Audible and Visual Signaling Devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442206 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Audible and Visual Signaling Devices Market Size

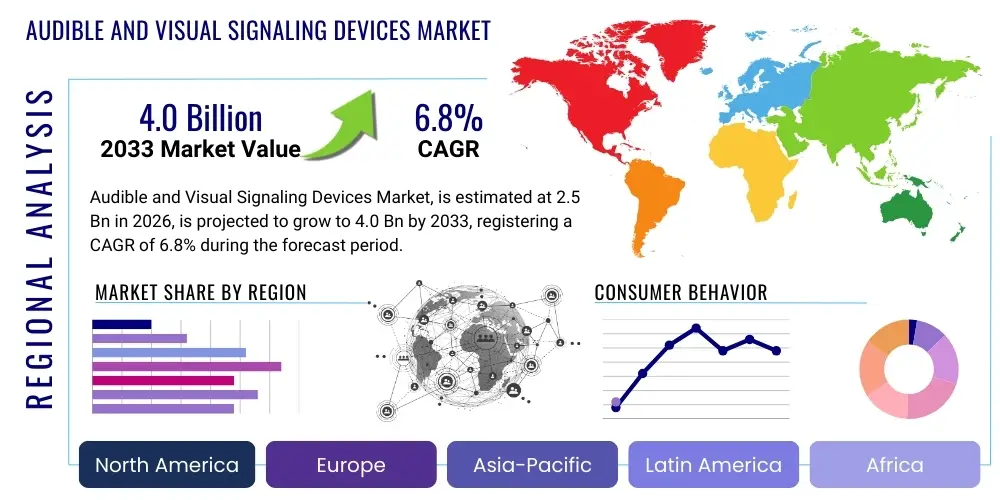

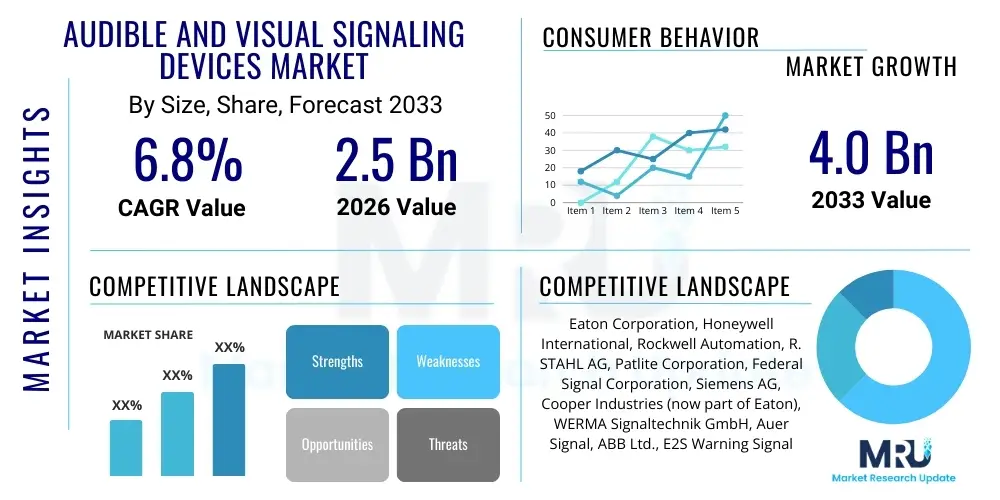

The Audible and Visual Signaling Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Audible and Visual Signaling Devices Market introduction

The Audible and Visual Signaling Devices Market encompasses a wide array of electronic and electromechanical components designed to alert personnel to potential hazards, operational status changes, or emergency situations through sound, light, or a combination of both. These devices are fundamental safety components across industrial, commercial, and public sectors, ensuring rapid response and compliance with stringent safety regulations. Key product types include horns, sirens, bells, beacons, strobes, and stack lights, which vary significantly in output intensity, environmental resilience, and communication protocol integration.

The core function of these devices is to overcome ambient noise and visibility challenges within complex operating environments, ranging from dimly lit warehouses and high-noise manufacturing floors to public transportation systems and maritime applications. The increasing complexity of industrial machinery and the growing global emphasis on worker safety standards, particularly in high-risk sectors like oil and gas, chemical processing, and mining, necessitate the adoption of highly reliable and digitally integrated signaling solutions. Modern devices are often IP-rated for resistance against dust and moisture and certified for use in hazardous areas (e.g., ATEX or IECEx zones).

Major applications span machine status indication, fire alarm systems, general emergency evacuation warnings, process control alerts, and vehicular safety systems. The market benefits from continuous technological enhancements, such as the transition from traditional incandescent bulbs to highly efficient LED technology, and the incorporation of wireless networking capabilities (e.g., IoT integration). Driving factors include mandatory safety compliance worldwide, the modernization of aging industrial infrastructure, and the demand for sophisticated signaling systems capable of providing differentiated alerts based on event severity, minimizing confusion during critical situations.

Audible and Visual Signaling Devices Market Executive Summary

The Audible and Visual Signaling Devices Market is undergoing a significant transformation driven by the confluence of digitalization, stringent regulatory environments, and the need for enhanced operational efficiency. Current business trends indicate a shift toward smart, connected devices that offer remote diagnostics, predictive maintenance capabilities, and integration with centralized control systems (SCADA and BMS). Manufacturers are focusing on developing products that consume less power while delivering higher output clarity, leveraging advances in acoustic technology and high-intensity LEDs. Furthermore, consolidation within the supply chain is leading to integrated solutions providers offering end-to-end safety and communication platforms rather than standalone signaling units, catering specifically to complex industrial automation projects and smart city infrastructure development.

Regionally, the Asia Pacific (APAC) segment is expected to exhibit the highest growth rate, primarily fueled by rapid industrialization, large-scale infrastructure projects (e.g., smart factories and metro systems), and the increasing adoption of Western safety standards in manufacturing hubs like China, India, and Southeast Asia. North America and Europe, while mature markets, maintain dominance in terms of market value due to established regulatory frameworks (e.g., OSHA, EU Directives) and high expenditure on retrofitting existing facilities with advanced, compliant signaling technologies. These regions are also leading the adoption of niche, high-performance signaling for harsh and hazardous environments (HAZLOC areas).

Segment trends reveal that the visual signaling devices segment, particularly LED-based beacons and strobes, is capturing significant market share due to their superior visibility, longevity, and reduced energy footprint compared to traditional halogen or xenon flashers. By application, the industrial segment remains the largest end-user, demanding multi-tone sirens and customizable stack lights for machine status monitoring. Within the product type segmentation, combination units (integrating both audible and visual alerts) are gaining traction, providing comprehensive solutions tailored for maximizing alert effectiveness in diverse operational settings, thus simplifying procurement and installation for end-users seeking maximal safety coverage with minimal hardware complexity.

AI Impact Analysis on Audible and Visual Signaling Devices Market

User inquiries regarding AI's influence on the signaling market often center on predictive anomaly detection, context-aware alerting, and false alarm reduction. Users are keenly interested in how Artificial Intelligence can move signaling systems beyond reactive alerts to proactive safety measures. Key themes include the integration of AI-powered video analytics with visual signaling (e.g., flashing lights triggered only when unauthorized personnel are detected in a high-risk zone), the use of machine learning algorithms to filter out ambient noise and ensure siren audibility optimization based on environmental conditions, and the potential for deep learning models to assess the severity of an incident in real-time, tailoring the alert signal (intensity, tone, pattern) accordingly. There is a strong expectation that AI will significantly enhance the intelligence and reliability of these devices, transforming them from simple indicators into integral components of sophisticated Industrial Internet of Things (IIoT) safety systems.

The application of AI introduces a paradigm shift by enabling signaling devices to participate actively in decision-making processes, rather than passively receiving activation commands. For instance, in complex manufacturing environments, an AI layer could analyze data streams from multiple sensors (vibration, temperature, pressure) and determine the probability of equipment failure, triggering a preventative, low-level warning signal before a critical event occurs. This predictive capability significantly reduces downtime and maintenance costs. Furthermore, AI facilitates personalized safety alerts; utilizing localization data, the system can ensure that only personnel in the immediate affected area receive the warning, minimizing widespread panic or operational disruption in unaffected zones.

However, concerns also revolve around the cybersecurity implications of connecting safety-critical devices to AI processing hubs, and the need for standardized protocols to ensure interoperability between proprietary AI safety platforms and diverse signaling hardware. The future integration of Generative AI (GenAI) might also enable highly customized signal creation, optimizing distinct auditory or visual patterns for specific neurological responses, maximizing reaction speed and clarity across different cultural and language groups, thereby elevating the universality and effectiveness of these safety mechanisms globally.

- AI-driven predictive maintenance: Algorithms analyze sensor data to signal potential equipment failure proactively.

- Context-aware alerting: Systems utilize environmental and locational data to adjust signal intensity and type dynamically.

- False alarm reduction: Machine learning filters out non-critical events, enhancing the credibility of genuine alerts.

- Integration with computer vision: AI analyzes camera feeds to trigger visual signals based on specific detected hazards (e.g., unauthorized access or unsafe acts).

- Optimized audibility: AI processes ambient noise levels to modulate siren frequency and volume for maximum penetration and clarity.

- Cybersecurity risks: Increased complexity necessitates robust security measures for interconnected safety systems.

DRO & Impact Forces Of Audible and Visual Signaling Devices Market

The market for Audible and Visual Signaling Devices is primarily governed by mandatory safety regulations (Drivers), constrained by integration complexities and costs (Restraints), and bolstered by the evolution toward smart, connected industrial infrastructure (Opportunities). The enduring impact forces include global efforts to minimize industrial accidents and fatalities, necessitating continuous upgrades and compliance checks. The demand for highly reliable, failsafe signaling apparatus, particularly in explosive atmospheres (HAZMAT environments), exerts constant pressure on manufacturers to innovate materials and certification processes.

Key drivers center around governmental mandates enforcing occupational safety and health standards across industries, notably the petrochemical, construction, and power generation sectors. This regulatory push ensures a stable baseline demand for new installations and mandated replacements of outdated, non-compliant equipment. Furthermore, the global trend toward sophisticated industrial automation, often implemented via Industry 4.0 principles, requires signaling devices that can communicate effectively within complex networked environments, acting as the human interface for machine-to-machine communication protocols. These factors accelerate the adoption of advanced, high-specification signaling solutions.

Conversely, the market faces restraints such as the relatively high initial investment costs associated with certified, high-durability signaling systems, especially those required for hazardous locations. Additionally, the heterogeneity of global regulatory standards, requiring multiple product certifications (e.g., UL, ATEX, CCC), complicates market entry and product standardization for multinational corporations. Opportunities lie predominantly in the integration of Wireless IoT technology into signaling devices, enabling flexible deployment and centralized monitoring, alongside the burgeoning demand from developing economies investing heavily in public infrastructure and manufacturing capacity, particularly within Asia Pacific and parts of the Middle East.

- Drivers: Strict global safety standards and occupational health regulations; rapid industrialization and expansion of manufacturing sector; technological migration towards high-efficiency LED and networked signaling solutions.

- Restraints: High initial investment cost for certified hazardous area devices; complexity in integrating legacy systems with new digital signaling platforms; fragmentation and variability of international regulatory compliance requirements.

- Opportunity: Expansion of the Industrial Internet of Things (IIoT) ecosystem; increasing demand for wireless and battery-powered signaling solutions; growth in smart city projects and public safety infrastructure modernization.

- Impact Forces: Consumer expectations for enhanced public safety; stringent insurance and liability requirements compelling companies to adopt best-in-class alerting technologies; innovation cycles driven by materials science improving device durability and environmental resistance.

Segmentation Analysis

The Audible and Visual Signaling Devices Market is comprehensively segmented based on product type, technology, application, and end-user, reflecting the diverse operational environments and compliance requirements globally. Understanding these segments is crucial for manufacturers to tailor their product development strategies and for end-users to select appropriate devices that meet specific safety mandates. Product types range from basic, localized alarms to complex, centralized communication systems, each optimized for distinct decibel levels, light output patterns, and environmental resilience requirements. The ongoing shift toward digital integration impacts all segments, increasing the preference for smart, addressable devices.

Technology segmentation highlights the evolution from traditional electromechanical and incandescent devices to solid-state electronics, primarily driven by energy efficiency and maintenance reduction goals. LEDs dominate the visual segment due to their longevity and high light output, while advancements in piezo and electronic sound generation improve the clarity and versatility of audible alarms. Application segmentation distinguishes between generalized warning systems (e.g., fire alarms) and process-specific indicators (e.g., machine status indicators on factory floors). This granular division allows for specialized solutions tailored to operational nuances, such as corrosive environments or extreme temperatures.

The end-user segmentation, spanning industrial, commercial, and public sectors, reveals where the highest safety expenditure occurs. Industrial users, particularly those in critical infrastructure and heavy manufacturing, demand the highest level of certification (e.g., explosion-proof signals). Conversely, commercial and institutional users focus more on aesthetically pleasing designs and integration with Building Management Systems (BMS). The growth trajectory of each segment is closely tied to regional industrial activity and governmental investment cycles, ensuring a dynamic competitive landscape where specialization often dictates market success.

- By Product Type:

- Audible Signaling Devices (Horns, Sirens, Bells, Buzzers)

- Visual Signaling Devices (Beacons, Strobes, Stack Lights, Status Lights)

- Combination Devices (Audible and Visual Integrated Units)

- Public Address/Voice Evacuation Systems

- By Technology:

- LED

- Xenon/Strobe

- Incandescent/Halogen

- Electromechanical (Mechanical Sirens, Bells)

- By Application:

- Industrial & Process Control

- Fire & Gas Alarm Systems

- Machine Status Indication

- Hazardous Location Warning

- Public Area Safety & Traffic Control

- By End-User Industry:

- Oil & Gas and Petrochemical

- Manufacturing and Automation (Automotive, Heavy Machinery)

- Mining and Construction

- Chemical & Pharmaceutical

- Energy & Power Generation

- Transportation (Rail, Marine, Road)

- Commercial & Institutional (Hospitals, Schools, Retail)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA) (Saudi Arabia, UAE, South Africa)

Value Chain Analysis For Audible and Visual Signaling Devices Market

The value chain for Audible and Visual Signaling Devices begins with the upstream suppliers of critical raw materials and components, which include electronic components (microcontrollers, drivers, LEDs), acoustic components (transducers, horns), and specialized materials (high-grade polymers, explosion-proof metals, and heat-resistant glass/polycarbonate lenses). Due to the safety-critical nature of the final product, upstream procurement emphasizes quality control, certified material sourcing, and adherence to specific environmental and performance standards (e.g., UV resistance, high temperature tolerance). Manufacturers rely heavily on specialized electronics and certified hazardous location component providers to ensure their final assemblies meet stringent regulatory requirements.

The core manufacturing stage involves design, assembly, testing, and regulatory certification (e.g., UL, ATEX, IECEx compliance), which is often the most time-consuming and capital-intensive part of the chain. Manufacturers leverage advanced production techniques for miniaturization and enhanced durability. Downstream activities involve distribution channels, installation, and post-sales service. Given the technical complexity of modern, networked signaling systems, installation and commissioning often require specialized systems integrators or certified electrical contractors, ensuring proper interconnection with existing safety and control systems (BMS, PLC, SCADA).

Distribution channels exhibit a dual structure: Direct sales are common for large-scale industrial projects or highly customized hazardous location solutions where technical consultation is mandatory. Indirect channels, primarily utilizing specialized industrial distributors, electrical wholesalers, and safety equipment resellers, handle standard, off-the-shelf products and routine replacement needs. The complexity of regulatory compliance significantly influences channel management, as distributors often need specialized knowledge to ensure end-users purchase the correct, certified product for their operational environment, reinforcing the importance of knowledgeable distribution partners.

Audible and Visual Signaling Devices Market Potential Customers

The primary end-users and buyers of Audible and Visual Signaling Devices are entities operating complex industrial processes or managing high-traffic public spaces where rapid and unambiguous communication of status or danger is non-negotiable. These customers span various verticals, including heavy industry procurement managers, facility safety directors, system integrators specializing in industrial automation, and government agencies responsible for public infrastructure and transportation safety. The decision-making process is heavily influenced by regulatory compliance mandates, insurance requirements, and the desire to protect expensive assets and human life, making reliability and certification paramount purchasing criteria.

In the industrial sector, potential customers include large global petrochemical companies requiring ATEX/IECEx certified explosion-proof signals for their refineries and offshore platforms, automotive manufacturers needing integrated stack lights for Lean Manufacturing processes, and utility companies modernizing their power generation and distribution facilities with networked alarms. These customers purchase devices for both fire/gas detection systems and process control monitoring.

Outside of heavy industry, key buyers are found in the commercial and public sectors. This includes hospitals, educational institutions, commercial office buildings, and transportation authorities (airports, railway systems). These entities prioritize voice evacuation systems and aesthetically integrated visual devices that comply with building codes (e.g., NFPA standards). Their purchasing decisions are often centralized through facilities management or construction firms handling large-scale installations, emphasizing ease of maintenance and integration with existing security and building management systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Honeywell International, Rockwell Automation, R. STAHL AG, Patlite Corporation, Federal Signal Corporation, Siemens AG, Cooper Industries (now part of Eaton), WERMA Signaltechnik GmbH, Auer Signal, ABB Ltd., E2S Warning Signals, Pfannenberg Group, Klaxon Signals Ltd., Moflash Signalling Ltd., Tomar Electronics, Inc., BRY-AIR (Asia) Pvt. Ltd., Shenzhen Kejin Electronic Co., Ltd., MAFELEC, Kahlenberg Bros. Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Audible and Visual Signaling Devices Market Key Technology Landscape

The current technology landscape in the Audible and Visual Signaling Devices market is dominated by digitalization and connectivity, moving away from simple, isolated warning systems toward integrated, intelligent safety networks. Key advancements focus on the implementation of high-efficiency LED matrices and optics to maximize light output while minimizing power consumption and maintenance requirements. Modern visual devices utilize advanced lensing and reflector designs to ensure 360-degree visibility and optimal light penetration in dusty or smoky environments. Furthermore, acoustic technology is evolving to include multi-tone and synthesized voice messages, allowing for customizable and highly differentiated alerts that minimize listener confusion, a crucial element in large industrial complexes where specific actions must follow specific alarms.

The primary technological disruption stems from the integration of wireless communication protocols and IoT capabilities. Many new devices are equipped with integrated Wi-Fi, Bluetooth, or proprietary low-power wide-area network (LPWAN) modules, enabling remote monitoring, diagnostics, and addressability. This connectivity facilitates compliance reporting, tracks device health in real-time, and allows for centralized command and control via cloud-based platforms. For instance, wireless stack lights eliminate complex wiring runs, significantly reducing installation time and costs in manufacturing retrofits, thereby addressing a long-standing constraint related to infrastructure complexity.

Another crucial area of innovation is in power management and intrinsic safety. Devices designed for hazardous areas (HAZLOC) are increasingly incorporating robust intrinsically safe circuits and energy harvesting or low-power technologies to maintain operation in environments where electrical sparks must be rigorously avoided. Standardized communication protocols, such as IO-Link, are also gaining traction, simplifying the interface between signaling devices and industrial control systems (PLCs), enhancing data exchange capabilities, and making the signaling device a true data-generating node within the automated factory ecosystem.

Regional Highlights

- North America: This region is characterized by exceptionally stringent regulatory enforcement, particularly by OSHA and NFPA standards, driving consistent demand for certified, high-reliability signaling equipment. The market here is mature, focusing heavily on technology upgrades, replacement of legacy systems, and the integration of sophisticated IoT-enabled safety networks across the oil and gas, utility, and heavy manufacturing sectors. Significant expenditure is directed towards certified Hazardous Location (HAZLOC) signaling devices.

- Europe: The European market is highly regulated by CE directives and ATEX standards, mandating the use of approved equipment in explosive atmospheres. Germany, the UK, and France are key drivers, showing strong adoption of advanced machine signaling (stack lights with IO-Link) due to advanced industrial automation efforts (Industry 4.0). Sustainability concerns also favor energy-efficient LED and low-power wireless solutions.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid infrastructural development, massive manufacturing capacity expansion (especially in China and India), and increasing awareness and implementation of international safety standards. The transition from local, rudimentary warning systems to standardized, networked solutions represents a major growth opportunity, particularly within new smart city and mega-factory construction projects.

- Latin America: This region demonstrates moderate growth, driven by investments in mining, oil exploration, and governmental infrastructure projects. Market growth is often dependent on commodity price stability, which influences capital expenditure in the industrial sector. Brazil and Mexico are leading the adoption of international safety norms, driving demand for compliance-certified equipment.

- Middle East & Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, heavily influenced by large-scale oil and gas investments and ambitious construction projects (e.g., NEOM in Saudi Arabia). Extreme environmental conditions in the region necessitate devices with exceptional durability, high ingress protection (IP ratings), and certified resistance to high temperatures and corrosive atmospheres, favoring premium-grade product suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Audible and Visual Signaling Devices Market.- Eaton Corporation

- Honeywell International Inc.

- Rockwell Automation, Inc.

- R. STAHL AG

- Patlite Corporation

- Federal Signal Corporation

- Siemens AG

- Cooper Industries (now part of Eaton)

- WERMA Signaltechnik GmbH + Co. KG

- Auer Signal GmbH

- ABB Ltd.

- E2S Warning Signals

- Pfannenberg Group

- Klaxon Signals Ltd.

- Moflash Signalling Ltd.

- Tomar Electronics, Inc.

- BRY-AIR (Asia) Pvt. Ltd.

- Shenzhen Kejin Electronic Co., Ltd.

- MAFELEC

- Kahlenberg Bros. Co.

Frequently Asked Questions

Analyze common user questions about the Audible and Visual Signaling Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Audible and Visual Signaling Devices Market?

The market growth is primarily driven by stringent global occupational safety and health regulations (like OSHA and ATEX), the rapid expansion and modernization of industrial infrastructure (Industry 4.0 adoption), and the technological shift toward highly efficient, durable LED and networked signaling solutions that improve operational safety and compliance reporting.

How is the integration of IoT technology influencing signaling device functionality?

IoT integration is transforming signaling devices into smart, addressable nodes capable of remote diagnostics, real-time status monitoring, and centralized control via cloud platforms. This functionality enhances maintenance efficiency, enables predictive alerting, and facilitates seamless integration with larger Building and Industrial Management Systems (BMS/SCADA).

What is the significance of hazardous location (HAZLOC) certification in this market?

HAZLOC certification (such as ATEX, IECEx, or UL) is critical for signaling devices used in potentially explosive atmospheres, common in the oil & gas, chemical, and mining industries. This certification ensures that the device is intrinsically safe and will not ignite flammable gases or dust, representing a mandatory compliance requirement that drives premium pricing and specialized product development.

Which product segment holds the largest market share and why?

The visual signaling devices segment, particularly LED-based beacons and strobes, typically holds a large share due to their widespread use across all end-user industries (industrial, commercial, public safety). LED technology offers superior lifespan, lower energy consumption, and high visibility compared to older incandescent or xenon technologies, making it the preferred choice for both new installations and system retrofits.

What role does Artificial Intelligence (AI) play in modern signaling systems?

AI is increasingly used to enhance the intelligence of signaling systems by enabling context-aware and predictive alerting. AI analyzes sensor data to filter out false alarms, dynamically adjust signal characteristics (volume/intensity) based on ambient conditions, and predict potential equipment failures before they occur, shifting the system from reactive alerting to proactive safety management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager