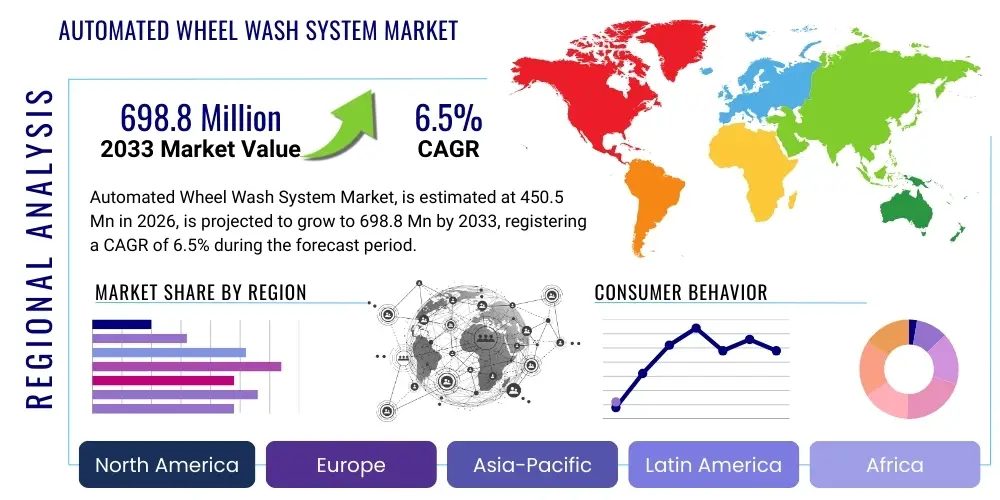

Automated Wheel Wash System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441561 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Automated Wheel Wash System Market Size

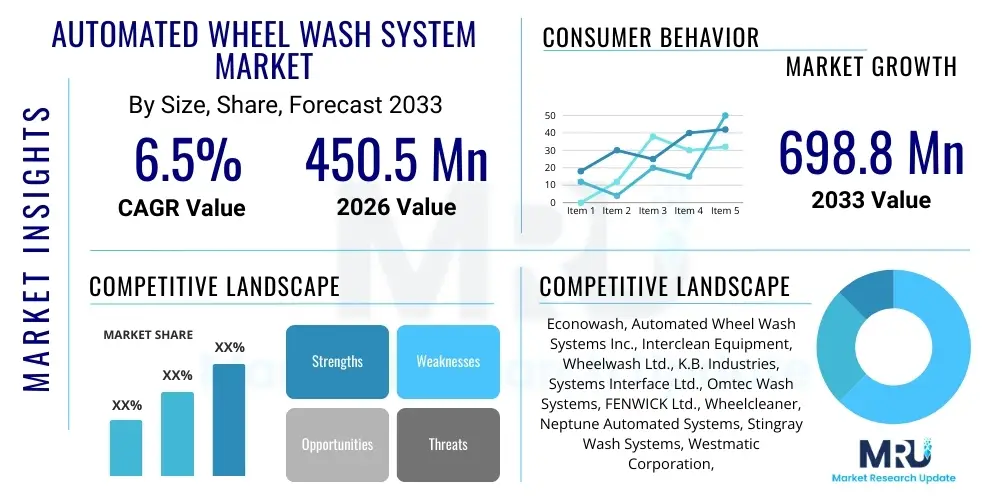

The Automated Wheel Wash System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 698.8 Million by the end of the forecast period in 2033.

Automated Wheel Wash System Market introduction

The Automated Wheel Wash System Market encompasses specialized industrial cleaning equipment designed to remove mud, debris, and contaminants from the wheels, chassis, and undercarriages of heavy vehicles, primarily before they exit construction sites, mining operations, or landfills onto public roads. These systems utilize advanced technologies, including high-pressure water jets, recycling mechanisms, and chemical treatments, to ensure regulatory compliance regarding road safety and environmental protection. The core objective of these systems is mitigating the risk of tracking pollutants, such as dirt, clay, and aggregates, onto municipal infrastructure, which helps prevent road hazards, minimize cleanup costs for local authorities, and reduce environmental pollution caused by fugitive dust and particulate matter. The necessity for these robust cleaning solutions is inherently linked to escalating urbanization and the continuous expansion of infrastructure projects globally, necessitating strict control over construction site contamination. Furthermore, the longevity and efficiency of these automated systems, which eliminate the need for manual cleaning processes, drive their widespread adoption across diverse high-traffic industrial settings, emphasizing throughput and sustainability.

Automated wheel wash systems are segmented based on their design—categorized primarily into drive-through systems, roller systems, and mobile units—each catering to specific site constraints and traffic volumes. Drive-through systems, often modular and installed semi-permanently, handle high volumes of traffic efficiently, utilizing sensors to trigger the washing sequence automatically. Roller systems, conversely, provide a more intensive clean by rotating the wheels during the wash cycle, dislodging stubborn materials from tire treads, which is crucial for extreme mining or quarry environments. Major applications span civil engineering, waste management facilities, material handling terminals, and aggregate processing plants, where heavy earth-moving equipment is constantly mobilized. The fundamental benefits include regulatory adherence, significantly reduced maintenance costs for vehicles and public roads, improved site safety through dust control, and efficient water conservation via advanced recycling and filtration loops, positioning these solutions as critical components of modern sustainable site management practices.

The market's expansion is significantly driven by increasingly stringent environmental regulations, particularly in developed economies, which mandate the prevention of soil and mud tracking onto public highways. Governments and environmental agencies globally are imposing substantial fines and penalties for non-compliance, forcing project developers and site operators to invest in reliable automated solutions. Technological advancements, such as intelligent sensor integration, IoT capabilities for remote monitoring, and enhanced water treatment mechanisms, are making these systems more efficient and easier to operate, reducing total cost of ownership. The burgeoning construction sector in the Asia Pacific region, coupled with substantial investments in mining infrastructure across Africa and Latin America, further stimulates demand for rugged and high-capacity wheel washing systems. Finally, the growing industry emphasis on corporate social responsibility (CSR) and sustainable operational practices pushes companies to adopt technologies that minimize environmental footprint, thereby solidifying the market trajectory for automated wheel wash technology over the forecast period.

Automated Wheel Wash System Market Executive Summary

The Automated Wheel Wash System Market exhibits robust growth, primarily propelled by global infrastructural development cycles and the increasing harmonization of stringent environmental protection mandates across continents. Business trends indicate a pronounced shift towards customized, modular systems that offer flexibility in installation and relocation, catering to the transient nature of construction and demolition sites. Key market players are focusing heavily on integrating smart technologies, such including remote diagnostics, predictive maintenance scheduling, and advanced telemetry, to enhance system uptime and operational efficiency, thereby offering significant value proposition improvements to end-users burdened by demanding project timelines. Furthermore, sustainability is emerging as a critical competitive differentiator; companies leading in water recycling efficiency and sludge management solutions are gaining significant market share, reflecting a broader industry focus on minimizing water consumption and waste disposal costs. Strategic mergers and acquisitions are observed, particularly among regional specialists and international manufacturers, aimed at consolidating technological expertise and expanding geographical footprints, specifically targeting high-growth urban development centers in emerging economies.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing region, driven by massive government investments in smart cities, transportation networks, and large-scale industrial projects across China, India, and Southeast Asian nations. North America and Europe maintain strong demand, characterized by a preference for technologically sophisticated, highly compliant systems that meet strict EU and EPA environmental standards, often incorporating integrated de-icing or specialized chemical dosing capabilities necessary for operations in diverse climatic zones. While APAC focuses on volume and deployment speed, Western markets prioritize durability, integration with existing site management systems, and low operational noise levels, reflecting sophisticated regulatory environments. Latin America and the Middle East & Africa (MEA) are emerging as significant opportunity areas, fueled by burgeoning oil & gas and mining sectors, demanding heavy-duty, ruggedized systems capable of operating reliably under harsh, high-ambient-temperature conditions, often coupled with requirements for mobile or semi-mobile configurations due to site remoteness and frequent logistical movements.

Segment trends highlight the substantial market share held by heavy-duty drive-through systems, particularly in mining and quarrying applications, where vehicle size and contamination levels are extreme. However, the roller system segment is projected to experience accelerated growth due to its superior cleaning efficacy for heavily lugged tires and suitability for sites requiring maximal contaminant removal, often mandated in sensitive environmental zones. From an application standpoint, the construction and civil engineering sector remains the largest consumer, yet the solid waste management and landfill segment is rapidly gaining traction, driven by the need to strictly control pathogens and odors tracked out of waste facilities. Water treatment and recycling technology within these systems are becoming paramount, with end-users increasingly selecting systems that demonstrate closed-loop operation exceeding 90% water reuse efficiency. The shift from outright purchase to flexible leasing and rental models, particularly for mobile units deployed on short-term infrastructure projects, is an undeniable financial trend impacting capital expenditure planning within the user base.

AI Impact Analysis on Automated Wheel Wash System Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into Automated Wheel Wash Systems is generating significant user interest, primarily centered on optimizing operational efficiencies, ensuring regulatory adherence, and implementing sophisticated predictive maintenance protocols. Common user inquiries revolve around the practical application of AI in minimizing water consumption, specifically asking how ML algorithms can dynamically adjust water pressure and nozzle angles based on real-time contamination levels detected by integrated vision systems, thereby reducing unnecessary water usage during lighter washes. Users frequently express concerns about the return on investment (ROI) associated with higher initial capital expenditure required for AI-enabled systems, querying whether the gains in reduced maintenance downtime and decreased operational costs truly justify the investment. Furthermore, there is considerable interest in how AI facilitates compliance reporting; specifically, users want systems that can autonomously generate auditable, time-stamped records detailing when vehicles were cleaned, the estimated level of debris removed, and confirmation of adherence to site-specific environmental discharge limits, minimizing human intervention in compliance management. The consensus theme is the expectation that AI should transform wheel washing from a reactive necessity into a proactive, intelligent resource management tool.

- AI-Powered Vision Systems: Utilizing image recognition to assess contamination severity and dynamically adjust wash cycle parameters (water volume, pressure, duration).

- Predictive Maintenance: Analyzing sensor data (pump vibration, filter pressure, water quality) to forecast component failure, minimizing unplanned downtime and optimizing spare parts inventory management.

- Smart Water Management: Implementing ML algorithms to optimize the flocculant dosing, sediment settling rate, and filtration cycles, maximizing water recycling efficiency, often exceeding 95%.

- Autonomous Compliance Reporting: Automatically logging, time-stamping, and certifying every wash event, providing verifiable digital documentation for environmental audits and regulatory bodies.

- Traffic Flow Optimization: Integrating AI with site traffic management systems (e.g., RFID, vehicle identification) to optimize the queuing and throughput process, reducing vehicle idle time at wash stations.

- Remote Diagnostics and Calibration: Enabling manufacturers to remotely access system parameters, diagnose faults, and recalibrate sensors and actuators, reducing the need for costly and time-consuming physical service visits.

- Energy Consumption Optimization: Using AI to schedule high-power operations (like pump activation) during periods of lower energy tariffs or dynamically adjusting energy use based on real-time load demand.

DRO & Impact Forces Of Automated Wheel Wash System Market

The Automated Wheel Wash System Market is simultaneously influenced by powerful drivers and significant restraints, generating complex impact forces that shape investment and adoption patterns. The primary driver is the pervasive and tightening global environmental regulatory framework, compelling industries like mining, construction, and waste management to adopt effective track-out control methods or face severe financial penalties and project halts. This regulatory pressure, coupled with a heightened corporate emphasis on minimizing environmental pollution and ensuring site safety, acts as a perpetual demand catalyst. Conversely, a major restraint involves the high initial capital investment required for heavy-duty, sophisticated wheel wash systems, particularly those incorporating advanced water recycling and AI components, which can deter small to medium-sized construction firms operating on tight budgets. Additionally, the operational challenge of managing substantial volumes of sludge and wastewater byproduct, including the costs associated with specialized disposal, poses a significant, ongoing burden for system operators, often requiring dedicated on-site personnel and infrastructure, impacting the overall cost of ownership calculations. These countervailing forces establish a dynamic market where high-specification systems are favored in regions with strict compliance, while price sensitivity dictates simpler solutions in developing economies.

Opportunities for market growth are vast, centered predominantly on technological innovation and geographic expansion. The most compelling opportunity lies in developing highly modular, quick-deployment mobile systems that can service short-duration infrastructure projects effectively, addressing the mobility demands of modern construction sites. Furthermore, enhancing water treatment efficiency through nano-filtration and specialized chemical treatment processes presents an avenue for differentiation, appealing directly to water-scarce regions or sites with severe limitations on wastewater discharge. The integration of IoT capabilities and remote monitoring offers significant service-based opportunities, allowing manufacturers to move beyond product sales into lucrative long-term maintenance and data subscription services, optimizing performance remotely. These opportunities directly impact the market by fostering competitive advantages for firms investing heavily in R&D and digital service delivery platforms, broadening the accessible market beyond traditional heavy industry users into adjacent sectors such as ports, military facilities, and large-scale agricultural operations requiring biosecurity measures.

The cumulative impact forces dictate that the future market landscape will favor solutions offering the lowest total cost of ownership (TCO), not merely the lowest purchase price. Regulatory stringency will continue to be the dominant non-negotiable factor, forcing end-users to adopt compliant, high-efficacy systems. Economic impact forces, such as fluctuating commodity prices affecting mining and construction activity, exert cyclical demand pressures. However, the underlying trend towards automation and sustainability acts as a stabilizing force, ensuring consistent demand for solutions that reduce manual labor and optimize resource consumption. The convergence of technological innovations (AI/IoT) with operational necessity (compliance) means that the market is rapidly moving toward 'Smart Wheel Washing,' where data-driven efficiency is the core value proposition. This shift will lead to market consolidation, as smaller players unable to invest in sophisticated electronics and integrated water treatment capabilities struggle to compete with comprehensive, technology-enabled offerings from larger market leaders.

Segmentation Analysis

The Automated Wheel Wash System Market is primarily segmented by System Type, Operational Mechanism, Application, and geographic region, allowing for tailored product offerings that meet the diverse and specific requirements of global industrial operations. The segmentation by system type distinguishes between fixed/permanent installations and mobile/modular units, reflecting the difference between long-term operational sites like quarries versus temporary construction projects. Segmentation by operational mechanism further categorizes the technology into dry-pit systems, which use minimal water and focus on mechanical brushing, and high-pressure wet systems (including roller and drive-through), which are crucial for sites dealing with highly adhesive materials like clay or concrete slurry. This granular analysis is essential for manufacturers to align product design with end-user requirements, maximizing cleaning efficacy while minimizing site disruption and resource consumption.

The application segmentation is particularly critical, as the required system specifications vary dramatically across different end-user industries. For instance, mining and heavy quarrying operations require extremely robust, high-throughput systems capable of handling large vehicle sizes and severe contamination, often necessitating high water volume and specialized sludge removal infrastructure. Conversely, systems deployed at municipal solid waste landfills must prioritize biosecurity and odor control alongside debris removal, often incorporating chemical dosing or disinfection capabilities. Recognizing these distinct needs allows vendors to develop specialized sales strategies and engineered solutions that address sector-specific challenges, such as integrating systems with existing site infrastructure like weighbridges or entry/exit barriers, enhancing overall site logistics management efficiency.

- By System Type

- Fixed/Permanent Systems

- Mobile/Modular Systems

- Semi-Mobile Systems (Skid-mounted)

- By Operational Mechanism

- Drive-Through Wash Systems

- Roller/Treadle Wash Systems

- Dry-Pit Systems (Brush/Vibrating)

- Combined Systems (Wet and Dry)

- By Application

- Construction and Civil Engineering Sites

- Mining and Quarrying Operations

- Waste Management (Landfills and Recycling Centers)

- Aggregate and Cement Production

- Ports and Logistics Terminals

- Military and Government Facilities

- By Geography

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Automated Wheel Wash System Market

The value chain for the Automated Wheel Wash System Market begins with the Upstream Analysis, which focuses on the procurement and fabrication of core components. This stage involves the sourcing of critical materials such as specialized steel alloys for structural integrity and corrosion resistance, high-pressure pump units, advanced sensor technology (proximity and load cells), and sophisticated control system components (PLCs, HMI interfaces). Key activities include precision engineering and welding, where manufacturers ensure system durability to withstand harsh industrial environments. Raw material sourcing and component manufacturing significantly influence the final product cost and reliability, with supply chain stability being crucial for maintaining production timelines, especially for high-specification pumps and filtration membranes, often sourced from specialized industrial equipment suppliers globally. Efficiency and cost optimization at this stage determine the competitive pricing structure for the downstream market, emphasizing robust quality control over material specifications.

Moving downstream, the value chain centers on system integration, distribution, installation, and post-sales servicing. Distribution channels are typically bifurcated into Direct and Indirect sales models. Direct sales are common for large, customized fixed systems sold to major mining or construction conglomerates, involving comprehensive consultation, site assessment, and tailored engineering solutions handled directly by the manufacturer or its specialized subsidiaries. Indirect channels, involving authorized dealers, regional distributors, and equipment rental companies, handle standardized mobile and modular units, offering broader market reach and localized support, particularly beneficial in fragmented markets like smaller construction sites. Installation is a crucial service activity, requiring specialized civil engineering knowledge to prepare the site (foundation, drainage, water supply), and professional commissioning to ensure system performance meets specified track-out requirements and regulatory compliance standards.

The final crucial element of the value chain is the sustained service and maintenance revenue stream. Given the rigorous operational environments, preventative maintenance contracts, and the supply of consumable parts (filters, chemical additives, replacement nozzles) constitute a substantial and profitable downstream activity. Direct service models allow manufacturers to collect valuable performance data, feeding back into R&D for continuous product improvement, especially concerning AI-driven predictive maintenance optimization. The overall efficiency of the distribution channel—whether direct engagement provides better customization and control, or indirect distribution offers necessary agility and speed—significantly dictates the market penetration rate. For high-value, long-lifecycle equipment like wheel wash systems, robust post-installation support and timely spare parts availability are often the deciding factors in customer procurement decisions, cementing the importance of a well-optimized and geographically capable service network.

Automated Wheel Wash System Market Potential Customers

The primary consumers and end-users of Automated Wheel Wash Systems are organizations involved in heavy earth movement, material processing, and waste management, where the control of environmental pollutants tracked onto public highways is a legal and operational necessity. These potential customers include major construction companies undertaking large-scale commercial, residential, and infrastructure projects, such as highway construction, bridge building, and subterranean tunneling operations, where massive quantities of soil and aggregate are moved daily. These entities require high-throughput, reliable systems that can handle hundreds of heavy vehicle movements per day, ensuring compliance with local government ordinances regarding site contamination and road cleanliness, mitigating the risk of substantial fines and reputational damage.

Another significant customer segment is the global mining and quarrying industry, encompassing operations for extracting coal, precious metals, industrial minerals, and aggregates. Vehicles in these environments, particularly massive haul trucks and specialized loaders, carry extreme levels of caked mud, rock dust, and corrosive materials, necessitating highly durable, heavy-duty roller or high-pressure drive-through systems designed for continuous operation in abrasive conditions. For these customers, system robustness, ease of sludge handling, and superior cleaning efficacy are paramount, often overriding initial cost considerations due to the severe consequences of component failure or inadequate cleaning performance impacting public road safety or environmental remediation efforts mandated by regulatory bodies in their concession areas.

Furthermore, entities involved in environmental services, particularly municipal landfill operators, recycling centers, and large-scale waste transfer stations, represent a rapidly growing customer base. In these applications, the contamination tracked out is often mixed with potentially hazardous, pathogenic, or odorous materials, making rigorous cleaning essential for public health and biosecurity reasons, not just debris removal. Logistics parks, ports handling bulk materials (e.g., grain, iron ore, coal), and specific government facilities, such as military bases or specialized testing grounds, also constitute potential customers, requiring tailored systems that address the unique contaminants, security protocols, and vehicle types specific to their complex operational requirements, thereby diversifying the market demand profile beyond traditional construction sites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 698.8 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Econowash, Automated Wheel Wash Systems Inc., Interclean Equipment, Wheelwash Ltd., K.B. Industries, Systems Interface Ltd., Omtec Wash Systems, FENWICK Ltd., Wheelcleaner, Neptune Automated Systems, Stingray Wash Systems, Westmatic Corporation, Landa Karcher Group, Hydro Engineering, Inc., MobyDick (FRUTIGER Company AG), Rinse & Roll, Northern Wash Systems, Wheelwash Solutions, Cleaning Technologies Group, Inc., and Morclean Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automated Wheel Wash System Market Key Technology Landscape

The technological landscape of the Automated Wheel Wash System Market is rapidly evolving, driven by the need for greater efficiency, reduced environmental impact, and enhanced operational intelligence. Central to this evolution is the implementation of sophisticated water recycling and filtration technologies, moving beyond simple sediment traps to incorporate multi-stage processes involving hydrocyclones, chemical flocculation, and advanced membrane filtration (e.g., ultrafiltration). These technologies ensure that over 90% of the water used in the wash process can be recovered, treated, and reused, directly addressing water scarcity concerns and minimizing discharge costs. Furthermore, the development of specialized sludge management solutions, including automated conveyer systems and dewatering units that prepare the contaminated waste for easy and cost-effective removal, is becoming a standard technological requirement, especially in high-volume mining and aggregate sites where sludge generation is significant and continuous.

Sensor technology and connectivity represent another critical pillar of the modern wheel wash system. Advanced proximity and load-sensing arrays, coupled with high-definition cameras and automated vehicle identification systems (like RFID tags), enable the precise customization of wash cycles based on vehicle type, weight, and detected contamination level, moving away from uniform, energy-intensive standard washes. The integration of Internet of Things (IoT) connectivity allows for real-time remote monitoring of system health, water levels, pump performance, and energy consumption. This capability is crucial for implementing proactive maintenance schedules, minimizing system downtime, and providing operators with immediate performance metrics via cloud-based dashboards accessible on mobile devices or centralized site management platforms, significantly enhancing operational visibility and accountability.

Looking forward, the technology landscape is increasingly defined by the application of Artificial Intelligence and machine learning (AI/ML) for predictive optimization. AI algorithms are being deployed to analyze accumulated operational data to fine-tune system parameters autonomously, such as optimizing chemical dosing for water treatment or adjusting pump pressures based on historical contamination trends related to weather patterns. Additionally, innovative mechanical designs, including modular, quick-connect components that facilitate rapid deployment, relocation, and minimal civil groundwork, are enhancing the versatility of mobile systems, making them highly attractive for temporary projects. The competitive edge is now held by companies that effectively blend robust mechanical engineering with cutting-edge digital intelligence, ensuring maximum regulatory compliance with minimal human intervention and resource waste, positioning these systems as high-tech infrastructure assets.

Regional Highlights

Regional dynamics heavily influence the demand, specification, and regulatory compliance requirements within the Automated Wheel Wash System Market. Developed markets, namely North America and Europe, exhibit maturity characterized by high regulatory stringency and a strong preference for sophisticated, automated, and environmentally compliant systems. In these regions, high capital cost is often secondary to guaranteed performance, low noise operation, and advanced water treatment capabilities, driven by demanding environmental agencies and densely populated urban areas where tracking mud is severely penalized.

Asia Pacific (APAC) stands out as the primary growth engine, witnessing unparalleled demand fueled by colossal infrastructure initiatives, including China's Belt and Road Initiative and rapid urbanization across India, Indonesia, and Vietnam. The emphasis in APAC is often on high-volume throughput and robust, cost-effective solutions capable of operating reliably in diverse climatic conditions, though environmental regulations are quickly catching up, particularly in key economic hubs, driving a secondary demand wave for more advanced recycling systems.

- North America: Driven by strict EPA and state-level compliance for construction and fracking sites. High demand for roller systems and integrated recycling units to handle heavy clay and specific oilfield contaminants. Focus on IoT integration for remote compliance monitoring.

- Europe: Characterized by highly stringent environmental directives (e.g., EU Waste Framework Directive). Strong market for low-noise, highly efficient fixed systems, with significant adoption of leasing models to manage capital expenditure. Germany and the UK are key markets due to heavy construction activity and regulatory enforcement.

- Asia Pacific (APAC): Highest growth trajectory, dominated by infrastructure and urbanization projects (India, China, Southeast Asia). Emphasis on durability, high throughput, and increasing transition from basic wash stations to sophisticated water-conserving mobile units.

- Latin America (LATAM): Demand largely concentrated in the vast mining sectors of Chile, Peru, and Brazil. Requires extremely rugged, heavy-duty systems capable of handling massive haul truck dimensions and abrasive materials. Mobile systems are popular due to remote site locations and frequent relocation needs.

- Middle East & Africa (MEA): Emerging market primarily driven by construction in the Gulf Cooperation Council (GCC) countries and significant mining/resource extraction in Africa. Focus on systems that efficiently manage dust (arid conditions) and conserve water, often requiring specialized cooling mechanisms for high ambient temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automated Wheel Wash System Market.- Econowash

- Automated Wheel Wash Systems Inc.

- Interclean Equipment

- Wheelwash Ltd.

- K.B. Industries

- Systems Interface Ltd.

- Omtec Wash Systems

- FENWICK Ltd.

- Wheelcleaner

- Neptune Automated Systems

- Stingray Wash Systems

- Westmatic Corporation

- Landa Karcher Group

- Hydro Engineering, Inc.

- MobyDick (FRUTIGER Company AG)

- Rinse & Roll

- Northern Wash Systems

- Wheelwash Solutions

- Cleaning Technologies Group, Inc.

- Morclean Ltd.

Frequently Asked Questions

Analyze common user questions about the Automated Wheel Wash System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the adoption of automated wheel wash systems?

The adoption is primarily driven by stringent environmental regulations and mandatory compliance requirements imposed by local and national authorities, aimed at preventing the tracking of mud and debris onto public roads. Secondary drivers include the need for reduced manual labor costs, improved site safety through dust suppression, and the necessity for robust water recycling capabilities to meet corporate sustainability goals and reduce operating expenses associated with water consumption and wastewater disposal.

How do fixed wheel wash systems compare in effectiveness and cost to mobile or modular systems?

Fixed systems typically offer higher throughput and superior cleaning efficacy for long-term, high-volume operations like quarries or major production facilities, justifying a higher upfront civil engineering and installation cost. Mobile or modular systems, conversely, provide flexibility, rapid deployment, and minimal civil groundwork, making them more cost-effective for short-term construction projects or temporary sites where relocation capability is essential, although their maximum throughput might be slightly lower than permanent installations.

What role does water recycling technology play in the total cost of ownership (TCO) for wheel wash systems?

Water recycling technology, often incorporating advanced filtration and sludge management, significantly reduces the TCO. While systems with high recycling efficiency (90%+) have a higher initial capital cost, they minimize continuous expenditures related to fresh water purchase, wastewater transportation, and disposal fees. This results in substantial operational savings over the system’s lifecycle, particularly in regions facing high water utility costs or strict discharge limitations.

Which application segment holds the largest market share for automated wheel washing, and why?

The Construction and Civil Engineering segment currently holds the largest market share. This is due to the sheer volume and frequency of large-scale infrastructure projects globally, generating substantial quantities of track-out material (soil, clay, aggregate). The temporary, yet demanding, nature of these sites requires robust systems capable of ensuring immediate regulatory compliance before vehicles exit the work zone onto public highways, sustaining continuous demand across diverse geographic regions.

How is Artificial Intelligence (AI) expected to impact the future design and maintenance of wheel wash equipment?

AI is set to transform maintenance from reactive to predictive, using machine learning to analyze sensor data for component failure prediction, significantly minimizing downtime. In design, AI will power smart vision systems to dynamically adjust wash intensity based on actual vehicle contamination levels, optimizing water use, reducing energy consumption, and providing automated, highly accurate digital compliance reporting, making operations more efficient and data-driven.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager