Automatic Fluorescence Microscopy Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442345 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Automatic Fluorescence Microscopy Market Size

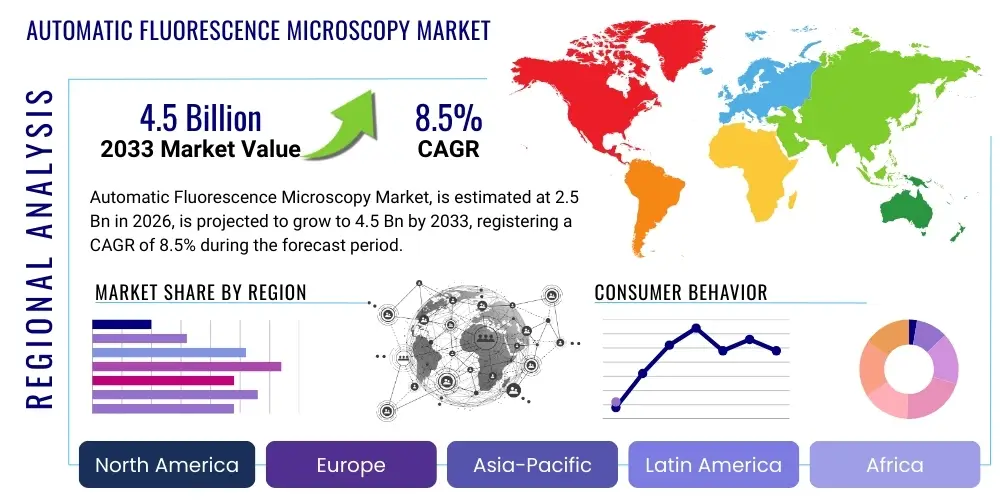

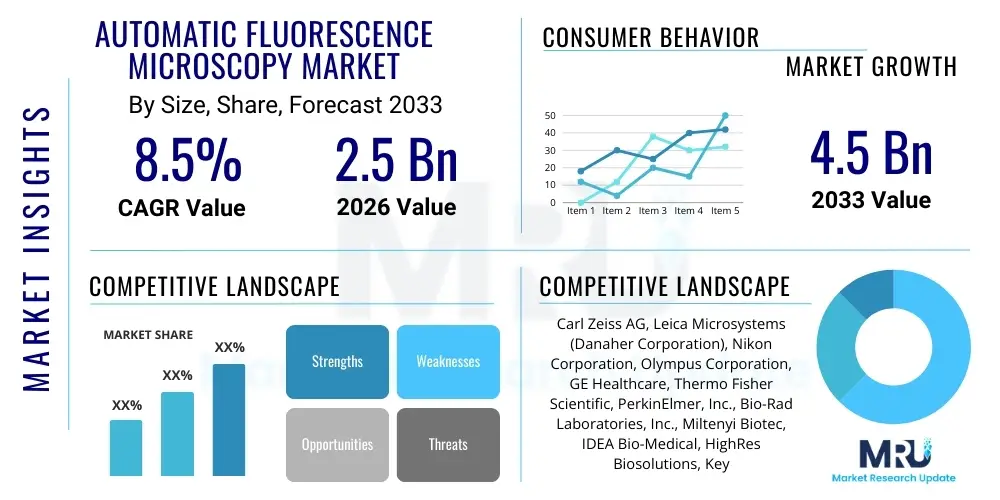

The Automatic Fluorescence Microscopy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033.

Automatic Fluorescence Microscopy Market introduction

The Automatic Fluorescence Microscopy Market encompasses highly sophisticated imaging systems designed for high-throughput, automated, and unbiased visualization of biological samples labeled with fluorophores. These systems integrate advanced features such as robotic stage movement, auto-focusing mechanisms, motorized filter wheels, and sophisticated software for image acquisition and analysis, significantly reducing manual intervention and increasing experimental reproducibility. The core product offering includes automated upright and inverted microscopes, often incorporating confocal, spinning disk, or structured illumination technologies to enhance image quality and speed. Major applications span critical areas of life science research, pharmaceutical development, and clinical diagnostics, enabling detailed cellular and subcellular analysis at scale, crucial for modern drug discovery pipelines and academic investigations into complex biological pathways.

The primary benefit of adopting automatic fluorescence microscopy lies in its capacity for high-content screening (HCS), allowing researchers to simultaneously measure multiple parameters within individual cells or tissues. This capability accelerates the screening of drug candidates, aids in phenotypic analysis, and supports large-scale genomic studies. The inherent automation capabilities address the burgeoning demand for processing vast numbers of samples quickly and accurately, thereby improving laboratory efficiency and minimizing human error associated with traditional manual microscopy techniques. Furthermore, these systems are pivotal in fields requiring quantitative data extraction from complex images, such as toxicological assessments, infectious disease research, and neuroscience studies, where subtle cellular changes need precise and objective quantification.

Key driving factors propelling market expansion include the exponential growth in global biotechnology and pharmaceutical R&D expenditures, particularly in emerging therapeutic areas like personalized medicine and cell therapy. The shift from qualitative observation to quantitative data analysis in biological research necessitates the adoption of automated, high-resolution imaging tools. Government and private sector investments in infrastructure for advanced life science research, coupled with continuous technological advancements leading to faster acquisition speeds, improved sensitivity, and enhanced integration with artificial intelligence (AI) for image processing, are further cementing the market's growth trajectory. The critical need for precise diagnostic tools in oncology and pathology also stimulates demand for automated fluorescence systems capable of digital slide scanning and rapid analysis.

Automatic Fluorescence Microscopy Market Executive Summary

The Automatic Fluorescence Microscopy Market is undergoing a rapid transformation, driven primarily by technological convergence, where robotics, advanced optics, and sophisticated computational analysis intersect to create high-efficiency research platforms. Current business trends indicate a strong move toward systems that offer modularity and scalability, allowing end-users to upgrade components—such as objectives, cameras, and software modules—to meet evolving research needs without replacing the entire system. Strategic mergers and acquisitions among key market players are focused on consolidating expertise in imaging, automation, and software development, aiming to offer integrated, end-to-end solutions that cover sample preparation, acquisition, and data interpretation. Furthermore, the increasing adoption of cloud-based data storage and analysis solutions tailored for microscopy data is a pivotal business trend, facilitating collaboration across geographically dispersed research teams and streamlining large dataset management.

Regionally, North America maintains its dominance due to substantial R&D investments, the presence of major pharmaceutical and biotechnology companies, and robust academic research infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This rapid expansion in APAC is fueled by governmental initiatives supporting the establishment of world-class life science research centers, increasing outsourcing of drug discovery activities to countries like China and India, and rising healthcare expenditure. European markets continue steady growth, supported by strong regulatory frameworks and established biotech clusters focusing heavily on precision medicine and advanced biological studies. Emerging markets in Latin America and the Middle East and Africa (MEA) are also showing promising potential, driven by infrastructure improvements in clinical diagnostics and academic institutions receiving increased public and private funding for biomedical research.

Segment trends highlight the growing preference for high-content screening systems within the application segment, driven by the need for phenotypic screening in drug development. In terms of product type, high-resolution automated inverted microscopes are seeing significant demand, especially in live-cell imaging and cell culture analysis, owing to their stability and suitability for complex cell models. The end-user segment is dominated by pharmaceutical and biotechnology companies, which utilize these systems extensively for compound screening and toxicity testing. However, contract research organizations (CROs) are emerging as a fast-growing segment, benefiting from the outsourcing trend as smaller biotech firms and large pharma seek specialized expertise and automated infrastructure to expedite their pipelines without massive upfront capital investment in proprietary equipment.

AI Impact Analysis on Automatic Fluorescence Microscopy Market

User interest regarding the impact of Artificial Intelligence (AI) on the Automatic Fluorescence Microscopy Market primarily centers on enhanced automation, improved image interpretation speed, and the ability to extract previously undetectable insights from complex biological data. Common inquiries revolve around how deep learning algorithms can overcome challenges inherent in microscopy, such as reducing noise and artifacts (denoising), segmenting overlapping cells or subtle structures accurately, and automatically classifying complex phenotypes in high-throughput screens. Users are keen to understand the potential of AI to revolutionize quantitative pathology and accelerate drug discovery by automating time-consuming tasks like feature extraction and image quality control, which currently require extensive manual calibration and expert validation, thereby generating consistent, objective, and high-quality results.

The core expectation from AI integration is not merely automation of the microscope hardware itself—which is already advanced—but rather the complete cognitive automation of image analysis and data generation. Researchers are specifically interested in deep learning models trained on vast microscopy datasets that can identify subtle biomarkers indicative of disease states or drug responses, moving beyond simple intensity measurements. Concerns often include the robustness and generalizability of these AI models across different experimental conditions, the necessity of large, high-quality, annotated training datasets, and the ethical implications concerning data privacy and algorithmic bias in clinical applications. Addressing these concerns through standardized data formats and explainable AI (XAI) is critical for broader acceptance and clinical implementation.

Ultimately, AI integration is transforming the automatic fluorescence microscope from a mere data acquisition tool into an intelligent data generation platform. By facilitating instantaneous, high-dimensional analysis at the point of acquisition, AI minimizes data bottlenecks and maximizes the translational utility of microscopy data. This convergence is driving the next generation of smart microscopes capable of adaptive imaging—where the system dynamically adjusts acquisition parameters (like illumination intensity or exposure time) based on real-time analysis of the image content, thus optimizing data quality and reducing phototoxicity in sensitive live-cell experiments, ensuring greater experimental success and data fidelity.

- AI-driven image processing enhances denoising and contrast restoration, improving signal-to-noise ratio in low-light conditions.

- Deep learning models enable precise, rapid, and automated segmentation of cellular structures and complex tissue morphology, essential for quantitative analysis.

- AI facilitates high-content image analysis (HCA) by automatically classifying subtle phenotypes and identifying statistically relevant patterns in massive screening datasets.

- Predictive algorithms optimize automated workflow scheduling, stage movement, and focus adjustments, significantly reducing total experiment time.

- Integration of machine vision supports real-time quality control and error detection during image acquisition, minimizing experimental waste.

- AI aids in label-free imaging modalities by predicting fluorescent stains from brightfield images, reducing costs and sample perturbation.

- Improved data interpretation speed accelerates preclinical toxicology assessment and drug efficacy testing by providing instantaneous feedback on cellular responses.

DRO & Impact Forces Of Automatic Fluorescence Microscopy Market

The Automatic Fluorescence Microscopy Market is powerfully influenced by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and structural Impact Forces. A significant Driver is the increasing prevalence of chronic diseases globally, particularly cancer and neurological disorders, which mandates intense research efforts requiring high-resolution, high-throughput cellular analysis for pathogenesis understanding and therapeutic target validation. Additionally, the continuous technological leap toward improved optics, more sensitive detectors, and faster data processing hardware contributes substantially to market momentum, making automated systems indispensable for competitive research. The growing trend of adopting digital pathology, especially in developed economies, where whole-slide imaging using fluorescence is replacing traditional glass slides, further accelerates market growth by expanding the addressable market beyond core research labs into clinical settings.

Despite these strong drivers, the market faces significant Restraints, primarily centered on the high initial capital investment required for purchasing and installing these advanced systems. Automatic fluorescence microscopes, particularly those with super-resolution or high-content screening capabilities, represent a major financial commitment, making adoption challenging for smaller academic laboratories or emerging biotech startups. Furthermore, the complexity associated with operating, maintaining, and developing protocols for these highly sophisticated instruments necessitates specialized technical expertise, leading to a shortage of trained personnel in many regions. Data management complexity, specifically handling the enormous volumes of image data generated by high-throughput systems, poses another formidable technical and logistical restraint that requires robust and costly IT infrastructure solutions.

Conversely, vast Opportunities exist, particularly in integrating these systems with novel technologies such as Organ-on-a-Chip platforms and 3D cell culture models, which are gaining traction in drug testing and disease modeling. These complex biological systems require automated, non-invasive imaging over extended periods, perfectly matching the capabilities of automatic fluorescence microscopy for longitudinal studies. Furthermore, the increasing focus on personalized medicine and single-cell analysis presents a lucrative avenue for vendors to develop targeted, ultra-sensitive systems capable of analyzing individual cells in heterogeneous populations. The COVID-19 pandemic also highlighted the critical need for rapid, automated viral detection and therapeutic screening, opening new opportunities for deployment in infectious disease surveillance and rapid response laboratories. These systems are positioned to become essential tools in high-containment facilities globally.

The primary Impact Forces shaping the competitive landscape are technological innovation and competitive rivalry. The force of technological change is exceptionally high, with continuous advancements in light sources (e.g., LED and laser technologies), camera sensor sensitivity (e.g., sCMOS and EMCCD), and software algorithms dictating market leadership. Competitive rivalry is fierce, characterized by key players continually introducing next-generation platforms that offer higher throughput, better resolution, and seamless integration with analysis software. Regulatory forces, particularly in the clinical diagnostic space (FDA, CE Mark), also exert pressure, ensuring high standards of validation and accuracy for systems used in patient care, which impacts product development cycles and market entry strategies. Economic forces, such as government funding cycles for scientific research and global economic stability, directly influence the purchasing power of primary end-users, thus impacting overall market demand and product pricing strategies in the short to medium term.

Segmentation Analysis

The Automatic Fluorescence Microscopy Market is comprehensively segmented based on product type, application, and end-user, reflecting the diverse requirements across research, clinical, and industrial environments. The product segmentation typically distinguishes between Automated Upright Microscopes, preferred for fixed samples and certain tissue analysis, and Automated Inverted Microscopes, which dominate live-cell imaging and high-content screening due to their stable platform and suitability for viewing cells in culture vessels. A key differentiator within this segment is the underlying technology, separating traditional wide-field systems from more advanced techniques like Confocal, TIRF (Total Internal Reflection Fluorescence), and Super-Resolution Microscopy, with automated features being integrated across all these specialized modalities to enhance throughput and precision. The selection criteria often revolve around required resolution, speed of acquisition, and the complexity of the biological assays being performed, directly influencing the final purchase decision by end-users.

Application segmentation illustrates the primary functional uses of these automated systems, with High-Content Screening (HCS) dominating due to its vital role in early-stage drug discovery, toxicology testing, and phenotype analysis, particularly in cellular assays involving complex biological pathways. Other critical applications include academic research, encompassing cell biology, microbiology, and neuroscience; clinical diagnostics, focusing on rapid tissue scanning and immunohistochemistry analysis; and quality control in industrial biotechnology processes. The growth in the HCS segment is particularly robust, fueled by the pharmaceutical industry’s push for smaller, more efficient compound libraries and the need to quickly identify potential drug candidates with specific cellular effects. The versatility of automated fluorescence systems allows them to adapt easily across these diverse functional areas, making them foundational infrastructure for modern life science facilities globally.

End-user segmentation clarifies the primary purchasing entities. Pharmaceutical and Biotechnology Companies represent the largest consumer base, driven by their extensive requirements for high-throughput screening, drug efficacy studies, and safety profiling, necessitating continuous operation of multiple automated platforms. Academic and Research Institutes constitute the second largest segment, relying on these instruments for fundamental biological discoveries, training, and government-funded projects. The fastest-growing segment, however, includes Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs), which leverage automated systems to offer specialized high-throughput services to the broader life science industry, benefiting from the trend of R&D outsourcing and the economies of scale afforded by automation. These segments exhibit distinct purchasing patterns, with industrial users prioritizing reliability, throughput, and integration capabilities, while academic users often focus on advanced resolution and customization for novel applications.

- By Product Type:

- Automated Upright Fluorescence Microscopes

- Automated Inverted Fluorescence Microscopes

- Automated Confocal Microscopy Systems

- Automated High-Content Screening (HCS) Systems

- Automated Super-Resolution Microscopy Systems

- By Application:

- High-Content Screening & Analysis

- Drug Discovery and Toxicology Testing

- Cell Biology and Genetics Research

- Clinical Diagnostics and Pathology

- Neuroscience and Developmental Biology

- By End User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs)

- Hospitals and Diagnostic Laboratories

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (Japan, China, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Automatic Fluorescence Microscopy Market

The Value Chain for the Automatic Fluorescence Microscopy Market begins with the Upstream Analysis, which focuses heavily on the procurement and manufacturing of highly specialized components critical for system performance. Key upstream elements include sophisticated optical components (high-numerical aperture objectives, specialized filters, and dichroic mirrors), advanced light sources (high-power LEDs, lasers, and arc lamps), high-sensitivity cameras (sCMOS, EMCCD), and precision mechanical components (motorized stages, auto-focus mechanisms). Suppliers in this segment must adhere to extremely stringent quality control standards to ensure the precision and stability required for high-resolution imaging. Competitive advantage at this stage often lies in securing reliable, proprietary supply chains for cutting-edge optics and sensor technology, as these components dictate the fundamental capabilities of the final microscopy platform in terms of speed, resolution, and sensitivity. Effective management of these complex supply relationships ensures cost optimization and component availability, which is vital for maintaining high manufacturing output.

Midstream activities involve the core manufacturing, integration, and assembly of the automated systems, encompassing system design, hardware fabrication, and crucial software development. Original Equipment Manufacturers (OEMs) integrate the high-precision components into robust, automated platforms, ensuring seamless coordination between the hardware (robotics, optics) and the complex control and image analysis software. Software development is a particularly high-value activity, as modern automatic fluorescence microscopes are fundamentally computational tools; the proprietary algorithms for image acquisition, deconvolution, high-content analysis, and data handling define the system's utility and market differentiation. Robust intellectual property protection surrounding software algorithms and specific automation techniques is essential in this phase. The complexity of integration demands significant in-house engineering expertise to ensure reliability and user-friendliness across the diverse application spectrum, positioning midstream players as the primary value creators.

Downstream analysis involves distribution channels, sales, installation, and post-sales support, which are critical for customer satisfaction and market penetration. Distribution typically occurs through a mix of direct and indirect channels. Direct sales are preferred for large, complex installations involving strategic accounts like major pharmaceutical companies and leading academic centers, allowing manufacturers to maintain direct control over pricing, installation, and specialized service contracts. Indirect channels, utilizing authorized distributors and value-added resellers (VARs), are employed to penetrate regional markets, especially in Asia Pacific and emerging economies, where local presence and language proficiency are crucial. Effective post-sales support, including application scientists, maintenance contracts, and continuous software updates, is vital due to the high capital cost and complexity of the equipment. This service component contributes significantly to long-term revenue and customer loyalty, often influencing repeat purchases and brand reputation within the tightly knit scientific community.

Automatic Fluorescence Microscopy Market Potential Customers

The primary consumers and end-users of Automatic Fluorescence Microscopy systems are highly institutional and specialized entities requiring high throughput, quantitative data, and advanced automation for their research and operational needs. Pharmaceutical and Biotechnology Companies stand as the most significant customer segment. These organizations rely heavily on automated systems to accelerate crucial stages of the drug discovery pipeline, including primary and secondary compound screening, identification of novel therapeutic targets, phenotypic screening in complex disease models, and comprehensive toxicology studies. Their demand is driven by the necessity to screen vast chemical libraries efficiently and identify subtle cellular changes indicative of efficacy or toxicity, thereby reducing the time and cost associated with bringing a new drug to market. The financial capability and continuous R&D investment cycles of these major players ensure sustained high demand for the latest, most advanced, and fully automated imaging platforms, focusing on features like multi-well plate compatibility and high-speed data acquisition.

Academic and Research Institutes form another major bloc of potential customers. Universities, governmental research laboratories, and specialized biomedical centers utilize automatic fluorescence microscopy for fundamental biological research across various disciplines, including molecular biology, cell signaling, genetics, and infectious disease modeling. Their procurement is often guided by grant funding and the need for versatility to support diverse research projects and collaborative studies. These customers frequently require high-resolution and advanced imaging modalities (e.g., automated super-resolution and light sheet microscopy) to push the boundaries of scientific discovery. The focus here is less on sheer throughput compared to pharmaceutical users, but more on the precision, flexibility, and the ability of the system to handle unique and complex experimental setups, often driving demand for highly customizable and specialized software solutions for complex image manipulation and analysis.

A rapidly expanding customer base includes Contract Research Organizations (CROs), particularly those specializing in preclinical studies and high-throughput screening services. CROs serve as essential partners for both large pharma seeking to outsource non-core activities and small biotech companies lacking the capital for their own high-end equipment. By purchasing and maintaining sophisticated automated fluorescence microscopy systems, CROs can offer specialized services, standardized assays, and rapid turnaround times, creating a business model centered on efficiency and scale. Furthermore, Clinical Diagnostic Laboratories, particularly those moving into digital pathology and specialized histopathology, are emerging customers. They utilize automated fluorescence systems for rapid quantification of fluorescently labeled tissue samples, especially in oncology and infectious disease diagnosis, where objective, high-speed, and standardized analysis is paramount for accurate patient outcomes and workflow efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss AG, Leica Microsystems (Danaher Corporation), Nikon Corporation, Olympus Corporation, GE Healthcare, Thermo Fisher Scientific, PerkinElmer, Inc., Bio-Rad Laboratories, Inc., Miltenyi Biotec, IDEA Bio-Medical, HighRes Biosolutions, Keyence Corporation, Bruker Corporation, Phasefocus Limited, Hitachi High-Tech Corporation, LBD Life Sciences, Hamamatsu Photonics K.K., MetaSystems, Agilent Technologies, Molecular Devices. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Fluorescence Microscopy Market Key Technology Landscape

The technological landscape of the Automatic Fluorescence Microscopy Market is defined by the integration of cutting-edge optical, mechanical, and computational technologies aimed at enhancing speed, resolution, and automation fidelity. Confocal Microscopy, particularly its automated versions, remains foundational, offering high optical sectioning capability critical for 3D reconstruction and eliminating out-of-focus light in thick samples, crucial for advanced tissue analysis and multicellular spheroid imaging. Technological advancements in automated confocal systems now include resonant scanning mechanisms, which dramatically increase imaging speed, allowing for high-speed live-cell observation without compromising image quality. Furthermore, the adoption of specialized light sources, such as multi-wavelength high-power lasers and tunable light engines, ensures optimal excitation across a broad spectrum of fluorophores, extending the utility of these systems in complex multiplexed assays and high-dimensional analysis, essential for detailed cellular phenotyping in drug screening campaigns.

Super-Resolution Microscopy (SRM) techniques, such as STORM, PALM, and STED, are increasingly being integrated into automated platforms, providing resolution beyond the diffraction limit of light, offering unprecedented detail in subcellular structure analysis. While traditionally challenging to automate due to sensitivity and complexity, modern automated SRM systems incorporate highly stable hardware, adaptive optics, and advanced real-time computational correction algorithms to maintain nano-scale precision across high-throughput scanning protocols. This capability is rapidly expanding the market's reach into fields like virology, membrane dynamics, and detailed protein-protein interaction studies where standard fluorescence resolution is insufficient. The combination of automation with SRM allows for statistically significant analysis of rare cellular events or fine structural changes across numerous samples, thereby transforming highly specialized research techniques into scalable methodologies suitable for industrial applications.

The most significant technological shift involves High-Content Screening (HCS) platforms and the integration of sophisticated software and AI. HCS systems are essentially automated microscopes combined with robotics for sample handling and advanced image informatics for data processing. Key technological features include fast, piezo-driven auto-focusing for rapid plate reading, motorized XYZ stages offering sub-micron precision for accurate position recall, and highly optimized fluidics handling for long-term live-cell kinetic assays. The software infrastructure is paramount, featuring advanced machine learning and deep learning modules that manage massive image files, perform automated feature extraction, and classify complex phenotypic responses without human intervention. This computational technology landscape, underpinned by cloud connectivity for data storage and analysis, fundamentally transforms the automatic fluorescence microscope into a powerful, automated decision-making tool, driving efficiency and objectivity across preclinical research and diagnostics.

Regional Highlights

-

North America: This region maintains the largest market share, predominantly driven by the United States, which benefits from the highest concentration of leading pharmaceutical and biotechnology companies globally, coupled with massive government and private funding directed towards advanced biomedical research. The rapid adoption of high-content screening systems for personalized medicine research, oncology drug discovery, and neuroscience studies fuels demand. The robust technological infrastructure and the early integration of AI-driven image analysis software ensure that North America remains at the forefront of automated microscopy innovation and adoption. High healthcare expenditure and strong competitive pressure among research institutions further solidify market dominance, necessitating continuous investment in the latest automated imaging technologies to maintain research superiority and attract top talent.

The U.S. market is characterized by stringent quality standards and a high demand for validation and throughput, particularly from large CROs and pharmaceutical giants based in key biotech hubs such as Boston, San Francisco, and San Diego. Innovation is frequently led by strong collaboration between instrument manufacturers and leading academic institutions, resulting in specialized automated platforms tailored for niche applications like advanced live-cell imaging and whole-organoid analysis. Canada also contributes significantly, supported by federal investment in science and technology infrastructure, though its market size is smaller compared to the U.S. The regional growth is sustained by continuous product replacement cycles and the increasing complexity of biological assays, demanding ever-higher levels of automation and resolution.

Investment trends in North America favor modular and integrated systems that can handle both traditional 2D cell cultures and complex 3D models (spheroids, organoids). The focus on digital pathology and clinical research also drives the uptake of automated slide scanning and analysis platforms, bridging the gap between basic research and clinical application. Key market drivers include the prevalence of chronic diseases and the resulting emphasis on complex drug testing, alongside the general trend of automation to reduce labor costs and increase the statistical validity of large biological datasets, making automated fluorescence microscopy a standard tool across high-tier facilities.

-

Europe: Europe represents a mature and technologically advanced market, holding the second-largest share, with significant contributions from Germany, the UK, France, and Switzerland. Market expansion is supported by substantial EU funding for collaborative research projects (e.g., Horizon Europe), strong public healthcare systems that promote advanced diagnostics, and the presence of globally recognized microscopy manufacturers and specialized biotech clusters. Countries like Germany are major production and innovation hubs for high-precision optical instruments, ensuring a continuous supply of cutting-edge automated fluorescence systems. The focus within Europe often lies in integrating automation into molecular diagnostics and precision medicine workflows, particularly in specialized oncology centers and centralized hospital laboratories seeking high operational efficiency.

The UK market shows steady demand driven by its strong university research base and active pharmaceutical sector, specializing particularly in advanced cell and gene therapies, which require rigorous, automated quantitative imaging. Regulatory frameworks like the General Data Protection Regulation (GDPR) influence the development of secure, automated data handling solutions for large microscopy datasets used in clinical trials. Adoption rates are high across university core facilities and national research institutes that provide shared access to expensive automated infrastructure. The demand for automated systems capable of super-resolution and functional imaging is robust, reflecting a strong emphasis on fundamental mechanisms of disease and drug action.

Challenges in the European market include varying procurement processes across different national healthcare systems and academic funding cycles. However, the overarching commitment to technological innovation and the push towards standardized, automated imaging protocols across multinational drug trials ensure stable growth. The increasing use of automated platforms in quality control for biomanufacturing processes, particularly in vaccine and cell therapy production, is also emerging as a significant market driver. Overall, European users prioritize high precision, optical quality, and seamless integration with existing laboratory automation systems, making advanced vendor services and customization capabilities highly valued in this region.

-

Asia Pacific (APAC): APAC is forecast to be the fastest-growing regional market, propelled by rapidly increasing government investments in biomedical research, expanding infrastructure development in China and India, and the rising prevalence of contract research and manufacturing activities. China, in particular, is witnessing exponential growth, fueled by ambitious national initiatives aimed at establishing world-class research centers and boosting its domestic pharmaceutical innovation capabilities. This environment encourages the acquisition of high-throughput, automated imaging equipment to handle the scale of local research and clinical trials effectively. Japan and South Korea remain critical contributors, known for early adoption of high-tech instrumentation and strong domestic manufacturing bases for optical components and electron microscopes.

The growth trajectory in India is notable, driven by the expanding generics pharmaceutical industry and the outsourcing of clinical trials, necessitating automation to ensure competitive turnaround times and global data quality standards. Government policies supporting scientific infrastructure modernization and the establishment of new medical schools and biotech parks are instrumental in creating a fertile ground for market penetration. While price sensitivity remains a factor in certain developing APAC countries, the demand for advanced features like AI integration and high-content screening is rapidly increasing, reflecting the convergence of research quality toward global standards, often leading to the preference for standardized international vendor platforms.

The APAC region benefits from a large patient population, driving extensive clinical research and demand for automated diagnostic tools in pathology. The need to screen large cohorts quickly and accurately, particularly for infectious diseases and endemic regional illnesses, favors the adoption of robust, highly automated fluorescence systems. Vendor strategies in APAC often involve establishing strong local service and application support teams to manage complex installations and training requirements, acknowledging the rapid expansion of research capabilities across diverse geographic and economic landscapes within the region, positioning it as the key growth engine for the global market through 2033.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Fluorescence Microscopy Market.- Carl Zeiss AG

- Leica Microsystems (Danaher Corporation)

- Nikon Corporation

- Olympus Corporation

- GE Healthcare

- Thermo Fisher Scientific

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Miltenyi Biotec

- IDEA Bio-Medical

- HighRes Biosolutions

- Keyence Corporation

- Bruker Corporation

- Phasefocus Limited

- Hitachi High-Tech Corporation

- LBD Life Sciences

- Hamamatsu Photonics K.K.

- MetaSystems

- Agilent Technologies

- Molecular Devices

Frequently Asked Questions

Analyze common user questions about the Automatic Fluorescence Microscopy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of automated fluorescence microscopy over manual systems?

The primary advantage lies in significantly enhanced throughput, reproducibility, and objectivity. Automation minimizes human error, allows for the precise, high-speed acquisition of massive datasets (High-Content Screening), and ensures consistent experimental conditions across thousands of samples, which is crucial for drug discovery and quantitative research demanding statistical power.

How is Artificial Intelligence (AI) transforming image analysis in this market?

AI, specifically deep learning, is transforming image analysis by enabling rapid, automated segmentation, denoising, and accurate classification of complex cellular phenotypes, often exceeding human capabilities. This accelerates data interpretation, reduces analysis bottlenecks, and extracts quantitative insights previously inaccessible, moving microscopy from qualitative observation to objective high-dimensional data generation.

Which end-user segment is driving the highest demand for these automated systems?

Pharmaceutical and Biotechnology Companies are driving the highest demand. Their continuous need for high-throughput screening, compound efficacy testing, and toxicology assessment in drug development necessitates large-scale automated platforms to accelerate preclinical pipelines and manage vast sample volumes efficiently.

What technological advancements are crucial for market growth in the coming years?

Crucial technological advancements include the further integration of super-resolution capabilities into automated HCS platforms, the development of faster and more sensitive camera technologies (e.g., sCMOS), and the optimization of computational tools for 3D and live-cell imaging analysis, particularly those leveraging machine learning for real-time adaptive imaging and data quality control.

What is the main restraint impacting the widespread adoption of automatic fluorescence microscopy?

The main restraint is the high initial capital investment required to purchase these sophisticated instruments, including the cost of high-precision optics and integrated robotic components. This high barrier to entry restricts adoption, especially among smaller laboratories and academic institutions with limited operational budgets, although shared facilities and CROs help mitigate this challenge.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager