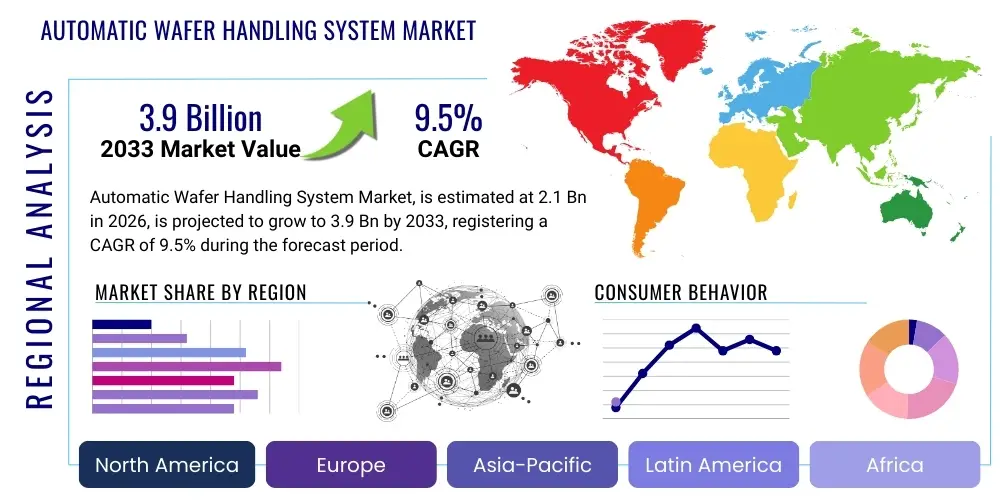

Automatic Wafer Handling System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441147 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Automatic Wafer Handling System Market Size

The Automatic Wafer Handling System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.9 Billion by the end of the forecast period in 2033. This growth trajectory is underpinned by the relentless expansion of semiconductor manufacturing capacity globally, driven primarily by investments in advanced node fabrication facilities (fabs). The transition to 300mm wafers and the increasing complexity of front-end and back-end processing steps necessitate highly reliable, precise, and automated material transport solutions to maintain yield and throughput.

Automatic Wafer Handling System Market introduction

The Automatic Wafer Handling System (AWHS) Market encompasses specialized robotic and mechanical equipment designed to move silicon wafers efficiently and contamination-free throughout the various stages of semiconductor manufacturing. These systems are integral to modern wafer fabrication plants (fabs), where they ensure precise positioning and transfer of wafers between process tools (such as deposition, etching, and lithography) and storage units (like FOUPs or cassettes). AWHS products include atmospheric and vacuum robots, End-Effectors, Load Ports, Equipment Front-End Modules (EFEMs), and sophisticated software control units, all operating under ultra-clean conditions to prevent particulate contamination which could severely impact device yield. The primary function is maximizing throughput while minimizing human intervention, thereby enhancing consistency and reliability in high-volume production environments.

The major applications of AWHS span the entire fabrication process, from initial cleaning and preparation to final inspection and packaging. They are critical in photolithography areas where extreme precision is mandatory, and in high-temperature or vacuum processing steps where human access is impossible or detrimental. Key benefits include drastically reduced wafer breakage and contamination rates, increased operational efficiency due to faster cycle times, and the enablement of lights-out manufacturing concepts. Furthermore, the modular design and increasing standardization of interfaces, such as the SEMI standards (e.g., SEMI E84 and E99), facilitate seamless integration of AWHS components with diverse process equipment, ensuring optimal facility layout and workflow management across technologically advanced fabs worldwide. The demand is particularly concentrated in sectors pushing the boundaries of miniaturization, such as logic processors, advanced memory chips, and specialized analog devices requiring stringent process control.

Driving factors for this market are multifaceted, anchored by the exponential demand for semiconductor devices across computing, automotive, and consumer electronics sectors. The global race among leading semiconductor manufacturers—including TSMC, Samsung, and Intel—to adopt sub-5nm and sub-3nm nodes necessitates superior automation capabilities that only advanced AWHS can provide. Furthermore, labor costs and the criticality of maintaining particle-free environments make automation a compulsory investment rather than an optional enhancement. Government incentives promoting domestic semiconductor production, coupled with the rising complexity of wafer processing techniques (e.g., multi-patterning, 3D stacking), reinforce the need for highly sophisticated, real-time controlled wafer movement systems capable of integrating seamlessly into the Industry 4.0 framework for smart manufacturing and predictive maintenance protocols.

Automatic Wafer Handling System Market Executive Summary

The Automatic Wafer Handling System Market is experiencing robust growth driven by sustained capital expenditure in the semiconductor industry, particularly in Asia Pacific, which dominates both fabrication capacity and advanced packaging development. Business trends emphasize the convergence of physical automation with software intelligence, leading to increased adoption of integrated solutions that combine robotics, real-time monitoring, and machine learning for predictive maintenance and optimized scheduling. Key manufacturers are focusing on developing faster, lighter, and more accurate robotic arms capable of handling diverse substrate materials beyond traditional silicon, including compound semiconductors (GaN, SiC) necessary for power electronics and 5G infrastructure. Strategic partnerships between AWHS suppliers and leading tool manufacturers (OEMs) are crucial for ensuring high compatibility and swift deployment of new fabrication processes, thereby streamlining technology transitions within operational fabs globally.

Regional trends highlight Asia Pacific, specifically Taiwan, South Korea, China, and Japan, as the principal engine of market expansion dueencing to the massive scale of existing and planned fabrication projects designed to address global chip shortages and technological sovereignty goals. North America and Europe, while possessing significant R&D capabilities, are primarily characterized by niche high-mix, low-volume production or advanced equipment manufacturing, though recent political initiatives (e.g., the CHIPS Act in the US and the European Chips Act) signal substantial future investments in localized high-volume manufacturing, promising a significant uptick in AWHS demand in these regions post-2027. This regional dynamism necessitates supply chain resilience and localized support capabilities from AWHS vendors to effectively manage diverse operational requirements and regulatory landscapes across these major geographic hubs.

Segment trends underscore the dominance of the 300mm wafer size segment due to its widespread use in high-volume memory (DRAM, NAND) and advanced logic production, although the 200mm segment maintains relevance due to persistent demand in automotive, IoT, and specialty analog/power device manufacturing, often requiring system upgrades rather than entirely new fabs. Component-wise, the demand for sophisticated EFEMs (Equipment Front-End Modules) and intelligent software platforms is surging, reflecting the industry's pivot toward integrated, data-driven automation environments. Furthermore, the application segment highlights lithography and deposition as key consumers of AWHS, given the extreme precision and clean environment requirements critical to these foundational fabrication steps, pushing manufacturers to continuously improve speed, vibration damping, and particulate control capabilities of their handling systems.

AI Impact Analysis on Automatic Wafer Handling System Market

Common user questions regarding AI's impact on the Automatic Wafer Handling System Market predominantly revolve around how artificial intelligence enhances operational efficiency, minimizes downtime, and improves process control beyond traditional automation. Users frequently inquire about the feasibility of implementing predictive maintenance algorithms that forecast mechanical failures in robotic systems, reducing unplanned stoppages which are extremely costly in wafer fabrication. Additionally, there is significant interest in AI-driven path planning and scheduling optimization for wafer movement, asking whether AI can dynamically adjust routes and queues in complex multi-tool environments to maximize overall fab throughput. Concerns also focus on the integration complexity, the requirement for vast amounts of operational data for training robust models, and the need for standardized AI interfaces compatible across different generations and brands of AWHS equipment. Users expect AI to move AWHS from reactive automation to proactive, self-optimizing handling systems capable of deep learning from facility-wide operations to achieve unprecedented levels of reliability and efficiency.

- AI-driven Predictive Maintenance (PDM) forecasts component failure in robots, minimizing unscheduled downtime.

- Real-time dynamic path optimization improves wafer transfer efficiency and reduces cycle time variability.

- Machine Learning algorithms enhance robot calibration and self-tuning, boosting placement accuracy.

- AI integration enables 'Smart Load Ports' for automatic substrate identification and validation, reducing human error.

- Deep Learning models process vast sensor data (vibration, temperature) for advanced anomaly detection and contamination control.

- Generative AI supports rapid simulation and modeling of new fab layouts and handling workflows before physical deployment.

DRO & Impact Forces Of Automatic Wafer Handling System Market

The Automatic Wafer Handling System Market is primarily driven by the continuous global investment in new semiconductor fabrication plants (Fabs), particularly those focused on advanced nodes (5nm and below) and 300mm wafer technology, which inherently require high levels of automation to achieve acceptable yields and throughput. Restraints include the extremely high initial capital expenditure associated with purchasing and integrating these sophisticated systems, coupled with long qualification cycles necessary for semiconductor equipment, which slows down market penetration for new entrants. Opportunities stem from the increasing adoption of automated material handling systems (AMHS) outside traditional silicon processing, specifically in compound semiconductors (SiC/GaN) and advanced packaging (e.g., Fan-Out Wafer-Level Packaging), alongside the growing trend towards incorporating IoT and AI capabilities for enhanced system intelligence and predictive operations. These forces collectively shape a market environment characterized by high growth potential, yet stringent entry barriers and intense pressure for technological innovation.

A key driver is the ongoing proliferation of data-intensive technologies such as 5G, High-Performance Computing (HPC), and advanced automotive electronics, which necessitate high-volume production of complex chips. This demand compels manufacturers to maximize equipment utilization rates (OEE), a goal achievable only through precise and rapid automated handling systems that minimize wafer travel time and wait times between process steps. Conversely, the market faces significant restraint from the vulnerability of global supply chains, particularly concerning specialized components like robotic arms and precision sensors, which can lead to prolonged lead times and increased costs. Furthermore, the semiconductor industry's cyclical nature means that market volatility and periodic inventory corrections can temporarily dampen capital expenditure, affecting demand for AWHS installations, requiring vendors to maintain flexible production and inventory management strategies to mitigate these fluctuations.

The primary impact forces propelling market growth are technological advancements centered on speed, cleanliness, and connectivity. Customers demand robots capable of faster accelerations and reduced settling times without compromising particulate control (Class 1 or better), thereby directly improving fab throughput. The second major impact force is standardization and integration; adherence to SEMI standards and seamless integration with Manufacturing Execution Systems (MES) are non-negotiable requirements for modern fabs, forcing vendors to prioritize open architectures and robust software interfaces. The opportunity landscape is expanding through the modernization of legacy 200mm fabs, which often require retrofitting with modern, efficient AWHS to remain economically viable for niche production runs. Furthermore, the shift towards fully automated, "lights-out" manufacturing represents a critical long-term opportunity, driving integrated AWHS sales encompassing robots, conveyors, and software orchestration platforms.

Segmentation Analysis

The Automatic Wafer Handling System Market is segmented based on component type, wafer size, application, and end-use industry, providing a granular view of market dynamics and adoption patterns across the semiconductor ecosystem. Component segmentation highlights the technical complexity of the systems, separating the mechanical hardware (robots, end-effectors) from the essential structural and controlling elements (EFEMs, load ports, software). Wafer size remains a critical differentiator, reflecting the established technology nodes (200mm) versus the high-volume, advanced nodes (300mm). Application segmentation reveals consumption patterns across different fabrication stages, emphasizing areas requiring highest precision and throughput, while end-use segmentation outlines the primary customer types driving procurement decisions, spanning pure-play foundries, integrated device manufacturers (IDMs), and specialized memory producers.

- By Component:

- Robots (Atmospheric, Vacuum, Transfer)

- Load Ports (FOUP, FOSB, Cassette)

- Equipment Front-End Modules (EFEMs)

- Controllers and Software

- End-Effectors and Grippers

- By Wafer Size:

- 200mm

- 300mm

- Others (e.g., 150mm, 450mm research)

- By Application:

- Etching and Cleaning

- Deposition (PVD, CVD, ALD)

- Photolithography

- Inspection and Metrology

- Packaging and Assembly

- By End-Use Industry:

- Foundries (Pure-Play)

- Integrated Device Manufacturers (IDMs)

- Memory Manufacturers (DRAM, NAND)

Value Chain Analysis For Automatic Wafer Handling System Market

The value chain for the Automatic Wafer Handling System Market starts with upstream raw material suppliers and specialized component manufacturers. Upstream analysis focuses on vendors providing high-precision components essential for robot functionality, including specialized motors, linear actuators, high-purity materials for end-effectors, sensors (vision systems, force sensors), and sophisticated control electronics. Suppliers of ultra-high-vacuum components and cleanroom-compatible lubricants also form a critical part of this stage. The quality, precision, and reliability of these upstream inputs directly influence the performance and lifespan of the final AWHS product. Strategic partnerships with reliable component suppliers are vital for major AWHS manufacturers to ensure supply chain stability and compliance with stringent cleanliness standards required for semiconductor fabrication environments.

The core of the value chain involves the AWHS manufacturers themselves, who engage in design, engineering, system integration, and software development. These companies transform high-precision components into functional EFEMs, load ports, and complex robotic systems optimized for high throughput and reliability. Following manufacturing, the product moves through distribution channels. Direct distribution is predominant, particularly for major Tier 1 clients (large foundries and IDMs), where AWHS manufacturers engage directly with fab engineering teams for customized system design, installation, and post-sales service. This direct approach ensures precise integration into existing fabrication infrastructure and compliance with complex fab protocols, often involving multi-year service contracts that contribute significant aftermarket revenue.

Downstream analysis involves the end-users—the semiconductor fabrication plants (fabs)—where the AWHS are installed and utilized within process tools. The efficiency of the AWHS directly impacts the fab’s yield and operational expenses. Indirect distribution, while less common for complex, high-capital equipment like AWHS, sometimes occurs through system integrators or specialized engineering consultants for smaller fabs or for peripheral equipment upgrades. The distribution channels are highly specialized due to the need for technical expertise during installation, calibration, and ongoing maintenance. Furthermore, the value chain extends into the maintenance and service sector, where providers offer crucial calibration, spare parts, and system upgrades necessary to sustain the high uptime demanded by 24/7 semiconductor manufacturing operations, often representing a significant portion of the total lifetime value derived from the AWHS investment.

Automatic Wafer Handling System Market Potential Customers

The primary potential customers and buyers of Automatic Wafer Handling Systems are the leading entities within the global semiconductor manufacturing ecosystem, fundamentally divided into three major categories: Pure-Play Foundries, Integrated Device Manufacturers (IDMs), and Specialized Memory Manufacturers. Pure-play foundries, such as TSMC and GlobalFoundries, represent the largest customer segment due to their business model reliance on maximizing wafer starts per month (WSPM) across a wide variety of advanced process nodes for external clients. Their need for highly flexible, high-speed, and ultra-reliable automation systems is paramount, driving consistent demand for new and replacement AWHS, particularly for 300mm wafer processes and advanced packaging lines.

Integrated Device Manufacturers (IDMs), including companies like Intel, Samsung, and STMicroelectronics, operate internal fabs to design and produce their own microchips (e.g., CPUs, microcontrollers). While they may produce lower volumes compared to pure-play foundries, their internal strategic focus on proprietary process technologies often necessitates customized AWHS solutions that integrate deeply with their unique manufacturing execution systems (MES) and cleanroom specifications. This segment is characterized by demanding buyers who require stringent quality control, long-term service agreements, and robust security features within the AWHS control software, reflecting the criticality of proprietary intellectual property protection.

Specialized Memory Manufacturers, focusing on DRAM and NAND flash technologies (e.g., Micron Technology, SK Hynix), are another crucial customer segment. Memory manufacturing involves massive volume production with highly repetitive steps, making automation efficiency the absolute key to cost competitiveness. These buyers prioritize systems offering the highest possible throughput (wafers per hour) and long Mean Time Between Failures (MTBF). Furthermore, customers across all segments require systems compliant with strict international standards (SEMI), robust cybersecurity features for their operational technology (OT) networks, and future-proof architectures that can accommodate next-generation wafer specifications or handling techniques, such as those related to heterogeneous integration and 3D stacking processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.9 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Brooks Automation, Hirata Corporation, Yaskawa Electric Corporation, Rorze Corporation, Kensington Laboratories, Inc., Daifuku Co., Ltd., Axus Technology, Genmark Automation, Inc., TDK Corporation (Adept Technology), CEE Technologies, ULVAC, Inc., Koh Young Technology, SUSS MicroTec SE, Tokyo Electron Limited (TEL), Murata Machinery, FANUC Corporation, SEMES Co., Ltd., Nidec Corporation, KLA Corporation, Applied Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automatic Wafer Handling System Market Key Technology Landscape

The technological landscape of the Automatic Wafer Handling System market is defined by continuous innovation focused on precision, speed, and contamination control, crucial for sub-micron fabrication processes. A key technology involves advanced robotic arm design, utilizing lightweight, rigid materials (such as carbon fiber composites) and sophisticated servo control mechanisms to achieve high speeds (up to 400mm/second) with minimal vibration and settling time, ensuring wafer stability during high-acceleration transfers. This focus on mechanical performance is directly linked to maximizing throughput in critical areas like EUV lithography tracks where every second counts. Furthermore, the development of intelligent, non-contact end-effectors, which minimize the surface area touching the wafer edge and employ specialized vacuum or Bernoulli gripping techniques, is vital for preventing micro-scratches and particle generation, safeguarding the integrity of sensitive circuitry on the wafer surface.

Another dominant technology area is the integration of advanced sensor technology and software architecture. AWHS now heavily rely on integrated vision systems (e.g., 2D/3D vision alignment systems) for precise wafer centering and orientation detection before transfer, achieving micron-level accuracy necessary for modern patterning techniques. Crucially, sophisticated control software incorporating real-time scheduling algorithms and predictive monitoring capabilities (often leveraging AI) is becoming standard. These software solutions manage complex traffic patterns of wafers across multiple process tools, optimize queue times, and provide diagnostic data that feeds directly into the fab's Manufacturing Execution System (MES). The adherence to SEMI standards (e.g., E99 for equipment reliability, E84 for communication) ensures plug-and-play compatibility and facilitates integrated factory automation.

The transition to vacuum handling technology, necessary for certain critical processes (like PVD and ALD), represents a specialized but essential part of the landscape. Vacuum robots and transfer modules must maintain extremely low pressure while performing high-speed movements, requiring specialized feedthroughs and materials with low outgassing properties. Finally, the evolution of EFEMs (Equipment Front-End Modules) towards fully enclosed, self-contained mini-environments that manage air flow, pressurization, and contamination control locally is critical. Modern EFEMs are modular, featuring highly flexible configurations of load ports and robot access points, allowing them to interface seamlessly with diverse and complex processing tools required for advanced node manufacturing, driving efficiency and minimizing the risk of airborne particle transfer during atmospheric handling phases.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global semiconductor manufacturing and thus the largest market for Automatic Wafer Handling Systems. The region, particularly Taiwan, South Korea, China, and Japan, houses the majority of the world's 300mm wafer fabrication capacity and is responsible for leading the charge in sub-5nm node technology development. Demand is driven by aggressive capacity expansion plans funded by major foundries (TSMC, Samsung) and government incentives promoting self-sufficiency (China). This region’s high capital expenditure ensures sustained, substantial procurement of AWHS, focusing primarily on high-throughput, advanced 300mm systems for logic and memory production. The high concentration of original equipment manufacturers (OEMs) and semiconductor capital expenditure here makes APAC the critical revenue generator and technological proving ground for AWHS vendors.

- North America: The North American market, historically focused on R&D and equipment design, is witnessing a resurgence in large-scale manufacturing capacity investment, driven by initiatives like the CHIPS Act. This is creating significant long-term demand for AWHS installations in new mega-fabs announced by Intel, TSMC, and Samsung within the United States. Current demand is characterized by high requirements for advanced automation features, deep integration with sophisticated MES, and an emphasis on security and data privacy within the handling software. North American companies often drive the innovation in robotics and software control, setting high standards for system intelligence and connectivity within the market.

- Europe: The European market is moderately sized but critically important, driven by strong foundations in automotive electronics, industrial IoT, and power management devices (often utilizing SiC/GaN). Recent regulatory efforts, specifically the European Chips Act, are catalyzing investments aimed at increasing regional self-reliance in semiconductor manufacturing, particularly in Germany, Ireland, and France. Demand here is typically concentrated in 200mm fabs undergoing modernization and specialized facilities focusing on high-mix, low-volume production. AWHS vendors must provide flexible systems capable of handling diverse substrate materials and integrated solutions adhering strictly to regional environmental and safety standards.

- Latin America, Middle East, and Africa (MEA): These regions currently represent the smallest share of the AWHS market, characterized by smaller, specialized fabrication facilities or assembly/packaging operations, rather than large-scale, high-volume front-end fabs. Growth is expected to be gradual, fueled by increasing localized demand for basic analog and power semiconductors, primarily driven by investments in renewable energy infrastructure and automotive component assembly. Market activity is often project-based, relying heavily on foreign direct investment or multinational expansion to justify the high cost of automated wafer handling infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automatic Wafer Handling System Market.- Brooks Automation

- Hirata Corporation

- Yaskawa Electric Corporation

- Rorze Corporation

- Kensington Laboratories, Inc.

- Daifuku Co., Ltd.

- Axus Technology

- Genmark Automation, Inc.

- TDK Corporation (Adept Technology)

- CEE Technologies

- ULVAC, Inc.

- Koh Young Technology

- SUSS MicroTec SE

- Tokyo Electron Limited (TEL)

- Murata Machinery

- FANUC Corporation

- SEMES Co., Ltd.

- Nidec Corporation

- KLA Corporation

- Applied Materials

Frequently Asked Questions

Analyze common user questions about the Automatic Wafer Handling System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the AWHS Market?

The primary driver is the massive global investment in new semiconductor fabrication facilities (fabs), especially those transitioning to 300mm wafers and utilizing sub-7nm process nodes for advanced logic and memory production. These complex processes necessitate ultra-high precision, contamination-free, and high-speed automation to achieve optimal yields and throughput, making AWHS essential infrastructure.

How do Automatic Wafer Handling Systems prevent contamination?

AWHS employ multiple layers of contamination control, including operations within strictly controlled cleanroom environments (Class 1 or better), utilizing specialized non-contact or low-contact end-effectors, engineering robots with minimal particle generation components, and integrating advanced air flow and filtration management within Equipment Front-End Modules (EFEMs).

Which wafer size segment dominates the market, and why?

The 300mm wafer size segment currently dominates the market because it is the standard size used for high-volume manufacturing of advanced logic devices (CPUs, GPUs) and most memory chips (DRAM, NAND). Utilizing 300mm wafers allows manufacturers to significantly reduce the cost per chip compared to smaller sizes, incentivizing investment in associated AWHS infrastructure.

What is the role of Artificial Intelligence (AI) in modern wafer handling?

AI is increasingly used to optimize AWHS operations through predictive maintenance (forecasting robot failures), dynamic path optimization (real-time routing adjustments for maximum throughput), and advanced anomaly detection for contamination control, transitioning systems from rigid automation to self-optimizing, intelligent material transport units.

What are the key technical challenges facing AWHS manufacturers?

Key challenges include achieving simultaneous high speed and ultra-low vibration during wafer transfer, ensuring absolute particle control (Class 1 cleanliness), managing the complexity of vacuum handling environments, and developing modular software architecture capable of seamless integration and interoperability across diverse process tools from various equipment manufacturers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager