Artificial Bone Material Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442090 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Artificial Bone Material Market Size

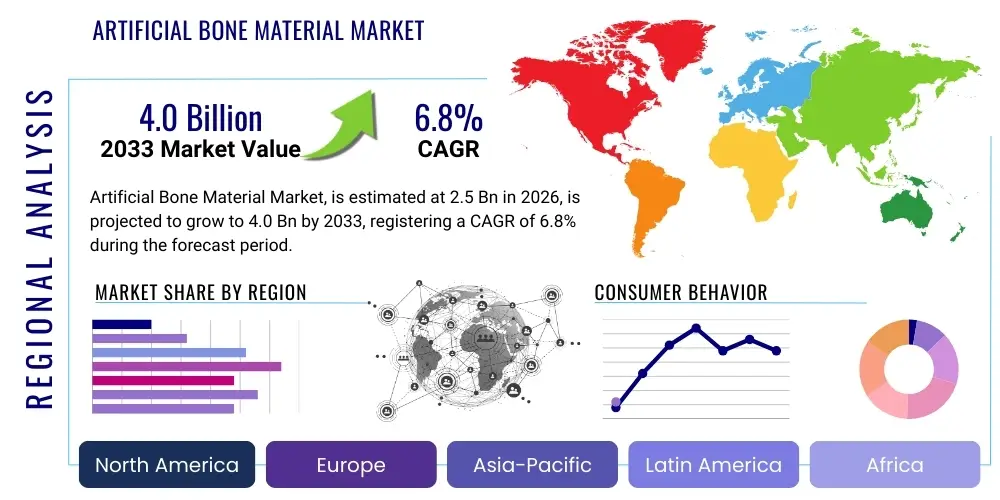

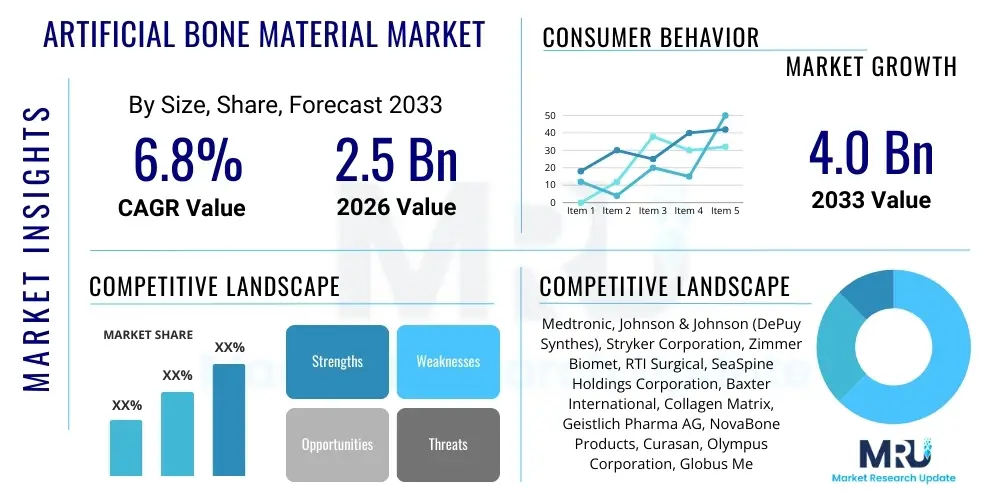

The Artificial Bone Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating prevalence of orthopedic conditions, including osteoporosis and degenerative joint diseases, coupled with a globally aging demographic that necessitates advanced skeletal reconstruction procedures. Furthermore, continuous innovation in biomaterials science, particularly the development of highly porous and bioactive scaffolds, is expanding the clinical applicability of artificial bone substitutes beyond traditional applications.

The valuation reflects robust demand from major end-use sectors such as trauma, spinal fusion, and dental reconstruction. Increased healthcare expenditure in emerging economies and the favorable reimbursement scenarios for complex orthopedic surgeries are critical factors supporting the market expansion. The shift towards synthetic and xenograft materials, aiming to mitigate the risks and limitations associated with autografts, further solidifies the market's positive trajectory toward the projected valuation. Investment in 3D printing technologies for patient-specific implants is also contributing significantly to market size acceleration.

Artificial Bone Material Market introduction

The Artificial Bone Material Market encompasses the manufacturing, distribution, and utilization of synthetic or natural substitute materials designed to repair, reconstruct, or replace damaged or diseased bone tissue. These materials, often referred to as bone graft substitutes, are indispensable in orthopedic, dental, and craniofacial surgeries where traditional autograft procedures are either insufficient or contraindicated. Key product categories include allografts, xenografts, demineralized bone matrix (DBM), synthetic materials such as calcium phosphates (e.g., hydroxyapatite, tricalcium phosphate), bioactive glasses, and advanced polymer composites. The primary objective of these materials is to provide a temporary scaffold, promote osteoconduction, osteoinduction, or osteogenesis, and ultimately facilitate the body's natural bone healing process and structural restoration.

Major applications of artificial bone materials span a wide range of surgical interventions. In orthopedics, they are crucial for spinal fusion procedures, joint reconstruction, fracture fixation, and filling bone voids created by trauma or tumor resection. In dentistry, these substitutes are utilized extensively in periodontal defect repair, socket preservation, and alveolar ridge augmentation prior to implant placement. The profound benefits of these artificial substitutes include reduced patient morbidity compared to autograft harvesting, unlimited supply, and tailored mechanical and biological properties. Advances in material science now allow for the creation of smart materials that release therapeutic agents or mimic the native bone structure with high fidelity, thus accelerating integration and functional recovery.

The market growth is primarily driven by the burgeoning geriatric population worldwide, which is highly susceptible to age-related bone disorders, coupled with a rising number of sports-related injuries and road accidents requiring immediate bone reconstruction. Additionally, technological advancements, such as the integration of growth factors, stem cells, and sophisticated porous architectures achieved through advanced manufacturing techniques like additive manufacturing (3D printing), are continuously enhancing the efficacy and reliability of artificial bone materials, positioning them as the standard of care in modern skeletal repair. Regulatory pathways are becoming increasingly streamlined for these advanced materials, further encouraging market penetration and clinical adoption globally.

Artificial Bone Material Market Executive Summary

The Artificial Bone Material Market is experiencing robust expansion driven by pronounced global demographic shifts and rapid technological progression in biomaterials engineering. Current business trends indicate a strong movement toward fully synthetic and bioresorbable materials, which offer superior customization capabilities and eliminate the risk of disease transmission associated with donor-derived products. Strategic mergers, acquisitions, and collaborations between material science firms, orthopedic device manufacturers, and biotechnology companies are shaping the competitive landscape, focused primarily on developing hybrid materials that combine mechanical strength with potent biological signaling capabilities. Furthermore, there is a distinct trend towards personalized medicine, where 3D printing allows for the creation of bone scaffolds specifically matched to the patient’s defect morphology and size, optimizing surgical outcomes and reducing recovery times. This focus on customization and advanced manufacturing techniques is redefining product portfolios across leading market players.

Regionally, North America maintains the dominant market share, attributed to high healthcare spending, advanced medical infrastructure, and favorable reimbursement policies for complex orthopedic procedures. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth in APAC is fueled by the rapid expansion of medical tourism, improving healthcare access, increasing disposable incomes, and the growing awareness regarding advanced surgical options in densely populated economies like China and India. European markets, characterized by stringent regulatory environments, emphasize research and development in premium, high-performance synthetic materials and cellular therapies integrated with bone grafts, maintaining steady but mature growth.

Segment trends highlight the dominance of synthetic bone grafts, particularly Calcium Phosphate-based substitutes (Hydroxyapatite and Tricalcium Phosphate), due to their established biocompatibility and adjustable resorption rates. Within applications, spinal fusion procedures represent the largest segment due to the high incidence of degenerative disc diseases and the complexity of spinal reconstruction requiring reliable bone void fillers. The Demineralized Bone Matrix (DBM) segment remains strong, prized for its inherent osteoinductive properties, although synthetic alternatives are increasingly capturing market share due to enhanced manufacturing consistency and safety profiles. The future market trajectory is heavily vested in tissue engineering and the commercialization of novel materials designed to actively stimulate host bone regeneration rather than merely acting as passive scaffolds.

AI Impact Analysis on Artificial Bone Material Market

User queries regarding the impact of Artificial Intelligence (AI) on the Artificial Bone Material Market frequently center on themes of material discovery, personalized treatment planning, and manufacturing optimization. Common concerns revolve around how AI can accelerate the identification of novel, highly bioactive materials, moving beyond current standard formulations. Users are intensely interested in AI's role in predictive modeling—specifically, predicting the long-term integration and biomechanical failure probability of implanted grafts based on patient-specific data, surgical technique, and material composition. Expectations are high concerning the optimization of 3D printing parameters for creating patient-specific scaffolds with complex, optimized porous structures, ensuring ideal vascularization and cell infiltration. The consensus theme is that AI represents a paradigm shift from empirical material selection to predictive, data-driven biomaterial design and application.

AI is fundamentally transforming the research and development phase of artificial bone materials by enabling high-throughput screening of thousands of potential material compositions and structures. Machine learning algorithms can analyze vast datasets concerning biocompatibility, mechanical properties, degradation kinetics, and cellular response, identifying optimal material combinations much faster than traditional laboratory experimentation. This capability significantly shortens the time-to-market for next-generation bone graft substitutes, such as composite materials with enhanced osteoinductive properties. By accurately simulating biological environments and mechanical stress loads, AI minimizes trial-and-error, leading to materials that are safer, more effective, and tailored for specific anatomical sites and pathological conditions.

Furthermore, the integration of AI in clinical practice is enhancing the efficacy of artificial bone material usage. Deep learning models analyze pre-operative imaging (CT scans, MRIs) to precisely map the bone defect geometry, allowing for the generation of optimally designed, patient-matched implants through AI-driven generative design processes. In the post-operative phase, AI algorithms are being developed to monitor graft integration and healing progression via automated analysis of follow-up radiographs, providing clinicians with early warnings of potential non-union or infection. This predictive diagnostic capability is crucial for timely intervention, improving patient outcomes, and demonstrating the material's clinical success, thereby increasing market confidence and adoption rates.

- AI accelerates the discovery and optimization of novel biomaterial formulations (e.g., ceramic-polymer composites) by predicting biological performance.

- Machine Learning (ML) algorithms optimize 3D printing parameters (pore size, interconnectivity, density) for creating patient-specific scaffolds.

- Predictive modeling enhances surgical planning by simulating the biomechanical performance and integration longevity of bone grafts in vivo.

- AI-driven image analysis improves post-operative monitoring, detecting signs of non-union or failure earlier than conventional methods.

- Automation of regulatory documentation and clinical trial data processing, streamlining the pathway for novel bone substitute approvals.

- Personalized medicine enabled by AI optimizes the dosing and localization of integrated growth factors or therapeutic agents within the bone material.

DRO & Impact Forces Of Artificial Bone Material Market

The dynamics of the Artificial Bone Material Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively summarized as the Impact Forces. A primary driver is the accelerating increase in the global elderly population, which inherently leads to a higher incidence of age-related bone deficiencies such as severe osteoarthritis, osteoporosis, and related fractures requiring surgical intervention and bone grafting. Concurrently, advancements in surgical techniques, particularly minimally invasive procedures, necessitate highly specialized, reliable bone substitutes that can be delivered efficiently. The rising acceptance and clinical preference for synthetic grafts over traditional autografts, due to superior safety profiles and the ability to tailor material properties, further propel market expansion. Continuous government funding for orthopedic research and development in mature economies also acts as a foundational driver, sustaining innovation.

Conversely, significant restraints hinder rapid market proliferation. High manufacturing costs associated with complex, highly regulated biomaterials, especially those utilizing advanced cellular or growth factor integration, elevate the final product price, potentially limiting adoption in cost-sensitive markets. Furthermore, the stringent and often protracted regulatory approval processes, particularly for novel composite or biologically enhanced materials, create substantial barriers to market entry and slow down the commercialization of cutting-edge technologies. Concerns regarding the long-term mechanical stability, unpredictable resorption rates, and potential inflammatory responses associated with certain synthetic materials remain a clinical challenge, requiring continuous post-market surveillance and rigorous testing to build confidence among orthopedic surgeons. Product recall events, though rare, can severely damage market trust and suppress segment growth temporarily.

Opportunities for exponential growth are concentrated in the realm of bio-active and smart materials. The development of scaffolds loaded with regenerative cells (e.g., Mesenchymal Stem Cells) or those capable of controlled release of osteoinductive proteins represents a major commercial opportunity. Expanding therapeutic indications beyond traditional orthopedics into fields like maxillofacial reconstruction, sports medicine, and reconstructive plastic surgery offers new revenue streams. Moreover, strategic focus on developing cost-effective, high-quality synthetic alternatives tailored for the massive, untapped markets in emerging economies, combined with local manufacturing capabilities, provides a fertile ground for high volume growth. The ongoing shift toward specialized materials for revision surgeries and complex bone tumor resections also presents a high-value niche market opportunity, demanding highly sophisticated material solutions.

Segmentation Analysis

The Artificial Bone Material Market is segmented based on Material Type, Application, and End-User, reflecting the diverse clinical needs and technological complexity inherent in skeletal reconstruction. This multi-dimensional segmentation allows for precise market sizing and strategic focus, highlighting areas of high growth potential. The Material Type segment differentiates between grafts based on their origin and composition, profoundly influencing their biological function—whether they primarily act as passive scaffolds (osteoconduction) or actively promote bone formation (osteoinduction/osteogenesis). The Application segmentation reveals the procedural volumes and clinical necessity across various surgical disciplines, while the End-User segmentation provides insight into consumption patterns and purchasing power of institutions utilizing these high-value products.

The market's structural integrity is largely dependent on the performance and regulatory status of the dominant material types. Synthetic grafts, encompassing calcium phosphates and bioactive glasses, are gaining momentum due to enhanced safety and manufacturing scalability, driving price competitiveness. Biologically derived grafts, specifically allografts and DBM, maintain strong clinical relevance owing to their intrinsic osteoinductive properties, although supply limitations and processing costs remain factors. Analyzing these segments is critical for understanding current market penetration and forecasting future technological dominance, particularly as researchers push toward hybrid materials that combine the best attributes of both synthetic strength and biological activity. The ongoing refinement of surgical techniques in trauma and spinal procedures continues to drive specialization within application segments, demanding materials engineered for specific load-bearing requirements and healing environments.

- Material Type:

- Bone Grafts (Allografts, Xenografts)

- Bone Graft Substitutes (BGS)

- Synthetic Bone Grafts (Calcium Phosphates (e.g., Hydroxyapatite, Tricalcium Phosphate), Bioactive Glass, Polymers, Composites)

- Demineralized Bone Matrix (DBM)

- Application:

- Spinal Fusion

- Trauma and Reconstructive Surgery

- Joint Reconstruction

- Dental Bone Grafts

- Craniofacial and Maxillofacial Applications

- Others (e.g., Veterinary)

- End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics (e.g., Dental Clinics, Orthopedic Centers)

Value Chain Analysis For Artificial Bone Material Market

The value chain for the Artificial Bone Material Market is intricate, beginning with the sourcing and purification of raw materials and culminating in the surgical implantation in the end-user setting. The upstream segment involves the acquisition and initial processing of primary components. For synthetic grafts, this means sourcing high-purity chemicals (calcium, phosphorus, silicates) essential for manufacturing calcium phosphates, bioactive glasses, or polymers. For allografts and xenografts, the upstream involves stringent donor screening, tissue harvesting, and initial sterilization and processing to ensure biological safety and structural integrity. Managing the supply chain for biological materials requires meticulous adherence to international biosafety standards, which adds significant complexity and cost, driving the need for robust quality control mechanisms from the outset.

Midstream activities are characterized by advanced manufacturing, which is the core value-addition stage. This includes powder processing, sintering, foaming, and increasingly, sophisticated additive manufacturing (3D printing) to create customized, highly porous scaffolds. Research and development investment is heaviest at this stage, focusing on optimizing material porosity, interconnectivity, mechanical strength, and bioactivity through surface modifications or the incorporation of growth factors. Companies differentiate themselves here through proprietary technologies that yield superior osteoconductive or osteoinductive performance. Regulatory compliance, including rigorous testing for biocompatibility and mechanical performance (ISO standards, FDA/CE marking), is paramount before moving to distribution.

The downstream segment encompasses the distribution channels, marketing, and final delivery to hospitals and specialty clinics. Distribution involves highly specialized logistics, often requiring controlled temperature storage, particularly for cellularized grafts or certain allografts. Sales are channeled both directly, through dedicated sales representatives engaging high-volume surgical centers, and indirectly, via partnerships with third-party medical device distributors, particularly in regions where manufacturers lack a direct presence. Effective education and technical support provided to orthopedic surgeons and surgical teams are crucial for successful product adoption, marking the final critical step in the value chain before surgical implantation and patient rehabilitation, which confirms the product's clinical value.

Artificial Bone Material Market Potential Customers

The primary customers and end-users of artificial bone materials are healthcare institutions and specialized clinical practices that perform skeletal reconstruction and repair procedures. Hospitals, particularly those with high-volume trauma centers, specialized orthopedic departments, and complex spinal surgery units, represent the largest and most critical segment of the customer base. These institutions require a constant, diverse supply of bone graft substitutes to manage emergency trauma cases, scheduled joint replacements, and intricate spinal fusion operations. Their purchasing decisions are heavily influenced by clinical evidence, product reliability, supply consistency, and favorable group purchasing organization (GPO) contracts, as they manage large patient populations and complex inventory needs.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing customer segment, focusing on less invasive, elective orthopedic and spinal procedures that often utilize synthetic and minimally processed bone substitutes. ASCs value products that facilitate quicker recovery times, reduce hospital stays, and are cost-effective for high turnover surgical schedules. Their preference often leans towards easy-to-use, pre-packaged, and reliable materials that integrate smoothly into optimized outpatient workflows. Furthermore, dental and maxillofacial specialty clinics form another significant customer base, relying heavily on bone graft materials for periodontal treatments, dental implant placement, and cosmetic bone augmentation, requiring materials specialized for lower load-bearing applications but high aesthetic and integration standards.

Finally, governmental and military healthcare systems also function as substantial potential customers, particularly in contexts involving high rates of battlefield trauma or standardized care for service members. These entities prioritize high durability, long shelf-life, and standardized procurement processes for materials suitable for severe bone loss injuries. The procurement requirements across all these customer types mandate rigorous quality assurance from manufacturers and often necessitate evidence of successful long-term clinical integration documented through extensive peer-reviewed data and large-scale post-market studies to secure large-volume, recurring contracts. The evolving customer landscape emphasizes products offering superior osteointegration with minimal biological risk.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Johnson & Johnson (DePuy Synthes), Stryker Corporation, Zimmer Biomet, RTI Surgical, SeaSpine Holdings Corporation, Baxter International, Collagen Matrix, Geistlich Pharma AG, NovaBone Products, Curasan, Olympus Corporation, Globus Medical, Berkeley Advanced Biomaterials, Orthofix Medical Inc., Wright Medical Group N.V. (now part of Stryker), Bioventus, CAM Bioceramics B.V., Ossur, Citagenix. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Bone Material Market Key Technology Landscape

The technological landscape of the Artificial Bone Material Market is characterized by a rapid evolution toward materials that are not only biocompatible and mechanically sound but also possess potent biological signaling capabilities. A critical technology driving this transformation is additive manufacturing (3D printing), which allows for the precise control over pore size, interconnectivity, and external shape of synthetic scaffolds. This capability ensures optimal nutrient exchange and cell migration, crucial for vascularization and effective bone regeneration. Technologies like Selective Laser Sintering (SLS) and Extrusion-Based Printing are now routinely used to produce complex calcium phosphate and polymer composite structures that can be customized pre-operatively based on patient imaging data, moving the industry decisively toward personalized medicine and patient-specific implants.

Another major technological advancement involves surface modification and biological enhancement of inert bone graft materials. Techniques such as plasma spraying, chemical etching, and physical adsorption are utilized to functionalize the surface of synthetic grafts, promoting better adhesion of osteogenic cells. Furthermore, the integration of osteoinductive factors—including bone morphogenetic proteins (BMPs) or other growth factors—into matrices is crucial. Delivery systems, often micro- or nano-encapsulated within the bone material, are being engineered to ensure the sustained and localized release of these proteins, maximizing their therapeutic effect while minimizing systemic exposure and associated risks. This focus on bio-activity represents a significant leap from passive scaffolding to active tissue regeneration stimulation.

Finally, the growing maturity of tissue engineering and regenerative medicine techniques is fundamentally reshaping the market. Research efforts are concentrating on developing living bone substitutes, utilizing autologous or allogeneic stem cells seeded onto sophisticated polymer or ceramic scaffolds. Bioreactors and specialized culture conditions are essential technological components that facilitate the differentiation of stem cells into osteoblasts in vitro before implantation. While still facing regulatory and cost challenges, these cell-based therapies represent the pinnacle of regenerative potential, promising full restoration of function. Innovations in injectable bone substitutes (IBS), often based on hydraulic calcium phosphate cements, provide a further technological niche, allowing minimally invasive delivery for fracture filling and vertebroplasty, offering rapid setting times and high clinical utility.

Regional Highlights

The global Artificial Bone Material Market exhibits diverse dynamics across key geographical regions, reflecting variations in healthcare infrastructure, surgical adoption rates, and regulatory environments. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is due to the presence of key market players, extensive R&D capabilities, high patient awareness regarding advanced orthopedic treatments, and robust healthcare expenditure supported by favorable reimbursement policies for complex bone grafting procedures. The region is a leader in adopting novel technologies, particularly 3D printed patient-specific implants and advanced synthetic composites, driven by a high volume of spinal fusion and joint reconstruction surgeries.

Europe represents the second-largest market, characterized by stringent quality standards enforced by bodies like the European Medicines Agency (EMA). Western European countries (Germany, France, UK) show high adoption rates for premium, evidence-based bone substitutes, focusing heavily on ceramics and advanced DBM products. The regulatory landscape, while strict, encourages sustained innovation in bioresorbable and functionalized materials. Eastern Europe is emerging, though market growth there is hampered somewhat by centralized healthcare procurement and lower overall healthcare spending per capita compared to the West.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This accelerated growth is primarily attributed to rapidly improving healthcare access, increasing medical infrastructure development, and the burgeoning medical tourism sector in countries such as South Korea, India, and China. While price sensitivity remains a factor, the massive population base and increasing incidence of age-related orthopedic issues ensure high volume demand. Local manufacturers in APAC are increasingly competing with global giants by offering cost-effective synthetic grafts. Latin America and the Middle East & Africa (MEA) are also showing steady growth, driven by investments in trauma care facilities and expanding public healthcare initiatives aimed at improving access to necessary orthopedic interventions, though these regions rely heavily on imported finished products.

- North America: Market leader, high technological adoption, significant R&D investment, and strong reimbursement coverage. Focus on personalized grafts and complex spinal applications.

- Europe: Second largest market, emphasis on high-quality synthetic and DBM products, regulated by strict EU standards. Mature markets in Western Europe driving steady, quality-focused growth.

- Asia Pacific (APAC): Highest projected CAGR, driven by healthcare infrastructure expansion, large patient pool, and growing medical tourism. Emerging local manufacturing capabilities focusing on volume.

- Latin America (LATAM): Growth driven by increasing surgical demand and improving economic stability; relies substantially on multinational import supply chains.

- Middle East & Africa (MEA): Growth concentrated in trauma centers and specialized clinics in GCC nations, supported by high private healthcare spending and government investments in modernizing facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Bone Material Market.- Medtronic plc

- Johnson & Johnson (DePuy Synthes)

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- RTI Surgical Holdings, Inc.

- SeaSpine Holdings Corporation

- Baxter International Inc.

- Collagen Matrix, Inc.

- Geistlich Pharma AG

- NovaBone Products LLC

- Curasan AG

- Olympus Corporation

- Globus Medical, Inc.

- Berkeley Advanced Biomaterials

- Orthofix Medical Inc.

- Smith & Nephew plc

- Bioventus LLC

- CAM Bioceramics B.V.

- Ossur hf

- Citagenix Inc.

Frequently Asked Questions

Analyze common user questions about the Artificial Bone Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Artificial Bone Material Market?

The primary factor driving market growth is the global demographic shift toward an aging population, which results in a significantly higher incidence of age-related orthopedic conditions like osteoporosis and degenerative joint diseases, necessitating frequent bone grafting and reconstruction surgeries worldwide.

How do synthetic bone grafts compare biologically to traditional autografts?

While autografts offer all three required properties (osteoinduction, osteoconduction, and osteogenesis), synthetic grafts (like Calcium Phosphates) primarily provide osteoconduction (a scaffold). However, advanced synthetics are increasingly incorporating growth factors or stem cell capabilities to achieve osteoinduction, offering superior supply consistency and mitigating donor site morbidity risk.

Which material type holds the largest market share in the Artificial Bone Material Market?

The Synthetic Bone Grafts segment, particularly calcium phosphate-based materials (Hydroxyapatite and Tricalcium Phosphate), currently dominates the market share due to their proven biocompatibility, unlimited supply, and ease of modification for specific surgical needs, especially in non-load-bearing applications.

What role does 3D printing play in the future development of artificial bone substitutes?

3D printing (additive manufacturing) is crucial for the future, enabling the creation of patient-specific bone scaffolds with highly precise, interconnected porous architectures. This personalization optimizes material integration, enhances mechanical fit, and improves the scaffold's ability to facilitate vascularization and natural bone regeneration in vivo.

Which geographical region is anticipated to demonstrate the fastest market growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This acceleration is fueled by substantial investments in healthcare infrastructure, increasing surgical volumes, and growing clinical adoption of advanced orthopedic procedures across key economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager