Artificial Intelligence Eye Screening Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443328 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Artificial Intelligence Eye Screening Software Market Size

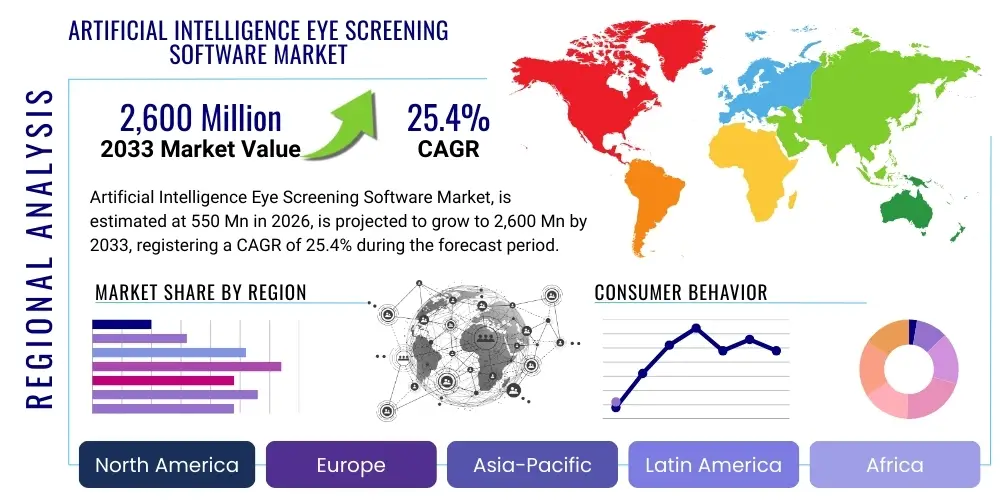

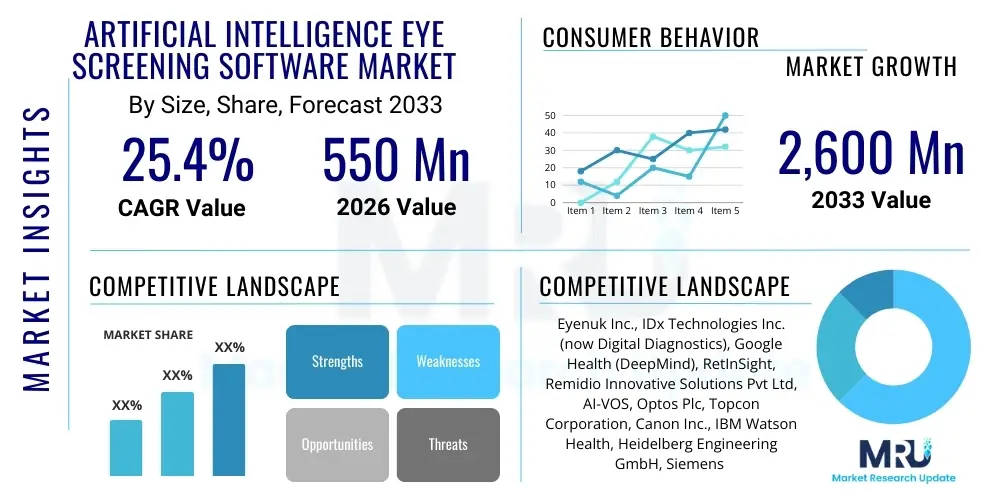

The Artificial Intelligence Eye Screening Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.4% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 2,600 Million by the end of the forecast period in 2033.

Artificial Intelligence Eye Screening Software Market introduction

The Artificial Intelligence Eye Screening Software Market encompasses specialized diagnostic tools and algorithms leveraging machine learning and deep learning to analyze ocular images, primarily fundus photographs and optical coherence tomography (OCT) scans, for the automated detection of prevalent eye diseases. These software solutions provide critical support to ophthalmologists and optometrists by offering rapid, objective, and scalable preliminary screening for conditions such as diabetic retinopathy (DR), age-related macular degeneration (AMD), and glaucoma. The core functionality revolves around processing complex visual data to identify subtle biomarkers indicative of pathology, thereby reducing human error and expediting the diagnostic process, particularly in resource-limited settings or high-volume screening programs.

Major applications of AI eye screening software include mass screening programs for chronic disease management, telemedicine platforms linking rural patients to specialized care, and integration into primary care settings for proactive health monitoring. By facilitating early and accurate detection, this technology significantly improves patient outcomes, as many vision-threatening conditions are asymptomatic in their initial stages. The shift towards preventive healthcare and the necessity for efficient management of the growing global burden of diabetes, a major contributor to vision loss, are accelerating the adoption of these sophisticated tools. Furthermore, the inherent efficiency of AI software allows healthcare systems to handle larger volumes of patient data without proportional increases in clinical staffing, offering substantial operational benefits.

Driving factors for this market include rapid advancements in deep learning algorithms, particularly Convolutional Neural Networks (CNNs), which enhance diagnostic accuracy to near human-expert levels. Regulatory approvals, especially from bodies like the FDA in the United States, are legitimizing the use of autonomous AI diagnostics, paving the way for wider clinical integration. Additionally, increasing investments in digital health infrastructure globally, coupled with the rising prevalence of chronic conditions that affect ocular health, underscore the market’s robust growth trajectory. The ability of these solutions to function on various hardware platforms, including portable devices, further expands their applicability and accessibility across diverse healthcare environments.

Artificial Intelligence Eye Screening Software Market Executive Summary

The Artificial Intelligence Eye Screening Software Market is characterized by vigorous innovation and strong integration into existing healthcare workflows, driven primarily by the need for scalable and early detection of chronic ophthalmic diseases. Business trends highlight a significant focus on strategic partnerships between AI developers and major medical device manufacturers to ensure seamless hardware-software integration and broader distribution access. Furthermore, the development of software-as-a-medical-device (SaMD) models is emerging as a preferred commercial strategy, allowing for flexible subscription-based revenue streams and rapid updates to algorithms. Key market players are concentrating research efforts on expanding the utility of their platforms beyond single-disease detection, moving towards comprehensive, multi-modal screening that integrates data from various imaging sources like OCT angiography (OCT-A) and visual field tests, increasing the value proposition for end-users such as large hospital networks and insurance providers.

Regional trends indicate North America currently dominating the market, underpinned by advanced regulatory frameworks, high rates of technology adoption, and significant venture capital investment in digital health start-ups. However, the Asia Pacific region is projected to exhibit the fastest growth over the forecast period, driven by massive patient populations suffering from diabetes and hypertension, coupled with government initiatives focused on improving primary healthcare access and leveraging telemedicine. Europe is also a mature market, benefiting from well-established healthcare systems and increasing public awareness regarding preventive eye care, although regulatory fragmentation across EU member states can sometimes pose a challenge to market entry. These geographical disparities necessitate tailored market entry strategies, focusing on localized clinical validation and adherence to regional data privacy regulations like GDPR.

Segment trends reveal that the Diabetic Retinopathy (DR) detection segment maintains the largest market share due to the clear clinical validation, established guidelines, and massive patient pool requiring routine screening. However, the Glaucoma and Age-related Macular Degeneration (AMD) segments are experiencing accelerated growth, fueled by continuous advancements in AI algorithms capable of analyzing complex structural changes visible in OCT scans. Technology-wise, deep learning algorithms, specifically those utilizing convolutional neural networks (CNNs), remain the dominant segment, offering unparalleled accuracy in image recognition tasks crucial for autonomous screening. The market is also seeing a shift towards cloud-based deployments, which offer scalability, reduced hardware costs for clinics, and easier data management compared to traditional on-premise installations, catering especially to large healthcare system integrations and remote screening initiatives.

AI Impact Analysis on Artificial Intelligence Eye Screening Software Market

Users frequently inquire about the reliability, clinical workflow integration, and regulatory status of autonomous AI screening tools. Common questions revolve around whether AI can truly replace human graders, the performance metrics (sensitivity and specificity) compared to traditional screening, and the liability implications when AI makes a diagnostic error. Furthermore, users, especially healthcare administrators, are keen to understand the return on investment (ROI) associated with implementing such high-technology systems, focusing on throughput, cost reduction per patient, and potential improvements in detecting early-stage disease. The summarized user consensus indicates a strong expectation that AI will act as an indispensable augmentative tool, significantly enhancing efficiency and standardization in screening, rather than replacing ophthalmologists entirely, while simultaneously expressing concerns regarding data security, algorithmic bias, and the long-term maintenance costs associated with evolving software.

- AI drives autonomous screening systems, drastically reducing the time and personnel required for preliminary diagnosis of conditions like Diabetic Retinopathy.

- Enhanced diagnostic accuracy (high sensitivity and specificity) surpassing human performance in identifying subtle pathological features in retinal images.

- Facilitation of telemedicine and remote diagnosis, expanding access to specialized eye care in underserved geographical areas.

- Standardization of screening protocols, minimizing inter-observer variability inherent in manual grading processes.

- Integration of predictive analytics, allowing AI models to forecast disease progression and prioritize high-risk patients for immediate specialist referral.

- Acceleration of drug discovery and clinical trials by providing automated, quantitative analysis of treatment efficacy through precise tracking of ocular biomarkers.

- Development of personalized treatment pathways based on granular patient data analysis and comparison against vast data repositories processed by machine learning models.

DRO & Impact Forces Of Artificial Intelligence Eye Screening Software Market

The market's dynamics are shaped by powerful drivers, substantial restraints, and compelling opportunities that influence its growth trajectory. Key drivers include the escalating global prevalence of diabetes and associated ocular complications, coupled with increasing governmental and organizational focus on implementing population-based screening programs to manage this rising disease burden efficiently. However, the market faces restraints such as significant upfront investment costs for integrating high-performance computing infrastructure in smaller clinics, coupled with the critical challenge of clinical data siloization and the difficulty in securing large, diverse, and well-annotated datasets necessary for training and validating robust AI algorithms. Opportunities lie primarily in expanding applications beyond DR to other underserved areas like pediatric ophthalmology and rare genetic eye disorders, alongside penetrating emerging markets through low-cost, portable screening solutions integrated with mobile health technology. These forces collectively dictate the adoption pace, requiring stakeholders to navigate stringent regulatory pathways and overcome skepticism regarding the 'black box' nature of deep learning models while capitalizing on the technological imperative for scalable healthcare.

Impact forces, specifically those related to technological innovation and regulatory environment, are particularly influential. The continuous refinement of deep learning architectures, such as the introduction of transformer models adapted for medical imaging, promises even greater accuracy and interpretability, thereby addressing a core restraint related to model transparency. Regulatory shifts, moving towards faster approval pathways for software-as-a-medical-device (SaMD), are acting as a strong accelerator, reducing time-to-market for innovative solutions. Socio-economic factors, including the global shortage of specialized ophthalmologists and the aging population demographic demanding more frequent care, create an undeniable pull for automated, efficient screening technologies. Conversely, external cybersecurity threats targeting patient data and the potential for algorithmic bias when deploying models trained on non-diverse populations pose critical external pressures that require proactive mitigation strategies from market participants, emphasizing data governance and ethical AI development.

The competitive landscape is being fundamentally altered by these impact forces. Established diagnostic equipment manufacturers are rapidly acquiring or partnering with specialized AI firms to integrate diagnostic intelligence directly into their hardware, offering bundled solutions that are highly appealing to large purchasers. This consolidation heightens competition but also accelerates technology diffusion. Market success is increasingly tied to demonstrating Level 4 autonomy (full automation with no human oversight required) in screening diagnostics, thereby achieving true operational efficiency. Addressing the ethical implications, particularly surrounding informed consent for AI diagnosis and ensuring equitable access to these technologies across socio-economic strata, is becoming a necessary component of corporate strategy, moving from a secondary concern to a primary factor influencing public and regulatory acceptance.

Segmentation Analysis

The Artificial Intelligence Eye Screening Software Market is comprehensively segmented across several key dimensions, primarily defined by the disease application, the underlying technology used, the deployment model, and the end-user base. This segmentation highlights diverse user needs and allows market players to focus their developmental and commercial efforts on high-growth niches. Disease application segmentation underscores the priority areas where AI delivers immediate clinical value, with diabetic retinopathy being the most mature and revenue-generating segment. Conversely, segmentation by deployment model, distinguishing between cloud-based and on-premise solutions, reflects varying infrastructural capabilities and data security requirements across different healthcare institutions, with cloud models increasingly favored for their scalability and reduced maintenance overheads, particularly in tele-screening environments.

The technology landscape segmentation further delineates the market based on the sophistication of the algorithms employed. Deep learning, specifically Convolutional Neural Networks (CNNs), dominates due to its superior capability in processing and interpreting complex ocular images, forming the backbone of most autonomous screening systems. Meanwhile, traditional machine learning approaches, while less dominant, still hold relevance for specific tasks or in conjunction with deep learning outputs for post-processing and risk prediction modeling. End-user segmentation reveals a focus on specialized ophthalmic clinics and hospitals, which are early adopters of advanced technology, alongside the growing penetration into primary care settings and retail eye care chains that are leveraging AI for high-volume, initial-level screening to efficiently triage patients.

Understanding these segments is crucial for strategic planning. For instance, companies targeting the hospital segment must prioritize integration with existing Electronic Health Records (EHRs) and regulatory compliance, while those focusing on primary care may prioritize user-friendly interfaces and portability. The segmentation matrix clearly shows the trend towards integrated platforms capable of screening multiple diseases (DR, AMD, Glaucoma) from a single input image, maximizing operational efficiency and establishing a more robust competitive advantage. The future growth will be heavily influenced by the expansion into non-retinal screening, such as anterior segment analysis and corneal topography, driven by advances in advanced imaging modalities and specialized AI training data sets.

- By Disease Application:

- Diabetic Retinopathy (DR)

- Age-related Macular Degeneration (AMD)

- Glaucoma

- Cataract

- Other Ocular Conditions (e.g., Retinopathy of Prematurity, Central Retinal Vein Occlusion)

- By Technology:

- Deep Learning

- Machine Learning (Traditional Methods)

- By Deployment Model:

- Cloud-based

- On-premise

- By End User:

- Hospitals and Clinics

- Ophthalmology Centers

- Research Institutes

- Telemedicine Providers

- Retail Eye Care Chains

Value Chain Analysis For Artificial Intelligence Eye Screening Software Market

The value chain for the Artificial Intelligence Eye Screening Software Market begins with upstream activities centered on fundamental research and development, involving data acquisition, curation, and the engineering of advanced deep learning algorithms. This phase is highly specialized, requiring collaboration between data scientists, clinical ophthalmologists who provide image annotation, and AI ethics experts to ensure model fairness and transparency. The quality and diversity of the training datasets are paramount, directly influencing the accuracy and generalizability of the final screening product. Companies that control proprietary, large-scale, annotated datasets often possess a significant competitive advantage in this initial stage. Financial investment in computational resources, such as high-performance GPUs and cloud computing platforms for iterative model training, represents a substantial cost component in the upstream process.

The midstream phase involves software development, clinical validation, and rigorous regulatory approval processes, which transform the validated algorithm into a marketable medical device (SaMD). This includes integrating the AI model into a user-friendly software platform, ensuring compatibility with various imaging hardware (fundus cameras, OCT machines), and achieving necessary certifications (e.g., FDA clearance, CE Mark). Distribution channels form the critical link to the end-users. Direct distribution is often favored for large hospital networks and government programs, allowing for tailored integration and support contracts. Indirect distribution relies on established partnerships with medical device distributors and equipment vendors who can bundle the AI software with their existing hardware sales, particularly useful for penetrating global markets where a localized sales force is prohibitively expensive.

The downstream segment focuses on post-implementation activities, including maintenance, customer support, and continuous algorithmic improvement. Since AI models degrade over time or require retraining to handle new image types or patient demographics, providing software updates and ongoing clinical validation is essential. Potential customers, including specialty clinics, general practitioners, and telemedicine platforms, derive value from the speed, accuracy, and efficiency the software provides in reducing the diagnostic burden and improving patient throughput. The financial success of the software depends heavily on effective marketing emphasizing clinical evidence, demonstrating high ROI through reduced screening costs, and establishing reliable support structures for seamless operation within complex healthcare IT environments.

Artificial Intelligence Eye Screening Software Market Potential Customers

The primary consumers and end-users of Artificial Intelligence Eye Screening Software are diverse healthcare entities focused on population health management and high-volume clinical diagnostics. Hospitals and integrated healthcare systems represent a significant customer base, driven by the need to manage large patient cohorts, particularly those with chronic systemic diseases such as diabetes, which necessitate routine and rapid ocular examinations. For these large organizations, AI software serves as a crucial tool for automating triage, ensuring that only patients requiring immediate intervention are seen by specialists, thereby optimizing the utilization of scarce ophthalmology resources and enhancing overall operational efficiency across multiple sites through centralized screening coordination.

Beyond traditional hospital settings, primary care clinics and endocrinology centers are rapidly emerging as vital purchasers. The ability of modern AI screening software to operate autonomously or near-autonomously allows general practitioners (GPs) to incorporate essential diagnostic eye care directly into routine physical examinations without requiring specialized training or an ophthalmologist on site. This decentralization of screening is particularly impactful in tackling the massive screening gap that exists globally for conditions like diabetic retinopathy. Furthermore, retail eye care chains and large optometry practices are adopting AI solutions to differentiate their service offerings, provide immediate preliminary diagnostic results to patients, and establish a clear, documented referral pathway to specialists when pathology is detected, enhancing their role in preventative healthcare.

Moreover, government health programs and non-governmental organizations (NGOs) focused on public health initiatives in low- and middle-income countries constitute a growing segment of potential customers. These organizations seek highly scalable, cost-effective solutions for widespread population screening, often leveraging portable hardware and cloud-based AI to reach remote or underserved communities where access to specialist care is extremely limited or non-existent. Telemedicine providers, whose business model relies inherently on remote diagnostics, utilize these AI platforms as foundational technology to deliver efficient, evidence-based remote consultations, making them ideal potential customers for SaaS (Software as a Service) AI models that can be seamlessly integrated into their existing telehealth infrastructure and patient management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 2,600 Million |

| Growth Rate | 25.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eyenuk Inc., IDx Technologies Inc. (now Digital Diagnostics), Google Health (DeepMind), RetInSight, Remidio Innovative Solutions Pvt Ltd, AI-VOS, Optos Plc, Topcon Corporation, Canon Inc., IBM Watson Health, Heidelberg Engineering GmbH, Siemens Healthineers, InferVision, VUNO Inc., Airdoc, Clearside Biomedical, Inc., ForeseeHome (Notal Vision), VersiSense, Inc., Visionary AI. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Artificial Intelligence Eye Screening Software Market Key Technology Landscape

The Artificial Intelligence Eye Screening Software Market is fundamentally driven by advancements in artificial neural networks, particularly deep learning architectures. The core technology utilized across most leading platforms is the Convolutional Neural Network (CNN), which excels at image classification, segmentation, and object detection—tasks essential for interpreting complex anatomical features and pathological indicators on retinal images. CNNs are specifically employed to process inputs from standard fundus photography, enabling autonomous identification of microaneurysms, hemorrhages, exudates, and optic disc anomalies indicative of diabetic retinopathy and glaucoma. The continuous development of more efficient and high-performing CNN variations, such as residual networks (ResNets) and U-Nets, allows software vendors to achieve clinically validated performance metrics that meet or exceed human expert levels in sensitivity and specificity, critical for regulatory approval and clinical trust.

Beyond basic image classification, the technological landscape is rapidly expanding to include multimodal data integration and advanced visualization techniques. Software solutions are increasingly incorporating inputs from Optical Coherence Tomography (OCT), which provides three-dimensional, cross-sectional imaging of the retina. Analyzing OCT data requires sophisticated deep learning models capable of volumetric segmentation to measure retinal thickness, identify fluid pockets, and detect structural changes associated with AMD and glaucoma progression. Furthermore, techniques like Explainable AI (XAI) are gaining prominence. XAI aims to address the ‘black box’ problem inherent in deep learning by providing visual heatmaps or localized confidence scores, allowing clinicians to understand *why* the AI reached a specific diagnostic conclusion. This interpretability enhances clinician confidence and facilitates smoother integration into existing medical workflows where documentation and accountability are paramount.

A major trend shaping the technology landscape is the optimization of algorithms for edge computing and cloud scalability. Edge computing involves running the AI model directly on the imaging device (e.g., a smart camera or portable screener) rather than sending raw data to the cloud for processing. This is crucial for environments with limited internet connectivity and addresses immediate data privacy concerns by keeping sensitive images localized. Simultaneously, cloud-based architectures utilizing high-throughput computing power enable rapid processing of massive batches of screening data for large-scale population health programs and facilitate continuous learning, where models are automatically updated and refined based on new, diverse clinical data collected across the platform’s user base, ensuring the software remains cutting-edge and robust against varying image qualities and patient demographics.

Regional Highlights

- North America: This region holds the largest market share, driven by favorable regulatory environments, high healthcare expenditure, early adoption of advanced medical technologies, and the presence of numerous key market players and pioneering AI startups. Robust public and private insurance systems frequently cover AI-assisted diagnostics, further incentivizing adoption. The high prevalence of chronic diseases, particularly diabetes, necessitates efficient mass screening solutions, making the U.S. the primary innovation hub for autonomous AI systems.

- Europe: The European market is mature, characterized by strong governmental emphasis on national screening programs and stringent data protection regulations (GDPR). Growth is supported by well-established national health services (NHS in the UK, centralized systems in Nordic countries) that are actively trialing and implementing AI to manage ophthalmology backlogs. Regulatory harmonization efforts via the EU Medical Device Regulation (MDR) are expected to streamline market access, accelerating adoption across member states despite varying reimbursement structures.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to enormous, largely untapped patient populations, increasing healthcare access initiatives, and rising disposable incomes. Countries like China, India, and Japan are heavily investing in digital health infrastructure and telemedicine to bridge the gap between large rural populations and specialized care facilities. Local manufacturing strength and government policies promoting 'smart healthcare' are key accelerators, with demand focused on cost-effective, scalable, and portable screening solutions tailored to diverse language and demographic groups.

- Latin America (LATAM): The LATAM market is nascent but shows strong potential, primarily in countries like Brazil and Mexico, where there is a substantial need for improving primary care diagnostics. Adoption is often linked to major public health initiatives and collaborations with international organizations aimed at combating conditions like diabetes and blindness. Economic volatility and varying levels of digital infrastructure pose challenges, favoring cloud-based, low-infrastructure deployment models.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, characterized by high per capita income and government investment in state-of-the-art medical facilities. The region offers high potential due to the prevalence of non-communicable diseases and a growing adoption of telehealth services. Adoption in Africa, while slower, is being propelled by NGO and governmental efforts focused on leveraging mobile health technology and AI to provide baseline screening in remote areas, particularly for infectious and chronic eye diseases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Artificial Intelligence Eye Screening Software Market.- Eyenuk Inc.

- Digital Diagnostics (formerly IDx Technologies Inc.)

- Google Health (DeepMind)

- RetInSight

- Remidio Innovative Solutions Pvt Ltd

- AI-VOS

- Optos Plc

- Topcon Corporation

- Canon Inc.

- IBM Watson Health

- Heidelberg Engineering GmbH

- Siemens Healthineers

- InferVision

- VUNO Inc.

- Airdoc

- Clearside Biomedical, Inc.

- ForeseeHome (Notal Vision)

- VersiSense, Inc.

- Visionary AI

- RetinaLogik, LLC

Frequently Asked Questions

Analyze common user questions about the Artificial Intelligence Eye Screening Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current regulatory status of autonomous AI eye screening software?

Autonomous AI eye screening software, particularly for Diabetic Retinopathy, has achieved FDA clearance (e.g., Digital Diagnostics’ IDx-DR) and CE marking in Europe, allowing its use as a self-standing diagnostic tool without requiring a specialist human interpreter for initial screening results. Regulatory bodies globally are increasingly establishing specific pathways for Software as a Medical Device (SaMD), accelerating market legitimacy and clinical adoption, provided high performance standards (sensitivity and specificity) are met and maintained through post-market surveillance.

How accurate are AI systems compared to human specialists in detecting common eye diseases?

Advanced deep learning AI models demonstrate diagnostic accuracy often comparable to or exceeding human specialists in high-volume screening tasks for specific, well-defined pathologies like moderate-to-severe Diabetic Retinopathy. Clinical studies frequently cite sensitivity and specificity metrics in the range of 90-95% for detecting referable disease, significantly reducing false negatives in primary screening settings and standardizing the diagnostic quality across different geographic locations and operator skill levels.

What is the primary application area driving the growth of the AI eye screening market?

The primary application driving market growth is the autonomous detection and grading of Diabetic Retinopathy (DR). This focus is due to the immense global burden of diabetes, established clinical guidelines requiring regular screening, and the highly visual nature of DR pathology on fundus images, which is exceptionally well-suited for current Convolutional Neural Network (CNN) technology, allowing for immediate, high-impact clinical utility and clear return on investment (ROI) in public health programs.

What are the main deployment models used for AI eye screening software in clinical settings?

The two main deployment models are cloud-based and on-premise. Cloud-based solutions offer superior scalability, lower initial hardware investment for end-users, and facilitate easier software updates and remote tele-screening services, making them popular for large healthcare systems and remote clinics. On-premise solutions are preferred by organizations with strict data residency requirements or limited network access, ensuring immediate processing and maximum control over sensitive patient data within the local infrastructure.

What are the key ethical challenges associated with deploying AI in ophthalmology?

Key ethical challenges include ensuring algorithmic transparency (addressing the 'black box' nature), mitigating algorithmic bias which could lead to inaccurate diagnoses across diverse racial or demographic groups if training data is unrepresentative, and establishing clear protocols for professional liability when the AI model makes an error leading to patient harm. Addressing these challenges requires robust clinical validation across diverse populations and transparent reporting of model limitations and confidence scores.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager