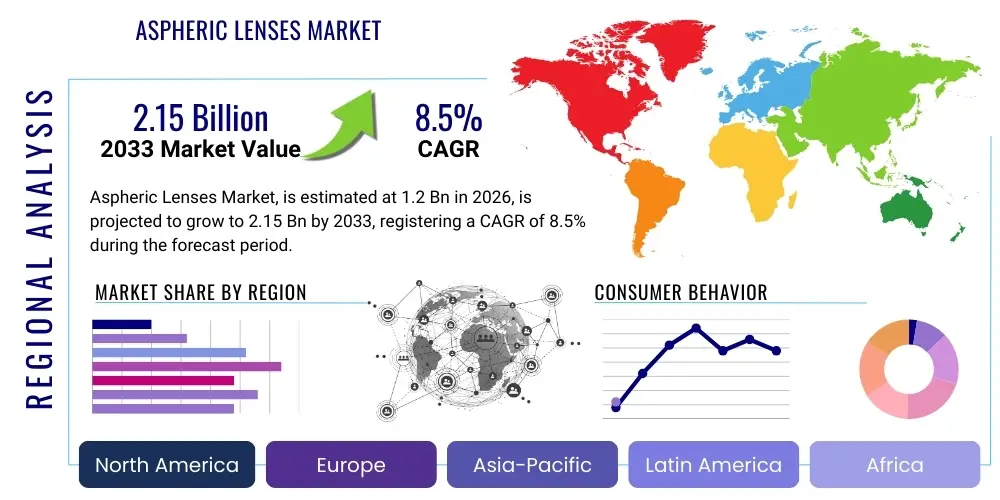

Aspheric Lenses Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442434 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Aspheric Lenses Market Size

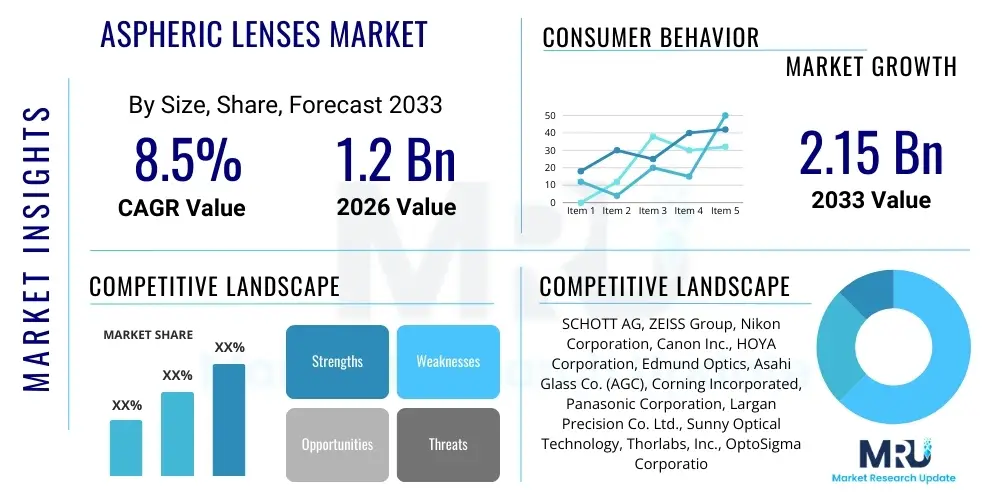

The Aspheric Lenses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

Aspheric Lenses Market introduction

Aspheric lenses, characterized by their non-spherical surfaces, represent a critical advancement in optical design, offering superior image quality and reduced system complexity compared to traditional spherical lenses. These lenses are engineered to eliminate spherical aberration, a common optical defect that occurs when light rays striking a lens far from the optical axis are focused closer to the lens than those striking near the axis. By precisely controlling the curvature across the entire lens surface, aspheric designs enable optical engineers to replace multiple standard spherical elements with a single aspheric element. This fundamental capability results in systems that are significantly lighter, more compact, and exhibit higher optical performance metrics, which is indispensable in modern high-resolution imaging and laser applications requiring stringent control over the light path.

The product description highlights their primary function: enhancing clarity and minimizing distortion across the entire field of view, particularly in systems with wide apertures or large fields of view. Major applications span a diverse technological landscape, including high-end digital cameras, sophisticated medical devices such as endoscopy and specialized ophthalmology equipment (e.g., intraocular lenses or IOLs), and critical defense and aerospace sensing technologies. Furthermore, the explosive growth in consumer electronics, including advanced smartphone cameras, virtual reality (VR), and augmented reality (AR) headsets, relies heavily on the miniature and high-performing characteristics of these optics. The distinct benefit of using aspheric components is the achievement of enhanced system efficiency and cost-efficiency in complex optical assemblies, as the reduction in component count simplifies alignment and assembly processes.

Key driving factors for the market include the robust expansion of the semiconductor and microelectronics industries requiring advanced lithography optics for wafer processing, the increasing global demand for high-resolution imaging systems used in security and surveillance infrastructure, and sustained government investment in advanced defense optical sighting systems. Moreover, the aging global population and rising prevalence of ophthalmic disorders necessitate high-precision medical optics, such as premium IOLs, which frequently utilize aspheric designs to optimize visual quality for patients. This confluence of accelerating demand across industrial, medical, and consumer technology sectors fuels significant market expansion, cementing the position of aspheric lenses as essential components for future high-fidelity optical systems.

Aspheric Lenses Market Executive Summary

The Aspheric Lenses Market is strategically positioned for rapid growth, primarily fueled by the accelerating trend of system miniaturization and the convergence of high-performance optics with digital sensor technology across various industries. Current business trends indicate a critical industry focus on refining precision manufacturing techniques, particularly specialized processes like Precision Glass Molding (PGM). PGM is increasingly enabling high-volume production of glass aspherics at competitive price points, which is crucial for meeting the substantial demand from consumer and automotive sectors. Strategic collaboration and vertical integration, involving partnerships between raw material suppliers (optical glass manufacturers) and component fabricators, are essential to ensure a reliable supply chain of specialty materials necessary for high-index, high-dispersion lens designs. Furthermore, market players are actively investing in enhancing optical coatings to maximize light transmission efficiency and durability, especially for lenses operating in harsh or challenging spectral environments.

Regionally, the market exhibits a clear bifurcation: the Asia Pacific (APAC) region dominates in terms of pure manufacturing output and high-volume consumption, driven by its established role as the global hub for consumer electronics assembly and robust industrial automation investments in economies like China, South Korea, and Japan. This region experiences the highest growth rate due to its foundational manufacturing capability and rapid adoption of advanced mobile and automotive technologies. In contrast, North America and Europe, while representing smaller volumes, remain critical centers for high-value, specialized optics. These mature markets focus intensely on cutting-edge research and development for highly customized defense, aerospace, and advanced medical imaging systems, where precision and compliance with stringent regulatory standards outweigh cost considerations, commanding premium pricing.

Segmentation analysis reveals nuanced trends across material and application types. Glass Aspheric Lenses maintain their superiority in applications requiring high thermal stability and resistance to high-power lasers, dominating industrial and scientific segments. Conversely, Plastic Aspheric Lenses are experiencing the fastest volume growth due to their cost-effectiveness and scalability via injection molding, making them the preferred choice for mass-market consumer devices and emerging AR/VR headsets. Application-wise, the Imaging Systems and Automotive Sensing (Lidar) segments are forecast to be the primary accelerators of market value, driven by the global transition towards autonomous driving and the persistent need for better security and industrial inspection tools. Investment is concentrated on developing robust manufacturing techniques that can bridge the gap between high precision and mass scalability.

AI Impact Analysis on Aspheric Lenses Market

The intersection of Artificial Intelligence (AI) and the Aspheric Lenses Market is generating significant user interest, primarily focusing on how AI can fundamentally revolutionize the traditionally iterative and time-consuming process of optical design and fabrication. Common inquiries address the capability of machine learning (ML) models to optimize complex aspheric surface equations faster than conventional simulation methods, thereby accelerating product development cycles. Users are also keen to understand how AI-driven metrology and quality control systems are being deployed on manufacturing floors to manage the ultra-high precision required for these optics, specifically regarding defect detection and real-time process adjustments. A core expectation is that AI will minimize manufacturing variability, leading to consistently 'perfect' lenses, even in high-volume production runs.

AI is having a profound impact by enabling next-generation computational optics. Generative design algorithms, leveraging ML, can swiftly explore the expansive solution space of non-spherical geometries, identifying optimal lens profiles that precisely meet stringent performance requirements (e.g., maximum numerical aperture, minimum aberration) under specific physical constraints (size, material type). This drastically reduces the dependency on human-intensive trial-and-error simulation, leading to breakthroughs in optical performance that were previously computationally infeasible. Furthermore, during the critical manufacturing phase, AI-powered computer vision systems are enhancing automated optical inspection (AOI) by interpreting subtle surface flaws, contamination, or deviations with unparalleled speed and accuracy, thereby improving yield rates in highly sensitive processes like diamond turning and precision molding.

Beyond manufacturing, AI is a major demand driver for high-quality aspheric lenses. Advanced AI systems, such as those used in autonomous vehicle Lidar and high-end industrial robotics, rely entirely on pristine, distortion-free optical input data. Aspheric lenses, by reducing aberration and improving light efficiency, are foundational components that ensure the optical fidelity necessary for successful algorithmic processing and decision-making. The demand for optics capable of supporting complex AI-driven vision architectures—often involving multiple lenses, wide fields of view, and various spectral requirements—necessitates customized aspheric solutions, directly correlating AI adoption rates with increased market consumption of high-specification aspheric components. This symbiotic relationship ensures sustained market growth as AI integration expands globally.

- AI accelerates computational optics design, utilizing machine learning to rapidly optimize complex aspheric surface profiles and reduce R&D cycles.

- AI-driven machine vision systems significantly enhance real-time quality control and nanometer-level defect detection during high-precision manufacturing processes.

- Generative design modeling is being used to invent novel, highly customized aspheric and freeform lens geometries tailored for specific sensor arrays.

- The deployment of advanced AI-powered sensors (e.g., Lidar, robotic vision) drives core market demand for high-fidelity, low-aberration aspheric lenses.

- Predictive maintenance schedules for high-capital equipment like diamond turning machines are optimized using ML, maximizing uptime and precision consistency.

DRO & Impact Forces Of Aspheric Lenses Market

The market for aspheric lenses is significantly influenced by a powerful array of drivers and opportunities that accelerate technological adoption, countered by inherent complexities that act as critical restraints. The most prominent driver is the overwhelming global trend of system miniaturization across nearly every technological sector. Achieving high performance in minimal space, whether in a smartphone camera or an aerospace satellite sensor, fundamentally necessitates the use of fewer, yet optically superior, components, a requirement perfectly met by the aberration-correcting capabilities of aspheric lenses. This is compounded by the relentless pursuit of higher resolution in digital imaging and the proliferation of advanced sensing technologies, which rely on the pristine optical quality and light gathering efficiency provided by these specialized lenses, solidifying a foundational layer of demand.

Key restraints largely revolve around the highly technical nature and associated cost of manufacturing. Production of precision aspherics demands extremely tight tolerances (often in the sub-micron or nanometer range), requiring substantial capital investment in highly specialized equipment such as multi-axis ultra-precision diamond turning machines, precision glass molding furnaces, and advanced non-contact metrology instruments. This high cost of entry limits the supplier base and imposes structural barriers that prevent rapid commoditization. Furthermore, the specialized knowledge and scarcity of highly skilled optical engineers and technicians capable of managing these sensitive processes represent a sustained operational restraint, contributing to higher unit costs for custom-designed aspheric components compared to their standard spherical counterparts.

Significant opportunities, however, promise to redefine the market landscape. The exponential growth of the autonomous vehicle industry and the mandated incorporation of advanced driver-assistance systems (ADAS) are creating massive, sustained demand for automotive-grade Lidar systems, which use complex arrays of aspheric optics for beam shaping and steering. Similarly, the rapid adoption of immersive technologies like AR and VR headsets requires wide field-of-view, lightweight, and distortion-free lenses, positioning aspherics as the only viable solution for comfortable and effective devices. Investment in developing high-throughput, low-cost injection molding techniques for durable polymer aspherics presents a crucial opportunity to overcome current cost restraints and tap into the immense volume requirements of the consumer electronics market.

- Drivers: Miniaturization of optical systems (SWaP reduction); escalating demand for high-resolution 4K/8K imaging and complex sensors; robust growth in medical diagnostics (advanced endoscopy and IOLs); mandatory incorporation of advanced sensing in vehicles.

- Restraints: High capital expenditure required for ultra-precision manufacturing machinery; operational complexity and need for tightly controlled production environments; limited availability of specialized technical expertise for design and metrology.

- Opportunities: Mass deployment of Lidar arrays and automotive sensing modules; rapid commercialization and adoption of AR/VR and head-mounted displays; continuous expansion of fiber optic communication requiring high-efficiency coupling lenses.

- Impact Forces: Technological advancements and integration with digital sensors exert high positive impact; manufacturing complexity and cost represent moderate but persistent restraining forces; governmental regulations in defense and medical sectors enforce slow but highly impactful quality mandates.

Segmentation Analysis

The Aspheric Lenses Market is intricately segmented based on material composition, proprietary manufacturing processes, the final application domain, and the target end-user industry. The fundamental material distinction separates Glass Aspheric Lenses, preferred for their superior thermal stability, durability, and index homogeneity, from Plastic/Polymer Aspheric Lenses, which are valued for their low weight, inherent shock resistance, and cost-effective scalability in high-volume contexts. Understanding the nuances between these material segments is crucial as they dictate suitability for high-power laser systems versus mass consumer applications.

Segmentation by manufacturing technique is critical, directly influencing lens quality, achievable tolerances, and unit cost. Precision Glass Molding (PGM) is favored for medium to high-volume glass production, offering a balance between cost and precision. Diamond Turning (DT), particularly Ultra-Precision Diamond Turning (UPDT), is reserved for achieving the highest possible form accuracy, often used for master molds, prototypes, or direct fabrication of low-volume, specialized optics in materials like germanium or silicon for IR applications. Injection Molding is the technique of choice for mass-producing polymer lenses, benefiting from extremely high throughput rates essential for consumer electronics supply chains. These process segments define the competitive landscape and technological investment priorities of market leaders.

Further segmenting the market by application highlights key consumption growth areas. The Imaging Systems segment (including surveillance and professional cameras) and the Medical Devices segment (IOLs, endoscopes) consistently contribute significant revenue. The emerging Automotive Sensing segment (Lidar, driver monitoring systems) is projected to exhibit explosive growth, demanding specialized aspheric arrays built to automotive reliability standards. End-user segmentation contrasts the volume requirements of the Consumer Electronics industry with the ultra-precision demands of the Aerospace & Defense and Semiconductor sectors. Detailed analysis across these dimensions allows market players to accurately target product development and capacity expansion strategies, focusing on the segments demonstrating the highest compound growth potential.

- By Material: Glass Aspheric Lenses (high performance, stability), Plastic/Polymer Aspheric Lenses (lightweight, cost-effective).

- By Manufacturing Technique: Precision Glass Molding (PGM), Ultra-Precision Diamond Turning (UPDT), Injection Molding, Grinding and Polishing (hybrid approaches).

- By Application: Cameras & Imaging Systems (Security, Professional), Medical Devices (Ophthalmic, Endoscopy), Optical Data Storage, Microscopy & Telescopes, Laser Systems & Fiber Optics, Automotive Sensing (Lidar/ADAS).

- By End-User Industry: Consumer Electronics (Mobile, AR/VR), Medical & Healthcare, Industrial & Scientific (Metrology, Lithography), Aerospace & Defense, Telecommunications.

Value Chain Analysis For Aspheric Lenses Market

The value chain for the Aspheric Lenses Market is complex and heavily weighted towards high-precision engineering and proprietary knowledge, starting with the upstream phase of material sourcing and optical design. Upstream activities involve the highly specialized synthesis and supply of optical-grade raw materials—such as high-index glass blanks (e.g., lanthanum glasses) or optical polymers—from specialized chemical companies. Simultaneously, the design process is executed by skilled optical engineers utilizing advanced computational software to model and finalize the non-spherical prescription. Success at this stage relies on minimizing material defects and achieving perfect alignment between theoretical design and fabrication feasibility, often involving costly iterative design optimization processes tailored to specific wavelength and performance requirements.

The midstream segment is the core value-add stage, characterized by the capital-intensive manufacturing processes. This includes the precise fabrication of molds for PGM or the direct machining of lenses using UPDT. Critical subsequent steps involve specialized coating processes (e.g., sputtering, plasma deposition) to apply highly durable, multi-layer anti-reflection or bandpass filters. Metrology and quality assurance are integral midstream activities, employing state-of-the-art non-contact measurement tools, such as interferometers and CMMs, to verify surface accuracy and transmission characteristics against nanometer-level specifications. Failure to maintain tolerances at this stage results in expensive component rejection, making process control paramount for profitability.

The downstream phase encompasses distribution, integration, and final end-user application. Distribution channels are largely bifurcated: highly technical, custom orders for defense, aerospace, or medical industries are usually managed via direct sales channels, fostering deep collaboration between the lens manufacturer and the OEM integrator to ensure perfect optical system integration. Conversely, high-volume polymer lens distribution utilizes specialized optical component brokers and indirect channels to reach large consumer electronics assembly plants, predominantly located in the Asia Pacific region. The primary downstream consumers—OEMs in automotive Lidar, medical devices, and consumer mobile technology—select suppliers based on proven reliability, volume scalability, and demonstrated expertise in meeting stringent technical specifications under challenging operational environments, thereby completing a chain where precision is valued at every single point.

Aspheric Lenses Market Potential Customers

The potential customer base for Aspheric Lenses is defined by industries that cannot compromise on image quality, system compactness, or light efficiency. A significant segment of buyers comprises Original Equipment Manufacturers (OEMs) within the professional imaging and broadcast equipment sector, requiring pristine optics for high-end digital cameras, cinematic lenses, and sophisticated surveillance systems. Furthermore, medical device manufacturers represent a vital, consistent customer base. Companies producing specialized surgical endoscopes, diagnostic retinal cameras, and advanced intraocular lenses (IOLs) are highly reliant on the flawless corrective power of aspheric designs to ensure accurate diagnostics and successful therapeutic outcomes, often governed by strict regulatory bodies like the FDA and CE.

A rapidly evolving and high-growth customer segment includes Tier 1 automotive suppliers and developers of autonomous and semi-autonomous driving systems. These clients require massive volumes of robust, environmentally resistant aspheric lens arrays integrated into Light Detection and Ranging (Lidar), Advanced Driver-Assistance Systems (ADAS) cameras, and heads-up displays. The necessity for these components to perform reliably across extreme temperatures and varied lighting conditions makes high-quality glass and hybrid aspherics a mandatory requirement, driving significant long-term demand. The unique ability of aspherics to manage high-power laser beams in Lidar systems further solidifies this customer base.

The largest volume consumer is the Consumer Electronics sector, particularly manufacturers of high-volume mobile devices (smartphones, tablets) and emerging wearables (AR/VR). These buyers prioritize cost-efficiency, low profile, and light weight, favoring injection-molded plastic and hybrid aspheric lenses to meet consumer demand for improved mobile photography and immersive experiences. Finally, the Industrial and Scientific sectors, including organizations manufacturing semiconductor lithography equipment, advanced metrology tools, and astronomical telescopes, constitute crucial, albeit lower volume, buyers who demand optics with absolute uniformity and exceptional dimensional accuracy for research and critical industrial processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCHOTT AG, ZEISS Group, Nikon Corporation, Canon Inc., HOYA Corporation, Edmund Optics, Asahi Glass Co. (AGC), Corning Incorporated, Panasonic Corporation, Largan Precision Co. Ltd., Sunny Optical Technology, Thorlabs, Inc., OptoSigma Corporation, Melles Griot (IDEX Health & Science), Syntec Optics, Precision Optical, LightPath Technologies, Inc., G&H (Gooch & Housego), Excelitas Technologies, Shanghai Optics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aspheric Lenses Market Key Technology Landscape

The competitive technology landscape of the Aspheric Lenses Market is fundamentally shaped by advancements in ultra-precision manufacturing and cutting-edge metrology, which are necessary to consistently achieve the nanometer-level accuracy required for non-spherical surfaces. Precision Glass Molding (PGM) remains the cornerstone technology for cost-effective mass production of high-quality glass aspherics, particularly for high-index materials used in consumer and medical optics. Recent technological refinements in PGM focus on enhancing the durability and anti-wear properties of the complex molding tools, extending their operational lifespan and enabling higher throughput rates, which directly translates to reduced unit cost and improved market scalability.

Complementing PGM is Ultra-Precision Diamond Turning (UPDT), an essential technology for prototyping, fabricating master molds, and manufacturing high-specification lenses in non-glass materials such as specialized polymers, crystals, and metals, particularly for infrared (IR) applications. Continuous technological evolution in UPDT involves integrating advanced, non-contact thermal and vibrational stabilization systems, allowing for the generation of complex freeform and steeply curved aspheric surfaces with sub-20 nanometer form accuracy. The integration of advanced Computerized Numerical Control (CNC) software with in-situ metrology capabilities ensures that the highly sensitive turning process maintains absolute precision, vital for defense and aerospace optics that must operate under extreme conditions.

Furthermore, the success of these fabrication methods is dependent on equally sophisticated metrology tools. Advanced non-contact measuring instruments, such as high-resolution interferometers and 3D optical profilometers, are mandatory for verifying the complex surface form errors and roughness against the ideal mathematical prescription. Beyond shaping, the application of specialized coatings is a vital part of the technology landscape. Innovations in thin-film deposition techniques, including ion-assisted deposition and atomic layer deposition (ALD), are used to create durable, highly efficient anti-reflection (AR) coatings, enabling broadband transmission and protecting the delicate aspheric surfaces from harsh chemical or mechanical environments, thus maximizing the overall performance and reliability of the final optical system.

Regional Highlights

The global distribution of the Aspheric Lenses Market is uneven, with substantial regional differences in manufacturing capabilities, technological adoption, and concentration of end-user demand, creating distinct market dynamics across continents.

Asia Pacific (APAC) is the dominant force, serving as the world's primary manufacturing base for electronics and high-volume components. This region accounts for the largest share of market revenue and experiences the highest Compound Annual Growth Rate (CAGR). Driven by massive electronics hubs in China, South Korea, and Japan, APAC excels in the mass production of polymer and mid-range glass aspheric lenses utilized in smartphones, security cameras, and integrated consumer devices. Investment in advanced factory automation and favorable government policies supporting the high-tech optical supply chain further solidify APAC's central role, making it the most competitive region for volume manufacturing.

North America represents a market focused on premium, high-specification optics, driven primarily by robust demand from the Aerospace, Defense, and Advanced Medical sectors. The market here is characterized by extremely high R&D spending, supporting cutting-edge applications such as space telescopes, military night vision, and highly complex biomedical imaging systems. North America is a pioneer in the integration of aspherics into disruptive technologies like commercialized Lidar for autonomous systems, necessitating lenses with stringent technical performance and traceability, rather than prioritizing low unit cost.

Europe holds a strong position rooted in its historical excellence in precision engineering and scientific instrumentation. Countries like Germany and Switzerland are global leaders in manufacturing optics for advanced metrology, microscopy, and high-power laser systems, including specialized optics required for lithography processes in semiconductor fabrication. The European market demands high-quality, durable aspheric components, often requiring compliance with stringent environmental and sustainability standards. The region’s advanced medical device industry also contributes significantly to the demand for precision aspheric optics.

Latin America (LATAM) and Middle East & Africa (MEA) currently hold smaller market shares, but exhibit potential growth tied to infrastructure development. In MEA, diversification away from hydrocarbon economies is fueling investment in localized healthcare and security infrastructure, increasing the demand for imported medical and surveillance optics. LATAM's growth is predominantly linked to the expansion of consumer electronics consumption and gradual upgrades in regional telecommunication networks, driving a modest, but increasing, requirement for polymer and fiber optic coupling aspheric lenses.

- Asia Pacific (APAC): Market volume leader; dominant in consumer electronics and automotive sensing optics; high growth driven by manufacturing scale. Key growth drivers: China, South Korea.

- North America: Value leader in defense, aerospace, and advanced medical sectors; strong R&D focus on Lidar and high-performance imaging. Key market strength: USA.

- Europe: Center for industrial metrology, scientific instrumentation, and high-power laser optics; driven by stringent quality standards and precision engineering. Key markets: Germany, Switzerland.

- Latin America (LATAM) & MEA: Emerging consumption markets; growth tied to expanding healthcare services, telecommunication infrastructure, and security upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aspheric Lenses Market.- SCHOTT AG

- ZEISS Group

- Nikon Corporation

- Canon Inc.

- HOYA Corporation

- Edmund Optics

- Asahi Glass Co. (AGC)

- Corning Incorporated

- Panasonic Corporation

- Largan Precision Co. Ltd.

- Sunny Optical Technology

- Thorlabs, Inc.

- OptoSigma Corporation

- Melles Griot (IDEX Health & Science)

- Syntec Optics

- Precision Optical

- LightPath Technologies, Inc.

- G&H (Gooch & Housego)

- Excelitas Technologies

- Shanghai Optics

Frequently Asked Questions

Analyze common user questions about the Aspheric Lenses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using an aspheric lens over a standard spherical lens?

The primary benefit of an aspheric lens is its unique non-spherical surface, which is specifically designed to correct or eliminate spherical aberration and other monochromatic defects. This allows optical designers to replace multiple standard spherical elements with a single aspheric lens, resulting in a significantly more compact, lightweight, and higher-performance optical system (improving SWaP metrics).

Which manufacturing technique is critical for achieving high-volume, cost-effective production of glass aspheric lenses?

Precision Glass Molding (PGM) is the critical technology for high-volume, cost-effective production. PGM uses heat and pressure to replicate complex aspheric profiles from a master mold, drastically reducing the labor and time associated with traditional grinding and polishing techniques, thereby enabling scalability for industrial and consumer applications.

How does the growth of autonomous vehicles influence the demand for aspheric lenses?

Autonomous vehicle development is a major driver, particularly through the proliferation of Light Detection and Ranging (Lidar) and ADAS vision systems. These systems require complex arrays of highly precise, wide field-of-view aspheric lenses to ensure accurate beam shaping, high light collection efficiency, and distortion-free data input for critical algorithmic processing.

What are the main distinctions between glass and plastic aspheric lenses in market application?

Glass aspheric lenses are favored in high-specification environments like defense, industrial, and medical imaging due to their superior thermal stability and index consistency. Plastic/polymer aspheric lenses are predominantly used in high-volume consumer electronics, such as mobile phones and VR/AR headsets, owing to their low cost, light weight, and ease of mass production via injection molding.

Which geographic region dominates the global manufacturing of aspheric lenses, and why?

The Asia Pacific (APAC) region, primarily China, Japan, and South Korea, dominates global manufacturing. This dominance is due to established high-volume production ecosystems for consumer electronics, favorable manufacturing infrastructure, and substantial investments in advanced optical component fabrication technologies and supply chains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager