Automatic Ship Auxiliary Engine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441550 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Automatic Ship Auxiliary Engine Market Size

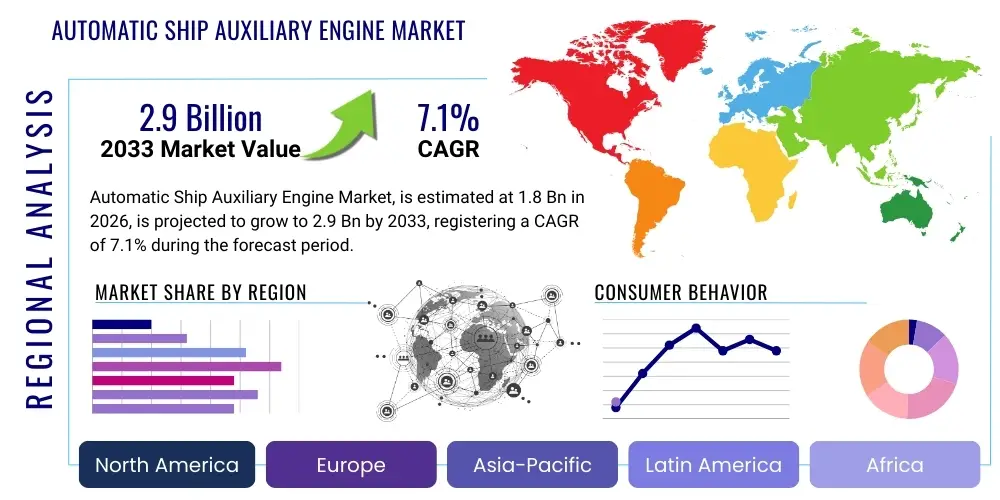

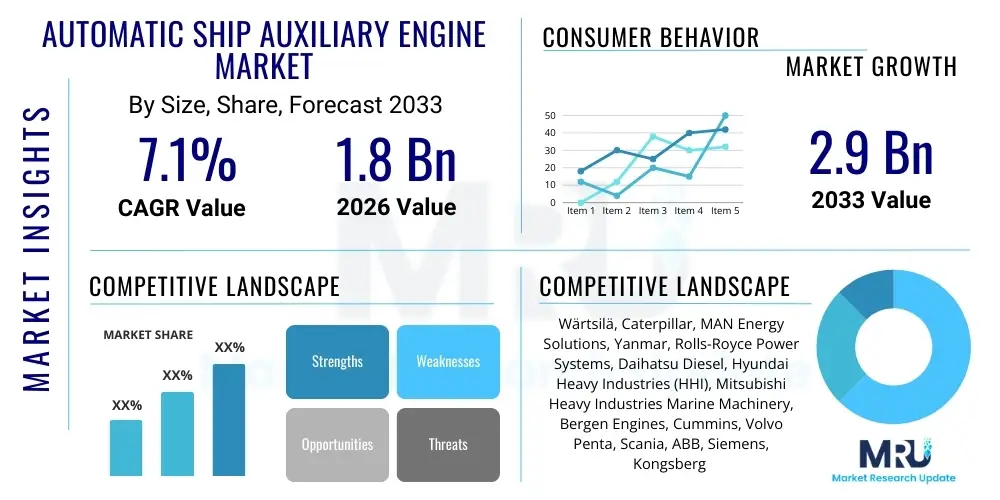

The Automatic Ship Auxiliary Engine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $2.9 Billion by the end of the forecast period in 2033.

Automatic Ship Auxiliary Engine Market introduction

The Automatic Ship Auxiliary Engine Market encompasses sophisticated power generation units essential for maintaining the operational integrity of modern marine vessels, distinct from the main propulsion system. These engines automatically manage and supply electrical power for critical shipboard systems, including lighting, ventilation, navigation equipment, cargo handling systems, refrigeration units, and complex control systems. The shift towards automation involves integrating advanced sensors, digital controllers, and predictive maintenance algorithms that optimize engine performance, ensuring reliability, compliance with stringent environmental regulations, and significant reductions in operational costs. This transformation is crucial as ships become increasingly complex and dependent on continuous, stable electrical supply, driving demand for self-regulating and highly efficient auxiliary power solutions across global maritime fleets.

Product sophistication is characterized by adaptability to various fuel types, notably Marine Gas Oil (MGO), Liquefied Natural Gas (LNG), and increasingly, methanol and ammonia, reflecting the industry's commitment to decarbonization pathways mandated by the International Maritime Organization (IMO). Automatic features include load-sharing mechanisms, automatic start-stop sequences based on energy demand fluctuations, and seamless integration into the vessel's centralized power management system (PMS). These advancements reduce human intervention, minimizing the risk of operational errors and maximizing fuel economy. Furthermore, the integration of automation technologies allows auxiliary engines to dynamically adjust output in real-time, matching the precise power requirements of the vessel at any given moment, whether maneuvering in port or traversing open seas.

Major applications of these automatic systems span the entire commercial and naval maritime spectrum, including large container ships, oil tankers, bulk carriers, passenger cruise liners, and specialized offshore vessels. Benefits derived from adopting automatic auxiliary engines are multifaceted, primarily centering on improved energy efficiency, lower emissions (meeting IMO Tier III and potentially future carbon intensity indicators), enhanced system redundancy, and increased vessel uptime due to predictive diagnostics. Driving factors include global trade growth requiring larger, more sophisticated vessels, mandatory emission reduction targets pushing technological upgrades, and the competitive necessity for ship operators to minimize operational expenditure (OPEX) through optimized energy consumption and reduced maintenance cycles. The convergence of digitalization and decarbonization acts as a powerful catalyst for market expansion, forcing the replacement of legacy, manually operated systems with fully automated, smarter engine solutions.

Automatic Ship Auxiliary Engine Market Executive Summary

The Automatic Ship Auxiliary Engine Market is undergoing rapid technological transformation, primarily driven by twin imperatives: enhancing operational efficiency through digitization and achieving drastic reductions in carbon emissions mandated by international bodies. Business trends highlight a strong shift toward dual-fuel and multi-fuel auxiliary engine systems, particularly those compatible with LNG and future synthetic fuels, reflecting significant investments in R&D by key market players like Wärtsilä and MAN Energy Solutions. Furthermore, the integration of Artificial Intelligence (AI) for predictive maintenance and automated load balancing is emerging as a core competitive differentiator, enabling operators to achieve near-zero downtime and optimize fuel consumption dynamically. Strategic partnerships between engine manufacturers and marine technology providers focusing on integrated power management systems (IPMS) are reshaping the competitive landscape, pushing the industry towards highly integrated, 'smart ship' solutions.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine for the market, driven by unparalleled shipbuilding activity in countries like China, South Korea, and Japan, which necessitates high volumes of new installations of advanced auxiliary power units. Europe, while slower in sheer volume of new builds, leads in technological adoption and regulatory compliance, particularly concerning stringent sulfur and NOx limits, fostering innovation in engine after-treatment systems and hybrid solutions. North America demonstrates robust demand within specialized maritime sectors, such as offshore oil and gas, and coastal shipping, where reliability and localized emission standards mandate sophisticated auxiliary power systems. The expansion of global shipping lanes and the continuous modernization of aging fleets worldwide provide a sustained demand floor across all geographic regions.

Segmentation trends reveal significant traction in the high-power output segment (above 5,000 kW), corresponding to the increasing size and complexity of modern mega-vessels, which require substantial auxiliary power for sophisticated cargo handling and extensive passenger amenities. By fuel type, the demand for LNG-capable auxiliary engines is accelerating rapidly, reflecting environmental regulations and fuel price volatility advantages. Furthermore, the segmentation by operation mode shows a marked preference for fully automatic, digitally controlled engines that can interface seamlessly with vessel data analytics platforms, offering superior energy management capabilities compared to semi-automatic models. These trends collectively underscore a market moving away from traditional, mechanically governed systems toward sophisticated, sensor-laden, and software-defined power generation units essential for the autonomous shipping paradigm.

AI Impact Analysis on Automatic Ship Auxiliary Engine Market

Users frequently inquire about how Artificial Intelligence and machine learning algorithms can fundamentally alter the maintenance cycles, operational efficiency, and control systems of ship auxiliary engines. Key concerns revolve around the reliability of autonomous decision-making in critical power failure scenarios, the cyber security implications of highly digitized control systems, and the necessary infrastructure investment required for effective AI deployment, including sensor retrofitting and data storage capabilities. Users expect AI to move beyond basic diagnostics, enabling true predictive maintenance that anticipates component failure with high accuracy, optimizing spare part inventory management, and reducing reliance on scheduled, calendar-based maintenance procedures. Furthermore, there is a high expectation that AI will deliver superior fuel optimization by automating real-time load balancing based on forecasted vessel needs and environmental conditions, thereby lowering operational expenditures significantly and aiding in environmental compliance.

The impact of AI on the Automatic Ship Auxiliary Engine Market is profound, primarily facilitating a transition from reactive or preventive maintenance paradigms to highly accurate predictive maintenance (PdM). Machine learning models analyze vast datasets generated by engine sensors—including temperature, vibration, pressure, and lubrication quality—to identify subtle deviations indicative of impending failure. This capability allows ship operators to schedule maintenance precisely when needed, dramatically reducing unplanned outages, minimizing repair costs, and extending the lifespan of critical engine components. AI also enhances the operational intelligence of the auxiliary engines by optimizing their collective performance, ensuring that load distribution among multiple engines is constantly balanced to maximize fuel efficiency and minimize wear and tear.

Beyond maintenance, AI algorithms are central to advanced Energy Management Systems (EMS), automating complex decisions regarding engine operation modes, paralleling, and synchronization, particularly in vessels utilizing hybrid or electric propulsion systems. By modeling the vessel’s power demand profiles against voyage plans and ambient conditions, AI can automatically adjust the operational parameters of the auxiliary engines, determining the optimal number of engines running and their ideal output level. This level of granular control is unattainable through conventional automation systems and is crucial for meeting stringent environmental targets by minimizing specific fuel oil consumption (SFOC). The growing adoption of digital twins, powered by AI, allows for simulation and testing of operational scenarios, further validating the efficiency gains and reinforcing the reliability of these autonomous power systems.

- AI enables highly accurate predictive maintenance (PdM), reducing unplanned downtime by identifying component degradation in advance.

- Machine learning algorithms optimize fuel consumption through dynamic, real-time automated load balancing and precise operational adjustments.

- AI integration supports the development of fully autonomous power management systems (PMS) essential for future smart and unmanned ships.

- Digital twin technology, driven by AI, allows for virtual testing and optimization of auxiliary engine performance under varying marine conditions.

- Data analytics derived from AI improves fault diagnosis speed and accuracy, minimizing human error during operational emergencies.

- AI facilitates automated reporting and compliance monitoring, ensuring adherence to complex international emission standards (e.g., IMO Tier III).

- The technology drives system redundancy management, enabling intelligent failover and seamless power transfer in case of component failure.

DRO & Impact Forces Of Automatic Ship Auxiliary Engine Market

The Automatic Ship Auxiliary Engine Market is shaped by a confluence of powerful regulatory drivers, technological innovation, and critical restraints related to infrastructure and initial investment hurdles. Key drivers include stringent global maritime regulations, particularly the IMO's continuous push for decarbonization and Tier III compliance for NOx emissions, which necessitates the adoption of cleaner, automated engine technologies like LNG or scrubbers integrated systems. The rapid global expansion of the shipbuilding industry, especially for large, highly electrified vessels (e.g., mega container ships and cruise liners), creates a massive demand base for sophisticated auxiliary power units capable of managing complex electrical loads automatically. Furthermore, the commercial imperative to reduce OPEX through maximizing fuel efficiency and minimizing labor costs through automation significantly fuels market adoption. These combined forces create a compelling environment for sustained market growth, prioritizing high-efficiency and digitally controlled systems.

However, the market faces significant restraints that slow the pace of widespread adoption. The high initial capital expenditure (CapEx) associated with installing advanced, automated auxiliary systems, particularly those utilizing alternative fuels like LNG, presents a substantial barrier for smaller ship operators or those operating older vessels. Additionally, the complexity inherent in integrating new digital control systems and sensor technology into existing vessel infrastructure requires specialized expertise and presents technical challenges. Furthermore, the dependence on global supply chains for critical electronic and mechanical components exposes the market to volatility, as evidenced by recent geopolitical and logistical disruptions. Skilled labor shortages, both for operating highly automated systems onboard and for specialized maintenance, also temper the rate of transition across the industry.

Opportunities within the market center on the expanding potential of hybrid and electric propulsion systems, where auxiliary engines transition into sophisticated range extenders or core charging units, opening new revenue streams for engine manufacturers specializing in high-density power generation. The push toward autonomous shipping represents a long-term, high-growth opportunity, as unmanned vessels are entirely reliant on fully automatic and self-diagnosing auxiliary power units. Moreover, the burgeoning retrofit market, driven by the need for existing fleets to comply with evolving environmental standards, offers substantial scope for installing advanced automation packages and cleaner fuel conversions onto existing auxiliary engines. The collective influence of these Drivers, Restraints, and Opportunities results in high impact forces, compelling stakeholders to invest heavily in fuel flexibility and digital integration to maintain competitiveness and ensure regulatory adherence.

Segmentation Analysis

The Automatic Ship Auxiliary Engine Market is comprehensively segmented based on fuel type, reflecting the industry's environmental goals; power output, correlating with vessel size and complexity; end-use application, categorized by the type of vessel; and operation mode, differentiating the level of automated control. This detailed segmentation allows manufacturers to target specific market needs, such as supplying high-efficiency, gas-fueled engines for new container ship construction in Asia or providing robust, low-emission diesel alternatives for the existing European ferry fleet. Analyzing these segments is critical for understanding shifting customer preferences, particularly the movement toward multi-fuel flexibility and integrated power management solutions across all categories, ensuring power stability and maximizing adherence to global maritime emissions mandates.

The fuel type segment is particularly dynamic, witnessing aggressive growth in non-traditional marine fuels as the industry seeks viable pathways to zero emissions. The high-power segment, driven by the expansion of global trade and the construction of larger ships, continues to dominate revenue share, but the medium-power range is vital for specialized vessels and coastal shipping. End-use segmentation confirms that commercial shipping, especially container and tanker fleets, remains the primary consumer base, but the naval and specialized vessel markets provide crucial demand for high-specification, redundant auxiliary systems. The underlying trend across all segments is the increasing reliance on integrated digital control systems, making the fully automatic operation mode the industry standard for new installations, thereby ensuring optimized performance and enabling remote monitoring capabilities.

- By Fuel Type

- Heavy Fuel Oil (HFO)

- Marine Gas Oil (MGO)

- Dual Fuel (DF) / Liquefied Natural Gas (LNG)

- Alternative Fuels (Methanol, Ammonia, Biofuels)

- By Power Output

- Up to 1,000 kW

- 1,001 kW – 5,000 kW

- Above 5,000 kW

- By Vessel Type (End-Use)

- Commercial Vessels (Container Ships, Bulk Carriers, Tankers)

- Specialized Vessels (Offshore Support Vessels, Cruise Ships, Ferries)

- Naval Vessels

- By Operation Mode

- Semi-Automatic Systems

- Fully Automatic (Digital Control) Systems

Value Chain Analysis For Automatic Ship Auxiliary Engine Market

The value chain for the Automatic Ship Auxiliary Engine Market is complex and highly specialized, beginning with the upstream supply of sophisticated raw materials and core components. Upstream activities involve high-precision manufacturing of engine components such as turbochargers, fuel injection systems, pistons, and advanced materials (e.g., high-grade steel and specialized alloys) necessary for high-performance combustion. Key players in this stage are specialized Tier 2 and Tier 3 suppliers who provide critical technologies like advanced sensor packages and digital control units, essential for achieving the 'automatic' function of the engines. The quality and availability of these components directly impact the final engine's efficiency, reliability, and compliance with stringent operational standards, meaning relationships with reliable, high-tech material providers are critical for Original Equipment Manufacturers (OEMs).

The core stage of the value chain is dominated by the major engine OEMs (like Wärtsilä, MAN, and Caterpillar) who are responsible for the design, assembly, testing, and integration of the auxiliary engine units. These companies invest heavily in R&D to incorporate new fuel technologies (e.g., dual-fuel capabilities) and advanced automation systems (e.g., AI-driven PMS). Once manufactured, these engines are distributed through multiple channels. Direct distribution involves sales agreements with large, established global shipbuilders, particularly those constructing massive container ships or cruise liners. Indirect distribution utilizes a network of authorized regional distributors and marine system integrators, especially for the retrofit market or for smaller, localized shipbuilding yards, ensuring broader market access and localized support services.

Downstream activities involve the crucial stages of installation, commissioning, and long-term maintenance and repair (MRO). Shipbuilders integrate the auxiliary engines into the vessel's power infrastructure, requiring close collaboration with the OEM. After commissioning, the end-user (ship owners/operators) relies heavily on global service networks for MRO. This service segment is increasingly digitized, utilizing remote diagnostics and predictive maintenance contracts, often managed directly by the engine OEMs or specialized service providers. The circular flow of value is completed as MRO services provide valuable performance data back to the OEMs, informing future design improvements and ensuring the continuous operational optimization necessary for highly automated engine systems to deliver maximum value over their extended lifecycle.

Automatic Ship Auxiliary Engine Market Potential Customers

The primary customers for automatic ship auxiliary engines are concentrated in the maritime and naval sectors, requiring reliable and efficient electrical power generation for operational continuity. The largest segment of potential customers comprises commercial fleet owners and operators, including companies managing vast fleets of container ships, Very Large Crude Carriers (VLCCs), liquefied natural gas (LNG) carriers, and bulk carriers. These customers prioritize fuel efficiency, low emissions (due to global trade routes passing through Emission Control Areas, or ECAs), and maximum system uptime. For them, an automatic auxiliary engine represents a direct investment in lowering operational costs and ensuring cargo integrity through stable power supply to refrigeration and monitoring systems. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO) and compliance documentation, favoring long-term service agreements and proven technology integration.

A second crucial customer segment is the specialized vessel market, which includes cruise line operators, ferry companies, and large Research & Development (R&D) vessels. Cruise ships, in particular, demand high-power auxiliary units because of extensive onboard hotel loads (lighting, air conditioning, entertainment) and complex dynamic positioning systems, requiring highly redundant and automated power systems to guarantee passenger safety and comfort. Ferry operators, often subject to stringent regional emission standards near coastal cities, require auxiliary engines compatible with alternative fuels and advanced exhaust after-treatment. These buyers typically focus on noise and vibration reduction, modular design for confined spaces, and systems that can seamlessly integrate into advanced ship automation bridges.

The third significant customer group is global navies and governmental maritime agencies (e.g., coast guards). Naval vessels require auxiliary engines characterized by high shock resistance, extreme reliability, stealth capabilities (low acoustic and thermal signatures), and robust redundancy for mission-critical operations. Automation in this segment is driven by the need to minimize crew requirements and enhance system survivability in contested environments. Furthermore, shipyards—acting as key intermediaries—are also major purchasers, as they procure engines based on specific contract specifications and often standardize on a few reliable brands for efficiency in construction and warranty management. The shift towards autonomous shipping will further cement the need for fully self-diagnosing and automatic systems across all these customer categories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $2.9 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wärtsilä, Caterpillar, MAN Energy Solutions, Yanmar, Rolls-Royce Power Systems, Daihatsu Diesel, Hyundai Heavy Industries (HHI), Mitsubishi Heavy Industries Marine Machinery, Bergen Engines, Cummins, Volvo Penta, Scania, ABB, Siemens, Kongsberg Gruppen, Deutz AG, General Electric (GE), Kawasaki Heavy Industries, CSSC Power (Group) Co., Ltd., Niigata Power Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Ship Auxiliary Engine Market Key Technology Landscape

The technology landscape for the Automatic Ship Auxiliary Engine Market is defined by digitalization, fuel diversification, and system integration complexity, aimed squarely at maximizing efficiency and minimizing environmental impact. Central to this transformation is the advanced Power Management System (PMS), which has evolved from basic load-sharing controllers to complex digital hubs utilizing proprietary software and cloud connectivity. Modern PMS technology incorporates predictive algorithms (often AI-driven) to optimize the number of engines running, manage the transition between different power sources (e.g., engines, batteries, shore power), and execute automatic sequencing for start-up and shutdown. This technological shift ensures power stability, crucial for sophisticated onboard electronics and sensitive cargo, while significantly reducing fuel wastage associated with running oversized or inefficient engine configurations.

Another major technological pillar is the multi-fuel engine architecture, primarily focused on dual-fuel (DF) systems that allow seamless switching between conventional fuels like Marine Gas Oil (MGO) and cleaner alternatives such as Liquefied Natural Gas (LNG). This flexibility is paramount for vessels traversing global routes with varying fuel availability and regulatory requirements. Manufacturers are also aggressively developing internal combustion engines compatible with future low-carbon fuels like methanol, ammonia, and hydrogen, necessitating innovations in fuel injection systems, storage, handling safety protocols, and robust emissions after-treatment technologies (e.g., Selective Catalytic Reduction (SCR) systems and exhaust gas recirculation (EGR)). These technological upgrades often involve sophisticated sensor arrays and automated monitoring systems to handle the unique combustion characteristics and safety challenges presented by these new fuels.

Furthermore, the integration of auxiliary engines within hybrid and full electric propulsion systems represents a significant technological leap. In a hybrid setup, the auxiliary engine acts in concert with high-capacity battery packs, optimizing transient loads and enabling 'peak shaving' to maintain the engine at its most efficient load point. The technology involves DC grid distribution systems that allow power to flow flexibly between generators, batteries, and the propulsion motors, requiring advanced automation and fault protection mechanisms. This integration not only boosts overall vessel efficiency and reduces engine hours but also enhances redundancy, making the entire power plant more resilient. The continuous development of these integrated, smart power solutions confirms the auxiliary engine's critical role as the backbone of modern, automated marine power generation.

Regional Highlights

The Automatic Ship Auxiliary Engine Market exhibits distinct regional dynamics driven by localized shipbuilding activity, regulatory environments, and maritime trade volumes. Asia Pacific (APAC) holds the largest market share and is projected to experience the highest growth rate throughout the forecast period. This dominance is directly attributable to the concentration of the world's largest shipbuilding nations—China, South Korea, and Japan—which drive immense demand for new auxiliary engine installations. Furthermore, the region's expanding intra-regional trade and the rapid modernization of its domestic fleets contribute significantly to the volume sales, particularly for medium and high-power output engines catering to mega-container vessels and bulk carriers. APAC also leads in adopting dual-fuel LNG engines due to high investment in LNG bunkering infrastructure.

Europe represents a highly mature but technologically advanced market, focusing intensively on retrofitting and high-specification new builds, particularly in the cruise and ferry segments. The European regulatory environment, notably the stricter implementation of the EU Emissions Trading System (ETS) and localized requirements in the Baltic and North Seas, drives demand for low-emission solutions, including hybrid power systems and advanced after-treatment technologies. European shipowners often prioritize operational efficiency, digital integration, and compliance, making this region a key early adopter of AI-driven power management systems and engines utilizing methanol or ammonia as pilot fuels. Key markets include Germany, Norway, Finland, and Italy, which host major maritime technology innovators and specialized shipyards.

North America maintains a strong market presence, particularly in specialized offshore and coastal shipping sectors. Demand is influenced by distinct regional emission control areas (e.g., within the US and Canadian coasts) that mandate the use of low-sulfur fuels (MGO) and often require higher levels of operational redundancy for deep-sea operations. The market here focuses on robustness, reliability, and automated diagnostics for remote operation. The Middle East and Africa (MEA) and Latin America (LATAM) markets are characterized by increasing investments in port infrastructure and expanding maritime fleets, particularly oil and gas tankers, driving sustained demand for conventional, yet reliable, high-power HFO and MGO-fueled auxiliary engines, often complemented by robust automation packages to manage regional operational challenges.

- Asia Pacific (APAC): Dominant region due to major shipbuilding hubs (China, South Korea, Japan); high volume demand for new installations, rapid adoption of LNG-fueled systems.

- Europe: Leader in technology adoption and regulatory compliance (ETS, strict ECAs); strong focus on retrofits, hybrid systems, and advanced low-carbon fuel integration (methanol/ammonia).

- North America: Focus on specialized vessels (offshore, military); demand driven by strict coastal emission zones and high need for operational reliability and automation.

- Middle East & Africa (MEA): Growth driven by oil and gas fleet expansion and infrastructure development; demand for robust, high-power conventional auxiliary systems.

- Latin America (LATAM): Market expansion driven by modernization of aging fleets and increased regional trade; growing interest in efficiency-focused automated systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Ship Auxiliary Engine Market.- Wärtsilä

- Caterpillar

- MAN Energy Solutions

- Yanmar

- Rolls-Royce Power Systems

- Daihatsu Diesel

- Hyundai Heavy Industries (HHI)

- Mitsubishi Heavy Industries Marine Machinery

- Bergen Engines

- Cummins

- Volvo Penta

- Scania

- ABB

- Siemens

- Kongsberg Gruppen

- Deutz AG

- General Electric (GE)

- Kawasaki Heavy Industries

- CSSC Power (Group) Co., Ltd.

- Niigata Power Systems

Frequently Asked Questions

Analyze common user questions about the Automatic Ship Auxiliary Engine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for fully Automatic Ship Auxiliary Engines?

The foremost driver is global compliance with stringent environmental regulations, particularly the IMO Tier III standards for NOx emissions and the broader mandate for decarbonization, compelling operators to adopt digitally controlled, highly efficient, and multi-fuel capable engine systems to maintain global trading access and reduce carbon intensity.

How do automated auxiliary engines contribute to reducing operational expenditure (OPEX) for shipowners?

Automated auxiliary engines optimize OPEX by utilizing sophisticated load-sharing and energy management systems that ensure engines run at peak thermal efficiency, minimizing fuel consumption. Furthermore, integrating AI for predictive maintenance dramatically reduces unplanned downtime and associated emergency repair costs, maximizing asset utilization.

Which fuel types are showing the fastest growth rate in the Automatic Ship Auxiliary Engine Market?

Dual-Fuel (DF) systems, primarily utilizing Liquefied Natural Gas (LNG), are experiencing the fastest growth due to their ability to meet current and near-future emission regulations. Significant market interest is also shifting towards zero-carbon alternative fuels like methanol and ammonia, although commercial adoption rates remain lower than LNG currently.

What role does Artificial Intelligence (AI) play in modern auxiliary engine operation?

AI is crucial for enabling predictive maintenance (PdM) by analyzing sensor data to forecast potential component failures, optimizing maintenance schedules. It also enhances automated Power Management Systems (PMS) by dynamically balancing power loads in real-time to maximize fuel efficiency and stability, essential for smart ship functionality.

Which region currently dominates the global market for Automatic Ship Auxiliary Engines?

The Asia Pacific (APAC) region dominates the global market due to its concentration of leading global shipbuilding nations, including China, South Korea, and Japan. High volume orders for new, large commercial vessels requiring integrated and automated power solutions significantly drive the demand in this region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager