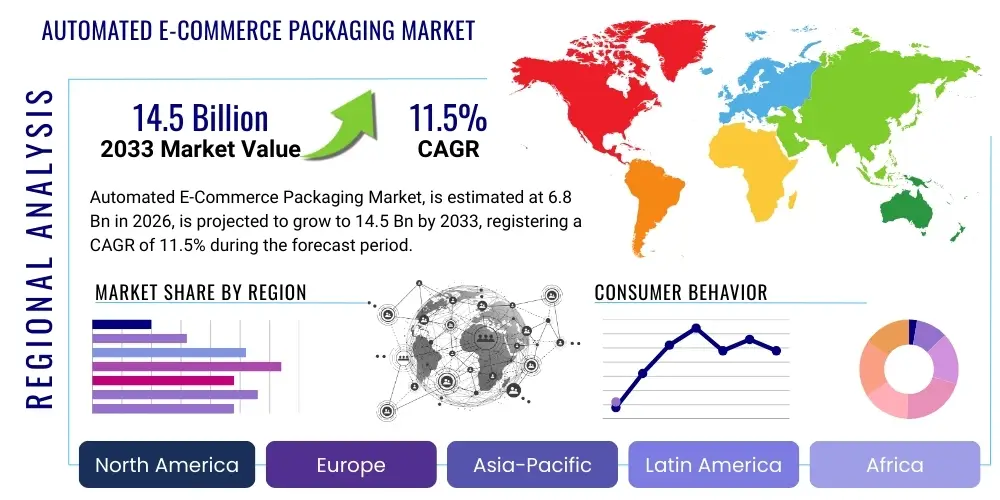

Automated E-Commerce Packaging Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441515 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automated E-Commerce Packaging Market Size

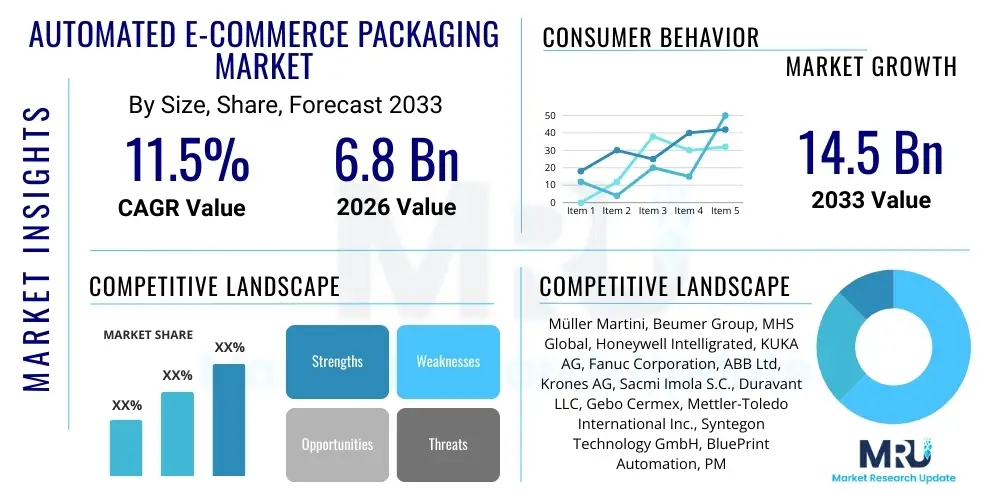

The Automated E-Commerce Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 14.5 Billion by the end of the forecast period in 2033.

Automated E-Commerce Packaging Market introduction

The Automated E-Commerce Packaging Market encompasses sophisticated systems and machinery designed to streamline and accelerate the packaging process for goods sold through online channels. This technology includes automated bagging, carton erection, sealing, labeling, dimensional scanning, and sortation systems. The primary product scope involves robotics, automated storage and retrieval systems (AS/RS), and highly integrated conveyor solutions engineered to handle the variable package sizes and high throughput demands characteristic of e-commerce fulfillment centers. These systems are crucial for maintaining efficiency, reducing labor costs, and ensuring product protection during transit, directly addressing the complexities introduced by omni-channel logistics and the persistent trend of smaller, more frequent orders.

Major applications of these automated solutions span across third-party logistics (3PL) providers, dedicated e-commerce retailers, wholesale distributors, and fulfillment houses in sectors such as apparel, electronics, food and beverage, and health and beauty products. The core benefit derived from adopting automated packaging lies in scalability, allowing companies to manage peak shopping seasons, such as the holiday rush, without massive increases in manual labor. Furthermore, automation improves packaging consistency, optimizes material usage (reducing void fill and dimensional weight penalties), and minimizes errors associated with incorrect labeling or mispacking, which are critical factors in enhancing customer satisfaction and operational viability in high-volume environments.

The driving factors propelling this market are fundamentally linked to the exponential growth of global e-commerce, which necessitates faster delivery speeds and greater operational accuracy. Retailers are actively seeking solutions that not only increase speed but also address sustainability concerns through right-sizing technology that reduces material waste. The increasing scarcity and rising cost of manual labor in developed economies, coupled with significant advancements in robotics, machine vision, and software integration, make the transition to automated packaging systems a compelling strategic imperative for major e-commerce players seeking a competitive edge and resilient supply chain operations.

Automated E-Commerce Packaging Market Executive Summary

The Automated E-Commerce Packaging Market is experiencing rapid structural transformation, driven primarily by the need for speed-to-market and resilience in the face of fluctuating consumer demand. Business trends indicate a strong focus on modular and flexible automation solutions that can adapt quickly to changes in product mix and packaging complexity. Key corporations are prioritizing investment in end-of-line robotics, specifically anthropomorphic arms capable of handling diverse products and automated custom box-making machines that eliminate excess void space. Consolidation is observable among system integrators as they strive to offer full-suite, integrated warehouse management and control systems that encompass packaging automation seamlessly. The shift from standardized packaging toward custom, on-demand solutions is defining the investment landscape for the near future.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive e-commerce adoption rates in countries like China and India, coupled with significant governmental investment in developing modern logistics infrastructure. North America and Europe, while already mature markets, are leading in the adoption of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance and dynamic packaging optimization. These regions are also characterized by high labor costs, making the return on investment (ROI) for automation technologies particularly attractive. Latin America and the Middle East and Africa (MEA) are emerging, focusing initially on semi-automated and scaled solutions, but are expected to rapidly accelerate full automation adoption as e-commerce penetration increases.

Segment trends highlight the dominance of automated bagging systems, particularly for soft goods and apparel, due to their speed and efficiency. However, automated carton packaging and erecting systems are gaining significant traction as retailers seek better protection for fragile or higher-value items. Technology-wise, robotics and associated software integration systems constitute the fastest-growing sub-segment, reflecting the industry's need for versatile, multi-functional machinery that can perform multiple packaging tasks simultaneously. Moreover, the demand for sustainable packaging materials is directly influencing the design and engineering of new automated machines, ensuring compatibility with eco-friendly alternatives.

AI Impact Analysis on Automated E-Commerce Packaging Market

User queries regarding the impact of AI on Automated E-Commerce Packaging predominantly center on predictive optimization, real-time decision-making, and the integration of machine vision for quality control. Common questions explore how AI algorithms can minimize dimensional weight charges, how machine learning facilitates dynamic package sizing based on product fragility and load requirements, and the role of AI in detecting packaging defects instantly. Users are keen to understand how AI drives prescriptive maintenance for packaging machinery, reducing unexpected downtime, and how it informs layout optimization within fulfillment centers. The overarching themes reflect expectations for increased efficiency, reduced operational waste, and enhanced system autonomy through intelligent sensing and learning capabilities.

AI is transforming the automated packaging workflow from a reactive process to a highly proactive, intelligent system. By analyzing vast datasets—including order history, product dimensions, shipping routes, and material properties—AI algorithms can predict the optimal packaging solution for every individual order in real-time. This capability leads directly to "right-sizing," ensuring that the smallest viable package is used, significantly reducing material consumption and lowering transportation costs by minimizing dimensional weight. Furthermore, AI-driven computer vision systems monitor packaging quality at unprecedented speeds, flagging issues like inadequate sealing, incorrect labeling, or improper void fill placement, thereby dramatically increasing outbound quality assurance.

The integration of AI also fundamentally changes how automated packaging systems are managed and maintained. Machine learning models continuously monitor the operational parameters of robotic arms, conveyors, and sealing equipment, identifying subtle patterns indicative of potential mechanical failure long before they manifest as critical downtime. This predictive maintenance approach maximizes equipment uptime and extends the lifespan of complex machinery, offering a superior return on capital expenditure. As AI sophistication grows, packaging lines are becoming increasingly autonomous, capable of self-adjusting parameters to handle mixed SKU batches and dynamically allocating resources across multiple packaging stations based on live order queues and production targets.

- AI-driven Right-Sizing: Dynamic determination of optimal package dimensions, reducing material waste and shipping costs.

- Predictive Maintenance: Use of ML algorithms to anticipate equipment failure, maximizing uptime and operational efficiency.

- Enhanced Quality Control: Real-time machine vision analysis to detect packaging defects, labeling errors, and sealing issues.

- Robotics Path Optimization: Intelligent algorithms guiding robotic arms for faster, collision-free picking, placing, and carton assembly.

- Demand Forecasting Integration: Linking packaging capacity planning directly to e-commerce demand forecasts for scalable operations.

DRO & Impact Forces Of Automated E-Commerce Packaging Market

The Automated E-Commerce Packaging Market is shaped by powerful Drivers, Restraints, and Opportunities, collectively forming the Impact Forces determining its growth trajectory. Key drivers include the relentless expansion of global e-commerce volumes and the consumer expectation for rapid, often same-day or next-day, delivery. This necessitates high-speed, reliable packaging operations that manual labor cannot sustain economically or consistently. Opportunities lie prominently in the development of highly flexible, multi-SKU handling systems and in leveraging advanced data analytics to integrate packaging decisions seamlessly with warehouse and transport management systems. These integrated solutions offer significant gains in operational visibility and control, creating new pathways for market innovation and expansion.

Significant restraints acting upon the market include the substantial initial capital investment required for installing complex automated systems, which can be prohibitive for Small and Medium-sized Enterprises (SMEs). Furthermore, the integration complexity associated with linking legacy Enterprise Resource Planning (ERP) systems with modern automation hardware presents a technical hurdle. Another restraint is the required skill gap—the need for specialized maintenance technicians and operational staff capable of managing and troubleshooting highly sophisticated robotic and software-intensive packaging lines. Addressing these restraints requires vendor strategies focused on modular, scalable solutions and accessible financing models, alongside comprehensive training programs.

The primary impact forces driving investment decisions are the mounting pressure to lower labor costs and the accelerating demand for sustainable packaging solutions. Companies are forced to automate to remain cost-competitive, pushing the adoption curve rapidly. The convergence of increased technological capability (faster, more versatile robotics) and evolving consumer expectations (eco-friendly packaging) compels manufacturers to innovate continuously. This dynamic interplay ensures sustained market growth but also elevates the technological complexity of new automated systems, making expertise in software integration as critical as hardware performance.

Segmentation Analysis

The Automated E-Commerce Packaging Market is broadly segmented based on system type, function, end-user industry, and technology used. This segmentation helps in understanding the varying needs of different e-commerce players, from small retailers requiring simple, automated bagging solutions to multinational corporations demanding fully integrated, high-throughput carton assembly and sortation systems. Analysis reveals that the packaging function segment is rapidly diversifying, moving beyond basic sealing and labeling to incorporate sophisticated steps like dynamic void filling and automated documentation insertion. The proliferation of specialized packaging machines tailored for specific product categories (e.g., cold chain logistics, fragile items) underscores the market's maturity and its response to nuanced consumer demands and regulatory requirements.

The dominant segment by system type is automated bagging equipment, favored by the apparel and accessories sector due to its operational speed and lower capital cost relative to custom carton systems. However, the fastest growth is observed in the automated carton and box erection segment, driven by increasing consumer awareness regarding product protection and the logistical necessity of maximizing trailer space efficiency through rigid, stackable packaging. Within the end-user landscape, the 3PL sector maintains a critical role, as they often invest heavily in advanced, flexible automation to service a wide array of clients with diverse packaging needs, acting as an early adopter of new technologies such as collaborative robotics (cobots) integrated directly into the packaging process to enhance flexibility.

Technology segmentation highlights the increasing dependency on sophisticated software and controls. While traditional mechanical systems still hold significant market share, the future growth is undeniably tied to sensor technology, machine vision systems, and the underlying Warehouse Control Systems (WCS) that orchestrate the entire packaging sequence. Investment in these digital components ensures maximum uptime, allows for real-time monitoring of key performance indicators (KPIs), and facilitates seamless integration with upstream order management systems, positioning software and integration services as high-value market components critical for future automated packaging performance.

- By System Type:

- Automated Bagging Systems

- Automated Carton and Box Erecting Systems

- Automated Sealing and Closing Equipment

- Automated Labeling and Printing Systems

- Automated Palletizing and De-palletizing Systems

- By Function:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging (Palletizing)

- By End-User Industry:

- 3PL and Fulfillment Centers

- Retail and E-commerce Companies (Direct Sales)

- Food and Beverage

- Healthcare and Pharmaceuticals

- Consumer Electronics

- Apparel and Accessories

- By Technology:

- Robotics (Articulated Robots, Collaborative Robots)

- Conveyor and Sortation Systems

- Software and Control Systems (WCS, WMS Integration)

- Machine Vision and Sensor Technology

Value Chain Analysis For Automated E-Commerce Packaging Market

The value chain for the Automated E-Commerce Packaging Market is highly integrated, starting with upstream suppliers of raw components and extending through machinery manufacturers, system integrators, and finally, the end-user logistics and e-commerce operations. Upstream analysis involves key suppliers providing essential components such as specialized motors, complex sensors, high-precision motion control systems, and industrial robots. The quality and reliability of these upstream inputs directly influence the overall performance and longevity of the automated packaging machinery. Furthermore, software development firms specializing in machine intelligence and vision systems constitute a critical part of the upstream value proposition, providing the foundational logic for optimized packaging decisions and system orchestration.

Midstream activities are dominated by original equipment manufacturers (OEMs) and machinery builders who assemble the components into complete automated packaging lines. Crucially, system integrators play a pivotal role here; they customize and integrate diverse machines—from different vendors—into a coherent, operational packaging workflow specific to a client’s fulfillment center layout and volume requirements. Direct distribution channels involve OEMs selling high-volume, standardized machinery directly to major e-commerce retailers, often supported by in-house maintenance and support teams. Conversely, indirect distribution utilizes a network of specialized distributors and value-added resellers (VARs) who provide localized sales, integration services, and ongoing technical support, particularly vital for entry into smaller or geographically dispersed markets.

Downstream analysis focuses on the end-users: the e-commerce fulfillment centers, 3PL providers, and internal logistics departments. The efficiency and reliability of the automated packaging system directly impact the downstream supply chain performance, affecting delivery timelines and customer satisfaction. The relationship between the system integrator and the end-user is continuous, often involving long-term maintenance contracts, software updates, and scaling consultancy. This ongoing service element represents a significant portion of the total market value. Ultimately, the successful deployment of automated packaging systems results in optimized use of shipping materials and labor, translating into cost savings for the downstream partners and faster, more reliable service for the final consumer.

Automated E-Commerce Packaging Market Potential Customers

The primary potential customers and end-users of automated e-commerce packaging solutions are entities managing high-volume fulfillment operations that require speed, accuracy, and scalability. This includes major global e-commerce giants who operate vast, dedicated fulfillment networks and frequently invest in cutting-edge, custom-engineered automation to maintain their competitive edge in delivery times. However, the market’s growth is increasingly driven by medium-sized enterprises (MEs) and retailers transitioning from traditional brick-and-mortar models to omni-channel fulfillment, necessitating automation to handle the complexity of individualized online orders efficiently. These customers prioritize modular, scalable solutions that offer a fast ROI and minimal disruption during implementation.

A highly significant segment of potential customers comprises Third-Party Logistics (3PL) providers. These firms specialize in outsourced logistics services and must accommodate the diverse packaging requirements of multiple clients simultaneously. 3PLs are high-volume buyers of flexible automation—systems capable of dynamically switching between different packaging formats (bags, boxes, envelopes) and materials. Their investment decisions are guided by versatility and throughput capacity, as their ability to efficiently handle peak season surges for diverse clients directly impacts their profitability and market share within the competitive logistics sector.

Furthermore, specialized end-users such as large food and beverage distributors (especially those handling perishable goods requiring temperature control), pharmaceutical companies adhering to stringent regulatory packaging standards, and major apparel retailers constitute robust customer bases. These sectors require automation tailored to specific needs—for instance, cold chain packaging systems or automated insertion of regulatory documentation. The appeal of automation to these end-users is not just cost reduction, but ensuring compliance, traceability, and maintaining product integrity throughout the e-commerce supply chain, making automated solutions an essential investment for maintaining quality assurance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 14.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Müller Martini, Beumer Group, MHS Global, Honeywell Intelligrated, KUKA AG, Fanuc Corporation, ABB Ltd, Krones AG, Sacmi Imola S.C., Duravant LLC, Gebo Cermex, Mettler-Toledo International Inc., Syntegon Technology GmbH, BluePrint Automation, PMMI Media Group, Vanguard Packaging, SICK AG, Zebra Technologies, Knapp AG, Daifuku Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automated E-Commerce Packaging Market Key Technology Landscape

The technological landscape of automated e-commerce packaging is dominated by the integration of advanced robotics and sophisticated control software, transitioning from traditional fixed automation to highly flexible, adaptive systems. Core technologies include articulated robots, collaborative robots (cobots), and automated guided vehicles (AGVs) used for material transport and end-of-line processes like palletizing. Articulated robots offer high speed and payload capacity for repetitive tasks like carton folding and sealing, while cobots are increasingly utilized for smaller, more variable batch packaging where human interaction is still necessary, enhancing safety and flexibility within the packaging environment. The performance of these systems is critically dependent on precision motion control technology and robust sensory feedback loops.

Machine vision and sensor technology represent another cornerstone of the modern automated packaging line. High-resolution cameras and 3D scanners are deployed to accurately measure product dimensions in real-time, enabling immediate, precise package right-sizing decisions, which is essential for minimizing void fill and reducing shipping costs associated with volumetric weight (DIM weight). Furthermore, these vision systems perform rapid quality checks, ensuring correct product insertion, accurate label placement, and detecting sealing integrity issues at speeds impossible for human inspection. These technologies, often powered by AI and deep learning algorithms, ensure maximum throughput while maintaining stringent quality control standards.

Crucially, the effectiveness of the hardware is unlocked by advanced software integration. Warehouse Control Systems (WCS) and Manufacturing Execution Systems (MES) act as the operational brain, seamlessly coordinating various packaging subsystems—from the automated picking area to the final labeling station. These systems communicate directly with the overarching Warehouse Management System (WMS) to receive order data, manage inventory allocation, and orchestrate the flow of goods to the appropriate packaging station. The shift towards cloud-based WCS solutions is providing greater flexibility, easier maintenance, and enhanced data accessibility, allowing operators to monitor performance metrics and optimize line efficiency remotely, thus cementing software as the primary competitive differentiator in the automation space.

Regional Highlights

- North America (NA): North America represents a mature yet dynamic market, characterized by high labor costs and the presence of the world's largest e-commerce retailers, necessitating substantial investment in high-speed, integrated automation. The focus here is on maximizing throughput and implementing cutting-edge technologies like advanced robotics and AI-driven sorting systems to handle complex reverse logistics and peak season volume surges. The United States leads in adopting custom box-making machinery and flexible automation systems designed for omni-channel fulfillment strategies. Regulatory pressures, particularly concerning worker safety and dimensional weight constraints, further accelerate the shift towards advanced automation solutions, ensuring sustained investment in this region.

- Europe: Europe exhibits strong growth, driven by stringent sustainability regulations and a fractured, diverse logistics landscape. The emphasis in Europe is placed on flexible, modular systems that can adapt to varying national standards and languages, alongside a strong push for eco-friendly packaging materials. German and UK markets are pioneers in adopting sophisticated AGV/AMR solutions within packaging centers, optimizing internal transport flow. The implementation of circular economy principles is prompting machinery manufacturers to design automated systems compatible with recycled and bio-based packaging inputs, ensuring the region remains a key innovator in sustainable automation.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by booming e-commerce markets in China, India, and Southeast Asia, characterized by rapidly expanding middle-class populations and increasing internet penetration. Government initiatives supporting logistics infrastructure development, coupled with comparatively lower initial investment thresholds for adopting automation compared to high labor cost regions, contribute to exponential growth. While cost-effective, high-volume automated bagging systems are prevalent, the region is quickly moving toward fully automated sorting and carton erecting systems to manage dense, urban fulfillment demands and complex intra-regional supply chains.

- Latin America (LATAM): The LATAM market is emerging, driven by increasing foreign investment in logistics infrastructure and the urbanization trends boosting e-commerce adoption, particularly in Brazil and Mexico. The market is currently characterized by initial investments in semi-automated and scaled-down modular systems, focusing on addressing labor intensity in key urban hubs. Challenges such as complex customs procedures and fragmented logistics networks necessitate automated packaging solutions that offer robust traceability and accurate documentation capabilities, positioning flexibility and reliability as core purchasing criteria.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing heavily in modernizing logistics capabilities as part of broader economic diversification efforts. High temperature and environmental control needs, particularly for food and pharma e-commerce, drive demand for specialized automated packaging, including cold chain solutions. While the market footprint is smaller, high average order values and governmental commitments to building world-class smart cities and logistics parks suggest significant long-term growth potential for advanced, integrated automation systems in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated E-Commerce Packaging Market.- Müller Martini

- Beumer Group

- MHS Global

- Honeywell Intelligrated

- KUKA AG

- Fanuc Corporation

- ABB Ltd

- Krones AG

- Sacmi Imola S.C.

- Duravant LLC

- Gebo Cermex

- Mettler-Toledo International Inc.

- Syntegon Technology GmbH

- BluePrint Automation

- PMMI Media Group

- Vanguard Packaging

- SICK AG

- Zebra Technologies

- Knapp AG

- Daifuku Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Automated E-Commerce Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Automated E-Commerce Packaging Market?

The primary driver is the accelerating global volume of e-commerce transactions, coupled with intense consumer expectations for ultra-fast, often same-day or next-day, delivery. Automation is essential to achieve the necessary high throughput and accuracy while managing rising labor costs.

How does automation contribute to sustainable packaging goals?

Automation systems, particularly those utilizing AI and 3D scanning technology, enable package right-sizing. This process ensures the minimal amount of material is used for each product, reducing plastic and cardboard consumption and significantly decreasing the dimensional weight (DIM) of shipments.

What are the most significant technological components in automated packaging?

Key technological components include high-speed industrial robotics (articulated and collaborative), integrated machine vision systems for quality control, and sophisticated Warehouse Control Systems (WCS) that orchestrate the entire packaging workflow and interface with inventory management.

Which regional market is exhibiting the highest growth rate for automated packaging solutions?

The Asia Pacific (APAC) region is demonstrating the highest Compound Annual Growth Rate (CAGR), driven by massive digital adoption, rapid e-commerce penetration in countries like China and India, and ongoing governmental investments in large-scale logistics and fulfillment infrastructure.

What are the main financial hurdles preventing smaller businesses from adopting full automation?

The primary hurdle is the substantial initial capital expenditure required for purchasing and integrating complex machinery and software. However, the increasing availability of modular, pay-as-you-go, and scalable automated systems is beginning to lower the entry barrier for Small and Medium-sized Enterprises (SMEs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager