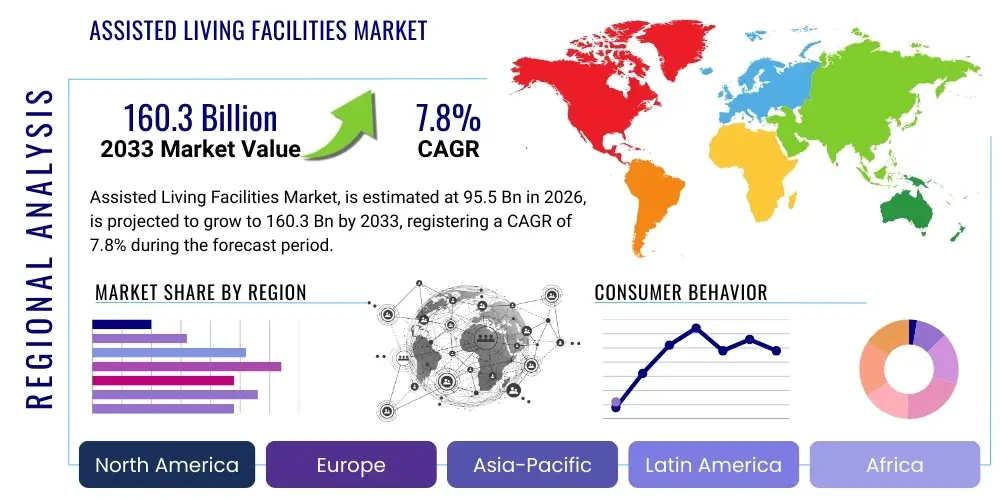

Assisted Living Facilities Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442624 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Assisted Living Facilities Market Size

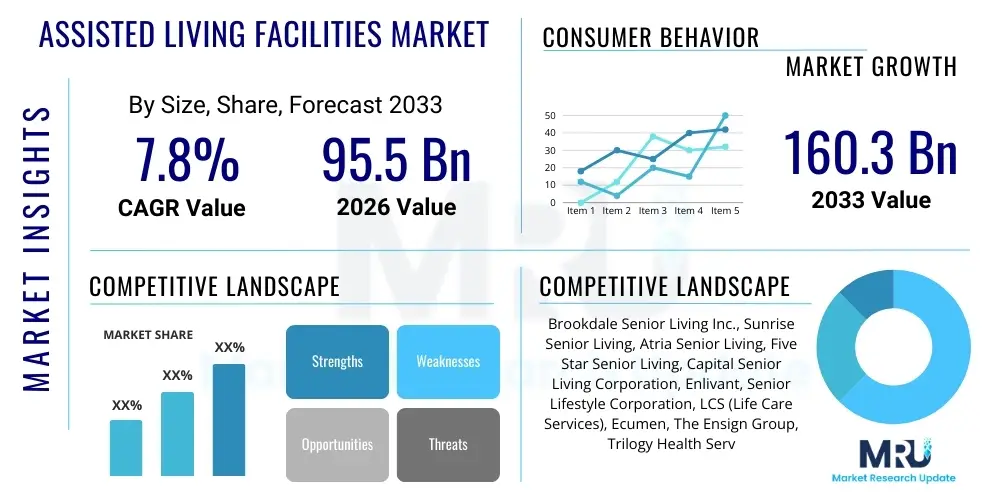

The Assisted Living Facilities Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 95.5 Billion in 2026 and is projected to reach USD 160.3 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by significant global demographic shifts, particularly the acceleration of the 65-and-older population segment across developed and rapidly developing economies. The increasing prevalence of age-related chronic conditions and the growing societal preference for personalized, non-institutionalized long-term care solutions are the primary catalysts fueling this expansion. Market valuation reflects both capital investment in new facility construction and operational revenue generated through resident services and ancillary healthcare provisions. The financial landscape is highly influenced by private pay models, although government programs like Medicaid waivers are beginning to expand coverage, especially in North America and parts of Europe, further stabilizing the revenue streams and expanding accessibility for middle-income seniors.

Assisted Living Facilities Market introduction

The Assisted Living Facilities Market encompasses residential settings designed to provide personal care services, health care monitoring, and supportive assistance for individuals who require help with Activities of Daily Living (ADLs) but do not necessitate the intensive medical supervision found in nursing homes. This market segment bridges the gap between independent living and skilled nursing facilities, offering a high degree of resident autonomy coupled with necessary supportive services. The core product offering is a comprehensive housing and service package, typically including meal preparation, housekeeping, medication management, transportation, and social engagement activities. These facilities are increasingly recognized as essential components of the long-term care continuum, driven by a consumer demand for environments that prioritize quality of life, privacy, and community engagement while addressing evolving medical needs. The market is highly fragmented, characterized by both large, nationally recognized chains and smaller, localized operators focusing on specialized populations, such as those requiring dedicated memory care.

Major applications of assisted living facilities center on providing holistic care for the elderly population, particularly those aged 75 and above who are experiencing functional decline or managing multiple chronic conditions such as dementia, cardiovascular disease, or diabetes. The benefits of choosing assisted living are manifold; residents gain access to structured social environments which mitigate loneliness and isolation, predictable access to 24/7 emergency support, and individualized service plans tailored to their specific cognitive and physical needs. This model significantly reduces the burden on family caregivers, allowing seniors to age in a secure, community-focused setting. The driving factors behind market expansion include the massive demographic bulge of baby boomers entering retirement age, technological advancements enabling sophisticated remote monitoring and personalized care delivery, and shifting consumer expectations favoring less restrictive, homelike environments over traditional institutional settings. Furthermore, governmental initiatives focused on controlling healthcare costs often encourage the use of assisted living over higher-cost institutional alternatives, acting as a crucial macroeconomic driver.

Assisted Living Facilities Market Executive Summary

The Assisted Living Facilities Market is defined by robust business trends centered on consolidation, diversification of service offerings, and significant technology integration. Large, national operators are increasingly acquiring smaller facilities to achieve economies of scale and standardize quality control, leading to greater market concentration. A key business trend involves the shift towards specialized programming, notably the expansion of dedicated memory care units and programs catering to specific chronic illness management, reflecting a deeper understanding of varying resident acuity levels. Regionally, North America continues to dominate the market due to its advanced regulatory framework and high penetration rates of private long-term care insurance. However, the Asia Pacific region is demonstrating the highest growth velocity, fueled by rapidly aging populations in countries like Japan, China, and South Korea, coupled with expanding middle-class wealth enabling access to private senior care services. Europe remains a mature market, emphasizing integrated care models linking assisted living providers with national health services, focusing heavily on sustainability and quality metrics.

Segment trends highlight the critical importance of payment model differentiation and facility size. Private pay remains the dominant funding source globally, indicating the market’s reliance on affluent seniors, yet there is rising segmentation targeting the middle market through innovative affordable housing models and partnerships leveraging government housing subsidies. The operational segment is seeing a significant trend toward implementing sophisticated Electronic Health Record (EHR) systems and predictive analytics to manage resident health proactively and optimize staffing efficiency, a direct response to persistent labor shortages. Facility design trends favor smaller, neighborhood-style communities that foster a less institutional feel and better social interaction, moving away from large, hospital-like structures. Overall, the market's executive summary points toward an environment of sustained growth, driven fundamentally by demographics, but operationally defined by technological adoption and a relentless pursuit of personalized, high-quality residential care experiences.

AI Impact Analysis on Assisted Living Facilities Market

Analysis of common user questions regarding the impact of AI on Assisted Living Facilities reveals a strong focus on balancing innovation with human connection. Users frequently inquire about the reliability of AI-driven safety systems, such as automated fall detection and predictive health monitoring, and the ethical implications of continuous surveillance on resident privacy and autonomy. A significant concern revolves around the economic feasibility and accessibility of integrating expensive AI technologies—will AI only benefit high-end facilities, or will it democratize quality care? Furthermore, users consistently seek clarity on whether AI, particularly robotic assistance and automated scheduling, will augment the human caregiving workforce (reducing burnout and improving service quality) or replace it, potentially diminishing the critical emotional and social aspects of care delivery. Key expectations center on AI’s ability to predict health crises before they occur, automate burdensome administrative tasks, and personalize daily activities and cognitive therapies for residents with conditions like dementia.

The integration of Artificial Intelligence and machine learning algorithms is poised to fundamentally redefine the operational efficiency and care quality within assisted living environments. AI applications are moving beyond basic automation to encompass sophisticated predictive modeling that analyzes vast amounts of resident biometric and behavioral data—sourced from wearables, in-room sensors, and EHRs—to anticipate adverse health events, such as urinary tract infections (UTIs) or septic episodes, often weeks before clinical symptoms become overt. This predictive capability shifts the care paradigm from reactive to proactive, drastically improving resident outcomes and reducing costly hospital readmissions, a significant value proposition for operators. Moreover, AI-driven scheduling tools are optimizing staff deployment by matching resident needs (acuity level) with staff availability and specialized skill sets, thereby addressing the pervasive challenge of workforce shortages while ensuring regulatory compliance regarding required resident-to-staff ratios. This efficiency boost is critical for maintaining financial viability in a high-labor cost sector.

However, the successful adoption of AI requires careful navigation of the regulatory landscape and consumer acceptance. Data governance, ensuring that sensitive resident health information processed by AI algorithms is secure and compliant with global privacy standards (like HIPAA or GDPR), is paramount. Facilities are investing heavily in robust cybersecurity infrastructure to protect these interconnected systems. From a service perspective, AI is enhancing personalization by tailoring dining options based on dietary restrictions and preferences, recommending optimized rehabilitation schedules, and providing customized cognitive engagement programs through virtual reality or interactive screens. This enhanced level of individualized attention, driven by data insights, differentiates top-tier assisted living services and drives willingness-to-pay among potential residents and their families, cementing AI as a core competitive differentiator rather than merely an optional technological add-on.

- AI-driven Predictive Health Monitoring: Anticipates falls, infections, and acute episodes using sensor and biometric data, reducing hospitalizations.

- Automated Administrative Tasks: AI handles billing, regulatory reporting, and medical coding, freeing staff for direct resident interaction.

- Personalized Cognitive Therapy: Machine learning algorithms tailor mental and social engagement programs for residents, especially those with Alzheimer's or dementia.

- Optimized Staff Scheduling: Uses resident acuity data and predictive models to ensure optimal staffing levels and skills mix 24/7.

- Robotic Assistance: Deployment of companion robots for social interaction and lift-assist exoskeletons to reduce physical strain on caregivers.

- Enhanced Medication Management: AI vision systems verify medication administration accuracy, minimizing human error in complex medication regimes.

DRO & Impact Forces Of Assisted Living Facilities Market

The Assisted Living Facilities Market is shaped by a powerful confluence of demographic drivers, economic restraints, and technological opportunities, resulting in significant impact forces that dictate investment and operational strategy. The foremost driver is the global acceleration of population aging, particularly the rapid increase in the "oldest old" (85+) segment, which represents the highest consumers of assisted living services. This demographic certainty provides a stable foundation for long-term market growth. Simultaneously, the increasing prevalence of chronic diseases and the growing preference among seniors and their families for maintaining a semblance of independence in a non-hospital environment further propel demand. Economic restraints, however, present a major hurdle; the high cost of private pay assisted living makes it inaccessible to the vast middle-income population, creating a significant market gap and limiting overall market penetration. Furthermore, acute and persistent workforce shortages (nurses, certified aides) severely constrain the ability of facilities to expand capacity or maintain high-quality care standards, leading to increased labor costs and operational inefficiencies. These competing pressures form intense impact forces on pricing and service delivery models.

Opportunities within the market primarily revolve around leveraging technological innovation to enhance both care efficiency and service quality. The proliferation of IoT, telehealth, and AI offers a pathway to mitigate staffing challenges through automation and remote patient monitoring, allowing existing staff to focus on high-touch care tasks. Furthermore, opportunities exist in developing specialized value-based care partnerships with integrated health systems (hospitals and Accountable Care Organizations, or ACOs). By demonstrating that assisted living facilities can effectively manage chronic conditions and prevent unnecessary emergency room visits, operators can access new revenue streams and align themselves with broader healthcare cost-saving objectives. These strategic partnerships enable operators to secure consistent resident referrals and tap into payer-driven incentives for superior health outcomes. The imperative to serve the untapped middle market also represents a critical opportunity for novel financing and architectural models, such as hybrid rental/ownership structures and tiered service offerings that make high-quality supportive living more financially attainable for a broader socioeconomic base.

The interplay of these factors—Drivers, Restraints, and Opportunities (DRO)—generates critical impact forces across the sector. Policy and regulatory changes, particularly adjustments to Medicaid waiver programs and state-level licensing requirements, significantly influence regional market viability and expansion strategies. The capital intensity of the sector, requiring substantial upfront investment in real estate and infrastructure, necessitates stable access to long-term financing, making interest rate environments a major impact force. Finally, consumer expectations have increased dramatically; families now demand higher transparency regarding quality metrics, infection control protocols, and specialized dementia care expertise. Facilities that successfully integrate technology to prove compliance, improve staff retention through better working conditions, and offer differentiated, personalized care services are the ones most likely to capture market share and achieve sustainable profitability in this rapidly evolving healthcare adjacent industry.

Segmentation Analysis

The Assisted Living Facilities Market segmentation provides a granular view of market structure based on service offering, facility size, type of ownership, and primary funding mechanism. Service-based segmentation is crucial, as the demands and operational requirements for memory care (serving residents with advanced cognitive impairment) differ fundamentally from those of independent living assistance (serving residents who require minimal support). Facility size segmentation helps operators target investment, recognizing that small, boutique facilities often command higher prices and cater to luxury segments, while large communities benefit from operational economies of scale. Understanding the payment source is vital for revenue stability; facilities relying heavily on private pay are susceptible to economic downturns, whereas those with a balanced mix including Medicaid waivers or long-term care insurance benefit from diversified risk profiles and access to a wider pool of residents, impacting overall geographical distribution and profitability across different market tiers.

- By Service Type:

- Standard Assisted Living

- Memory Care/Dementia Care

- Independent Living with Supportive Services

- Respite Care Services

- By Ownership Type:

- For-Profit Chains (National/Regional)

- Non-Profit Organizations (Religious/Community-Based)

- Government/Public Facilities

- By Facility Size:

- Small (Less than 50 Units)

- Medium (50 - 150 Units)

- Large (More than 150 Units)

- By Payment Source:

- Private Pay (Out-of-Pocket)

- Long-Term Care Insurance

- Government Funded Programs (Medicare/Medicaid Waivers)

- Veterans Benefits

Value Chain Analysis For Assisted Living Facilities Market

The Assisted Living Facilities value chain begins with the upstream segment, dominated by Real Estate Development and construction financing, which determines the physical capacity and location of the facilities. Key upstream suppliers include medical device manufacturers (for monitoring and emergency call systems), pharmaceutical companies (for medication management systems), and specialized software providers (for EHR and facility management platforms). The high capital expenditure required for land acquisition, building design tailored for accessibility and safety, and equipping facilities necessitates strong, long-term relationships with institutional investors and healthcare real estate investment trusts (REITs). Operational excellence in this segment relies heavily on managing construction timelines and ensuring compliance with stringent safety and accessibility standards, directly impacting the long-term profitability and resident appeal of the asset. Efficiency in the upstream phase significantly influences the operational costs throughout the facility's lifecycle.

The core of the value chain is the Service Provision segment, executed by the facility operators themselves. This is where value is added through the delivery of high-quality, personalized care, encompassing food service, housekeeping, personal assistance with ADLs, and social programming. This segment is characterized by intensive labor management; optimizing staff recruitment, training, and retention is paramount to quality of care and financial health. Downstream analysis focuses on how the service reaches the end-user (the resident). Distribution channels are predominantly indirect, relying heavily on professional referral networks. These include geriatric care managers, hospital discharge planners, primary care physicians, and community-based organizations. Direct channels involve consumer outreach via digital marketing, reputation management (online reviews), and personalized tours, driven heavily by adult children researching options for their aging parents.

The success of the downstream activities hinges on establishing trusted relationships within the healthcare ecosystem. Partnerships with acute care hospitals and rehabilitation centers ensure a consistent flow of residents transitioning out of higher-acuity settings. Furthermore, facilities are increasingly integrating telehealth and external geriatric specialty services (e.g., mobile dentistry, physical therapy) into their service offerings, effectively extending the value chain to provide comprehensive, on-site health maintenance. The payment collection process, involving complex management of private pay schedules, insurance claims, and government reimbursement applications, constitutes a vital administrative layer of the value chain. Operational proficiency in managing these diverse distribution and payment mechanisms ensures high occupancy rates and reliable cash flow, crucial metrics for investors and sustained market viability.

Assisted Living Facilities Market Potential Customers

The primary target demographic and end-user for the Assisted Living Facilities Market are seniors aged 75 and older, often referred to as the "frail elderly," who require consistent, non-medical assistance with Activities of Daily Living (ADLs) such as bathing, dressing, and medication management. This segment includes individuals who may be managing two or more chronic conditions and are increasingly vulnerable to social isolation or fall risks if residing independently. A significant subsegment comprises individuals diagnosed with early- to mid-stage cognitive impairments, necessitating specialized memory care services that provide a secure environment and structured therapeutic activities. The purchasing decision, however, is rarely made by the resident alone; adult children, particularly those aged 45 to 65, serve as the crucial decision-makers and financial guarantors, making them an equally important audience for marketing and outreach efforts.

A rapidly expanding segment of potential customers includes integrated healthcare systems, particularly hospital networks and Accountable Care Organizations (ACOs). These organizations increasingly view high-quality assisted living facilities not just as referral sources, but as strategic partners in the value-based care model. By collaborating with assisted living providers, healthcare systems aim to ensure continuity of care post-discharge, effectively managing complex patients, reducing costly readmissions, and lowering overall per-capita healthcare expenditure. This shift means that facilities must demonstrate superior clinical quality reporting and seamless data integration with external health records, transforming the relationship from a transactional one into a clinical alliance focused on shared patient health outcomes. The focus here is on preventative care and chronic disease management capabilities.

The final, increasingly important customer group is the middle-market senior—those who have modest retirement savings but cannot afford the typical USD 4,000 to USD 6,000 monthly private pay rates, yet they earn too much to qualify easily for full Medicaid coverage. This segment represents a vast, underserved portion of the market, spurring innovation in affordable assisted living models, often subsidized through combinations of state housing programs, modified facility designs (e.g., shared rooms), or community-based subsidies. Facilities successful in capturing this customer base utilize optimized operational efficiencies and strategic partnership with local non-profit housing agencies to deliver necessary services at a lower monthly cost, fundamentally expanding the market's reach beyond the top income quintiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 95.5 Billion |

| Market Forecast in 2033 | USD 160.3 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brookdale Senior Living Inc., Sunrise Senior Living, Atria Senior Living, Five Star Senior Living, Capital Senior Living Corporation, Enlivant, Senior Lifestyle Corporation, LCS (Life Care Services), Ecumen, The Ensign Group, Trilogy Health Services, Holiday Retirement, Belmont Village Senior Living, Pacific Retirement Services, Civitas Senior Living, Integral Senior Living, Senior Resource Group, Heritage Communities, Gardant Management Solutions, Merrill Gardens |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Assisted Living Facilities Market Key Technology Landscape

The operational efficiency and resident safety within the Assisted Living Facilities market are increasingly reliant on a sophisticated technology landscape, transforming facility management and care delivery. Core to this landscape are Electronic Health Records (EHRs) and comprehensive Facility Management Software, which integrate clinical documentation, billing, staff scheduling, and resident demographic data onto a unified platform. Modern EHR systems must offer interoperability, allowing seamless data exchange with external hospitals and physicians, which is critical for value-based care participation and optimizing resident transitions. Beyond administration, the market relies heavily on robust communication platforms, including secure messaging tools for staff coordination and telehealth portals that facilitate remote consultations with geriatric specialists, reducing the need for resident transportation and improving timely medical interventions.

Safety and wellness technologies represent the most rapidly evolving segment of the technological landscape. This includes advanced Internet of Things (IoT) sensor networks deployed throughout resident rooms and common areas. These sensors monitor ambient conditions, identify unusual behavior patterns, and power sophisticated fall detection systems that utilize passive infrared, radar, or computer vision, moving beyond traditional, often cumbersome, pull-cord or pendant systems. Data collected by these devices is funneled into Machine Learning (ML) algorithms that learn individual resident norms and alert staff only when deviations occur that suggest a potential health crisis or immediate danger. Furthermore, smart medication management systems, including automated dispensing carts and electronic verification tools, significantly reduce the risk of medication errors, a leading cause of adverse events in senior care settings, ensuring precise adherence to complex prescribed regimes.

Beyond safety, technology is being leveraged to enhance resident engagement and quality of life. Virtual Reality (VR) platforms are being adopted for cognitive stimulation and reminiscence therapy, particularly effective in memory care units, offering immersive, personalized experiences that reduce agitation and improve mood. Additionally, sophisticated building automation systems (BAS) manage climate control, lighting, and security access, contributing to energy efficiency and resident comfort. The successful adoption of these diverse technological layers requires significant capital investment and continuous staff training to bridge the digital divide. Facilities that successfully integrate these technologies are positioning themselves as leaders in delivering not just supportive housing, but a truly intelligent, safe, and engaging living environment, setting a new benchmark for quality in the continuum of elder care services.

Regional Highlights

The Assisted Living Facilities market exhibits distinct characteristics and maturity levels across different global regions, heavily influenced by local demographics, healthcare funding models, and regulatory environments. North America, particularly the United States, commands the largest market share, characterized by high consumer awareness, a mature private pay model, and an advanced technological adoption rate. The market here is fragmented but driven by large, national REIT-backed chains and robust competition, leading to continuous innovation in service delivery, especially in memory care and specialized rehabilitation services. Regulatory frameworks at the state level often dictate minimum staffing and service requirements, creating regional operational variances. The substantial presence of sophisticated private equity and investment capital ensures continued development of new facilities and high asset valuation.

Europe represents a mature yet heterogeneous market, where assisted living often intersects closely with national public health and social care systems. Western European nations, such as the UK, Germany, and France, focus heavily on integrated care pathways, aiming to keep seniors closer to home through community-based support before moving to assisted living. The market is defined by a mix of private, often non-profit, operators and publicly funded facilities. Growth is steady, fueled by long life expectancies, but restrained by high labor costs and complex social welfare bureaucracies. Conversely, the Asia Pacific (APAC) region is projected to experience the fastest growth rate. This rapid expansion is driven by unparalleled demographic aging in China, Japan, and India, coupled with rising middle-class affluence that is shifting cultural preferences away from traditional multi-generational family care towards professional, paid senior services. Investment is flowing rapidly into large-scale, modern facilities in urban centers across key APAC nations.

Latin America and the Middle East & Africa (MEA) currently represent smaller, nascent markets for formal assisted living, but possess immense latent potential. In MEA, particularly the Gulf Cooperation Council (GCC) countries, rapidly expanding wealth and changing social structures are initiating demand for Western-style senior care solutions, although cultural traditions surrounding familial care remain strong. The initial market penetration in these regions is often focused on high-net-worth individuals, offering luxurious, amenity-rich facilities. As government health initiatives mature and awareness of structured long-term care options increases across both Latin America and MEA, these regions are anticipated to see gradual but significant investment inflows, albeit often tailored to specific cultural and religious requirements regarding dining, privacy, and social structure.

- North America (U.S. and Canada): Market leader by revenue, focused on private pay dominance, high technology integration (EHR, AI safety systems), and regulatory complexity at state/provincial levels.

- Asia Pacific (APAC): Highest CAGR, driven by mass demographic aging (China, Japan), rising disposable income, and increasing urbanization demanding formal, professional care alternatives.

- Europe (Western and Nordic Countries): Mature market emphasizing integrated care, strong non-profit sector presence, and focus on blending social care with healthcare services.

- Latin America (LATAM): Emerging market concentrated in urban centers, gradual shift from family care, characterized by early investment in high-end, privately-funded facilities.

- Middle East & Africa (MEA): Nascent market, driven by changing demographics and economic liberalization, high demand for personalized, culturally sensitive luxury care facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Assisted Living Facilities Market.- Brookdale Senior Living Inc.

- Sunrise Senior Living

- Atria Senior Living

- Five Star Senior Living

- Capital Senior Living Corporation

- Enlivant

- Senior Lifestyle Corporation

- LCS (Life Care Services)

- Ecumen

- The Ensign Group

- Trilogy Health Services

- Holiday Retirement

- Belmont Village Senior Living

- Pacific Retirement Services

- Civitas Senior Living

- Integral Senior Living

- Senior Resource Group

- Heritage Communities

- Gardant Management Solutions

- Merrill Gardens

- Welltower Inc. (REIT partner)

- Ventas, Inc. (REIT partner)

Frequently Asked Questions

Analyze common user questions about the Assisted Living Facilities market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between assisted living and nursing homes?

Assisted living facilities (ALFs) focus on supportive, non-medical help with daily activities (ADLs) and offer greater autonomy in a residential setting. Nursing homes, or skilled nursing facilities (SNFs), provide 24/7 medical supervision by licensed nurses and are intended for residents requiring complex medical interventions or long-term rehabilitation.

How much does assisted living typically cost, and how is it paid for?

The average monthly cost varies widely by location and services but is typically between $4,000 and $6,000 USD. The majority of assisted living expenses are covered through private pay (out-of-pocket savings) or by long-term care insurance. Government programs like Medicare do not cover routine assisted living costs, though Medicaid waivers may cover care services for eligible low-income seniors in some states.

How are technology and AI improving safety in assisted living communities?

Technology, particularly AI and IoT sensors, enhances safety by enabling predictive fall detection, remote health monitoring, and smart medication management systems. These tools analyze behavioral data to identify subtle changes in resident health status early, allowing staff to intervene proactively and significantly reduce the risk of emergencies and hospitalizations.

What are the most significant challenges facing the growth of the Assisted Living Market?

The most significant challenges are the pervasive shortage of qualified caregiving staff (labor constraints) and the high cost of services, which renders assisted living unaffordable for the substantial middle-market senior population. Overcoming these requires innovative staffing models and developing more affordable, middle-market facility options.

What regulatory factors impact the operations of assisted living facilities?

Assisted living facilities are primarily regulated at the state or provincial level, encompassing stringent licensing requirements, staffing ratios, mandated training, and safety standards (e.g., fire safety). Unlike nursing homes, federal regulation (Medicare/Medicaid) is less dominant, but state-level compliance regarding quality assurance and resident rights is critical for operational integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager