Artificial Fur Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443642 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Artificial Fur Market Size

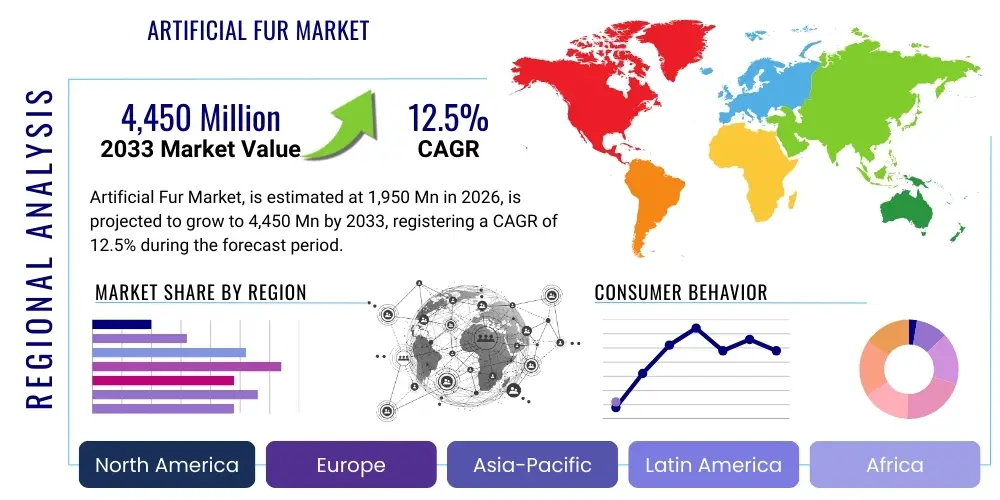

The Artificial Fur Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1,950 Million in 2026 and is projected to reach USD 4,450 Million by the end of the forecast period in 2033.

Artificial Fur Market introduction

The Artificial Fur Market, also frequently termed faux fur or synthetic fur, encompasses a variety of textile products manufactured to mimic the aesthetic appearance and tactile feel of genuine animal fur. These materials are primarily composed of synthetic fibers such as modacrylic, acrylic, polyester, and various polymer blends, which are processed using complex knitting or weaving techniques to create dense, textured pile fabrics. The fundamental goal of artificial fur production is to offer a cruelty-free, environmentally conscientious, and cost-effective alternative to natural fur, catering to a global consumer base increasingly focused on ethical sourcing and sustainable fashion practices. This shift towards synthetic alternatives is driven by stringent animal welfare regulations and evolving consumer preference, establishing artificial fur as a crucial component across multiple industries.

Major applications of artificial fur span diverse sectors, prominently featuring in the apparel industry for manufacturing high-end coats, jackets, vests, and various accessories like scarves, hats, and boot linings. Beyond fashion, it finds substantial use in home furnishings, including luxury throws, decorative pillows, area rugs, and bedding, adding texture and warmth to interior spaces. Furthermore, the automotive sector utilizes faux fur for seat covers and interior trims, while the toy manufacturing industry heavily relies on it for creating soft toys and stuffed animals. The versatility, durability, and relatively low cost of production compared to natural fur further solidify its position as a highly desirable material across these widespread applications.

The primary benefits driving market expansion include ethical consumption, cost efficiency, and ease of maintenance. Artificial fur provides designers with immense flexibility in color, texture, and pattern customization that natural fur often restricts, allowing for rapid adaptation to changing fashion trends. Key driving factors underpinning the projected growth trajectory are the escalating global awareness regarding animal cruelty, the implementation of widespread bans on natural fur sales in major economies, technological advancements in fiber engineering resulting in hyper-realistic textures, and the aggressive marketing of sustainable fashion lines by major global brands, positioning faux fur as a staple rather than a mere substitute.

- Product Description: Textile materials manufactured from synthetic polymers (e.g., acrylic, polyester, modacrylic) designed to replicate the appearance and texture of real animal fur, offering ethical and versatile alternatives.

- Major Applications: Apparel (outerwear, linings, accessories), Home Furnishings (throws, rugs, pillows), Automotive Interiors, and Toy manufacturing.

- Benefits: Cruelty-free production, lower material cost, high durability, superior resistance to pests, and extensive design versatility.

- Driving Factors: Strict global animal welfare legislation, rising ethical consumerism, enhanced realism through advanced textile technology, and endorsement by high-profile fashion designers.

Artificial Fur Market Executive Summary

The global Artificial Fur Market is experiencing robust acceleration, fundamentally propelled by deep-seated shifts in consumer ethics and regulatory frameworks favoring sustainable and cruelty-free materials. Business trends indicate a marked consolidation towards manufacturers capable of producing high-grade, bio-based faux fur alternatives, addressing sustainability concerns inherent in traditional petroleum-derived synthetics. Key market players are heavily investing in research and development to achieve superior fiber realism, tactile quality, and breathability, effectively blurring the line between natural and synthetic textiles. Furthermore, the expansion of e-commerce platforms and digitally native brands has dramatically increased the accessibility and visibility of faux fur products globally, bypassing traditional retail constraints and accelerating market penetration, especially in fast-fashion and mid-range luxury segments.

Regionally, the market demonstrates heterogeneous growth patterns. North America and Europe currently represent the largest consumption hubs, largely due to stringent regulatory environments concerning animal welfare and high consumer disposable income supporting ethical purchasing decisions. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) during the projection period. This rapid growth in APAC is primarily attributed to rising urbanization, increasing affluence leading to higher adoption of Western fashion trends, and the expansion of domestic textile production capabilities. Governments in countries like China and India are also beginning to implement stricter environmental and ethical guidelines, indirectly bolstering the demand for alternatives like artificial fur.

Segmentation analysis reveals that the Modacrylic segment dominates the market by material type due to its inherent fire resistance and premium feel, making it suitable for high-quality apparel and home goods. Concurrently, the Apparel application segment retains the largest market share, driven by continuous innovation in outerwear and fashion accessories, which utilize faux fur extensively for insulation and aesthetic appeal. The crucial trend across all segments is the increasing consumer demand for traceable and transparent sourcing, pushing manufacturers towards achieving certifications for environmentally friendly production processes and the eventual development of fully biodegradable artificial fur options to mitigate end-of-life disposal concerns.

AI Impact Analysis on Artificial Fur Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Artificial Fur Market predominantly revolve around themes of design innovation, supply chain optimization, and consumer personalization. Common questions include: "How can AI predict faux fur color and texture trends?", "Can AI enhance the efficiency of synthetic fiber production?", and "Will AI-driven personalized fashion increase the demand for customized faux fur garments?" Analysis reveals that consumers and industry stakeholders are highly concerned with how AI can democratize high-fidelity textile design, accelerate the speed-to-market for new collections, and, crucially, improve the environmental footprint of the manufacturing process by optimizing resource use and minimizing waste in dyeing and knitting operations. Expectations center on AI contributing significantly to material science breakthroughs that improve the realism and sustainability of faux fur.

The integration of AI and machine learning models is transforming the product lifecycle management within the artificial fur industry, starting from conceptual design through to consumer delivery. AI algorithms are now capable of analyzing vast datasets comprising historical sales figures, social media trends, meteorological data, and catwalk designs to accurately forecast upcoming consumer preferences for specific textures, pile lengths, and color palettes. This predictive capability allows manufacturers to optimize inventory levels and reduce speculative production, significantly decreasing material wastage and enhancing profitability. Furthermore, generative design AI tools enable rapid prototyping and simulation of new fiber weaves and synthetic compositions, accelerating the development cycle for next-generation, high-performance artificial furs that offer better insulation and breathability.

In the manufacturing domain, AI-powered systems are being deployed for real-time quality control and process optimization. Computer vision systems equipped with machine learning can monitor the consistency of the synthetic fur pile during the weaving or knitting process, immediately identifying defects or deviations in texture far quicker and more accurately than human inspection. This leads to higher overall product quality and reduces batch failures. Moreover, AI is crucial in optimizing complex global supply chains, managing logistics, predicting potential disruptions, and routing materials efficiently, ensuring raw synthetic fibers are procured and finished goods are distributed promptly. This enhanced operational efficiency is vital for maintaining competitive pricing and fulfilling the rapid delivery cycles demanded by modern e-commerce consumers.

- AI-Driven Trend Forecasting: Utilizing machine learning to predict highly localized and global preferences for textures, colors, and patterns, optimizing design pipelines.

- Supply Chain Optimization: AI algorithms enhance transparency, predict logistical bottlenecks, and optimize inventory management of raw synthetic fibers and finished goods.

- Generative Design & Material Science: AI accelerates the creation of new polymer blends and weaving techniques, leading to more realistic, sustainable, and functional artificial fur.

- Automated Quality Control: Deployment of computer vision systems in production lines ensures consistent pile quality, density, and color uniformity, reducing manufacturing defects.

- Personalized Product Recommendations: AI enhances retail platforms by providing consumers with highly specific faux fur product recommendations based on individual purchasing history and style profiles.

DRO & Impact Forces Of Artificial Fur Market

The market dynamics of the Artificial Fur industry are governed by a robust interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the Impact Forces on market progression. The core drivers are undeniably ethical shifts in consumer behavior and pervasive legislative measures against natural fur trade. A growing global population prioritizes cruelty-free consumption, leading to a substantial and irreversible decline in demand for animal-derived products. This primary driver is powerfully supplemented by technological advances in textile manufacturing, enabling the creation of artificial fur that matches the aesthetic and tactile attributes of natural fur, thus eliminating the trade-off between ethics and luxury. These forces exert a powerful positive momentum, compelling rapid market expansion and innovation in material development.

Conversely, significant restraints exist that impede growth, predominantly centered on sustainability and raw material sourcing. Most traditional artificial furs are petroleum-based, relying heavily on non-renewable fossil fuels (e.g., acrylic, polyester), leading to concerns about microplastic shedding and end-of-life disposal in landfills. The environmental footprint associated with synthetic fiber production remains a critical point of friction, attracting scrutiny from environmental advocacy groups and sustainability-conscious consumers. Furthermore, the volatility in crude oil prices directly impacts the cost of raw materials for synthetic fibers, leading to fluctuating production costs, which introduces instability in the supply chain planning and pricing strategies of manufacturers.

The opportunities within the artificial fur space are vast and are concentrated in sustainable innovation and expansion into non-traditional applications. The most compelling opportunity lies in the development and commercialization of bio-based and recycled artificial fur variants—using materials derived from plant fibers, recycled plastics (like RPET), or innovative fermentation processes—which directly addresses the environmental restraint. Such advancements offer a clear pathway to achieving circularity in the fashion and textile supply chain, appealing strongly to Gen Z and Millennial consumers. Additionally, the increasing demand for high-performance thermal and acoustic materials in the automotive and aerospace industries presents novel avenues for diversifying the application base beyond traditional apparel and home decor, potentially unlocking premium market segments requiring specialized technical textiles.

- Drivers (D):

- Global rise in ethical consumerism and anti-fur sentiments.

- Increasing government regulations and bans on natural fur farming and sales (e.g., California, Israel).

- Technological breakthroughs improving the realism, drape, and feel of synthetic fibers.

- Cost-effectiveness and inherent durability compared to natural fur.

- Restraints (R):

- Environmental concerns related to microplastic shedding from synthetic (petroleum-based) fibers.

- Dependence on fluctuating crude oil prices impacting raw material costs for acrylic and polyester.

- Perceived lower social status or luxury appeal compared to high-end natural fur in certain traditional markets.

- Challenges in recycling complex textile blends used in multi-layered artificial fur products.

- Opportunities (O):

- Development and scaling of bio-based, recycled, and biodegradable artificial fur alternatives.

- Expansion of application scope into technical textiles, particularly automotive soundproofing and interior trims.

- Growth in emerging economies fueled by rising disposable income and adoption of global fashion trends.

- Integration of smart technology (e.g., heated textiles) within artificial fur apparel and home goods.

- Impact Forces: The powerful societal shift toward ethical sourcing, intensified by regulatory action, currently outweighs the environmental restraints associated with petroleum derivatives, resulting in a net positive impact and accelerating demand, particularly for innovative, sustainable faux fur options.

Segmentation Analysis

The Artificial Fur Market is meticulously segmented based on key structural attributes, including the type of material used for fiber creation, the specific application of the final textile product, and the distribution channel employed for retail sales. This segmentation is crucial for understanding nuanced market trends, pinpointing high-growth areas, and developing targeted marketing strategies. The complexity of faux fur production, which often involves blending different fiber types to achieve specific textures, mandates a detailed analysis of the material segment, as performance characteristics like thermal retention, flammability, and softness are directly contingent on the polymer composition.

From a material perspective, Modacrylic fibers command a substantial share, primarily due to their superior flame-retardant properties and plush feel, making them ideal for high-end fashion and regulated interior applications. However, the polyester segment is rapidly expanding, fueled by the accessibility and cost-efficiency of utilizing recycled polyethylene terephthalate (RPET) in fiber manufacturing, aligning with circular economy objectives. The application segmentation reveals that while Apparel remains the primary revenue generator, segments like Home Furnishings and Automotive are increasingly important, capitalizing on consumer desires for luxurious, tactile materials within private spaces and vehicle interiors.

Furthermore, the analysis of distribution channels highlights the pivotal role of Online Retail, which provides consumers globally with unparalleled access to diverse product lines and niche brands, often facilitating direct-to-consumer (D2C) sales. This channel minimizes overheads and allows brands to communicate their ethical and sustainability narratives directly. Specialty Stores and high-end boutiques retain significance for consumers seeking tactile evaluation of premium quality faux fur and personalized shopping experiences, particularly for luxury apparel and bespoke interior design elements.

- By Material:

- Modacrylic

- Polyester

- Acrylic

- Others (e.g., Blends, Natural Fiber-based Synthetics)

- By Application:

- Apparel

- Coats and Jackets

- Vests and Linings

- Accessories (Hats, Scarves, Mittens)

- Home Furnishings

- Rugs and Carpets

- Throws and Blankets

- Pillows and Cushions

- Automotive (Trims, Seat Covers)

- Toys and Plush Items

- Others (e.g., Crafting, Pet Accessories)

- Apparel

- By Distribution Channel:

- Online Retail

- Hypermarkets/Supermarkets

- Specialty Stores and Boutiques

- Departmental Stores

Value Chain Analysis For Artificial Fur Market

The Value Chain for the Artificial Fur Market is complex, beginning with the production of synthetic polymers (upstream), moving through specialized textile processing and garment manufacturing (midstream), and concluding with multi-channel distribution to end-consumers (downstream). The upstream segment is dominated by petrochemical giants and chemical companies that synthesize the primary raw materials—acrylic, modacrylic, and polyester pellets—which are crucial for fiber extrusion. Strategic sourcing in this phase is critical, as fluctuations in energy and chemical prices directly influence the base cost of the final product. A key emerging trend in the upstream value chain is the increased reliance on recycled materials and bio-based polymers to future-proof supply chains against environmental critiques and resource depletion.

The midstream activities involve highly technical processes such as fiber spinning, texturizing, weaving or knitting the fabric base, and specialized finishing treatments (e.g., dyeing, shearing, and brushing) to achieve the characteristic fur-like appearance. Manufacturers specializing in artificial fur fabrics require significant investment in specialized knitting machines (like circular or raschel knitting machines) and advanced dyeing facilities that ensure color fastness and realistic texture depth. Quality control at this stage is paramount, focusing on pile density, fiber shedding resistance, and replication accuracy of natural fur patterns. Integration between fiber producers and textile mills is often tight, especially for proprietary fiber blends.

Downstream distribution channels manage the flow of finished artificial fur goods to the consumer market. Distribution is bifurcated into direct and indirect methods. Direct distribution involves sales through brand-owned stores or D2C e-commerce platforms, offering higher margin control and direct consumer feedback loops. Indirect channels include wholesale agreements with large retailers, department stores, and, most importantly, online marketplaces (like Amazon or specialized fashion portals). The dominance of e-commerce has necessitated robust logistics and warehousing infrastructure capable of handling large volumes of seasonal, bulky items. Success in the downstream segment is tied to efficient logistics and sophisticated marketing that highlights the ethical and aesthetic value proposition of artificial fur.

Artificial Fur Market Potential Customers

The primary end-users and buyers of artificial fur products span multiple consumer demographics and industrial sectors, reflecting the material’s broad application versatility. In the apparel segment, potential customers are highly segmented, ranging from fast-fashion retailers seeking inexpensive, trendy materials for high turnover items, to luxury fashion houses integrating premium, high-fidelity faux fur as an ethical alternative to real pelts. These consumers are generally characterized by a high degree of ethical awareness, an appreciation for fashion aesthetics, and, increasingly, a preference for durable and easy-to-care-for garments that align with sustainable purchasing ideologies.

Beyond apparel, a significant customer base resides in the home goods and interior design industries. These buyers—including residential interior decorators, hospitality developers, and wholesale furniture manufacturers—purchase artificial fur for its ability to add textural richness, warmth, and luxury appeal to spaces through throws, rugs, and upholstery. For this segment, the material's durability, hypo-allergenic properties, and resistance to moth damage are key purchasing factors. The low cost relative to animal hides allows for large-scale, luxury aesthetic implementation in commercial environments such as hotels and high-end residential complexes.

Industrial consumers form another important segment, particularly in the automotive and toy sectors. Automotive manufacturers utilize high-quality, often flame-retardant artificial fur for sophisticated interior trims, headliners, and specialty accessories, valuing its consistent quality, uniform texture, and sound-dampening capabilities. Toy manufacturers constitute a massive volume buyer base, relying on artificial fur for stuffed animals due to its softness, safety standards compliance, and cost-efficiency. These diverse customer groups ensure consistent, year-round demand, mitigating the inherent seasonality often observed in the fashion-driven segment of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,950 Million |

| Market Forecast in 2033 | USD 4,450 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ecopel, Xinxiang Huafu Textile, Jiangsu Qingsong Fur Co., Ltd., Everest Textile, Furry Friends Fashion, Tissavel, FakeFur.com, Meijin Fur, Kanecaron (Kaneka Corporation), Shandong Weifang No. 2 Wool Textile Factory, Regal Fabrics, Inc., Dongwoo Textile Co., Ltd., Yongdali Textile, Riri Zippers (Material supplier for apparel), Huntsman Corporation (Chemical supplier) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Fur Market Key Technology Landscape

The technological landscape of the Artificial Fur Market is characterized by continuous process innovation aimed at improving fiber realism, functional performance, and environmental sustainability. Traditional production methods relied on standard knitting and weaving techniques, but modern advancements focus on high-fidelity simulation. A pivotal technology is the development of ultra-fine denier synthetic fibers, often achieved through specialized polymer extrusion processes. These microfibers, sometimes less than 1 denier, allow for the creation of denser, softer, and more fluid piles that closely mimic the natural movement and luxurious feel of real fur, thereby overcoming previous aesthetic limitations associated with synthetic materials. Furthermore, sophisticated dyeing and printing techniques, including 3D digital printing, enable intricate, realistic patterning that replicates complex animal markings (e.g., leopard spots, striped gradients) with unparalleled precision and durability.

Another significant technological advancement is the integration of specialized finishing processes designed to enhance the physical characteristics of the faux fur. This includes advanced shearing, tipping, and brushing equipment that carefully sculpts the pile surface to create varied lengths and textures within a single fabric piece, contributing substantially to the realism. Chemical finishing treatments are also critical; these treatments are applied to improve characteristics like antistatic properties, water repellency, and flame resistance (particularly important for Modacrylics used in children’s wear and automotive interiors). Innovation in these post-production stages allows manufacturers to cater to highly specific market demands, from luxurious, long-haired shags to tightly curled, resilient sheepskin imitations.

Looking forward, the most transformative technological shift centers on material science for sustainability. The focus is on replacing petroleum-based raw materials with bio-based or recycled polymers. Technologies such as enzymatic recycling of polyester (depolymerization) are gaining traction, allowing textile waste to be broken down into monomer building blocks for the creation of new, high-quality synthetic fibers without relying on virgin fossil resources. Additionally, research into innovative cellulosic or protein-based fibers that can be engineered to possess the necessary structure and tactile feel of fur is poised to revolutionize the market by offering fully biodegradable and renewable faux fur options, directly addressing the microplastic challenge.

- Ultra-Fine Denier Fiber Extrusion: Production of synthetic fibers less than 1 denier to ensure maximum softness, density, and realistic drape in the resulting fabric.

- Advanced Knitting and Weaving Machinery: High-speed circular and raschel knitting machines optimized for dense pile creation and precise fiber alignment, minimizing shedding.

- 3D Digital Printing and Dyeing: Techniques allowing for accurate, durable replication of complex natural fur patterns and gradients, improving aesthetic appeal.

- Specialized Finishing Processes: Automated shearing, tipping, and brushing technologies used to manipulate pile length and surface texture for hyper-realistic simulation.

- Chemical Recycling Technologies: Processes like depolymerization that convert textile waste (polyester) back into monomers for sustainable, closed-loop production of new synthetic fibers.

Regional Highlights

North America: The North American market is characterized by high demand for premium, ethically sourced artificial fur and strong regulatory pressures against the natural fur trade, particularly in the United States and Canada. This region benefits from a robust fashion industry that aggressively promotes faux fur in designer collections and fast-fashion lines. Consumers here possess high disposable incomes and a strong commitment to ethical consumption, driving market growth. Key growth segments include luxury home furnishings, where high-end faux fur throws and rugs are popular, and the increasing use of technical faux fur in specialized winter sports apparel for enhanced insulation and water resistance. Significant investments in sustainable fiber research within US universities and textile corporations further solidify North America's position as a mature, high-value market.

Europe: Europe is a global leader in the adoption of artificial fur, driven by historical animal welfare activism and comprehensive legislative bans on fur farming across several key nations (e.g., UK, Netherlands, Germany). The region’s sophisticated textile manufacturing base and strong tradition in fashion design ensure continuous innovation in faux fur aesthetics and quality. Western European countries, particularly Italy and France, integrate artificial fur into high-fashion garments, setting global trends. The European market emphasizes circular economy principles, leading to higher demand for recycled and bio-based faux fur materials. Strict EU directives regarding chemical use and textile quality (REACH regulations) ensure that artificial fur products sold in the region adhere to elevated safety and environmental standards, pushing manufacturers toward cleaner production methods.

Asia Pacific (APAC): APAC is the fastest-growing region, presenting substantial untapped potential for artificial fur consumption and manufacturing. China dominates regional production, serving as a critical global hub for both raw material synthesis and textile manufacturing. Rising disposable incomes, rapid urbanization, and the increasing exposure of younger generations to Western ethical fashion trends are fueling demand. While traditional textile use is still prevalent, the shift towards synthetic alternatives is accelerating, particularly in urban centers of South Korea, Japan, and India. The market is primarily driven by the apparel and toy manufacturing sectors, which rely on cost-effective, high-volume material sourcing. Future growth will be dependent on improving the quality perception of domestic faux fur products and addressing rising environmental concerns related to manufacturing waste and air pollution.

Latin America (LATAM): The LATAM market remains relatively nascent but exhibits promising growth, driven by localized fashion trends and increasing awareness of global ethical standards. Economic volatility poses a challenge, often leading consumers to prioritize cost-effective options, favoring standard polyester or acrylic faux fur materials over premium modacrylic blends. Brazil and Mexico are the primary market drivers, benefiting from large domestic apparel industries and a growing middle class interested in affordable luxury items. Expansion into this region requires localized marketing strategies that balance cost considerations with the ethical benefits of artificial fur, focusing heavily on accessibility through digital retail channels.

Middle East and Africa (MEA): The MEA region is developing, with growth concentrated in wealthy Gulf Cooperation Council (GCC) countries. High per capita income in the GCC fuels demand for luxury apparel and sophisticated home decor, positioning faux fur as a desirable, often imported, textile. The hot climate restricts widespread use in outerwear but drives demand for specialized applications such as luxury accessories, car interiors, and high-end throws for climate-controlled indoor spaces. South Africa also represents a key regional market due to its established fashion industry and growing adherence to international ethical standards. Market penetration relies heavily on import channels and partnerships with international luxury retailers.

- North America: Dominates premium segment; driven by strong ethical consumerism, strict animal welfare laws, and high disposable income. Focus on technical and sustainable faux fur innovations.

- Europe: Pioneer in ethical fashion; growth supported by extensive natural fur bans and commitment to circular economy principles; strong demand for high-quality, regulated products.

- Asia Pacific (APAC): Fastest growing market; major manufacturing hub (China); rising demand fueled by urbanization, increasing affluence, and expanding domestic fashion industries in India and Korea.

- Latin America: Emerging market with growth focused on Brazil and Mexico; sensitive to pricing, driving demand for cost-efficient synthetic options, expanding primarily through e-commerce.

- Middle East & Africa (MEA): Luxury-focused consumption, concentrated in GCC countries; demand for imported, high-end faux fur for accessories and climate-controlled interiors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Fur Market.- Ecopel

- Xinxiang Huafu Textile

- Jiangsu Qingsong Fur Co., Ltd.

- Everest Textile

- Furry Friends Fashion

- Tissavel

- FakeFur.com (Distribution/Retailer focus)

- Meijin Fur

- Kanecaron (Kaneka Corporation)

- Shandong Weifang No. 2 Wool Textile Factory

- Regal Fabrics, Inc.

- Dongwoo Textile Co., Ltd.

- Yongdali Textile

- Riri Zippers (Material supplier focus)

- Huntsman Corporation (Chemical/Dye supplier focus)

- Toray Industries (Advanced synthetic fiber producer)

- Albini Group (Luxury textile focus)

- Moda Fabrics (Home furnishing textile focus)

- DuPont (Polymer material focus)

- Sankyo Chemical Co., Ltd.

Frequently Asked Questions

What is the primary difference between artificial fur and natural fur in terms of market dynamics?

The primary market distinction is ethical sourcing; artificial fur addresses mounting consumer and regulatory resistance to animal cruelty, offering a cruelty-free alternative. Economically, faux fur benefits from predictable, lower raw material costs (synthetics) and high versatility, contrasting with the fluctuating, ethically contentious, and costly supply chain of natural fur.

Which application segment holds the largest market share in the global Artificial Fur Market?

The Apparel segment holds the largest market share, driven by its extensive use in coats, jackets, and fashion accessories. The continuous innovation by designers and the rapid adoption of faux fur in fast fashion and high-end ethical collections ensure its consistent dominance over home furnishings and industrial applications.

What key innovations are addressing the environmental concerns related to petroleum-based artificial fur?

Innovations are focused on material science, specifically developing and scaling production of bio-based artificial fur (derived from plant cellulose or fermentation) and chemically recycled polyester (RPET) fibers. These sustainable alternatives reduce reliance on virgin fossil fuels and mitigate concerns regarding microplastic shedding and end-of-life landfill waste.

How is technological advancement influencing the quality and realism of faux fur products?

Technological advancement, particularly ultra-fine denier fiber extrusion and specialized finishing techniques (shearing and brushing), allows manufacturers to create synthetic materials with exceptional softness, realistic density, and fluid drape. This enhanced realism has made artificial fur virtually indistinguishable from mid-range natural furs, increasing consumer acceptance across luxury segments.

Why is the Asia Pacific (APAC) region projected to exhibit the highest growth rate for artificial fur?

APAC's high projected growth rate is attributed to rapid economic expansion, urbanization, and the rise of a middle class adopting Western fashion trends. Furthermore, the region's position as a major global textile manufacturing hub, coupled with increasing domestic demand for ethical and affordable luxury goods, significantly accelerates market penetration compared to mature markets like North America and Europe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager