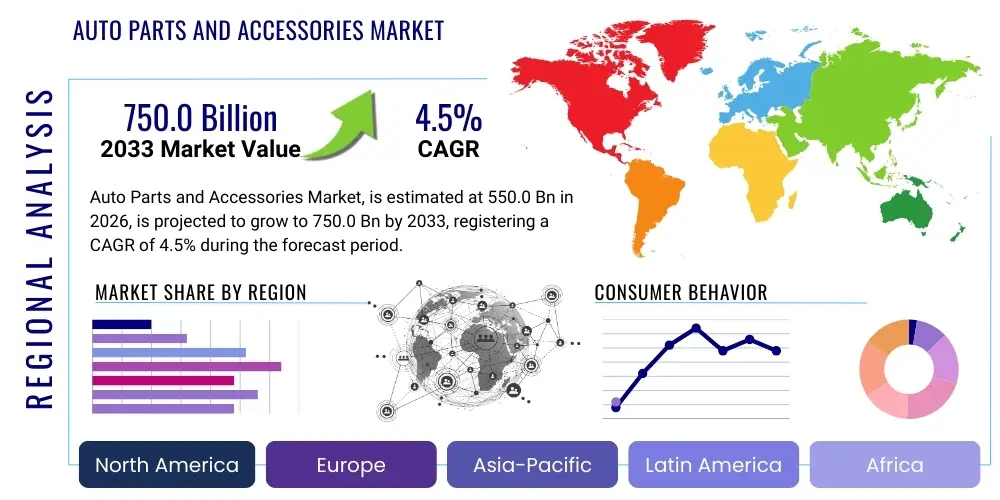

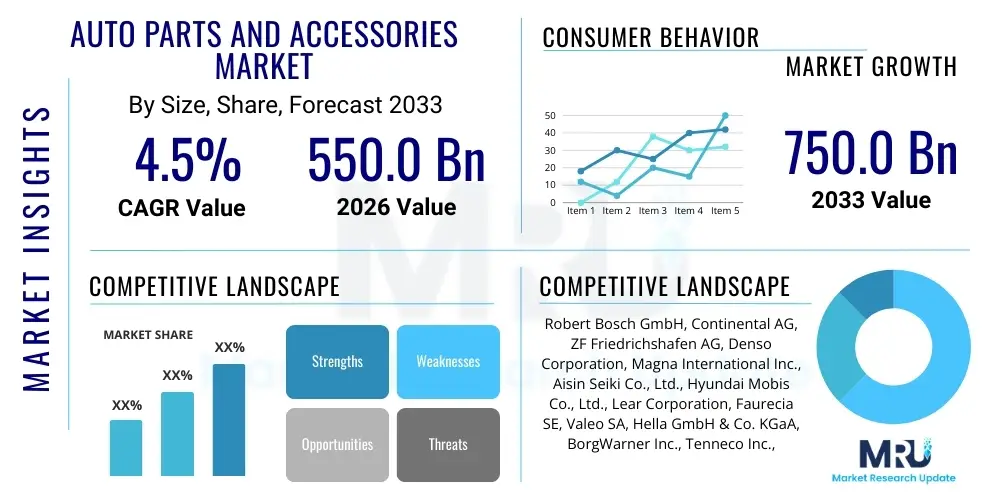

Auto Parts and Accessories Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441368 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Auto Parts and Accessories Market Size

The Auto Parts and Accessories Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 550.0 Billion in 2026 and is projected to reach USD 750.0 Billion by the end of the forecast period in 2033.

Auto Parts and Accessories Market introduction

The Auto Parts and Accessories Market encompasses the manufacturing, distribution, and sale of components required for the maintenance, repair, and enhancement of vehicles, covering both Original Equipment Manufacturers (OEMs) and the Aftermarket. This vast ecosystem includes critical mechanical components like engine parts, brake systems, chassis, and drivetrain components, alongside electrical and electronic systems such as sensors, lighting, and infotainment modules. The increasing complexity of modern vehicles, driven by electrification, autonomous features, and advanced safety standards, necessitates a robust supply chain capable of delivering high-precision, technologically integrated components. Furthermore, the longevity of vehicles globally, particularly in developed markets, fuels consistent demand for replacement parts in the independent aftermarket (IAM).

Product descriptions within this market range widely, from essential consumable items like filters, oils, and tires, which require regular replacement, to complex, high-value structural components. Major applications span collision repair, routine maintenance, performance modification, and aesthetic customization. The rise of electric vehicles (EVs) is fundamentally reshaping the product mix, shifting demand away from internal combustion engine (ICE) components towards battery systems, thermal management units, and high-voltage electronics. This technological transition is compelling traditional suppliers to invest heavily in R&D to maintain relevance and capture new revenue streams associated with sustainable mobility solutions.

Key benefits derived from this market include enhanced vehicle safety, improved fuel efficiency, extended operational life of automobiles, and opportunities for personalization. Driving factors are predominantly linked to the expanding global vehicle fleet, stringent regulatory mandates concerning emissions and safety, rapid advancements in vehicle technology (especially connectivity and ADAS), and the growing consumer preference for specialized accessories. Economic factors, such as disposable income growth in emerging economies and the average age of vehicles increasing globally, further stabilize and drive market expansion, ensuring steady demand across both the OEM and aftermarket segments.

Auto Parts and Accessories Market Executive Summary

The global Auto Parts and Accessories Market is characterized by significant digital transformation and geopolitical shifts, leading to nuanced business trends. Major participants are aggressively pursuing vertical integration and strategic partnerships to secure critical raw material supplies and control advanced manufacturing processes, particularly those related to semiconductor components and battery raw materials. The shift towards e-commerce platforms is revolutionizing distribution channels, offering consumers greater access to specialized parts while simultaneously pressuring traditional wholesale models. Business models are evolving to incorporate predictive maintenance services, utilizing telematics data to forecast component failure and optimize replacement schedules, thereby ensuring greater efficiency for fleet operators and individual consumers alike.

Regional trends indicate that Asia Pacific (APAC) remains the largest and fastest-growing market, primarily fueled by massive vehicle production volumes in China and India, coupled with increasing disposable incomes driving aftermarket consumption. North America and Europe, while growing at a slower pace, are leading the charge in technological adoption, particularly concerning advanced driver-assistance systems (ADAS) components and EV powertrain parts. These established markets emphasize supply chain resilience and sustainability, often prioritizing locally sourced components to reduce reliance on complex global logistics chains, a trend accelerated by recent global disruptions. Furthermore, regulatory alignment across the EU and North America on emissions standards heavily influences component design and material choice.

Segmentation trends highlight the increasing dominance of electronic components and the stable growth of the aftermarket segment. Within the product type segmentation, the electronics category (sensors, ECUs, infotainment systems) is experiencing exponential growth due to the 'software-defined vehicle' paradigm. The distribution channel analysis shows a significant surge in the Independent Aftermarket (IAM), particularly through online channels, contrasting with the relatively stable, but high-value, Original Equipment Supplier (OES) channel. Vehicle segmentation reveals robust growth in the Electric Vehicle (EV) components sector, although traditional internal combustion engine (ICE) parts still command the largest market share in the short term, sustained by the existing enormous global ICE fleet requiring routine maintenance.

AI Impact Analysis on Auto Parts and Accessories Market

Common user inquiries regarding AI's influence in the Auto Parts and Accessories Market often revolve around how artificial intelligence will automate manufacturing processes, optimize complex global supply chains, and revolutionize vehicle diagnostics and maintenance. Users frequently ask about the role of AI in quality control (defect detection), demand forecasting accuracy, and whether AI-driven predictive maintenance will diminish the need for routine parts replacement, impacting the aftermarket sales volume. Key expectations center on AI’s ability to drive hyper-personalization in accessories, improve logistics efficiency, and accelerate the design cycle for new, technologically advanced components. Concerns usually focus on the data privacy implications of utilizing vehicle telematics for parts planning and the potential displacement of human labor in manufacturing and inventory management roles due to advanced automation.

The deployment of AI and machine learning algorithms is significantly enhancing operational efficiency across the value chain, shifting manufacturing towards smart factories. In component design, AI is utilized for generative design, allowing engineers to rapidly iterate lightweight, high-performance parts that meet stringent safety and efficiency requirements. On the demand side, AI analyzes vast datasets, including telematics, geographical sales history, and macroeconomic indicators, to forecast parts demand with unprecedented accuracy. This minimizes inventory holding costs and reduces obsolescence, optimizing cash flow for both manufacturers and distributors. Moreover, AI-powered quality inspection systems, using computer vision, ensure that components meet zero-defect standards before shipment, which is critical for safety-sensitive parts like brake systems and airbags.

Furthermore, AI is pivotal in reshaping the customer service experience and logistics. AI-driven chatbots and virtual assistants provide immediate technical support for parts inquiries, cross-referencing compatibility and installation guidance. Within the aftermarket, predictive maintenance systems leverage AI to monitor vehicle health in real-time and recommend the exact moment a specific part requires replacement, transitioning maintenance from reactive schedules to proactive intervention. This ensures higher vehicle uptime and improved customer satisfaction. The long-term impact of this technology is expected to create highly specialized demand for integrated electronic components that communicate health data, further deepening the integration between hardware manufacturing and software intelligence.

- Manufacturing Automation: AI-driven robotics and quality control systems ensuring near-perfect assembly and defect detection.

- Predictive Maintenance: Using machine learning on telematics data to forecast component failure and schedule proactive parts replacement.

- Supply Chain Optimization: AI algorithms optimizing logistics routes, inventory levels, and mitigating disruption risks through real-time analysis.

- Generative Design: Accelerating the development of complex, lightweight, and customized parts for EV and ADAS applications.

- Personalization: Utilizing consumer data and AI to recommend highly customized accessories and performance parts.

- Demand Forecasting: Enhancing accuracy of parts demand, reducing overstocking and stock-outs, especially for seasonal and critical items.

DRO & Impact Forces Of Auto Parts and Accessories Market

The dynamics of the Auto Parts and Accessories Market are driven by an intricate interplay of macro-level economic factors and technological revolutions. Key drivers include the ever-expanding global car parc, particularly in developing economies, which guarantees a consistent base demand for maintenance parts. Secondly, the rapid technological integration in vehicles—such as Advanced Driver-Assistance Systems (ADAS), sophisticated infotainment, and battery technologies—creates demand for high-value, complex components. However, this growth is restrained by substantial factors, primarily volatile raw material prices (steel, aluminum, plastics, semiconductors), which compress profit margins, and stringent environmental regulations that necessitate costly R&D investments to develop eco-friendly components and production processes.

Significant opportunities are emerging from the paradigm shift toward Electric Vehicles (EVs). This transition opens new markets for thermal management systems, charging infrastructure components, and specialized lightweight materials, fundamentally redefining the market landscape. Furthermore, the increasing consumer focus on vehicle customization and personalization drives strong sales in the accessories segment. The primary impact forces shaping the competitive environment include the consolidation among Tier 1 suppliers seeking economies of scale and technological breadth, and the disruptive impact of digital sales channels challenging traditional brick-and-mortar distribution networks. Geopolitical instability and trade tariffs also act as powerful external forces, compelling companies to diversify manufacturing locations and build regionalized supply chains.

The inherent resilience of the aftermarket, which tends to be counter-cyclical during economic downturns, acts as a stabilizing force for overall market performance. When consumers delay purchasing new vehicles, they invest in maintaining their existing cars, ensuring continuous demand for replacement parts. Conversely, the market faces strong downward pressure from vehicle manufacturers seeking to standardize components and extend parts lifespan through better engineering, which could slow down replacement cycles. The need for cybersecurity measures, particularly for connected car components, also represents a growing and necessary expense, acting as a functional restraint on development budgets but simultaneously creating a new, specialized market niche for secured electronic parts.

Segmentation Analysis

The Auto Parts and Accessories Market is comprehensively segmented based on product type, distribution channel, vehicle type, and material. This multi-dimensional segmentation allows for granular analysis of market trends and growth pockets, crucial for strategic decision-making. The segmentation by product type is perhaps the most diverse, encompassing everything from essential mechanical systems (e.g., braking and suspension) to rapidly evolving electronic components (e.g., ADAS sensors and ECUs). Understanding the growth trajectory of these sub-segments is key, especially as the industry shifts towards software-defined vehicles, where the value of electronic parts is skyrocketing relative to traditional mechanical hardware.

Segmentation by distribution channel—comprising the Original Equipment Channel (OES) and the Aftermarket—determines market access and pricing strategies. The OES channel, supplying parts directly to OEMs for new vehicle assembly, is highly concentrated and quality-driven, whereas the Aftermarket is fragmented, involving wholesalers, independent repair shops, and a rapidly expanding e-commerce ecosystem. The shift in consumer behavior, favoring DIY repairs and online purchasing, continues to boost the prominence of the Independent Aftermarket (IAM) over traditional OES dealer networks for service and repairs, especially for older vehicles.

Further analysis by vehicle type (Passenger Vehicles, Commercial Vehicles, and two-wheelers) reveals differing needs: passenger vehicles drive demand for technological and aesthetic accessories, while commercial vehicles prioritize durability, uptime, and heavy-duty mechanical and electronic fleet management components. Material segmentation, covering metal, plastic, rubber, and composite materials, is increasingly influenced by lightweighting mandates aimed at improving fuel efficiency and extending EV range. The continuous evolution across all these segments necessitates constant market monitoring to adapt to technological obsolescence and emerging consumer trends.

- Product Type:

- Engine Components

- Drive Train and Axles

- Electrical and Electronic Parts (Sensors, ECU, Wiring Harness)

- Body and Chassis

- Braking Systems

- Suspension and Steering

- Filtration Products

- Exhaust Components

- Tires and Wheels

- Accessories and Customization

- Distribution Channel:

- Original Equipment Supplier (OES)

- Aftermarket (Independent Aftermarket (IAM) and Dealer/Franchise)

- Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Electric Vehicles (EV)

- Material Type:

- Metal Alloys (Steel, Aluminum)

- Plastics and Polymers

- Rubber

- Composites

Value Chain Analysis For Auto Parts and Accessories Market

The value chain of the Auto Parts and Accessories Market is extensive, starting from raw material procurement and extending through highly specialized manufacturing, complex global logistics, and final distribution channels. Upstream analysis involves the sourcing of critical materials such as specialized steel for chassis, rare earth elements for magnets and electronics, and polymers for interiors and lightweight structural parts. Raw material volatility profoundly impacts the cost structure upstream, pushing manufacturers to establish long-term procurement contracts and hedge against price fluctuations. Tier 2 and Tier 3 suppliers, who specialize in basic components like castings, forgings, and simple assemblies, form the foundational input layer, requiring close collaboration with Tier 1 suppliers regarding quality control and compliance.

Midstream activities are dominated by Tier 1 suppliers (e.g., Bosch, Continental) who integrate materials and smaller components into sophisticated modules and systems (e.g., engine control units, ADAS systems). These companies invest heavily in R&D and advanced manufacturing technologies, often co-developing specifications with OEMs. The shift towards just-in-time (JIT) manufacturing remains critical for OEM supply, minimizing inventory risks but heightening dependency on flawless logistics. Downstream activities focus on the delivery of parts, characterized by two primary channels: direct supply to vehicle assembly lines (OEM channel) and sales to the aftermarket (replacement channel).

Distribution channels are categorized as Direct and Indirect. The Direct channel involves Tier 1 suppliers shipping directly to OEM assembly plants or franchised dealer service centers (OES). The Indirect channel, or Aftermarket, involves a multi-layered structure including master distributors, regional wholesalers, independent garages, and increasingly, direct-to-consumer e-commerce platforms. The profitability in the aftermarket often depends on efficient inventory management and speed of delivery. The ongoing digitization of the supply chain, incorporating IoT and blockchain for traceability and authentication, is redefining efficiency and combating the proliferation of counterfeit parts, particularly in high-demand emerging markets.

Auto Parts and Accessories Market Potential Customers

The potential customer base for the Auto Parts and Accessories Market is highly diversified, spanning major global automakers, independent repair professionals, fleet managers, and individual vehicle owners. Original Equipment Manufacturers (OEMs) such as Toyota, Volkswagen, and General Motors are the primary buyers in the OES channel, requiring massive volumes of components that meet stringent quality and performance standards for new vehicle production. Their purchasing decisions are driven by cost efficiency, reliability, technological partnership, and adherence to production schedules, making them high-volume, high-value customers subject to lengthy contract negotiations.

The aftermarket buyer segment includes three major groups. First, the Professional Aftermarket, comprising independent repair shops (IRSs), national repair chains, and specialty service providers (e.g., tire shops). These customers prioritize speed of delivery, availability of diverse parts (generic and brand-specific), and competitive pricing. Second, fleet operators (logistics, rental, and public transport companies) are critical end-users, focusing on parts that minimize downtime and enhance the total cost of ownership (TCO) of their commercial vehicle fleets. They often require specialized heavy-duty components and reliable supply agreements.

Third, the Do-It-Yourself (DIY) and Do-It-For-Me (DIFM) individual consumers represent the retail segment, purchasing parts and accessories through physical retail stores (auto parts chains) or rapidly expanding online marketplaces. DIY consumers require easy access to maintenance parts and installation guides, while DIFM customers rely on the expertise of service providers. The rise of customization trends means that high-performance and aesthetic accessories attract a distinct segment of enthusiasts willing to pay a premium for specialized products, further diversifying the market's revenue streams.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Billion |

| Market Forecast in 2033 | USD 750.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Magna International Inc., Aisin Seiki Co., Ltd., Hyundai Mobis Co., Ltd., Lear Corporation, Faurecia SE, Valeo SA, Hella GmbH & Co. KGaA, BorgWarner Inc., Tenneco Inc., Aptiv PLC, Bridgestone Corporation, Michelin Group, Gestamp Automoción, Schaeffler AG, Eberspächer Group, Sumitomo Electric Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Auto Parts and Accessories Market Key Technology Landscape

The technology landscape of the Auto Parts and Accessories Market is rapidly shifting from mechanical emphasis to high-tech electronic and software integration, driven primarily by autonomous driving and electrification trends. Key technologies include advanced sensor fusion systems, essential for ADAS components such as LiDAR, radar, and cameras, which require specialized manufacturing precision and robust connectivity solutions. Battery components and thermal management systems are also paramount, utilizing advanced material science (e.g., silicon carbide power electronics) to maximize energy efficiency and operational safety in electric vehicles. Furthermore, the deployment of 3D printing and additive manufacturing techniques is transforming prototyping and small-batch production, allowing suppliers to quickly produce complex, lightweight geometries and specialized repair parts on demand.

Digitalization technologies are equally critical in optimizing operational efficiencies. Industrial Internet of Things (IIoT) sensors are embedded throughout manufacturing facilities to monitor equipment health and product quality in real-time, facilitating predictive maintenance for machinery and minimizing production disruptions. Supply chain management leverages blockchain technology to create immutable records of component origins, crucial for ensuring authenticity and combating the pervasive issue of counterfeit auto parts, particularly within the aftermarket segment of emerging markets. These digital tools ensure greater transparency and efficiency from raw material sourcing to final delivery.

The future of the market is intrinsically linked to the development of software-defined components. Components are no longer merely hardware but integrated systems requiring constant software updates and cybersecurity protocols. Over-The-Air (OTA) updates, initially reserved for high-end vehicle manufacturers, are becoming standard for electronic control units (ECUs) and infotainment systems, requiring suppliers to transition into being software providers as much as hardware manufacturers. This technological convergence demands a highly skilled workforce and significant investment in software development capabilities, redefining the competitive advantage in the auto parts sector from purely mechanical reliability to digital sophistication and seamless vehicle integration.

Regional Highlights

Asia Pacific (APAC) dominates the global Auto Parts and Accessories Market, a position cemented by its status as the world’s primary automotive manufacturing hub, led by massive production volumes in China, Japan, South Korea, and India. The region benefits from rapidly increasing vehicle ownership rates, a burgeoning middle class, and comparatively younger vehicle fleets, translating into strong growth in both OEM supply and the aftermarket. Furthermore, government incentives supporting electric vehicle adoption in China and South East Asia are driving immense investment in localized production of EV battery components, power electronics, and specialized thermal management parts. The competitive intensity in APAC is high, characterized by a mix of powerful local suppliers and international Tier 1 players establishing regional manufacturing bases to reduce logistics costs and mitigate trade risks.

North America and Europe represent mature markets characterized by high technological sophistication and stringent regulatory environments concerning safety and emissions. In these regions, growth is primarily driven by the replacement market for aging vehicles and the high-value electronics segment (ADAS, connectivity, and cybersecurity systems). Europe, in particular, is leading the global push towards comprehensive electrification, accelerating the demand for lightweight materials and advanced componentry compliant with Euro 7 emission standards and beyond. Supply chain resilience remains a central strategic concern in both regions, prompting initiatives to near-shore or re-shore manufacturing capabilities to mitigate vulnerability to global logistical bottlenecks and geopolitical tensions experienced over the past few years.

Latin America (LATAM) and the Middle East and Africa (MEA) offer substantial, albeit often volatile, growth potential. LATAM's market is largely dependent on macroeconomic stability in countries like Brazil and Mexico, focusing predominantly on robust and durable mechanical replacement parts and essential accessories due to challenging road conditions and high utilization rates. MEA, especially the Gulf Cooperation Council (GCC) countries, exhibits strong demand for high-end accessories and sophisticated vehicle repair parts due to a preference for luxury and high-performance vehicles. However, both regions face challenges related to infrastructure gaps, which impact logistics efficiency, and the persistent presence of counterfeit goods, demanding stronger technological solutions for product authentication and reliable distribution networks.

- Asia Pacific (APAC): Highest volume manufacturing, fastest growth in EV components, dominated by China and India.

- North America: Strong aftermarket demand due to older vehicle fleet; rapid adoption of ADAS and autonomous vehicle components.

- Europe: Regulatory leader in electrification and emissions; high demand for premium, lightweight materials and sophisticated electronics.

- Latin America (LATAM): Focus on durability and essential mechanical replacement parts; growth linked to regional economic stability.

- Middle East and Africa (MEA): High demand for premium accessories and specialized heavy-duty parts; efforts focused on combating counterfeiting.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Auto Parts and Accessories Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Magna International Inc.

- Aisin Seiki Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Lear Corporation

- Faurecia SE

- Valeo SA

- Hella GmbH & Co. KGaA

- BorgWarner Inc.

- Tenneco Inc.

- Aptiv PLC

- Bridgestone Corporation

- Michelin Group

- Gestamp Automoción

- Schaeffler AG

- Eberspächer Group

- Sumitomo Electric Industries

- Visteon Corporation

- Autoliv Inc.

- Federal-Mogul LLC (Tenneco)

- Mahle GmbH

- Pirelli & C. S.p.A.

- Johnson Controls International plc (Now part of Clarios/Adient)

- Brose Fahrzeugteile GmbH & Co. KG

- Mando Corporation

- JTEKT Corporation

- Brembo S.p.A.

- Garrett Motion Inc.

- TI Fluid Systems plc

- Tokai Rika Co., Ltd.

- Toyoda Gosei Co., Ltd.

- L&T Technology Services Limited (For Software)

- WABCO Holdings Inc. (Acquired by ZF)

- Novares Group

- Standard Motor Products Inc.

- Yazaki Corporation

- Flex-N-Gate Corporation

Frequently Asked Questions

Analyze common user questions about the Auto Parts and Accessories market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Auto Parts Aftermarket?

The primary factor driving aftermarket growth is the increasing average age of vehicles globally (vehicle parc expansion). As vehicles remain operational longer, the demand for routine maintenance and replacement parts (tires, batteries, brakes, filters) intensifies, ensuring stable sales even during new vehicle market contractions. E-commerce penetration also significantly boosts accessibility.

How is the shift to Electric Vehicles (EVs) impacting the demand for traditional auto components?

The EV shift is causing a structural decline in demand for traditional ICE-specific parts (e.g., spark plugs, exhaust systems, complex transmissions). However, it is simultaneously creating new high-growth segments for thermal management systems, battery components, lightweight body parts, and specialized power electronics (inverters, converters).

Which geographical region holds the largest market share for auto parts and accessories?

The Asia Pacific (APAC) region currently holds the largest market share due to its massive vehicle production capacity, high volume of new vehicle sales, and rapidly expanding internal combustion and electric vehicle fleets, driven primarily by China and India.

What are the key technological advancements shaping the future of auto parts manufacturing?

Key technological advancements include the extensive use of sensor technology and high-performance computing for ADAS integration, additive manufacturing (3D printing) for prototyping and specialized components, and AI-driven quality control and supply chain management systems to achieve zero-defect manufacturing.

What are the main risks associated with the Auto Parts and Accessories supply chain?

The main risks include volatility in raw material prices (especially semiconductors and metals), ongoing logistical complexities and costs, geopolitical instability leading to trade barriers, and the pervasive threat of counterfeit parts, which necessitates significant investment in product authentication technologies.

The global Auto Parts and Accessories Market is navigating a pivotal era of transformation, characterized by the dual pressures of technological disruption and sustainability mandates. The foundational segments related to mechanical repair continue to provide stability, underpinned by the vast global vehicle population. However, the future trajectory is overwhelmingly dictated by the electrification and digitalization of vehicles. Suppliers who successfully transition their portfolios to high-value electronic and software-integrated systems, coupled with optimized, regionally resilient supply chains, are positioned to capture the greatest share of future growth. This market is increasingly complex, requiring stakeholders to prioritize advanced manufacturing techniques, robust cybersecurity measures, and proactive engagement with the rapidly evolving regulatory landscape, especially concerning environmental compliance and vehicle safety standards.

The competitive environment is intensifying, leading to frequent mergers, acquisitions, and strategic partnerships, particularly as Tier 1 suppliers seek to acquire niche technology expertise in areas like power management and sensor fusion. Furthermore, the rising influence of non-traditional entrants, particularly tech companies focusing on software and AI-driven diagnostics, challenges incumbent business models. Success requires a sophisticated, balanced approach: maintaining efficient production of traditional replacement components while simultaneously accelerating investment into next-generation mobility solutions. The effectiveness of distribution, transitioning smoothly between traditional wholesale and high-speed e-commerce fulfilment, is also a critical differentiator in maintaining market relevance and customer loyalty, especially within the highly competitive aftermarket segment.

In conclusion, the projected CAGR of 4.5% reflects a mature industry undergoing radical retooling. While profitability margins in high-volume, standard components face downward pressure, the specialized and technologically advanced segments offer premium pricing power and substantial expansion opportunities. Stakeholders must leverage data analytics and predictive intelligence not only for internal operations but also to anticipate dynamic consumer behaviors and regulatory shifts. The successful navigation of this market environment necessitates agility, technological foresight, and a commitment to global sustainability goals, ensuring that the supply chain remains robust enough to support the accelerating pace of innovation across all vehicle segments.

The extensive analysis of the Auto Parts and Accessories Market reveals several micro-trends contributing significantly to the overall forecasted valuation. Specifically, the growing adoption of shared mobility and autonomous vehicle (AV) testing, while still nascent, demands specialized, high-durability components capable of withstanding intensive usage cycles. This niche segment is driving innovation in material science, particularly in developing wear-resistant plastics and lightweight composites. Additionally, the increasing complexity of vehicle repair, requiring specialized diagnostic tools and training, is bolstering the revenue streams of parts suppliers who also offer comprehensive technical support and proprietary software solutions to independent repair facilities, thereby strengthening their position in the downstream value chain.

Furthermore, the segmentation analysis emphasizes the critical role of material innovation in achieving vehicle performance goals. For instance, the demand for aluminum and high-strength, low-alloy (HSLA) steels is outpacing conventional steel usage due to their essential role in vehicle lightweighting, which is non-negotiable for extending EV range and improving fuel economy in ICE vehicles. Suppliers who have optimized their manufacturing processes to handle these advanced materials efficiently and sustainably are gaining a significant competitive advantage. The focus on circular economy principles is also driving demand for recycled and refurbished parts, particularly in the European aftermarket, introducing complexities related to traceability, quality certification, and remanufacturing processes that require investment in specialized industrial facilities.

Finally, the long-term forecast suggests a convergence of the OEM and aftermarket channels, driven by connectivity. As vehicles continuously transmit component health data, OEMs and their affiliated dealer networks gain better visibility into replacement needs, potentially encroaching on the independent aftermarket's traditional territory. However, the IAM’s flexibility, lower labor costs, and speed of service will ensure its sustained relevance, particularly for older vehicles and non-warranty repairs. Therefore, future market strategies must balance direct technological collaboration with OEMs against maintaining competitive pricing and broad availability within the indirect aftermarket distribution network to ensure holistic market coverage and sustained revenue generation throughout the entire lifecycle of the vehicle fleet.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager