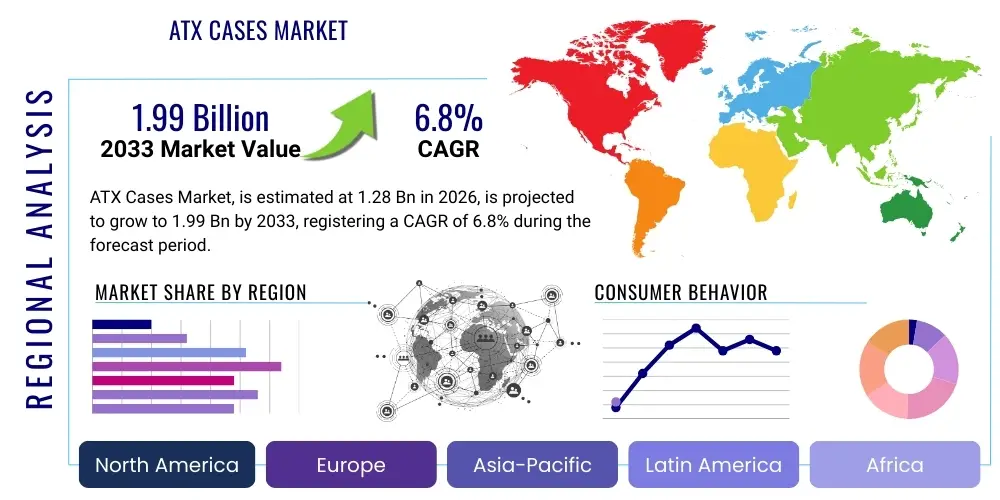

ATX Cases Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441982 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

ATX Cases Market Size

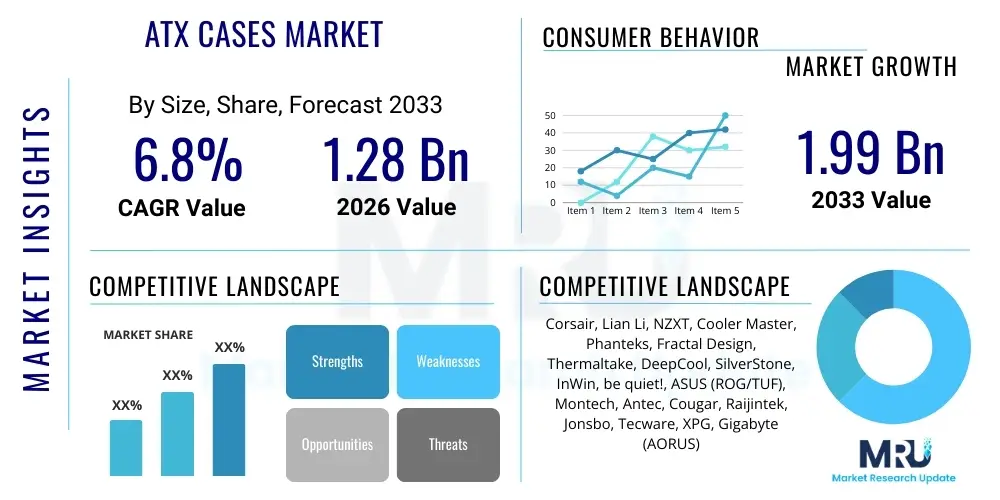

The ATX Cases Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.75% between 2026 and 2033. The market is estimated at USD 1.28 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033.

ATX Cases Market introduction

The ATX Cases market encompasses the global trade of enclosures designed specifically to accommodate ATX (Advanced Technology eXtended) standard motherboards and their associated components. These cases serve as the foundational structure for personal computers, protecting sensitive internal hardware while providing necessary structural support, thermal management solutions, and aesthetic presentation. The evolution of the ATX case has moved significantly beyond simple metal boxes; modern designs prioritize efficient airflow, modularity for customization, integration of aesthetic elements like tempered glass and RGB lighting, and compatibility with high-performance components such as large GPUs and complex liquid cooling systems. This shift is driven primarily by the escalating demand for high-end gaming rigs and professional workstations requiring superior thermal dissipation.

Key applications of ATX cases span various sectors, with the gaming and enthusiast segment representing the largest consumer base, demanding maximum internal space for extensive custom cooling loops and oversized graphics cards. Furthermore, professional applications, including video editing, 3D rendering, and data science workstations, rely on robust ATX enclosures to house multiple storage devices, high core-count CPUs, and specialized accelerator cards, ensuring stable performance under continuous heavy load. The market benefits from a continuous cycle of PC hardware upgrades, where new component generations often necessitate larger or redesigned cases for optimal fit and cooling performance, thus sustaining replacement demand.

The primary driving factors propelling this market include the relentless growth of the global gaming industry, which demands state-of-the-art computational hardware housed in visually appealing and thermally optimized chassis. The increasing popularity of Do-It-Yourself (DIY) PC building, driven by user desire for personalization and cost-effectiveness, further fuels the market. Additionally, the technological advancements in component miniaturization alongside the increase in component power draw (leading to higher heat output) creates a continuous need for innovative case designs focused on maximizing airflow and integrating superior cable management, enhancing both user experience and system longevity.

ATX Cases Market Executive Summary

The ATX Cases market is currently characterized by several pivotal business trends, notably the increasing emphasis on aesthetic features such as panoramic tempered glass panels, minimalist industrial designs, and sophisticated integrated RGB lighting synchronization systems. Functionally, the market is trending toward enhanced modularity, allowing users to reconfigure internal layouts for different component requirements (e.g., maximizing space for front-mounted radiators or vertical GPU installations). Leading manufacturers are differentiating themselves through proprietary tool-less designs, advanced dust filtration systems, and superior materials science, particularly the use of lightweight aluminum and high-quality steel alloys, positioning high-end enclosures as premium components rather than mere protective shells.

Regionally, the Asia Pacific (APAC) territory, particularly China, South Korea, and Japan, demonstrates the fastest growth trajectory, primarily driven by the colossal, young, and enthusiastic gaming population and significant growth in eSports infrastructure. North America and Europe, while representing mature markets, maintain high market share due to the strong presence of established PC gaming communities, professional content creation industries, and high average disposable incomes allocated to premium hardware. Regional demand often dictates segment trends; for example, smaller, design-focused Mid-Tower ATX cases are popular in space-constrained urban areas of Europe and Asia, while expansive Full Tower cases dominate the high-end enthusiast segment in North America, catering to extreme overclocking and custom liquid cooling.

Segment trends highlight a strong consumer preference shift towards Mid-Tower ATX cases, offering the optimal balance between footprint, capacity, and price accessibility. Material segmentation is heavily influenced by the adoption of Tempered Glass for showcasing internal components and improved aesthetics. The Gaming End-Use segment continues to dominate revenue generation, pressuring manufacturers to innovate constantly in terms of thermal performance and aggressive styling. Furthermore, the rise of specialized workstation ATX cases catering to professionals, prioritizing noise dampening, large storage capacity, and subdued designs, represents a rapidly growing niche within the overall market structure.

AI Impact Analysis on ATX Cases Market

User queries regarding AI's impact on ATX cases frequently revolve around whether AI accelerators, deep learning GPUs, and specialized hardware necessitate fundamentally new case designs; common concerns include managing the intense heat generated by modern AI hardware, ensuring adequate space for oversized professional GPUs (like NVIDIA A-series or specialized AI accelerators), and optimizing airflow for dense computational loads typical in AI development environments. Users are seeking assurances that current ATX standards and premium cases can effectively support future generations of high-power AI infrastructure without overheating or structural compromise. Key themes emerging from these questions are the demand for "AI-Ready" certification emphasizing superior thermal management, increased vertical height clearance for large coolers, and modular support for extensive I/O tailored for high-speed data transfer required in AI training and inferencing.

The implementation of AI technology, particularly in fields requiring heavy computation, is fundamentally influencing the thermal and spatial requirements of ATX case design. AI-driven simulation tools are increasingly utilized by manufacturers to optimize internal chassis airflow patterns through Computational Fluid Dynamics (CFD), resulting in more efficient fan placements and component layouts that reduce thermal throttling. This focus on performance computing necessitates larger, more structurally rigid cases capable of handling the weight and dimensions of high-density components. Moreover, the long-term impact involves a bifurcation of the market: standard gaming/consumer ATX cases remain focused on aesthetics and general performance, while specialized AI and workstation ATX cases are engineered purely for maximum thermal capacity and component compatibility, often adopting simplified, utilitarian designs to maximize cooling potential.

- AI hardware requires significantly enhanced thermal dissipation, driving demand for larger, high-airflow ATX cases.

- Increased internal volume is mandatory to accommodate specialized AI accelerator cards and oversized cooling solutions.

- Manufacturers utilize AI-driven CFD simulation for optimizing case airflow and ventilation layouts.

- The rise of specialized AI/Deep Learning workstations creates a niche demand for high-capacity, professional-grade ATX enclosures.

- AI workloads increase continuous heat stress, necessitating superior material quality and advanced dust filtration systems to maintain component longevity.

DRO & Impact Forces Of ATX Cases Market

The ATX Cases Market is shaped by a critical interplay of drivers, restraints, opportunities, and internal and external impact forces. The dominant drivers include the sustained expansion of the global PC gaming ecosystem, the recurring necessity for hardware upgrades driven by component power creep (which mandates better thermal solutions), and the burgeoning interest in content creation and professional computing (e.g., 4K video editing, game development) which requires high-performance, multi-GPU systems. These factors create consistent baseline demand for robust, innovative, and aesthetically pleasing chassis designs, forcing manufacturers to integrate features like USB 3.2 Gen 2 connectivity, advanced dust filters, and superior acoustic dampening.

Restraints primarily involve the standardization limitations imposed by the ATX form factor itself, which can inhibit radical design innovation or necessitate significant compromises between size and feature inclusion. Furthermore, the increasing popularity of Small Form Factor (SFF) builds and highly portable computing solutions presents a competitive constraint, particularly among users who prioritize desk space or mobility over maximum upgradeability. Economic fluctuations, particularly the volatile pricing of raw materials like steel and aluminum, also impact manufacturing costs and consumer pricing, potentially dampening volume growth in budget segments.

Significant opportunities lie in the continuous integration of smart features, such as app-controlled RGB synchronization, temperature monitoring integrated into the chassis itself, and easily swappable modular panels to accommodate evolving user preferences and emerging hardware standards (e.g., PCIe 6.0 and beyond). The growing market for specialized silent computing solutions, utilizing sound-dampening materials and passive cooling designs within the ATX framework, also presents a lucrative niche. Furthermore, sustainability initiatives, including the use of recycled materials and modular designs facilitating easier component replacement and recycling, offer manufacturers a path to differentiation and meeting growing consumer ethical demands, establishing a strong external impact force on product development.

Segmentation Analysis

The ATX Cases market segmentation provides a comprehensive view of market dynamics based on distinct product characteristics, materials, and end-user applications. Understanding these segments is crucial for manufacturers to tailor product development, pricing strategies, and marketing efforts effectively. The segmentation framework addresses not only the physical specifications, such as size and material composition, but also the primary purpose for which the enclosure is purchased, differentiating between the needs of the casual user, the dedicated gamer, and the professional workstation operator.

The market is predominantly segmented by Size/Form Factor, which determines internal volume and compatibility, with Mid-Tower ATX cases dominating due to their versatility. Material segmentation is increasingly important, with the combination of steel, plastic, and high-end tempered glass defining modern case aesthetics and structural integrity. End-user segmentation remains focused heavily on the Gaming sector, yet the demand from professional Workstation users is rapidly maturing, requiring specialized features like superior noise reduction and extensive storage bay configurations, thus creating a clear division in product focus and design priorities across the industry.

- By Size/Form Factor:

- Mid-Tower ATX

- Full Tower ATX

- Super Tower ATX (Extended ATX / EATX compatible)

- By Material:

- Steel (SECC)

- Aluminum

- Tempered Glass

- Plastic/Acrylic Composites

- By End-User Application:

- Gaming/Enthusiast PC Builds

- Professional Workstations (Content Creation, Data Science)

- Standard/Office Desktop PCs

- By Price Range:

- Budget (Below $70)

- Mid-Range ($70 - $150)

- Premium/High-End (Above $150)

Value Chain Analysis For ATX Cases Market

The value chain for the ATX Cases Market begins with upstream activities focused on raw material procurement, including steel (Sheet Metal), aluminum, specialized plastics, and tempered glass panels. Key upstream suppliers are primarily based in Asian manufacturing hubs, providing standardized components such as screws, fan mounts, and basic electronic components (power buttons, front panel I/O connectors). Efficiency in this stage is determined by global commodity pricing and the negotiation power of large case manufacturers who purchase materials in bulk. Quality control at this initial stage, particularly concerning metal stamping and welding accuracy, is paramount as it dictates the structural integrity and precision of the final product assembly.

The core midstream activity involves design, manufacturing, and assembly. Major brand companies often outsource the physical production to specialized Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs), mostly in China and Taiwan, while retaining control over product design, engineering specifications (airflow patterns, cable management routes), and branding. Logistics and freight management represent a significant cost factor in the midstream, given the bulk and relative low-density of finished PC cases. Downstream activities involve distribution channels, encompassing both direct-to-consumer sales (via manufacturer websites) and indirect distribution through a complex network of e-commerce platforms (Amazon, Newegg), specialized electronics retailers, and regional distributors who supply smaller local computer shops and system integrators.

The distribution channel landscape is heavily optimized for e-commerce due to the consumer electronics nature of the product. Direct sales allow manufacturers to capture higher margins and maintain direct control over branding and customer service. However, indirect channels, particularly large online retailers, provide unparalleled market reach and logistical efficiency, handling warehousing and rapid fulfillment. System Integrators (SIs) represent a crucial downstream consumer, purchasing cases in large volumes to construct pre-built PCs, particularly for corporate or gaming PC brands. The entire value chain is characterized by rapid product cycles driven by continuous hardware updates, requiring flexible manufacturing and agile inventory management to prevent stock obsolescence.

ATX Cases Market Potential Customers

Potential customers for ATX Cases are broadly categorized based on their technical needs, budgetary constraints, and primary use case for the finished computer system. The largest and most influential segment comprises PC Gaming Enthusiasts and Hobbyist Builders. These buyers are typically highly knowledgeable about component specifications and prioritize features such as high-airflow designs, aesthetic customization (RGB lighting, tempered glass), ample space for custom liquid cooling, and support for the largest, latest graphics cards. They frequently seek Mid-Tower or Full-Tower options in the mid-to-high price range and are often early adopters of new design trends and technology standards.

A second crucial customer base consists of Professional Users and Workstation Operators, including graphic designers, video editors, 3D animators, software developers, and AI/ML engineers. This demographic prioritizes functionality over aesthetics, demanding superior noise dampening, large internal volume for multiple storage drives (HDD/SSD arrays), robust structural rigidity to support heavy components, and excellent cable management features for clean server-like setups. These users generally opt for cases designed for maximum airflow and often purchase premium models optimized for silence and professional environments. Furthermore, large System Integrators (SIs) and Original Equipment Manufacturers (OEMs) purchasing cases in bulk for pre-built desktop lines constitute a significant B2B customer segment, driven primarily by cost-effectiveness, ease of assembly, and consistent supply chain reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.28 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | 6.75% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corsair, Lian Li, NZXT, Cooler Master, Phanteks, Fractal Design, Thermaltake, DeepCool, SilverStone, InWin, be quiet!, ASUS (ROG/TUF), Montech, Antec, Cougar, Raijintek, Jonsbo, Tecware, XPG, Gigabyte (AORUS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ATX Cases Market Key Technology Landscape

The ATX Cases market, while centered on a relatively static form factor standard, relies heavily on continuous technological refinement concerning materials science, manufacturing processes, and thermal engineering. A major technological focus is the optimization of airflow dynamics, often leveraging high-precision laser cutting for mesh panels and utilizing advanced perforated materials to achieve maximum air intake while maintaining adequate dust filtration. The integration of tool-less design mechanisms is a crucial technological advancement, utilizing magnetic closures, quick-release panels, and screw-less drive bays, dramatically improving the user experience during the build and maintenance phases. This emphasis on accessibility simplifies complex component installation, making high-end PC building more approachable for a broader consumer base.

A second significant technological pillar is thermal management. Modern ATX cases are engineered to support complex liquid cooling infrastructure, requiring precise mounting points for large radiators (up to 420mm) in multiple locations (front, top, side). Advanced models integrate proprietary cable management solutions, such as dedicated cable routing channels and reusable Velcro straps, which not only enhance aesthetics but critically reduce air blockage caused by disorganized wiring, thereby maximizing internal airflow efficiency. Furthermore, the adoption of proprietary fan control hubs and integrated RGB controllers, often managed via a single USB connection to the motherboard, streamlines component synchronization and thermal monitoring, transitioning the case from a passive shell into an active thermal management component.

Material innovation, particularly the sophisticated use of tempered glass and high-grade aluminum, continues to drive the premium segment. Aluminum allows for lighter weight while maintaining structural rigidity, often employed in high-end enthusiast cases. Tempered glass panels are increasingly utilizing easy-access hinge mechanisms rather than fixed screws, further simplifying maintenance. In the budget and mid-range segments, advancements in stamped steel and plastic injection molding techniques allow manufacturers to achieve complex geometries, mimicking the high-end aesthetic at a fraction of the cost, ensuring that modern design language permeates all price tiers of the ATX case market.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by massive youth demographics, rapid urbanization, and the region's established dominance in the eSports and professional gaming sectors, particularly in China, South Korea, and India. High PC penetration rates, coupled with the regional propensity for frequent technology upgrades, ensure a consistently high demand for both budget and premium ATX enclosures. Manufacturing concentration in Taiwan and mainland China also facilitates rapid design-to-market cycles, giving APAC a competitive advantage in pricing and innovation dissemination.

- North America (NA): North America holds a substantial market share, driven by high consumer spending power and a mature market for enthusiast PC building and professional content creation. Demand in this region leans heavily towards premium, feature-rich Full Tower and Mid-Tower ATX cases that support extreme liquid cooling and multiple high-end GPUs. Key drivers include the strong DIY culture, the large community of streamers and professional gamers, and significant demand from the tech industry for high-performance workstations.

- Europe: The European market is characterized by a high demand for aesthetically refined and acoustically optimized ATX cases. Consumers in Western Europe (Germany, UK, France) often prioritize silent operation and minimalist design, favoring manufacturers who incorporate high-density sound dampening materials and highly efficient low-noise cooling solutions. Regulatory environments regarding energy efficiency and electronic waste also influence purchasing decisions, favoring modular and durable case designs.

- Latin America (LATAM): The LATAM region represents an emerging market with significant growth potential, although market penetration is currently constrained by economic factors and fluctuating currency values. Demand is focused predominantly on the budget and mid-range ATX segment, driven by the expanding middle class and the growing affordability of entry-level gaming hardware. Distribution channels and local assembly are critical elements defining market success in this diverse region.

- Middle East and Africa (MEA): The MEA market, while the smallest, is experiencing concentrated growth in specific high-income areas, particularly the GCC countries, driven by significant government investment in technology infrastructure and the rising popularity of high-end console and PC gaming. Thermal performance is a critical buying factor due to high ambient temperatures, leading to a strong preference for high-airflow mesh designs and robust cooling support in ATX cases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ATX Cases Market.- Corsair

- Lian Li

- NZXT

- Cooler Master

- Phanteks

- Fractal Design

- Thermaltake

- DeepCool

- SilverStone

- InWin

- be quiet!

- ASUS (ROG/TUF)

- Montech

- Antec

- Cougar

- Raijintek

- Jonsbo

- Tecware

- XPG

- Gigabyte (AORUS)

Frequently Asked Questions

Analyze common user questions about the ATX Cases market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key thermal design considerations in modern ATX cases?

Modern ATX case thermal design prioritizes high-volume unrestricted airflow, achieved through mesh panels and strategically placed fan mounts (front intake, top exhaust). Essential considerations include dedicated space for large radiators (up to 420mm) and optimized cable management to prevent internal air turbulence, ensuring efficient heat dissipation from high-power CPUs and GPUs.

How is the adoption of modularity impacting ATX case design and consumer choice?

Modularity allows consumers to reconfigure internal layouts, such as swapping drive cages or removing fan brackets, to suit specific build needs like maximizing liquid cooling space or installing oversized GPUs. This enhances versatility, simplifies the building process, and extends the lifespan of the case across multiple hardware upgrades.

Which regional market holds the highest growth potential for ATX cases?

The Asia Pacific (APAC) region, specifically countries like China and India, exhibits the highest growth potential. This growth is driven by the enormous size of the gaming market, increasing disposable income, rapid urbanization, and a youthful population with a strong interest in DIY PC building and eSports.

What is the primary difference between a Mid-Tower and a Full Tower ATX case?

A Mid-Tower ATX case offers a balanced footprint, supporting standard ATX motherboards and typically two large radiators. A Full Tower ATX case offers substantially more internal volume, supporting E-ATX motherboards, multiple large radiators (three or more), extensive storage arrays, and custom water cooling loops, catering primarily to extreme enthusiasts and workstation users.

Are Tempered Glass panels detrimental to ATX case cooling performance?

Historically, solid tempered glass panels on the front or top restricted airflow, negatively impacting cooling. However, modern designs mitigate this by using perforated mesh alongside glass or offsetting the glass panels from the chassis frame to ensure adequate side ventilation, balancing aesthetics with necessary thermal performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager