructure projects such as highway construction, airport development, dam building, and port expansion. These companies require fleets of reliable, high-capacity ADTs (25 MT to 40 MT) to manage massive earthmoving tasks efficiently and ensure project timelines are met under often challenging terrain conditions, driving consistent demand for new and replacement units.

Another crucial segment is represented by global mining and quarrying conglomerates involved in the extraction of coal, metals, aggregates, and industrial minerals. These customers demand the highest capacity ADTs (often 40 MT and above) and are increasingly adopting automated and remote-controlled versions to maximize productivity in continuous 24/7 operations and enhance safety in potentially hazardous environments. Investment decisions in this sector are highly correlated with global commodity prices and the opening of new resource exploration sites, making them a high-value, albeit cyclical, customer segment heavily focused on Total Cost of Ownership (TCO) and uptime metrics.

Additionally, public works departments, government agencies responsible for large-scale utility and environmental restoration projects, and specialized heavy equipment rental companies are significant buyers. Rental fleets act as crucial intermediaries, purchasing large volumes of standard and medium-capacity ADTs and subsequently supplying them to smaller and mid-sized contractors across construction, forestry, and waste management sectors. This ensures that a diverse range of buyers, from small regional builders to major national infrastructure operators, have access to high-quality ADT solutions, making rental companies indispensable potential customers for OEMs focused on widespread market accessibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.8 Billion |

| Market Forecast in 2033 | USD 15.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Volvo Construction Equipment, Komatsu Ltd., John Deere, Bell Equipment, Terex Trucks, Doosan Corporation, Liebherr Group, Hitachi Construction Machinery, JCB, Astra S.p.A., Rokbak (formerly Terex Trucks), Shantui Construction Machinery Co., Ltd., Hyundai Construction Equipment, SANY Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Articulated Dump Trucks Market Key Technology Landscape

The technology landscape within the Articulated Dump Trucks (ADT) market is rapidly evolving, moving beyond simple mechanical enhancements toward integrated digital, autonomous, and powertrain innovations designed to maximize productivity while minimizing environmental impact. A central technological focus remains the adherence to increasingly strict global emissions standards, such as EPA Tier 4 Final in North America and EU Stage V in Europe, compelling OEMs to develop sophisticated diesel engine technologies incorporating selective catalytic reduction (SCR) systems and diesel particulate filters (DPF). This complex engine technology ensures environmental compliance but also necessitates advanced telematics to monitor performance, diagnostics, and manage the complexity of these high-efficiency power units.

Connectivity and telematics represent the most pervasive technological layer across the modern ADT fleet. Virtually all new models are equipped with advanced sensors and embedded communication modules that facilitate real-time data transmission regarding location, machine health, operational parameters (e.g., payload weight, fuel consumption, cycle times), and operator behavior. This data feeds into fleet management platforms, often cloud-based, enabling sophisticated predictive maintenance scheduling, detailed operational analytics, and enhanced asset utilization tracking. Furthermore, integrated safety features are increasingly common, leveraging radar and LiDAR technology for object detection, proximity warnings, and automated braking systems, greatly improving site safety and reducing risk in congested work areas.

Looking forward, the key technological differentiators are centered on autonomy and powertrain electrification. Autonomous Hauling Systems (AHS) are being piloted and deployed in large-scale, controlled environments, using GPS, advanced mapping, and sensor fusion to allow ADTs to operate continuously without human input, promising dramatic increases in efficiency and safety. Simultaneously, significant investment is being channeled into developing battery-electric ADTs and hybrid solutions. While still facing challenges related to battery energy density, charging infrastructure, and total operational weight, electric models are critical for accessing emissions-sensitive urban construction sites and for lowering long-term operating costs, marking a fundamental shift in how power is delivered and managed in these heavy-duty machines.

Regional Highlights

Global demand for Articulated Dump Trucks is geographically diverse, driven by varying levels of infrastructure maturity, commodity dependence, and regulatory environments. Asia Pacific (APAC) stands out as the highest growth region, fueled by unparalleled urbanization rates, extensive government-led infrastructure projects (such as China’s Belt and Road Initiative and India’s highway development plans), and robust activity in mining, particularly coal and iron ore extraction. The APAC market is characterized by high volume demand for medium-capacity trucks and a rapidly increasing adoption rate of modern, efficient fleets as regulatory pressure on older equipment begins to mount across key economies.

North America (NA) represents a mature yet dynamic market, heavily influenced by cyclical fleet replacement mandates and a strong emphasis on integrating advanced technology. Demand here is sustained by substantial investments in public works and private residential/commercial construction, often requiring high-spec, large-capacity ADTs compliant with stringent emissions standards (Tier 4 Final). NA operators are early adopters of telematics, autonomous features, and advanced safety systems, driving OEMs to prioritize technological innovation and high resale value. The strong presence of the equipment rental sector also ensures continuous demand for high-quality, up-to-date machinery across the U.S. and Canada.

Europe, characterized by high regulatory stringency (EU Stage V emissions), focuses intensely on operational efficiency, fuel economy, and lower carbon footprints. The European market sees strong demand for mid-sized ADTs optimized for maneuverability in confined urban environments and quarrying operations. Adoption of alternative power sources, specifically electric and hybrid models, is highest in Western European countries due to proactive sustainability policies and financial incentives. Latin America (LATAM) and the Middle East & Africa (MEA) offer high potential growth, linked directly to resource extraction booms (e.g., copper in Chile, oil & gas infrastructure in Saudi Arabia, and minerals in South Africa). These regions prioritize rugged reliability and operational simplicity, though the market for technologically advanced, high-capacity ADTs is expanding rapidly in major mining hubs.

- Asia Pacific (APAC): Highest volume growth driven by extensive infrastructure development, urbanization, and expanding mining operations in China, India, and Southeast Asia. Focus on mid-range and high-capacity units.

- North America (NA): Mature market dominated by fleet replacement cycles, stringent environmental regulations, and leading adoption of autonomous and digital fleet management technologies. Strong rental sector influence.

- Europe: High regulatory environment (Stage V) pushing rapid adoption of hybrid and electric ADTs; demand concentrated in efficient, mid-capacity models for quarrying and specialized construction.

- Latin America (LATAM): Growth tied to volatile commodity markets and major mining investment (e.g., copper, iron ore), focusing on robust, reliable high-capacity trucks for challenging geological conditions.

- Middle East & Africa (MEA): Emerging growth driven by large-scale government infrastructure initiatives and significant resource projects, requiring robust earthmoving equipment often utilized in high-temperature desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Articulated Dump Trucks Market.- Caterpillar Inc.

- Volvo Construction Equipment

- Komatsu Ltd.

- John Deere

- Bell Equipment

- Terex Trucks (now Rokbak)

- Doosan Corporation

- Liebherr Group

- Hitachi Construction Machinery

- JCB

- Astra S.p.A.

- Rokbak

- Shantui Construction Machinery Co., Ltd.

- Hyundai Construction Equipment

- SANY Group

- XCMG Group

- CASE Construction Equipment

- Takeuchi Mfg. Co., Ltd.

- Wacker Neuson SE

- Hidromek

Frequently Asked Questions

Analyze common user questions about the Articulated Dump Trucks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Articulated Dump Trucks and Rigid Dump Trucks?

The primary difference is flexibility and terrain capability. ADTs feature a pivot joint (articulation) between the cab and the bed, enabling superior maneuverability, all-wheel drive (typically 6x6), and effective operation on soft, steep, and extremely uneven off-road terrain. Rigid trucks are designed for high-speed hauling on prepared roads, well-maintained haul roads, or very large, flat mining operations, offering higher payloads but less off-road capability.

What are the key technological advancements driving growth in the ADT market?

Key technological advancements include the integration of advanced telematics and IoT for predictive maintenance and fleet optimization, the rapid development and deployment of semi-autonomous and fully autonomous hauling systems (AHS), and ongoing innovation in powertrain technologies, specifically the introduction of hybrid and battery-electric ADT models to meet stringent global emissions standards.

Which end-user industry holds the largest market share for Articulated Dump Trucks?

The Construction industry, encompassing large-scale civil engineering, infrastructure development (roads, railways), and commercial projects, generally holds the largest market share in terms of volume. However, the Mining and Quarrying sectors represent the highest value segment due to their requirement for large-capacity, heavy-duty, and increasingly specialized autonomous ADTs.

How is electrification impacting the long-term operational costs of Articulated Dump Trucks?

Electrification promises a significant reduction in long-term operational costs primarily by eliminating fuel consumption, which is a major expense for diesel ADTs, and reducing maintenance requirements due to fewer moving engine parts. While upfront costs for electric ADTs are high, the reduced energy costs and improved uptime offer a compelling Total Cost of Ownership (TCO) argument, especially in environments with strict emission zones.

What is the expected Compound Annual Growth Rate (CAGR) for the Articulated Dump Trucks Market between 2026 and 2033?

The Articulated Dump Trucks Market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 6.5% over the forecast period from 2026 to 2033, driven by sustained global infrastructure investment and technological fleet modernization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Articulated Dump Trucks Market Size Report By Type (30 to 40 Ton, Under 30 Ton, Above 40 Ton), By Application (Construction, Mining, Agriculture & Forestry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Articulated Dump Trucks Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (30 to 40 Ton, Under 30 Ton, Above 40 Ton), By Application (Construction, Mining, Agriculture and Forestry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager