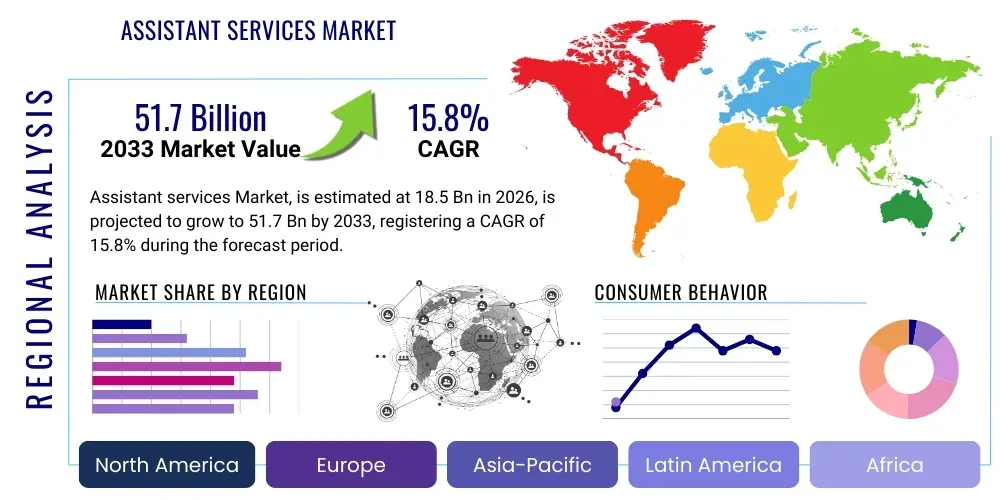

Assistant services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442673 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Assistant services Market Size

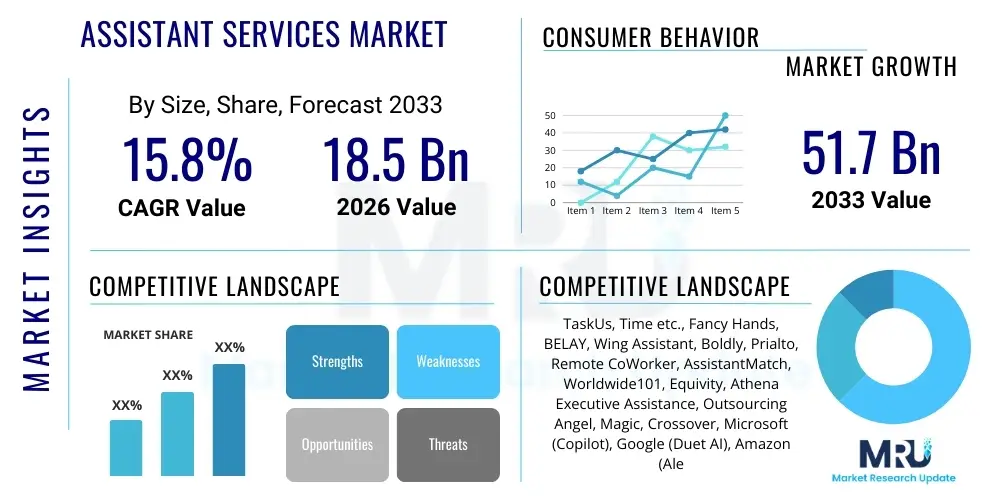

The Assistant services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 51.7 Billion by the end of the forecast period in 2033.

Assistant services Market introduction

The Assistant services Market encompasses a broad spectrum of outsourced support functions, ranging from specialized executive virtual assistance (VA) and administrative support to highly advanced, AI-powered digital assistants and intelligent automation solutions. These services are strategically employed by businesses of all sizes—from startups requiring flexible, on-demand support to large enterprises seeking operational efficiencies and core task prioritization. The fundamental purpose of these services is to offload non-core, repetitive, or time-consuming tasks, thereby allowing internal staff and executives to focus on strategic initiatives and high-value decision-making. Key offerings include scheduling, email management, travel arrangements, data entry, social media management, and personalized customer interaction support, forming an essential component of modern business operations.

The core product within this market is the provision of dedicated or shared support staff, increasingly augmented by sophisticated technological platforms. Major applications span across diverse verticals, including professional services, healthcare, finance, information technology, and real estate, where demand for efficient, scalable administrative and analytical support is paramount. The increasing complexity of global business operations, coupled with the rising cost of hiring full-time, in-house staff, positions assistant services as a cost-effective and flexible solution for maintaining productivity and organizational flow. Furthermore, the shift toward remote and hybrid work models has naturally accelerated the adoption of virtual assistant solutions, which are inherently designed for geographically dispersed team collaboration.

Driving factors propelling the market include the global imperative for cost reduction, enhanced access to a worldwide talent pool for specialized skills, and continuous technological advancements in Natural Language Processing (NLP) and machine learning that improve the efficacy of digital assistants. The benefits derived from adopting these services are multifaceted, encompassing improved workflow efficiency, reduced overhead expenses associated with employee benefits and office space, and significant time savings for executive leadership. The market’s resilience is rooted in its ability to adapt quickly to evolving business needs, offering bespoke support packages that cater precisely to client specifications, whether the need is for temporary project support or long-term operational integration.

Assistant services Market Executive Summary

The Assistant services Market is characterized by robust growth driven primarily by technological integration and the strategic shift toward operational outsourcing across major economies. Current business trends indicate a significant convergence between traditional human-centric virtual assistant models and advanced AI-driven conversational interfaces, creating hybrid offerings that deliver both personalized relationship management and scalable, automated task execution. Small and Medium-sized Enterprises (SMEs) represent a vital segment experiencing rapid adoption, as these businesses leverage outsourced assistance to compete effectively with larger organizations without incurring substantial capital expenditure. Furthermore, there is a pronounced trend toward specialized assistant services tailored for niche industries, such as legal support, medical transcription, and high-level financial analysis, indicating a movement away from generalized administrative support toward domain-specific expertise.

Regionally, the market exhibits varied dynamics. North America remains the dominant revenue generator, fueled by a mature outsourcing culture, high penetration of cloud-based services, and the presence of leading technological innovators developing AI assistant platforms. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily due to the availability of skilled, multilingual talent pools (particularly in countries like India and the Philippines) and increasing digitalization across emerging economies. Europe is also a critical market, driven by stringent data privacy regulations which necessitate specialized, compliant assistant services, particularly within the financial and healthcare sectors. These regional variations underscore the need for providers to offer geographically sensitive and regulatory-compliant solutions.

In terms of segment trends, the AI-Powered Assistant segment is projected to grow substantially faster than the traditional human Virtual Assistant segment, though the latter maintains critical relevance for tasks requiring complex human judgment, emotional intelligence, or highly sensitive client interaction. The service delivery model segmentation highlights a growing preference for managed services and subscription-based models, offering predictable pricing and guaranteed service levels. Verticals such as Professional Services (consulting, legal) and Technology are consistently the largest consumers, demanding highly organized and flexible support structures to manage complex project timelines and client communication. The long-term outlook is characterized by consolidation among providers seeking to offer end-to-end solutions combining global talent delivery with proprietary automation software.

AI Impact Analysis on Assistant services Market

User queries regarding the impact of Artificial Intelligence on the Assistant services Market overwhelmingly center on job displacement, data security, and the perceived limitations of AI in handling nuanced communication and complex decision-making. Common concerns include: "Will AI completely replace human VAs?" "How secure is the confidential data handled by AI assistants?" and "Can AI assistants truly understand complex business context?" This analysis reveals that users are seeking clarity on the future role of human professionals—expecting AI to handle mundane, repetitive tasks while human assistants transition into roles focused on strategic oversight, quality assurance, and high-touch client relationship management. The key thematic summary is the expectation of symbiotic growth, where AI acts as an efficiency amplifier rather than a complete replacement, demanding upskilling among human assistants.

The integration of AI is transforming service delivery models by enabling hyper-personalization and scaling services without proportional increases in human resources. Advanced machine learning models are now capable of predicting executive needs, automating complex scheduling across multiple time zones, and generating first drafts of correspondence, drastically reducing the turnaround time for critical tasks. This operational overhaul mandates that market participants invest heavily in robust security frameworks and compliance certifications to address prevalent user concerns regarding data privacy and governance, especially concerning GDPR and CCPA requirements. Providers successfully integrating explainable AI (XAI) capabilities are likely to gain a competitive edge by building trust and demonstrating transparency in automated decision-making processes.

Furthermore, AI facilitates the expansion of assistant services into highly specialized domains previously restricted due to the high cost of human expertise. For instance, AI-driven legal assistants can rapidly review contract clauses and summarize complex documents, while specialized medical coding assistants reduce administrative burden in healthcare facilities. The market is evolving from offering generalized administrative support to providing intelligent business enablement. The ultimate impact is the creation of a tiered service offering: basic automation via pure AI, complex coordination via hybrid AI-human teams, and strategic consulting delivered by highly specialized human experts supported by AI analytics.

- AI automates routine and repetitive administrative tasks, increasing operational efficiency exponentially.

- Natural Language Processing (NLP) enhances conversational AI quality, improving customer and internal stakeholder interaction.

- Predictive analytics allows AI assistants to anticipate user needs, optimizing scheduling and resource allocation proactively.

- Data security risks are managed through advanced encryption and compliance monitoring built into AI platforms.

- Human Virtual Assistants transition to oversight, strategic planning, and complex emotional labor roles.

- Democratization of specialized support services through scalable, lower-cost AI deployments.

- Development of hybrid service models combining the scalability of AI with the judgment of human professionals.

DRO & Impact Forces Of Assistant services Market

The Assistant services Market is shaped by a powerful confluence of Drivers, Restraints, and Opportunities, collectively forming the key impact forces governing market expansion. A primary driver is the accelerating trend of digital transformation and cloud adoption across enterprises worldwide, which provides the necessary technological infrastructure for seamless remote service delivery. Economic pressure to reduce operational expenditure post-global events further compels businesses to favor flexible, outsourced labor models over fixed, in-house staffing costs. The opportunity landscape is significantly bolstered by the untapped potential of emerging markets in APAC and LATAM, which are rapidly adopting digital tools and require scalable solutions to manage newfound growth. Strategic expansion into niche markets, such as specialized compliance assistance or technical product support, presents high-margin opportunities for focused providers.

Restraints, however, pose critical challenges to widespread adoption and market maturation. Data security and privacy concerns remain paramount, especially given the handling of sensitive financial and operational information by remote teams and AI systems. Regulatory fragmentation, particularly concerning cross-border data transfer (e.g., conflicting regulations between the EU and the US), complicates service delivery for international providers. Furthermore, the reliance on stable internet infrastructure in sourcing locations presents an operational bottleneck. Impact forces highlight the critical role of technological innovation; services that fail to integrate cutting-edge AI and automation risk obsolescence, while those successfully implementing secure, reliable, and intelligent systems will capture dominant market share. The competitive environment is intensifying, placing pressure on pricing and the need for demonstrable value proposition beyond simple cost savings.

Another significant driver is the increasing complexity of modern executive roles, which necessitates delegation of non-essential tasks to maintain focus on strategic leadership. The global shortage of specialized talent in specific domains (e.g., advanced coding, specialized legal research) also drives organizations to outsource these functions to VA providers who maintain dedicated talent pools. Conversely, a key restraint involves the challenge of quality control and integration friction. Ensuring consistent service quality across geographically dispersed teams and seamlessly integrating outsourced assistants into existing corporate workflows often requires significant managerial oversight and dedicated training. The long-term impact of these forces dictates a trajectory toward highly differentiated, secure, and technologically advanced service offerings, favoring providers who prioritize compliance, AI integration, and specialized vertical expertise.

Segmentation Analysis

The Assistant services Market is segmented along critical dimensions including Service Type, Deployment Model, End-User Vertical, and Geographic Region, reflecting the diverse needs of the global business landscape. Understanding these segmentation nuances is vital for providers to tailor their offerings, pricing strategies, and marketing efforts effectively. The segmentation by Service Type—Human Virtual Assistant versus AI-Powered Assistant—is particularly crucial, differentiating high-touch, personalized support from scalable, automated efficiency tools. As technology permeates all aspects of business, hybrid models combining the strengths of both are increasingly dominating the sophisticated enterprise segment, emphasizing the need for flexible, modular service packages.

Deployment Model segmentation highlights the preference for flexible engagement structures, primarily categorized into retainer-based (fixed hours per month), project-based (task-specific contracts), and dedicated full-time equivalent (FTE) models. Retainer models offer stable, predictable revenue streams for providers and consistent support for clients, making them popular among SMEs and high-growth startups. End-User Vertical segmentation reveals distinct requirements across industries; for instance, the Healthcare vertical demands stringent HIPAA-compliant handling of Protected Health Information (PHI), driving demand for specialized, compliant assistants, while the Technology sector prioritizes technical project management and developer support assistance. This granularity ensures that market players can specialize and build deep expertise relevant to specific client operational environments.

- By Service Type:

- Human Virtual Assistant (HVA)

- AI-Powered Assistant (APA)

- Hybrid Model

- By Deployment Model:

- Retainer Model

- Project-Based Model

- Dedicated FTE Model

- On-Demand Services

- By End-User Vertical:

- Professional Services (Legal, Consulting, Accounting)

- Information Technology and Telecommunication

- Healthcare and Pharmaceutical

- Banking, Financial Services, and Insurance (BFSI)

- Real Estate

- Others (Retail, Manufacturing, Education)

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For Assistant services Market

The Value Chain of the Assistant services Market begins with the Upstream analysis, focusing on the sourcing and training of human talent and the development of core technological assets. Upstream activities involve rigorous recruitment (often globally, utilizing platforms like LinkedIn and specialized job boards), comprehensive skill development in areas like communication, project management, and specialized software proficiency, and the procurement of necessary IT infrastructure, including secure communication platforms and proprietary workflow management systems. For AI-powered services, this phase includes the development, training, and continuous refinement of machine learning models and Natural Language Processing (NLP) engines, requiring significant investment in data sets and computational resources. Ensuring a high quality upstream supply of skilled personnel and cutting-edge technology is fundamental to delivering reliable downstream services.

The core Midstream activity involves the actual service delivery and quality assurance. This phase encompasses client onboarding, task management, adherence to Service Level Agreements (SLAs), and ongoing performance monitoring. This stage is heavily influenced by the distribution channel used. Direct channels involve providers contracting directly with end-user companies, facilitating highly customized service delivery and close relationship management. Indirect channels involve partnerships with Business Process Outsourcing (BPO) firms, Managed Service Providers (MSPs), or specialized outsourcing marketplaces, which act as intermediaries, broadening the provider's reach but potentially adding layers of complexity to communication and service control. Effective quality management systems, often involving layered human supervision and automated performance metrics, are crucial midstream components for maintaining client satisfaction.

Downstream analysis focuses on market penetration, customer relationship management, and service scaling. Key downstream factors include optimizing client retention through proactive communication, offering flexible upgrade paths (e.g., scaling from a shared VA model to a dedicated FTE model), and continuous service enhancement based on client feedback. The distribution channel selection profoundly impacts market access; direct sales efforts targeting large enterprises require specialized business development teams, while indirect reliance on marketplace aggregators or channel partners is often a strategy for quickly penetrating the SME market. The success of the downstream activities ultimately depends on demonstrating clear Return on Investment (ROI) to clients through measurable improvements in productivity and cost savings, solidifying long-term strategic partnerships.

Assistant services Market Potential Customers

Potential customers for the Assistant services Market are exceptionally diverse, spanning nearly every industry and organizational size globally, all united by the common need to optimize time and resources. End-users fall into distinct categories, primarily driven by their core business objectives and internal capacity constraints. Large Enterprises (LEs) are major buyers, seeking assistant services for executive support, managing high-volume, non-core tasks (e.g., travel desk operations, standardized reporting), and supporting specialized departments like legal or human resources with data processing and compliance monitoring. For LEs, the motivation is often about achieving enterprise-wide efficiency and maintaining business continuity by outsourcing non-critical functions to resilient third parties.

Small and Medium-sized Enterprises (SMEs) constitute one of the most rapidly growing buyer segments. For SMEs, utilizing assistant services is frequently a necessity for survival and growth, allowing them to access high-caliber executive or technical support skills that they cannot afford to hire internally on a full-time basis. These businesses often favor flexible, retainer-based or project-based models to manage fluctuating workloads and control budgetary spend tightly. The ability to instantly scale administrative capacity without the long lead times and high costs associated with traditional hiring makes the value proposition of assistant services highly compelling to this demographic, positioning virtual assistants as extensions of their core team.

Individual executives, entrepreneurs, consultants, and independent professionals also represent a significant potential customer base. These individuals require highly personalized, responsive support to manage demanding schedules, complex client communication, and personal administrative tasks, effectively maximizing their own billable hours. Specific sectors, such as Venture Capital (VC) firms, private equity, and high-growth technology startups, are major consumers, demanding assistants capable of complex research, financial modeling support, and managing investor relations documentation. The critical factor for all potential customers is the seamless integration and high level of trust established with the service provider, ensuring that outsourced tasks are managed confidentially and efficiently, enabling the core business focus to remain undisturbed.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 51.7 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TaskUs, Time etc., Fancy Hands, BELAY, Wing Assistant, Boldly, Prialto, Remote CoWorker, AssistantMatch, Worldwide101, Equivity, Athena Executive Assistance, Outsourcing Angel, Magic, Crossover, Microsoft (Copilot), Google (Duet AI), Amazon (Alexa for Business), IBM. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Assistant services Market Key Technology Landscape

The technology landscape underpinning the Assistant services Market is rapidly evolving, driven by advancements in artificial intelligence and secure cloud infrastructure. Core to this evolution is the utilization of advanced Natural Language Processing (NLP) and Natural Language Understanding (NLU) technologies, which enable AI assistants to accurately interpret complex human commands, context, and intent across text and voice interfaces. Machine Learning (ML) algorithms, particularly deep learning models, are essential for continuous improvement, allowing these systems to learn from historical user interactions, optimize scheduling, and proactively manage communication filters. This technological synergy is crucial for blurring the line between human and digital assistance, driving higher efficiency and greater satisfaction for end-users seeking highly personalized service interactions.

Cloud computing platforms (AWS, Azure, Google Cloud) serve as the fundamental backbone, providing the scalable, elastic infrastructure necessary to host global teams and power resource-intensive AI models. These platforms facilitate secure data storage, high-speed communication, and global service delivery without geographical constraints, a necessity for a market defined by virtual operations. Furthermore, sophisticated workflow automation tools and Robotic Process Automation (RPA) are increasingly integrated into service delivery, allowing human assistants to leverage bots for high-volume, repetitive tasks like invoicing, data validation, and basic reporting. This integration significantly enhances the productivity of human VAs, shifting their focus toward strategic tasks that require cognitive reasoning and emotional intelligence.

Security technologies represent a non-negotiable component of the market landscape. Encryption (end-to-end and in-transit), multi-factor authentication, and robust access control mechanisms are critical for maintaining client trust, especially when handling confidential corporate and personal data. Furthermore, seamless integration capabilities via Application Programming Interfaces (APIs) are essential, allowing assistant service platforms to interface directly with client-side enterprise software such as CRM systems (Salesforce), project management tools (Asana, Trello), and communication platforms (Slack, Teams). The competitive edge in this market is held by providers who not only adopt the latest AI but also ensure flawless, secure, and integrated connectivity across the client’s existing technological ecosystem, minimizing operational friction during onboarding and daily execution.

Regional Highlights

The regional analysis of the Assistant services Market underscores significant disparities in maturity, growth rates, and service preferences globally. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributable to high enterprise spending on outsourced services, the early adoption of cloud and AI technologies, and a pervasive corporate culture that values time efficiency and specialized executive support. The presence of major technology hubs and a highly competitive service provider landscape drive continuous innovation, particularly in sophisticated AI-driven and hybrid assistant solutions targeting the technology and financial services sectors. The market here is mature, focusing heavily on value-added services beyond basic administration, such as strategic market research support and compliance monitoring assistance.

Asia Pacific (APAC) is projected to experience the fastest growth during the forecast period. This rapid expansion is fueled by two primary factors: the massive and highly skilled talent pool available in countries like India, the Philippines, and Vietnam, which serve as crucial outsourcing destinations; and the increasing digitalization and globalization of businesses within the APAC region itself. Local companies are beginning to adopt virtual assistant models to manage their own rapid domestic and international growth. Government initiatives supporting digital infrastructure and favorable economic conditions further facilitate market penetration. However, challenges related to diverse regulatory environments and data localization requirements necessitate locally tailored service approaches from international providers operating in this region.

Europe represents a highly fragmented yet essential market, driven by varying economic conditions and strict regulatory frameworks, notably the General Data Protection Regulation (GDPR). Western European countries (Germany, UK, France) are primary consumers, demanding specialized assistant services compliant with local labor laws and data protection mandates, particularly in the BFSI and healthcare industries. The market favors providers that demonstrate high levels of security certification and offer multilingual capabilities. The Middle East and Africa (MEA) and Latin America (LATAM) markets, while currently smaller, show promising growth potential. Growth in these regions is largely linked to increasing foreign investment, the rise of regional startups, and the need for scalable operational support, particularly in fast-growing sectors like energy and construction, where traditional administrative structures often lag behind operational scale.

- North America (Dominant Market): Characterized by high AI integration, demand for specialized executive support, and mature outsourcing practices across IT and finance.

- Asia Pacific (Fastest Growth): Driven by vast talent availability, increasing digitalization of local SMEs, and emergence as the global outsourcing hub for administrative and technical support.

- Europe (Compliance-Focused): Strict adherence to GDPR and local labor laws drives demand for specialized, highly secure, multilingual virtual assistant services, particularly in Western Europe.

- Latin America (Emerging Market): Growing startup ecosystem and foreign direct investment increase the need for scalable, cost-effective administrative and technical support solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Assistant services Market.- TaskUs

- Time etc.

- Fancy Hands

- BELAY

- Wing Assistant

- Boldly

- Prialto

- Remote CoWorker

- AssistantMatch

- Worldwide101

- Equivity

- Athena Executive Assistance

- Outsourcing Angel

- Magic

- Crossover

- Microsoft (Copilot)

- Google (Duet AI)

- Amazon (Alexa for Business)

- IBM (Watson Assistant)

- Concentrix

Frequently Asked Questions

Analyze common user questions about the Assistant services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the Assistant services Market between 2026 and 2033?

The Assistant services Market is projected for substantial expansion, growing at a Compound Annual Growth Rate (CAGR) of 15.8% during the 2026-2033 forecast period, driven by digitalization and increasing outsourcing demands globally.

How are AI-Powered Assistants fundamentally changing traditional Virtual Assistant service delivery models?

AI-Powered Assistants automate routine tasks, enabling human Virtual Assistants to focus on high-value activities requiring complex judgment, emotional intelligence, and strategic client relationship management, leading to hybrid, highly efficient service models.

Which geographical region currently dominates the market share, and which is exhibiting the highest growth rate?

North America currently holds the largest market share due to mature outsourcing adoption and high technological investment. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily fueled by extensive talent pools and accelerated regional digitalization.

What are the main security concerns and challenges associated with utilizing outsourced Assistant services?

The primary challenges revolve around data security, cross-border data privacy compliance (such as GDPR), and ensuring confidential handling of sensitive corporate information, necessitating robust encryption, access controls, and verifiable provider certifications.

What are the key deployment models available for businesses seeking Assistant services?

Key deployment models include the Retainer Model (fixed monthly hours), the Project-Based Model (task-specific contracts), and the Dedicated FTE Model (full-time outsourced equivalent), providing flexibility tailored to different operational needs and budgetary constraints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager