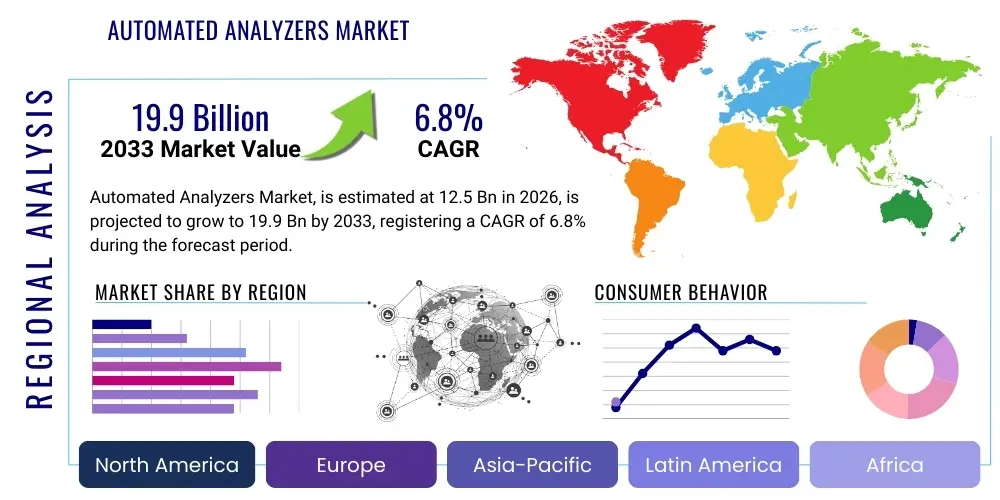

Automated Analyzers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441390 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Automated Analyzers Market Size

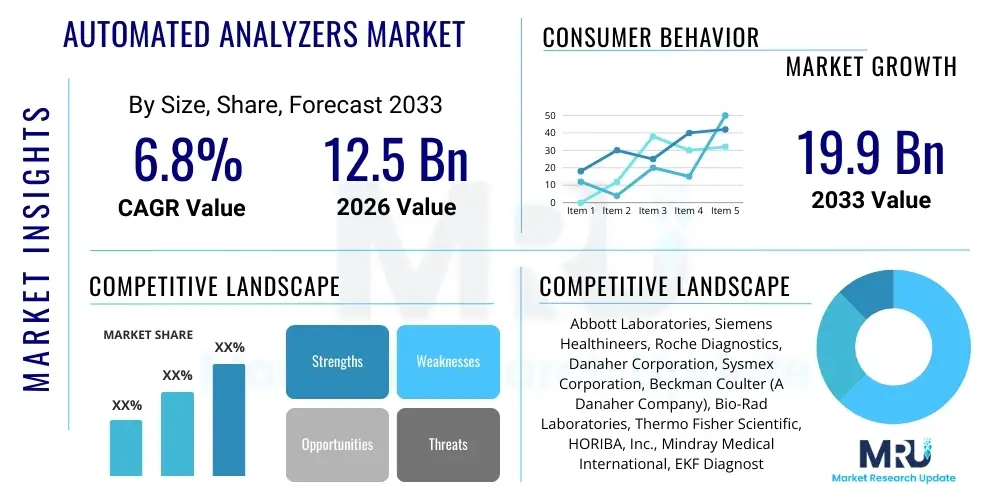

The Automated Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $19.9 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global demand for rapid and accurate diagnostic solutions, coupled with technological advancements integrating AI and robotics into laboratory workflows, which enhance throughput and minimize human error.

Automated Analyzers Market introduction

The Automated Analyzers Market encompasses a range of sophisticated instruments designed to perform complex laboratory tests—such as clinical chemistry, hematology, immunology, and molecular diagnostics—with minimal human intervention. These systems integrate various stages of analysis, including sample preparation, reagent handling, incubation, measurement, and results calculation, into a single, seamless workflow. The primary objective of these analyzers is to increase efficiency, standardize testing procedures, reduce turnaround time (TAT), and improve the overall quality and reliability of diagnostic results, making them indispensable tools in modern healthcare systems.

Major applications for automated analyzers span across clinical diagnostics in hospitals and reference laboratories, pharmaceutical research for high-throughput screening, and specialized testing in environmental and food safety sectors. The core product categories include clinical chemistry analyzers, which measure metabolites and electrolytes; hematology analyzers, which count and classify blood cells; and immunoassay analyzers, vital for hormone and infectious disease testing. The increasing prevalence of chronic and infectious diseases globally, combined with an aging population requiring frequent diagnostic screening, continues to propel the adoption of these high-efficiency systems.

The benefits associated with automated analysis—such as enhanced precision, scalability of operations, and reduction in operational costs over manual methods—are key driving factors for market growth. Furthermore, the rising awareness and expenditure on preventive healthcare in emerging economies are creating substantial opportunities. Regulatory harmonization and the continuous development of miniaturized and portable analyzer systems also contribute significantly to expanding the market reach beyond centralized laboratories into Point-of-Care Testing (POCT) settings, ensuring faster diagnostic capabilities closer to the patient.

Automated Analyzers Market Executive Summary

The global Automated Analyzers Market is characterized by intense technological competition, primarily focused on integrating advanced computing capabilities, such as Machine Learning (ML) and robotics, to achieve higher throughput and greater analytical accuracy. Business trends indicate a strong shift towards consolidated, multi-parameter platforms that can handle diverse testing needs, reducing the physical footprint required in laboratories. Key market players are strategically engaging in mergers, acquisitions, and collaborations with software providers to enhance data integration capabilities, moving beyond simple automation to intelligent automation that assists in diagnostic decision-making and predictive maintenance of instruments.

Regional trends reveal that North America and Europe remain the largest revenue contributors due to well-established healthcare infrastructure, high research expenditure, and rapid adoption of advanced diagnostics. However, the Asia Pacific (APAC) region is poised for the fastest growth, driven by massive investments in modernizing public health infrastructure in countries like China and India, increasing healthcare access, and a growing patient population base demanding advanced testing services. Latin America and MEA are also showing steady growth, motivated by the expansion of private diagnostic chains and rising government initiatives aimed at combating infectious diseases.

In terms of segment trends, Molecular Diagnostics Analyzers are witnessing the most dynamic growth, fueled by the accelerating adoption of personalized medicine and the urgent need for robust infectious disease detection capabilities, as demonstrated during recent global health crises. The trend among end-users, particularly hospital laboratories, is focused on Total Laboratory Automation (TLA), where modular systems are linked via robotics to manage samples from entry to archival, drastically increasing efficiency and reducing potential pre-analytical errors. Furthermore, specialized segments like toxicology and environmental testing analyzers are seeing increased adoption due to stricter regulatory environments globally.

AI Impact Analysis on Automated Analyzers Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Automated Analyzers Market center on themes such as improving diagnostic accuracy, managing complex data streams generated by high-throughput instruments, and predicting equipment failure. Users frequently ask how AI can reduce the false positive rate in immunoassay testing or how machine learning algorithms can automate the interpretation of complex molecular diagnostic patterns, which currently require highly specialized human expertise. Key concerns also revolve around the validation and regulatory approval of AI-driven diagnostic tools and the need for seamless integration of these algorithms into existing Laboratory Information Management Systems (LIMS). Users expect AI to transform analyzers from measurement tools into proactive decision support systems.

The integration of AI is fundamentally transforming the function and capability of automated analyzers, moving them beyond mere mechanics into cognitive systems. AI algorithms, particularly deep learning models, are now being employed to enhance image recognition in hematology and pathology, automatically flagging abnormal cells or complex patterns that might be missed by human reviewers or simpler algorithms. This capability significantly improves diagnostic throughput and reduces diagnostic variability across different testing sites. Moreover, AI aids in optimizing the operational efficiency of the analyzer itself, predicting potential mechanical faults or drift in calibration parameters before they lead to costly downtime or invalidated results, thus maximizing the uptime of expensive laboratory equipment.

Furthermore, AI plays a critical role in data management and quality control within the automated laboratory environment. High-volume analyzers produce vast amounts of raw data; AI systems are essential for processing, standardizing, and integrating this data with patient records, ensuring compliance with privacy regulations. For clinical research, ML models can rapidly identify relevant patient cohorts or drug efficacy patterns from large historical datasets generated by these analyzers, accelerating translational research. This evolution establishes AI not just as an auxiliary tool but as a core component of future automated diagnostic platforms, essential for unlocking their full potential in personalized medicine.

- AI-driven image analysis improves accuracy in hematology and cytology.

- Machine Learning optimizes workflow scheduling and resource allocation within laboratory automation systems.

- Predictive maintenance algorithms reduce instrument downtime and operational costs.

- Enhanced data integration capabilities link analyzer results directly to Electronic Health Records (EHR) systems.

- AI facilitates automated quality control and flags subtle data irregularities indicative of sample or instrument errors.

- Deep Learning models accelerate the interpretation of complex genetic sequencing and molecular diagnostic data.

DRO & Impact Forces Of Automated Analyzers Market

The Automated Analyzers Market is primarily driven by the escalating global incidence of chronic diseases, the imperative for early and accurate diagnosis, and significant advancements in instrument technology that improve efficiency and multiplexing capabilities. Restraints include the extremely high initial capital investment required for purchasing and installing these complex systems, particularly in resource-constrained settings, and the ongoing need for highly skilled technical personnel to operate and maintain them. Opportunities lie in the expansion of Point-of-Care Testing (POCT) applications using miniaturized analyzers, development of consolidated multi-assay platforms, and penetrating underserved emerging markets with affordable, robust automation solutions. These forces collectively shape the market's trajectory, driving innovation toward higher automation levels while simultaneously addressing accessibility and cost challenges.

Key drivers center on the global demographic shift, particularly the aging population, which necessitates frequent and extensive diagnostic screening, boosting demand for high-throughput clinical analyzers. Furthermore, government funding and regulatory support aimed at improving diagnostic standards in developed and developing nations provide a significant impetus for market growth. The constant innovation cycle, especially the move from semi-automated processes to full Total Laboratory Automation (TLA), allows laboratories to handle exponentially increasing sample volumes without proportional increases in staffing, solidifying the economic case for automation despite high initial costs. The rapid integration of molecular diagnostics into routine testing, often requiring highly specialized automation, also serves as a major driver.

Conversely, significant market restraints include the stringent regulatory hurdles and lengthy approval processes required for new analyzer technologies, which can delay market entry. Another critical constraint is the ongoing challenge of achieving complete standardization across various platforms and manufacturers, which creates interoperability issues for integrated laboratory systems. The complexity of maintenance, requiring specialized field engineers and high-cost proprietary reagents and consumables, contributes to high total cost of ownership (TCO). Addressing these restraints through open-source integration standards and cost-effective servicing models remains crucial for achieving widespread adoption, particularly in lower-income settings where capital expenditure is a significant barrier.

Segmentation Analysis

The Automated Analyzers Market is comprehensively segmented based on the core technology (Type), the specific environment in which the testing occurs (End-User), and the analytical targets (Application). This segmentation provides a granular view of market dynamics, highlighting areas of rapid innovation and specialized demand. The diversity of instruments, ranging from small benchtop units designed for specialty testing to large, floor-model integrated systems capable of handling thousands of tests per hour, reflects the varying needs across healthcare settings, research institutions, and industrial quality control laboratories. Analyzing these segments is essential for stakeholders to identify optimal investment areas and tailor product development strategies toward specific clinical or research requirements, focusing particularly on segments like molecular diagnostics which show accelerated growth.

Key segments include Type segmentation, where instruments are categorized by their function—such as Clinical Chemistry, responsible for routine metabolic panels, and Immunoassay Analyzers, critical for hormonal and infectious disease markers. The End-User segment differentiates between large volume users like Hospital Laboratories and high-growth segments like Diagnostic Laboratories (independent and reference labs) which prioritize rapid scalability and high-throughput capabilities. Finally, the Application segment clarifies the utility across human diagnostics, drug discovery, environmental monitoring, and food safety, recognizing that technological adaptations often cater to unique regulatory and sensitivity standards specific to each analytical context. These distinct segmentation categories underpin the strategic approaches of market leaders, influencing R&D priorities and regional market focus.

- By Type:

- Clinical Chemistry Analyzers

- Immunoassay Analyzers

- Hematology Analyzers

- Molecular Diagnostics Analyzers

- Urine Analyzers

- Microbiology Analyzers

- By Application:

- Clinical Diagnostics

- Research Laboratories

- Pharmaceutical and Biotechnology Testing

- Environmental Testing

- Food and Beverage Testing

- By End-User:

- Hospital Laboratories

- Diagnostic Laboratories

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Blood Banks

Value Chain Analysis For Automated Analyzers Market

The Value Chain for the Automated Analyzers Market begins with upstream activities dominated by the sourcing of highly specialized components, including precision optics, microfluidic devices, robotics, and advanced sensor technologies. The raw materials stage is characterized by dependence on specialized suppliers for sensitive biological reagents, enzymes, antibodies, and proprietary chemical consumables, which often form a significant part of the recurring revenue stream for analyzer manufacturers. Manufacturers then engage in complex R&D and assembly, focusing heavily on software integration, system validation, and rigorous quality control to meet stringent medical device regulations. Intellectual property surrounding assay methodologies and automation software is a critical competitive advantage at this stage.

Midstream activities involve sophisticated manufacturing and assembly processes, often requiring ISO-certified cleanroom environments, followed by clinical trials and regulatory approval (e.g., FDA, CE mark). Distribution channels are multi-faceted; direct sales forces are used for large, high-value integrated systems sold to major hospital networks and reference laboratories, ensuring hands-on support and training. Indirect channels, involving third-party distributors and regional partners, are essential for penetrating geographically diverse or niche markets, especially in Asia Pacific and Latin America, where local market knowledge and distribution networks are crucial for effective reach and localized support services.

Downstream activities center around installation, extensive operator training, and comprehensive post-sale service and support, which is mandatory due to the complexity and criticality of the equipment. Maintenance contracts, calibration services, and the continuous supply of proprietary reagents and consumables form the long-term revenue backbone. End-users, primarily hospitals and large diagnostic labs, value reliability and minimal downtime above all else. Consequently, the efficiency of the service network and the quality of customer support significantly influence purchasing decisions and overall lifetime value within this highly competitive market segment.

Automated Analyzers Market Potential Customers

The primary End-Users and potential customers for automated analyzers are large institutional healthcare providers, namely major Hospital Laboratories, which require high-volume, integrated systems to manage general chemistry, hematology, and immunoassay testing for acute care and inpatient services. These customers prioritize Total Laboratory Automation (TLA) solutions that integrate multiple testing platforms via track systems, optimizing workflow and reducing manual handling errors. The procurement cycle in this sector is long, driven by budgeting constraints, large capital expenditure requirements, and the need for rigorous system validation and integration with existing hospital information systems (HIS).

A second major customer segment consists of independent Diagnostic Laboratories and large Reference Laboratories. These facilities operate on commercial models, emphasizing efficiency, cost-per-test optimization, and rapid turnaround time (TAT) to maintain competitiveness. They are primary drivers for adopting highly specialized molecular diagnostics analyzers and high-throughput screening instruments, focusing on scalability and the ability to handle diverse sample types from various external clinics. These customers frequently look for flexible purchasing options, including reagent rental agreements or pay-per-use models, to minimize upfront capital outlay and manage operational costs effectively.

Furthermore, specialized sectors represent significant potential customers, including Academic and Clinical Research Institutes utilizing analyzers for drug development and biomarker discovery; Pharmaceutical and Biotechnology Companies needing automated systems for high-throughput screening of drug candidates; and public health entities (such as blood banks and public health laboratories) that require specialized, robust analyzers for infectious disease surveillance and screening programs. The rise of personalized medicine is also generating demand for highly sophisticated, low-volume, specialized molecular analyzers among clinical genetic centers, highlighting the market's fragmentation and the need for diversified product portfolios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $19.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, Danaher Corporation, Sysmex Corporation, Beckman Coulter (A Danaher Company), Bio-Rad Laboratories, Thermo Fisher Scientific, HORIBA, Inc., Mindray Medical International, EKF Diagnostics, Randox Laboratories, Ortho Clinical Diagnostics, Hitachi High-Tech Corporation, QIAGEN N.V., BioMérieux SA, Agilent Technologies, Tecan Group, Becton, Dickinson and Company (BD), Fujifilm Wako Pure Chemical Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automated Analyzers Market Key Technology Landscape

The technological landscape of the Automated Analyzers Market is rapidly evolving, moving beyond simple electromechanical automation to advanced integration of microfluidics, biosensors, and sophisticated computational analysis. Microfluidic technologies are central to miniaturization, enabling the development of compact, portable analyzers crucial for Point-of-Care Testing (POCT) and reducing sample and reagent consumption, thereby lowering operational costs per test. Furthermore, the development of highly sensitive and specific biosensors, particularly electrochemical and optical sensors, is increasing the analytical performance of analyzers, allowing for the detection of biomarkers at extremely low concentrations and improving assay robustness across various sample matrices.

A major focus of technological innovation is the integration of Total Laboratory Automation (TLA) systems, utilizing advanced robotics and interconnected track systems to automate all phases of laboratory processing, from pre-analytical (sample sorting, centrifugation) to post-analytical (storage, archival). This requires sophisticated middleware and IT connectivity to ensure seamless communication between diverse analytical instruments and the central LIMS/HIS. Recent innovations also include the adoption of digital morphology systems in hematology, which use automated microscopy and AI to provide digital slides and comprehensive cell classification, moving away from traditional manual slide reviews and enhancing the consistency of results.

The most transformative technologies currently being deployed involve Molecular Diagnostics (MDx) automation, particularly platforms designed for rapid, high-throughput nucleic acid extraction and Polymerase Chain Reaction (PCR) analysis. These systems are crucial for pathogen identification and genetic testing, supporting personalized medicine initiatives. Manufacturers are investing heavily in automated sample-to-answer solutions that minimize the risk of contamination and reduce hands-on time. The convergence of these technological advances—robotics, AI, microfluidics, and advanced biosensors—is creating the next generation of analyzers that are faster, more reliable, and capable of highly complex multiplexed testing.

Regional Highlights

Regional dynamics within the Automated Analyzers Market show distinct patterns influenced by healthcare expenditure, regulatory frameworks, and disease prevalence. North America, led by the United States, holds the largest market share, characterized by its well-developed, highly technological healthcare system, high adoption rates of cutting-edge TLA systems, and substantial research funding allocated to clinical diagnostics and drug discovery. The presence of major market players and favorable reimbursement policies further solidify its dominance, with a high demand for specialized analyzers used in cancer screening and genetic sequencing.

- North America: Market leader due to advanced infrastructure, high per capita healthcare spending, and early adoption of AI-driven TLA solutions. Focus on complex testing such as personalized medicine and molecular diagnostics.

- Europe: High adoption driven by standardized quality assurance protocols (e.g., EU IVDR regulations) and strong government support for healthcare modernization. Emphasis on integrated healthcare networks and chronic disease management analyzers.

- Asia Pacific (APAC): Fastest-growing region, fueled by massive public investment in healthcare infrastructure, rising awareness about preventive diagnostics, and a large patient pool. China, India, and Japan are key growth hubs seeking cost-effective, high-throughput solutions.

- Latin America (LATAM): Steady growth attributed to the expansion of private diagnostic laboratory chains and increasing foreign investment. Demand is growing for robust, mid-level automation solutions addressing infectious disease diagnostics.

- Middle East and Africa (MEA): Emerging market segment focusing on improving access to basic and advanced diagnostics, particularly for endemic infectious diseases. Growth is dependent on government procurement and international aid funding for centralized public health laboratories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated Analyzers Market.- Abbott Laboratories

- Siemens Healthineers

- Roche Diagnostics

- Danaher Corporation

- Sysmex Corporation

- Beckman Coulter (A Danaher Company)

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- HORIBA, Inc.

- Mindray Medical International

- EKF Diagnostics

- Randox Laboratories

- Ortho Clinical Diagnostics

- Hitachi High-Tech Corporation

- QIAGEN N.V.

- BioMérieux SA

- Agilent Technologies

- Tecan Group

- Becton, Dickinson and Company (BD)

- Fujifilm Wako Pure Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the Automated Analyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Total Laboratory Automation (TLA) systems?

The primary factor driving TLA adoption is the necessity to manage increasing sample volumes and test complexity while simultaneously reducing the risk of pre-analytical errors, minimizing turnaround time (TAT), and optimizing staffing utilization in high-throughput diagnostic laboratories.

How is Point-of-Care Testing (POCT) influencing the demand for automated analyzers?

POCT demands miniaturized, robust, and user-friendly automated analyzers that provide rapid results outside central laboratories. This trend is accelerating demand for microfluidic-based, cartridge-based systems, expanding the market reach into clinics and remote settings.

Which segment is projected to exhibit the fastest growth in the Automated Analyzers Market?

The Molecular Diagnostics Analyzers segment is projected to exhibit the fastest growth due to the rising demand for personalized medicine, infectious disease testing (including COVID-19, influenza, and HPV), and advancements in genetic sequencing automation.

What are the main financial restraints impacting the purchase of automated analyzer systems?

The main financial restraints are the high initial capital expenditure (CapEx) required for procurement, installation, and integration, compounded by the high recurring operational costs associated with proprietary reagents, consumables, and specialized maintenance contracts.

What is the role of Artificial Intelligence (AI) in modern automated analyzers?

AI's role involves enhancing diagnostic accuracy through image analysis (e.g., cell classification), optimizing laboratory workflow and resource allocation, and implementing predictive maintenance to ensure instrument reliability and maximum operational uptime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager