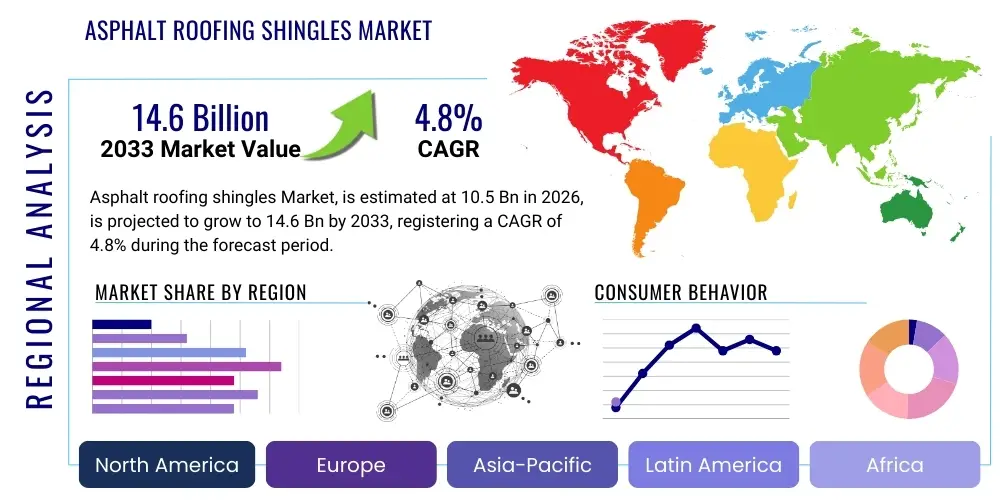

Asphalt roofing shingles Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442720 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Asphalt roofing shingles Market Size

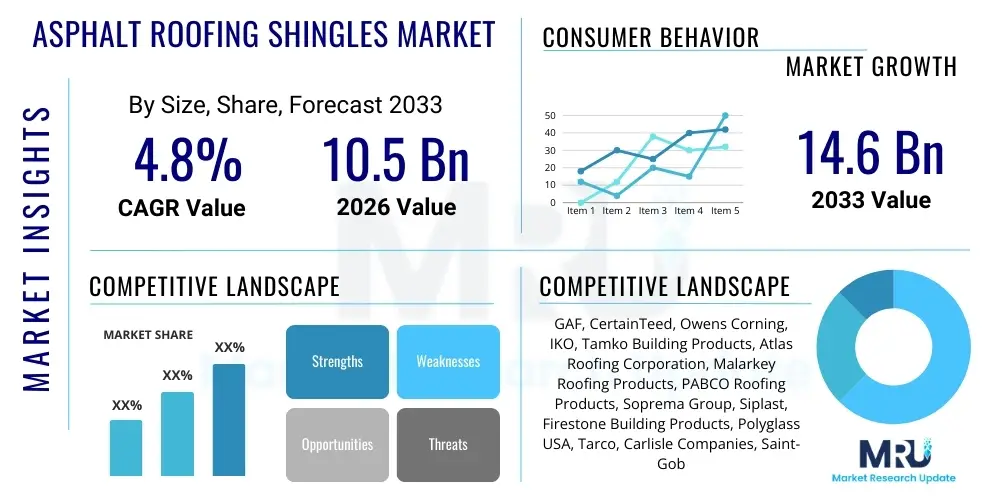

The Asphalt roofing shingles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $14.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by robust residential construction activity across North America and Asia Pacific, coupled with the persistent demand for cost-effective, durable, and aesthetically versatile roofing solutions in repair, re-roofing, and new construction projects.

Asphalt roofing shingles Market introduction

The Asphalt Roofing Shingles Market encompasses the manufacturing, distribution, and installation of roofing materials primarily composed of a base mat (usually fiberglass or organic) saturated with asphalt and surfaced with ceramic granules. These shingles serve as the uppermost layer of the roof, providing critical weather protection, thermal insulation, and aesthetic appeal to structures globally. The versatility of asphalt shingles, available in various colors, textures, and designs (such as 3-tab, dimensional, and premium laminates), makes them a dominant choice, particularly in the residential segment due to their favorable balance of cost, durability, and ease of maintenance.

Major applications for asphalt roofing shingles span the residential sector, where they are integral to single-family and multi-family housing, and increasingly, certain low-slope commercial structures. The primary benefits driving their widespread adoption include superior waterproofing capabilities, inherent fire resistance (especially fiberglass mats), resilience against harsh weather elements like wind and hail, and a significantly lower upfront installation cost compared to alternatives such as metal, tile, or slate. Furthermore, the extensive network of certified installers and the material’s relative simplicity in handling contribute to its market ubiquity.

Key driving factors accelerating the market’s growth include rising homeowner disposable income channeled toward renovation and remodeling projects, stringent building codes mandating impact-resistant and energy-efficient materials, and favorable government initiatives supporting housing development in emerging economies. The sustained need for replacing aging infrastructure, particularly in established markets like the United States and Canada, provides a continuous revenue stream. Technological advancements focusing on enhanced granule adhesion, reflective coatings for cool roofing properties, and improved polymer modification for greater flexibility further solidify asphalt shingles’ market position.

Asphalt roofing shingles Market Executive Summary

The Asphalt Roofing Shingles Market is characterized by steady growth underpinned by cyclical construction trends and sustained replacement demand in mature regions. Business trends indicate a focus on manufacturing optimization, with key players investing heavily in vertical integration to control raw material supply, specifically asphalt and fiberglass matting, thereby mitigating price volatility risks. Strategic mergers and acquisitions are observed as large manufacturers seek to expand geographic reach, particularly into high-growth urban centers, and diversify their product portfolios to include specialized, high-margin products like cool roof and solar-integrated shingles. The shift toward premium dimensional shingles, offering enhanced longevity and superior aesthetic value, represents a significant positive margin driver for the industry.

Regionally, North America remains the primary revenue generator due to an established housing stock requiring regular re-roofing and robust new residential construction activity. However, the Asia Pacific region, led by rapidly urbanizing economies such as China and India, exhibits the highest growth trajectory, fueled by large-scale infrastructure projects and increasing adoption of Western-style residential building standards. European markets show stable, moderate growth, emphasizing sustainable and energy-efficient roofing systems, often driven by stricter environmental regulations concerning material lifecycle and energy performance. Manufacturers are tailoring products to meet specific regional climatic challenges, from extreme heat resistance in the Middle East to heavy snowfall load bearing in Northern Europe.

Segment trends highlight the dominance of Fiberglass Shingles owing to their superior fire rating, lightweight nature, and cost-efficiency. Dimensional (Laminate) Shingles are rapidly increasing their market share, cannibalizing the traditional 3-tab segment due to their aesthetic appeal mimicking slate or shake and offering better warranty periods. Application-wise, the Residential segment is overwhelmingly dominant, necessitating continuous product innovation tailored for homeowners, including easy-to-install systems and enhanced color blends. The Institutional and Light Commercial segments are also showing increased adoption, specifically utilizing modified bitumen shingles for low-slope applications that require superior flexibility and waterproofing capabilities over wide spans.

AI Impact Analysis on Asphalt roofing shingles Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can be practically integrated into the highly physical manufacturing and construction sectors characteristic of the Asphalt Roofing Shingles Market. Common questions revolve around predictive maintenance for complex manufacturing lines, optimizing raw material procurement (especially volatile asphalt costs), enhancing quality control processes for shingle consistency, and improving logistics efficiency in the distribution chain. Key themes emerging from user concerns involve the immediate applicability of high-cost AI solutions to low-margin products, the required upskilling of the existing workforce, and the potential for AI-driven design tools to influence product innovation toward greater customization and performance metrics, particularly concerning impact and wind resistance testing protocols.

AI is poised to revolutionize the manufacturing efficiency and quality assurance within the shingle production lifecycle. By deploying ML algorithms to analyze sensor data collected from production lines—measuring variables like granule dispersal uniformity, asphalt saturation consistency, and curing temperature—manufacturers can predict equipment failure before it occurs, drastically reducing unscheduled downtime and improving overall yield. Furthermore, sophisticated image recognition AI can be utilized post-production to inspect every shingle for defects, ensuring perfect adherence to quality standards far exceeding the capability of human inspectors, thus minimizing waste and warranty claims. This AI-driven precision leads directly to cost savings and enhanced product reliability, which are crucial competitive differentiators.

Beyond the factory floor, AI is transforming sales, installation, and supply chain management. AI-powered demand forecasting, integrating historical sales data with external factors like weather predictions and housing start reports, allows companies to optimize inventory levels and reduce warehousing costs. In the contracting and installation phase, AI tools can help roofing professionals estimate material requirements and layout optimization through 3D modeling of roof surfaces derived from drone footage, ensuring minimal waste and faster, more accurate bids for homeowners. This streamlined process, coupled with AI-enhanced logistics routing for timely material delivery, improves the overall efficiency of the distribution channel, ultimately benefiting the end-user through quicker project completion.

- AI-driven predictive maintenance optimizes shingle manufacturing throughput and minimizes production line downtime.

- Machine Learning algorithms enhance raw material procurement strategies, buffering against asphalt price volatility.

- Computer vision and image recognition significantly improve automated quality control checks for shingle consistency and defect detection.

- AI enhances logistics and supply chain efficiency through optimized routing and demand forecasting models.

- Digital twins and simulation technologies aid in designing and testing new shingle formulations for superior wind, impact, and fire resistance.

- AI tools support contractors in accurate job estimation, material waste reduction, and rapid 3D roof modeling for installation planning.

DRO & Impact Forces Of Asphalt roofing shingles Market

The market dynamics of asphalt roofing shingles are heavily influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic decisions of market participants. The primary driver remains the inherent cost-effectiveness of asphalt shingles compared to alternatives like tile, slate, or metal, making them the preferred choice for budget-conscious new residential construction and widespread re-roofing efforts globally. This affordability, combined with relative ease of installation that minimizes labor costs and time on site, ensures sustained demand, particularly in densely populated areas experiencing rapid vertical expansion. Moreover, manufacturers continuously innovate to meet evolving aesthetic demands and stricter building codes, offering products with enhanced warranties and specialized performance attributes, such as superior algae resistance and reflective properties, further compelling consumer preference and driving market volume.

Despite strong foundational drivers, the market faces significant restraints that necessitate careful strategic navigation. Chief among these is the volatile nature of raw material pricing, particularly crude oil derivatives, which directly impact the cost of asphalt, a primary component. Fluctuations in petroleum markets introduce unpredictability into manufacturing costs and pricing strategies, challenging profitability margins. Additionally, environmental concerns regarding the long lifecycle disposal of asphalt shingles, which contribute to landfill waste, are mounting, leading to increased regulatory scrutiny and pushing R&D efforts towards sustainable or recyclable alternatives. Competition from alternative roofing materials, notably durable metal roofing systems and aesthetically pleasing clay or concrete tiles, is also intensifying, especially in regions prioritizing longevity or specialized architectural styles, thereby capping asphalt shingles' market share expansion.

Opportunities for growth are abundant, primarily focused on technological advancement and geographic expansion. The development and commercialization of cool roofing technology, utilizing highly reflective granules that reduce solar heat gain and lower energy consumption in buildings, present a substantial opportunity for manufacturers to meet growing energy efficiency mandates and appeal to environmentally conscious consumers. Furthermore, integrating asphalt shingle systems with emerging solar photovoltaic (PV) technologies, offering aesthetically subtle solar roofing solutions, opens up a lucrative niche market. Geographically, emerging economies in Asia Pacific and Latin America, characterized by massive unmet housing demand and underdeveloped infrastructure, represent Greenfield opportunities where asphalt shingles' balance of cost and performance is highly attractive. The industry must leverage these opportunities by emphasizing sustainability initiatives, superior warranties, and innovative product features to secure long-term market dominance against competitive materials.

Segmentation Analysis

The Asphalt Roofing Shingles Market is comprehensively segmented based on three primary categories: Type, Design, and Application. Analyzing these segments provides a granular understanding of consumer preferences, technological maturation, and regional consumption patterns. The type segmentation, distinguishing between organic, fiberglass, and modified bitumen shingles, reflects differences in base materials, fire ratings, weight, and suitability for various climates and roof slopes. Fiberglass shingles currently dominate the market volume due to their inherent lightweight nature and excellent fire resistance, making them the standard choice for most residential applications across North America.

The segmentation by design—3-Tab, Dimensional (Laminate), and Premium (Designer)—reveals a significant consumer shift towards premiumization. Traditional 3-tab shingles, while the most economical, are losing ground rapidly to Dimensional shingles. Dimensional products, characterized by their multi-layer construction, offer a thicker, more textured appearance that mimics natural slate or wood shake, along with enhanced wind resistance and extended warranties, justifying their higher price point. Premium or Designer shingles cater to the high-end custom home market, providing unique shapes, colors, and the highest performance characteristics, often integrated with specialized technology like solar readiness or extreme impact resistance, thus commanding the highest profit margins for manufacturers.

Application segmentation clearly delineates the market’s reliance on the Residential sector, which accounts for the vast majority of consumption due to the material’s strong historical presence and suitability for steep-slope roofs common in houses. The Commercial and Institutional segments primarily utilize asphalt shingles for structures with steep slopes, although modified bitumen sheets are often preferred for low-slope commercial roofs. Understanding these application distinctions is critical for manufacturers to tailor their marketing and distribution strategies, focusing on the distinct purchase decision-makers and regulatory requirements applicable to each end-use segment.

- Type:

- Organic Shingles

- Fiberglass Shingles

- Modified Bitumen Shingles

- Design:

- 3-Tab Shingles

- Dimensional (Laminate) Shingles

- Premium (Designer) Shingles

- Application:

- Residential

- Commercial

- Institutional

Value Chain Analysis For Asphalt roofing shingles Market

The value chain for the Asphalt Roofing Shingles Market begins with the upstream procurement of critical raw materials, primarily crude oil derivatives for asphalt production, fiberglass or organic mats (cellulose fiber), and mineral granules sourced from specialized quarries. The stability and cost of crude oil fundamentally dictate the variable cost of the final product, positioning raw material suppliers, particularly refiners and fiberglass mat manufacturers, as key influential nodes in the upstream analysis. Manufacturers often engage in long-term contracts or, in the case of major industry players, utilize vertical integration strategies, owning or co-owning mineral granule quarries and asphalt processing facilities to mitigate supply chain risk and control input costs, ensuring a stable influx of necessary components for continuous high-volume production.

The midstream stage involves the highly technical and capital-intensive manufacturing process, where the base mat is saturated with asphalt, coated with specialized stabilizers, and topped with ceramic-coated granules under strict quality controls for weight, flexibility, and fire rating. This manufacturing step, coupled with subsequent packaging and inventory management, adds significant value through proprietary technology and economies of scale. Direct and indirect distribution channels define the downstream structure. Direct channels involve sales to large home builders or commercial contractors, often facilitated by a dedicated sales force and specified contract pricing. Indirect channels, which form the bulk of residential sales, rely on extensive networks of two-step distributors and local building supply dealers who stock inventory, manage localized logistics, and provide credit to the vast ecosystem of independent roofing contractors and remodelers.

The final consumption stage involves professional roofing contractors, who act as the primary interface between the manufacturer/distributor and the end-user (homeowner or building owner). These contractors influence material choice based on familiarity, installation efficiency, and perceived warranty reliability. The efficiency of the distribution channel, which includes large national chains and specialized regional distributors, is paramount for timely project completion and cost management. Effective management of this complex value chain, from securing stable asphalt supplies to optimizing last-mile delivery to the job site, is crucial for market competitiveness, as material availability and cost predictability directly impact the success of roofing contractors and the satisfaction of end customers.

Asphalt roofing shingles Market Potential Customers

The primary customer base for the Asphalt Roofing Shingles Market is heavily concentrated within the residential sector, comprising both new home builders and, crucially, existing homeowners requiring repair and replacement services. New home builders, particularly those focusing on production housing and multi-family residential complexes, are significant bulk buyers who prioritize materials that offer a favorable blend of low cost, speed of installation, and recognized long-term reliability. Their purchasing decisions are often driven by large-volume discounts and standardized product lines, ensuring consistency across developments. However, the largest segment of potential buyers are homeowners, driven by the cyclical need for re-roofing projects typically occurring every 15 to 30 years, depending on shingle quality and regional climate severity.

A second major customer segment includes professional roofing contractors and remodeling firms. While not the ultimate end-user, these entities act as key gatekeepers, influencing product selection based on ease of handling, warranty support from the manufacturer, and availability through local distribution channels. Manufacturers target this audience through specialized training, certification programs, and loyalty incentives, recognizing that contractor recommendation is often the deciding factor for homeowners. The Institutional and Light Commercial sectors, including schools, small retail strips, and apartment buildings with sloped roofs, represent a specialized segment where purchasing decisions are often tied to lifecycle cost analysis and adherence to specific fire safety and durability requirements mandated by governmental or corporate guidelines.

Furthermore, insurance companies and property management firms increasingly function as indirect potential customers, especially in regions prone to severe weather events such as hurricanes or hail storms. These entities often mandate the use of high-impact or wind-resistant shingles (like Class 4 impact rated products) to mitigate future damage claims, thereby driving demand for premium, performance-oriented shingle lines. Targeting these institutional stakeholders with data on product resilience and longevity is becoming a crucial sales strategy, as their requirements can steer the consumption patterns of thousands of properties under their management or insurance umbrella, further solidifying the need for differentiated and highly durable asphalt shingle products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $14.6 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GAF, CertainTeed, Owens Corning, IKO, Tamko Building Products, Atlas Roofing Corporation, Malarkey Roofing Products, PABCO Roofing Products, Soprema Group, Siplast, Firestone Building Products, Polyglass USA, Tarco, Carlisle Companies, Saint-Gobain |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asphalt roofing shingles Market Key Technology Landscape

The technological evolution within the Asphalt Roofing Shingles Market centers primarily on enhancing durability, weather resistance, and thermal performance, moving beyond the traditional basic asphalt-saturated felt. A key advancement is the refinement of modified asphalt technology, particularly using polymers like Styrene-Butadiene-Styrene (SBS) or Atactic Polypropylene (APP). SBS modification enhances the shingle's rubber-like flexibility, making the material highly resistant to cracking at low temperatures and improving adhesion, crucial for superior wind resistance and impact performance, especially important for Class 4 rated products targeting hail-prone regions. APP modification generally offers better UV and heat resistance, suitable for extremely hot climates, ensuring the shingle maintains its structural integrity and granular embedment over prolonged exposure to intense sunlight, thereby extending the overall product lifespan significantly.

Another crucial area of technological innovation involves the ceramic granule coating process. Manufacturers are continually developing specialized reflective granules that minimize solar heat absorption, leading to the creation of "Cool Roof" shingles compliant with programs like ENERGY STAR and relevant building codes in warm climates. These granules employ complex pigmentation and surface treatments to increase solar reflectance and thermal emittance, significantly lowering the temperature of the roof deck and reducing cooling costs for the building occupants. Furthermore, copper-based or zinc-infused granules are utilized to provide algae resistance (AR), preventing discoloration and moss growth, which is a major aesthetic and performance concern in humid environments. The consistent application and deep embedment of these high-performance granules, monitored through sophisticated laser scanning and quality control systems, are central to technological competitiveness.

The most forward-looking technology involves the integration of building-integrated photovoltaics (BIPV) directly into the shingle form factor. Solar shingles or roof tiles are designed to maintain the aesthetic appeal and installation profile of traditional asphalt shingles while generating electricity. While still a nascent and premium segment, this technology leverages advancements in thin-film solar materials and robust encapsulation techniques to create durable, waterproof, and visually appealing solar energy solutions. This convergence of traditional roofing materials with renewable energy generation represents a critical future technological trajectory, positioning asphalt shingle manufacturers to capitalize on the increasing global push for distributed energy resources and sustainable building practices, thereby transforming the role of the roof from mere protection to active energy generation.

Regional Highlights

- North America, comprising the United States and Canada, represents the most mature and significant revenue generator for the Asphalt Roofing Shingles Market globally. This dominance is attributed to a massive existing housing stock, much of which utilizes asphalt shingles and requires consistent replacement and re-roofing every 15-25 years. The construction culture heavily favors dimensional and premium fiberglass shingles due to stringent building codes mandating high wind and fire ratings, especially in coastal and extreme weather areas. Robust residential remodeling activity, fueled by high consumer disposable income and favorable financing conditions, ensures steady demand, positioning the region as the epicenter for product innovation, particularly in impact resistance (Class 4) and cool roofing technologies. The competitive landscape is characterized by established, vertically integrated manufacturers with strong distribution networks, dictating market trends for product quality and extended warranties.

- The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period, driven by unprecedented urbanization and massive investments in residential infrastructure, particularly in developing economies like India, China, and Southeast Asian nations. Although traditional roofing materials like concrete and clay tile historically dominated, the affordability, ease of transport, and recognized durability of asphalt shingles are increasingly appealing to emerging middle-class consumers and large-scale builders seeking rapid construction solutions. Demand is primarily focused on cost-effective, high-volume fiberglass 3-tab and basic dimensional shingles. However, rapid regulatory changes related to building safety and energy efficiency are slowly paving the way for higher-grade, polymer-modified products, indicating a future shift towards premium offerings mirroring Western markets, making APAC a critical strategic focus for global expansion.

- Europe demonstrates stable, moderate growth, primarily concentrated in re-roofing projects and renovation activities, as new residential construction rates are generally lower than in North America or APAC. European markets, particularly in Western and Northern countries, place a strong emphasis on sustainability, material lifespan, and high thermal performance. While competition from metal and clay tiles is strong, asphalt shingles, often modified bitumen variations, are favored for specific residential and light commercial applications where flexibility, waterproofing, and ease of maintenance are prioritized. Strict European Union regulations regarding material procurement, energy performance (EPBD directives), and recyclability heavily influence product development, pushing manufacturers toward adopting greener production techniques and longer-lasting materials to meet stringent lifecycle assessment requirements enforced across the continent.

- Latin America is characterized by fragmented but high-potential growth, driven by fluctuating economic conditions but fundamentally supported by growing housing needs in large nations such as Brazil and Mexico. Asphalt shingles offer an attractive, durable solution for climates ranging from tropical humidity to high-altitude cold. Market penetration is gradually increasing as distribution networks mature and local builders become more aware of the material's benefits over traditional concrete slab roofs, especially concerning waterproofing and insulation. Price sensitivity remains a dominant factor, favoring basic 3-tab and standard fiberglass dimensional shingles, but investment in local manufacturing or assembly facilities is essential for companies aiming to capitalize on regional trade agreements and reduce import duties, thereby making the final product more economically viable for the local populace.

- The Middle East and Africa (MEA) region presents unique challenges and opportunities, largely driven by extreme climatic conditions, including high solar radiation and frequent sandstorms, which necessitate specialized roofing solutions. Demand is concentrated in the Gulf Cooperation Council (GCC) countries where massive construction projects are ongoing, demanding materials that offer excellent UV stability, high thermal reflectance, and resistance to rapid temperature shifts. Modified bitumen shingles and membranes are highly preferred for commercial and institutional structures due to their robust performance under intense heat. The African market, while varied, sees opportunity in urbanization trends, where asphalt shingles provide a relatively quick and durable shelter solution, though logistic challenges and competition from localized, low-cost materials remain substantial barriers that must be strategically navigated by international market players.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asphalt roofing shingles Market.- GAF

- CertainTeed

- Owens Corning

- IKO

- Tamko Building Products

- Atlas Roofing Corporation

- Malarkey Roofing Products

- PABCO Roofing Products

- Soprema Group

- Siplast

- Firestone Building Products

- Polyglass USA

- Tarco

- Carlisle Companies

- Saint-Gobain

- Duro-Last, Inc.

- Tegola Canadese SpA

- Shur-Gard (Continental Building Products)

- Brava Roof Tile

- DECRA Roofing Systems

Frequently Asked Questions

Analyze common user questions about the Asphalt roofing shingles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Asphalt Roofing Shingles Market?

The Asphalt Roofing Shingles Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 4.8% between the forecast years of 2026 and 2033, driven by sustained residential repair cycles and robust new construction activity, primarily in North America and the Asia Pacific region.

Which type of asphalt shingle is currently dominating the market in terms of volume and preference?

Fiberglass Shingles dominate the market volume due to their cost-effectiveness, superior fire resistance, and lightweight characteristics, making them the standard choice for most residential steep-slope applications, although the Dimensional (Laminate) design segment is rapidly increasing its market share.

How is the volatility of raw material prices impacting asphalt shingle manufacturers?

The primary restraint facing manufacturers is the price volatility of crude oil derivatives, which directly determines the cost of asphalt. This necessitates strategic raw material hedging, vertical integration efforts, and supply chain optimization to stabilize production costs and maintain competitive pricing strategies across the highly competitive market landscape.

What role does technology play in enhancing the durability and performance of modern asphalt shingles?

Technological advancements focus on polymer modification (SBS/APP) to enhance flexibility and weather resistance, specialized ceramic granule coatings for superior UV reflectivity (Cool Roofs), and copper or zinc granule treatments for long-term algae resistance, ensuring extended product lifespan and superior energy efficiency.

Which geographical region offers the highest growth potential for the asphalt shingle industry?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapid urbanization, significant government investment in housing infrastructure, and increasing adoption of affordable, Western-style construction materials in economies such as China, India, and various Southeast Asian nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager