Automatic Phoropters Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443649 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Automatic Phoropters Market Size

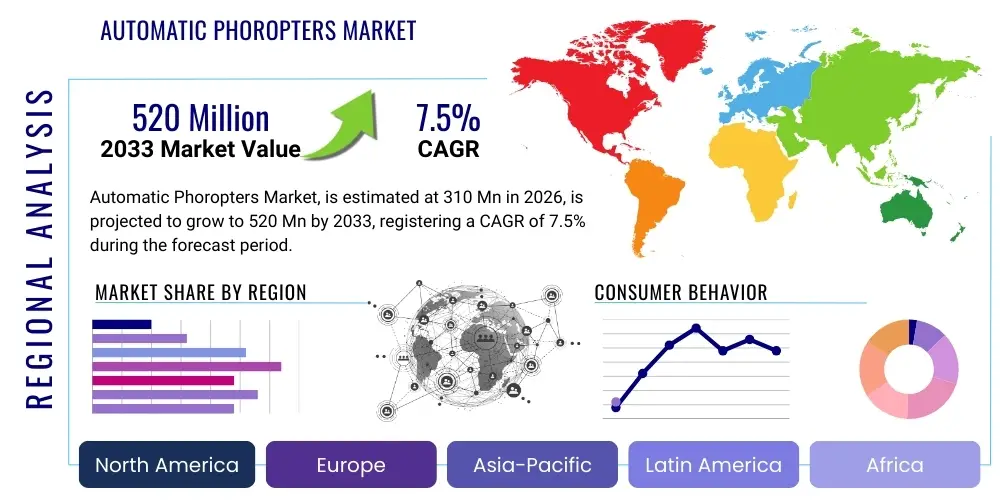

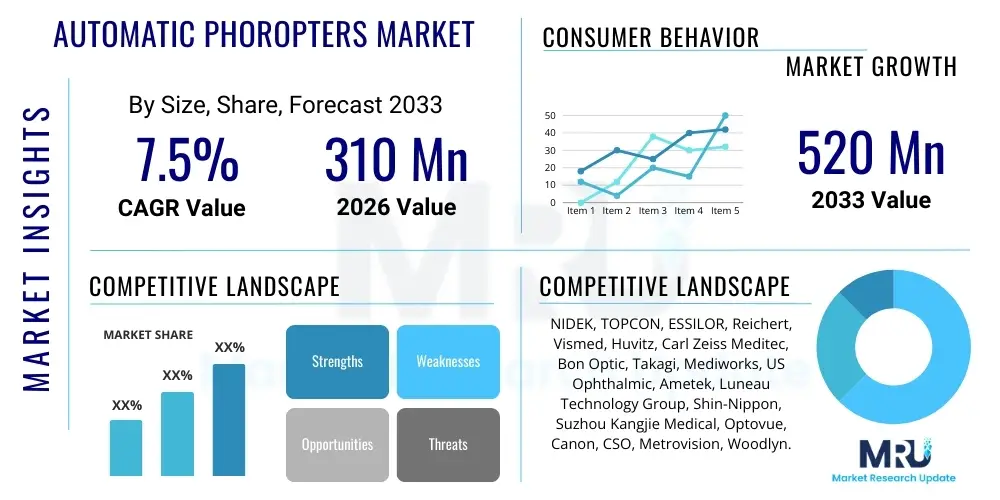

The Automatic Phoropters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. This robust expansion is fueled by the accelerating global demand for accurate and efficient ophthalmic diagnostic equipment, driven primarily by the rising prevalence of refractive errors and aging populations requiring precise vision correction. The adoption of digital workflows in eye care clinics worldwide further cements the market’s positive trajectory, positioning automatic phoropters as essential tools for modern optometric and ophthalmological practices.

The market is estimated at USD 310 Million in 2026 and is projected to reach USD 520 Million by the end of the forecast period in 2033. This significant valuation increase reflects the premium pricing associated with advanced digital models that offer integrated features such as wavefront analysis and seamless electronic medical record (EMR) integration. Investments in automated systems are seen as a critical competitive advantage for healthcare providers seeking to reduce examination time, minimize operator error, and enhance the overall patient experience through objective and highly repeatable measurements.

Geographically, North America and Europe currently dominate the revenue share due to high disposable income, well-established healthcare infrastructure, and early adoption of technologically sophisticated medical devices. However, the Asia Pacific region is expected to exhibit the fastest growth rate during the forecast period, spurred by increasing healthcare expenditure, rapid expansion of eye care clinics in emerging economies like China and India, and governmental initiatives aimed at improving access to vision screening and correction services, thereby creating lucrative opportunities for market penetration.

Automatic Phoropters Market introduction

The Automatic Phoropters Market encompasses the manufacturing, distribution, and utilization of computerized, automated devices designed for measuring refractive errors of the eye and determining the precise lens prescription required for vision correction. These instruments represent a significant technological leap from traditional manual phoropters, offering speed, accuracy, and ease of use, making them indispensable in contemporary optometry and ophthalmology settings. The core product function involves the rapid presentation of various lenses to the patient, with digital controls allowing the practitioner to efficiently refine the prescription parameters, including sphere, cylinder, and axis measurements, often integrated with automatic chart displays and patient communication tools.

Major applications for automatic phoropters span routine vision testing, comprehensive eye examinations, fitting of spectacles and contact lenses, and pre-operative assessments for refractive surgeries. The primary benefits driving their adoption include objective refraction capabilities, reduced examination time (leading to higher patient throughput), enhanced data accuracy, minimized subjectivity during the testing process, and seamless integration of data into digital patient records. These devices significantly improve clinical efficiency and standardize the refraction procedure across different clinicians, ensuring consistent and high-quality patient care outcomes.

Key driving factors accelerating market growth include the escalating global burden of vision impairment and refractive errors, notably myopia and presbyopia, requiring standardized correction methods. Furthermore, technological advancements such as the incorporation of advanced algorithms, wavefront aberrometry, and the development of compact, portable automatic systems are expanding their utility and accessibility. Increased healthcare spending, particularly in developing countries, coupled with a rising emphasis on preventive and diagnostic eye care, are collectively fostering a fertile environment for sustained market expansion throughout the projection period.

Automatic Phoropters Market Executive Summary

The global Automatic Phoropters Market is characterized by robust technological innovation and significant competitive fragmentation, with leading players consistently focusing on developing hybrid systems that merge subjective refinement with objective diagnostic capabilities. Current business trends indicate a strong move towards subscription-based software models and integrated diagnostic suites, allowing clinics to streamline operations and manage patient data more effectively. Furthermore, supply chain resilience remains a key strategic focus, especially given the concentration of sophisticated optics and sensor manufacturing in specific global hubs, necessitating diversified sourcing strategies and robust inventory management to meet growing global demand.

Regionally, the market dynamics are shifting, although established markets in North America and Western Europe maintain dominance in terms of revenue derived from high-end equipment purchases and rapid adoption of the latest technological iterations. However, the Asia Pacific market is emerging as the fastest-growing region, driven by expanding middle classes, increasing access to private healthcare, and aggressive government-led initiatives to address poor vision health. These regional variations dictate differentiated market entry strategies, requiring manufacturers to tailor product features—such as portability and cost-effectiveness—to suit the diverse infrastructural and economic landscapes of emerging economies.

Segment trends highlight the increasing preference for fully digital/automated phoropters over traditional manual counterparts due to enhanced precision and operational efficiency. The Application segment is dominated by specialty eye clinics and high-volume hospital ophthalmology departments, reflecting the high initial investment required for these systems. Technology integration, particularly the incorporation of artificial intelligence for predictive diagnostics and automated refraction sequencing, is the paramount trend shaping future product development, aiming to further reduce human error and optimize the prescriptive process for complex refractive conditions.

AI Impact Analysis on Automatic Phoropters Market

User inquiries regarding the influence of AI on the Automatic Phoropters Market frequently revolve around automation capabilities, diagnostic accuracy enhancement, and the potential displacement of human expertise. Key themes consistently emerging include: "How accurately can AI determine a prescription compared to a human optometrist?", "Will AI-powered phoropters replace the need for subjective patient feedback?", and "What are the cybersecurity implications of connecting advanced AI diagnostic tools to patient data systems?". Users are keenly interested in the extent to which AI can streamline the clinical workflow, offering objective assessments that reduce examination time while maintaining or surpassing current standards of precision, especially in diagnosing complex or subtle refractive errors that might be missed during standard subjective testing protocols.

The introduction of AI algorithms into automatic phoropters marks a transformative shift from simple automation to cognitive assistance in refraction. AI models are being trained on vast datasets of patient refractive profiles to provide predictive initial starting points, optimize the sequence of subjective lens choices, and detect patterns indicative of underlying ocular pathologies that may affect the final prescription. This integration is crucial for enhancing the efficiency of the clinical process, potentially allowing practitioners to manage higher patient volumes while maintaining a high level of personalized care, thereby justifying the higher capital expenditure associated with these advanced, intelligent systems.

Furthermore, AI is expected to revolutionize remote refraction and telehealth services. AI-powered automatic phoropters can facilitate self-guided or minimally supervised refraction testing in remote settings or kiosks, with results instantly analyzed and verified by algorithms before being reviewed by a clinician. While AI significantly boosts objectivity and speed, user expectations regarding the replacement of subjective feedback are tempered by the current understanding that human interaction remains vital for complex cases and ensuring patient comfort and confidence in the final prescription. Therefore, AI's role is evolving primarily as a powerful decision-support tool, not an absolute substitute for the clinician.

- AI integration leads to predictive initial prescription generation, significantly reducing overall examination time.

- Enhanced diagnostic accuracy through algorithmic analysis of wavefront aberrometry data and historical patient records.

- Facilitation of automated objective refraction in remote or telemedicine environments, improving accessibility.

- Optimization of subjective refinement processes by suggesting the most efficient sequence of lens changes.

- Automatic detection and flagging of anomalies or potential pathological indicators during the refraction process.

- Improved data management and EMR integration by automatically classifying and analyzing refractive trends over time.

DRO & Impact Forces Of Automatic Phoropters Market

The Automatic Phoropters Market is influenced by a dynamic interplay of propelling and restricting forces. Drivers primarily include the global rise in age-related vision disorders and the surging prevalence of refractive errors such as myopia and hyperopia, necessitating precise and frequent vision correction. The inherent efficiency and accuracy offered by automated systems, which allow clinics to increase patient throughput, serve as a major incentive for adoption. Conversely, the market faces significant restraints, chiefly the substantial initial investment cost associated with high-end automatic units, making them prohibitive for smaller, independent practices or clinics in emerging markets with constrained budgets. Additionally, the requirement for highly specialized training to operate and maintain these complex digital devices poses a barrier to wider adoption in regions lacking specialized technical ophthalmology staff.

Opportunities for growth are plentiful, centered around the increasing sophistication of telehealth and remote diagnostics. Developing compact, portable, and lower-cost automatic phoropters tailored for mobile clinics and remote vision screening programs presents a substantial market opportunity. The integration of advanced AI and machine learning capabilities not only improves precision but also opens avenues for value-added services, such as personalized vision coaching and early pathology detection, thereby diversifying revenue streams for manufacturers. Furthermore, strategic collaborations between equipment manufacturers and EMR providers are crucial for ensuring seamless clinical integration and data interoperability, which is highly valued by modern healthcare systems.

The collective impact forces suggest a strong positive momentum favoring market expansion. The high demand stemming from demographic shifts (aging populations) and increasing eye care awareness is structurally powerful. While initial cost remains a restraint, the long-term cost-effectiveness derived from reduced examination time and minimized subjective error increasingly outweighs the upfront investment for large clinic chains and hospital systems. The rapid technological advancements are accelerating the replacement cycle of older, manual equipment, ensuring sustained demand for the latest automated models, thus cementing the positive long-term outlook for the automatic phoropters sector globally.

Segmentation Analysis

The Automatic Phoropters Market is comprehensively segmented based on technology, application, and end-user, enabling manufacturers and stakeholders to precisely target their product offerings and strategic investments. Understanding these segments is vital for identifying areas of fastest growth and tailoring marketing strategies. The technology segmentation differentiates between advanced features such as integrated wavefront systems and standard digital refractor heads, reflecting varying levels of sophistication and price points available to clinicians. Application segmentation helps define the primary use-cases, distinguishing between routine check-ups and complex diagnostic procedures requiring higher precision and integration.

The End-User segment is critical, as it dictates purchasing power, volume requirements, and integration needs. Hospitals typically demand high-throughput, fully integrated systems capable of servicing diverse patient demographics, while independent eye care clinics often seek flexible, reliable, and user-friendly devices that offer good value proposition. The market is increasingly witnessing demand from non-traditional settings, such as retail optical chains, which prioritize speed and ease of operation to quickly process customers for spectacle prescriptions.

Future growth within the segmentation structure is heavily biased towards the digital and fully automated categories, driven by the efficiency gains they provide. Furthermore, the increasing establishment of specialty clinics focused purely on refractive surgery or complex pediatric eye care will drive demand for specialized, high-resolution automatic phoropters capable of precise measurement in challenging clinical scenarios. This trend necessitates continuous investment in R&D to maintain product leadership across these specialized sub-segments.

- By Technology Type:

- Wavefront Sensing Phoropters

- Digital Refraction Systems (Standard Automated)

- Integrated System Phoropters (Combining Auto-refractor and Phoropter functionality)

- AI-Powered Phoropters

- By Application:

- Routine Eye Examinations

- Refractive Surgery Pre-Assessment

- Contact Lens Fitting Assessment

- Pediatric Refraction

- By End-User:

- Hospitals

- Specialty Eye Clinics and Ophthalmology Centers

- Optical Retail Stores and Chains

- Ambulatory Surgical Centers (ASCs)

- Academic & Research Institutes

Value Chain Analysis For Automatic Phoropters Market

The value chain for the Automatic Phoropters Market begins with the upstream activities centered on the procurement and manufacturing of highly specialized components, including precision optics (lenses and prisms), advanced digital sensors, sophisticated electromechanical components, and custom software development. This upstream phase requires stringent quality control and high precision engineering due to the critical nature of the device's function in measuring vision. Key players in this stage often specialize in precision instrument manufacturing and source high-quality glass and integrated circuit boards globally, maintaining tight supply relationships with specialized component providers to ensure reliability and performance consistency.

Moving downstream, the value chain encompasses assembly, rigorous testing, certification (FDA, CE marking), and final distribution. Distribution channels are typically complex, involving a mix of direct sales forces (especially for high-volume hospital systems) and specialized third-party medical equipment distributors who provide localized sales support, installation, and ongoing maintenance services. The effectiveness of the indirect distribution channel relies heavily on the distributor’s technical proficiency and regional network penetration, particularly in fragmented markets like Asia Pacific.

The final stage involves end-user interaction, which includes post-sale training, technical support, software updates, and maintenance contracts. Direct engagement with end-users allows manufacturers to gather crucial feedback for product iteration and service improvement. The increasing importance of digital integration means that software and service updates—often delivered indirectly via internet connectivity—are becoming a significant value component, requiring manufacturers to invest heavily in robust cybersecurity protocols and reliable customer support infrastructure to maintain competitive edge and operational integrity for clinical partners.

Automatic Phoropters Market Potential Customers

Potential customers for automatic phoropters are primarily institutions and professionals engaged in primary and specialized eye care delivery. The primary end-users, or buyers, are large, multi-specialty hospitals and dedicated ophthalmology departments that require high-throughput diagnostic tools capable of integration with comprehensive EMR systems. These large institutions often prioritize total cost of ownership (TCO) and advanced technological features, such as integration with wavefront analyzers and network connectivity, making them key targets for premium, high-capacity automatic phoropter models.

Specialty eye clinics and independent optometrists constitute the second major customer segment. While they may require fewer units, their purchasing decisions are heavily influenced by ease of use, reliability, and the ability of the phoropter to enhance patient experience and minimize chair time. For this segment, localized technical support and flexible financing options are often critical factors in the procurement process, favoring mid-range, modular automated systems that offer excellent performance without unnecessary, high-cost features.

A rapidly growing customer base includes large optical retail chains and franchise operations. These entities utilize automatic phoropters as a core component of their in-store examination services, prioritizing speed, standardization across multiple locations, and user-friendliness for technicians rather than highly specialized diagnostic capabilities. Furthermore, governmental health agencies and non-profit organizations focused on public health initiatives, particularly in developing nations, represent a significant potential customer base for portable and robust entry-level automatic phoropters used in mass vision screening programs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 310 Million |

| Market Forecast in 2033 | USD 520 Million |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NIDEK, TOPCON, ESSILOR, Reichert, Vismed, Huvitz, Carl Zeiss Meditec, Bon Optic, Takagi, Mediworks, US Ophthalmic, Ametek, Luneau Technology Group, Shin-Nippon, Suzhou Kangjie Medical, Optovue, Canon, CSO, Metrovision, Woodlyn. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Phoropters Market Key Technology Landscape

The technological landscape of the Automatic Phoropters Market is characterized by continuous innovation focused on optimizing precision, reducing examination time, and enhancing integration capabilities. A cornerstone technology is Wavefront Aberrometry, which measures how light passes through the eye, identifying aberrations beyond standard refractive errors. Integrating wavefront sensing directly into the phoropter allows for a more comprehensive and objective starting point for subjective refinement, crucial for patients with complex visual needs or those undergoing custom refractive surgery planning. Manufacturers are continuously refining the optics and sensor arrays used in these systems to capture higher-resolution data points, ensuring minute changes in the eye's refractive state are accurately measured and translated into a final prescription.

Digital Refraction Systems form the base technology, utilizing advanced stepper motors and computerized controls to quickly and silently switch between trial lenses, replacing the mechanical complexity and potential wear associated with manual devices. Modern digital systems often feature touch-screen interfaces, graphical user feedback mechanisms, and automated data logging, significantly improving the clinical workflow and minimizing the potential for transcription errors. Furthermore, connectivity standards, particularly DICOM (Digital Imaging and Communications in Medicine) compliance, are becoming essential, ensuring the seamless transfer of refraction data to electronic health records and other diagnostic instruments within a clinical network, thereby realizing the vision of a truly integrated eye care environment.

The most transformative trend is the incorporation of Artificial Intelligence and Machine Learning (AI/ML). AI algorithms are being used to analyze objective measurements alongside patient history to calculate highly refined starting prescriptions and guide the subjective testing process by predicting the patient's likely responses, thereby reducing testing fatigue and variability. Furthermore, miniaturization and portability technologies are enabling the development of compact, handheld, or tablet-based automatic phoropters, expanding the market reach beyond traditional clinical settings into community screening and home-based monitoring, relying heavily on stable, low-latency wireless data transmission capabilities for effective remote operation and supervision.

Regional Highlights

Regional dynamics heavily influence the adoption and growth rate of the Automatic Phoropters Market, driven by variances in healthcare spending, regulatory frameworks, and demographic needs. North America stands as a dominant force, characterized by high technological maturity, extensive private insurance coverage, and a strong preference for high-end, fully automated diagnostic equipment. The region's market is primarily driven by the replacement demand for sophisticated systems that offer integrated features and robust EMR compatibility, with the United States being the largest contributor to revenue due to its large population and established infrastructure of specialty eye care clinics.

Europe represents another mature market, where strict regulatory standards (e.g., MDR compliance) ensure a focus on device quality and clinical validation. Western European countries like Germany, France, and the UK exhibit high adoption rates, supported by well-funded public health systems and a growing geriatric population demanding precise vision correction. Conversely, Central and Eastern European markets show increasing growth potential as healthcare modernization efforts accelerate and disposable incomes rise, driving the transition from manual to automated refraction technologies.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive unmet clinical needs, particularly in populous nations like China and India, where the prevalence of myopia is reaching epidemic levels. Market growth here is stimulated by expanding private healthcare investments, increasing awareness of preventive eye care, and government incentives to equip new clinics. Manufacturers must adapt to a highly price-sensitive environment in APAC, often necessitating the development of cost-effective, durable automatic phoropter models that can operate effectively in varying infrastructural conditions.

Latin America and the Middle East & Africa (MEA) are emerging regions experiencing moderate growth. Growth in Latin America is uneven but promising, driven by urbanization and the expansion of private optical retail chains. The MEA region's market growth is concentrated in the Gulf Cooperation Council (GCC) states, where high government healthcare spending facilitates the procurement of advanced medical equipment, although market size remains constrained by infrastructure limitations and socio-economic variability across the wider region.

- North America: Dominates revenue share; driven by replacement cycles, advanced technology adoption, and robust EMR integration demand.

- Europe: High adoption rates due to aging population and stringent quality standards; steady growth supported by public health investments.

- Asia Pacific (APAC): Fastest growing market; fueled by high myopia prevalence, expanding private clinics, and increasing healthcare access in China and India.

- Latin America: Moderate, accelerating growth; driven by optical retail expansion and modernization of healthcare facilities.

- Middle East & Africa (MEA): Growth concentrated in affluent GCC countries; focused on acquiring advanced medical technologies to establish regional medical hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Phoropters Market, covering their product portfolios, strategic initiatives, regional presence, and recent developments shaping the competitive landscape. These companies are pivotal in driving innovation through R&D investment in AI, connectivity, and miniaturization technologies, maintaining a strong hold over global market shares and influencing pricing strategies.- NIDEK Co., Ltd.

- TOPCON Corporation

- ESSILOR (Luxottica Group)

- Reichert, Inc. (AMETEK, Inc.)

- Vismed Technologies, Inc.

- Huvitz Co., Ltd.

- Carl Zeiss Meditec AG

- Bon Optic Vertriebsgesellschaft mbH

- Takagi Seiko Co., Ltd.

- Mediworks International Co., Ltd.

- US Ophthalmic

- Luneau Technology Group

- Shin-Nippon (AJINOMOTO Fine-Techno Co., Inc.)

- Suzhou Kangjie Medical Instrument Co., Ltd.

- Canon Inc.

- CSO Costruzione Strumenti Oftalmici

- Optovue, Inc.

- Metrovision

- Woodlyn, Inc.

- Visionix (Ametek Group)

Frequently Asked Questions

Analyze common user questions about the Automatic Phoropters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using an automatic phoropter over a manual phoropter?

The primary benefit is significantly increased efficiency and objective accuracy. Automatic phoropters reduce examination time, minimize human error, and offer precise digital measurements and data integration into Electronic Medical Records (EMR), standardizing the refraction process.

How is AI influencing the future development of automatic phoropters?

AI is transforming phoropters by enabling predictive prescription generation, optimizing subjective testing sequences, and facilitating remote diagnostics. This integration enhances precision and supports clinical decision-making, moving towards fully automated objective refraction systems.

Which geographical region exhibits the fastest growth rate in the Automatic Phoropters Market?

The Asia Pacific (APAC) region is projected to register the fastest CAGR, driven by the immense burden of refractive errors, particularly myopia, coupled with rapid infrastructure development and increasing investments in specialty eye care services across countries like China and India.

What are the main financial constraints hindering the widespread adoption of automatic phoropters?

The main constraint is the high initial capital expenditure required for purchasing advanced digital and automated units. This cost often restricts adoption among smaller independent practices and clinics operating in markets with limited access to specialized financing or capital investment.

Do automatic phoropters eliminate the need for subjective patient feedback during a vision test?

No, automatic phoropters provide highly accurate objective measurements and excellent starting points, but subjective patient feedback (the "Which is better, 1 or 2?") remains crucial for fine-tuning the final prescription, ensuring patient comfort, and addressing complex visual needs effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager