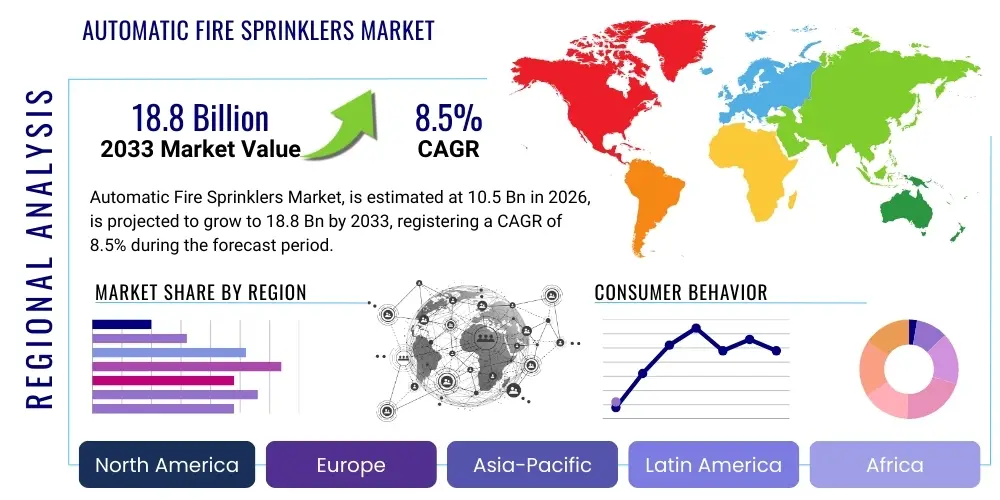

Automatic Fire Sprinklers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441696 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Automatic Fire Sprinklers Market Size

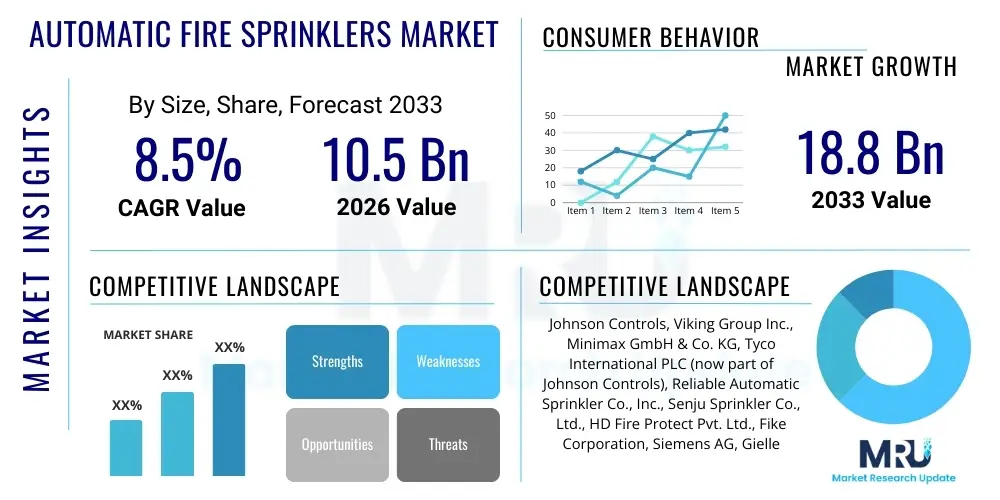

The Automatic Fire Sprinklers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $18.8 Billion by the end of the forecast period in 2033.

Automatic Fire Sprinklers Market introduction

The Automatic Fire Sprinklers Market encompasses the manufacturing, distribution, installation, and maintenance of integrated fire suppression systems designed to automatically detect and extinguish fires in their incipient stages. These systems are critical components of modern building safety infrastructure, operating independently based on thermal activation, thereby minimizing property damage and significantly reducing the risk of fatality. The core technology involves a network of piping connected to a reliable water source, utilizing sprinkler heads that are sensitive to specific heat thresholds. When the ambient temperature reaches the activation point, typically 135°F to 165°F, a heat-sensitive element (usually a glass bulb or fusible link) breaks, releasing water directly over the fire area. This localized activation mechanism is a key differentiating factor, ensuring efficient water usage compared to total flooding systems.

Major applications for automatic fire sprinklers span across various sectors, including high-rise commercial buildings, critical infrastructure such as data centers and power plants, residential complexes, and specialized industrial facilities like chemical processing plants and warehouses. The versatility of sprinkler systems—ranging from wet pipe and dry pipe to deluge and pre-action systems—allows them to be tailored to specific environmental conditions and occupancy risks. For instance, dry pipe systems are essential in unheated areas where freezing is a concern, while pre-action systems are preferred in locations requiring dual confirmation before water release, such as museums or telecommunication rooms, to prevent accidental water damage. The increasing complexity of modern architectural designs and the density of urban environments further necessitate robust, reliable fire suppression solutions.

The principal driving factors accelerating market growth include stringent global fire safety regulations enforced by authorities like the National Fire Protection Association (NFPA) and equivalent international bodies, mandating sprinkler installation in new constructions and often requiring retrofitting in older structures. The benefits provided by these systems—primarily life safety assurance, continuous business operation, and reduced insurance premiums—have solidified their position as indispensable safety assets. Furthermore, rapid global urbanization, coupled with the rising number of infrastructural projects, particularly in emerging economies of the Asia Pacific region, fuels the demand for advanced fire protection technologies. Continuous innovation in sprinkler head design, materials science, and integration with smart building management systems (BMS) are also contributing significantly to market expansion and efficiency improvements.

Automatic Fire Sprinklers Market Executive Summary

The Automatic Fire Sprinklers Market is characterized by steady growth driven predominantly by tightening regulatory landscapes and escalating awareness regarding life safety and asset preservation across commercial, industrial, and residential sectors. A significant business trend involves the integration of IoT and smart monitoring capabilities into traditional sprinkler infrastructure, transforming passive systems into proactive, networked safety platforms capable of real-time diagnostics and remote maintenance checks. This shift towards smart fire safety solutions enhances reliability and reduces lifecycle maintenance costs, attracting higher investment from facility managers and property developers focused on maximizing operational efficiency. Furthermore, the market is witnessing increased consolidation among key players, driven by the need to offer comprehensive, integrated fire safety portfolios encompassing detection, suppression, and emergency response solutions to meet complex modern building codes.

From a regional perspective, the Asia Pacific (APAC) market is projected to exhibit the highest growth trajectory, primarily fueled by massive infrastructure development, rapid industrialization, and government initiatives aimed at upgrading public safety standards, particularly in densely populated countries such as China and India. North America and Europe, while being mature markets, maintain substantial market shares due to strict adherence to historical building codes and robust retrofitting activities in existing structures, alongside a continuous demand for sophisticated, specialized systems tailored for unique environments like data centers and healthcare facilities. Regional regulatory divergence, particularly regarding mandatory installation thresholds and testing frequency, influences procurement cycles and system specifications, creating unique competitive dynamics that require localized strategic approaches from vendors. The Middle East and Africa (MEA) region also presents emerging opportunities tied to major construction booms associated with economic diversification initiatives.

Segment trends indicate a sustained dominance of the wet pipe sprinkler segment globally due to its simplicity, cost-effectiveness, and reliability in non-freezing environments. However, the pre-action and deluge systems segments are experiencing rapid growth, driven by specialized application demands where minimizing potential water damage is paramount, such as high-value storage facilities, archives, and clean manufacturing environments. Technology segmentation highlights a crucial transition towards incorporating addressable sprinkler heads and intelligent valves that allow for granular control and rapid isolation of system failures, minimizing downtime and false alarms. This technological evolution underscores the industry's commitment to enhancing system performance beyond basic fire suppression, aligning fire safety installations with broader smart building infrastructure goals. Additionally, the residential segment, though smaller, is showing accelerated growth supported by residential fire safety mandates in several developed economies.

AI Impact Analysis on Automatic Fire Sprinklers Market

Common user questions regarding AI's impact on the Automatic Fire Sprinklers Market frequently revolve around how artificial intelligence can move fire safety systems beyond simple heat activation to achieve true predictive capabilities. Users are highly interested in understanding how AI-driven analytics can integrate diverse sensor data—including smoke detectors, thermal cameras, air quality monitors, and existing Building Management Systems (BMS)—to assess the probability and location of a fire event before it progresses, minimizing the time between ignition and response. Key concerns often center on data privacy, the cost-effectiveness of implementing complex AI algorithms into traditionally hardware-focused systems, and regulatory approval for AI-guided suppression actions. Users also question AI's role in system maintenance, specifically seeking solutions for automated fault diagnosis, component lifespan prediction, and optimizing testing schedules, which currently require labor-intensive manual processes. The consensus expectation is that AI will significantly enhance system reliability and reduce operational overhead.

The adoption of AI is fundamentally transforming the maintenance and monitoring aspects of fire sprinkler systems. AI algorithms can process continuous streams of data related to water pressure fluctuations, valve status, pipe corrosion rates, and ambient temperature shifts to develop accurate predictive maintenance schedules. This predictive capability allows facility managers to address minor issues, such as small leaks or compromised fittings, well before they lead to system failure during a critical event, thereby ensuring maximal system uptime and compliance readiness. Furthermore, AI models are being trained using vast datasets of historical fire events and building characteristics to refine sensitivity settings and deployment strategies for specialized sprinkler systems, such as optimizing water droplet size and discharge pattern based on anticipated fire load.

In the near future, AI integration will facilitate highly sophisticated fire risk mapping within complex facilities. By continuously analyzing occupancy changes, storage configurations, HVAC operation, and external weather data, AI can dynamically adjust the risk profile of different zones within a building. This dynamic risk assessment informs proactive measures, such as adjusting environmental controls or alerting security personnel, and, potentially, in advanced pre-action systems, preparing specific water lines for activation with higher precision than traditional systems. This level of intelligent operation moves the market from reactive suppression to advanced predictive safety management, fundamentally changing how fire safety systems are procured, installed, and utilized in high-risk environments, ultimately delivering superior protection and long-term cost savings through reduced false activations and improved efficiency.

- AI enables predictive maintenance by analyzing sensor data for component degradation (e.g., pressure loss, valve status).

- Integration of AI with BMS facilitates dynamic risk assessment and optimized resource deployment during emergencies.

- Machine learning algorithms enhance the reliability of specialized systems (e.g., gas suppression coupled with water mist) by reducing false alarms.

- AI assists in optimizing the strategic placement and calibration of new sprinkler head installations based on building geometry and occupancy modeling.

- Automated reporting and regulatory compliance checks are simplified using AI-driven data logging and trend analysis.

DRO & Impact Forces Of Automatic Fire Sprinklers Market

The Automatic Fire Sprinklers Market is significantly influenced by a powerful combination of mandatory legislative drivers, structural restraints inherent in retrofitting older infrastructure, and substantial technological opportunities focused on smart integration and performance enhancement. The primary driver is the pervasive and continually evolving legislative mandate globally, demanding fire safety compliance in commercial, institutional, and increasingly, multi-family residential buildings. Restraints often center on the high initial installation cost, particularly the disruption and complexity associated with retrofitting operational buildings, and the regional lack of standardized installation practices or skilled labor, which can slow adoption rates in emerging economies. Opportunities are abundant in the realm of digitization, where integrating IoT devices, cloud-based monitoring, and advanced materials science allows for the development of highly efficient, corrosion-resistant, and aesthetically integrated sprinkler systems that address previous installation objections, such as visual intrusion.

Impact forces within the market are exerted by several factors, including the intensifying competition among established global manufacturers and specialized regional players, which drives continuous price optimization and product diversification, such as specialized nozzles for unique fire types (e.g., lithium-ion batteries). Insurance industry mandates also exert considerable influence; insurance carriers frequently offer substantial premium reductions or require specific NFPA-compliant systems for coverage, making installation economically compelling even when not strictly mandated by local building codes. Furthermore, the rising sophistication of end-user demands, particularly in high-value sectors like healthcare, aerospace, and data centers, pushes manufacturers towards continuous investment in R&D to deliver customized, highly reliable suppression solutions, such as hybrid water mist and inert gas systems that minimize secondary damage while maximizing fire control. These forces ensure that technological innovation remains a central determinant of market success and competitive differentiation.

The regulatory environment acts as a stable foundational driver, creating a guaranteed baseline demand, while technological advancements serve as the primary engine for future growth and margin expansion. Overcoming the initial cost restraint often involves lifecycle cost analysis, where the long-term benefits of reduced damage, minimized business interruption, and insurance savings outweigh the upfront investment, a message effectively leveraged by market leaders. The development of wireless sensors and flexible piping materials is also working to mitigate the complexity and expense associated with traditional installation methods, particularly in retrofitting projects, expanding the addressable market considerably. Consequently, market participants are strategically focusing on developing integrated service models—offering system design, installation, maintenance, and long-term monitoring—to capture greater value across the entire product lifecycle and solidify customer loyalty.

Segmentation Analysis

The Automatic Fire Sprinklers Market is comprehensively segmented based on System Type, Component, Application, and Activation Technology, providing a granular view of diverse end-user requirements and technological preferences. The System Type segmentation distinguishes between fundamental installation methodologies, such as Wet Pipe, Dry Pipe, Pre-action, and Deluge systems, each tailored to specific environmental conditions (e.g., temperature stability) and risk tolerance levels (e.g., sensitivity to accidental discharge). The Component segmentation focuses on the key hardware elements required for system operation, including Sprinkler Heads (further categorized by orientation and response type), Valves, Piping, Fittings, and Fire Pumps. These segmentations are critical for manufacturers to tailor their production lines and for distributors to manage inventory efficiently across varied project specifications, while also serving as foundational elements for regulatory compliance assessment and system performance rating.

Application analysis provides crucial insights into demand drivers by dividing the market into Commercial (offices, retail, hospitality), Industrial (manufacturing, logistics, chemical), Residential (single-family and multi-family units), and Institutional (schools, hospitals, government buildings) sectors. Commercial and Industrial applications typically require complex, high-pressure systems, often leveraging specialized suppression agents, whereas residential demand, increasingly driven by local mandates, tends to favor simpler, fast-response systems designed for aesthetics and rapid human evacuation. The Activation Technology segment examines the mechanism used to trigger water release, distinguishing between Fusible Link, Frangible Bulb (Glass Bulb), and specialized technologies like chemically-activated or electrically-activated heads used in high-tech pre-action systems. Understanding the interplay between these segments is vital for strategic market positioning, allowing companies to focus their resources on high-growth areas such as industrial warehousing and institutional healthcare facilities where compliance requirements are strictest and asset value protection is paramount.

The ongoing trend towards smart buildings is introducing sub-segments focused on digital integration, such as IoT-enabled sprinkler components and addressable valves that allow facility managers to monitor system health remotely and execute localized testing without shutting down the entire system. Furthermore, geographical segmentation remains critical, as building codes dictate the required flow rates, density, and type of system used, profoundly affecting the regional mix of system types sold. For example, countries with severe winter climates naturally have a higher demand for dry pipe or antifreeze systems, whereas dense urban centers necessitate robust, high-capacity pumps. Analyzing these segmentations allows stakeholders to identify niche opportunities, such as the growing demand for specialized corrosion-resistant components in facilities dealing with hazardous materials or the miniaturization of components for historical building retrofitting.

- System Type: Wet Pipe, Dry Pipe, Pre-action, Deluge, Water Mist

- Component: Sprinkler Heads (Standard Response, Quick Response, Early Suppression Fast Response), Valves (Control Valves, Alarm Valves, Check Valves), Fittings and Hangers, Pipes, Fire Pumps.

- Application: Commercial (Office Space, Retail, Hospitality), Industrial (Manufacturing, Warehousing, Oil & Gas), Residential (Single-Family, Multi-Family), Institutional (Healthcare, Educational, Government).

- End-User: Contractors, Distributors, Facility Managers, Developers.

Value Chain Analysis For Automatic Fire Sprinklers Market

The value chain for the Automatic Fire Sprinklers Market commences with the upstream supply of fundamental raw materials, primarily steel (for piping and fittings), copper (for specialized components and fittings), and various specialized polymers and glass required for sprinkler head elements (frangible bulbs and seals). This initial stage is heavily influenced by global commodity price fluctuations and sourcing stability. Manufacturers then undertake the critical process of fabrication, assembly, and quality testing, involving complex processes such as specialized casting, welding, and precise machining of components, ensuring strict adherence to international safety standards like UL (Underwriters Laboratories) and FM (Factory Mutual). Efficiency at this manufacturing stage, particularly concerning modularization and component standardization, is crucial for maintaining competitive pricing and scalability. Companies often specialize, with some focusing solely on high-precision sprinkler heads while others concentrate on large-scale piping and valve assembly.

The midstream of the value chain is dominated by distribution channels, which act as the bridge between manufacturers and the downstream installation process. Distribution involves a mix of direct sales to large, specialized installation contractors and indirect channels through large industrial supply houses, wholesale plumbing distributors, and specialized fire protection dealers. Direct distribution is often preferred for large, complex commercial or industrial projects where engineering consultation is required, whereas indirect channels serve smaller contractors and residential installers. Effective inventory management and localized stock availability are paramount in this stage, as project timelines are frequently stringent, requiring immediate access to diverse component sizes and types. Successful distributors often provide value-added services such as system configuration support and logistics management, mitigating supply chain risks for contractors.

The downstream segment encompasses professional installation, system commissioning, and crucial long-term maintenance services, which are largely handled by specialized fire protection contractors and certified engineering firms. End-users, who are the final consumers (building owners, facility managers), interact primarily with these contractors for system lifecycle management. The maintenance phase is a significant revenue generator, involving periodic testing, inspection, and repair mandated by regulatory bodies to ensure system readiness. Direct interaction often occurs between key manufacturers and large institutional end-users who require dedicated service contracts for complex systems, fostering long-term relationships. This high reliance on specialized, certified labor for both installation and maintenance differentiates the fire sprinkler market from many other building component sectors, requiring manufacturers to invest heavily in training and certification programs for their partners to maintain high standards and control product reputation.

Automatic Fire Sprinklers Market Potential Customers

The primary potential customers for automatic fire sprinkler systems fall into three broad categories: Commercial and Residential Real Estate Developers, Facility Management and Operations Groups, and specialized Industrial and Institutional End-Users. Real estate developers constitute a major initial purchasing group, as they integrate these systems into new construction projects to meet mandatory building codes and enhance the property's marketability and compliance status. For multi-family residential units and high-rise commercial towers, developers prioritize systems that offer high reliability, minimal maintenance, and the highest level of regulatory compliance, often selecting quick-response wet pipe or pre-action systems depending on the building's usage profile. The decision process for developers is heavily influenced by total installed cost versus long-term insurance and safety benefits, necessitating detailed lifecycle cost presentations from suppliers.

Facility Management and Operations Groups represent a continuous stream of aftermarket and maintenance revenue. These customers are responsible for ensuring the ongoing operability and regulatory compliance of installed fire safety infrastructure in existing buildings. Their focus shifts from initial installation cost to system reliability, ease of inspection, and the total cost of ownership (TCO) over the system’s lifespan. They are the target audience for modern solutions incorporating IoT and remote monitoring capabilities, which streamline mandatory inspection and testing procedures, reducing labor costs and improving diagnostic accuracy. Facility managers actively seek long-term service contracts that guarantee system performance and rapid response in the event of failure or necessary regulatory upgrades, driving demand for technologically advanced maintenance solutions.

Specialized Industrial and Institutional End-Users, including data centers, hospitals, chemical plants, pharmaceutical manufacturers, and large logistics warehouses, represent high-value customers with unique and demanding requirements. These entities often require specialized suppression technologies—such as water mist, clean agents, or foam systems—to protect high-value assets or critical operational continuity, where standard wet pipe systems might cause unacceptable collateral damage. For example, data centers require inert gas or pre-action systems to avoid damage to sensitive electronics, while chemical plants demand systems capable of handling flammable liquids. Purchasing decisions in this segment are dominated by engineering specifications, regulatory enforcement, and the paramount need for zero downtime, making system redundancy and specialized certification key differentiating factors for potential suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $18.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Controls, Viking Group Inc., Minimax GmbH & Co. KG, Tyco International PLC (now part of Johnson Controls), Reliable Automatic Sprinkler Co., Inc., Senju Sprinkler Co., Ltd., HD Fire Protect Pvt. Ltd., Fike Corporation, Siemens AG, Gielle Group, Victaulic, Wormald International, Cosco Fire Protection, VFP Fire Systems, Fire Suppression Systems, Inc., United Technologies Corporation, Grundfos, Cla-Val, NAFFCO, Kidde-Fenwal. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Fire Sprinklers Market Key Technology Landscape

The technology landscape of the Automatic Fire Sprinklers Market is undergoing a rapid evolution, moving beyond purely mechanical systems towards integrated, intelligent fire protection networks. A core technological shift involves the widespread adoption of IoT sensors and networked components. These smart components, including addressable flow sensors, smart valves, and pressure monitoring devices, enable real-time health checks of the entire system, allowing facility managers to remotely identify potential failures such as pressure drops or corrosive buildup before system integrity is compromised. This transition is crucial for ensuring compliance with mandated inspection schedules while significantly reducing the operational expenditures associated with manual quarterly or annual testing, a major pain point for large facility owners. Furthermore, these networked systems facilitate centralized data collection, providing valuable analytics for optimizing system performance and predictive maintenance strategies, enhancing overall reliability and uptime.

Another significant area of innovation is in the development of highly specialized sprinkler heads and suppression agents tailored for unique modern risks, such as high-piled storage warehouses and facilities housing large banks of lithium-ion batteries. Early Suppression Fast Response (ESFR) sprinkler technology, which allows for the elimination of in-rack sprinklers in many high-bay warehouse applications, continues to evolve, increasing storage density capabilities while maintaining superior fire control. Concurrently, the rise of water mist systems represents a key technological advancement, utilizing significantly less water than traditional sprinklers but generating fine droplets that rapidly cool and suppress fires while minimizing water damage. This technology is particularly favored in high-value, sensitive environments like museums, telecom facilities, and cruise ships where water damage prevention is as critical as fire suppression effectiveness. Advances in materials science are also producing non-metallic piping and corrosion-resistant coatings, extending the lifespan of systems in challenging industrial environments.

Finally, the integration of Building Information Modeling (BIM) and advanced simulation software is revolutionizing the design and installation phase of fire sprinkler projects. BIM allows engineers to create highly accurate 3D models of the sprinkler system, facilitating precise coordination with other building systems (HVAC, electrical) and dramatically reducing installation errors and conflicts on-site. Simulation software uses Computational Fluid Dynamics (CFD) to model fire dynamics and smoke migration, ensuring optimal sprinkler head placement and flow density according to NFPA standards and localized regulations, often exceeding the capabilities of traditional hydraulic calculation methods. This technological integration enhances system efficiency, shortens project timelines, and ensures higher levels of compliance and performance from the outset, appealing directly to large construction firms and engineering consultants focused on lean construction methodologies and risk mitigation across complex, large-scale developments.

Regional Highlights

- North America: This region holds a significant market share, driven by mature regulatory frameworks (NFPA standards) and a high rate of commercial and institutional retrofitting. The U.S. and Canada emphasize technological adoption, particularly in smart building integration and sophisticated hazard protection systems required by the robust industrial and data center sectors. Insurance industry requirements exert a strong influence, often necessitating premium-grade systems.

- Europe: The European market is characterized by diverse national standards but is unified by EU directives focused on sustainable and safe building practices. Germany and the UK lead in market adoption, with a strong focus on water efficiency, leading to higher penetration of water mist and hybrid suppression systems. Strict historical building preservation mandates drive innovation in discreet and non-intrusive sprinkler component designs.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by rapid urbanization, massive infrastructure spending, and escalating safety awareness in emerging economies like China, India, and Southeast Asian nations. Government mandates enforcing sprinkler systems in residential high-rises and new factory constructions are major catalysts. The region presents significant opportunities for standardized, high-volume manufacturing and installation services.

- Latin America (LATAM): Market growth in LATAM is more sporadic but steady, tied primarily to large-scale commercial development and industrial expansion, particularly in Brazil and Mexico. Adoption is heavily influenced by international investment which brings higher safety standards, though challenges remain related to economic instability and inconsistent enforcement of building codes.

- Middle East and Africa (MEA): Growth in MEA is dominated by major construction projects in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar). These regions prioritize state-of-the-art safety technologies in iconic, large-scale projects (e.g., world expo sites, smart cities), leading to high demand for advanced, integrated fire suppression systems designed for harsh climatic conditions, including extreme heat.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Fire Sprinklers Market.- Johnson Controls

- Viking Group Inc.

- Minimax GmbH & Co. KG

- Tyco International PLC (now part of Johnson Controls)

- Reliable Automatic Sprinkler Co., Inc.

- Senju Sprinkler Co., Ltd.

- HD Fire Protect Pvt. Ltd.

- Fike Corporation

- Siemens AG

- Gielle Group

- Victaulic

- Wormald International

- Cosco Fire Protection

- VFP Fire Systems

- Fire Suppression Systems, Inc.

- United Technologies Corporation

- Grundfos

- Cla-Val

- NAFFCO

- Kidde-Fenwal

Frequently Asked Questions

Analyze common user questions about the Automatic Fire Sprinklers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key benefits of installing automatic fire sprinklers beyond basic fire suppression?

The primary benefits extend beyond suppression to include immediate asset protection, minimizing business interruption, ensuring regulatory compliance, and significantly reducing insurance premiums due to demonstrably lower risk profiles. Quick activation limits fire spread and smoke damage.

How do smart sprinkler systems enhance traditional fire protection efficiency?

Smart systems incorporate IoT sensors and remote monitoring capabilities that enable real-time system diagnostics, predictive maintenance scheduling, automated compliance reporting, and the rapid, precise identification of component faults, minimizing false alarms and improving system reliability.

Which type of automatic fire sprinkler system is most suitable for buildings prone to freezing temperatures?

Dry Pipe sprinkler systems are the most suitable solution for unheated environments or areas prone to freezing, such as loading docks or refrigerated storage facilities. These systems utilize compressed air or nitrogen in the piping, releasing water only after a sprinkler head activates.

What is the main driver behind the rapid market growth in the Asia Pacific region?

Rapid market growth in APAC is primarily driven by accelerating urbanization, massive governmental infrastructure investments, and the implementation of increasingly stringent, mandatory national building codes that require fire suppression systems in new commercial, industrial, and high-density residential developments.

Are fire sprinkler systems required in residential buildings, and how does this affect market trends?

While requirements vary regionally, there is a growing trend, especially in North America and Europe, to mandate sprinkler installation in new multi-family dwellings and sometimes in large single-family homes. This mandate significantly expands the market size and drives innovation in less intrusive, more aesthetically pleasing residential sprinkler head designs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager