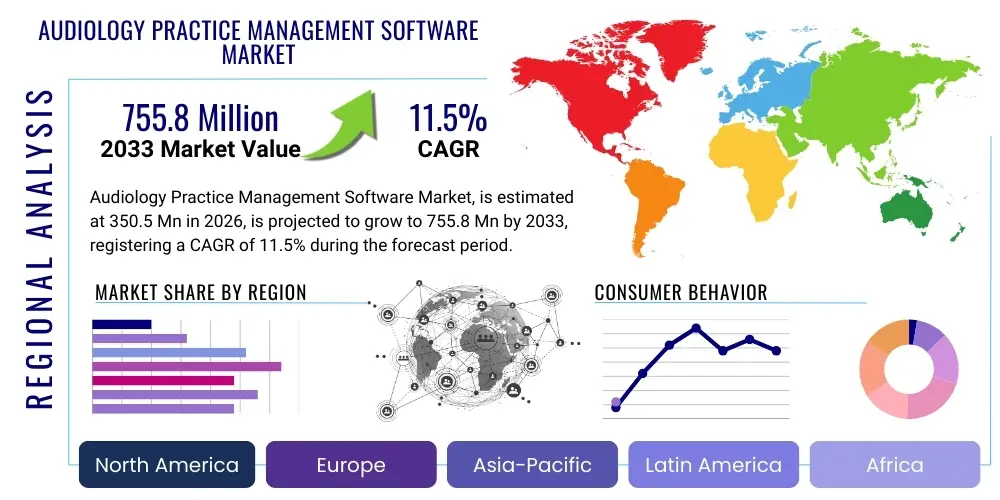

Audiology Practice Management Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442439 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Audiology Practice Management Software Market Size

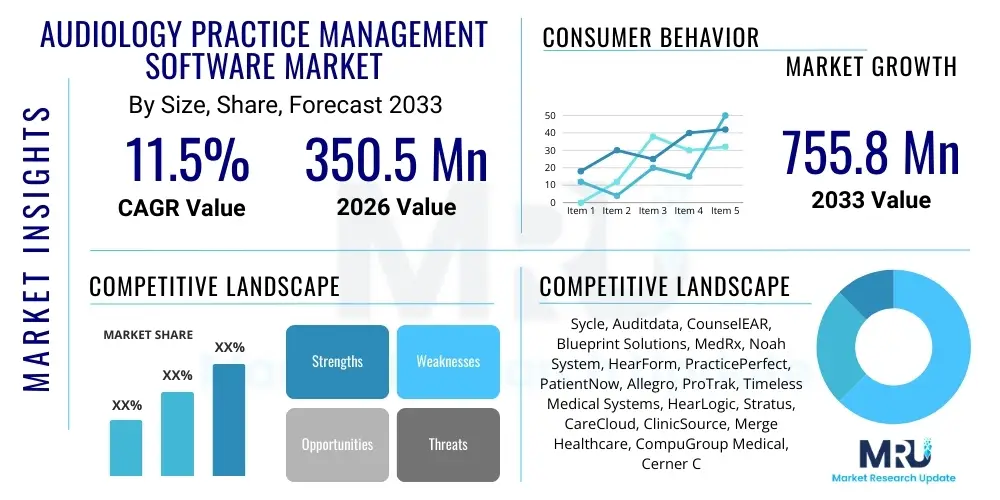

The Audiology Practice Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 755.8 Million by the end of the forecast period in 2033.

Audiology Practice Management Software Market introduction

The Audiology Practice Management Software (APMS) Market encompasses specialized digital solutions designed to streamline and optimize the operational, clinical, and administrative workflows within audiology clinics, hearing aid centers, and ENT practices. These comprehensive systems integrate functions ranging from patient scheduling and electronic health records (EHR) management to complex claims processing and inventory control for hearing devices. The core product offering revolves around enhancing efficiency, ensuring regulatory compliance, and ultimately improving patient care delivery by providing a centralized, accessible platform for all practice data. Given the increasing prevalence of hearing loss globally and the corresponding rise in specialized audiological services, the adoption of sophisticated APMS is becoming a critical requirement for modern practice viability.

Major applications of APMS include automated appointment reminders, real-time diagnostic data integration (e.g., audiogram integration), comprehensive billing and insurance claim submission (including coordination of benefits), and detailed financial reporting. The immediate benefits derived from implementation are multifaceted, including significant reductions in administrative overhead, minimization of human errors associated with manual data entry, and faster revenue cycle management due to optimized coding and prompt claims follow-up. Furthermore, these platforms facilitate enhanced interoperability with other healthcare systems, crucial for holistic patient treatment pathways.

Key driving factors propelling the growth of this market include the global transition toward digital healthcare infrastructure, the increasing demand for seamless integration of diagnostic and clinical data, and stringent regulatory requirements pertaining to patient data security (such as HIPAA in the US and GDPR in Europe). The necessity for audiology practices to manage complex inventory associated with high-value hearing aids and cochlear implants further necessitates specialized software solutions. Moreover, technological advancements focusing on cloud deployment and mobile access are lowering entry barriers and increasing scalability for smaller private practices, thereby fueling overall market expansion.

Audiology Practice Management Software Market Executive Summary

The Audiology Practice Management Software Market is experiencing robust acceleration driven by the imperative for operational efficiency and regulatory adherence across healthcare sectors. Current business trends indicate a strong movement towards cloud-based deployments, which offer greater flexibility, lower initial capital expenditure, and enhanced security features compared to traditional on-premise systems. Furthermore, market competition is increasingly focused on offering all-in-one solutions that seamlessly integrate EHR, inventory management, and telehealth capabilities, moving away from disparate system utilization. Strategic mergers and acquisitions among software providers are also shaping the competitive landscape, aiming to consolidate feature sets and expand geographic reach, thereby standardizing best practices for audiological workflow management.

Regionally, North America maintains market dominance due to its highly structured healthcare reimbursement system, high adoption rates of advanced medical technologies, and the presence of numerous large-scale audiology chains and specialized clinics demanding sophisticated solutions. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by expanding healthcare infrastructure investments, rising disposable incomes leading to greater access to specialized hearing care, and governmental initiatives promoting digital health records adoption in developing economies such as India and China. European markets exhibit mature adoption, driven primarily by stringent data protection laws that necessitate certified and secure APMS platforms.

Segment trends highlight the dominance of the billing and revenue cycle management (RCM) module, as optimizing financial throughput remains a primary concern for practice owners. Simultaneously, the electronic health records (EHR) segment is witnessing significant innovation, specifically related to integrating sophisticated diagnostic reporting and visualization tools tailored for audiometric data. Private practices, which represent the largest end-user segment, are rapidly adopting tailored, subscription-based cloud solutions to manage growing patient volumes while minimizing internal IT burden. The shift towards value-based care models also emphasizes the need for advanced reporting and analytics capabilities integrated within APMS to demonstrate clinical outcomes and justify reimbursement.

AI Impact Analysis on Audiology Practice Management Software Market

User queries regarding the impact of Artificial Intelligence (AI) on Audiology Practice Management Software frequently center on automation potential, diagnostic augmentation, and workflow efficiency improvements. Key concerns revolve around whether AI can reliably handle complex claims submission, personalize patient communication, and integrate predictive analytics without compromising data privacy or ethical boundaries. Users are highly expectant that AI will reduce the administrative burden associated with documentation and scheduling, while simultaneously seeking assurance that these technologies will enhance, rather than replace, the critical human interaction element in audiological care. The primary theme identified is the expectation of intelligent automation for non-clinical tasks and enhanced decision support tools for clinical data interpretation.

- AI-driven automation of claims scrubbing and error detection, accelerating the revenue cycle.

- Predictive scheduling algorithms optimizing resource allocation and reducing no-show rates.

- Enhanced diagnostic support systems utilizing machine learning to analyze audiometric data trends and suggest preliminary treatment pathways.

- Natural Language Processing (NLP) integration for automated clinical documentation and transcription from patient consultations.

- Personalized patient engagement tools, including AI chatbots for initial inquiries and tailored follow-up based on treatment status.

- Integration of machine vision for improved inventory management of specialized hearing aids and devices.

- Risk scoring mechanisms for patient populations, identifying those requiring proactive intervention based on historical data patterns.

DRO & Impact Forces Of Audiology Practice Management Software Market

The market for Audiology Practice Management Software is primarily driven by the increasing global prevalence of hearing disorders, which necessitates efficient management of specialized patient populations and complex treatment regimens. This driver is powerfully complemented by regulatory mandates across major economies that push healthcare providers toward the adoption of certified electronic health records (EHRs) to ensure data interoperability, security, and standardization. Furthermore, the commercial need for optimized revenue cycle management (RCM) is a potent force, as specialized audiology services often involve intricate insurance coding and inventory tracking that demand automated, purpose-built software solutions to maximize financial viability. These collective factors create a sustained demand for robust and integrated APMS platforms capable of handling both clinical documentation and advanced administrative logistics efficiently.

Restraints, however, temper this growth trajectory. A significant challenge remains the high initial cost of implementation and migration, particularly for smaller, independent audiology practices with limited IT budgets and internal expertise. Data migration from legacy systems or paper records poses substantial logistical hurdles and security risks. Additionally, resistance to technological change among certain demographics of healthcare professionals, coupled with the steep learning curve required for mastering complex integrated platforms, slows down the rapid uptake of new software features. Interoperability issues, particularly the seamless exchange of data between APMS and hospital information systems (HIS) or proprietary hearing aid programming software, also present a technical restraint requiring ongoing vendor investment.

Opportunities for market expansion are substantial, particularly through the development of highly integrated telehealth modules, which gained prominence post-pandemic and allow for remote audiological consultations and device adjustments, broadening the geographical reach of practices. Furthermore, the untapped potential in emerging markets, coupled with the increasing focus on preventive and proactive hearing health management, creates avenues for vendors to offer specialized APMS tailored for screening programs and public health initiatives. The increasing sophistication of data analytics and business intelligence features within APMS provides opportunities for practices to make data-driven decisions regarding staffing, inventory stocking, and marketing strategies, transitioning from mere data record-keeping to actionable strategic intelligence. The major impact forces thus center on the acceleration provided by regulatory compliance and digital integration, while being mitigated by cost sensitivity and technological adoption challenges.

Segmentation Analysis

The Audiology Practice Management Software Market is extensively segmented based on deployment model, end-user type, functionality, and pricing structure, allowing vendors to cater specifically to the varied operational requirements of different audiology settings. Analyzing these segments provides crucial insights into adoption trends, expenditure patterns, and the specific technological needs driving purchasing decisions, ranging from large hospital-affiliated clinics demanding robust, on-premise solutions to small private practices preferring flexible, cloud-based subscriptions. This multi-dimensional segmentation ensures that the diverse complexities of modern audiology service delivery are adequately addressed by market offerings.

- By Deployment Model:

- Cloud-Based

- On-Premise

- By End-User:

- Hospitals and Medical Centers

- Private Audiology Clinics

- Hearing Aid Centers

- Research and Academic Institutions

- By Functionality:

- Electronic Health Records (EHR)

- Scheduling and Appointment Management

- Billing and Revenue Cycle Management (RCM)

- Inventory Management

- Reporting and Analytics

- Telehealth and Remote Services

- By Pricing Model:

- Subscription-Based (SaaS)

- Perpetual License

Value Chain Analysis For Audiology Practice Management Software Market

The value chain for the Audiology Practice Management Software Market begins with upstream activities focused on core software development, technological infrastructure provisioning, and specialized content creation, such as pre-built audiometric templates and compliance modules. Upstream analysis involves highly skilled software engineers, data scientists specializing in healthcare data management, and partnerships with cloud service providers (like AWS or Azure). Key inputs include robust cybersecurity frameworks, scalable database architecture, and integration standards (e.g., HL7, DICOM) to ensure seamless data exchange. Success at this stage relies heavily on vendor investment in research and development to maintain technological parity and regulatory certification across different jurisdictions, providing a foundational product that is both functional and legally compliant.

Downstream analysis primarily involves the distribution, implementation, training, and continuous post-sales support of the software. The distribution channel is bifurcated into direct and indirect methods. Direct distribution involves the vendor's internal sales teams targeting large hospital systems or national audiology chains, allowing for customized pricing and implementation strategies. Indirect channels leverage authorized resellers, strategic consultants, and integration partners who focus on reaching smaller, geographically dispersed private practices, often bundling the APMS solution with other essential IT services or hardware. The downstream value is heavily influenced by the quality of implementation consulting, user training programs, and the responsiveness of the technical support team, all of which directly affect user adoption rates and customer retention.

The operational efficiency of the entire value chain is determined by the seamless flow of information from development to the end-user practice. Direct channels offer greater control over customer experience and feedback loops, allowing for faster product iteration based on specific clinical needs. Conversely, indirect distribution provides wider market penetration at a lower internal cost. The evolution of this segment sees increasing consolidation among system integrators and APMS vendors, aiming to offer a one-stop solution that reduces complexity for the end-user. The most critical aspect of the value chain is maintaining stringent security protocols at every stage, given the sensitive nature of patient health information (PHI) being managed by the software.

Audiology Practice Management Software Market Potential Customers

The primary end-users and buyers of Audiology Practice Management Software are diversified healthcare entities focused on diagnosing, managing, and treating hearing and balance disorders. The largest segment comprises private audiology clinics, ranging from solo practitioners to multi-location regional chains. These buyers seek comprehensive, often cloud-based solutions that offer scalability, easy integration with dispensing processes, and robust revenue cycle management capabilities, as they operate independently and rely solely on optimized billing for financial sustainability. Their buying decisions are highly influenced by the software’s ease of use, cost-effectiveness (typically subscription pricing), and specialized features tailored specifically to audiological workflows, such as hearing aid tracking and repair management.

Hospitals and large medical centers represent another critical customer segment. These institutions typically require more complex, highly secure, and often on-premise installations that must integrate seamlessly with existing Hospital Information Systems (HIS) and Electronic Medical Record (EMR) systems used organization-wide. Their purchasing criteria prioritize system robustness, enterprise-level reporting and analytics, and rigorous compliance certification to meet the high demands of large, multidisciplinary clinical settings. For these major institutional buyers, the software must demonstrate superior interoperability, centralized data governance, and high user capacity to serve a broad spectrum of medical specialists, not just audiologists.

Furthermore, specialized hearing aid centers, particularly those associated with major hearing device manufacturers or large retail chains, constitute a significant customer base. Their procurement focus centers heavily on inventory management modules capable of tracking high-value items, managing warranties, and facilitating complex ordering processes across multiple vendor platforms. Academic and research institutions also utilize APMS, although often focusing more intensely on the data extraction, statistical analysis, and reporting functionalities necessary for clinical trials and longitudinal studies rather than pure financial management. The commonality across all potential customers is the need for solutions that reduce manual paperwork and ensure adherence to evolving healthcare compliance standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 755.8 Million |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sycle, Auditdata, CounselEAR, Blueprint Solutions, MedRx, Noah System, HearForm, PracticePerfect, PatientNow, Allegro, ProTrak, Timeless Medical Systems, HearLogic, Stratus, CareCloud, ClinicSource, Merge Healthcare, CompuGroup Medical, Cerner Corporation, AdvancedMD. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Audiology Practice Management Software Market Key Technology Landscape

The core technology underpinning the Audiology Practice Management Software market is migrating rapidly towards robust, cloud-native architectures utilizing Software as a Service (SaaS) delivery models. This transition is essential for ensuring scalability, automated maintenance, and critical data redundancy and security, meeting the modern demands of healthcare IT. Key technological components include microservices architecture, which allows for independent deployment and scaling of modules (e.g., scheduling versus billing), and the use of sophisticated encryption standards (such as AES-256) and advanced authentication protocols to protect sensitive Patient Health Information (PHI) stored in distributed cloud environments. Furthermore, integration technologies relying on Fast Healthcare Interoperability Resources (FHIR) are becoming standard, replacing older, less flexible standards like HL7 to facilitate seamless, real-time data exchange with diagnostic devices, laboratory systems, and external referral networks.

Beyond fundamental infrastructure, modern APMS utilizes advanced technological stacks to enhance functionality. The development of sophisticated business intelligence (BI) and reporting tools involves integrating data warehousing solutions and leveraging visualization software to transform complex operational data—such as appointment metrics, claim denial rates, and hearing aid sales trends—into actionable insights for practice managers. Furthermore, the incorporation of mobile technologies is crucial, enabling practitioners to access patient records, modify schedules, and perform documentation via dedicated applications on smartphones or tablets, enhancing mobility within the clinical setting and supporting remote or home-visit consultations. The successful implementation of these technologies directly correlates with the overall efficiency and competitive positioning of the software product.

A burgeoning technological trend is the infusion of Artificial Intelligence (AI) and Machine Learning (ML) capabilities, particularly in automating high-volume, repetitive tasks. This includes ML algorithms deployed for predictive scheduling optimization, automatically identifying the best appointment slots based on historical data patterns, and AI tools assisting in accurate clinical coding for complex procedures, minimizing billing errors and maximizing reimbursement. Furthermore, advancements in telehealth technology, specifically secure video conferencing platforms with integrated device monitoring capabilities, are essential components of cutting-edge APMS, enabling practitioners to remotely program or adjust hearing aids and conduct follow-up consultations, thereby expanding the scope and accessibility of specialized audiology services beyond physical clinic walls.

Regional Highlights

- North America (United States and Canada): Dominant market share attributed to stringent government regulations promoting EHR adoption, high levels of digital literacy among healthcare providers, and a mature reimbursement structure that necessitates detailed RCM and billing capabilities. The US market, in particular, is highly competitive and acts as the primary driver for innovation in cloud-based APMS solutions.

- Europe (Germany, UK, France): Characterized by high penetration rates and strong demand for APMS that complies strictly with GDPR data privacy regulations. The shift towards national digital health initiatives and the need for seamless integration with country-specific social insurance systems are key factors influencing product localization and procurement decisions.

- Asia Pacific (China, Japan, India, Australia): Fastest-growing region, driven by rapid expansion of healthcare infrastructure, increasing awareness regarding hearing health, and significant government investments aimed at modernizing clinical operations. The market here focuses on scalable, often multilingual, solutions accessible to a wide range of practice sizes, from metropolitan clinics to rural health centers.

- Latin America (Brazil, Mexico): Emerging market where growth is spurred by improving economic conditions and increasing private healthcare investment. Adoption is primarily concentrated in urban centers, with an increasing shift towards affordable, flexible cloud-based solutions to manage expanding patient bases efficiently despite fragmented healthcare systems.

- Middle East and Africa (MEA): Growth is steady, primarily driven by Gulf Cooperation Council (GCC) countries investing heavily in advanced healthcare facilities and medical tourism. Demand centers around high-security systems and specialized inventory management for high-end hearing device dispensing. Adoption in Africa remains slower but shows potential due to international health aid programs and infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Audiology Practice Management Software Market.- Sycle

- Auditdata

- CounselEAR

- Blueprint Solutions

- MedRx

- Noah System

- HearForm

- PracticePerfect

- PatientNow

- Allegro

- ProTrak

- Timeless Medical Systems

- HearLogic

- Stratus

- CareCloud

- ClinicSource

- Merge Healthcare

- CompuGroup Medical

- Cerner Corporation

- AdvancedMD

Frequently Asked Questions

Analyze common user questions about the Audiology Practice Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Audiology Practice Management Software Market?

The Audiology Practice Management Software Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 11.5% during the forecast period from 2026 to 2033, driven by digitalization imperatives and increasing demand for specialized clinical efficiency tools.

Which deployment model dominates the APMS market?

The Cloud-Based deployment model is increasingly dominant in the APMS market, favored by its lower initial costs, enhanced accessibility, superior scalability, and automatic maintenance, making it particularly attractive to independent private audiology clinics seeking minimal internal IT management.

How is AI impacting the functionality of Audiology Practice Management Software?

AI is significantly impacting APMS by automating administrative tasks such as complex claims scrubbing and predictive scheduling, while also offering advanced decision support and data analytics, enhancing both operational efficiency and clinical documentation accuracy within audiology practices.

What are the key functions included in specialized Audiology Practice Management Software?

Key functions include Electronic Health Records (EHR) tailored for audiometric data, sophisticated Revenue Cycle Management (RCM) for specialized claims processing, comprehensive Inventory Management for hearing devices, appointment scheduling, and integrated Telehealth capabilities for remote consultations and device support.

Which geographic region currently leads the global APMS market?

North America, encompassing the United States and Canada, currently leads the global APMS market due to its mature digital healthcare infrastructure, high regulatory requirements for data standardization and interoperability, and the presence of numerous large audiology practice chains demanding advanced software solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager