Autocrane Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441619 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Autocrane Market Size

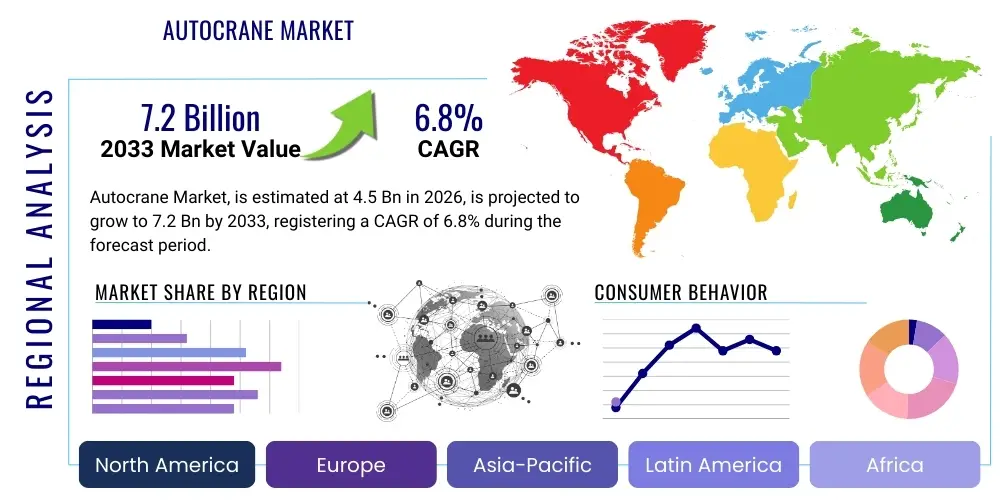

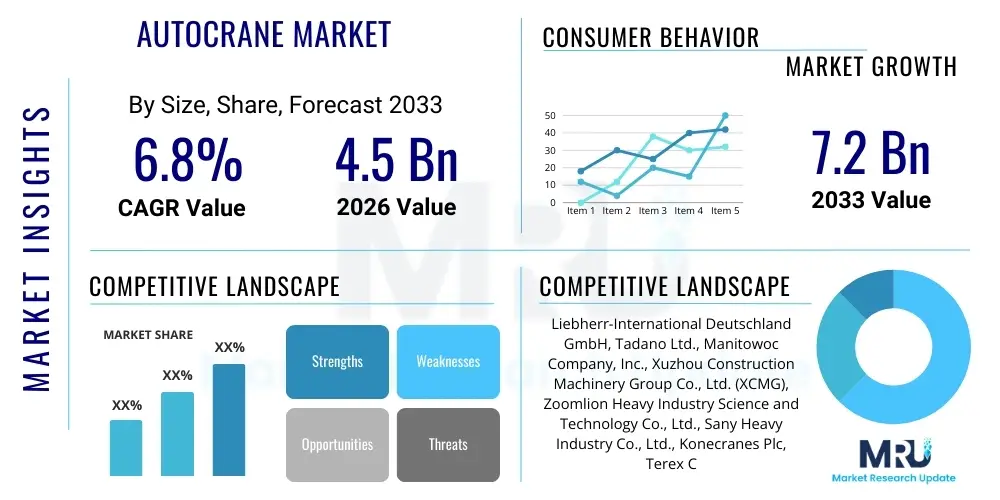

The Autocrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Autocrane Market introduction

The Autocrane Market encompasses the global trade and utilization of mobile cranes, specialized heavy machinery designed for lifting and transporting heavy materials across construction, industrial, and infrastructural sites. These machines, often referred to as truck cranes or mobile telescopic cranes, offer unparalleled mobility, rapid setup times, and versatility, making them indispensable tools in modern construction and logistics. The design sophistication of contemporary autocranes integrates advanced hydraulics, robust structural engineering, and sophisticated computer control systems, ensuring high precision, safety, and efficiency during complex lifting operations. Products range from small, nimble pick-and-carry cranes to large, multi-axle all-terrain cranes capable of handling loads exceeding 1,000 tons. The core function is to facilitate material handling in environments where permanent tower cranes are impractical or uneconomical.

Major applications driving the demand for autocranes include large-scale commercial and residential construction projects, the development of energy infrastructure such as wind farms and oil refineries, and extensive port operations for container handling and shipbuilding. The inherent benefit of autocranes—mobility coupled with significant lifting capacity—allows construction managers to optimize site logistics, reduce reliance on fixed infrastructure, and accelerate project timelines. Furthermore, the modular design of many modern autocrane systems enables swift customization to specific site constraints and lifting requirements, enhancing overall operational flexibility. This adaptability is crucial in industries like petrochemicals and mining, where lifting tasks are often performed in challenging, confined, or remote environments.

The primary driving factors sustaining market growth include unprecedented global investment in urban development and public works, especially in developing economies prioritizing smart city initiatives and critical infrastructure modernization. Increased focus on renewable energy, particularly the installation and maintenance of large wind turbines, mandates the use of high-capacity mobile cranes. Additionally, technological advancements related to enhanced safety features, greater fuel efficiency, and telematics integration are encouraging fleet owners to upgrade their existing equipment. Regulatory standards demanding safer, lower-emission machinery also contribute to the replacement cycle, pushing market participants toward adopting next-generation autocrane models that offer superior performance characteristics and reduced environmental footprint, thereby solidifying the market’s positive trajectory.

Autocrane Market Executive Summary

The Autocrane Market is experiencing robust expansion, fundamentally driven by global infrastructure development and digitalization trends impacting heavy machinery operation. Key business trends include a notable shift toward high-capacity, all-terrain and rough-terrain cranes, driven by complex energy and mining projects requiring operations in challenging topographical regions. Manufacturers are heavily investing in automation and hybridization, offering machines that improve efficiency and meet stringent emission standards, effectively transforming operational expenditure models for fleet owners. Mergers and acquisitions focused on expanding geographic reach and integrating specialized technology portfolios are defining the competitive landscape, pushing established market leaders to consolidate technological superiority and supply chain resilience. The leasing segment is gaining significant traction globally, offering flexible procurement options that appeal particularly to small and medium-sized construction enterprises, thus lowering the barrier to entry for utilizing advanced crane technology.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive governmental expenditure on transportation networks, burgeoning urbanization, and rapid industrialization, particularly in China and India. North America and Europe demonstrate a maturity characterized by demand for high-value, digitally integrated machines, focusing less on sheer volume growth and more on replacement cycles driven by sustainability mandates and advanced safety regulations. Emerging markets in Latin America and the Middle East and Africa (MEA) offer high potential, linked to large-scale oil and gas investments and diversified infrastructure projects, though growth in these regions is often subject to geopolitical and commodity price volatility. The regional heterogeneity requires market players to tailor their product offerings, sales strategies, and service networks to specific local needs, including adherence to varying payload and road safety regulations.

Segmentation trends indicate that the all-terrain crane segment is expected to show the highest CAGR due to its versatility and superior mobility across different surfaces, essential for modern multi-faceted construction sites. Capacity-wise, the demand is polarizing; while large capacity cranes (over 200 tons) are vital for specialized applications like wind energy, the mid-capacity range (50-100 tons) maintains strong market share driven by standard commercial construction. Application analysis highlights that the construction and mining sectors remain dominant, although the growth rate within the utility and telecommunications sectors is accelerating, reflecting the need for specialized lifting solutions for maintaining power grids and installing cellular towers. The integration of advanced telematics as a standard feature is segment-agnostic, improving fleet utilization rates, predictive maintenance scheduling, and overall equipment management efficiency across all product categories.

AI Impact Analysis on Autocrane Market

User queries regarding AI in the Autocrane Market primarily revolve around safety improvements, the feasibility of autonomous operation, and the economic benefits derived from advanced data analytics. Common concerns center on whether AI can genuinely prevent human error and severe accidents, the expected timeline for fully automated or remote-controlled cranes on commercial sites, and the costs associated with retrofitting existing fleets with AI-enabled hardware. Users are keenly interested in predictive maintenance capabilities—how AI analyzes operational data (load cycles, engine performance, environmental conditions) to preempt component failure, thereby minimizing costly downtime. Expectations are high concerning AI's role in optimizing lift planning, calculating real-time risk assessments, and improving overall site logistics management, transforming the labor-intensive aspects of crane operation into a data-driven process. The core theme is leveraging AI to enhance operational safety, efficiency, and resource allocation in complex lifting scenarios.

The immediate impact of Artificial Intelligence in the autocrane sector is concentrated in enhancing safety through real-time operational monitoring and load calculation assistance. AI algorithms process data from sensors, load cells, and cameras, providing operators with instantaneous feedback and warnings regarding potential instability, exceeding safe operating limits, or proximity hazards. This real-time analysis significantly mitigates the risk associated with human judgment errors during high-stress lifting operations. Furthermore, AI contributes substantially to sophisticated lift planning by simulating complex maneuvers before execution, allowing for the optimization of boom angle, counterweight distribution, and rigging setup, thereby ensuring maximum efficiency and safety compliance, a critical advancement for projects with strict insurance and regulatory requirements.

Beyond safety, AI is transforming fleet management and maintenance protocols. Machine learning models analyze historical and real-time operational data—such as hydraulic pressure, engine temperature, and usage patterns—to predict equipment failure with high accuracy, shifting maintenance strategy from reactive or time-based schedules to true predictive maintenance. This proactive approach minimizes unplanned downtime, drastically reducing maintenance costs and improving overall asset utilization rates. In the long term, AI is paving the path toward semi-autonomous and fully autonomous crane operation, particularly for repetitive or dangerous tasks in controlled environments like container ports or large fabrication yards. This transition promises to enhance productivity, standardize lifting quality, and address the persistent challenge of skilled operator shortages globally.

- AI-driven real-time stability control and load moment indication systems.

- Predictive maintenance analytics reducing unplanned equipment downtime by up to 30%.

- Optimization of complex lift planning through simulation and pathfinding algorithms.

- Integration of computer vision for identifying hazards, personnel proximity, and restricted zones.

- Enhancement of operator training through virtual reality simulations powered by operational data.

- Facilitation of remote diagnostics and over-the-air software updates.

- Development of semi-autonomous functions for repetitive tasks like material stockpiling and retrieval.

DRO & Impact Forces Of Autocrane Market

The Autocrane Market is shaped by a powerful confluence of drivers, restraints, opportunities, and internal and external impact forces that dictate its evolutionary path and growth trajectory. Key drivers include accelerating global infrastructure development, significant capital deployment in renewable energy projects (especially wind and solar), and the persistent need for rapid urbanization solutions that require versatile heavy lifting equipment. Restraints primarily involve the high initial cost of advanced, high-capacity autocrane units, stringent and varying regulatory requirements across different jurisdictions regarding road transport and emissions, and the critical shortage of certified, highly skilled crane operators globally. Opportunities reside in the emerging fields of crane hybridization and full electrification, the application of telematics and IoT for operational efficiency gains, and penetrating nascent markets in Central Africa and Southeast Asia where infrastructure buildup is commencing. These internal forces are augmented by external impact forces such such as fluctuating commodity prices affecting steel and fuel costs, geopolitical instability impacting major infrastructure financing, and technological standardization efforts which accelerate market adoption.

The primary drivers exert immense pressure on the market for continuous expansion and technological upgrades. Specifically, the global shift towards constructing larger, heavier wind turbines necessitates cranes with extreme lift height and capacity, pushing manufacturers to innovate beyond traditional design limits. Similarly, government mandates across the G20 nations focused on rebuilding aging infrastructure—bridges, ports, and power plants—guarantee a sustained demand pipeline for reliable, mobile lifting solutions. This consistent demand environment ensures robust capital investment in manufacturing capacity and R&D, solidifying market fundamentals. However, the influence of these positive drivers is often tempered by significant restraints that challenge operational efficiency and market accessibility. The high capital expenditure required for acquiring new equipment acts as a major barrier, particularly for small to mid-sized construction firms, leading to reliance on the leasing market which introduces complexities related to fleet availability and pricing models.

Opportunities in the autocrane sector are intrinsically linked to sustainable technological advancements and geographic diversification. The opportunity to transition from diesel power to electric or hydrogen fuel cell-powered cranes (hybridization) presents a significant growth avenue, driven by evolving environmental regulations and corporate sustainability commitments. Furthermore, the integration of advanced sensors and data analytics offers lucrative service revenue streams through predictive maintenance contracts and fleet optimization consulting, moving the industry beyond mere equipment sales. Impact forces, particularly the cyclical nature of the construction and mining industries and volatility in steel and energy prices, dictate manufacturer margins and end-user purchasing power. Geopolitical stability, especially concerning large-scale international projects funded through development banks, acts as a crucial external force influencing regional market strength and the predictability of future demand, requiring sophisticated risk management strategies from all market participants.

| Factor Type | Key Attributes |

|---|---|

| Drivers (D) | Global surge in infrastructure development; Expansion of renewable energy installations (wind farms); Rapid urbanization and commercial construction boom; Demand for high-capacity, versatile lifting solutions. |

| Restraints (R) | High capital investment and operating costs; Shortage of skilled and certified crane operators; Stringent environmental and road safety regulations; Fluctuations in raw material (steel) and energy prices. |

| Opportunities (O) | Technological adoption (Hybridization, IoT, AI-assisted lifting); Growth in emerging economies (APAC, MEA); Increasing demand for leasing and rental services; Specialized applications in maintenance and telecommunications. |

| Impact Forces (I) | Regulatory mandates (Tier 4/Stage V emission standards); Economic cycles affecting construction spending; Technological standardization; Geopolitical stability influencing major project funding. |

Segmentation Analysis

The Autocrane Market segmentation provides a granular view of diverse product categories, capacity ranges, and application areas, allowing for targeted market strategies and precise demand forecasting. The market is primarily segmented based on product type (e.g., Truck-Mounted, All-Terrain, Rough-Terrain, Crawler), reflecting variations in mobility, site suitability, and lifting mechanism. Capacity is a critical differentiator, ranging from small hydraulic cranes used for urban tasks to ultra-high capacity lattice boom cranes utilized in major industrial assembly projects. Furthermore, segmentation by end-user application—Construction, Oil & Gas, Energy & Utility, and Manufacturing—highlights the specific operational demands and procurement cycles associated with each industry, revealing specialized niche markets within the broader heavy machinery landscape. Analyzing these segments is essential for understanding the underlying growth dynamics and competitive positioning of various market players.

The product type segmentation is heavily influenced by site conditions. Rough-terrain cranes dominate rugged and undeveloped construction sites, offering excellent ground clearance and maneuverability, commonly seen in mining and oil field operations. Conversely, truck-mounted cranes, characterized by rapid highway speeds and quick setup, are preferred for short-term tasks in urban environments and routine infrastructure maintenance. All-terrain cranes represent the premium, high-value segment, combining the on-road speed of truck cranes with the off-road capability of rough-terrain models, making them the default choice for large-scale, mobile projects requiring versatility across varied terrains. The crawler crane segment, while less mobile, is indispensable for projects requiring immense lifting capacity and stability over long periods, such as nuclear plant construction or bridge assembly, driving demand in specialized, long-duration civil engineering undertakings.

From an end-user perspective, the Construction sector remains the largest segment globally, driven by residential, commercial, and public works construction. However, the Energy and Utility sector, particularly wind energy installation and maintenance, exhibits the fastest growth rate, commanding the need for cranes in the 400-ton plus capacity range. This rapid evolution in end-user demands forces manufacturers to continually adapt specifications, focusing on reach, precision control, and sustainable power sources tailored to industry-specific operational environments. The precise analysis of these segments helps stakeholders allocate resources effectively, determine production focus areas, and anticipate future technological shifts driven by evolving regulatory and operational requirements across different industrial verticals.

- By Product Type:

- Truck-Mounted Cranes

- All-Terrain Cranes

- Rough-Terrain Cranes

- Crawler Cranes

- Others (Pick & Carry, Marine Cranes)

- By Lifting Capacity:

- Up to 50 Tons

- 51 Tons – 100 Tons

- 101 Tons – 200 Tons

- Above 200 Tons

- By Application/End-User:

- Construction (Residential, Commercial, Industrial)

- Oil & Gas and Mining

- Energy and Utility (Wind, Power Plants)

- Shipping and Port Operations

- Telecommunications and Infrastructure Maintenance

Value Chain Analysis For Autocrane Market

The Value Chain for the Autocrane Market is complex, beginning with the upstream supply of highly engineered raw materials and concluding with comprehensive aftermarket services. Upstream analysis focuses on the procurement of high-strength specialized steel alloys (crucial for lightweight yet robust booms and chassis), advanced hydraulic components (pumps, valves, cylinders), and sophisticated electronic control units (ECUs) and sensors. The quality and availability of these components significantly impact the final product’s performance, reliability, and cost structure. Key challenges upstream include managing commodity price volatility and ensuring a reliable supply of bespoke, heavy-duty components from specialized engineering firms. Manufacturers must maintain deep strategic partnerships with steel suppliers and hydraulic system integrators to mitigate supply chain risks and maintain quality standards essential for safety-critical lifting equipment.

The midstream phase involves manufacturing and assembly, characterized by high capital intensity and specialized labor. This stage includes chassis fabrication, precision welding of the boom structures, integration of the complex hydraulic and electrical systems, and rigorous quality control testing, including non-destructive testing (NDT) of critical load-bearing parts. Manufacturers often operate highly automated facilities but rely on skilled technicians for final assembly and calibration. Downstream activities are dominated by distribution, sales, rental services, and after-sales support. The distribution channel is often bifurcated, involving direct sales to major construction conglomerates and state-owned enterprises, and reliance on extensive dealer networks and rental companies for broader market penetration, especially among smaller contractors.

The distribution network relies heavily on both direct and indirect channels. Direct sales are preferred for complex, high-capacity, customized units, allowing the manufacturer to maintain direct control over pricing and technical consultation. Indirect channels, primarily independent dealers and third-party rental giants, are crucial for reaching dispersed geographic markets and providing local service support and equipment financing. The aftermarket segment—including parts supply, maintenance contracts, and equipment refurbishment—is a significant profit center, requiring robust global service networks and prompt availability of genuine spare parts to minimize client downtime. Efficient management of the entire value chain, from securing high-grade materials to providing superior service support, is paramount for competitive advantage in this capital-intensive industry.

Autocrane Market Potential Customers

Potential customers for the Autocrane Market represent a broad spectrum of heavy industrial and construction entities whose operations require reliable and efficient vertical and horizontal material movement. The primary end-users are large-scale construction contractors involved in major civil engineering projects, such as bridge building, highway construction, and high-rise commercial and residential development. These buyers demand versatility, superior safety ratings, and advanced telematics for fleet management. Another crucial segment includes national and international rental companies that purchase large fleets of diverse crane types to lease to smaller contractors and specialized niche firms, prioritizing uptime, standardization, and ease of maintenance across their massive equipment portfolios.

Beyond traditional construction, the energy sector forms a vital customer base. This includes utility companies and independent power producers involved in the erection and servicing of wind turbines, the assembly of solar farms, and the construction of traditional power generation facilities, demanding cranes with exceptional height, reach, and precision, often operating in remote or constrained environments. Furthermore, heavy manufacturing and industrial facilities, such as petrochemical plants, shipyards, and aerospace assembly lines, are frequent buyers or renters of autocranes for periodic maintenance, heavy component installation, and facility expansion projects. These industrial customers emphasize operational precision and strict adherence to internal safety standards, often favoring customized lifting attachments and advanced operator assistance systems.

The procurement decision among these diverse end-users is typically driven not just by the initial purchase price, but by total cost of ownership (TCO), residual value, and the quality of local service support. Large construction firms often prefer outright purchase to secure long-term depreciation benefits, while smaller players increasingly opt for leasing to maintain flexibility and minimize capital outlay. Geographically, governments and public works departments are also key potential customers, often procuring cranes through long-term contracts for maintenance of public infrastructure, where the purchase is highly regulated and influenced by criteria such as local content requirements and environmental compliance standards, ensuring a stable, albeit cyclical, demand source.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Liebherr-International Deutschland GmbH, Tadano Ltd., Manitowoc Company, Inc., Xuzhou Construction Machinery Group Co., Ltd. (XCMG), Zoomlion Heavy Industry Science and Technology Co., Ltd., Sany Heavy Industry Co., Ltd., Konecranes Plc, Terex Corporation, Kato Works Co., Ltd., Palfinger AG, Kobelco Construction Machinery Co., Ltd., Link-Belt Construction Equipment Company, Effer S.p.A., F.lli Ferrari Corporation, Altec Industries, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autocrane Market Key Technology Landscape

The technological landscape of the Autocrane Market is rapidly evolving, moving toward digitization, enhanced automation, and sustainable power solutions. The most significant advancement lies in telematics and IoT integration, transforming cranes from isolated machines into networked data-generating assets. These systems utilize advanced sensors and GPS to provide real-time data on location, operational hours, fuel consumption, and component health directly to fleet managers. This technological capability allows for precise planning, optimizing asset utilization across multiple project sites, and providing crucial inputs for accurate, AI-driven predictive maintenance scheduling, which drastically improves equipment uptime and lowers overall operational expenses.

Another major technological trend is the development and adoption of advanced safety and operator assistance systems. These include sophisticated Load Moment Indicators (LMI) that utilize high-speed processing units and complex algorithms to monitor the load, boom angle, and outrigger pressure, preventing tipping hazards or over-stressing structural components. Anti-collision systems, often leveraging LiDAR and computer vision, are becoming standard, ensuring safer operation in congested construction environments by automatically slowing or stopping crane movement when hazards or personnel encroach upon the working radius. These technologies are crucial for meeting increasingly strict global safety regulations, especially those mandated in mature markets like Germany and the US.

Furthermore, the drive for sustainability is accelerating the transition toward hybrid and fully electric powertrain technologies, particularly in the mid-capacity range used in urban environments where noise and air pollution regulations are stringent. Hybrid cranes utilize efficient diesel engines coupled with electric motors to manage peak loads, improving fuel economy and reducing emissions. Simultaneously, advancements in high-strength, lightweight materials, such as specialized steel and carbon fiber composites, are critical for increasing crane capacity and reach without increasing the overall weight of the vehicle, optimizing road transport compliance and enhancing the efficiency of the lifting structure itself. The convergence of digital connectivity, safety automation, and green technology defines the competitive edge in the modern Autocrane Market.

Regional Highlights

The regional analysis reveals differential growth trajectories influenced by localized economic cycles, infrastructure investment levels, and regulatory environments.

- Asia Pacific (APAC): APAC dominates the global autocrane market, primarily driven by massive infrastructure spending in China, India, and Southeast Asian nations (Indonesia, Vietnam). The rapid pace of urbanization, coupled with large-scale projects in rail, road, and power generation, creates overwhelming demand for all crane types, especially mid-to-high capacity truck-mounted and crawler cranes. China, as the largest producer and consumer, sets key market trends, emphasizing domestic technological self-sufficiency. India's accelerating highway and port development projects ensure robust near-term demand, making this region the central focus for market volume growth.

- North America: This region is characterized by high demand for sophisticated, specialized equipment, driven by strict safety and environmental regulations and high labor costs. The market is focused on replacement cycles and the adoption of high-value, technologically advanced cranes, particularly all-terrain models favored for utility and oil & gas operations. Investments in renewable energy (e.g., US wind energy projects) and infrastructure modernization, particularly in replacing aging bridges, are key demand drivers. Operators prioritize fuel efficiency, advanced telematics, and compliance with Tier 4 Final emission standards.

- Europe: Europe is a mature market defined by stringent emission regulations (Stage V) and a strong emphasis on operational sustainability and efficiency. The demand here centers on electric, hybrid, and low-emission diesel cranes. Germany, France, and the UK are key markets, driven by wind energy maintenance and complex urban construction requiring compact, versatile machines. The presence of major global manufacturers means the region is a hub for R&D and the early adoption of automation and safety technology.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) states, driven by massive sovereign-funded projects in tourism, urban development (e.g., NEOM), and ongoing oil & gas infrastructure maintenance and expansion. The climate necessitates rugged, desert-proof equipment. Demand is high for high-capacity cranes (above 200 tons) for heavy lifting in petrochemical facilities and large construction sites. African markets are nascent, with potential tied to mining and resource extraction infrastructure development.

- Latin America: This region presents moderate, albeit volatile, growth, primarily driven by commodity prices impacting mining and oil & gas investments (e.g., Brazil, Chile). Infrastructure development, particularly in transportation logistics and energy, provides steady demand. Market dynamics are often influenced by financing availability and political stability, leading to preference for reliable, cost-effective equipment and strong local distribution support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autocrane Market.- Liebherr-International Deutschland GmbH

- Tadano Ltd.

- Manitowoc Company, Inc.

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Sany Heavy Industry Co., Ltd.

- Konecranes Plc

- Terex Corporation

- Kato Works Co., Ltd.

- Palfinger AG

- Kobelco Construction Machinery Co., Ltd.

- Link-Belt Construction Equipment Company

- Effer S.p.A.

- F.lli Ferrari Corporation

- Altec Industries, Inc.

- Böcker Maschinenwerke GmbH

- Elliott Equipment Company

- Alimak Group AB

- Hyva Group N.V.

- Cargotec Corporation (Hiab)

Frequently Asked Questions

Analyze common user questions about the Autocrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the high-capacity Autocrane segment?

The primary driver for high-capacity autocrane growth (cranes above 200 tons) is the massive global investment in renewable energy projects, particularly the installation and maintenance of larger, heavier wind turbines, alongside complex heavy-lift requirements in oil and gas and bridge construction.

How are environmental regulations affecting Autocrane manufacturing?

Environmental regulations, such as the EU Stage V and US EPA Tier 4 Final emission standards, mandate cleaner engines, pushing manufacturers toward developing and commercializing hybrid, electric, and more fuel-efficient diesel powertrain technologies, increasing operational costs but improving market competitiveness.

Which geographical region represents the largest potential market?

Asia Pacific (APAC), particularly driven by massive governmental investments in infrastructure and urbanization in China and India, represents the largest market in terms of volume and exhibits the highest growth potential during the forecast period due to persistent development needs.

What role does telematics play in Autocrane fleet management?

Telematics integrates IoT sensors and GPS to provide real-time data on crane usage, performance, and health. This enables predictive maintenance scheduling, optimizes asset allocation across projects, reduces fuel consumption through operational insights, and enhances theft prevention, directly improving ROI for fleet owners.

What is the current impact of AI on Autocrane safety?

AI significantly enhances safety by powering sophisticated Load Moment Indicators (LMIs), offering real-time stability monitoring, and utilizing computer vision for anti-collision systems. This technology assists operators in preventing critical human errors and ensures adherence to strict safety parameters during complex lifts.

Why are All-Terrain Cranes increasingly popular over other types?

All-Terrain cranes offer superior versatility, combining the high-speed road travel capability of truck cranes with the robust off-road performance of rough-terrain models. This adaptability makes them ideal for modern construction projects that span varied topographical and logistical environments.

What are the main financial challenges facing small Autocrane operators?

Small operators primarily face the challenges of high initial capital expenditure for acquiring advanced equipment and the substantial ongoing costs associated with maintenance, insurance, and compliance with stringent environmental and safety certification requirements.

How does the shortage of skilled operators influence market demand?

The persistent shortage of skilled operators drives demand for cranes featuring enhanced automation, advanced operator assistance systems (OAS), and intuitive controls, including remote operation capabilities, as manufacturers seek to mitigate the reliance on extensive human expertise.

What is the typical lifespan of a modern Autocrane?

A modern, well-maintained Autocrane typically has an operational lifespan exceeding 15 to 20 years, though its economic lifespan (before replacement becomes fiscally preferable) often depends on utilization rates, technological obsolescence, and the adherence to rigorous maintenance schedules.

Is the rental segment or the direct sales segment growing faster?

The rental and leasing segment is generally exhibiting faster growth globally, especially in emerging markets, as it allows construction firms to manage capital expenditure more flexibly, gain access to specialized equipment without ownership risk, and quickly adapt to fluctuating project demands.

What technological factors influence the optimization of boom length?

Boom length optimization is influenced by advancements in high-tensile steel alloys, computer-aided structural design, and sophisticated hydraulic cylinder technology that allows for lighter yet stronger telescopic sections, maximizing reach and lifting capacity while maintaining road travel legality.

How is digitalization impacting the crane repair and maintenance market?

Digitalization facilitates remote diagnostics, allowing technicians to troubleshoot issues remotely using data gathered via telematics. This reduces diagnostic time, lowers field service costs, and enables more precise delivery of necessary spare parts, fundamentally streamlining the repair process.

Which application segment shows the most stable demand?

The infrastructure maintenance segment (e.g., repairing bridges, utility grids, and roads) tends to show the most stable and predictable demand, as these activities are continuous and less susceptible to the cyclical economic downturns that heavily affect new residential or commercial construction.

What role do Chinese manufacturers play in the global market?

Chinese manufacturers like XCMG, Sany, and Zoomlion have become dominant global players, specializing in high-volume production across all segments, offering competitive pricing, and rapidly expanding their technological footprint, especially in the mid-to-high capacity crane segments globally.

How critical is the aftermarket service for manufacturer profitability?

Aftermarket service, including genuine parts sales and maintenance contracts, is extremely critical. It provides high-margin, recurring revenue streams, significantly contributing to manufacturer profitability and serving as a crucial factor in building customer loyalty and ensuring machine uptime.

What are the main risks associated with using Autocranes near power lines?

The main risks include electrocution hazards due to boom contact with high-voltage lines. Modern cranes mitigate this through sophisticated proximity warning systems, height limiting technology, and strict adherence to mandated minimum safe approach distances (MSADs) enforced by regulatory bodies.

How are manufacturers addressing the issue of crane cyber security?

Manufacturers are addressing cyber security by implementing secure boot mechanisms, encrypting operational data transmission via telematics, and securing access control systems to prevent unauthorized remote access or tampering with safety-critical software and control algorithms.

What is the expected long-term impact of hydrogen fuel cells on the market?

While currently nascent, hydrogen fuel cell technology holds significant long-term potential, especially for heavy-duty, high-capacity cranes where battery power is impractical. It promises zero-emission operation with rapid refueling times, aligning with future stringent environmental mandates.

How does the crane capacity segmentation influence pricing strategy?

Pricing strategy is highly elastic based on capacity; lower capacity cranes are priced competitively based on volume, while ultra-high capacity cranes (200+ tons) command premium prices due to the specialized engineering, low volume production, and critical application requirements they serve.

What is the significance of outrigger technology innovation?

Outrigger innovation focuses on automatic leveling, variable spread systems (VarioBase), and integrated pressure sensors. This allows cranes to maximize lifting performance in non-standard or restricted setup areas, significantly increasing site flexibility and safety margins.

What defines the 'rough-terrain' Autocrane segment?

Rough-terrain cranes are specialized for operations on poorly prepared construction sites, featuring rugged four-wheel-drive systems, large tires, high ground clearance, and telescoping booms, making them essential for mining, oil field, and preliminary construction site work.

How are global steel tariffs affecting Autocrane production costs?

Fluctuations and increases in global steel tariffs directly impact the upstream supply chain, raising the cost of crucial raw materials (high-strength steel), which subsequently pressures manufacturers' margins and can lead to higher end-product pricing, particularly affecting cost-sensitive emerging markets.

Is there a trend toward lighter or heavier Autocranes?

There is a dual trend: a move toward lighter, more compact cranes for constrained urban environments (aided by lightweight materials) and a concurrent increase in the capacity of ultra-heavy cranes (400+ tons) to meet the demands of oversized infrastructure components like wind turbine hubs and large precast elements.

What specific safety technology is mandated in European markets?

European markets often mandate advanced safety features including overload protection systems, dynamic load monitoring (DLM), restricted working envelope features, and strict adherence to machine directives that govern stability, robustness, and control systems integrity.

How do currency exchange rates impact international Autocrane sales?

Currency exchange rate volatility significantly impacts the pricing of internationally traded cranes. Strong currencies (like the Euro or Yen) can make European and Japanese cranes more expensive abroad, while a weak Yuan can enhance the competitiveness of Chinese exporters.

What is the expected timeline for fully autonomous Autocranes?

Fully autonomous autocrane operation for open commercial construction sites is still several years away (likely beyond 2033), pending further regulatory approvals and comprehensive sensor validation. However, semi-autonomous functions and fully remote operation in controlled environments are already being deployed.

What are the key differentiators for purchasing decisions in the Oil & Gas sector?

In the Oil & Gas sector, purchasing decisions prioritize reliability, extreme environmental suitability (e.g., explosion-proof certifications, desert resilience), high lifting capacity for module assembly, and verifiable safety track records and certifications.

How does modular design benefit Autocrane users?

Modular design allows for easier and quicker setup and dismantling, facilitates transport compliance by breaking down heavy components, and enables swift component replacement for maintenance, reducing overall operational logistics and downtime.

Why is Latin America considered a moderate growth market?

Latin America is moderate due to reliance on commodity prices (mining, oil) and susceptibility to economic and political instability which can halt large-scale infrastructure projects. Growth, while present, lacks the aggressive consistency seen in parts of Asia or North America.

What is the impact of specialized lifting attachments on market innovation?

Specialized lifting attachments (e.g., synchronized hoist systems, customized spreaders) drive innovation by allowing standard cranes to perform complex, non-standard tasks with greater safety and efficiency, opening niche applications in sectors like precast concrete and aerospace manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Autocrane (Auto Crane) Market Size Report By Type (All Terrain Crane, Truck Crane, Trailer-Mounted Crane, Rough Terrain Crane, Others), By Application (Construction, Industries, Utilities, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Autocrane Market Statistics 2025 Analysis By Application (Construction, Industries, Utilities), By Type (All Terrain Crane, Truck Crane, Trailer-Mounted Crane, Rough Terrain Crane), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Autocrane Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (All Terrain Crane, Truck Crane, Trailer-Mounted Crane, Rough Terrain Crane, Others), By Application (Construction, Industries, Utilities, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager