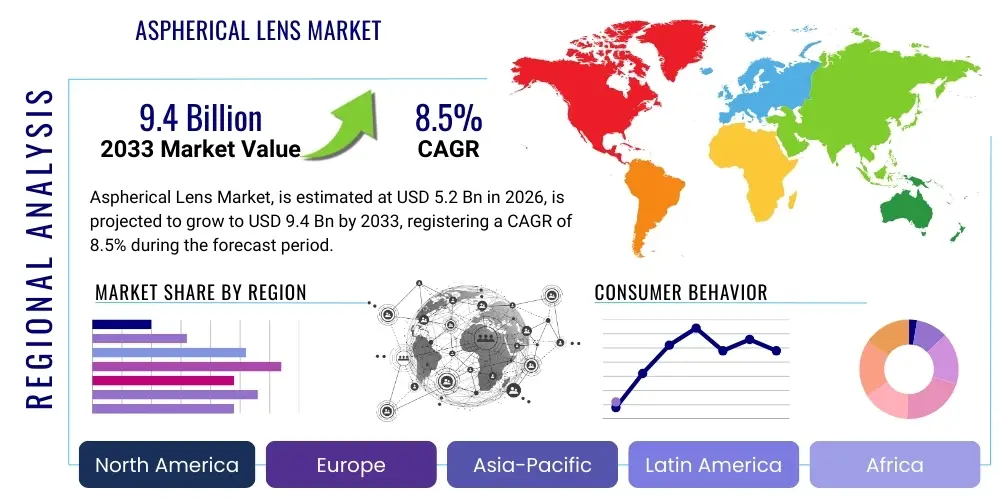

Aspherical Lens Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441056 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Aspherical Lens Market Size

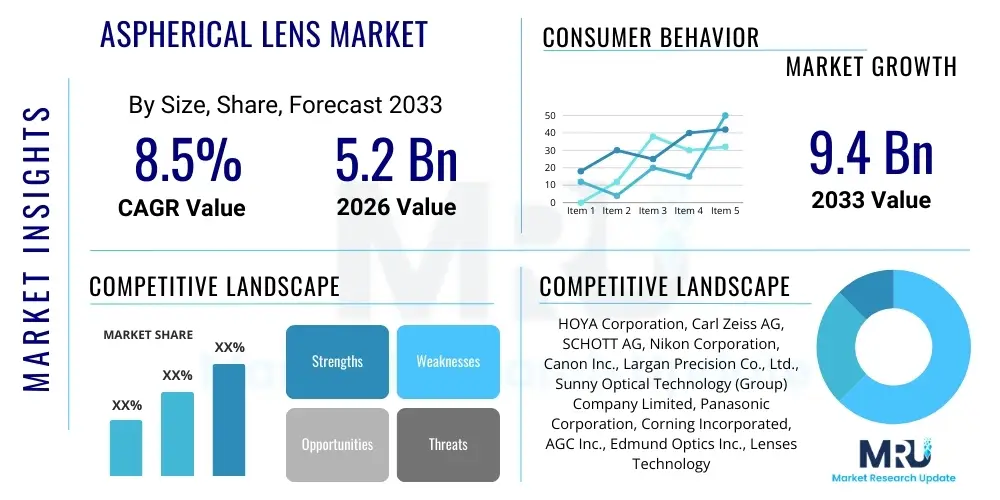

The Aspherical Lens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033.

Aspherical Lens Market introduction

The Aspherical Lens Market is defined by the production and deployment of optical components that possess a surface profile deviating from a perfect sphere or cylinder. Unlike traditional spherical lenses, aspheric designs utilize a complex curve to correct spherical aberration and reduce other optical distortions, significantly enhancing image quality and optical system efficiency while simultaneously minimizing the overall size and weight of optical assemblies. This inherent ability to replace multiple spherical elements with a single, highly optimized aspheric lens drives its increased adoption across high-precision applications. Key applications span consumer electronics, where they are crucial for thin camera modules in smartphones and virtual reality (VR) headsets; medical devices, particularly in endoscopy and ophthalmic instruments; and the automotive sector, where they are essential components in advanced driver-assistance systems (ADAS) like LiDAR and night vision cameras. The primary benefit derived from aspherical lenses is superior optical performance, achieved through the elimination of monochromatic aberrations at wide apertures, leading to brighter, sharper images and increased light throughput.

The product description involves lenses manufactured using ultra-precision techniques, such as precision glass molding (PGM) for high volume and cost efficiency, or diamond turning for specialized, low-volume, or large-diameter elements. The complexity of the surface profile is mathematically defined by an equation that calculates the sagitta of the lens as a function of the distance from the optical axis. This high degree of design freedom allows system architects to consolidate the functions of several conventional lenses into one, simplifying assembly and reducing manufacturing tolerance stack-up errors. Major applications are increasingly concentrated in digital imaging, including machine vision systems necessary for industrial automation, and sophisticated diagnostic equipment. The integration of high-resolution sensors demands equally high-performance optics, positioning aspherical lenses as indispensable components in the ongoing miniaturization trend across all sectors utilizing light detection and ranging technologies. The manufacturing sophistication required ensures a high barrier to entry, maintaining the competitive edge of established specialized lens producers.

Driving factors propelling the robust growth of the Aspherical Lens Market are fundamentally linked to advancements in digitalization and automation. The exponential proliferation of smart devices, coupled with the burgeoning demand for augmented reality (AR) and VR technologies, necessitates compact and powerful optical engines. Furthermore, stringent safety regulations and the widespread integration of ADAS features—including sophisticated sensor fusion systems relying heavily on accurate optical inputs—in modern vehicles fuel demand dramatically. The medical imaging field, driven by the shift towards minimally invasive procedures, relies on micro-optics and high-performance aspherical lenses for superior diagnostic quality in miniaturized endoscopes. These macro trends intersect with continuous improvements in manufacturing processes, such as the development of novel glass compositions and advanced replication techniques, which are gradually lowering the unit cost of high-quality aspheric optics, making them accessible for broader commercial use beyond traditional niche markets like high-end scientific instruments and space optics. This convergence of demand and technological maturity firmly establishes aspherical lenses as a cornerstone technology in future optical systems.

Aspherical Lens Market Executive Summary

The Aspherical Lens Market is experiencing significant dynamic shifts driven by accelerating technological convergence and diversification of end-use applications. Business trends highlight a pronounced shift towards precision glass molding (PGM) as the preferred mass-production technique, facilitating economies of scale crucial for the consumer electronics and automotive sectors. Furthermore, strategic partnerships between lens manufacturers and technology integrators (such as sensor makers and device assemblers) are increasing, aiming to co-develop optimized optical modules that meet specific system performance requirements, particularly for LiDAR and complex camera arrays. Sustainability is also emerging as a trend, with efforts focused on reducing material waste during the high-precision diamond turning process and optimizing energy consumption in molding facilities. Geographically, Asia Pacific dominates the market, largely due to the concentration of major consumer electronics manufacturing hubs and a rapidly expanding automotive production base incorporating ADAS features. North America and Europe, while possessing slower volume growth, lead in high-value, specialized segments suchation as defense, aerospace, and advanced medical diagnostics, characterized by demand for bespoke, ultra-precise custom optics.

Segment trends emphasize robust growth in the automotive segment, which is leveraging aspherical optics for thermal imaging, night vision, and sophisticated machine vision required for autonomous driving. The medical sector continues its steady growth, prioritizing lens durability and biocompatibility for sterilization processes in surgical instruments. Technology-wise, hybrid aspheres—which combine a glass substrate with a polymer layer to achieve the aspheric shape—are gaining traction as a cost-effective alternative for certain applications where extreme thermal stability is not the paramount concern. Conversely, pure glass molded aspheres maintain supremacy in environments requiring maximum thermal stability and radiation resistance. The competitive landscape is characterized by intense focus on intellectual property surrounding lens design algorithms and advanced manufacturing tooling. Companies are heavily investing in quality control systems, utilizing techniques like non-contact 3D profilometry and interferometry, to ensure the exacting surface form tolerances required for high-performance systems are consistently met. This operational focus is crucial as even minute deviations in the aspheric surface can introduce unacceptable levels of wavefront error, undermining system performance.

Regional dynamics are increasingly influential in shaping market investment and supply chain decisions. While China remains the largest single market consumer and producer, driven by expansive smartphone and automotive production, other regions are fostering growth through specialized capabilities. Japan holds a strong position in high-end glass molding and diamond turning machinery necessary for producing the molds themselves, demonstrating expertise further up the value chain. Europe is distinguished by its leadership in ophthalmic lenses and highly specialized industrial optics for advanced lithography and scientific research equipment, demanding stringent quality standards and traceability. Overall, the market trajectory is marked by relentless innovation aimed at miniaturization and enhanced performance across all segments. The shift away from traditional spherical optics is nearly complete in high-performance niches, ensuring sustained demand for aspherical components. Key market players are focused on scaling production capacity while simultaneously refining manufacturing yields to capture market share, particularly in the explosively growing AR/VR and automotive imaging spaces, anticipating continuous high-volume demand over the forecast period and solidifying the market's trajectory towards digitalization and optical sophistication.

AI Impact Analysis on Aspherical Lens Market

User queries regarding the impact of Artificial Intelligence (AI) on the Aspherical Lens Market predominantly center on optimization processes, quality control, and the acceleration of R&D cycles. Users frequently ask: "Can AI optimize the complex design parameters of aspheric lenses faster than traditional methods?" and "How will machine learning improve the yield and consistency of precision glass molding?" Concerns also focus on the competitive landscape, specifically whether AI-driven design tools will lower the barrier to entry, potentially destabilizing the market leadership of traditional expert optical designers. The overarching expectation is that AI will primarily serve as a powerful tool for predictive analytics in manufacturing and iterative design optimization. The analysis suggests that key themes revolve around achieving tighter tolerances, predicting tooling wear in real-time to prevent defects, and simulating complex light paths through non-traditional optical configurations. AI is viewed as an enabling technology that enhances the capabilities of existing precision manufacturing infrastructure rather than fundamentally replacing the core manufacturing processes.

The implementation of AI algorithms, particularly deep learning models, is revolutionizing the design phase of aspherical lenses. Traditional optical design requires iterative calculations and extensive human expertise to balance aberrations, which can be time-consuming and prone to local optima traps. AI-driven generative design tools can explore a vast design space quickly, generating novel, highly efficient aspheric surface equations that might not be intuitively obvious to human designers. Furthermore, in the manufacturing process, AI is instrumental in enhancing yield rates. By integrating machine learning with sensor data collected during precision glass molding or diamond turning—such as temperature profiles, pressure fluctuations, and vibrational data—manufacturers can predict potential defects, adjust process parameters dynamically, and significantly reduce material waste. This transition to predictive quality control ensures greater uniformity and reliability, crucial for demanding applications like automotive LiDAR where component failure is unacceptable.

Beyond design and manufacturing, AI also plays a critical role in application development. The increasing use of aspherical lenses in AI-enabled systems—such as robotic vision, drone navigation, and augmented reality glasses—creates a positive feedback loop. As these systems become more reliant on perfect imaging for decision-making (e.g., in autonomous vehicles recognizing obstacles), the demand for precisely characterized, high-quality aspherical lenses increases. AI is used in the final testing phase, utilizing automated visual inspection combined with neural networks trained on acceptable and unacceptable lens surface flaws, significantly speeding up the quality assurance pipeline compared to traditional methods that relied heavily on manual inspection or simpler algorithms. Consequently, AI is not just impacting how lenses are made; it is also accelerating the adoption of the sophisticated devices that require these advanced optical components, ensuring sustained high-volume demand in the future.

- AI-driven generative design optimizing complex aspheric surface profiles for minimal aberration.

- Predictive maintenance models reducing downtime and improving yield rates in high-precision molding.

- Real-time monitoring and correction of manufacturing parameters (e.g., temperature, pressure) using machine learning.

- Automated quality control via computer vision algorithms for high-speed, non-contact defect detection.

- Acceleration of R&D cycles by simulating optical performance across varied material and environmental conditions.

- Enhanced supply chain efficiency through AI-powered forecasting of component demand based on end-market production schedules.

- Optimization of tooling lifetime and wear compensation in diamond turning processes.

DRO & Impact Forces Of Aspherical Lens Market

The Aspherical Lens Market is shaped by a confluence of powerful forces: the primary drivers are the relentless pursuit of miniaturization and superior image quality across consumer and industrial sectors, particularly the integration of high-resolution cameras in smartphones, drones, and medical endoscopes. However, significant restraints impede growth, most notably the extremely high manufacturing cost associated with ultra-precision tooling (molds and diamond turning machines) and the rigorous, complex quality control processes required to meet sub-micron surface tolerances. Opportunities abound in emerging fields such as high-power laser systems, advanced astronomical instruments, and specialized defense applications that demand custom, non-standard aspheric geometries. The combined impact forces are substantial, pushing market players toward continuous investment in process innovation, particularly in replication technologies and hybrid lens structures, striving to balance the high demand for performance with the necessity of cost reduction in high-volume markets.

Key drivers include the dramatic global expansion of the automotive sector's transition toward Level 2+ autonomy, which necessitates complex arrays of high-performance optics for environment sensing, including cameras, LiDAR, and thermal sensors. Simultaneously, the consumer electronics space, specifically AR/VR and mixed reality (MR) devices, demands ultra-lightweight, wide field-of-view (FOV) optics, achievable only through highly customized aspheric designs. This sustained demand pressure from mass-market segments validates the substantial investment in scalable manufacturing technologies like PGM. Conversely, market restraints are rooted in the technical difficulty of producing these components consistently. The materials science challenge of finding suitable glass or plastic formulations that maintain stability during molding cycles while achieving the required refractive index adds another layer of complexity. Furthermore, the specialized knowledge and highly skilled labor required for designing and fabricating the molds themselves create a significant human capital barrier to rapid expansion and market entry for new competitors.

The primary opportunity lies in material diversification and enhanced integration. The development of infrared (IR) transmitting aspheric materials is opening up lucrative opportunities in thermal imaging and defense applications, while the advancement of diffractive-refractive hybrid optics (often incorporating an aspheric base) allows for even greater system weight and size reductions. Impact forces emphasize that market success is heavily weighted toward manufacturers who can consistently deliver high-quality, high-volume products at competitive prices, effectively weeding out smaller players incapable of managing the high upfront tooling costs. Geopolitical risks also act as an impact force, affecting supply chains for specialized raw materials (e.g., certain rare earth elements used in optical glass compositions) and impacting the strategic location of manufacturing facilities, prompting a drive toward supply chain redundancy and regionalized production capabilities, particularly in North America and Europe, countering the predominant Asia-Pacific concentration.

- Drivers:

- Global surge in ADAS and autonomous vehicle technologies requiring LiDAR and camera systems.

- Exponential growth and miniaturization in consumer electronics (smartphones, AR/VR headsets).

- Increasing prevalence of minimally invasive surgery demanding compact, high-resolution endoscopes.

- Demand for enhanced optical performance and light throughput across various imaging platforms.

- Restraints:

- High initial capital expenditure required for ultra-precision tooling and manufacturing equipment (PGM, diamond turning).

- Technical complexity and rigorous tolerance requirements leading to lower manufacturing yields initially.

- Limited availability of highly skilled optical engineers and technicians capable of complex design and process control.

- High material costs for specialized optical glasses and polymers with required thermal and refractive properties.

- Opportunities:

- Expansion into infrared and UV optics for specialized sensing and defense applications.

- Development of cost-effective hybrid aspheres combining glass and polymer elements.

- Integration of smart manufacturing and AI tools to optimize design and increase production efficiency.

- Growth of metrology and scientific instrumentation markets demanding custom, high-fidelity optics.

- Impact Forces:

- Technological Advancements in Glass Molding: High impact, driving cost reduction and volume scalability.

- Regulatory Demands (e.g., Automotive Safety Standards): Medium to High impact, mandating performance and reliability.

- Supply Chain Volatility: Medium impact, affecting raw material costs and delivery timelines.

- Competitive Pricing Pressure: High impact, especially in the consumer electronics segment.

Segmentation Analysis

The Aspherical Lens Market is segmented across several critical dimensions, including Manufacturing Technology, Application, and Material Type, each reflecting distinct market drivers and performance requirements. Understanding these segments is crucial for strategic positioning, as volume and pricing dynamics differ significantly between, for instance, mass-produced plastic aspheres for cameras and custom-ground glass aspheres for medical lasers. The Application segment reveals the most dynamic growth, led by automotive and consumer electronics due to their massive scale and constant requirement for size and weight reduction. Material type segmentation highlights the trade-off between the superior thermal and optical stability of glass versus the lower cost and lighter weight achievable with polymer or plastic molding. The dominance of precision molding techniques underscores the industry's successful pivot towards scalable manufacturing methods necessary to meet global consumer demand without compromising the tight tolerances integral to aspheric performance.

The segmentation by Manufacturing Technology distinguishes between the high-throughput, low-cost methods suitable for commercial applications and the slower, more precise methods required for custom, high-performance optics. Precision Glass Molding (PGM) is highly favored for its ability to produce highly accurate glass aspheres rapidly, making it the bedrock of supply for smartphone cameras and digital cameras. Diamond Turning, conversely, is critical for prototyping, large diameter lenses (often used in defense or scientific instruments), and generating the molds used in PGM, retaining its importance despite being slower and higher cost per unit. This technological split dictates the competitive landscape, with major players often specializing in one method. Furthermore, the segmentation by end-user application demonstrates clear differentiation in performance specifications. Automotive applications require extreme durability against vibration and thermal cycling, dictating the use of high-stability glass, whereas consumer electronics prioritizes cost and compactness, frequently employing hybrid or plastic options.

The material segmentation—Glass, Plastic, and Hybrid—reflects a critical decision point in the lens selection process. Glass aspheres offer the highest refractive indices, lowest dispersion, and superior environmental stability, making them mandatory for high-precision metrology, aerospace, and high-power laser systems. Plastic aspheres (often utilizing materials like acrylic or polycarbonate) are significantly cheaper, easier to mold, and lighter, making them ideal for high-volume, cost-sensitive applications like simple viewing systems or basic mobile camera lenses. Hybrid aspheres leverage the best of both worlds, using a stable glass substrate with a precisely molded polymer layer to achieve the aspheric shape, offering a balance of performance, cost, and design flexibility. The increasing refinement of polymer materials capable of resisting higher temperatures and environmental stress is blurring the line between plastic and glass applications, although glass maintains its dominance where absolute optical purity and stability are paramount, ensuring the material segmentation remains highly relevant for market forecasting and competitive analysis.

- By Manufacturing Technology:

- Precision Glass Molding (PGM)

- Diamond Turning and Polishing

- Injection Molding (Plastic Aspheres)

- UV Replication (Hybrid Aspheres)

- By Application:

- Consumer Electronics (Smartphones, Digital Cameras, AR/VR)

- Automotive (ADAS, LiDAR, Head-Up Displays, Night Vision)

- Medical and Life Sciences (Endoscopy, Ophthalmic Devices, Diagnostic Imaging)

- Defense and Aerospace (Targeting Systems, Surveillance)

- Industrial and Machine Vision (Automation, Quality Control, Metrology)

- Telecommunications (Fiber Optic Coupling, Laser Collimation)

- By Material Type:

- Glass Aspheres

- Plastic/Polymer Aspheres

- Hybrid Aspheres

Value Chain Analysis For Aspherical Lens Market

The value chain for the Aspherical Lens Market is highly specialized and spans from upstream raw material providers to highly technical downstream integrators. Upstream analysis focuses on the supply of specialized optical glass (e.g., low-dispersion, high-refractive index materials) and optical polymers, alongside the machinery required for manufacturing, such as ultra-precision diamond turning machines and specialized molding presses. The midstream involves the core manufacturing expertise: designing the complex aspheric surface using sophisticated software, fabricating the molds with sub-micron accuracy, and performing the high-precision molding or grinding processes. This stage is characterized by high capital intensity and stringent quality control protocols using metrology instruments like interferometers. Downstream activities involve anti-reflection (AR) coating application, integration into optical modules, and final assembly into end-user products. Distribution channels are varied, including direct sales to large Original Equipment Manufacturers (OEMs) like Apple or Bosch, and indirect distribution through specialized optical component distributors catering to smaller industrial or medical device manufacturers.

Upstream complexity is defined by the need for materials with impeccable homogeneity and specific thermal expansion properties to withstand the PGM process without defects. Key material suppliers hold significant leverage due to the specialized nature of these optical blanks and polymers. Simultaneously, manufacturers of the ultra-precision capital equipment, such as Moore Nanotechnology and Toshiba Machine, are critical enablers, as the accuracy of the final lens is directly proportional to the precision of the mold fabrication machine. The transition point from upstream to midstream, the design phase, requires highly skilled optical engineers utilizing specialized ray-tracing software. Achieving the perfect aspheric curve that compensates for system aberrations is a highly proprietary process, contributing significantly to the final product value and distinguishing leading manufacturers based on their design IP.

Downstream analysis highlights the critical role of integration and application expertise. Due to the high sensitivity of optical systems, lenses are often sold as part of an assembled module (e.g., an entire camera block for a smartphone or a laser collimator for fiber optics) rather than as standalone components. Direct channels are typical for high-volume, long-term contracts with Tier 1 OEMs, ensuring just-in-time delivery and strict adherence to customized specifications. Indirect channels, utilizing specialized distributors who provide technical support and stock a catalogue of standard aspheric components, serve the fragmented industrial and scientific markets. This dual distribution approach maximizes market reach. The overall flow indicates that the highest value capture occurs in the midstream (manufacturing and design) and at the integration stage (downstream), emphasizing that control over proprietary manufacturing techniques and strong relationships with major OEMs are the primary determinants of competitive advantage within the value chain structure.

Aspherical Lens Market Potential Customers

Potential customers for aspherical lenses are highly diverse but can be broadly categorized into industries requiring high-fidelity imaging, light manipulation, or system miniaturization. The largest volume segment consists of major consumer electronics OEMs, including manufacturers of smartphones, tablets, and wearable technologies like AR/VR headsets, where the relentless drive for thinner devices with superior photographic capabilities makes aspheres indispensable. Secondly, Tier 1 and Tier 2 suppliers in the automotive sector represent a rapidly expanding customer base, purchasing lenses for integration into sensor modules essential for Advanced Driver-Assistance Systems (ADAS), including complex LiDAR systems and camera arrays used for surround view, lane departure warnings, and pedestrian detection. These automotive customers demand extreme environmental robustness and reliability over long operational periods, leading to higher average selling prices (ASPs) for their specialized optics.

Another major segment is the medical device industry, specifically manufacturers of endoscopic and ophthalmic equipment. In endoscopy, aspheric lenses enable larger fields of view and superior image clarity within the tight dimensional constraints of surgical instruments, facilitating minimally invasive procedures. Ophthalmic device customers utilize them in diagnostic instruments, such as optical coherence tomography (OCT) scanners, and increasingly in prescription eyewear and intraocular lenses (IOLs) to improve visual acuity and reduce aberrations for patients. This segment is characterized by demanding regulatory hurdles (e.g., FDA approval) and a focus on biocompatibility and sterility, ensuring a high-value, albeit slower-moving, market dynamic. The fourth major customer category involves industrial and scientific clients, including manufacturers of high-power laser systems, industrial machine vision cameras used for quality control, and metrology equipment like 3D scanners.

Finally, customers within the defense and aerospace sectors constitute a niche but crucial market for ultra-high-performance, custom aspherical lenses. These components are used in military surveillance systems, targeting optics, and specialized space telescopes or satellite imaging payloads, where performance requirements often exceed commercial standards, justifying the highest manufacturing costs. These contracts typically involve highly specific material requirements (e.g., resistance to radiation or extreme temperatures) and long procurement cycles. Across all customer bases, the underlying requirement is optical perfection—the ability of the aspherical lens to control light precisely and minimize aberrations that spherical optics cannot eliminate. The strategic focus for lens manufacturers is therefore on building deep technical relationships with these customers to co-design customized optics that precisely meet the unique performance envelope of their final application, securing long-term supply agreements and insulating against generic commoditization pressure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HOYA Corporation, ZEISS Group, Largan Precision Co., Ltd., Corning Incorporated, Canon Inc., Panasonic Corporation, SCHOTT AG, Edmund Optics, Precision Optics Corporation, Inc., Kinko Optical Co., Ltd., Ophir Optronics Solutions Ltd., Nippon Sheet Glass Co., Ltd. (NSG), Sunny Optical Technology (Group) Company Limited, Fujifilm Corporation, Jenoptik AG, Mahr GmbH, Avantier Inc., Lytid, Excelitas Technologies Corp., Asahi Glass Co., Ltd. (AGC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aspherical Lens Market Key Technology Landscape

The technological landscape of the Aspherical Lens Market is highly focused on achieving micron and sub-micron accuracy consistently and affordably at scale. The primary technological pillars supporting this market are Precision Glass Molding (PGM) and Ultra-precision Diamond Turning (UPDT). PGM involves pressing a heated glass preform between two highly precise, customized molds to replicate the desired aspheric shape. This technique is favored for high-volume applications because it bypasses the need for costly and time-consuming grinding and polishing steps, leading to significant cost reductions per unit, provided the initial mold cost can be amortized over millions of units. Innovations in PGM technology center around developing mold materials (e.g., ceramics or specialized metals) that resist wear and thermal deformation, extending the lifetime of the tooling and maintaining accuracy over prolonged production runs. Furthermore, sophisticated thermal control mechanisms within the molding presses are essential to ensure the glass cools uniformly, minimizing residual stress and maintaining the precise surface profile.

Ultra-precision Diamond Turning (UPDT) remains the foundational technology, not just for manufacturing the lenses themselves, particularly those made of plastic, IR materials, or metal, but crucially for fabricating the high-precision molds used in PGM. UPDT utilizes single-crystal diamond tools mounted on ultra-stable air-bearing spindles to cut the material directly to the required aspheric shape with nanometer-level precision. Continuous technological advancement in this domain involves multi-axis turning capabilities for freeform optics (which are derivatives of aspheres), and the integration of highly sensitive metrology sensors into the turning machine itself to monitor and correct cutting errors in real-time. For plastic aspheres, high-temperature injection molding techniques are employed, requiring specialized mold release agents and complex thermal cycling to achieve optical clarity and minimize shrinkage-related defects. The material science aspect, particularly the development of polymers with superior clarity and heat resistance, is key to the progress in this sub-segment.

Beyond core manufacturing, metrology technologies are central to maintaining the market's high standards. Non-contact measurement techniques, primarily phase-shifting interferometry and 3D optical profilometry, are essential for verifying the accuracy of the aspheric surface profile. These technologies ensure that the manufactured lens deviates from the mathematically perfect design by no more than a few nanometers, a requirement critical for high-performance systems like OCT and advanced cameras. Further technological diversification includes advancements in thin-film coating deposition (e.g., sophisticated multi-layer anti-reflection coatings) to maximize light transmission and minimize glare, a necessary final step for almost all commercial aspheres. The industry is also exploring novel methods for creating hybrid aspheres, often using UV-curing replication techniques, where a polymer layer is cured onto a glass substrate using a highly accurate mold. These technological advancements collectively reduce manufacturing costs, improve optical performance, and expand the material spectrum available for aspheric production, ensuring the market's robust growth trajectory and sustained competitive focus on precision engineering excellence.

Regional Highlights

- Asia Pacific (APAC): Dominates the market, driven by its unparalleled manufacturing capacity in consumer electronics and automotive components. Countries like China, South Korea, and Taiwan are critical hubs for smartphone camera production and AR/VR component assembly, creating immense, high-volume demand for plastic and glass molded aspheres. Japan remains a technological powerhouse, specializing in ultra-precision machinery, high-end optical glass materials, and PGM mold fabrication technology, maintaining a leading role in the value chain's upstream segment. Rapidly growing automotive production in India and China, heavily adopting ADAS, further solidifies APAC's position as the largest market region by volume and value.

- North America: Characterized by high investment in R&D, specialized defense/aerospace applications, and advanced medical diagnostics. The region leads in demand for custom, ultra-precision glass aspheres used in scientific instrumentation, high-power laser systems, and advanced metrology. While production volume is lower than APAC, the average selling price (ASP) of lenses sold in North America is generally higher due to the stringent performance requirements and specialized nature of end-applications. The presence of major technology innovators (e.g., Silicon Valley) also drives high demand for specialized optics in VR/AR hardware development.

- Europe: Exhibits strong demand in the automotive sector, driven by key German luxury vehicle manufacturers integrating advanced sensing systems, and a mature industrial automation sector requiring high-quality machine vision optics. Europe is also a leader in the ophthalmic optics segment (prescription glasses and IOLs), utilizing highly customized aspheric designs for vision correction. The region's focus is balanced between high-quality PGM production and specialized diamond turning for bespoke industrial and scientific lenses, ensuring technological depth across the supply spectrum.

- Latin America (LATAM): Represents an emerging market with moderate growth potential, primarily centered around automotive assembly plants and gradual expansion of medical infrastructure. Demand is often satisfied through imports from APAC and North America, focusing primarily on standard, high-volume optics for consumer goods and simpler industrial applications. Local production capabilities are still nascent but are developing in countries like Mexico and Brazil, linked closely to regional automotive supply chains.

- Middle East and Africa (MEA): Currently the smallest market contributor, growth is tied to government investment in infrastructure, defense capabilities, and modernization of healthcare systems. Demand is highly concentrated in specialized defense surveillance optics and advanced medical imaging equipment, with production almost exclusively reliant on imports. Investment in new technology hubs, particularly in the UAE and Saudi Arabia, is expected to slowly stimulate demand for industrial machine vision and telecommunications optics over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aspherical Lens Market.- HOYA Corporation

- ZEISS Group

- Largan Precision Co., Ltd.

- Corning Incorporated

- Canon Inc.

- Panasonic Corporation

- SCHOTT AG

- Edmund Optics

- Precision Optics Corporation, Inc.

- Kinko Optical Co., Ltd.

- Ophir Optronics Solutions Ltd.

- Nippon Sheet Glass Co., Ltd. (NSG)

- Sunny Optical Technology (Group) Company Limited

- Fujifilm Corporation

- Jenoptik AG

- Mahr GmbH

- Avantier Inc.

- Lytid

- Excelitas Technologies Corp.

- Asahi Glass Co., Ltd. (AGC)

Frequently Asked Questions

Analyze common user questions about the Aspherical Lens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of an aspherical lens over a spherical lens?

Aspherical lenses are superior because they correct spherical aberration and other optical distortions, allowing a single aspheric element to replace multiple spherical lenses. This results in significantly lighter, smaller, and higher-performing optical systems, crucial for modern miniaturized devices like smartphones and medical endoscopes.

Which manufacturing technology dominates the high-volume segment of the Aspherical Lens Market?

Precision Glass Molding (PGM) technology dominates high-volume production, especially for consumer electronics and automotive camera lenses. PGM efficiently replicates the complex aspheric surface by pressing heated glass, minimizing the need for costly and time-consuming grinding, thereby reducing the unit cost for large batches.

How is the automotive industry driving demand for aspherical lenses?

The automotive industry is a critical growth driver due to the pervasive integration of Advanced Driver-Assistance Systems (ADAS). Aspherical lenses are essential components in LiDAR systems, night vision cameras, and surround-view camera arrays, providing the distortion-free, high-resolution imaging required for autonomous and semi-autonomous driving functions.

What is a hybrid aspherical lens and where is it primarily used?

A hybrid aspherical lens combines a stable glass substrate with a precisely molded polymer layer (often UV-cured) to create the aspheric surface profile. They offer a balance between the stability of glass and the cost-effectiveness of polymer molding, making them popular in digital cameras and consumer-grade optical instruments where cost reduction is a priority.

What challenges exist in the manufacturing of ultra-precision aspherical optics?

The main challenges include the extremely high capital investment required for ultra-precision tooling (molds), the necessity for maintaining sub-micron tolerances during molding or turning processes, and the complexity involved in designing the optimal surface profiles, which often results in lower initial production yields.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Aspherical Lens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aspherical Lens Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Glass Aspherical Lense, Plastic Aspherical Lense), By Application (Cameras, Optical Instruments, Ophthalmic, Mobile phone), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager