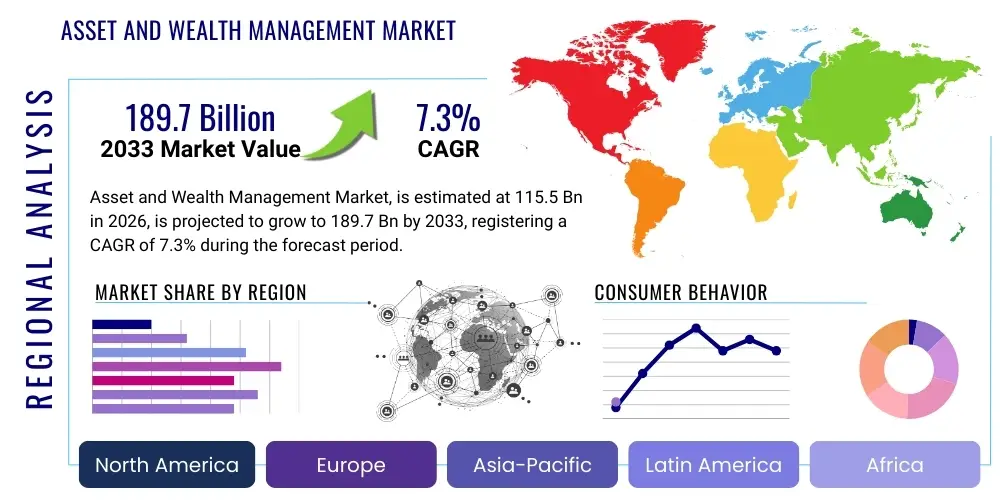

Asset and Wealth Management Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441913 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Asset and Wealth Management Market Size

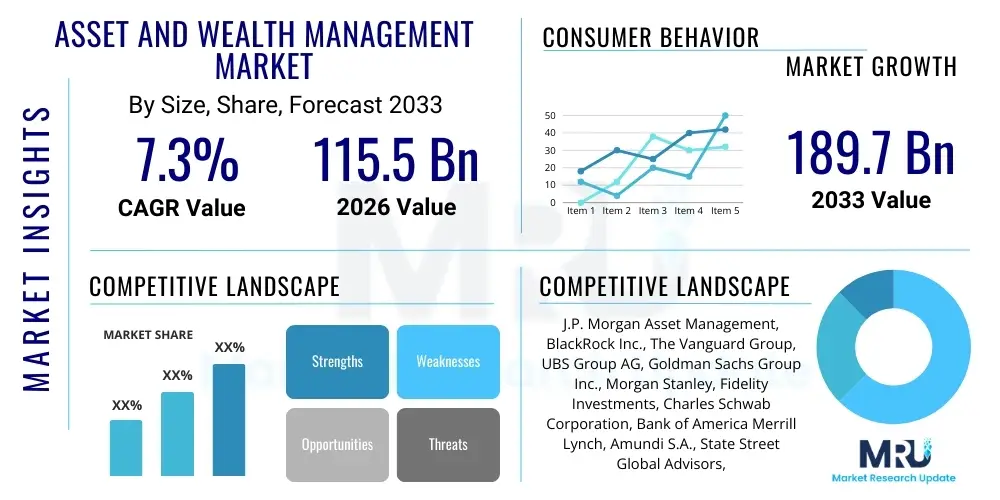

The Asset and Wealth Management Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% between 2026 and 2033. The market is estimated at $115.5 Billion in 2026 and is projected to reach $189.7 Billion by the end of the forecast period in 2033.

Asset and Wealth Management Market introduction

The Asset and Wealth Management (AWM) market encompasses professional services dedicated to managing the financial assets and wealth of individuals, families, and institutions. This includes investment advice, portfolio management, financial planning, estate planning, and tax optimization. The primary product offering is tailored investment solutions, ranging from traditional equity and fixed-income strategies to alternative investments such as private equity, hedge funds, and real estate. Major applications of AWM services span across ultra-high-net-worth individuals (UHNWIs) seeking complex trust structures, high-net-worth individuals (HNWIs) requiring bespoke portfolio allocations, and retail investors utilizing scalable digital advisory platforms. The fundamental benefit provided by AWM firms is the optimization of financial performance, preservation of capital, and strategic alignment of financial resources with long-term client goals, offering expertise that transcends typical self-managed investment capabilities.

A significant driving factor propelling the AWM market expansion is the sustained global increase in disposable income and the consequent proliferation of wealth, particularly in emerging economies across the Asia Pacific region. Furthermore, the demographic shift characterized by aging populations in developed countries is fueling demand for sophisticated retirement planning and intergenerational wealth transfer services. Technological advancements, notably in artificial intelligence (AI) and machine learning (ML), are transforming operational efficiencies, lowering service costs, and enhancing the personalization of advice, making professional wealth management accessible to a broader client base. The regulatory environment, while often stringent, also fosters market growth by demanding high standards of transparency, fiduciary duty, and robust risk management practices, pushing traditional institutions to innovate and integrate advanced compliance technologies.

Asset and Wealth Management Market Executive Summary

The Asset and Wealth Management (AWM) market is currently undergoing a paradigm shift driven by intense fee compression, rapid technological integration, and evolving client expectations demanding hyper-personalized and transparent services. Business trends indicate a strong focus on consolidation, where major financial institutions acquire specialist FinTech firms to rapidly integrate capabilities such as robo-advisory platforms and advanced data analytics for superior alpha generation and operational efficiency. The transition towards Environmental, Social, and Governance (ESG) investing is no longer a niche trend but a core strategic imperative, profoundly influencing portfolio construction and product development across the industry. Firms are aggressively investing in cloud infrastructure and cybersecurity protocols to manage increasingly complex digital interaction models and protect sensitive client data against sophisticated cyber threats, recognizing that robust digital trust is paramount for client retention.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by the rapid creation of new wealth, especially among first-generation entrepreneurs in China, India, and Southeast Asia. North America maintains its dominance as the largest market, characterized by mature regulatory frameworks and a highly competitive landscape dominated by technological innovation, particularly in customized digital advice and tax-efficient strategies. European markets are characterized by stringent regulations like MiFID II, which mandates greater fee transparency and rigorous product governance, leading to a structural shift towards fee-based advisory models over transactional commission structures. Segment trends reveal an accelerated adoption of passive investment strategies (ETFs, index funds) due to cost sensitivity, although demand for high-alpha alternative investments remains robust among institutional and ultra-high-net-worth client segments seeking diversification away from volatile public markets. The technological segment, specifically digital wealth management platforms, is experiencing double-digit growth, democratizing access to professional financial advice.

AI Impact Analysis on Asset and Wealth Management Market

Common user inquiries regarding AI's influence in the AWM sector predominantly revolve around its ability to deliver true portfolio alpha, the extent to which it can replace human advisors, implications for data privacy and security, and its role in meeting complex regulatory requirements. Users frequently ask about the quantifiable return on investment (ROI) derived from implementing AI algorithms for predictive modeling and trading execution, alongside concerns regarding algorithmic bias and the transparency of 'black box' AI decision-making systems. There is high expectation that AI will dramatically lower the minimum asset threshold required for personalized advice, thereby expanding market accessibility, but concurrently, there is apprehension about potential large-scale job displacement among junior analysts and relationship managers focused on routine tasks. Key themes emerging from this analysis confirm that AI is viewed as an indispensable tool for scalability and personalization, fundamentally shifting the competitive landscape toward firms capable of effectively leveraging vast datasets.

The implementation of artificial intelligence is fundamentally redefining the operational and advisory paradigms within the Asset and Wealth Management industry, moving beyond simple automation to sophisticated cognitive capabilities. AI algorithms are now crucial for advanced portfolio optimization, enabling managers to process billions of data points—including market sentiment derived from news feeds and social media—to identify transient market inefficiencies and execute high-frequency trading strategies with unmatched speed. Furthermore, AI is heavily utilized in compliance and risk management, where RegTech solutions powered by machine learning continuously monitor transactional activity for patterns indicative of fraudulent behavior or breaches of mandated investment suitability rules. This proactive compliance capability not only mitigates significant regulatory risk but also reduces the high operational costs traditionally associated with manual compliance audits, ensuring adherence to increasingly fragmented global financial regulations.

Client interaction is also being revolutionized by AI-driven chatbots and hyper-personalized digital interfaces. These tools provide 24/7 client support, answer common inquiries regarding portfolio performance, and even offer initial goal-based financial planning suggestions, freeing up human advisors to concentrate on complex emotional advice and strategic relationship building. The ability of AI to segment client populations with extreme precision allows wealth managers to tailor communication, product offerings, and risk disclosures based on granular behavioral data, substantially improving client engagement and retention rates. This integration of AI creates a hybrid advisory model, combining the efficiency and scalability of technology with the empathy and complex judgment of human expertise, ultimately delivering a superior and more cost-effective client experience across all wealth tiers.

- Enhanced Algorithmic Trading: Utilization of machine learning for predictive market modeling and high-speed execution, leading to optimized trade timing and potential alpha generation.

- Hyper-Personalization of Advice: AI-driven analysis of client data to provide customized investment roadmaps, risk profiles, and goal-based financial planning at scale.

- Automated Compliance and Risk Management (RegTech): Deployment of ML systems for real-time monitoring of transactions, detecting anomalies, ensuring regulatory adherence, and mitigating operational risk.

- Operational Efficiency and Cost Reduction: Automation of back-office functions such as reporting, data reconciliation, and client onboarding, significantly lowering the total cost-to-serve.

- Advanced Cybersecurity: AI systems used to predict and identify novel cyber threats and sophisticated phishing attacks targeting high-value client accounts and proprietary data.

- Democratization of Wealth Management: Robo-advisory platforms powered by AI making sophisticated, low-cost advice accessible to mass affluent and retail investors.

- Improved Customer Relationship Management (CRM): AI analyzing client sentiment and behavior to proactively manage relationships and predict churn risk.

DRO & Impact Forces Of Asset and Wealth Management Market

The Asset and Wealth Management market is profoundly influenced by a complex interplay of internal and external forces summarized by key Drivers, Restraints, and Opportunities. Primary drivers include the massive global accumulation of private wealth, particularly in Asia, and the ongoing digital transformation compelling firms to adopt scalable and efficient operating models. The shift in global demographics, characterized by aging populations and the impending 'Great Wealth Transfer' to younger generations who demand digital-first services, further necessitates innovation. Counteracting these growth factors are significant restraints, primarily stemming from intense regulatory scrutiny, heightened demands for fee transparency which compress margins, and the persistent challenge of ensuring robust cybersecurity against increasingly sophisticated threats aimed at valuable client data. These forces collectively shape the competitive landscape, pushing firms toward strategic mergers and acquisitions to achieve economies of scale and acquire specialized technological capabilities.

Impact forces within the market are predominantly driven by technological disruption and evolving client sentiment. The widespread acceptance of robo-advisory and hybrid models represents a powerful force democratizing access to investment management, challenging the historical dominance of high-fee, traditional advisory structures. Another critical impact force is the mandatory integration of ESG criteria into investment mandates; institutional investors and younger wealth holders are increasingly allocating capital only to firms demonstrating sustainable and ethical investment practices, making ESG expertise a competitive necessity. Opportunities are abundant in the field of niche financial technology, such as Blockchain and Distributed Ledger Technology (DLT), which promise to revolutionize middle and back-office functions by dramatically reducing settlement times and operational complexities. Furthermore, providing highly specialized services targeting specific wealth segments, such as family office structuring for UHNWIs or digital financial wellness programs for corporations, represents high-margin growth avenues for agile market participants.

The interaction between these elements—where digitization (Driver) meets regulatory complexity (Restraint)—often gives rise to specialized opportunities like RegTech adoption. Firms that successfully navigate the balance between deploying cutting-edge technology for efficiency and maintaining stringent compliance standards are best positioned to capture market share. The need for specialized expertise in alternative asset classes (Opportunity), such as private credit and infrastructure, is also a powerful factor, as traditional fixed income yields remain low, compelling sophisticated investors to seek diversification in less liquid, higher-return instruments. The market’s direction is clear: future success relies on scalability, specialization, technological sophistication, and a demonstrated commitment to responsible investment principles, all while managing relentless pressure on advisory fees.

Segmentation Analysis

The Asset and Wealth Management market is systematically segmented based on various criteria to accurately reflect the diversity of services offered, the client base served, the types of assets managed, and the delivery channels utilized. Understanding these segmentations is critical for firms aiming to design targeted product offerings and distribution strategies, allowing them to optimize resource allocation toward the most lucrative and rapidly growing areas. Key segmentation metrics include client type (e.g., HNWI, institutional), service model (e.g., advisory, discretionary), and asset class focus (e.g., traditional, alternative). The increasing integration of technology also mandates segmentation based on delivery channel, distinguishing between traditional face-to-face service models, pure digital robo-advisors, and sophisticated hybrid platforms that combine both human and algorithmic advice, addressing the complex needs of modern investors.

- By Client Type:

- High Net Worth Individuals (HNWIs)

- Ultra-High Net Worth Individuals (UHNWIs)

- Affluent (Mass Affluent)

- Institutional Investors (Pension Funds, Endowments, Sovereign Wealth Funds)

- By Asset Class:

- Traditional Assets (Equities, Fixed Income, Cash Equivalents)

- Alternative Assets (Hedge Funds, Private Equity, Real Estate, Commodities)

- By Service Type:

- Financial Planning and Advisory

- Investment Management (Discretionary vs. Non-Discretionary)

- Trust and Estate Planning

- Retirement Planning

- Tax Management

- By Delivery Channel:

- Traditional/Human Advisory

- Robo-Advisors

- Hybrid Advisory Models

- Direct-to-Consumer Platforms

Value Chain Analysis For Asset and Wealth Management Market

The value chain of the Asset and Wealth Management market begins with upstream activities focused heavily on research, data sourcing, and technology infrastructure. This initial stage involves gathering massive amounts of structured and unstructured market data from vendors like Bloomberg and Refinitiv, coupled with proprietary fundamental and quantitative research conducted by investment teams. Key upstream participants are data analytics providers, specialized FinTech software vendors supplying portfolio management systems (PMS), and cloud service providers offering scalable computing power necessary for running complex risk models and AI algorithms. Successful firms in this segment prioritize investment in proprietary data lakes and machine learning specialists to gain an informational edge, recognizing that superior data intelligence is the foundation for generating alpha and enhancing operational resilience.

The core of the value chain involves investment decision-making, portfolio construction, trading, and middle-office operations, which transform raw data into executable strategies and managed portfolios. This stage includes asset allocation decisions made by portfolio managers, trade execution by desk traders, and meticulous risk monitoring performed by dedicated operational teams. Technological components such as order management systems (OMS) and execution management systems (EMS) are crucial for efficiency and minimizing slippage costs. Robust middle-office processes, encompassing performance measurement, reconciliation, and regulatory reporting, ensure that investment activities remain transparent and compliant with client mandates and global financial regulations, acting as the critical link between front-office strategy and back-office settlement.

The downstream component of the value chain focuses on distribution, client servicing, and ongoing relationship management. Distribution channels vary widely, including direct sales forces, independent financial advisors (IFAs), banks, and increasingly, digital platforms. The transition to fee-based models has elevated the importance of excellent client service, necessitating sophisticated client relationship management (CRM) systems and digital portals that provide transparent reporting and 24/7 access to information. Direct distribution (D2C) utilizes digital channels to reach the mass affluent, while indirect distribution relies on intermediary networks, such as broker-dealers and custodial platforms, to scale reach. Effective downstream operations are essential for client retention and asset gathering, emphasizing personalized communication and educational resources tailored to diverse investor knowledge levels.

Asset and Wealth Management Market Potential Customers

The clientele for Asset and Wealth Management services is highly diversified, ranging from individuals across the wealth spectrum to large, complex institutional entities, each possessing distinct financial needs and expectations. High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) represent the traditional core customer base. These clients typically require bespoke, holistic solutions that extend beyond simple investment management to include complex tax optimization, legacy planning, philanthropic advisory, and the integration of diverse, illiquid assets (e.g., business holdings, private equity stakes). UHNWIs often utilize dedicated family office structures or specialized private wealth management services that demand high-touch, confidential relationships and access to exclusive investment opportunities, such as co-investments and direct placements.

Institutional clients, comprising pension funds, sovereign wealth funds, endowments, foundations, and corporate treasury departments, constitute another crucial customer segment. These entities are characterized by specific long-term liabilities, stringent fiduciary duties, and requirements for highly sophisticated risk management frameworks. Their demands frequently focus on specialized mandates, such as liability-driven investment (LDI), outsourced chief investment officer (OCIO) services, and access to large-scale infrastructure or distressed debt funds. Asset managers targeting this segment must demonstrate deep quantitative capabilities, robust governance structures, and the ability to handle massive capital allocations while adhering strictly to complex regulatory and internal governing rules.

Finally, the mass affluent and retail investor segments are rapidly growing, driven primarily by the accessibility provided by digital wealth management solutions. These customers, while possessing lower average assets under management (AUM), are targeted through scalable, low-cost delivery models such as robo-advisory and direct mutual fund/ETF platforms. Their key requirements are ease of access, low transaction fees, basic goal-based planning (e.g., saving for a down payment or retirement), and educational resources to navigate investing fundamentals. While the fees generated per client are lower, the vast scale of this segment makes it vital for long-term growth and market democratization, compelling wealth management firms to invest heavily in user-friendly mobile and web platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $115.5 Billion |

| Market Forecast in 2033 | $189.7 Billion |

| Growth Rate | 7.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | J.P. Morgan Asset Management, BlackRock Inc., The Vanguard Group, UBS Group AG, Goldman Sachs Group Inc., Morgan Stanley, Fidelity Investments, Charles Schwab Corporation, Bank of America Merrill Lynch, Amundi S.A., State Street Global Advisors, Northern Trust Corporation, Credit Suisse Group AG (post-merger structure), Wellington Management, T. Rowe Price Group, PIMCO, Schroders plc, Legg Mason (Franklin Templeton), Invesco Ltd., Allianz Global Investors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asset and Wealth Management Market Key Technology Landscape

The technological landscape of the Asset and Wealth Management market is characterized by a strategic focus on digital tools that enhance efficiency, improve risk modeling, and create seamless, personalized client experiences. Cloud computing infrastructure, particularly specialized financial clouds, forms the foundation, offering scalable storage and processing power necessary for running complex portfolio optimization algorithms and handling the massive data volumes generated by modern financial markets. The adoption of Application Programming Interfaces (APIs) is paramount, enabling seamless integration between front-office client portals, middle-office portfolio management systems, and back-office custody and accounting platforms. This interoperability fosters an open architecture approach, allowing AWM firms to rapidly integrate best-of-breed FinTech solutions (e.g., specialized planning software or tax optimization engines) without undergoing lengthy and costly system overhauls, thereby speeding up time-to-market for new services and drastically reducing operational latency.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most transformative technologies within this space. Beyond simple automation, these technologies drive sophisticated analytics for predictive risk modeling, behavioral finance insights, and customized portfolio construction that dynamically adjusts based on real-time market volatility and individual client goals. Natural Language Processing (NLP), a subset of AI, is increasingly used to process vast quantities of textual data, including earnings reports, regulatory filings, and market commentary, enabling investment teams to extract timely, actionable signals for investment decisions. Furthermore, AI fuels the development of advanced personalization engines that tailor communication, reporting, and product recommendations to individual clients, moving away from standardized batch communications and significantly enhancing the perceived value of the advisory relationship.

Blockchain and Distributed Ledger Technology (DLT) are gradually moving from experimental concepts to practical applications, primarily focusing on improving the efficiency of the back and middle office. DLT holds the potential to reduce counterparty risk and settlement cycles from days to near-instantaneous execution, significantly lowering the capital tied up in post-trade processes. While full industry adoption faces regulatory hurdles, specific applications, such as tokenization of illiquid assets (e.g., real estate or private equity), are gaining traction, providing fractional ownership and improved liquidity for traditionally hard-to-trade investments, thereby expanding the investment universe available to a broader range of wealth management clients. Cybersecurity tools, incorporating biometric authentication and continuous risk monitoring, are also critical components of the technology stack, ensuring the integrity and confidentiality of high-value client assets and sensitive personal information against persistent and evolving threats.

Regional Highlights

- North America (NA): North America, encompassing the mature and highly competitive markets of the United States and Canada, represents the largest global segment for Asset and Wealth Management services, driven by high concentrations of wealth and a pioneering spirit in financial technology. The region benefits from a robust regulatory environment that, while demanding, fosters innovation, particularly in areas like robo-advisory, complex derivatives, and alternative investments. Key growth factors include the maturation of retirement savings vehicles (401(k)s, IRAs) and the widespread integration of advanced digital platforms by major wirehouses and independent RIAs. A strong emphasis on customized tax-efficient strategies and personalized wealth transfer solutions catering to Baby Boomers transitioning assets to Millennials defines the service landscape.

- Europe: The European AWM market is highly fragmented but sophisticated, characterized by significant differences across national borders and unified by comprehensive regulatory frameworks like MiFID II, which enforces strict transparency requirements on fees and product suitability. Growth is largely propelled by the increasing demand for sustainable and ESG-compliant investments, with European investors often leading global adoption in green finance and socially responsible mandates. The market is trending toward consolidation, driven by the need for scale to manage high compliance costs and the competitive pressure from FinTech firms in key financial hubs like London, Frankfurt, and Zurich, which specialize in digital onboarding and cross-border wealth solutions.

- Asia Pacific (APAC): APAC is undeniably the fastest-growing region globally, fueled by rapid economic expansion, urbanization, and the exponential growth of the middle class and HNW population, particularly in China, India, and Southeast Asia. The market is defined by high savings rates, a cultural preference for wealth preservation, and an increasing appetite for global diversification. Digital penetration is accelerating rapidly, often leapfrogging older technologies seen in Western markets, leading to high adoption rates of mobile-first wealth management applications. Firms are focusing on tailoring products to cater to first-generation wealth creators who demand efficient, transparent, and technology-enabled access to investment products.

- Latin America (LATAM): The LATAM region presents a diverse market with significant untapped potential, though growth is often hampered by macroeconomic volatility, currency fluctuations, and political instability in several key economies. Wealth management services are heavily utilized for capital preservation and diversification outside domestic markets, driving demand for cross-border advisory and offshore financial solutions. Regulatory environments are evolving, and digitalization is accelerating, particularly in countries like Brazil and Mexico, allowing local banks and emerging FinTechs to provide accessible investment vehicles to the mass affluent segment, gradually shifting away from traditional low-yield savings accounts.

- Middle East and Africa (MEA): The MEA region’s AWM landscape is characterized by the presence of large Sovereign Wealth Funds (SWFs) and a concentration of UHNW family wealth, particularly in the Gulf Cooperation Council (GCC) nations. Demand is high for specialized services focusing on estate planning, Sharia-compliant investments (Islamic finance), and succession planning for family businesses. The region is actively promoting financial diversification away from oil dependence, leading to investments in infrastructure and technology-focused venture funds. Africa represents a vast, fragmented market with nascent wealth management infrastructure but presents long-term growth opportunities driven by rapid digitization and rising youth populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asset and Wealth Management Market.- BlackRock Inc.

- The Vanguard Group

- UBS Group AG

- J.P. Morgan Asset Management

- Morgan Stanley

- Goldman Sachs Group Inc.

- Fidelity Investments

- Charles Schwab Corporation

- Bank of America Merrill Lynch

- Amundi S.A.

- State Street Global Advisors

- Northern Trust Corporation

- BNY Mellon Investment Management

- Allianz Global Investors

- Invesco Ltd.

- T. Rowe Price Group

- PIMCO (Allianz subsidiary)

- Schroders plc

- Wellington Management

- LGT Group

Frequently Asked Questions

Analyze common user questions about the Asset and Wealth Management market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Asset and Wealth Management market?

The primary driver of growth in the Asset and Wealth Management market is the substantial global increase in private wealth, especially among high-net-worth individuals and the expanding middle class in emerging economies, notably the Asia Pacific region. This demographic trend, coupled with the need for sophisticated retirement planning in developed nations and technological advancements reducing the cost of advice, fuels market expansion.

How is technology, specifically AI and robo-advisory, changing client engagement?

Technology is fundamentally shifting client engagement by enabling hyper-personalization, scalability, and 24/7 accessibility. AI drives sophisticated risk assessment and portfolio tailoring, while robo-advisory platforms democratize access to professional management through low-cost, digitally seamless interfaces. This convergence creates a hybrid model, reserving human advisors for complex relationship and emotional planning, while technology handles execution and routine support.

What are the greatest regulatory challenges facing wealth management firms?

The greatest regulatory challenges include meeting stringent transparency requirements, such as those mandated by MiFID II in Europe and the evolving fiduciary standards globally, which necessitate detailed disclosure of fees and investment suitability. Furthermore, firms face intensive pressure regarding data governance, privacy compliance (e.g., GDPR), and managing cross-border regulatory complexities, demanding significant investment in RegTech solutions.

What role does ESG (Environmental, Social, and Governance) investing play in AWM market strategy?

ESG investing has evolved from a niche preference to a core strategic mandate. It influences capital allocation, product development, and risk management across the AWM market. Clients, particularly institutional investors and younger wealth holders, increasingly demand portfolios that align with sustainable values, compelling firms to integrate ESG data and criteria into their fundamental investment decision-making processes to remain competitive and attract capital.

Which geographical region offers the most significant growth opportunity for asset managers?

The Asia Pacific (APAC) region offers the most significant growth opportunity. Driven by robust economic growth, rapid wealth creation among entrepreneurs, and low historical penetration rates of professional wealth management services compared to North America and Europe, APAC represents the highest potential for asset gathering and new client acquisition throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager