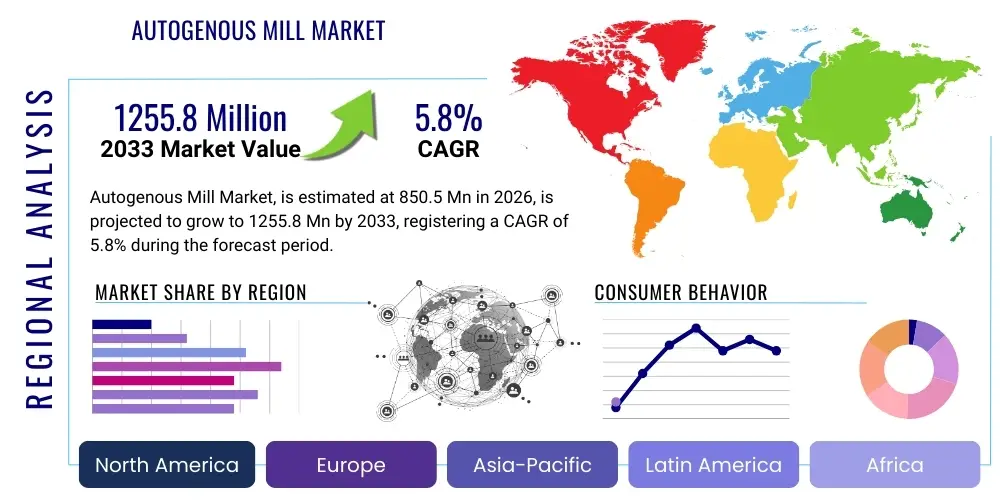

Autogenous Mill Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442029 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Autogenous Mill Market Size

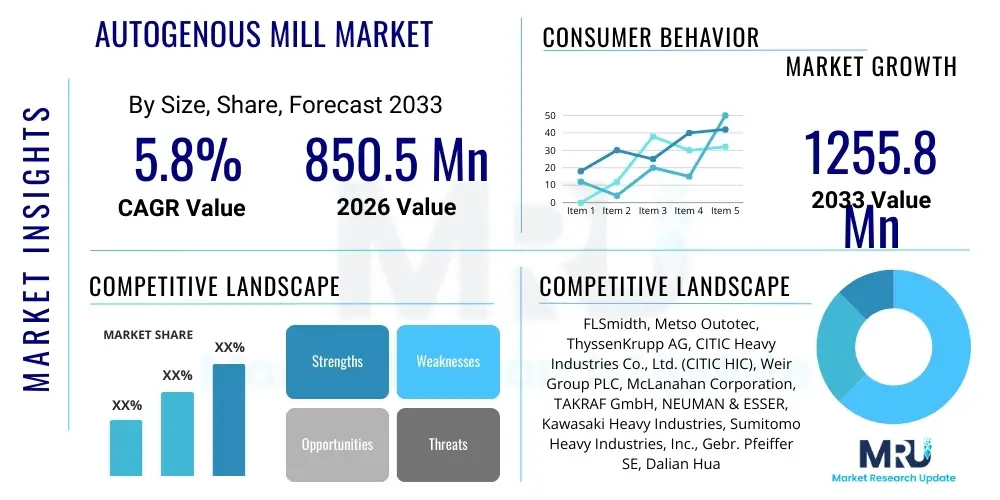

The Autogenous Mill Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1255.8 Million by the end of the forecast period in 2033.

Autogenous Mill Market introduction

Autogenous mills (AG Mills) represent a crucial technology within the mineral processing industry, specifically utilized for comminution, which involves reducing the size of ore particles. Unlike traditional ball mills or rod mills that rely on external grinding media (steel balls or rods), AG mills use the ore itself—or larger pieces of the ore designated as 'rocks'—as the grinding medium. This principle, known as autogenous grinding, offers significant operational advantages, including reduced media consumption costs, lower environmental impact due to the elimination of steel scrap, and optimized energy efficiency for certain ore types. The process is particularly effective for large-scale operations processing complex, hard, and abrasive ores, leading to increased throughput and improved liberation of valuable minerals. The primary function of these mills is to prepare the ore for subsequent downstream processing steps, such as flotation or leaching.

The product description of an autogenous mill emphasizes its large diameter, robust design, and slow rotational speed, necessary to accommodate the massive volumes of rock required for effective grinding action. These mills are typically horizontal cylinders lined with wear-resistant materials, equipped with lifting liners to cascade the rock media and ore particles within the shell. Major applications are concentrated in the mining sector, specifically in the processing of copper, gold, iron ore, and platinum group metals (PGMs). Their robust capacity makes them indispensable in greenfield mining projects and large expansion programs where maximizing productivity and minimizing operational expenditure (OPEX) are paramount. The design complexity and high capital expenditure (CAPEX) associated with these systems are offset by long-term savings in consumables and maintenance, establishing them as a preferred choice in high-tonnage primary grinding circuits.

Key benefits driving market adoption include superior energy utilization, especially when compared to crushing circuits followed by conventional grinding, and adaptability to varying feed characteristics, provided the ore possesses sufficient hardness and lump size distribution to act as an effective grinding medium. The escalating global demand for base metals and critical minerals, essential for the energy transition and infrastructure development, acts as a primary driving factor for the AG Mill market. Furthermore, stricter environmental regulations concerning steel slag disposal and the continuous industry push toward automation and energy optimization solidify the market's growth trajectory. Technological advancements focusing on improved liner designs, variable speed drives, and advanced process control systems are making AG mills more efficient and appealing across diverse geological environments globally.

Autogenous Mill Market Executive Summary

The Autogenous Mill market is characterized by moderate but stable growth, driven predominantly by the necessity for large-scale, cost-efficient mineral processing in mature mining regions and emerging economies rich in mineral resources. Current business trends indicate a strong focus among leading equipment manufacturers on integrating sophisticated digitalization features, such as predictive maintenance (PdM) systems and real-time operational optimization tools, into AG mill offerings. The high initial investment required for these colossal machines means that procurement decisions are inherently linked to long-term global commodity price stability and the commencement of major, multi-billion dollar mining projects. Strategic partnerships between engineering, procurement, and construction (EPC) firms and AG mill suppliers are becoming more frequent to offer integrated comminution solutions, thereby streamlining project execution timelines and enhancing technical support across the equipment lifecycle. Furthermore, the market is experiencing increasing pressure to develop modular and faster-to-deploy grinding solutions to cater to medium-sized mining operations or expansions requiring quicker ramp-up times.

Regionally, the market dynamics are heavily influenced by the geographical distribution of major hard rock mining activities. Asia Pacific (APAC), particularly driven by extensive mining operations in China, Australia, and Indonesia, remains the largest market segment due to robust demand for iron ore, copper, and gold, coupled with ongoing infrastructure development necessitating efficient mineral extraction. North America and Latin America, with their vast reserves of copper and precious metals, represent critical growth regions, emphasizing technological upgrades and replacement cycles of older equipment to meet increasingly stringent environmental and efficiency standards. Latin America, especially countries like Chile and Peru, stands out due to massive copper mining projects where the energy efficiency and throughput capabilities of AG mills are critical operational differentiators. European growth is more niche, focusing on specialized applications and the replacement market, leveraging advanced manufacturing techniques and automation expertise.

Segmentation trends highlight the dominance of large-capacity AG mills (over 10,000 HP) due to the economies of scale achieved in primary grinding circuits, especially within copper and gold processing. However, the market for semi-autogenous mills (SAG Mills), which use a smaller percentage of steel balls alongside the ore, often overshadows pure AG mills, particularly in ores lacking optimal autogenous grinding characteristics. Despite this competition, the Autogenous Mill segment retains a crucial role where ore competency is high. By application, gold and copper mining consistently contribute the highest revenue, reflecting the high tonnage and hard rock characteristics typical of these operations. Future segmentation growth is anticipated in specialized mineral applications, such as lithium and rare earth elements, where customized comminution circuits are being designed to optimize liberation and recovery rates, thereby slightly diversifying the traditional application base of AG grinding technology.

AI Impact Analysis on Autogenous Mill Market

User queries regarding AI's influence on the Autogenous Mill market primarily revolve around three core themes: enhancing energy efficiency, optimizing throughput variability, and enabling predictive maintenance (PdM) strategies. Users frequently question how AI algorithms can manage the inherent variability in ore hardness and size distribution—a major challenge in AG grinding—to maintain consistent product size and minimize unplanned downtime. There is significant interest in AI's capacity to analyze vibration data, acoustic signatures, and process variables (like power draw, speed, and feed rate) simultaneously, allowing for ultra-fine adjustments to mill parameters in real-time, thereby maximizing Specific Energy Consumption (SEC) and extending liner life. Expectations center on AI transitioning mill operations from reactive or rule-based control systems to highly adaptive, self-optimizing environments that autonomously manage complex grinding dynamics. Users anticipate that AI integration will mitigate reliance on highly specialized human operators for minute-by-minute adjustments, standardizing performance across shifts and sites.

The integration of Artificial Intelligence, particularly through machine learning models, promises a transformative shift in the operation and maintenance lifecycle of Autogenous Mills. These sophisticated systems can consume vast datasets generated by numerous sensors—including weightometers, particle size analyzers, and power meters—to build highly accurate predictive models of mill performance. For instance, AI can predict liner wear patterns with high precision, allowing maintenance schedules to be optimized for maximum equipment uptime and minimizing the inventory holding costs associated with replacement parts. Furthermore, AI-driven control loops can dynamically adjust feed rates and water addition based on predicted changes in ore characteristics hours in advance, ensuring the mill operates at its optimal grind curve despite geological heterogeneity. This proactive approach significantly reduces energy wastage associated with suboptimal operation and reduces the risk of catastrophic failures resulting from undetected mechanical stresses.

A major focus area for AI deployment is the development of virtual sensors and soft sensors, where physical sensors are impractical or cost-prohibitive. AI algorithms infer critical operational metrics, such as the pulp density inside the mill or the precise circulating load, based on easily measurable variables like motor current and hydrostatic pressure. This enhanced visibility into the internal workings of the mill allows operators (or the AI itself) to make immediate, informed decisions, thereby improving overall system recovery and efficiency. The impact of AI extends beyond simple optimization; it facilitates the creation of digital twins of the entire comminution circuit, allowing engineers to simulate various scenarios, test control strategies safely, and train operators using realistic, data-driven models. This comprehensive digitalization, powered by AI, is anticipated to solidify Autogenous Mills as high-tech assets capable of delivering superior cost efficiency over their traditional counterparts.

- Real-Time Optimization (RTO) of grinding parameters based on ore variability.

- Predictive Maintenance (PdM) using acoustic and vibration analysis to forecast component failure.

- Enhanced energy efficiency through dynamic adjustment of speed and feed rate, minimizing Specific Energy Consumption (SEC).

- Development of digital twins for simulating operational improvements and operator training.

- Automated anomaly detection in bearing temperatures and lubrication systems.

- Improved classification efficiency and consistent product size distribution using smart control systems.

DRO & Impact Forces Of Autogenous Mill Market

The Autogenous Mill market is significantly influenced by a complex interplay of global economic, environmental, and technological forces. Key drivers center around the diminishing availability of high-grade ore bodies, forcing miners to process lower-grade, harder ores at higher tonnages to meet global demand, a scenario where the massive throughput and efficiency of AG mills become indispensable. Additionally, the increasing cost and logistical challenges associated with sourcing and utilizing steel grinding media provide a strong economic incentive for mining companies to adopt true autogenous or semi-autogenous grinding circuits, thereby capitalizing on media cost savings. Global infrastructure spending, particularly in rapidly industrializing nations, fuels consistent demand for key metals (copper, iron, gold), anchoring major AG mill installations. Furthermore, stringent global environmental regulations promoting resource efficiency and waste reduction favor AG technology, given its inherently lower environmental footprint compared to media-intensive grinding circuits, driving replacement and expansion cycles in established mining regions.

However, the market faces notable restraints that temper rapid expansion. The principal challenge is the exceptionally high capital expenditure (CAPEX) required for purchasing, installing, and commissioning large AG mills, which necessitates long payback periods and substantial financing, often limiting adoption to Tier 1 mining companies. Operational complexity and the prerequisite for the ore itself to possess adequate competence (hardness and size distribution) for autogenous grinding represent significant technical restraints; if the ore lacks these characteristics, efficiency plummets, often leading to a forced transition to the less cost-effective Semi-Autogenous Grinding (SAG) configuration. Economic volatility in commodity markets, coupled with geopolitical instability in major mining regions, introduces uncertainty regarding long-term project viability, leading to deferred investment decisions for multi-million dollar comminution equipment. Finally, competition from established high-pressure grinding rolls (HPGRs) in certain applications, which offer a different energy efficiency profile, also acts as a constraint, forcing AG mill suppliers to continuously prove superior life-cycle cost performance.

Opportunities for market expansion are centered on the rapid growth of demand for battery metals, such as lithium, nickel, and cobalt, which require specialized comminution circuits, presenting new application niches for customized AG mill solutions. The proliferation of digital technologies, particularly IoT and AI integration, offers a substantial opportunity for manufacturers to differentiate their products by providing superior operational efficiency, predictive maintenance services, and remote optimization capabilities, thereby overcoming the perceived complexity constraint. Developing modular and smaller-footprint AG mill solutions could unlock opportunities in mid-tier mining projects previously deterred by the size and scale requirements of traditional equipment. The impact forces are generally high; the long lifespan and critical nature of AG mills mean that once installed, they create significant market inertia, locking in maintenance and spare parts revenue streams for decades. The influence of raw material prices (steel for liners) and global energy costs directly impacts the cost of operation and manufacturing, creating high-impact economic pressure points that necessitate continuous technological innovation to maintain competitive advantages in efficiency.

Segmentation Analysis

The Autogenous Mill market is critically segmented based on criteria relating to operational scale, application in specific mineral extraction processes, and the mechanism of grinding, particularly concerning whether media assistance is used. The segmentation by capacity is paramount, directly reflecting the tonnage requirements of various mining operations, ranging from smaller research and pilot plants to massive, high-throughput primary grinding circuits found in globally significant copper mines. Application segmentation demonstrates the dependency of the market on major commodity cycles, with base metals (copper, nickel) and precious metals (gold, silver) dominating demand, although industrial mineral processing provides a resilient, albeit smaller, revenue stream. Furthermore, understanding the split between new installations (Greenfield projects) and retrofitting/replacement demand in existing operations (Brownfield projects) provides essential insights into market maturity and capital allocation strategies by mining conglomerates globally, influencing manufacturer focus on reliability versus innovative design.

- By Type:

- Autogenous Mills (AG Mills)

- Semi-Autogenous Mills (SAG Mills)

- By Capacity (Diameter):

- Less than 20 ft

- 20 ft to 36 ft (Standard Large Capacity)

- Above 36 ft (Ultra-Large Capacity)

- By Drive System:

- Ring Motor Drives (Gearless Drives)

- Gear Drives (Pinion Drives)

- By Application:

- Copper Mining

- Gold Mining

- Iron Ore Mining

- Platinum Group Metals (PGMs)

- Others (e.g., Industrial Minerals, Uranium)

- By End-Use Sector:

- Large-Scale Mining Operations

- Mid-Scale Mining Operations

Value Chain Analysis For Autogenous Mill Market

The value chain for the Autogenous Mill market begins with upstream activities, focusing heavily on the sourcing of high-grade specialty steels and complex alloys required for manufacturing the massive components, especially the mill shells, heads, and, critically, the wear-resistant liners (such as high-chrome steel or rubber/polymer composites). Key upstream suppliers include specialized metallurgy firms and heavy forging companies capable of producing components with the structural integrity required to withstand immense operational stresses and abrasive environments over decades. Design and engineering activities form the crucial middle part of the value chain, where major OEMs utilize advanced finite element analysis (FEA) and computational fluid dynamics (CFD) modeling to optimize mill geometry, liner design, and drive system configuration (e.g., selecting between gearless vs. geared drives) to meet specific client ore requirements. The quality and cost of upstream raw materials directly impact the final CAPEX of the mill and its long-term operational lifespan, establishing high entry barriers and favoring manufacturers with robust supply chain control.

The core manufacturing and assembly phase is complex, requiring large, specialized fabrication facilities, often located strategically near major shipping ports due to the colossal size and weight of the mill components. This phase includes the integration of high-power drive systems (motors, gearboxes, variable frequency drives), which are often sourced from specialized electrical engineering firms, adding another layer of complexity to the supply chain. Distribution channels for AG mills are predominantly direct; due to the bespoke nature, immense capital cost, and required installation expertise, equipment is sold directly from the OEM to the mining company, usually through a formal tender process managed by an EPC (Engineering, Procurement, and Construction) firm acting on the miner’s behalf. Indirect channels are rarely used for the primary sale but might involve specialized regional service providers handling spare parts distribution, routine maintenance, and specific technical audits, particularly in geographically remote mining locations.

Downstream analysis focuses on the installation, commissioning, operation, and extensive after-market services, which constitute a significant portion of the total life-cycle value. Installation is a massive logistical and technical undertaking, often requiring months of specialized labor on-site. Once commissioned, the operational phase is heavily dependent on reliable after-sales support, encompassing the supply of consumables (especially liners, which require periodic replacement) and highly technical service contracts for drive system maintenance and process optimization. The downstream success is measured by mill uptime, throughput, and efficiency (SEC). End-users—the mining companies—are highly sophisticated buyers who integrate the AG mill output directly into critical downstream processes (flotation, leaching, separation), making mill performance central to their overall operational profitability and mineral recovery rates. Therefore, continuous technical collaboration between the OEM and the mine’s process engineers is a critical element of the downstream value delivery.

Autogenous Mill Market Potential Customers

The primary customer base for Autogenous Mills consists exclusively of large-scale mining corporations and mineral processing firms that operate high-tonnage processing plants globally. These companies are typically multinational entities involved in the extraction and processing of hard rock ores, where maximizing output while managing energy consumption and media costs is essential for economic viability. Potential customers include major global producers of copper (e.g., Freeport-McMoRan, BHP, Rio Tinto), gold (e.g., Barrick Gold, Newmont, Gold Fields), and iron ore (e.g., Vale, Rio Tinto). These Tier 1 customers have the financial capacity to absorb the high CAPEX of AG mills and possess the necessary technical expertise to operate and maintain these complex systems. Their decision-making process is fundamentally driven by project size, anticipated mine life (often 20+ years), ore characteristics (hardness, abrasiveness), and the overarching need to meet projected output targets demanded by global commodity markets.

A secondary, yet rapidly growing, customer segment involves mid-tier mining companies that are expanding operations or developing specialized, high-grade deposits that require specific comminution strategies. While these companies might lean towards smaller AG or standard SAG mills, they represent important targets, particularly in regions experiencing mining sector revitalization or exploration success. Additionally, engineering, procurement, and construction (EPC) firms act as critical indirect customers, as they often handle the procurement and specification processes on behalf of the ultimate mine owner. Winning contracts with leading EPC providers is crucial for OEMs, as these firms often dictate the selection of equipment based on standardized performance metrics, integration ease, and proven reliability across multiple large projects.

The evolving landscape of critical minerals extraction also introduces specialized customers focused on battery metals (e.g., lithium, nickel, cobalt). While the tonnages might be lower than traditional copper operations, the complex mineralogy often requires tailored grinding solutions to ensure high liberation rates for subsequent chemical processing. These customers, often specialized ventures or joint partnerships focused on the energy transition supply chain, require equipment manufacturers who can provide not just scale, but also highly adaptable and precise process control, leveraging the latest advancements in AG milling technology to address unique processing challenges inherent in these valuable, non-traditional ore bodies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1255.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLSmidth, Metso Outotec, ThyssenKrupp AG, CITIC Heavy Industries Co., Ltd. (CITIC HIC), Weir Group PLC, McLanahan Corporation, TAKRAF GmbH, NEUMAN & ESSER, Kawasaki Heavy Industries, Sumitomo Heavy Industries, Inc., Gebr. Pfeiffer SE, Dalian Huarui Heavy Industry Group Co., Ltd. (DHHI), Shenyang Northern Heavy Industries Group Co., Ltd. (NHI), Outotec Oyj (now part of Metso Outotec), R. A. F. Engineering (Pty) Ltd., Cemtec Cement and Mining Technology GmbH, Zhengzhou Dingsheng Engineering Technology Co., Ltd., Polycorp Ltd., Multotec, Teknik Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Autogenous Mill Market Key Technology Landscape

The technological evolution in the Autogenous Mill market is primarily driven by the imperative to maximize grinding efficiency (measured in tonnes per kilowatt-hour) and minimize wear and tear, thereby reducing long-term OPEX. A pivotal technology is the widespread adoption of Gearless Mill Drives (GMDs), also known as ring motor drives. These direct-drive systems eliminate the need for high-maintenance components like gearboxes, couplings, and pinion systems, drastically improving reliability, reducing noise levels, and offering precise, infinitely variable speed control. Variable speed control is crucial for AG mills because it allows operators to finely tune the mill speed (critical velocity) to match the dynamic physical properties of the ore feed, ensuring optimal grinding kinetics and energy consumption. While highly capital intensive, GMDs are becoming the de-facto standard for ultra-large capacity AG mills due to their superior efficiency, smaller footprint, and enhanced control capabilities essential for complex comminution circuits.

Another crucial area of technological advancement lies in materials science, specifically relating to wear parts, such as mill liners and grates. Liner life directly correlates with mill uptime and maintenance costs; thus, innovation focuses on developing composite materials—combining high-impact resistance metal alloys with resilient rubber or polymer compounds—to extend operational cycles. Modern liner designs utilize advanced geometric shapes, often determined through CFD and Discrete Element Method (DEM) simulations, to optimize the lifter action, ensuring effective cascading and impact dynamics of the grinding media (the rock). Furthermore, sensor technology has become integral. Modern AG mills are heavily instrumented, employing high-frequency acoustic sensors, vibration monitors, and embedded temperature sensors in bearings and motors. These sensors feed data into advanced control systems and AI platforms, enabling the real-time monitoring of grinding conditions, the detection of mechanical anomalies, and the automatic adjustment of operational parameters to prevent harmful resonance or inefficient grinding regimes.

Process control and optimization technologies are arguably the most impactful recent innovations. Modern AG mills utilize Model Predictive Control (MPC) systems, which integrate complex mathematical models of the comminution circuit to predict future states and determine the optimal control actions (feed rate, water addition, discharge settings) necessary to maintain target product specifications. The integration of advanced ore sorting technology upstream is also influencing AG mill operation, allowing for homogenization of the feed grade and size, which stabilizes the grinding process. Looking forward, the key technological trend is the seamless convergence of mechanical design robustness with digital intelligence (Industrial IoT), making the AG mill a smart asset capable of self-diagnosis and autonomous optimization. This technological trajectory ensures that AG mills remain competitive against alternative comminution methods like HPGRs, especially in high-tonnage applications demanding maximum resilience and predictable performance under varying geological conditions.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market region for Autogenous Mills, driven by continuous demand from mining giants in Australia, China, and Indonesia. Australia, in particular, requires high-capacity AG and SAG mills for its vast iron ore and gold operations, often involving abrasive and hard rock deposits. China's domestic mining sector and its significant investment in global mining projects (Belt and Road Initiative) fuel procurement. The region benefits from lower manufacturing costs for equipment assembly in some areas, although premium brands retain dominance in large-scale projects requiring high reliability. Infrastructure development and urbanization across Southeast Asia ensure sustained demand for base metals, underpinning the necessity for large-scale comminution solutions.

- Latin America: This region is a critical market, dominated by the copper belt encompassing Chile, Peru, and Mexico. These countries host some of the world's largest copper deposits, characterized by massive throughput requirements and declining ore grades, necessitating efficient AG/SAG grinding circuits. Investment in Latin America is driven by greenfield project development and modernization of existing mines. The emphasis here is heavily on minimizing energy consumption and maximizing uptime due to the remote nature of many operations and the strategic importance of copper supply in the global energy transition.

- North America: The market in North America (U.S. and Canada) is mature but technologically advanced. Demand is primarily driven by replacement cycles, expansion projects targeting low-grade porphyry copper deposits, and gold mining operations in harsh climates. North American miners prioritize high reliability, advanced automation (GMDs and smart controls), and adherence to stringent environmental, social, and governance (ESG) standards. The adoption of AI and digitalization in comminution is notably higher here compared to other regions.

- Europe: Europe represents a relatively smaller market for new large-scale AG mill installations, as mining operations are less extensive than in other regions. However, it is a significant hub for manufacturing and technology development, with major OEMs headquartered here. Demand focuses on niche applications, specialized mineral processing (e.g., industrial minerals), and providing sophisticated components and services (e.g., GMDs, advanced liners) to global mining projects. Scandinavian countries maintain specific mining activities (iron ore) that utilize high-tech grinding solutions.

- Middle East and Africa (MEA): This region offers long-term growth potential, particularly in South Africa (PGMs, gold), Zambia, and the Democratic Republic of Congo (DRC) (copper, cobalt). The market is characterized by a mix of mature, deep-level mines undergoing modernization and new, large-scale projects targeting critical minerals. Challenges include logistical constraints and political instability, but the immense mineral wealth guarantees sustained interest and investment in efficient comminution technology like AG mills.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Autogenous Mill Market.- FLSmidth

- Metso Outotec

- ThyssenKrupp AG

- CITIC Heavy Industries Co., Ltd. (CITIC HIC)

- Weir Group PLC

- McLanahan Corporation

- TAKRAF GmbH

- NEUMAN & ESSER

- Kawasaki Heavy Industries

- Sumitomo Heavy Industries, Inc.

- Gebr. Pfeiffer SE

- Dalian Huarui Heavy Industry Group Co., Ltd. (DHHI)

- Shenyang Northern Heavy Industries Group Co., Ltd. (NHI)

- R. A. F. Engineering (Pty) Ltd.

- Cemtec Cement and Mining Technology GmbH

- Zhengzhou Dingsheng Engineering Technology Co., Ltd.

- Polycorp Ltd. (Specialized in Liners)

- Multotec (Specialized in Components)

- Teknik Group

- Siemens AG (Drive Systems Supplier)

Frequently Asked Questions

Analyze common user questions about the Autogenous Mill market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Autogenous Mills over traditional grinding methods?

The primary advantage is the elimination of steel grinding media, leading to substantial cost savings on consumables, reduced environmental impact from steel scrap, and optimized energy efficiency when processing ores with suitable characteristics (competence and size distribution).

How does the high Capital Expenditure (CAPEX) of AG mills influence buyer decisions?

High CAPEX mandates that AG mills are typically only feasible for large-scale, long-life mining operations. Buyers prioritize maximum reliability, operational efficiency, and low maintenance costs over the system's projected 20+ year lifespan to ensure adequate return on investment (ROI).

What is the difference between Autogenous (AG) and Semi-Autogenous (SAG) grinding?

AG mills use only the ore itself for grinding media. SAG mills, the more common configuration, use a small charge (typically 6%–15%) of steel balls alongside the ore to assist the grinding action, which is necessary when the ore lacks sufficient competence for true autogenous grinding.

Which geographical region dominates the demand for new Autogenous Mill installations?

Asia Pacific (APAC) and Latin America dominate demand due to extensive greenfield and brownfield projects in copper, gold, and iron ore. Latin America, particularly, relies heavily on large-capacity AG/SAG mills for massive copper deposits.

How is AI technology improving the operational efficiency of Autogenous Mills?

AI implements predictive maintenance (PdM) to reduce unplanned downtime and uses machine learning algorithms for real-time optimization of mill speed, feed rate, and power draw, thereby stabilizing the grinding circuit and significantly lowering Specific Energy Consumption (SEC).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager