Artificial intelligence (AI) in Supply Chain and Logistics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441170 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Artificial intelligence (AI) in Supply Chain and Logistics Market Size

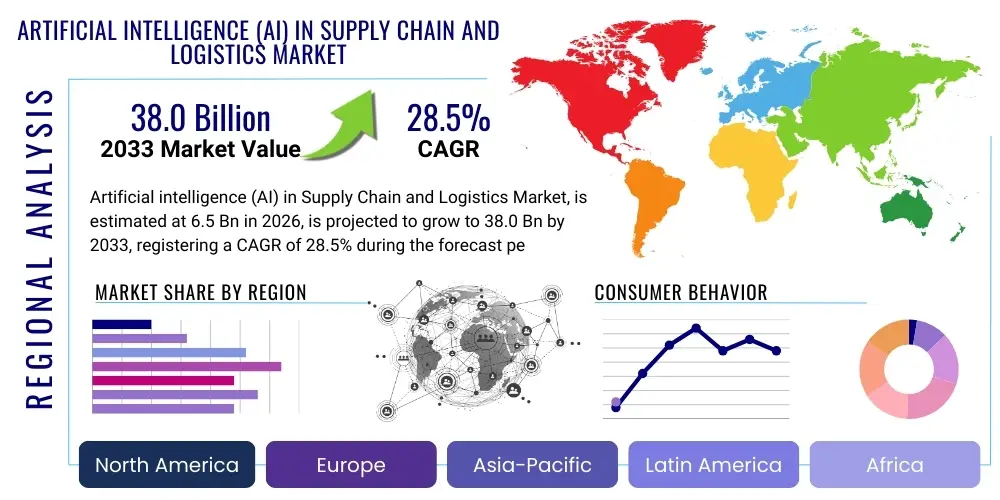

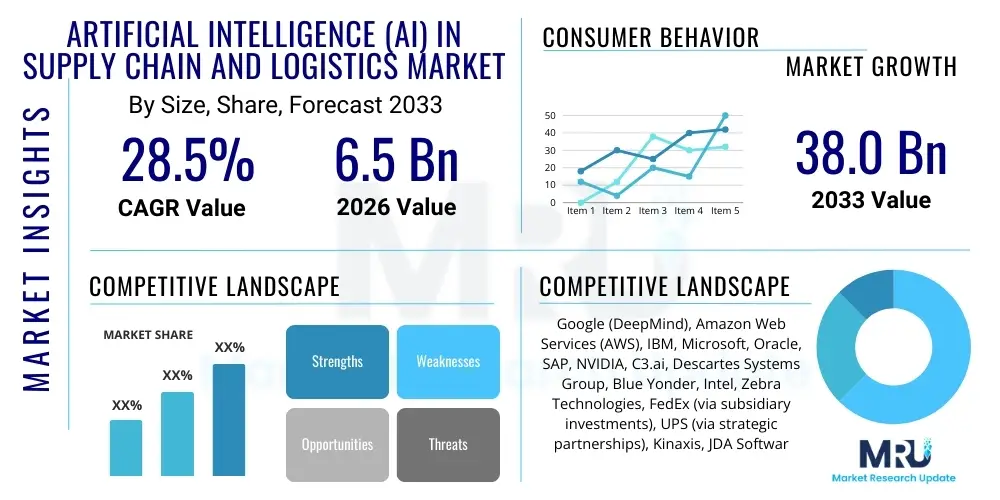

The Artificial intelligence (AI) in Supply Chain and Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 38.0 Billion by the end of the forecast period in 2033.

Artificial intelligence (AI) in Supply Chain and Logistics Market introduction

The Artificial intelligence (AI) in Supply Chain and Logistics Market encompasses the adoption of advanced AI technologies, including machine learning, computer vision, natural language processing (NLP), and predictive analytics, specifically designed to optimize, automate, and enhance efficiency across the entire supply chain network. These solutions are utilized for complex tasks such as demand forecasting, inventory management, route optimization, warehouse automation, risk assessment, and last-mile delivery planning. The core objective is to move supply chain operations from reactive processes to proactive, self-learning systems capable of adapting to real-time variables and external disruptions.

Major applications of AI in this sector span across planning, execution, and visibility layers. In planning, AI algorithms accurately predict future demand patterns by analyzing massive historical datasets, seasonal trends, and macroeconomic indicators, significantly reducing overstocking or stock-out scenarios. For execution, AI powers robotic process automation (RPA) in warehouses, optimizes robotic picking and sorting, and manages autonomous vehicles (AVs) and drones for logistics tasks. Furthermore, AI enhances real-time visibility by processing sensor data and IoT inputs, offering end-to-end tracking and ensuring integrity, particularly crucial for temperature-sensitive or high-value goods.

The principal benefits driving market expansion include substantial cost reduction achieved through optimized routes and reduced labor intensity, improved operational efficiency, and enhanced resilience against supply chain shocks. The primary factors propelling the market forward are the explosive growth of e-commerce, which demands faster and more accurate fulfillment; the increasing complexity of global supply networks necessitating advanced risk management tools; and the rapid reduction in the cost of computational power and sophisticated AI infrastructure, making these solutions accessible to a wider array of enterprises, from global logistics providers to small and medium-sized manufacturers.

Artificial intelligence (AI) in Supply Chain and Logistics Market Executive Summary

The AI in Supply Chain and Logistics market is characterized by robust technological integration and a shift toward platform-based solutions offering prescriptive analytics. Current business trends indicate a strong move toward hyper-personalization in last-mile delivery, driven by consumer expectations fueled by major e-commerce platforms. Enterprises are increasingly prioritizing investment in AI tools that offer demonstrable Return on Investment (ROI) in inventory optimization and demand sensing, mitigating volatility caused by geopolitical events and fluctuating global trade policies. Strategic partnerships between established logistics providers and AI startups are accelerating the development and deployment of specialized logistics AI modules, particularly focusing on mitigating labor shortages through automation and improving sustainability metrics by optimizing transportation modes and fuel consumption.

Regionally, North America and Europe maintain leading positions, primarily due to high technology adoption rates, the presence of major AI solution providers, and significant investment in smart warehousing infrastructure. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, largely fueled by the massive scale of manufacturing and e-commerce markets in China and India, coupled with substantial government initiatives supporting industrial digitization and smart city developments that incorporate advanced logistics planning. Latin America, the Middle East, and Africa (MEA) are emerging markets focusing on utilizing AI to overcome infrastructure limitations and enhance cross-border trade efficiency, typically through software-as-a-service (SaaS) models for easier deployment.

Segment trends reveal that the Software component segment, particularly predictive analytics and prescriptive planning applications, commands the largest market share due to its immediate scalability and utility in decision-making processes. Hardware components, encompassing smart sensors, robotics, and automated guided vehicles (AGVs), are experiencing rapid adoption, driven by the need for physical automation in fulfillment centers. Within end-use verticals, the Retail and E-commerce segment dominates the market demand, followed closely by the Manufacturing sector, which leverages AI for production planning synchronization with raw material supply and just-in-time inventory systems. This strategic deployment across all segments ensures that AI transforms both the strategic planning and the physical execution layers of logistics.

AI Impact Analysis on Artificial intelligence (AI) in Supply Chain and Logistics Market

User queries regarding the impact of AI in supply chain management frequently center on themes of job displacement versus augmentation, the trustworthiness and explainability of AI recommendations (the "black box" problem), and the necessary organizational changes required for successful adoption. Users are keenly interested in how AI addresses fundamental challenges like real-time disruption mitigation (e.g., Suez Canal blockage, pandemic-related shutdowns) and the transition from traditional, siloed planning systems to integrated, cognitive supply chain networks. Key concerns revolve around data governance, cybersecurity risks associated with integrating disparate systems, and the significant upfront investment required for specialized AI infrastructure and talent acquisition.

The overarching expectation is that AI will introduce unprecedented levels of efficiency and resilience, moving supply chains toward autonomous operations where planning and execution adapt dynamically without human intervention for routine tasks. Specifically, the integration of generative AI models is starting to influence strategic planning by simulating numerous market scenarios and generating optimal supply chain designs based on complex constraints, far exceeding the capability of traditional optimization software. This transition redefines the role of human professionals, shifting focus from manual data aggregation and routine decision-making to overseeing AI systems, managing exceptions, and focusing on high-level strategic partnerships and innovation.

The positive impacts are largely related to cost reduction and speed, while challenges focus on ethical implementation and the necessity of high-quality data. Companies succeeding in this transition are those prioritizing data harmonization and developing robust change management protocols to integrate AI systems seamlessly into existing enterprise resource planning (ERP) and warehouse management systems (WMS). The long-term impact is a fully digitalized, self-correcting supply chain ecosystem, offering competitive advantages based on responsiveness and forecasting accuracy.

- Enhanced Demand Forecasting Accuracy: AI significantly reduces forecast errors by analyzing millions of data points, minimizing buffer stock requirements.

- Autonomous Warehouse Operations: Integration of machine learning-driven robotics and AGVs for automated picking, packing, and sorting, boosting throughput.

- Dynamic Route and Network Optimization: Real-time adjustments to delivery routes based on traffic, weather, and dynamic delivery window changes, improving efficiency.

- Predictive Maintenance: AI monitors logistics assets (trucks, machinery) to predict failures, minimizing unexpected downtime and associated costs.

- Supply Chain Risk Management: Real-time analysis of global events (geopolitical, weather, health crises) to model potential impacts and suggest alternative sourcing/routing strategies.

- Improved Supplier Relationship Management: AI-driven performance tracking and contract analysis automate compliance checks and optimize procurement strategies.

DRO & Impact Forces Of Artificial intelligence (AI) in Supply Chain and Logistics Market

The market is predominantly driven by the imperative for operational excellence fueled by the global expansion of e-commerce, which places enormous strain on traditional logistics systems, demanding speed, precision, and transparency. Coupled with this is the escalating complexity of global trade networks, characterized by fluctuating tariffs, trade agreements, and geopolitical volatility, making predictive risk mitigation essential for business continuity. Furthermore, significant advancements in supporting technologies such as IoT sensors, 5G connectivity, and cloud computing infrastructure have lowered the barriers to entry for sophisticated AI solutions, allowing real-time data ingestion and processing necessary for effective supply chain AI.

However, the market faces significant restraints. The primary impediment is the high initial capital expenditure required for deploying AI infrastructure, particularly in hardware-intensive automation projects like robotics and smart warehousing, making adoption challenging for smaller enterprises. A related challenge is the critical shortage of skilled data scientists and AI engineers who possess domain expertise in supply chain management, creating a bottleneck in development and deployment. Additionally, resistance to change within legacy logistics organizations, coupled with concerns regarding data privacy, security risks, and the difficulty of integrating AI tools with decades-old, heterogeneous enterprise systems, slow down widespread adoption.

Opportunities in this sector are abundant, particularly in the development of specialized, affordable SaaS-based AI modules tailored for specific industry niches (e.g., cold chain logistics for pharmaceuticals, just-in-time for automotive). Another major opportunity lies in leveraging Generative AI for strategic supply chain design and simulation, enabling firms to model hundreds of potential network configurations under various stress tests instantly. The increasing focus on supply chain sustainability and traceability provides a unique opening for AI applications in monitoring emissions, optimizing empty mile reduction, and ensuring ethical sourcing transparency, driven by regulatory pressures and consumer demand.

The impact forces currently shaping the AI in Supply Chain and Logistics market are profound, acting as simultaneous accelerators and inhibitors. The strongest accelerator force is the undeniable economic benefit derived from efficiency gains; AI implementation consistently demonstrates high ROI through reduced inventory costs and optimized transportation spend. Conversely, the high technological complexity and the need for organizational overhaul act as a powerful restraining force, often delaying large-scale projects until proven pilot successes are established. The regulatory landscape, particularly around data residency and autonomous vehicle operations, also acts as an external impact force that companies must navigate. Overall, the transformative potential of AI is compelling enterprises across all verticals to address the internal resistance and infrastructural limitations, thereby ensuring continued robust market expansion throughout the forecast period.

Segmentation Analysis

The Artificial intelligence (AI) in Supply Chain and Logistics market is meticulously segmented based on components, applications, technology, deployment type, and end-use industry to provide granular insights into adoption patterns and investment areas. Component segmentation distinguishes between the tangible infrastructure (Hardware) and the intellectual property (Software and Services) required for AI implementation, revealing where expenditure is concentrated. Application analysis highlights specific functional areas—such as inventory management, warehouse automation, or route optimization—where AI delivers the most significant value and is most actively deployed by logistics firms and shippers.

Technology segmentation focuses on the specific type of AI utilized, ranging from Machine Learning (ML), which underpins predictive analytics and forecasting, to Computer Vision, which is critical for quality control, automated identification, and robotic guidance in physical environments. Deployment type differentiates between on-premise solutions, favored by large organizations with stringent data security requirements, and the rapidly growing cloud-based solutions (SaaS), which offer scalability and lower operational costs, driving democratization of AI tools for SMEs. Finally, the End-Use Industry segment clarifies market penetration across key verticals, with E-commerce and Retail being major demand drivers due to their high volume and complexity of fulfillment.

This segmented view is crucial for vendors to tailor their offerings effectively and for investors to identify high-growth sub-markets. For instance, while Machine Learning dominates in strategic planning applications, the rapid advancements in robotics and edge computing are simultaneously driving exponential growth in the Computer Vision and Hardware segments within the physical logistics infrastructure, signaling a holistic market expansion across both physical and digital domains of the supply chain.

- By Component:

- Software (Platforms, Solutions, Tools)

- Hardware (Robots, Sensors, Drones, IoT Devices, Automated Guided Vehicles (AGVs))

- Services (Consulting, Implementation, Support, and Maintenance)

- By Technology:

- Machine Learning (ML)

- Computer Vision

- Natural Language Processing (NLP)

- Context-Aware Computing

- By Application:

- Demand Forecasting and Planning

- Inventory Management and Optimization

- Warehouse Management and Automation

- Transportation Management and Route Optimization

- Risk Management and Compliance

- Customer Experience Management

- Supply Chain Visibility and Tracking

- By Deployment Type:

- Cloud-Based

- On-Premise

- By End-Use Industry:

- Retail and E-commerce

- Manufacturing (Automotive, Electronics, Heavy Industry)

- Healthcare and Pharmaceuticals

- Food and Beverages (F&B)

- Aerospace and Defense

- Others (Oil and Gas, Chemical)

Value Chain Analysis For Artificial intelligence (AI) in Supply Chain and Logistics Market

The value chain for AI in Supply Chain and Logistics starts with the upstream activities centered on core technology development and data acquisition. This stage involves AI research institutions and technology vendors developing proprietary algorithms, machine learning models, and specialized deep learning frameworks optimized for logistical challenges like dynamic pricing and predictive maintenance. Critical upstream inputs include high-quality, normalized data from IoT sensors, ERP systems, and external sources (weather, geopolitical data), as the efficacy of any AI system is directly dependent on the volume and quality of its training data. Key players here are major cloud providers offering infrastructure and foundational AI services, alongside specialized logistics software firms.

The midstream involves the integration and customization phase, where system integrators and specialized service providers tailor generic AI platforms to the unique operational requirements of specific clients (e.g., cold chain demands vs. heavy industry transport needs). Distribution channels are predominantly direct for large, complex enterprise deployments, involving bespoke consulting and implementation services. However, indirect channels, relying on channel partners and value-added resellers (VARs), are crucial for scaling standardized, cloud-based SaaS offerings to small and medium-sized logistics enterprises globally. The direct channel ensures closer control over complex deployments, while the indirect model facilitates market reach and reduces time-to-market for packaged solutions.

Downstream activities focus on the end-user deployment, ongoing maintenance, and continuous optimization of the AI systems. This includes the utilization of AI for physical execution tasks, such as robotic deployment in warehouses and real-time monitoring of autonomous fleets. Post-deployment services—including model recalibration, security patches, and user training—are vital for ensuring the sustained performance and ROI of the AI investment. The overall structure emphasizes a highly collaborative ecosystem where technology providers, integrators, and end-users must work closely to manage the continuous data flow and algorithmic refinements necessary for a self-optimizing supply chain.

Artificial intelligence (AI) in Supply Chain and Logistics Market Potential Customers

Potential customers for AI solutions in the supply chain and logistics market span the entire economic spectrum, from massive multinational corporations managing complex global trade flows to regional distributors seeking efficiency gains. The primary buyers are large third-party logistics (3PL) providers and global shipping giants (e.g., Maersk, FedEx, UPS) who utilize AI to optimize their massive networks, manage fleet maintenance, and enhance last-mile delivery. These players invest heavily in sophisticated, often custom-built, on-premise solutions to handle proprietary data and maintain competitive advantage in operational speed and cost.

The Retail and E-commerce sector represents another major customer base, including major online retailers and brick-and-mortar stores with omnichannel operations. These customers prioritize AI solutions for highly accurate demand forecasting, inventory placement across distributed fulfillment centers, and enhancing customer satisfaction through proactive delivery updates. The Manufacturing industry, particularly automotive and electronics, are key buyers focused on synchronizing their production schedules with raw material flow, using AI for just-in-time inventory management, and ensuring quality control through computer vision systems on assembly lines.

Additionally, smaller and medium-sized logistics enterprises (SMEs) are increasingly becoming potential customers, facilitated by the availability of affordable, subscription-based cloud AI platforms. These SMEs utilize AI primarily for basic route optimization, warehouse space planning, and mitigating high labor costs. The common denominator among all potential customers is the recognized need to transition from reactive operational models to predictive, resilient, and adaptive supply chain ecosystems to maintain profitability in a volatile global market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 38.0 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google (DeepMind), Amazon Web Services (AWS), IBM, Microsoft, Oracle, SAP, NVIDIA, C3.ai, Descartes Systems Group, Blue Yonder, Intel, Zebra Technologies, FedEx (via subsidiary investments), UPS (via strategic partnerships), Kinaxis, JDA Software, Logility, PTV Group, FourKites, Llamasoft. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial intelligence (AI) in Supply Chain and Logistics Market Key Technology Landscape

The technological landscape in the AI supply chain market is dominated by a convergence of advanced analytical tools and physical automation enablers. Machine Learning (ML), particularly supervised and unsupervised learning models, forms the analytical backbone, utilized extensively for pattern recognition in forecasting, fraud detection, and optimizing pricing strategies. Deep Learning (DL), a subset of ML, is increasingly vital for handling vast unstructured datasets, such as images for quality control via computer vision, and predicting highly non-linear demand curves affected by complex external factors. These analytical tools operate primarily on cloud-based hyperscale infrastructure provided by technology giants, ensuring the necessary compute power and data storage capacity for global operations.

The physical execution layer is heavily reliant on Computer Vision and Edge Computing. Computer Vision technologies, deployed on cameras and sensors in warehouses and delivery vehicles, enable real-time object recognition, inventory auditing using autonomous drones, and safety monitoring. Edge computing is essential because it allows AI models to process data locally on the factory floor or within a moving truck, enabling immediate decision-making (e.g., obstacle avoidance for an AGV) without the latency of sending all data back to a central cloud server. The proliferation of IoT devices provides the critical data streams—temperature, location, pressure—that feed these AI models, turning physical assets into cognitive nodes within the network.

Furthermore, Natural Language Processing (NLP) plays a crucial role in the service and coordination aspect of the supply chain. NLP is used to process unstructured data from contracts, customer feedback, and customs documents, automating compliance checks and improving the efficiency of contact centers through sophisticated chatbots and virtual assistants that handle logistics inquiries. The continued advancement of 5G and future 6G networks is paramount, as enhanced connectivity is necessary to support the massive, low-latency data transmission required for the seamless integration of distributed AI systems, from autonomous trucking fleets to complex global sensor networks.

Regional Highlights

The regional dynamics of the AI in Supply Chain and Logistics market are defined by varying levels of technological maturity, infrastructure readiness, and market demand complexity. North America currently holds the largest market share, driven by aggressive investment from major retailers, e-commerce giants, and 3PL companies in smart warehouse technology, autonomous robotics, and advanced predictive analytics software. The region benefits from a robust ecosystem of venture capital funding directed toward specialized AI logistics startups and a strong emphasis on leveraging AI to manage cross-border complexities with Canada and Mexico. High labor costs also accelerate the necessity for automation, making the adoption rate for physical AI solutions particularly high.

Europe represents a mature yet dynamic market, characterized by strict regulatory environments (e.g., GDPR) that heavily influence AI implementation, particularly concerning data privacy and cross-border data transfer. Western European countries, notably Germany, the UK, and the Netherlands, are leaders in utilizing AI for transportation management systems (TMS) and optimizing complex multi-modal logistics networks. Emphasis is placed on sustainability-driven logistics, where AI is employed to minimize carbon footprint through optimized routing and load consolidation. Eastern Europe is rapidly adopting cloud-based AI solutions to modernize logistics infrastructure and align with Western European operational standards.

Asia Pacific (APAC) is projected to exhibit the highest CAGR during the forecast period. This rapid growth is propelled by the sheer volume of manufacturing and the explosive growth of regional e-commerce markets, particularly in China, Japan, South Korea, and India. Governments across APAC are heavily investing in smart port development and digital infrastructure, creating fertile ground for AI adoption in optimizing massive, high-volume operations. The focus is dual: utilizing ML for hyper-localized demand sensing in densely populated urban centers and leveraging computer vision for large-scale, automated quality assurance in manufacturing supply chains.

Latin America, the Middle East, and Africa (MEA) constitute emerging markets where AI adoption is still fragmented but growing rapidly, often skipping older technologies directly to cloud-based AI solutions. In the MEA, particularly the UAE and Saudi Arabia, large-scale infrastructure projects and the establishment of global logistics hubs are driving significant AI investment in port automation and cross-border trade optimization. Latin America faces unique challenges related to diverse infrastructure quality and regulatory environments, making SaaS solutions that offer adaptable risk management and visibility tools particularly attractive for enhancing supply chain resilience.

- North America: Dominant market share; High adoption of warehouse automation and predictive analytics; Strong presence of major technology and e-commerce companies.

- Europe: Focus on sustainability (green logistics) and regulatory compliance; High utilization of AI for multi-modal transportation network optimization; Rapid integration into industrial IoT platforms.

- Asia Pacific (APAC): Fastest growth rate; Driven by massive e-commerce scale and manufacturing volumes; Significant government investment in smart infrastructure (ports and cities).

- Middle East and Africa (MEA): Emerging market focused on logistics hub development (UAE, Saudi Arabia); AI used primarily for overcoming infrastructure gaps and optimizing port efficiency.

- Latin America: Growing interest in cloud-based AI SaaS solutions; Focus on improving visibility and risk management across challenging operational terrains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial intelligence (AI) in Supply Chain and Logistics Market.- Google (DeepMind)

- Amazon Web Services (AWS)

- IBM

- Microsoft

- Oracle

- SAP

- NVIDIA

- C3.ai

- Descartes Systems Group

- Blue Yonder

- Intel

- Zebra Technologies

- FedEx (via subsidiary investments)

- UPS (via strategic partnerships)

- Kinaxis

- JDA Software

- Logility

- PTV Group

- FourKites

- Llamasoft

Frequently Asked Questions

Analyze common user questions about the Artificial intelligence (AI) in Supply Chain and Logistics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of AI in modern logistics?

The primary applications include enhanced demand forecasting and inventory optimization, autonomous warehouse operations using robotics and computer vision, dynamic transportation management (route and fleet optimization), and real-time risk assessment for supply chain resilience. AI shifts operational focus from reactive troubleshooting to predictive planning.

Which AI technology segment is currently experiencing the highest growth in the supply chain market?

While Machine Learning (ML) remains fundamental for planning, the Computer Vision segment, often coupled with robotics and edge computing, is experiencing rapid growth due to the immediate need for physical automation in large-scale fulfillment centers and for real-time quality control checks during manufacturing and sorting processes.

What is the main challenge companies face when adopting AI in their supply chains?

The main challenge is the complexity of integrating new AI solutions with existing legacy Enterprise Resource Planning (ERP) and Warehouse Management Systems (WMS). This integration requires significant data harmonization efforts, high initial capital investment, and addressing the critical shortage of specialized data scientists with supply chain domain expertise.

How does AI contribute to supply chain sustainability goals?

AI significantly contributes to sustainability by optimizing transportation routes to minimize fuel consumption and emissions, reducing "empty miles," improving load factor utilization, and enhancing supply chain traceability to ensure ethical sourcing and compliance with environmental, social, and governance (ESG) standards.

What role do cloud platforms play in the market growth of AI in logistics?

Cloud platforms are crucial accelerators, offering scalable infrastructure, reducing upfront investment barriers, and enabling rapid deployment of Software-as-a-Service (SaaS) AI tools. Cloud accessibility democratizes advanced AI capabilities, making sophisticated predictive and prescriptive analytics accessible to Small and Medium-sized Enterprises (SMEs) globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager