Automated Compounding System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442454 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automated Compounding System Market Size

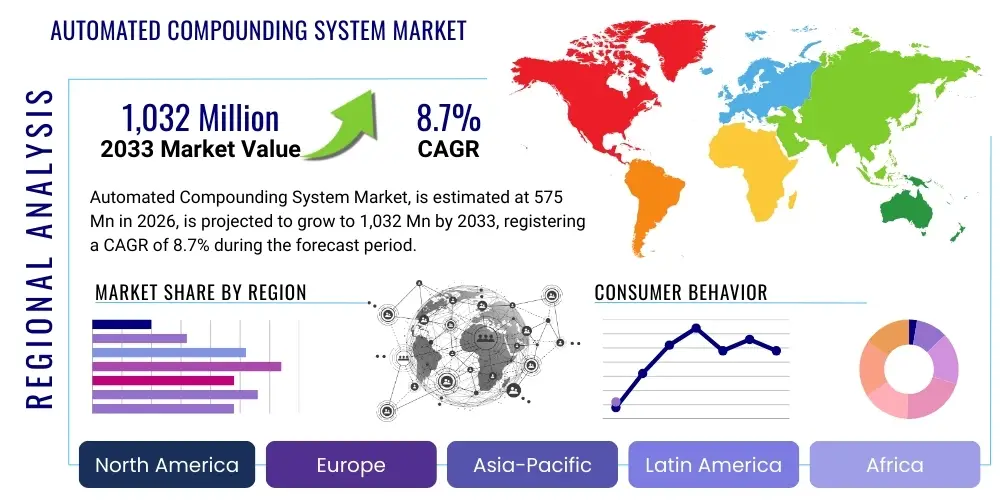

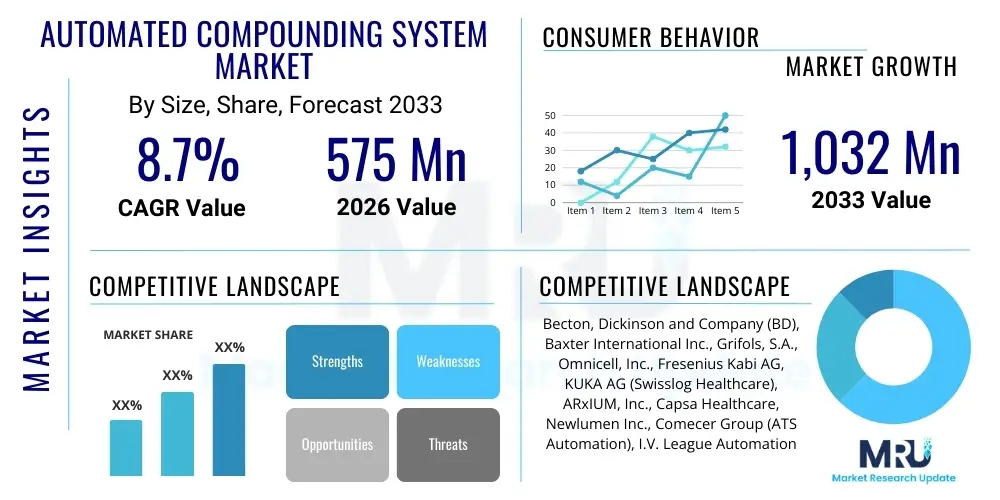

The Automated Compounding System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% between 2026 and 2033. The market is estimated at USD 575 Million in 2026 and is projected to reach USD 1,032 Million by the end of the forecast period in 2033.

Automated Compounding System Market introduction

The Automated Compounding System Market encompasses sophisticated robotic and mechanical solutions designed to accurately and safely prepare pharmaceutical compounds, primarily sterile intravenous (IV) medications, parenteral nutrition (PN) solutions, and specialized non-sterile formulations. These systems replace manual processes, significantly mitigating the risks associated with human error, contamination, and inconsistencies in dosing, which are critical concerns in high-stakes healthcare environments like hospitals and specialized compounding pharmacies. The fundamental goal of these systems is to enhance patient safety through meticulous precision, ensuring compliance with stringent regulatory standards, such as those set by the FDA and USP <797> and <800> guidelines, while simultaneously improving pharmacy workflow efficiency and reducing operational costs associated with drug waste and labor.

Major applications for automated compounding systems span acute care hospitals, specialized children’s hospitals requiring highly customized pediatric doses, ambulatory surgery centers, and outsourcing facilities that handle large-volume sterile preparation. Key benefits driving adoption include superior accuracy, documented accountability for every compound prepared, sterile processing environments minimizing microbial contamination risk, and the ability to handle hazardous drugs safely, thereby protecting pharmacy staff. Furthermore, these automated platforms facilitate rapid scaling of operations, essential during public health crises or unexpected surges in patient volume requiring complex pharmaceutical interventions, ensuring timely and consistent patient care across diverse therapeutic areas including oncology, nutrition, and critical care.

The market growth is primarily driven by the increasing global focus on reducing medication errors, the escalating complexity of pharmaceutical formulations (especially personalized medicine and complex IV therapies), and the continuous pressure on healthcare providers to optimize operational expenses while maintaining the highest quality of care. Regulatory bodies worldwide are mandating stricter standards for sterile preparation, pushing manual compounding facilities toward automated solutions that offer inherent quality assurance features like gravimetric verification and barcode verification. These factors, combined with technological advancements in robotics and integrated software, are collectively accelerating the deployment of automated compounding technology across developed and emerging healthcare markets.

Automated Compounding System Market Executive Summary

The Automated Compounding System Market is entering a dynamic phase characterized by rapid technological integration and increasing demand for decentralized compounding solutions. Business trends indicate a robust shift towards integrated software platforms that offer real-time inventory management, complete preparation traceability, and seamless electronic health record (EHR) integration, moving beyond standalone compounding units. Key players are heavily investing in expanding their portfolios to include smaller, modular systems suitable for satellite pharmacies and infusion centers, recognizing the need for compounding closer to the patient bedside. Furthermore, subscription-based models for software and maintenance are gaining traction, lowering the initial capital expenditure barrier for smaller institutions and accelerating market penetration, driving consistent revenue streams for manufacturers throughout the forecast period.

Regionally, North America maintains market dominance due to high healthcare expenditure, early adoption of advanced technology, and rigorous regulatory standards (USP compliance) that necessitate automation for adherence. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapidly modernizing healthcare infrastructure, increasing awareness of medication safety issues, and rising government investments in hospital infrastructure, particularly in China and India. Europe shows stable growth, driven by standardization efforts across the European Union and the necessity to manage complex polypharmacy regimens common among aging populations, emphasizing precision and efficiency in high-volume settings.

Segment trends highlight the leading share held by the Sterile Compounding segment, driven by the critical need for safe IV preparations in acute care. Within applications, hospitals remain the largest end-user, though outsourcing facilities are rapidly gaining significance due to their ability to provide bulk, standardized preparations efficiently. Technology trends emphasize the transition from purely volumetric systems to gravimetric and vision-system-supported solutions, offering verifiable accuracy and enhancing audit capabilities. The shift toward specialized non-sterile automation for complex oral dosage forms and dermatological creams also represents a key area of future expansion, catering to niche market needs and diversifying revenue streams beyond traditional IV compounding.

AI Impact Analysis on Automated Compounding System Market

User inquiries regarding AI's impact on automated compounding systems frequently center on concerns about process optimization, predictive maintenance, and enhanced error detection capabilities. Users seek assurance that AI can transcend current hardware limitations, asking if machine learning algorithms can predict component failure before it occurs, thereby maximizing system uptime, or if AI vision systems can detect subtle defects in drug preparation (e.g., particulates or insufficient mixing) missed by traditional sensors. Another primary theme involves how AI can optimize complex compounding workflows, particularly in calculating the most efficient batch schedules for multi-drug preparations and minimizing waste based on real-time patient demand forecasts. There is significant expectation that AI will be the crucial element that ensures fully autonomous, error-proof compounding, moving the industry toward a zero-defect environment while providing data-driven insights into compounding sterility and quality control.

- AI-Driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast hardware failure, minimizing system downtime and optimizing service schedules.

- Enhanced Quality Control (QC): Implementing AI-powered vision systems for real-time particulate inspection, consistency verification, and final product quality assurance far surpassing human capacity.

- Dynamic Workflow Optimization: Machine learning algorithms optimizing complex scheduling for multi-drug compounding batches based on hospital demands, resource availability, and stability constraints.

- Recipe Formulation Assistance: AI assisting pharmacists in developing stable, customized formulations by analyzing large datasets of ingredient compatibility and regulatory guidelines.

- Inventory and Waste Minimization: Predictive AI modeling patient demand to precisely control drug inventory levels, thereby reducing expiration-related drug waste in high-cost preparations.

- Regulatory Compliance Auditing: Automated generation of comprehensive compliance reports and deviation identification based on continuous monitoring of preparation parameters.

DRO & Impact Forces Of Automated Compounding System Market

The Automated Compounding System Market is shaped by a confluence of powerful drivers and stringent restraints, balanced by promising opportunities that define its future trajectory. Key drivers include global mandates for medication safety improvements, heightened regulatory pressure (such as USP 797/800 revisions) demanding strict adherence to sterile preparation guidelines, and the fundamental operational need within hospitals to reduce high labor costs and increase workflow efficiency. Restraints primarily involve the significant initial capital investment required for these sophisticated systems, complexity in integrating them with existing hospital IT infrastructure (EHRs and inventory systems), and a persistent shortage of highly specialized pharmacy technicians trained to operate and maintain robotic equipment effectively. These forces collectively dictate the adoption rate, emphasizing the need for manufacturers to develop more affordable, scalable, and user-friendly solutions to overcome existing market friction.

Opportunities for market growth are abundant, particularly in the rapid expansion of outsourcing facilities that rely heavily on automation to achieve economies of scale and meet regulatory expectations for consistency and quality across massive volumes. Furthermore, the growing trend toward personalized medicine and specialty pharmacy necessitates precise, small-batch compounding, a process perfectly suited for automation. Technological advancements, specifically the miniaturization of robotic systems and the integration of advanced sensors for enhanced verification (e.g., Raman spectroscopy for chemical identity verification), offer avenues for market expansion into smaller clinics and emerging markets. Addressing the training gap through comprehensive manufacturer support and simulation-based training programs presents a crucial opportunity to accelerate adoption among hesitant end-users.

Impact forces in the market are primarily driven by technological substitution, where current manual processes are rapidly being replaced by automated solutions, and competitive intensity, as major players race to offer superior software integration and validation capabilities. The substitution force is strongest in high-risk areas like oncology and parenteral nutrition. The bargaining power of buyers remains moderate to high, as these systems represent major capital expenditures, leading hospitals to demand strong return-on-investment guarantees and comprehensive long-term service agreements. Regulatory changes act as an external amplifier, instantaneously increasing demand for automated solutions that provide verifiable compliance documentation, making regulatory shifts one of the most significant external impact forces shaping market dynamics.

Segmentation Analysis

The Automated Compounding System Market is systematically segmented based on complexity, technology deployed, final application, and end-user environment. This granular segmentation allows for targeted understanding of demand dynamics, separating the market based on whether the systems handle complex sterile preparations (like IV admixtures) or simpler non-sterile forms (like oral solutions). Technology segmentation distinguishes between large-scale robotic systems and simpler volumetric or gravimetric machines. End-user categorization, focused on hospitals, ambulatory centers, and outsourcing facilities, highlights where the highest volume and most critical need for verifiable accuracy resides, providing a clear map of investment priorities for both manufacturers and potential buyers seeking solutions tailored to their specific operational scale and regulatory demands.

- By Product Type:

- Automated Sterile Compounding Systems

- IV Compounding Robots

- Total Parenteral Nutrition (TPN) Compounders

- Chemotherapy Compounding Systems

- Automated Non-Sterile Compounding Systems

- Automated Weighing and Measuring Systems

- Automated Capsules/Tablets Preparation Systems

- Automated Topical/Transdermal Preparation Systems

- By Technology:

- Gravimetric Technology

- Volumetric Technology

- Robotic Systems (Advanced Automation)

- By End-User:

- Hospitals and Clinics

- Acute Care Hospitals

- Children's Hospitals

- Ambulatory Surgery Centers (ASCs)

- Compounding Pharmacies and Outsourcing Facilities

- Specialty Clinics (e.g., Oncology Centers)

- By Application:

- Parenteral Nutrition

- IV Admixtures

- Oncology/Chemotherapy

- Pain Management

- Others (Antibiotics, customized doses)

Value Chain Analysis For Automated Compounding System Market

The value chain for automated compounding systems begins with upstream activities focused on the specialized manufacturing of precision components, including robotic arms, high-accuracy pumps, sensors (gravimetric scales and visual scanners), and proprietary sterile containment hardware like isolators and specialized clean air systems. Key upstream suppliers include manufacturers of medical-grade plastics, customized robotics firms, and advanced software developers specializing in control logic and data integrity platforms necessary for FDA validation. Competitive advantage at this stage hinges on quality control of mechanical parts and the intellectual property related to the compounding software algorithms, which ensure precise, verified preparation and integration with pharmacy information systems.

Midstream activities involve the core system manufacturing, integration, assembly, and rigorous testing of the final compounding unit. This phase is characterized by intense research and development focused on creating compact, faster, and more versatile systems capable of handling a broader range of drug viscosities and preparation complexities. Distribution channels are typically highly specialized, involving direct sales forces focused on engaging pharmacy directors and C-suite executives in hospital systems, coupled with specialized biomedical service teams for installation and validation. Indirect channels, such as authorized distributors and value-added resellers (VARs), often play a role in reaching smaller hospital groups or international markets where direct presence is cost-prohibitive, offering localized sales, training, and support services critical for successful system deployment.

Downstream activities center on deployment, training, and continuous post-sales support, which is paramount given the critical, high-stakes nature of the equipment. This involves comprehensive validation services (IQ, OQ, PQ) to ensure regulatory compliance and extensive training for pharmacy staff on operation and troubleshooting. The end-users—hospitals and outsourcing facilities—utilize these systems to produce final, customized medication doses. The critical value captured downstream is the verifiable reduction in medication errors, labor costs, and operational risk, which translates directly into improved patient safety metrics and compliance with regulatory audits, driving the overall lifetime value and justification for the high initial investment in the automated system.

Automated Compounding System Market Potential Customers

The primary customers for automated compounding systems are institutional healthcare providers and specialized pharmaceutical preparation entities where high volume, complex dosing, and verifiable sterility are mandatory operational requirements. Hospitals represent the largest segment of potential customers, particularly large acute care centers, teaching hospitals, and major integrated delivery networks (IDNs) that handle thousands of IV admixtures daily, including high-risk medications such as chemotherapy. These institutions seek automation to standardize processes across multiple pharmacy locations, reduce exposure to hazardous drugs for staff, and provide detailed documentation for every dose prepared, satisfying increasingly strict regulatory requirements for patient safety and quality management.

A rapidly expanding segment of high-value potential customers includes compounding pharmacies and outsourcing facilities. These entities operate under rigorous FDA oversight (e.g., 503B outsourcing facilities in the US) and require highly scalable, validated automated systems to achieve the necessary production volume while maintaining impeccable quality standards and batch consistency. Their business model relies fundamentally on the efficiency, accuracy, and compliance benefits derived from automation, making them continuous investors in advanced robotic compounding solutions. Pediatric hospitals and specialized oncology centers, which require extremely precise, often micro-dosing for vulnerable populations, also constitute a significant niche market segment where the accuracy afforded by automation is non-negotiable.

Furthermore, ambulatory surgery centers (ASCs) and large infusion clinics are emerging as strategic customers. As complex procedures shift out of traditional hospital settings, these centers require efficient, small-scale compounding solutions for immediate use medications. While their volume is generally lower than large hospitals, the critical need for immediate readiness and verifiable sterile preparation for high-acuity procedures drives their interest in smaller, modular automated systems. Manufacturers are increasingly tailoring compact, specialized systems to meet the space and budget constraints of these distributed healthcare settings, broadening the potential customer base beyond the traditional large hospital market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 575 Million |

| Market Forecast in 2033 | USD 1,032 Million |

| Growth Rate | 8.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton, Dickinson and Company (BD), Baxter International Inc., Grifols, S.A., Omnicell, Inc., Fresenius Kabi AG, KUKA AG (Swisslog Healthcare), ARxIUM, Inc., Capsa Healthcare, Newlumen Inc., Comecer Group (ATS Automation), I.V. League Automation, S.r.l., ForHealth Technologies, Inc., Equashield, LLC, RIVA Solutions Inc., Loccioni Group, Medimix International, Automated Dispensing Technologies, ScriptPro LLC, Zydus Medical Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automated Compounding System Market Key Technology Landscape

The technological landscape of the Automated Compounding System Market is dominated by advancements aimed at enhancing accuracy, sterility assurance, and integration capabilities. The cornerstone technologies include precision volumetric pumping and, increasingly, gravimetric verification systems, which use highly sensitive scales to confirm the exact weight and volume of ingredients dispensed, offering a crucial layer of quality assurance that surpasses traditional methods. Robotics forms the backbone of sterile compounding, utilizing highly articulated arms and closed-system transfer devices (CSTDs) within ISO Class 5 environments to handle hazardous and high-risk medications, ensuring both product sterility and operator protection. Modern systems are modular, allowing hospitals to scale their capacity without needing complete system replacement, driving long-term investment viability.

Software and data management technologies are equally critical, transforming automated compounders from simple mechanical devices into integrated data hubs. Key technologies here include advanced middleware for interfacing with Hospital Information Systems (HIS) and Electronic Health Records (EHRs), enabling automated order verification and patient-specific dose preparation. Furthermore, barcode scanning technology (using 2D and 3D matrix codes) is employed extensively for ingredient verification, ensuring the "five rights" of compounding—right drug, right concentration, right base, right patient, and right time—are adhered to. The integration of image processing and machine vision cameras is emerging as a vital technology for real-time visual inspection of the final product, detecting issues like syringe plunger position or visible particulates, supplementing traditional physical verification processes.

Future technological developments are focusing heavily on integrating Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance, process optimization, and enhanced quality control, as previously noted. Specifically, spectroscopic technologies, such as Near-Infrared (NIR) or Raman spectroscopy, are being piloted for real-time chemical identity verification of raw materials within the compounding process, moving beyond simple barcoding to ensure the correct drug substance is used before final mixing. Furthermore, cybersecurity technologies are becoming essential components of the compounding system software architecture to protect sensitive patient and drug data from breaches, ensuring data integrity and regulatory adherence (e.g., HIPAA compliance) within these increasingly connected pharmacy ecosystems, positioning data security as a core functional requirement.

Regional Highlights

- North America (Dominance and Technological Pioneers)

- Europe (Standardization and Quality Emphasis)

- Asia Pacific (APAC) (Highest Growth Potential)

- Latin America (LAMEA) and Middle East & Africa (MEA) (Emerging Markets)

North America, particularly the United States, holds the largest market share in the Automated Compounding System Market. This dominance is attributed to several critical factors, including the highly sophisticated healthcare infrastructure, high per capita healthcare spending, and the early and rigorous adoption of stringent regulatory standards, notably those published by the United States Pharmacopeia (USP <797> and <800>). These mandates directly necessitate the use of automated systems to achieve verifiable compliance in sterile and hazardous drug preparation, forcing institutions to transition away from manual processes to avoid severe regulatory penalties and patient safety risks. The presence of leading system manufacturers, coupled with high awareness among pharmacy professionals regarding the risks of manual compounding errors, further solidifies the region's market leadership.

The market trajectory in the US and Canada is characterized by high demand from large Integrated Delivery Networks (IDNs) and the rapid growth of 503B outsourcing facilities, which serve multiple hospitals and require massive, reliable automation to maintain competitive advantage and compliance. Investment trends show a pivot toward integrated solutions that offer comprehensive data analytics, remote monitoring, and seamless interoperability with existing hospital IT architecture, reflecting a mature market focused on optimizing system utilization rather than mere installation. Furthermore, the region is a pioneer in the application of automation for high-cost personalized medicine and gene therapies, where dosing accuracy is paramount and justifies substantial capital investment.

Competitive activity in North America is intense, driving innovation in system reliability and user interface design. Manufacturers prioritize robust service networks and accredited training programs to mitigate the skilled labor shortage restraint, offering full-service contracts that include validation and ongoing compliance assistance. The sustained need to manage rising drug costs and labor pressures ensures that the demand for efficiency-boosting automation remains exceptionally high, maintaining North America's position as the primary revenue generator and technology testing ground for the global market.

Europe represents the second-largest market, characterized by a fragmented healthcare system that is increasingly striving for standardization in pharmaceutical preparation. Market growth is driven by national health services (NHS in the UK, centralized systems in Nordic countries) prioritizing patient safety initiatives and recognizing the long-term cost savings associated with reduced medication errors. While adoption rates vary significantly between Western and Eastern Europe, regulatory harmonization efforts across the EU are gradually pushing all member states toward higher quality standards in compounding, boosting the necessity for automated solutions that provide auditable preparation records and sterility assurance.

Germany, France, and the United Kingdom are key contributors to the European market, demonstrating high demand for TPN compounders and IV admixture systems, primarily driven by aging populations requiring complex nutritional and critical care therapies. The focus here is less on sheer volume (compared to US outsourcing facilities) and more on precision in complex hospital pharmacy settings. Manufacturers operating in this region must adhere to specific national guidelines (e.g., GMP requirements) in addition to EU directives, often requiring localized system customization and documentation tailored to each country’s regulatory body and language requirements, adding layers of complexity to market entry.

Future growth in Europe is expected to accelerate in Southern and Eastern European countries as healthcare infrastructure investment increases, aided by EU funding programs dedicated to modernizing hospital technology. The market shows a strong preference for closed-system solutions and those offering superior ergonomics and occupational safety, particularly concerning handling cytotoxic drugs. Collaborative initiatives between regional healthcare technology providers and global automation leaders are common, aiming to integrate automation capabilities smoothly within existing, often older, hospital pharmacy layouts and workflows.

The Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) during the projection period, emerging as a critical growth engine for the automated compounding market. This exponential growth is primarily fueled by rapid economic development, massive government investment in healthcare infrastructure expansion, and a burgeoning middle class demanding higher standards of medical care and safety. Countries like China, India, Japan, and South Korea are experiencing an infrastructural revolution in their hospital sectors, with new facilities being designed and equipped with automation from inception, bypassing older manual practices.

While Japan and South Korea represent mature segments focused on advanced robotics and high-precision automation, the large populations and developing regulatory environments of China and India offer immense untapped market potential. Increased awareness of global standards for sterile compounding and the necessity of preventing hospital-acquired infections (HAIs) are major drivers. However, market adoption faces challenges related to price sensitivity, the complexity of managing a diverse regulatory landscape across various countries, and the need for simplified, easily maintainable systems suitable for varied facility sizes and technical capabilities.

The current trend in APAC focuses on essential automation technologies, particularly basic TPN and volumetric compounders, providing foundational safety improvements. Over the forecast period, as local manufacturing capabilities mature and healthcare budgets increase, there will be a substantial shift toward fully robotic IV compounding systems. Partnerships between global leaders and local distributors are crucial for navigating regulatory hurdles and providing localized sales and technical support, essential components for capitalizing on the region’s explosive growth trajectory.

Latin America and the Middle East & Africa regions represent emerging markets for automated compounding systems, exhibiting cautious yet steady growth. In the MEA region, particularly the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), high oil wealth translates to significant investment in world-class, large-scale hospital projects, often prioritizing the latest medical technology, including advanced robotics for sterile compounding. The emphasis here is often on quality and prestige, accelerating the adoption of premium automation solutions in major urban medical centers.

In contrast, Latin America’s market is characterized by budget constraints and economic volatility, often leading to slower adoption confined mostly to large, private hospital chains in major metropolitan areas such as São Paulo, Mexico City, and Santiago. Demand is typically driven by the need to manage rising patient volumes efficiently and combat endemic issues of medication errors prevalent in manual preparation systems. Market expansion depends heavily on manufacturer strategies that offer flexible financing options and scalable, entry-level automation platforms that demonstrate a clear, immediate return on investment.

The collective growth across these emerging regions is driven by increasing urbanization, improved access to insurance, and the gradual modernization of public healthcare systems. Regulatory oversight is generally less developed than in North America or Europe, but increasing adherence to international accreditation standards (like Joint Commission International - JCI) is subtly encouraging hospitals to invest in automated systems to achieve and maintain accreditation, serving as a critical non-regulatory driver for market growth across both LAMEA and MEA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated Compounding System Market.- Becton, Dickinson and Company (BD)

- Baxter International Inc.

- Grifols, S.A.

- Omnicell, Inc.

- Fresenius Kabi AG

- KUKA AG (Swisslog Healthcare)

- ARxIUM, Inc.

- Capsa Healthcare

- Newlumen Inc.

- Comecer Group (ATS Automation)

- I.V. League Automation, S.r.l.

- ForHealth Technologies, Inc.

- Equashield, LLC

- RIVA Solutions Inc.

- Loccioni Group

- Medimix International

- Automated Dispensing Technologies

- ScriptPro LLC

- Zydus Medical Technologies

- Exacta Pharm Robotic Solutions

Frequently Asked Questions

Analyze common user questions about the Automated Compounding System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory drivers accelerating the adoption of automated compounding systems?

The primary drivers are stringent regulatory mandates, particularly the United States Pharmacopeia (USP) General Chapters 797 (Sterile Compounding) and 800 (Hazardous Drugs), which require documented, verifiable accuracy and containment. Automation ensures compliance by providing digital traceability and standardized, closed-system preparation environments, significantly mitigating contamination and exposure risk.

How do automated systems ensure accuracy compared to manual compounding?

Automated systems utilize gravimetric technology, employing high-precision scales to verify the exact weight of every ingredient added, which is directly linked to volume via specific gravity. This verification method provides objective, quantifiable proof of accuracy for each preparation, a level of detail and consistency unattainable through purely manual volumetric measurements.

What is the typical Return on Investment (ROI) period for installing a sterile compounding robot?

While initial capital outlay is high, the ROI is generally realized through reduced medication waste, decreased labor costs associated with manual preparation, and minimized liability from medication errors. For high-volume outsourcing facilities or large hospitals, the ROI period is often estimated between three to five years, largely depending on system utilization rates and regulatory risk mitigation benefits.

What are the main technical challenges associated with implementing automated compounding?

Key technical challenges include seamless integration of the proprietary compounding software with existing hospital electronic health record (EHR) and pharmacy inventory management systems. Furthermore, achieving reliable, continuous throughput requires specialized maintenance and overcoming complexity in handling a wide variety of drug viscosities and container types efficiently within the automated workflow.

Are automated compounding systems suitable for both sterile and non-sterile applications?

Yes, the market is segmented to address both needs. Advanced robotic systems are predominantly used for complex, high-risk sterile compounding (IVs, TPNs, oncology). Separate, smaller automated systems focused on accurate weighing and measuring are available and increasingly utilized for non-sterile preparations, such as customized oral solutions and topical medications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager