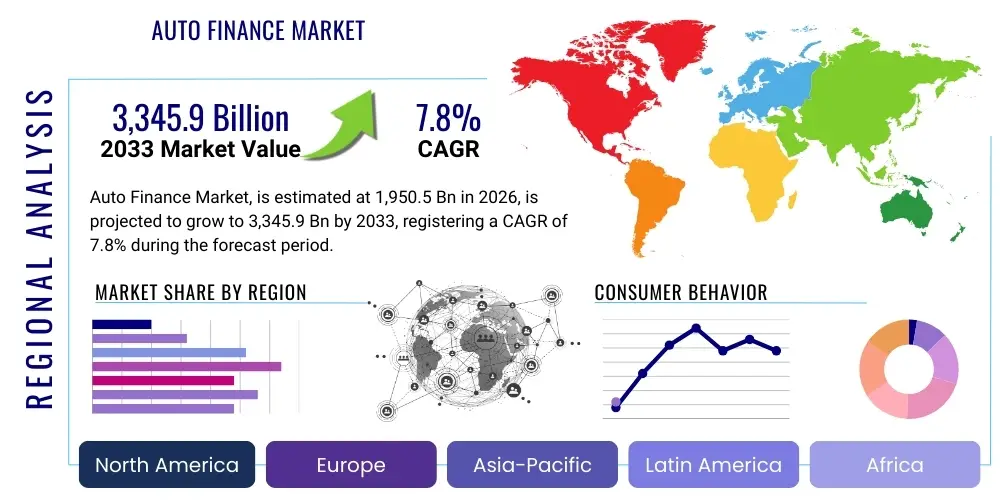

Auto Finance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443300 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Auto Finance Market Size

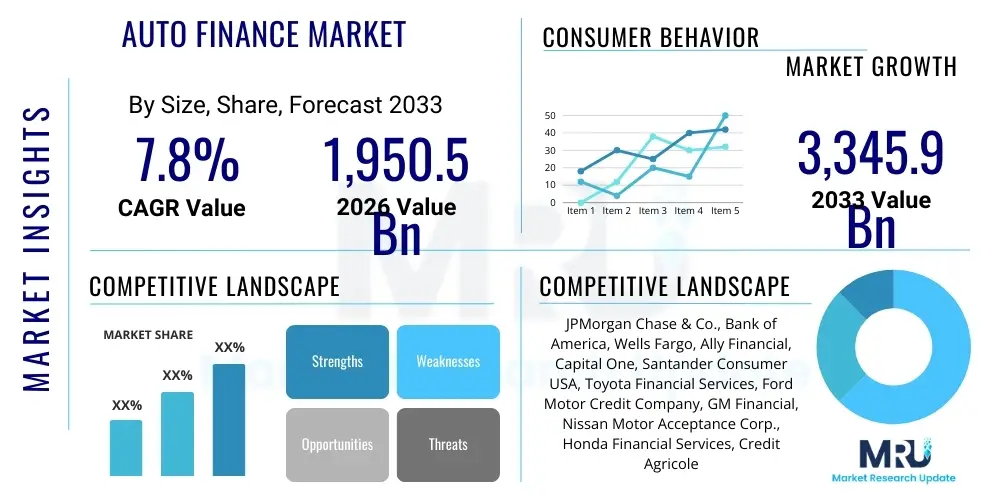

The Auto Finance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1,950.5 Billion in 2026 and is projected to reach USD 3,345.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the robust recovery in global vehicle sales, particularly in emerging economies, coupled with evolving consumer preferences toward flexible ownership models, including leases and subscription services. The overall market valuation reflects not only the volume of new and used vehicle transactions but also the increasing average transaction price (ATP) across major global economies, necessitating larger financing structures to bridge the affordability gap for mass-market consumers. Furthermore, the rapid integration of digital lending platforms and advanced risk assessment technologies is streamlining the application process, thereby enhancing market accessibility and accelerating overall growth throughout the forecast timeline.

Auto Finance Market introduction

The Auto Finance Market encompasses the lending ecosystem that facilitates the purchase or leasing of motorized vehicles, including cars, trucks, and utility vehicles, for both personal and commercial use. This market is characterized by a diverse array of financial products such as traditional auto loans, lease agreements (open-end and closed-end), balloon financing, and rapidly emerging vehicle subscription models. Key stakeholders in this highly interconnected ecosystem include captive finance arms of original equipment manufacturers (OEMs), traditional commercial banks, credit unions, specialized non-bank financial institutions, and FinTech platforms. The core product description revolves around providing capital to consumers and businesses to acquire vehicles, spreading the cost over an agreed-upon term, usually ranging from 36 to 84 months, thereby making expensive assets immediately accessible. Major applications span retail consumer financing for personal transportation, and commercial fleet financing for logistics, rentals, and corporate operations, each requiring specialized underwriting criteria and loan structures tailored to their respective risk profiles and usage patterns.

The primary benefits offered by the auto finance sector include enhanced vehicle affordability, enabling rapid fleet renewal, and stimulating overall economic activity through capital injection into the automotive manufacturing and sales industries. For consumers, financing provides immediate access to reliable transportation without requiring a significant upfront capital outlay. Driving factors underpinning the market's trajectory are multifaceted: strong global GDP growth, increasing disposable income in Asia Pacific and Latin America, the continuous technological innovation leading to frequent vehicle replacement cycles (e.g., transition to electric vehicles), and supportive regulatory frameworks that encourage consumer lending. Furthermore, competitive interest rate environments, although subject to macroeconomic volatility, generally encourage borrowing. The proliferation of digital lending channels, which offer speed, convenience, and highly personalized financing options, has significantly lowered the barriers to entry for both lenders and borrowers, acting as a crucial catalyst for market expansion. The sophistication of credit scoring models, leveraging big data analytics, allows lenders to accurately price risk, optimizing profitability while maintaining high loan origination volumes across various credit tiers.

However, the market is also characterized by complexity, particularly concerning risk management in periods of economic uncertainty. The interplay between interest rate hikes, residual value volatility (especially concerning rapid EV adoption and battery degradation concerns), and rising delinquency rates necessitates sophisticated portfolio management strategies. Regulatory pressures focusing on consumer protection and fair lending practices, notably in jurisdictions like the US and EU, continuously shape product offerings and disclosure requirements. Despite these challenges, the long-term outlook remains profoundly positive, anchored by the fundamental need for personal mobility and the increasing demand for high-value, technologically advanced vehicles, ensuring that auto financing remains an indispensable component of the global automotive economy and a cornerstone of modern financial services.

Auto Finance Market Executive Summary

The Auto Finance Market is currently undergoing a transformative period marked by three primary forces: profound technological integration (Business Trends), shifting power dynamics among regional financial hubs (Regional Trends), and the accelerated differentiation of product offerings (Segment Trends). In terms of Business Trends, the pervasive adoption of digitization across the entire loan lifecycle—from lead generation and application submission to underwriting, servicing, and collections—is redefining operational efficiency and customer experience. Traditional lending institutions are aggressively partnering with or acquiring FinTech solutions to deploy technologies such as blockchain for secure title management and advanced telematics data for usage-based insurance and financing, leading to highly optimized risk portfolios. The major strategic shift involves the aggressive push by captive finance companies to retain control over the customer journey, often subsidizing rates or offering unique incentive packages to drive sales volumes for their parent OEMs, creating intense competitive pressure on traditional banks and credit unions which must rely primarily on competitive interest rates and superior relationship banking.

Regionally, the market exhibits divergent growth trajectories. While North America and Europe remain mature and highly saturated markets characterized by stringent regulatory oversight and high average loan values, the Asia Pacific (APAC) region stands out as the primary growth engine, fueled by rapidly expanding middle-class populations in China, India, and Southeast Asia. These markets are experiencing exponential growth in vehicle ownership and are less dependent on established credit histories, favoring innovative financing models and mobile-first lending solutions. Latin America and the Middle East & Africa (MEA) are also emerging as critical strategic focuses, albeit characterized by higher interest rate volatility and currency risks, demanding localized underwriting strategies that incorporate socio-economic factors beyond standard FICO scores. The concentration of wealth and high luxury vehicle demand in Gulf Cooperation Council (GCC) countries drives substantial high-value financing activity in the MEA region, contrasting sharply with the volume-driven mass-market lending seen in APAC.

Segmentation trends highlight a pronounced shift from ownership to access. Although traditional retail auto loans for new vehicles remain the market bedrock, the leasing segment, particularly Personal Contract Purchase (PCP) in Europe and closed-end leasing in North America, is growing rapidly, driven by consumers seeking lower monthly payments and flexibility in frequent vehicle upgrades. Furthermore, the rise of specialized financing for Electric Vehicles (EVs) is a critical segment trend, characterized by longer loan terms, often incorporating battery warranties, and benefiting from government incentives and green financing mandates. Used car financing, amplified by the digital used car marketplace (e.g., Carvana, Vroom), represents another high-growth segment, demanding specialized valuation and collateral assessment tools due to the inherent complexity and depreciation risks associated with pre-owned assets. Lenders are increasingly diversifying their offerings to capture these niche segments, moving away from a one-size-fits-all product strategy toward highly tailored financing solutions based on vehicle type, usage pattern, and consumer credit profile.

AI Impact Analysis on Auto Finance Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Auto Finance Market predominantly revolve around three critical themes: risk mitigation efficiency, the fairness and bias of automated decision-making, and the optimization of the customer experience. Users frequently ask: "How exactly does AI improve credit scoring beyond traditional methods?" and "Will AI reduce application processing time, and by how much?" A significant concern addressed by prospective borrowers is the transparency (or lack thereof) of AI algorithms used for loan denial, falling under the umbrella of responsible AI and regulatory compliance. Lenders, conversely, focus on questions related to predictive maintenance financing, fraud detection capabilities using machine learning (ML), and the integration of AI-powered chatbots for 24/7 customer service. The overall expectation is that AI will fundamentally transition auto finance from a reactive, historical data-driven model to a proactive, predictive model, enabling highly granular, real-time risk pricing and dramatically enhancing operational scale.

The integration of AI and Machine Learning (ML) techniques is fundamentally revolutionizing credit underwriting by moving beyond static, historical credit scores (like FICO) to incorporate dynamic data points, including behavioral biometrics, unstructured data from loan application documents, and real-time income verification. This enhanced predictive capacity allows lenders to accurately assess risk for "thin file" borrowers (those with limited credit history), expanding market reach while maintaining or even lowering portfolio default rates. AI-driven models excel in detecting sophisticated fraud patterns that evade traditional rules-based systems, offering significant savings in losses. Moreover, AI powers personalized marketing and product recommendation engines, ensuring that customers are presented with the most suitable financing options (e.g., loan vs. lease) at the optimal moment in the buying journey, which significantly improves conversion rates and customer satisfaction.

Operational applications of AI extend deeply into the loan servicing phase. Predictive analytics are being deployed to identify borrowers likely to default, allowing servicers to engage in proactive intervention strategies, such as offering modified payment plans before a loan becomes seriously delinquent. Furthermore, Natural Language Processing (NLP) and robotic process automation (RPA) are streamlining back-office operations, automating document processing, compliance checks, and disbursement procedures, thereby dramatically cutting administrative costs and reducing human error. The long-term impact of AI is the creation of hyper-efficient, highly personalized lending ecosystems where financing decisions are instantaneous, transparent, and seamlessly integrated into the vehicle purchasing process, whether online or at the dealership, creating a competitive advantage for technologically advanced institutions.

- Enhanced Credit Scoring: Utilization of machine learning for alternative data analysis, improving predictive accuracy for high-risk and thin-file borrowers.

- Automated Underwriting: Instantaneous decision-making, reducing loan approval times from days to minutes, maximizing dealership efficiency.

- Fraud Detection: AI algorithms identify complex, evolving fraud rings and application irregularities in real-time.

- Portfolio Risk Management: Predictive models forecast potential delinquencies, enabling proactive customer intervention and loss mitigation strategies.

- Customer Service Optimization: Implementation of AI-powered chatbots and virtual assistants for 24/7 support and initial inquiry handling.

- Personalized Product Offering: Dynamic pricing and tailored financing recommendations based on real-time consumer behavior and vehicle preferences.

DRO & Impact Forces Of Auto Finance Market

The dynamics of the Auto Finance Market are shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces influencing market profitability and structure. Key drivers include the consistent growth in global vehicle sales, driven by urbanization and rising middle-class income, particularly in APAC, coupled with the cyclical need for vehicle replacement and fleet modernization. Furthermore, low-to-moderate interest rate environments (historically, though currently volatile) have encouraged debt-financed purchases, maintaining high volumes of loan originations. Technological advancements, such as digital lending platforms and advanced telematics integration, also serve as significant drivers, enhancing efficiency and expanding market access. However, the market faces considerable restraints, notably macroeconomic uncertainty, which triggers higher interest rates, reduces consumer confidence, and increases the potential for loan defaults. Over-leveraged consumers and rising vehicle prices (creating affordability pressures) also restrict market expansion, particularly in developed economies where debt burdens are already substantial. Regulatory changes, specifically those tightening consumer protection and requiring extensive data privacy compliance (like GDPR or CCPA), impose high operational costs on lenders.

Opportunities in the market center around innovation in product delivery and target segments. The transition to Electric Vehicles (EVs) presents a massive opportunity for specialized green financing products and long-term battery residual value insurance, creating entirely new segments of lending. The rapid expansion of the used vehicle market, facilitated by sophisticated online marketplaces, demands scalable, technology-enabled financing solutions for pre-owned assets. Furthermore, incorporating Vehicle-as-a-Service (VaaS) models and subscription-based financing structures offers lenders pathways to recurrent revenue streams, moving beyond traditional lump-sum loan origination. The impact forces are generally weighted toward digitalization and regulatory compliance; digitalization accelerates efficiency and market reach, while heightened compliance requirements constrain product flexibility and increase operational overhead. The structural tension between these forces necessitates significant strategic investment in technology and robust governance frameworks for sustainable growth.

The market’s stability is continuously tested by external impact forces, including supply chain disruptions (which influence vehicle inventory and pricing, directly affecting loan values) and geopolitical instabilities, which can dramatically alter consumer sentiment and investment appetite. Lenders must therefore adopt agile financing strategies that account for rapid shifts in vehicle availability and pricing volatility. The overall market force structure dictates that successful players will be those who can leverage AI for superior risk pricing and customer relationship management while simultaneously navigating a complex and increasingly fragmented regulatory landscape, maintaining compliance across diverse global jurisdictions to ensure ethical and sustainable lending practices. The long-term trajectory is defined by consolidation among smaller players and intense technological competition between captive finance arms and major financial institutions vying for consumer loyalty early in the purchase funnel.

Segmentation Analysis

The Auto Finance Market is broadly segmented based on the type of vehicle being financed (New vs. Used), the type of provider offering the financing (Banks, Captives, Credit Unions, etc.), and the application of the vehicle (Commercial vs. Personal use). This segmentation is crucial for market stakeholders as it dictates underwriting criteria, risk assessment models, and competitive strategy. The Used Vehicle segment generally exhibits higher growth volatility but offers attractive yields due to higher perceived risk and shorter loan terms, driven by the massive volume of transactions facilitated by online used car platforms. Conversely, the New Vehicle segment, often subsidized by OEM incentives through captive finance companies, is highly volume-dependent and maintains lower delinquency rates. Analyzing these segments allows lenders to strategically allocate capital based on risk-return profiles and allows regulators to monitor specific sectors for potential overheating or predatory lending practices.

The Provider Type segmentation reveals the competitive landscape, where Captive Finance companies often dominate the New Vehicle segment through promotional rates and deep integration with dealership networks, providing seamless point-of-sale financing. Banks, offering broader financing portfolios and stronger capital bases, compete primarily on rate and consumer relationship depth, particularly in the prime and super-prime credit segments. Credit Unions, focused on member benefits, often provide slightly better rates but may lack the technological scale or geographic reach of major commercial banks. The growing presence of FinTech lenders, often categorized under 'Others,' focuses intensely on niche segments, such as subprime or specialized EV financing, utilizing proprietary AI scoring models to compete effectively against established institutions. This diverse array of providers ensures that consumers across the credit spectrum have access to financing options, maintaining a highly dynamic and competitive market structure across all geographic regions.

The Application segmentation distinguishes between personal retail financing, which constitutes the majority of the market volume and is characterized by individual credit risk, and commercial fleet financing, which involves complex balance sheet assessments, specialized master lease agreements, and requires large-scale capital deployment. Commercial financing is typically less susceptible to consumer credit cycles but is highly dependent on corporate investment sentiment and macroeconomic business confidence indices. The increasing trend of gig economy participation also blurs these lines, necessitating hybrid financing products tailored for individuals using their personal vehicles for commercial gain (e.g., ride-sharing), demanding flexible mileage terms and usage-based insurance considerations, further complicating the segmentation matrix but simultaneously unlocking lucrative specialized lending opportunities that leverage real-time telematics data for risk mitigation and accurate asset valuation over the loan term.

- Vehicle Type:

- New Vehicles

- Used Vehicles

- Provider Type:

- Banks

- Captive Finance Companies (OEMs)

- Credit Unions

- Other Non-Banking Financial Companies (NBFCs) / FinTech Lenders

- Application:

- Personal (Retail)

- Commercial (Fleet)

- Loan Type:

- Auto Loans (Traditional Fixed Rate)

- Leasing (PCP, Closed-End, Open-End)

- Balloon Financing

- Subscription Services

Value Chain Analysis For Auto Finance Market

The Value Chain for the Auto Finance Market starts with the Upstream Analysis, which is dominated by funding sources and capital acquisition. This includes global money markets, commercial paper issuance, asset-backed securitization (ABS), and bank deposits. Lenders (Banks, Captives) rely heavily on favorable interest rate environments to secure low-cost capital, which is then structured into various financial products. Effective upstream management is crucial for maintaining competitive interest rates offered to consumers. Key activities here involve rigorous financial forecasting, hedging against interest rate volatility, and ensuring compliance with capital adequacy requirements (e.g., Basel III). The efficiency of ABS markets, which allow lenders to sell pools of auto loans to investors, is vital for continuously recycling capital and maintaining high lending capacity. Technology providers supplying core banking systems and sophisticated credit modeling tools also reside in the upstream segment, setting the foundational capabilities for risk assessment and operational processing.

Midstream activities primarily focus on loan origination and servicing. Origination involves customer acquisition (often through dealership networks or direct digital channels), application processing, risk underwriting, and contract execution. Dealerships serve as the primary distribution channel for the majority of new vehicle financing, acting as intermediaries between the buyer and the financial institution, receiving compensation in the form of dealer reserve or flat fees. Captive finance companies excel in this phase due to proprietary technology integration with OEM sales systems. Loan servicing—the management of the loan portfolio post-origination—includes payment processing, customer communication, managing escrow accounts, collections, and asset recovery (repossession). Highly efficient servicing platforms, often leveraging AI and RPA, are essential for minimizing operating costs and mitigating delinquency losses across massive loan portfolios. The quality of data collection and compliance reporting throughout the midstream process is paramount for regulatory adherence and accurate risk reporting to investors.

The Downstream Analysis involves the ultimate disposition of the asset or the loan. This includes the end of the loan term, where the borrower either pays off the loan, refinances, or, in the case of a lease, returns the vehicle. The efficiency of residual value management and remarketing of returned or repossessed vehicles significantly impacts profitability, especially for leasing and balloon financing portfolios. Distribution channels are bifurcated into Direct and Indirect models. Direct channels involve the lender interacting straight with the borrower (e.g., online applications, bank branches, or call centers) and offer lenders full control over the customer experience and data. Indirect channels, primarily utilizing dealerships, leverage the dealer's sales presence to originate loans, providing convenience to the buyer but introducing third-party risk management complexity. The ongoing shift toward digital retailing and pure online vehicle purchasing is rapidly enhancing the relevance and market share of direct digital distribution channels, compelling traditional lenders to heavily invest in robust, user-friendly mobile and web platforms to maintain competitive parity.

Auto Finance Market Potential Customers

The Auto Finance Market serves a vast and highly stratified customer base, predominantly categorized by individual retail borrowers and diverse commercial enterprises. The core end-users are individuals requiring personal transportation, spanning all credit tiers—from super-prime borrowers demanding the lowest rates for high-value vehicles to subprime borrowers needing specialized risk-priced financing to secure basic transportation. This segment is characterized by varying degrees of digital literacy, demanding both sophisticated online self-service tools and traditional, in-person assistance at dealerships or bank branches. Financing institutions must tailor their products (loan amounts, terms, and required documentation) based on factors such as income stability, credit history, vehicle age (new vs. used), and geographic location, recognizing that consumer demographics and needs differ significantly across major markets like the US, Germany, or China, each having unique regulatory protections and cultural expectations regarding debt accumulation and vehicle ownership.

The other major customer segment comprises commercial buyers, which includes small and medium-sized enterprises (SMEs), large multinational corporations managing extensive vehicle fleets (e.g., logistics, rentals, utilities), and governmental entities. Commercial buyers focus heavily on total cost of ownership (TCO), fleet management capabilities, flexible lease structures, and specialized financing for heavy-duty vehicles or large volume purchases, often requiring master credit agreements rather than individual retail contracts. The increasing demand for sustainable and electric commercial vehicle fleets presents a significant new subset of potential commercial customers seeking specialized green financing products that align with corporate sustainability mandates and carbon reduction goals. These customers prioritize long-term partnerships with lenders who can offer integrated fleet management technology and predictable cost models throughout the vehicle lifecycle, often leveraging operating leases to keep assets off their balance sheets.

A rapidly emerging customer group is the 'mobility-focused' consumer, who prioritizes flexibility and access over outright ownership. This segment drives demand for innovative products such as subscription services, short-term leasing, and usage-based financing models, particularly prevalent among urban, tech-savvy populations who view personal vehicle ownership as inefficient or unnecessary. Lenders are targeting this demographic through partnerships with mobility-as-a-service (MaaS) platforms and leveraging telematics data to offer dynamic pricing based on actual vehicle utilization. Catering effectively to this diverse spectrum—from the risk-averse, prime retail borrower to the sophisticated corporate fleet manager and the flexible, urban mobility consumer—requires an agile product development pipeline and sophisticated data analytics capabilities to ensure that financing offers remain relevant and competitively priced across every major customer demographic and purchase intent. The successful identification and nurturing of these specific customer micro-segments are key determinants of market leadership.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,950.5 Billion |

| Market Forecast in 2033 | USD 3,345.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JPMorgan Chase & Co., Bank of America, Wells Fargo, Ally Financial, Capital One, Santander Consumer USA, Toyota Financial Services, Ford Motor Credit Company, GM Financial, Nissan Motor Acceptance Corp., Honda Financial Services, Credit Agricole Consumer Finance, BNP Paribas Personal Finance, Daimler Financial Services, BMW Financial Services, Hyundai Capital America, Volkswagen Financial Services, AmeriCredit, TD Auto Finance, PNC Bank. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Auto Finance Market Key Technology Landscape

The Auto Finance Market's technological landscape is defined by a shift toward hyper-automation and data-driven decision-making, utilizing a stack of advanced tools to optimize every stage of the lending cycle. The foundation of this transformation is robust Digital Origination Systems (DOS) and Loan Management Systems (LMS), which handle the core processing, but are increasingly augmented by Artificial Intelligence (AI) and Machine Learning (ML) platforms. These analytical tools are not only used for predictive credit scoring, leveraging alternative data sources to enhance risk assessment accuracy and inclusivity but also for dynamic pricing models that adjust interest rates in real-time based on market conditions and individual risk profiles. Furthermore, Robotic Process Automation (RPA) plays a critical role in standardizing and accelerating back-office functions, such as document verification, regulatory compliance checks, and integration with third-party data providers (e.g., credit bureaus, income verification services), minimizing manual intervention and drastically reducing the cost-to-serve a loan.

Another crucial technological development involves the integration of telematics and Internet of Things (IoT) devices within vehicles. This technology enables usage-based financing (UBF) and personalized insurance offerings by collecting real-time data on mileage, driving behavior, and vehicle health. For lenders, telematics data significantly improves asset tracking, especially in subprime portfolios, and provides better residual value management by monitoring vehicle condition, which is paramount for leasing profitability. Blockchain technology is also gaining traction, particularly for secure digital titling and lien management. By providing an immutable, transparent ledger for vehicle ownership and financial obligations, blockchain streamlines cross-border transactions, reduces the complexity and cost associated with manual title processing, and mitigates the risk of title fraud. This technological convergence is creating 'smart contracts' for auto financing, automatically executing terms (like payment triggers or lien releases) upon predefined conditions being met, driving transparency and efficiency.

The customer-facing technology stack is equally critical, focusing heavily on Mobile Application interfaces and advanced customer relationship management (CRM) systems. Lenders are deploying sophisticated mobile apps that allow borrowers to manage their accounts, make payments, receive personalized offers, and even initiate refinancing or trade-in processes directly from their devices. These platforms are supported by AI-driven conversational interfaces (chatbots) capable of handling a significant volume of routine customer inquiries, thereby freeing up human agents for complex problem resolution. The overall technological direction points toward a fully seamless, integrated digital ecosystem where the financing process is invisible to the consumer, embedded directly within the point-of-sale experience—whether that point is a physical dealership, a virtual showroom, or a dedicated online auto retailer—setting new benchmarks for speed, convenience, and personalization across the highly competitive global auto finance marketplace.

Regional Highlights

Regional dynamics heavily influence the Auto Finance Market, driven by local regulatory frameworks, economic maturity, and unique consumer behavior patterns.

- North America (U.S. and Canada): Characterized by high market maturity, standardized credit reporting (FICO scores), and significant competition between major banks (e.g., JPMorgan Chase, Bank of America) and large captive finance arms (e.g., GM Financial, Toyota Financial Services). The market is defined by high loan values, long loan terms (up to 84 months), and substantial penetration of both traditional loans and leasing (closed-end leasing dominates). Recent growth is driven by the robust used vehicle market and aggressive digital innovation in origination and servicing platforms.

- Europe (Germany, UK, France, Italy): Highly fragmented and regulated, with divergent product preferences across nations. The UK and Germany show high adoption of Personal Contract Purchase (PCP) and Personal Contract Hire (PCH) models, emphasizing flexible access over ownership. Germany remains a powerhouse due to its strong OEM captives (e.g., BMW Financial Services, VW Financial Services). Regulatory pressures (MiFID II, consumer credit directives) enforce stringent transparency requirements, influencing product structure and pricing disclosure across the Eurozone.

- Asia Pacific (APAC - China, India, Japan): The engine of global growth, led by China's immense volume and India's rapidly expanding market driven by rising disposable incomes and low vehicle penetration rates. The market is characterized by a strong shift toward mobile-first lending, greater acceptance of non-traditional credit scoring, and high growth in two-wheeler and used vehicle financing. Japanese auto finance remains stable, dominated by captives and focused on high-quality customer service and competitive rates.

- Latin America (Brazil, Mexico): Markets face higher volatility due to fluctuating interest rates and currency risk, requiring lenders to incorporate significant economic buffers into their underwriting models. Growth is steady, fueled by increasing vehicle sales, but market penetration is lower than in developed regions. Specialized risk management techniques and strong collateral assurance mechanisms are paramount for mitigating high default risks inherent in these markets.

- Middle East and Africa (MEA): Segmentation is stark; the Gulf Cooperation Council (GCC) countries exhibit high demand for premium and luxury vehicle financing with sophisticated product offerings, largely driven by high net worth individuals. The African market remains highly nascent, focusing primarily on microfinance for vehicle purchases and basic loans, often requiring collateral and community-based lending models due to unreliable formal credit histories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Auto Finance Market.- JPMorgan Chase & Co.

- Bank of America Corporation

- Wells Fargo & Company

- Ally Financial Inc.

- Capital One Financial Corporation

- Santander Consumer USA Holdings Inc.

- Toyota Financial Services

- Ford Motor Credit Company LLC

- GM Financial

- Nissan Motor Acceptance Corp.

- Honda Financial Services

- Credit Agricole Consumer Finance

- BNP Paribas Personal Finance

- Daimler Financial Services (Mercedes-Benz Financial Services)

- BMW Financial Services

- Hyundai Capital America

- Volkswagen Financial Services AG

- TD Auto Finance

- PNC Bank

- Discover Financial Services

Frequently Asked Questions

Analyze common user questions about the Auto Finance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the global Auto Finance Market?

The global Auto Finance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, driven by digitalization and increasing demand in emerging economies.

How are Electric Vehicles (EVs) changing the auto financing landscape?

EVs introduce new complexities related to battery depreciation and residual value volatility. This drives demand for specialized financing products, often involving longer terms and focused on the Total Cost of Ownership (TCO) including charging infrastructure costs.

Which technology is most significantly impacting auto loan origination efficiency?

Artificial Intelligence (AI) and Machine Learning (ML) are the most significant technological impacts, enabling automated, instantaneous credit underwriting decisions and reducing loan approval times from days to mere minutes at the point of sale.

What is the primary difference between captive finance companies and traditional banks in this market?

Captive finance companies (owned by OEMs) prioritize supporting vehicle sales volume, often offering subsidized interest rates and unique incentives to drive brand loyalty, whereas traditional banks compete primarily on interest rates and customer relationship depth across a wider range of credit profiles.

Where is the highest growth expected in the Auto Finance Market geographically?

The highest growth is expected in the Asia Pacific (APAC) region, particularly in China and India, fueled by rising disposable incomes, expanding middle-class populations, and rapid adoption of digital lending platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager