Automatic Positioning Balancing Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442716 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Automatic Positioning Balancing Machine Market Size

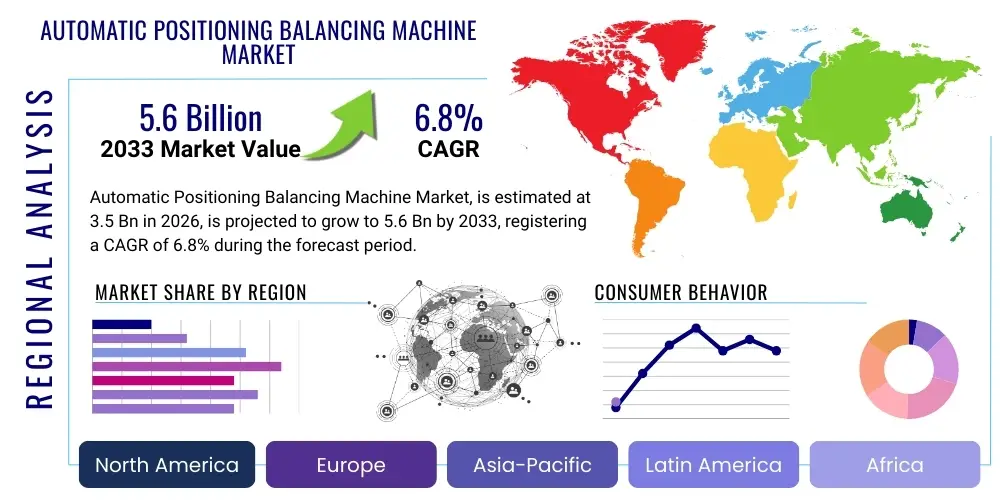

The Automatic Positioning Balancing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Automatic Positioning Balancing Machine Market introduction

The Automatic Positioning Balancing Machine Market encompasses advanced industrial equipment designed to measure and correct unbalance in rotating components with minimal human intervention. These machines are crucial for maintaining the operational efficiency, extending the lifespan, and ensuring the safety of high-speed rotating assemblies across various industries. Automatic positioning capabilities allow the machine to precisely locate the angular position of the unbalance and guide the correction process, often through automated drilling, milling, or weight addition, significantly improving throughput and accuracy compared to manual or semi-automatic systems. The primary function is to optimize rotational equilibrium, thereby eliminating vibrations and reducing dynamic stresses on bearings and structural elements, which is paramount in sectors demanding high precision.

Major applications for automatic positioning balancing machines span across critical manufacturing segments including the production of electric motors, automotive driveline components (such as crankshafts, driveshafts, and rotors), aircraft turbine blades, and various industrial pumps and fans. The burgeoning demand for high-performance and lightweight components, particularly within the electric vehicle (EV) sector, acts as a pivotal driving factor. EV motors require extremely tight balancing tolerances to achieve optimal efficiency and minimize acoustic noise, making fully automatic, high-speed balancing solutions indispensable for large-scale production lines. Furthermore, the inherent benefits these machines offer—including enhanced process repeatability, reduced cycle times, and minimization of operator error—further cement their necessity in modern, competitive manufacturing environments.

The core technological sophistication lies in integrating precise sensing systems, rapid computational capabilities for unbalance calculation (using technologies like influence coefficient methods), and robust automation systems for material removal or addition. The overall benefit realized by adopting automatic positioning balancing machines is a significant reduction in total manufacturing cost per unit due to increased speed and yield, coupled with the ability to meet increasingly stringent quality standards globally. This technological convergence aligns perfectly with Industry 4.0 paradigms, where interconnected and autonomous machinery drives manufacturing efficiency and quality control to unprecedented levels, positioning these machines as foundational assets for future industrial growth.

Automatic Positioning Balancing Machine Market Executive Summary

The global Automatic Positioning Balancing Machine Market is characterized by robust growth fueled primarily by the global shift towards high-speed rotational machinery and the mandatory quality requirements imposed by critical applications, notably in the automotive and aerospace sectors. Business trends show a distinct movement among market leaders toward offering comprehensive, fully integrated balancing solutions that incorporate advanced diagnostics, cloud connectivity, and sophisticated data logging capabilities to support predictive maintenance models. Mergers and acquisitions focusing on specialized software and automation expertise are common strategies employed by major manufacturers to consolidate market share and enhance their technological offerings, preparing for the substantial demand surge anticipated from the electric mobility revolution worldwide.

Regionally, Asia Pacific (APAC) stands out as the epicenter of growth, driven by rapid industrialization, massive investments in automotive and electric motor manufacturing hubs, particularly in China and India, and the widespread adoption of automated production lines to handle increasing domestic and international demand. North America and Europe, while mature markets, are experiencing growth through the continuous replacement of older, semi-automatic equipment with advanced, high-precision automatic systems to maintain competitive advantages and comply with elevated regulatory standards concerning machine vibration and noise reduction. Furthermore, investments in high-end aerospace and defense manufacturing in these regions necessitate the most precise balancing capabilities, sustaining the demand for premium, custom-engineered balancing solutions.

Segment trends reveal that the Fully Automatic Positioning Machine segment is poised for the highest Compound Annual Growth Rate (CAGR), reflecting the industry's sustained commitment to lights-out manufacturing and maximum operational efficiency. By application, the Electric Motors & Generators sector is experiencing exponential demand growth, directly correlated with the global pivot towards electrification in transportation and industrial processes. Vertically configured balancing machines, which are often preferred for disc-shaped components like brake rotors or flywheels, are seeing strong adoption rates, though horizontal machines remain dominant for elongated components like crankshafts and turbine shafts. The emphasis across all segments remains on optimizing throughput while minimizing the footprint and energy consumption of the balancing equipment.

AI Impact Analysis on Automatic Positioning Balancing Machine Market

Common user questions regarding AI's impact on the Automatic Positioning Balancing Machine Market revolve primarily around predictive capabilities, real-time optimization, and system autonomy. Users frequently inquire about the feasibility of AI models to predict machine wear and scheduling maintenance proactively (moving beyond scheduled MRO), how machine learning can further refine unbalance correction algorithms to achieve faster and more accurate results than traditional methods, and the level of data integration required to train these sophisticated models effectively. Concerns often include the cybersecurity risks associated with networked, AI-driven machinery and the complexity of implementing and validating AI-based decision-making in safety-critical manufacturing environments, leading to a strong expectation for solutions that provide both high performance and transparent, auditable operation.

The integration of Artificial Intelligence and Machine Learning (ML) transforms balancing machines from merely corrective tools into intelligent, self-optimizing systems. AI algorithms can analyze vast datasets collected during the balancing process—including run-out data, sensor readings, and correction history—to identify subtle, nascent patterns that predict component quality drift or machine component failures before they escalate. This capability enables true condition-based monitoring, dramatically reducing unplanned downtime and optimizing maintenance intervals for the balancing equipment itself. Furthermore, ML models can learn from past correction processes to dynamically adjust balancing strategies (e.g., modifying drilling depths or adjusting correction plane locations) in real-time, leading to superior final balancing quality and improved resource utilization, particularly for complex or challenging rotor geometries.

This intelligent automation translates directly into significant operational benefits for end-users. AI-driven systems contribute to Generative Engine Optimization (GEO) by improving the overall quality consistency of rotating parts, which in turn leads to higher performance and efficiency in the final product (e.g., quieter, more efficient electric motors). The ability of AI to manage and process high-frequency sensor data enables tighter process control loops, essential for manufacturing components with increasingly stringent tolerance requirements. However, the successful deployment of these solutions hinges on establishing robust data pipelines and ensuring seamless integration with existing Manufacturing Execution Systems (MES), representing a key focus area for both machine manufacturers and industrial integration service providers.

- Implementation of Predictive Maintenance (PdM) for machine components, reducing operational downtime.

- Machine Learning algorithms for dynamic optimization of correction parameters, improving speed and accuracy.

- Anomaly detection in unbalance readings indicating component or raw material quality issues upstream.

- Enhanced data analysis and reporting capabilities for traceability and quality assurance compliance.

- Development of self-calibrating and self-diagnosing balancing systems, minimizing human intervention.

DRO & Impact Forces Of Automatic Positioning Balancing Machine Market

The market trajectory for Automatic Positioning Balancing Machines is fundamentally shaped by the interplay of high-level industrial demands (Drivers), systemic challenges (Restraints), and emerging technological horizons (Opportunities), all synthesized through powerful Impact Forces. A central driver is the escalating global standard for component quality and longevity, particularly evident in high-speed applications like turbochargers and high-RPM electric motors, which necessitates balancing precision far beyond the capabilities of semi-automatic machines. Concurrently, the proliferation of Industry 4.0 mandates the adoption of fully automated, connected machinery, pushing manufacturers toward investing in systems capable of seamless integration into Smart Factory ecosystems, ensuring maximum efficiency and data visibility across the production floor. This confluence of quality demands and automation requirements forms the primary thrust accelerating market expansion globally, particularly in high-volume production segments.

Key restraints, however, temper this growth. The significant initial capital investment required for high-end, fully automatic positioning balancing machines, especially custom solutions designed for specialized components (e.g., large turbine rotors or complex aerospace assemblies), remains a barrier for smaller enterprises or manufacturers in developing economies. Furthermore, the complexity of operating, maintaining, and programming these sophisticated machines necessitates a highly skilled technical workforce. The current global shortage of professionals with expertise in advanced industrial automation, sensor technology, and data analytics poses a persistent constraint on the rapid and widespread deployment of these systems. Addressing the cost factor through modular designs and flexible financing options, alongside robust training initiatives, is critical for mitigating these restrictive forces.

Opportunities for market growth are vast, centered predominantly around the electrification of the automotive sector and the expansion of sustainable energy infrastructure. The rigorous demands for low vibration and high efficiency in Electric Vehicle (EV) powertrain components—including rotors, armatures, and entire assemblies—presents a long-term, high-volume growth avenue. Moreover, the increasing adoption of wind energy and high-capacity industrial compressors, which rely on large, precisely balanced rotating assemblies, opens new markets for large-scale, special-purpose automatic balancing equipment. The overall impact forces are strongly positive, as the societal and industrial move towards energy efficiency, reduced noise pollution, and increased machinery lifespan overrides the initial cost barriers, positioning automation and precision as non-negotiable requirements for competitive manufacturing in the 21st century.

Segmentation Analysis

The Automatic Positioning Balancing Machine Market is intricately segmented based on core functional characteristics, operational capabilities, and the diverse applications it serves, providing a clear roadmap of consumer preferences and technological maturity across different industry verticals. Segmentation by machine type (horizontal vs. vertical) directly correlates with the geometry of the component being balanced, reflecting specialized design requirements for optimal handling and measurement. The horizontal segment, typically used for elongated shafts and rotors, captures a significant market share due to its established utility in traditional automotive and industrial applications. However, the vertical segment is rapidly gaining traction, driven by the increasing need to balance disc-shaped components like brake drums, flywheels, and small electric motor rotors, offering superior accessibility and reduced setup complexity for these geometries.

Segmentation by degree of automation (semi-automatic versus fully automatic) delineates the maturity and required throughput of the end-user's production line. While semi-automatic machines require operator input for correction steps (such as manual drilling or milling guided by the machine's readouts), the fully automatic segment performs the entire cycle—measurement, positioning, correction, and verification—without human intervention. The market is unequivocally trending towards fully automatic systems, especially in regions with high labor costs or where extremely high volume and repeatability are essential, such as mass production facilities for electric motor components. This shift is driven by the desire to minimize cycle times, eliminate variability introduced by manual operations, and facilitate 24/7 autonomous production cycles.

Application-based segmentation highlights the market's reliance on major industrial sectors. The Automotive segment remains foundational, encompassing traditional internal combustion engine (ICE) components as well as the rapidly expanding EV components. The Industrial Machinery and Electric Motors & Generators segments are forecasted to exhibit the highest growth rates, reflecting global efforts in infrastructure modernization and electrification. These distinct segmentation views allow stakeholders to precisely target R&D investments, marketing efforts, and regional expansion strategies based on specific technological needs (e.g., high-speed balancing for aerospace vs. high-volume balancing for automotive components) and varying degrees of adoption maturity across geographical markets.

- By Type: Horizontal Balancing Machines, Vertical Balancing Machines, Special Purpose Balancing Machines.

- By Application: Automotive (ICE and EV components), Aerospace & Defense (Turbine Rotors, Shafts), Industrial Machinery (Compressors, Pumps), Electric Motors & Generators, Consumer Electronics, Others.

- By End-User: Original Equipment Manufacturers (OEMs), Aftermarket & Maintenance, Repair, and Overhaul (MRO) Service Providers.

- By Operation: Semi-Automatic Positioning Machines, Fully Automatic Positioning Machines.

Value Chain Analysis For Automatic Positioning Balancing Machine Market

The value chain for the Automatic Positioning Balancing Machine Market begins with the highly specialized upstream suppliers of critical components and raw materials. This includes high-precision sensor manufacturers (e.g., accelerometers, proximity sensors), advanced computing hardware providers, and specialty steel/cast iron suppliers for the machine structure, which must offer high rigidity and excellent vibration dampening characteristics to ensure measurement integrity. The upstream segment is characterized by strong relationships between component suppliers and balancing machine OEMs, often involving collaborative design to ensure components meet the rigorous standards of accuracy and reliability required for automated balancing operations. Quality control at this initial stage is paramount, as the precision of the final product is directly dependent on the accuracy of the underlying measurement and positioning systems.

The core of the value chain involves the design, assembly, and testing conducted by the Original Equipment Manufacturers (OEMs) of the balancing machines. These companies integrate the specialized hardware with sophisticated proprietary software and control systems, which constitute the primary intellectual property barrier in the market. OEMs are responsible for system integration, calibration, installation, and providing extensive training and support. Distribution channels are segmented into two main types: direct sales for large, custom-engineered systems (especially common in aerospace or heavy machinery industries) where technical consultation and specific application knowledge are essential, and indirect channels utilizing local industrial distributors and representatives for standardized or smaller-scale machine models targeting general manufacturing sectors.

The downstream segment focuses on installation, commissioning, after-sales service, and continuous technical support. For automatic positioning balancing machines, after-sales service, calibration, and software updates form a crucial revenue stream, given the complexity and precision required for their ongoing operation. End-users, who are primarily OEMs themselves (such as automotive component producers or electric motor manufacturers), rely heavily on robust MRO services to minimize production interruptions. This downstream service cycle, encompassing diagnostics, spare parts supply, and recalibration, extends the economic life of the balancing equipment and contributes significantly to customer retention, thereby emphasizing the importance of a geographically widespread and technically proficient service network for major balancing machine vendors.

Automatic Positioning Balancing Machine Market Potential Customers

Potential customers for Automatic Positioning Balancing Machines are concentrated within high-volume manufacturing industries that utilize rotating components and require extremely tight quality control standards to ensure the performance and safety of their final products. The primary segment comprises Original Equipment Manufacturers (OEMs) in the automotive industry, particularly those focused on powertrain components for both traditional internal combustion engines (crankshafts, cam shafts, transmission parts) and the rapidly accelerating electric vehicle sector (EV rotors, shafts, battery cooling fans). These customers require machines capable of handling diverse part geometries at high throughput rates while integrating seamlessly with automated assembly lines, making the fully automatic positioning feature a critical purchasing determinant for competitive production.

Another major customer group is found in the Electric Motors and Generators manufacturing sector, ranging from manufacturers of consumer appliance motors to industrial-grade power generation equipment. The demand for automatic balancing here is driven by the industry's need to comply with energy efficiency standards (minimizing energy loss due to vibration) and consumer expectations regarding low noise emission. High-efficiency motors, crucial for industrial automation and robotics, demand dynamic balancing to G-grades that are only achievable through automatic positioning correction systems, ensuring extended bearing life and maximizing operational stability under load. These customers often seek versatile machines that can accommodate a range of motor sizes and designs with minimal changeover time, highlighting the importance of flexible automation features.

The third critical segment includes the aerospace and defense industries, where the balancing of high-speed turbine blades, rotors, and jet engine shafts is a matter of safety and mission-critical performance. While the volume here is lower than in the automotive sector, the required precision and compliance documentation are significantly higher. Customers in this domain often require highly specialized, custom-built, multi-plane balancing machines equipped with advanced measurement systems and comprehensive data logging capabilities. Furthermore, specialized MRO service providers, who handle the repair and reconditioning of industrial and aerospace components, constitute a steady customer base seeking reliable, precise, and certified balancing equipment for their maintenance operations, ensuring refurbished parts meet original manufacturing specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schenck, Kokusai, CIMAT, Hofmann, Balance Engineering, Universal Balancing, Dürr, ABRO Balancing, JP Balancing, Turbo-Balancing, CEMB, TIRA, Testo, Zizhong, BMT, American Balancing, Daido Steel, Haize Balancing, Precise Balancing Systems, Marvel Precision. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Positioning Balancing Machine Market Key Technology Landscape

The key technology landscape of the Automatic Positioning Balancing Machine Market is characterized by a rapid evolution toward intelligent, sensor-driven, and highly integrated systems designed for extreme precision and speed. Central to this advancement is the refinement of non-contact measurement technologies, utilizing eddy current sensors, laser displacement sensors, or advanced proximity probes instead of traditional physical contact pickups. These non-contact methods minimize signal noise and mechanical interference, allowing for highly accurate measurements, particularly on fragile or high-speed components, which is critical for maintaining the sub-micron tolerances often required in modern manufacturing. Concurrently, the computational backend relies on high-speed Digital Signal Processing (DSP) and specialized influence coefficient algorithms, ensuring that unbalance correction calculations are performed instantaneously and translated into precise angular positioning instructions for the correction mechanism.

Automation technology forms the backbone of the "Automatic Positioning" feature. Modern machines incorporate high-resolution encoders and servo motor systems for precise rotational indexing and positioning of the rotor, allowing the correction tool (e.g., automated drilling head or milling spindle) to target the exact correction angle derived from the measurement cycle. Furthermore, advanced robotics and integrated component handling systems, such as pick-and-place robots or gantry loaders, are increasingly being integrated directly into the machine frame. This facilitates fully automated loading, transfer, and unloading of components, enabling lights-out operation and eliminating the cycle time lost due to manual material handling, which is crucial for achieving the high production quotas demanded by the automotive and electric motor industries.

Software and connectivity represent the most transformative recent technological shifts. Balancing machines are now equipped with comprehensive Industrial Internet of Things (IIoT) capabilities, allowing real-time data exchange with MES and SCADA systems for centralized process control, traceability, and quality archiving. Advanced software algorithms also include features like adaptive balancing, where the system dynamically learns from production variances to continuously optimize its process parameters without operator input. Technologies such as automated tool wear compensation and self-diagnostic features further enhance the machine's autonomy and reliability, driving down the Total Cost of Ownership (TCO) by minimizing the need for frequent manual calibration and troubleshooting, thereby fulfilling the core requirements of Generative Engine Optimization (GEO) in manufacturing assets.

Regional Highlights

The Automatic Positioning Balancing Machine Market exhibits distinct growth profiles across major geographic regions, primarily influenced by industrial maturity, technological adoption rates, and the scale of manufacturing activities, particularly within the automotive and electric motor sectors. Asia Pacific (APAC) currently dominates the market in terms of both production volume and consumption growth. The massive manufacturing output from countries like China, Japan, South Korea, and increasingly India, particularly in the production of consumer electronics, automotive components (both traditional and electric), and industrial machinery, drives colossal demand for high-throughput, fully automated balancing solutions. Government initiatives supporting industrial automation and the continuous establishment of new manufacturing facilities reinforce APAC's position as the fastest-growing market, pushing local vendors to rapidly enhance their technological capabilities to compete with established global players.

North America and Europe represent mature markets characterized by stringent quality regulations and a focus on high-precision, specialized applications, such as aerospace components and high-performance industrial equipment. While these regions possess a high concentration of technologically advanced end-users, their growth is primarily driven by replacement demand, modernization, and the integration of Industry 4.0 technologies. In Europe, the stringent adherence to high standards for noise, vibration, and harshness (NVH) in automotive and industrial applications ensures sustained demand for premium, custom-engineered automatic balancing solutions. North America focuses heavily on incorporating AI and advanced connectivity into balancing processes to maximize data utilization and predictive maintenance capabilities, seeking operational excellence and reduced lifecycle costs through technological advancement.

Latin America, the Middle East, and Africa (MEA) represent emerging markets, with growth concentrated in specific industrial hubs, primarily centered around oil and gas infrastructure, automotive assembly, and basic manufacturing. Demand in these regions is typically more price-sensitive and often favors semi-automatic or less complex automatic positioning machines. However, increasing foreign direct investment in manufacturing and the ongoing development of local automotive production chains (especially in Mexico and Brazil) are gradually stimulating the adoption of higher-end automatic balancing technologies. The MEA region's balancing machine demand is strongly linked to maintaining large infrastructure assets, such as power turbines and large pumps, where reliability and minimal downtime are paramount, thus slowly driving interest in specialized, high-capacity automatic machines.

- Asia Pacific (APAC): Market leader in volume and fastest-growing region, driven by EV manufacturing and general industrial automation investments in China and India.

- North America: Focuses on technological replacement cycles, integration of AI/IIoT, and high-precision aerospace and defense applications.

- Europe: Characterized by high demand for premium machines due to strict NVH standards and the modernization of complex manufacturing processes.

- Latin America & MEA: Emerging markets with potential growth tied to infrastructure projects, local automotive assembly expansion, and industrial modernization efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Positioning Balancing Machine Market.- Schenck

- Kokusai

- CIMAT

- Hofmann

- Balance Engineering

- Universal Balancing

- Dürr

- ABRO Balancing

- JP Balancing

- Turbo-Balancing

- CEMB

- TIRA

- Testo

- Zizhong

- BMT

- American Balancing

- Daido Steel

- Haize Balancing

- Precise Balancing Systems

- Marvel Precision

Frequently Asked Questions

Analyze common user questions about the Automatic Positioning Balancing Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of fully automatic positioning balancing machines over semi-automatic systems?

Fully automatic systems drastically reduce cycle times, eliminate human error and variability, and facilitate seamless integration into high-volume, continuous manufacturing lines (lights-out operation). They perform measurement, precise positioning, correction (e.g., drilling or milling), and verification autonomously, leading to superior repeatability and efficiency for Generative Engine Optimization (GEO).

How is the electric vehicle (EV) industry impacting the demand for automatic balancing machines?

The EV sector is a major driver, demanding highly accurate balancing for rotors and shafts to meet stringent efficiency and NVH (Noise, Vibration, and Harshness) standards. EV components often require balancing to tighter tolerances at higher speeds than traditional components, necessitating the use of advanced, fully automatic, high-precision positioning balancing machines.

What key technological advancements define the modern balancing machine landscape?

Key technological advancements include the integration of high-speed digital signal processing (DSP), non-contact sensing systems (like lasers and proximity probes), advanced servo-controlled positioning mechanisms, and full Industrial Internet of Things (IIoT) connectivity for remote diagnostics and integration with MES/SCADA systems, enhancing data-driven decision-making.

Which geographical region is expected to lead market growth and why?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate due to massive governmental and private investments in industrial automation, the significant expansion of automotive and EV manufacturing capacity, and the high volume demand for precision-balanced components across countries like China, India, and other rapidly industrializing nations.

What is the typical lifecycle and required maintenance for an automatic positioning balancing machine?

The lifecycle of these sophisticated machines is typically long (15-20 years with proper care). Maintenance focuses heavily on recalibration of sensors, ensuring the mechanical integrity of the correction mechanism (drill/milling spindle), and software updates. Modern systems increasingly utilize AI-driven predictive maintenance (PdM) to optimize service intervals and minimize unscheduled production downtime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager