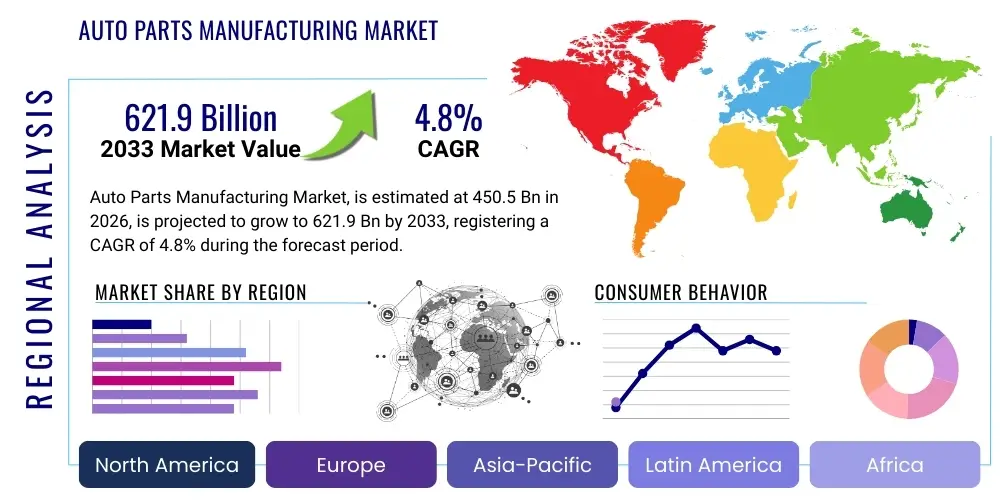

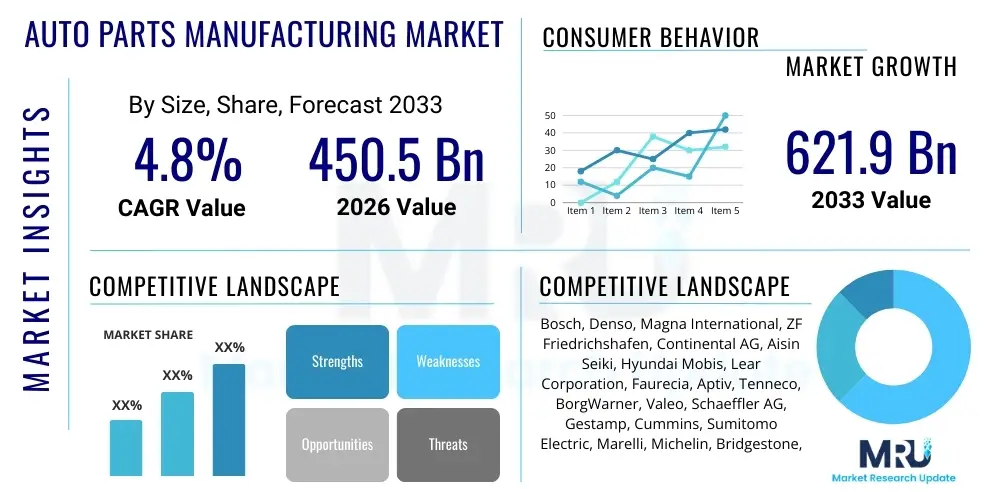

Auto Parts Manufacturing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440993 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Auto Parts Manufacturing Market Size

The Auto Parts Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 621.9 Billion by the end of the forecast period in 2033.

Auto Parts Manufacturing Market introduction

The Auto Parts Manufacturing Market, often referred to as the Tier 1 and Tier 2 supply base of the automotive industry, encompasses the entire ecosystem responsible for the design, precision engineering, production, and global distribution of vehicular components and integrated systems. This market is intrinsically linked to the macroeconomic health of major automotive producing nations and is a core driver of technological innovation within mobility. Components span mechanical, electrical, chemical, and software domains, supplying products ranging from foundational chassis elements and powertrain assemblies to advanced sensor arrays, human-machine interfaces (HMIs), and complex battery thermal management systems (BTMS). The dual challenge for manufacturers is managing the continued operational efficiency for the existing, massive global fleet of Internal Combustion Engine (ICE) vehicles while simultaneously making strategic, multi-billion-dollar investments to secure leadership in the rapidly evolving Electric Vehicle (EV) and autonomous vehicle sectors. This requires navigating divergent product lifecycles and highly differentiated manufacturing standards across global jurisdictions, particularly concerning safety, cybersecurity, and environmental compliance, demanding unprecedented flexibility in capital allocation and operational planning.

The contemporary product description of auto parts is increasingly defined by system integration and connectivity rather than discrete mechanical units. For instance, braking systems are no longer purely hydraulic; they are now sophisticated electro-hydraulic systems integrated with Electronic Stability Control (ESC) and regenerative braking functionalities required by EVs. Key product categories driving the current market expansion include power electronics (inverters, converters, onboard chargers), specialized components for lightweighting (e.g., high-pressure die-cast aluminum structures and carbon fiber reinforced plastics), and extensive high-speed, high-capacity wiring harnesses engineered to handle high voltage loads efficiently and safely, critical for modern vehicle architectures. Major applications remain segmented by vehicle category—Passenger Vehicles (PV), Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV). However, the complexity of PV components, especially in luxury and high-tech segments, often sets the technological benchmark for the entire industry. The transition toward modular, standardized vehicle platforms (e.g., VW’s MEB or GM’s Ultium) demands that parts manufacturers adapt their production methodologies to supply standardized, scalable modules rather than bespoke components, fundamentally altering design-to-production cycles, quality control requirements, and necessitating greater collaboration with software developers.

The tangible benefits provided by the sector extend beyond merely supplying parts; they underpin global transport safety, efficiency, and sustainability. A competitive auto parts market ensures Original Equipment Manufacturers (OEMs) have access to cost-effective, high-quality components, enabling affordable vehicle ownership and continuous improvement in vehicle performance metrics, such as improved fuel economy, reduced pollutant emissions, or maximized EV range. Driving factors for the market’s robust projected CAGR are multifaceted: the sheer increase in global vehicle production fueled by growing disposable income in developing economies, creating a larger vehicle parc; stringent global mandates for reduced CO2 emissions and enhanced passenger safety (e.g., mandatory ADAS inclusion, stricter crash testing protocols); and the structural capital inflow supporting the EV revolution, especially subsidies and tax breaks focused on local production. These factors, combined with the increasing average age of vehicles in key mature markets which fuels steady, high-margin aftermarket demand, create a compelling environment for sustained investment and technological evolution. Manufacturers must also strategically manage the geopolitical risks associated with volatile raw material prices, semiconductor sourcing, and battery material supply chains to capitalize fully on these driving forces, ensuring supply stability amidst global complexity.

Auto Parts Manufacturing Market Executive Summary

The Auto Parts Manufacturing Market Executive Summary reveals an industry at an inflection point, marked by high investment volatility and a strategic pivot away from internal combustion engine (ICE) legacy products toward electrification and connectivity components. Business trends are dominated by aggressive vertical integration and strategic partnerships, particularly in the realm of battery production and vehicle-level software development, where traditional Tier 1 manufacturers are collaborating with technology specialists to secure expertise in areas previously outside their core competencies. There is a strong consolidation trend driven by the need for economies of scale in capital-intensive EV component manufacturing and a necessity to divest or restructure non-core legacy assets that face long-term demand contraction. Furthermore, the adoption of digital twin technology and advanced Manufacturing Execution Systems (MES) defines a leading business practice, aimed at achieving unparalleled operational efficiency, enhanced product traceability, and minimized time-to-market for complex, safety-critical systems, catering to the exacting standards of modern OEMs.

Geographically, regional trends confirm Asia Pacific’s enduring dominance in absolute manufacturing output, significantly supported by China’s world-leading production of both EVs and associated high-volume components, including high-capacity wiring harnesses, structural battery components, and foundational electronics. Nevertheless, government policies such as the US Inflation Reduction Act (IRA) and the European Green Deal are successfully catalyzing substantial investments in North America and Europe, particularly in establishing localized giga-factories for battery cells and modules, often co-located with Tier 1 suppliers. These Western regions are positioning themselves as leaders in high-value, research-intensive areas like advanced sensor technology, highly automated assembly processes, and specialized materials engineering for lightweighting, often attracting manufacturers through substantial subsidies and tax incentives designed to create closed-loop, regional supply chains. This regional diversification is not merely economic; it is a strategic imperative for supply chain resilience, reducing systemic risk associated with overly concentrated manufacturing bases and ensuring regulatory compliance across varied trade blocs.

Segmentation trends illustrate a dramatic and accelerating shift in technological priorities. The highest growth is unequivocally observed in the Electrical and Electronics segment, encompassing everything from advanced microprocessors necessary for domain control units (DCUs) to specialized high-power inverters, onboard chargers, and complex wire and cable solutions. This structural shift is simultaneously depressing long-term growth prospects for traditional mechanical powertrain components (e.g., pistons, fuel injectors, complex gearboxes) as EVs inherently simplify the driveline architecture. However, adjacent segments like thermal management systems (TMS) are seeing explosive growth, requiring sophisticated manufacturing of precision fluid conduits, complex pumps, and specialized heat exchangers essential for maintaining optimal battery performance and longevity in extreme climates. The materials segment reflects this change, with demand soaring for advanced lightweight materials (composices, engineering plastics) utilized to mitigate the weight penalty introduced by large battery packs, reinforcing the critical link between material science innovation and overall vehicle energy efficiency and performance.

AI Impact Analysis on Auto Parts Manufacturing Market

The widespread adoption of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the Auto Parts Manufacturing Market by enabling levels of precision and responsiveness previously unattainable, thereby addressing critical industry pain points related to efficiency, quality assurance, and predictive supply chain management. Common user inquiries often center on how AI can handle the extreme variability and complexity introduced by highly customized EV architectures and diverse global regulatory requirements, especially concerning zero-defect manufacturing for safety components. Manufacturers are keen on leveraging AI in complex welding and high-speed assembly processes where human error risks are high, utilizing advanced computer vision systems integrated with collaborative robotic arms to monitor weld penetration depth, material flow in casting, and dimensional accuracy in real-time. This cognitive automation minimizes waste, reduces expensive rework cycles, and drastically shortens the ramp-up time for new product introductions (NPI), providing a tangible competitive edge in time-to-market and capital utilization.

Furthermore, AI is instrumental in achieving breakthrough efficiencies through advanced Predictive Maintenance (PdM) across high-capital assets, a crucial element for improving Overall Equipment Effectiveness (OEE). Instead of relying on static, time-based maintenance schedules, AI models ingest massive, continuous streams of sensor data—vibration analysis, temperature fluctuation, current draw, and acoustic signatures—from presses, CNC machines, and specialized component assembly robots. These models accurately predict component degradation and potential failure hours or even days in advance, allowing maintenance to be scheduled precisely during planned downtime, minimizing unscheduled stoppages which can cost millions per hour in high-volume production facilities. This refinement in operational uptime translates directly into increased profitability and reliability for suppliers under tight OEM contracts. AI also manages energy consumption dynamically, optimizing complex production schedules to run high-load processes during off-peak energy hours, thereby addressing the increasing need for sustainable and cost-efficient manufacturing practices across global facilities.

Beyond the factory floor, Generative AI is catalyzing radical innovation in component design, enabling topological optimization that results in parts that are simultaneously lighter, stronger, and cheaper to produce than traditionally engineered counterparts. By setting complex boundary conditions (load requirements, material type, thermal constraints, and available manufacturing methods), AI algorithms autonomously generate structurally optimized component geometries, drastically reducing the iterative cycle between design, simulation, and physical testing. In the supply chain, deep learning models analyze global logistics data, factoring in thousands of variables like unexpected weather patterns, geopolitical events, customs clearance delays, and freight capacity shortages, to offer dynamic adjustments to shipping routes and optimize inventory holding levels proactively. This data-driven resilience is vital for maintaining the just-in-time and just-in-sequence delivery expectations of OEMs, particularly in managing the geographically dispersed and politically sensitive sources of critical EV materials like lithium, cobalt, and specialized magnets.

- AI-driven Predictive Maintenance: Minimizes equipment downtime, extending asset life, and increasing Overall Equipment Effectiveness (OEE) through condition-based monitoring of critical production machinery.

- Generative Design: Accelerates development and testing cycles, resulting in topologically optimized, lightweight component structures (e.g., chassis components, structural battery supports) that improve vehicle energy efficiency and material usage.

- Enhanced Quality Control: AI vision systems utilize deep learning to enable real-time, high-speed, non-destructive defect inspection, ensuring zero-defect rates for safety-critical parts like electronic control units, braking systems, and complex welds.

- Smart Process Optimization: AI fine-tunes parameters in complex, delicate manufacturing processes like robotic welding, laser cutting, advanced casting, and painting, improving material utilization, reducing scrap rates, and lowering overall energy consumption for sustainable operations.

- Supply Chain Optimization: Machine learning algorithms predict nuanced demand fluctuations, optimize inventory placement globally, and manage complex logistics risks dynamically by suggesting alternate sourcing or transport routes, ensuring seamless JIT/JIS delivery to OEMs.

DRO & Impact Forces Of Auto Parts Manufacturing Market

The core dynamics of the Auto Parts Manufacturing Market are governed by a powerful interplay of structural Drivers, formidable Restraints, strategic Opportunities, and overarching Impact Forces that define long-term viability and competitive strategy. The principal Driver is the irreversible global push toward electrification, mandated by regulatory bodies and increasingly favored by shifting consumer preference, requiring manufacturers to completely re-engineer their product lines and focus capital expenditure on high-growth EV components like standardized battery packs, high-efficiency e-axles, and sophisticated thermal systems. Alongside this, the Driver of increasingly stringent global safety and environmental regulations (e.g., mandating the inclusion of Advanced Driver-Assistance Systems (ADAS), higher levels of crash integrity, and lower overall vehicle weight to meet fleet emissions compliance targets) necessitates continuous, high-intensity R&D spending on active safety components (e.g., Lidar, radar sensors, and central domain controllers) and specialized low-emission mechanical parts.

These powerful drivers are severely restrained by several macro-economic and operational challenges. A primary Restraint is the substantial, multi-billion-dollar capital expenditure required to transition existing manufacturing infrastructure designed for ICE production over to EV component manufacturing, a process often spanning years and carrying significant stranded asset risk. Furthermore, persistent global supply chain instability, particularly concerning the consistent sourcing and highly volatile pricing of key raw materials (lithium, nickel, aluminum, and palladium) and critical semiconductors, creates severe operational bottlenecks and squeezes profit margins across the industry, demanding complex financial hedging strategies. The specialized technical skill gap necessary for designing, manufacturing, and servicing high-voltage EV components and complex embedded software systems also acts as a critical restraint, limiting rapid scalability and delaying technological deployment in high-demand areas.

Opportunities are overwhelmingly concentrated in areas adjacent to the core EV transition, offering avenues for high-margin growth and product differentiation. These include the specialized Aftermarket for EV repair, requiring diagnostics and specific high-voltage component replacements and remanufacturing capabilities, presenting a unique, stable revenue stream as the global EV parc matures. Furthermore, the Opportunity in developing sophisticated sensor fusion technologies, solid-state Lidar systems, and powerful computing hardware for realizing Level 3 and Level 4 autonomous driving systems represents a massive, untapped market for electronic component manufacturers capable of meeting automotive-grade reliability and cybersecurity standards. The Impact Forces shaping strategic decisions are the relentless pressure from OEMs for zero-defect production coupled with just-in-time delivery mandates, and the rising geopolitical requirement for supply chain regionalization, compelling manufacturers to build parallel, redundant production capabilities across North America, Europe, and Asia to mitigate risks associated with trade barriers and localized instability, thereby increasing initial investment complexity and overall operating costs significantly.

Segmentation Analysis

A detailed Segmentation Analysis reveals the intrinsic complexity and diversity within the Auto Parts Manufacturing Market, partitioning it along component functionality, end-user application, sales route, and foundational materials utilized. The breakdown by Component Type is currently the most dynamic area, reflecting the aggressive technological divergence between legacy mechanical production and future-focused electronic systems. Component segmentation allows stakeholders to accurately gauge which manufacturing capabilities will face long-term atrophy (e.g., traditional ICE engine blocks) and which require immediate, heavy investment to capture future growth (e.g., power electronics). Vehicle Type segmentation helps manufacturers tailor production volume, durability, and cost targets, recognizing that commercial vehicles often demand robust, high-durability components with long service lives, whereas passenger vehicles emphasize comfort, connectivity, and aesthetics. This analytical granularity is crucial for defining targeted R&D roadmaps and optimizing resource allocation efficiently across highly diversified product families.

The segmentation by Distribution Channel—OEM versus Aftermarket—is fundamental to understanding profitability and volume dynamics. The OEM channel demands exceptionally large volumes, low unit costs negotiated under long-term contracts, and absolute adherence to quality specifications and zero-defect requirements, often resulting in lower per-unit margins but guaranteed, stable sales volume over the vehicle platform lifecycle. Conversely, the aftermarket segment, serving repair, maintenance, and modification, involves smaller volumes of a broader variety of parts (high SKU count), often achieving significantly higher profit margins per unit. Manufacturers must strategically balance the high-efficiency, standardized operational requirements for the OEM channel with the supply chain agility and extensive inventory management required for the aftermarket, especially as they navigate supplying parts for aging ICE fleets while simultaneously introducing new, complex EV service parts. Finally, material segmentation, driven by the critical demand for lightweighting and enhanced thermal properties, provides essential insights into commodity price sensitivity and strategic sourcing of advanced materials necessary for maximizing energy efficiency and structural performance.

- By Component Type:

- Drivetrain and Powertrain: Engine components (Pistons, Turbochargers, Fuel systems), Transmission systems (Manual/Automatic gearboxes, clutches), Axles, and increasingly, high-efficiency E-Axles and high-density electric motors.

- Chassis and Suspension Systems: Brake components (Calipers, Rotors, ABS modules, electronic braking systems), Steering systems (Electronic Power Steering - EPS, steering racks), and specialized suspension elements (shocks, air suspension).

- Electrical and Electronics (E&E): Sensors (Lidar, Radar, Cameras), Electronic Control Units (ECUs), Domain Controllers (DCUs), Battery Management Systems (BMS), high-voltage Wiring Harnesses, and sophisticated In-Vehicle Infotainment (IVI) units.

- Interior and Exterior: Seating systems (Advanced thermal and massage functions), Lighting (LED, Matrix lighting technology), Body panels (lightweight composites), and sophisticated climate control systems (HVAC, specialized battery cooling loops).

- By Vehicle Type:

- Passenger Vehicles: High-volume, high-technology demand segment, heavily impacted by consumer electronics integration, safety feature mandates, and aesthetic design requirements.

- Commercial Vehicles: Focused on extreme durability, payload capacity, operational uptime, and total cost of ownership (TCO), leading to a more measured adoption of electrification and autonomy features tailored specifically for fleet and logistics operations.

- By Distribution Channel:

- Original Equipment Manufacturer (OEM): Direct supply line to vehicle assembly plants, characterized by Just-In-Time (JIT) and Just-In-Sequence (JIS) logistics and intense cost scrutiny.

- Aftermarket: Supplies independent repair shops, franchised dealers, and retail consumers, focused on inventory availability, expansive catalog breadth, and competitive pricing for maintenance and replacement parts.

- By Material Type:

- Metals: Specialized high-strength steel (HSS), various aluminum alloys (especially for large structural castings), and advanced cast iron for specific high-heat or friction applications.

- Plastics and Polymers: Used extensively for interior trim, advanced engine covers, fuel tanks (in ICE), and complex composite ducting, consistently driven by aggressive weight reduction targets and cost efficiency.

- Composites and Carbon Fiber: Niche but rapidly growing segment, utilized in high-performance structural components and exterior paneling where extreme strength-to-weight ratios are mandatory, often substituting traditional metals for high-end or high-performance EVs.

Value Chain Analysis For Auto Parts Manufacturing Market

The Value Chain of the Auto Parts Manufacturing Market is a complex, multi-tiered structure beginning with raw material extraction and concluding with component deployment in a vehicle, demanding exceptional coordination across global supply networks. The Upstream Analysis focuses intensely on the sourcing and processing of critical materials, encompassing iron ore and specialized metals for high-strength steel and aluminum alloys, petroleum derivatives for plastics and rubber, and rare earth minerals essential for electric motors and advanced sensors. At this stage, supply risks are pronounced, driven by geopolitical instability, dependence on limited mining sources (e.g., specific rare earth elements), and highly volatile commodity market pricing influenced by global energy costs. Tier 3 and 4 suppliers manage this upstream segment, and their performance dictates the initial cost structure and fundamental material quality for the entire chain. Efficient hedging strategies and long-term contracts with miners and processors are paramount for manufacturers to ensure predictable input costs and material conformity, particularly as demand for specialized, ethically-sourced EV materials rapidly increases and scrutiny over sustainability practices intensifies.

The core Manufacturing phase is typically handled by Tier 2 and Tier 1 suppliers, representing the high-capital investment core of the value chain. Tier 2 suppliers focus on component specialization (e.g., stamping, forging, precision casting, and initial sub-assembly of component blanks), requiring high levels of operational expertise in specialized manufacturing techniques and sophisticated quality validation. Tier 1 suppliers operate at the apex of the supply pyramid, acting as sophisticated system integrators who take inputs from Tier 2 and assemble them into complex, integrated modules (e.g., full electronic brake systems, complete cockpit assemblies, or certified e-axle units) that are shipped directly to the OEM. This tier demands substantial R&D capability, as they must not only manufacture to specification but often co-develop systems with the OEM, integrating complex proprietary software and hardware interfaces. Profitability here is determined by successful capital utilization, highly optimized production yield rates, stringent cost control, and absolute adherence to severe quality metrics mandated by OEMs (often zero-parts-per-million defect targets over millions of units).

The Downstream Analysis involves the crucial distribution and service channels, segmented into Direct and Indirect sales routes. The Direct channel is defined by the high-stakes, time-sensitive relationship between Tier 1 suppliers and Original Equipment Manufacturers (OEMs). Components are often delivered Just-In-Sequence (JIS), meaning parts arrive at the assembly plant precisely in the order required for a specific vehicle on the line, minimizing OEM working capital, inventory holding costs, and floor space. This demands flawless logistical execution and robust electronic data interchange (EDI) and advanced logistics management systems. The Indirect Channel, serving the global aftermarket, is vastly more dispersed, relying on layers of independent distributors, large retail chains, and authorized service centers. Success in the indirect channel hinges on inventory depth (covering thousands of SKUs for aging and modern fleets), efficient cataloging, and responsive delivery networks. The shift to EVs challenges both channels: the Direct channel requires highly customized logistics for heavy, sensitive battery modules, while the Indirect channel must rapidly evolve training, expertise, and safety protocols for high-voltage EV repair parts and sophisticated diagnostic software updates.

Auto Parts Manufacturing Market Potential Customers

The potential customers and end-users of the Auto Parts Manufacturing Market are broadly categorized into two major groups corresponding to the distribution channels: Original Equipment Manufacturers (OEMs) and the Aftermarket segment, which includes independent service operators and individual vehicle owners. OEMs, such such as global automotive giants (e.g., Toyota, Volkswagen, Ford, Tesla, and numerous emerging Chinese electric vehicle specialists), represent the primary, highest-volume buyers, purchasing parts for integration into new vehicles. Their purchasing decisions are driven by extremely stringent quality standards (reliability and durability), engineering compliance, the ability of the supplier to scale globally (requiring supplier production footprints to align with OEM assembly locations), and intense pressure for annual cost reduction. Securing long-term supply contracts with multiple OEMs across various high-volume platforms is essential for Tier 1 suppliers' stability, scale, and ability to fund necessary capital expenditures for future technology.

The second substantial customer group comprises the Aftermarket segment, which provides critical revenue stability across economic cycles. This includes a diverse ecosystem of entities: franchised dealerships and authorized service workshops, independent repair garages (IRGs) which dominate volume globally, large retail chains selling parts directly to consumers (DIY market), and specialized wholesalers/distributors. Demand in the aftermarket is influenced by the size and age of the vehicle parc, economic conditions affecting repair versus replacement decisions, and vehicle longevity. As vehicles become more technologically advanced, the aftermarket customer base for complex electronic and software-driven components is evolving, demanding suppliers offer not only the physical components but also associated diagnostic tools, calibration services, and certified technical training, particularly for high-voltage and ADAS systems.

Beyond these traditional segments, emerging customer groups include specialized vehicle manufacturers (e.g., manufacturers of high-performance luxury sports cars, specialized defense vehicles, or agricultural machinery), fleet operators focused intently on maximizing vehicle uptime through optimized parts supply and predictive maintenance contracts, and technology companies developing last-mile delivery vehicles or dedicated autonomous shuttles. These specialized buyers often require customized, low-volume, high-specification components, offering niche high-margin opportunities for parts manufacturers capable of agile design, adaptive production processes, and advanced system integration expertise. The shift towards Mobility-as-a-Service (MaaS) platforms also creates a concentrated purchasing customer base demanding extreme component durability and highly efficient supply logistics for maintenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 621.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Denso, Magna International, ZF Friedrichshafen, Continental AG, Aisin Seiki, Hyundai Mobis, Lear Corporation, Faurecia, Aptiv, Tenneco, BorgWarner, Valeo, Schaeffler AG, Gestamp, Cummins, Sumitomo Electric, Marelli, Michelin, Bridgestone, Autoliv, Plastic Omnium, American Axle & Manufacturing (AAM), Eaton Corporation, Hella GmbH & Co. KGaA, Visteon Corporation, Flex-N-Gate Corporation, JTEKT Corporation, Knorr-Bremse AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Auto Parts Manufacturing Market Key Technology Landscape

The Key Technology Landscape in the Auto Parts Manufacturing Market is fundamentally defined by the convergence of material science innovation and pervasive digitalization (Industry 4.0), shifting the competitive focus from sheer mechanical efficiency to integrated, smart, and sustainable systems. In material science, manufacturers are pioneering the use of advanced multi-material joining techniques, such as friction stir welding and advanced bonding adhesives, allowing the seamless integration of high-strength steel, various aluminum alloys, and structural composites to create body-in-white structures and component enclosures that are significantly lighter without compromising crash performance. The pressure to reduce vehicle mass, especially for EVs to maximize crucial driving range, necessitates continuous innovation in lightweight materials and novel manufacturing processes like specialized high-pressure die casting for large, intricate components such as battery housings and motor casings, demanding extremely tight tolerances, high material integrity, and repeatable production cycles at high volumes.

Operational technology is dominated by the adoption of smart factory infrastructure, a core tenet of Industry 4.0 implementation. This involves deploying highly interconnected, collaborative robotic systems equipped with high-resolution sensors and AI integration for tasks ranging from delicate, precise electronic component placement and soldering to heavy-duty handling of battery packs and large body panels. The backbone of this system is the Industrial Internet of Things (IIoT), which facilitates continuous, real-time data collection from every machine, tool, and sensor on the floor, feeding into sophisticated Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) tools. This deep integration allows for end-to-end traceability of every component, crucial for fulfilling stringent OEM quality mandates and simplifying potential recall processes while simultaneously allowing dynamic adjustments to production schedules to optimize throughput and energy usage.

Finally, the most disruptive area involves technologies specific to the Electric Vehicle (EV) ecosystem, demanding entirely new technological competencies. Manufacturing expertise in power electronics is paramount, including the sophisticated cleanroom environments necessary for producing high-reliability inverters and converters that manage the complex, high-speed flow of power between the battery, motor, and vehicle systems. Specialized machinery is required for precise winding, stacking, and assembly of high-density electric motors (e-motors), demanding micron-level accuracy to maximize magnetic flux, efficiency, and torque delivery. Furthermore, advanced laser welding, high-energy ultrasonic welding, and specialized joining techniques are critical for assembling battery cells into modules and packs, where thermal stability, structural integrity, and electrical isolation are non-negotiable safety requirements. The manufacturer capable of mastering these high-precision, high-voltage manufacturing techniques and integrating them with robust software management systems is strategically best positioned for market leadership in the future of mobility.

Regional Highlights

The global Auto Parts Manufacturing market exhibits distinct regional characteristics, driven by local production ecosystems, technological maturity, regulatory frameworks, and consumer maturity regarding new technologies and electrification adoption rates.

- Asia Pacific (APAC): The dominant global manufacturing region by volume, APAC benefits from sheer scale and established, high-efficiency supply chains, centered in China, Japan, and South Korea. China, particularly, drives massive EV component growth, offering highly cost-competitive sourcing for everything from standard mechanical parts to advanced electronics and comprehensive battery component systems. Japan and South Korea remain global leaders in high-tech component reliability (e.g., precision ADAS sensors and complex electrical architecture). The region’s focus is on scaling production rapidly while simultaneously meeting tightening domestic regulatory standards, leveraging extensive automation and robotics deployment to manage vast output requirements efficiently.

- North America: This region is characterized by accelerating reshoring and localization efforts, heavily stimulated by governmental incentives like the IRA, aimed at building a robust domestic EV supply chain, especially battery manufacturing (cells and modules). North America leads in the development and initial manufacturing of autonomous driving component development (Lidar, advanced sensor fusion hardware, and central domain control computers) and large-scale manufacturing automation. The market structure emphasizes high-value content, resilience against supply shocks, and deep integration between software development and component hardware, catering significantly to large SUV and truck platforms which dominate regional vehicle sales.

- Europe: Defined by a strong historical emphasis on quality, precision engineering, and highly stringent sustainability requirements, Europe is mandating a swift transition to electrification under aggressive environmental legislation (Euro 7 compliance). European parts manufacturers excel in sophisticated component engineering for complex active safety systems, premium lighting technologies, and maintaining technological superiority in highly automated, digitalized production environments (exemplifying Industry 4.0 adoption) across key manufacturing nations like Germany and Central Europe, albeit facing heightened pressure to secure non-Asian raw material supplies.

- Latin America (LATAM): Primarily focused on serving regional OE assembly markets (Brazil and Mexico) and a massive, robust, and necessity-driven aftermarket. Manufacturing in LATAM tends to concentrate on cost-effective, durable, and reliable components for well-established vehicle platforms. Mexico, however, acts as a crucial export platform, increasingly integrated into the US supply chain for high-volume OE parts due to preferential trade agreements and logistical proximity, offering competitive operational costs for manufacturers targeting the North American market, particularly for structural components and interior systems.

- Middle East and Africa (MEA): While local manufacturing capacity is limited compared to the industrialized regions, MEA is a vital consumer market, particularly for aftermarket components due to harsh operating conditions, high utilization rates, and an older average fleet age. Investment in localized component assembly and specialized vehicle modification (e.g., upfitting for extreme climates) is gradually growing, driven by national industrialization strategies (e.g., in Turkey and South Africa), aiming to establish regional hubs for automotive assembly and reducing high import dependence for high-volume maintenance parts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Auto Parts Manufacturing Market.- Bosch

- Denso

- Magna International

- ZF Friedrichshafen

- Continental AG

- Aisin Seiki

- Hyundai Mobis

- Lear Corporation

- Faurecia

- Aptiv

- Tenneco

- BorgWarner

- Valeo

- Schaeffler AG

- Gestamp

- Cummins

- Sumitomo Electric

- Marelli

- Michelin

- Bridgestone

- Autoliv

- Plastic Omnium

- American Axle & Manufacturing (AAM)

- Eaton Corporation

- Hella GmbH & Co. KGaA

- Visteon Corporation

- Flex-N-Gate Corporation

- JTEKT Corporation

- Knorr-Bremse AG

- Mahle GmbH

- Pirelli

- Delphi Technologies (BorgWarner)

- Exide Industries

- Goodyear Tire & Rubber Company

Frequently Asked Questions

Analyze common user questions about the Auto Parts Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant technological driver impacting the auto parts manufacturing industry?

The most significant technological driver is the global transition to electric vehicles (EVs). This shift fundamentally changes component demand, replacing traditional engine and transmission parts with specialized battery systems, power electronics, and high-voltage components. This demands significant investment in new manufacturing techniques, high-voltage component production lines, and specialized thermal management systems, necessitating massive manufacturing reconfiguration across Tier 1 and Tier 2 suppliers.

How are supply chain dynamics changing for auto parts manufacturers?

Supply chain dynamics are shifting aggressively from pure cost optimization to risk mitigation and resilience, driven by geopolitical instability and the 2020-2022 semiconductor shortages. Manufacturers are increasingly adopting nearshoring or regional manufacturing strategies (localization) to stabilize supply, especially for critical semiconductors and battery raw materials, reducing reliance on single geographic sources and protecting against trade disruptions while adhering to regional incentive programs like the IRA.

Which component segment of the auto parts market is projected to see the highest growth?

The Electrical and Electronics (E&E) segment is projected to experience the highest growth rate. This growth is fueled by massive demand for sophisticated components required for electrification (Battery Management Systems, inverters, power distribution units) and autonomy (Advanced Driver-Assistance Systems sensors, central domain controllers, and high-speed in-vehicle networking equipment), which are becoming standard features across all new vehicle platforms globally.

What role does Artificial Intelligence (AI) play in modern auto parts manufacturing?

AI is crucial for operational excellence, enabling high-speed, zero-defect quality control through machine vision, dramatically increasing operational uptime via predictive maintenance schedules, and optimizing complex logistics networks to ensure just-in-time delivery efficiency. Furthermore, generative AI is accelerating component design optimization for lightweighting and structural integrity, significantly cutting R&D timelines.

How is the aftermarket segment adapting to the rise of electric vehicles?

The aftermarket is adapting by requiring new specialized diagnostic tools, mandatory high-voltage safety training for technicians, and the stocking of unique EV-specific components, such as coolant pumps for battery thermal management and high-voltage harnesses. The long-term growth will focus increasingly on specialized component refurbishment (remanufacturing) and software-based diagnostics and updates for complex EV systems, shifting expertise requirements from mechanical to electrical engineering.

Why is lightweighting a critical trend in auto parts manufacturing?

Lightweighting—the strategic use of lighter materials like aluminum and composites—is critical for two reasons: in traditional ICE vehicles, it improves fuel economy and reduces emissions; in electric vehicles, it is essential for offsetting the significant weight of the battery pack, which directly influences the vehicle's driving range and overall energy consumption efficiency, making it a primary design objective for Tier 1 suppliers.

What are the primary operational challenges for Tier 1 suppliers today?

The primary operational challenges include managing the dual requirements of simultaneously sustaining high-volume, cost-competitive ICE component production while diverting substantial capital toward high-risk, high-reward EV component development. Other severe challenges involve securing consistent supplies of critical raw materials, maintaining technological competitiveness against new market entrants (tech companies), and navigating complex global logistics to meet strict OEM delivery schedules, all while facing persistent cost-reduction pressure.

How does Industry 4.0 affect auto parts manufacturing?

Industry 4.0 refers to the integration of cyber-physical systems, IIoT, and real-time data analytics into manufacturing. It affects auto parts manufacturing by creating 'smart factories' that enable unprecedented levels of automation, end-to-end traceability of components, dynamic process optimization, and highly flexible production lines capable of switching between different component specifications quickly, drastically improving efficiency, quality control, and reducing human error.

What distinguishes the manufacturing requirements for battery components?

Manufacturing battery components (cells, modules, packs) is highly specialized, demanding cleanroom environments, extremely high precision in assembly (often automated), and specific expertise in high-voltage engineering and thermal control. Advanced laser welding and joining techniques must ensure structural integrity and electrical isolation under harsh operating conditions, making quality assurance significantly more stringent than for conventional mechanical parts.

What is the role of domain control units (DCUs) in future parts manufacturing?

Domain Control Units (DCUs) are central, high-performance computing platforms that consolidate the control functions of previously separate Electronic Control Units. Their rise requires manufacturers to shift from supplying discrete mechanical parts to supplying highly complex, powerful, ruggedized, and software-centric computing hardware, demanding stronger competencies in embedded software development, systems integration, and cybersecurity standards (ISO 21434).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager